Knowing when to refinance your mortgage isn't just about chasing a low number. It's a strategic decision that comes down to two things: your personal financial situation and what the market is doing right now.

Get the timing right, and it can be a game-changer for your financial health. But it has to be the right time for you.

Is Now the Right Time to Refinance Your Tampa Home?

For homeowners here in Tampa, the question of when to refinance can feel like a moving target. Interest rates go up and down, life happens, and it's tough to know when to pull the trigger.

The decision gets a whole lot simpler once you know exactly what you're trying to accomplish.

Think of a refinance as more than just swapping out your loan. It’s a powerful financial tool. You're replacing your old mortgage with a new one that has better terms, and the first step is always understanding your "why."

Defining Your Refinance Goal

Before you even start looking at rates or filling out applications, you have to ask yourself what the end goal is. Most homeowners in Tampa are looking to do one of three things:

- Lower the Monthly Payment: This is the big one. Grabbing a lower interest rate can shrink your monthly mortgage bill, freeing up cash for everything else life throws at you.

- Pay Off the Loan Faster: Switching from a 30-year loan to a 15-year term is a fantastic way to build equity fast. You'll also save a massive amount in total interest paid over the life of the loan.

- Access Home Equity: A cash-out refinance lets you tap into the value you've built in your Tampa home. It's a popular way to fund big-ticket items like a home renovation, pay off high-interest debt, or handle major life expenses.

Your primary goal is the compass for your entire refinance journey. It dictates the kind of loan you'll choose and the best time to apply. Nailing this down is the most important part of the whole process.

As a local Tampa lender, we at Residential Acceptance Corporation (RAC Mortgage) live and breathe this market. We're here to give you straightforward advice based on your situation and help you figure out if now is the smart time to make a move.

The Three Main Goals of Refinancing Your Mortgage

Once you understand why you're thinking about refinancing, you can start using your home like the strategic financial tool it is. For most Tampa homeowners, the decision on when to refinance boils down to one of three powerful objectives.

At Residential Acceptance Corporation (RAC Mortgage), we see our job as helping homeowners match their refinance with a clear, achievable goal. Let’s break down the main reasons people decide to pull the trigger.

1. Secure a Lower Monthly Payment

This is the big one. It's often the most immediate and attractive reason to refinance. Locking in a lower interest rate can slash your monthly mortgage payment, sometimes significantly.

This isn’t just about having a little extra cash. It’s about creating real breathing room in your budget. Those savings can be channeled into other financial priorities, like building up an emergency fund, starting a college fund, or simply dialing down the financial stress each month.

2. Accelerate Your Path to Ownership

Here’s a savvy move for those thinking long-term: shortening the life of your loan. We see many Tampa residents make the switch from a 30-year mortgage to a 15-year term. While this might mean your monthly payment goes up a bit, the long-term savings can be absolutely massive.

You end up paying far less in total interest over the life of the loan and—best of all—you own your home free and clear that much sooner. This strategy is a powerful way to build equity at a much faster rate, turning your home into a more valuable asset in less time.

3. Access Your Home's Equity

Don't forget that your home equity is a valuable resource you can tap into when you need it. A cash-out refinance lets you borrow against the value you’ve already built up, giving you a lump sum of cash to tackle major expenses.

Some of the most common uses we see include:

- Funding Home Renovations: That new kitchen or bathroom you've been dreaming of can add serious value to your property. To make sure you get the most bang for your buck, it pays to understand how to maximize your kitchen renovation's return on investment.

- Consolidating High-Interest Debt: Using a lower-interest mortgage to wipe out high-interest credit card or personal loan debt can save you thousands.

- Covering Major Life Events: A cash-out refi can provide the funds for college tuition, unexpected medical bills, or other significant life investments.

This has become an incredibly popular option. Even with higher rates, cash-out refinance activity has approached three-year highs as homeowners tap into record levels of equity. To see what might be possible for you, check out our guide on cash-out refinance requirements.

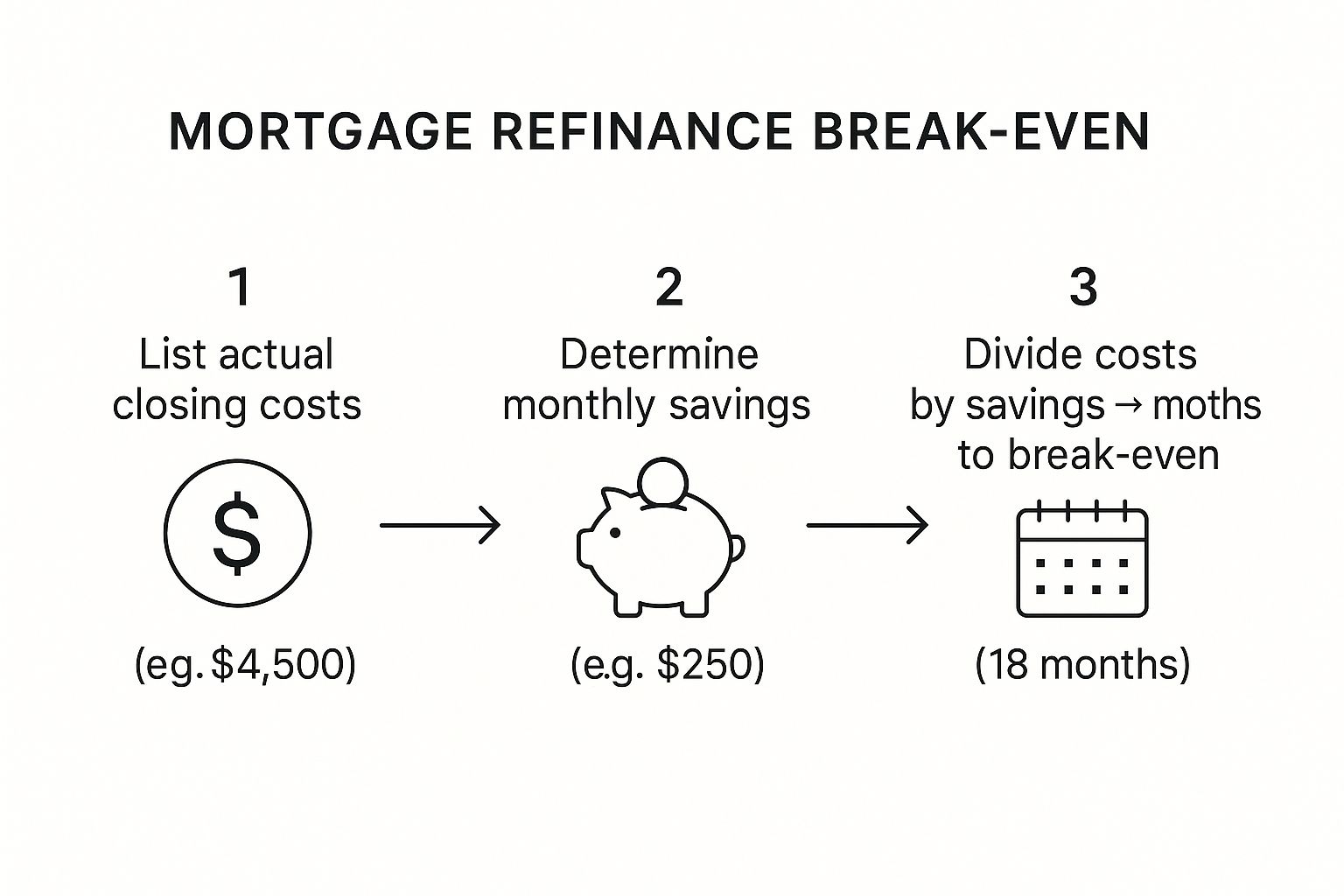

Calculating Your Break-Even Point to Ensure Savings

Let’s be clear: refinancing isn’t free. Just like when you first bought your home, you’ll have upfront expenses called closing costs. Getting a handle on these costs is the most important step in deciding if a refinance makes financial sense for you.

The key is figuring out your break-even point. Think of it as the moment your new, lower monthly payment has officially paid back all the upfront costs. After you hit that point, every single dollar you save is pure cash back in your pocket.

Finding this magic number is just simple math. You divide the total closing costs by how much you'll save each month. The result is the number of months it'll take to recoup what you spent.

A Tampa Refinance Example

Let's walk through a real-world scenario for a Tampa homeowner. Imagine you get a quote for a refinance with these numbers:

- Total Closing Costs: $4,500

- New Monthly Savings: $250

The calculation is straightforward: $4,500 ÷ $250 = 18 months. In this case, your break-even point is a year and a half. If you know for sure you’ll be in your home longer than 18 months, this refinance is a great financial move.

This visual shows just how simple it is to map out the break-even point for your own refinance.

As the infographic shows, dividing your total upfront costs by your monthly savings gives you the exact number of months until your refinance starts paying you back.

To give you another look, here’s a table breaking down a sample calculation step-by-step.

Sample Break-Even Point Calculation

| Calculation Step | Example Value | Description |

|---|---|---|

| 1. Total Closing Costs | $4,500 | The sum of all fees required to finalize the new loan. |

| 2. Monthly Savings | $250 | The difference between your old and new mortgage payment. |

| 3. Break-Even Formula | $4,500 / $250 | Divide the total costs by your monthly savings. |

| 4. Time to Break Even | 18 Months | The number of months it takes for savings to cover costs. |

The most critical part of this equation is getting an accurate, transparent breakdown of all closing costs. Don't base your decision on guesswork.

A local expert like Residential Acceptance Corporation (RAC Mortgage) can provide a detailed estimate so your calculation is based on real numbers, not a fuzzy approximation.

Knowing these figures empowers you to make a smart, informed choice. If you're wondering how to handle these initial expenses, you might be interested in our guide that explains if closing costs can be rolled into the loan. It’s a strategic way to manage the upfront investment of a refinance.

How Interest Rate Fluctuations Create Opportunity

If there's one thing you can count on with mortgage rates, it's that they never sit still. They're constantly on the move, responding to the ups and downs of the broader economy. It's best to think of them like the tide—they rise and fall based on powerful forces, and for savvy Tampa homeowners, this creates clear windows of opportunity.

For anyone in Tampa with a mortgage, watching these shifts is the key to knowing when to pounce on a refinance. The movement is mostly tied to the country's economic health and the decisions coming out of the Federal Reserve. When the economy is roaring, rates often creep up. But when it needs a shot in the arm, rates tend to drop, making it cheaper for everyone to borrow money. That's the moment a refinance can become a game-changer.

The Real-World Impact of a Rate Drop

It’s easy to dismiss a small rate change, but even a minor dip can translate into major savings over time. Let’s say you have a $350,000 mortgage on your Tampa home with a 7% interest rate. If the market shifts and you’re able to lock in a new rate at 6%, the effect is immediate.

Your monthly principal and interest payment could drop by over $200. That’s nice pocket money each month, but the long-term benefit is where it really gets impressive. You could end up saving tens of thousands of dollars in total interest payments over the life of your loan. This is exactly why timing your refinance is so critical.

We've seen this play out dramatically in recent years. During 2020 and 2021, rates plunged to historic lows below 3%. Then, as inflation heated up, they shot past 7% by 2023. For a homeowner with a $400,000 loan, refinancing from 7.25% to 6.5% could free up around $200 every single month. As rates continue to ease, millions of homeowners suddenly find themselves in a position to save. It's estimated that over 7 million homeowners could benefit if rates drop to 5.5%. You can dig into the data yourself and learn more about historical mortgage rate charts to see just how much they can swing.

Think of your mortgage like an investment. By monitoring the market, you can choose the optimal moment to trade your old, higher-cost loan for a new, more affordable one, maximizing your financial return.

This is where having a local expert in your corner makes all the difference. An advisor at Residential Acceptance Corporation (RAC Mortgage) doesn't just process paperwork; we actively monitor the Tampa market for you. We'll help you make sense of the trends and get you ready to seize the opportunity when the conditions are perfect for your unique financial situation.

The Green Lights in Your Own Finances

While falling interest rates grab all the headlines, what’s happening in your own financial life is just as crucial. A great rate from a lender doesn't mean much if you're not in a position to actually qualify for it. It’s a two-part equation: the market has to be right, but so do your personal numbers.

So, how do you know if you’re ready? Look for these three green lights in your finances. They're strong signals that lenders will see you as a prime candidate for a refinance.

Your Credit Score Got a Nice Bump

One of the biggest indicators is a healthier credit score. Lenders reserve their best rates for borrowers who have proven they’re reliable, and your credit score is their main scorecard.

Even a small jump of 20-30 points can be enough to push you into a more favorable lending tier. This could literally save you thousands of dollars over the life of your new loan. A higher score tells a lender you’re a low-risk applicant, and they’ll reward you with better offers.

Your Income is Looking Strong and Stable

Lenders are always looking at your debt-to-income (DTI) ratio. It’s simply the percentage of your monthly income that goes toward paying off debts. If you’ve recently gotten a raise, landed a more stable job, or paid down some credit cards or a car loan, your DTI has likely improved.

This shows lenders that you can comfortably handle a new mortgage payment without stretching your budget too thin. A lower DTI strengthens your application and can be the key to getting that approval.

You've Built Up Solid Home Equity

Equity is the portion of your home that you truly own—the difference between its market value and what you still owe on the mortgage. For most refinances, you'll need at least 20% equity to get started.

This is especially important if you’re considering a cash-out refinance. The amount of cash you can pull out is directly tied to how much equity you've built up over the years.

Your financial picture is unique. An expert assessment can reveal opportunities you might not see on your own.

The surest way to know if your personal finances are aligned for a refinance is to have a professional take a look. Here in Tampa, the team at Residential Acceptance Corporation (RAC Mortgage) can review your specific situation and help you figure out if now is the perfect time to make a move.

Your Next Steps with RAC Mortgage

Deciding when to refinance isn't a simple math problem—it’s a personal one. The right time is a unique mix of good market rates, your own financial situation, and how long you plan to stay in your home. It’s about making sure the numbers work for you.

So, how do you move from wondering if it’s a good idea to knowing for sure? The best way is to get a personalized analysis from an expert who actually knows the Tampa market inside and out.

A no-obligation consultation can cut through the noise. We'll sit down with you, run the actual numbers for your specific loan, and show you exactly what you could save. It’s the clearest way to see if refinancing is the right strategic move for your future here in Tampa.

Ready to see if a refi makes sense for you? Let's connect. The team of local experts at Residential Acceptance Corporation (RAC Mortgage) is here to help.

Common Refinancing Questions in Tampa

Navigating the world of refinancing is bound to stir up some questions. For Tampa homeowners trying to figure out if now is the right time to refinance their mortgage, getting clear, straightforward answers is the first step toward making a confident decision. Here are a few of the most common questions we hear all the time at Residential Acceptance Corporation (RAC Mortgage).

How Much Equity Do I Need to Refinance?

This is a big one, and the answer really depends on what you're trying to accomplish.

If you’re just looking for a standard rate-and-term refinance, most lenders, including us at RAC Mortgage, typically want to see at least 20% equity in your home. That just means your outstanding loan balance is 80% or less of what your Tampa home is currently worth on the market.

However, the requirements can shift a bit if you're aiming for a cash-out refinance to pull from your home's value. Having a healthy amount of equity doesn't just make you a stronger candidate for approval; it also helps you steer clear of Private Mortgage Insurance (PMI), which is a nice bonus.

What Credit Score Is Required for the Best Rates?

Your credit score is a major player in determining the interest rate a lender will offer you. You don't need to be perfect, but a higher score definitely opens the door to more competitive rates.

To get the most attractive terms here in Tampa, a credit score of 740 or higher is generally the sweet spot. If your score is a little lower, don't worry—you can still refinance. But taking some time to boost your credit before you apply is a smart move that can lead to some serious long-term savings.

Knowing where you stand is crucial. An expert at RAC Mortgage can help you understand how your current credit score impacts your potential refinance options and what steps you could take to improve it.

A little historical context can be helpful, too. The MBA Mortgage Refinance Index, which keeps track of refinance applications, soared to an all-time high of 9977.80 points back in May 2003 when rates were incredibly low. Unsurprisingly, everyone was refinancing. While market conditions are always changing, looking back helps Tampa homeowners spot new windows of opportunity as rates move up and down. You can dig deeper into these trends to understand the mortgage refinance index better.

Ready to explore your refinancing options and get personalized answers to your questions? The local experts at Residential Acceptance Corporation are here to provide a clear path forward for your financial goals in Tampa. Visit us online to get started today!