You’ve submitted your loan application, found your dream home in Tampa, and now you’re on to the next step: underwriting. So, what exactly is this mysterious process?

Think of it as the final, critical checkpoint before you get the keys. It’s the lender's deep-dive into your finances to make sure everything adds up and that you can comfortably repay the loan. A lender like Residential Acceptance Corporation (RAC Mortgage) will meticulously review your application to assess the risk and confirm you’re good to go.

Demystifying Your Tampa Mortgage Underwriting Journey

Navigating the path to homeownership in Tampa can feel like a maze, but understanding underwriting takes away a lot of the confusion. Once you send in your application, it doesn’t just get a rubber stamp of approval. Instead, it lands on the desk of a professional underwriter.

Their job is to be a financial detective. They carefully comb through every detail of your financial life to make sure the loan is a solid investment for the lender and, just as importantly, a manageable commitment for you. This isn’t about trying to find a reason to say no; it's about building confidence that you can handle the responsibility of a mortgage.

For instance, an underwriter at RAC Mortgage is going to double-check that the income you put on your application lines up with your pay stubs and tax returns. They’ll also confirm that the home you’re buying in a neighborhood like Hyde Park or Seminole Heights is actually worth the price you’ve agreed to pay.

The Core Purpose of Underwriting

At its heart, underwriting is all about managing risk. Lenders are about to hand over a huge chunk of cash, and they need to feel certain they'll get it back. To do that, underwriters zero in on three fundamental pillars of your application.

Underwriting is the critical step where a lender verifies your financial story. It’s a thorough review designed to protect both you and the lender by ensuring the loan is a responsible and sustainable decision for everyone involved.

This careful evaluation is what turns a hopeful application into a confident approval. It’s how underwriters make a truly informed decision.

Your Financial Profile Under the Microscope

To get a clear picture of you as a borrower, underwriters put specific parts of your financial health under the microscope.

Here are the key areas they focus on:

- Your Credit History: This is your report card for handling debt. Underwriters look at your credit score, payment history, and how you’ve managed credit cards and other loans in the past.

- Your Capacity to Repay: Can you actually afford this new mortgage payment on top of your existing bills? They’ll calculate your debt-to-income (DTI) ratio to make sure you won’t be stretched too thin.

- The Property as Collateral: The house itself is a huge piece of the puzzle. An independent appraisal is ordered to confirm the property's market value, making sure it’s enough to back the loan amount.

To give you a clearer roadmap, here’s a quick overview of the journey.

A Quick Look at Your Mortgage Underwriting Journey

This table outlines the main stages of the mortgage underwriting process, giving you a clear roadmap of what to expect from start to finish.

| Underwriting Stage | What It Means for You | Your Main Responsibility |

|---|---|---|

| Initial Review | An underwriter does a first pass on your complete loan file to check for completeness. | Provide all requested documents upfront and accurately. |

| Conditional Approval | Good news! The underwriter has approved your loan, but with a list of "conditions" to meet. | Promptly submit any additional documents or clarifications. |

| Appraisal & Title Review | The property's value is confirmed, and the title is checked for any claims or liens. | Coordinate with your agent to ensure access for the appraiser. |

| Final Review & Clear to Close | The underwriter reviews the fulfilled conditions and gives the final green light. | Get ready for your closing appointment! |

| Funding | The lender sends the loan funds to the closing agent, and the home is officially yours. | Sign the final paperwork and receive your keys. |

By breaking down these core components, you’ll be much better prepared for what is mortgage underwriting process and can face it with total confidence. This guide will walk you through each step, getting you ready for your journey to owning a home in Tampa with a trusted partner like RAC Mortgage.

The Four Pillars of Your Financial Profile

When an underwriter at Residential Acceptance Corporation (RAC Mortgage) looks at your loan file, they're not just glancing at a single number. Think of it like a skilled builder inspecting the foundation of a house. They check it from every angle to make sure it's solid enough to last for years to come. It’s a comprehensive look into your financial health.

This deep dive focuses on what we in the industry call the "Four Pillars" of underwriting: Credit, Capacity, Capital, and Collateral. Each one tells a different—but equally critical—part of your financial story. Getting a grip on these four areas demystifies the whole process and helps you put your best foot forward for a smooth approval on your Tampa home loan.

Pillar 1: Credit History

Your credit history is your financial report card. It's the story of how you've handled borrowing money in the past, and an underwriter reads that story very carefully, looking well beyond that three-digit FICO score.

They're really digging into a few key areas:

- Payment History: Do you pay your bills on time, every time? This is huge because it shows you're reliable.

- Credit Utilization: How much of your available credit are you actually using? Maxed-out credit cards can sometimes look like a sign of financial stress.

- Length of Credit History: A longer track record of responsible borrowing gives the underwriter more confidence.

- Types of Credit: A good mix of credit—like a car loan and a few credit cards—shows you can successfully manage different kinds of debt.

Red flags like late payments or bankruptcies will definitely get a closer look. But a less-than-perfect history isn't an automatic "no," especially if you have a solid explanation and have been on the right track since.

Pillar 2: Capacity to Repay

Credit shows your past, but capacity is all about the here and now. Can you comfortably take on this new mortgage payment? The main metric for this is your debt-to-income (DTI) ratio. It's a simple calculation, but it carries a lot of weight.

Your DTI ratio is just your total monthly debt payments (including the new mortgage you’re applying for) divided by your gross monthly income. It gives the underwriter a quick, clear picture of how the new loan will fit into your budget.

For instance, if you make $8,000 a month before taxes and all your debts (car, credit cards, new mortgage) add up to $3,200, your DTI is 40%. Lenders have strict DTI limits, making this a make-or-break number. It's a critical piece of the puzzle, and if you want to get ahead, learning how to calculate your Debt-to-Income (DTI) ratio is a smart move. You can also dive deeper into what this means on our blog about the debt-to-income ratio.

Pillar 3: Capital and Assets

Capital is all about the cash and other liquid assets you have ready for the down payment, closing costs, and reserves. This pillar shows the underwriter you’re financially stable and can handle the upfront costs of homeownership without wiping out your savings.

Underwriters will verify your assets by looking at:

- Bank Statements: They’ll review your checking and savings accounts to see that the funds needed to close are really there.

- Investment Accounts: Statements from your 401(k), stocks, or other investments can show you have a solid financial cushion.

- Gift Funds: If a family member is helping you out, you'll need a signed gift letter and proof that the money was transferred.

Having "reserves"—money left in the bank after you close—is a huge plus. It proves you have a safety net for those unexpected repairs or a temporary income hiccup, which gives the underwriter a lot more peace of mind.

Pillar 4: Collateral

The final pillar is the collateral—the Tampa property you're actually buying. The house itself acts as the security for the loan. If something goes wrong and a borrower can't pay, the lender needs to know they can sell the property to get their money back.

To make sure the home is worth what you're paying, an independent appraisal is ordered. A professional appraiser inspects the house, compares it to other nearby homes that have sold recently, and gives their expert opinion on its market value. For the loan to be approved, the appraised value has to be at least as much as the sales price. This step protects us, and it protects you from overpaying for your new home.

The mortgage landscape is always shifting, and new tech is shaping how underwriting works in the Tampa market. Digital systems are becoming essential, using real-time data to get a better handle on things like loan-to-value and DTI ratios for local homebuyers.

Navigating the Underwriting Process Step by Step

Understanding the flow of the underwriting process really takes the mystery out of what can feel like a super complex journey. When you work with a Tampa-based lender like Residential Acceptance Corporation (RAC Mortgage), the whole thing is a structured sequence of checks and verifications designed to get you to the closing table without any drama. It’s truly a partnership between you, your loan officer, and the underwriter.

Let’s walk through what really happens from start to finish. This roadmap will shine a light on what’s going on behind the scenes after you submit your application and help you know what to expect.

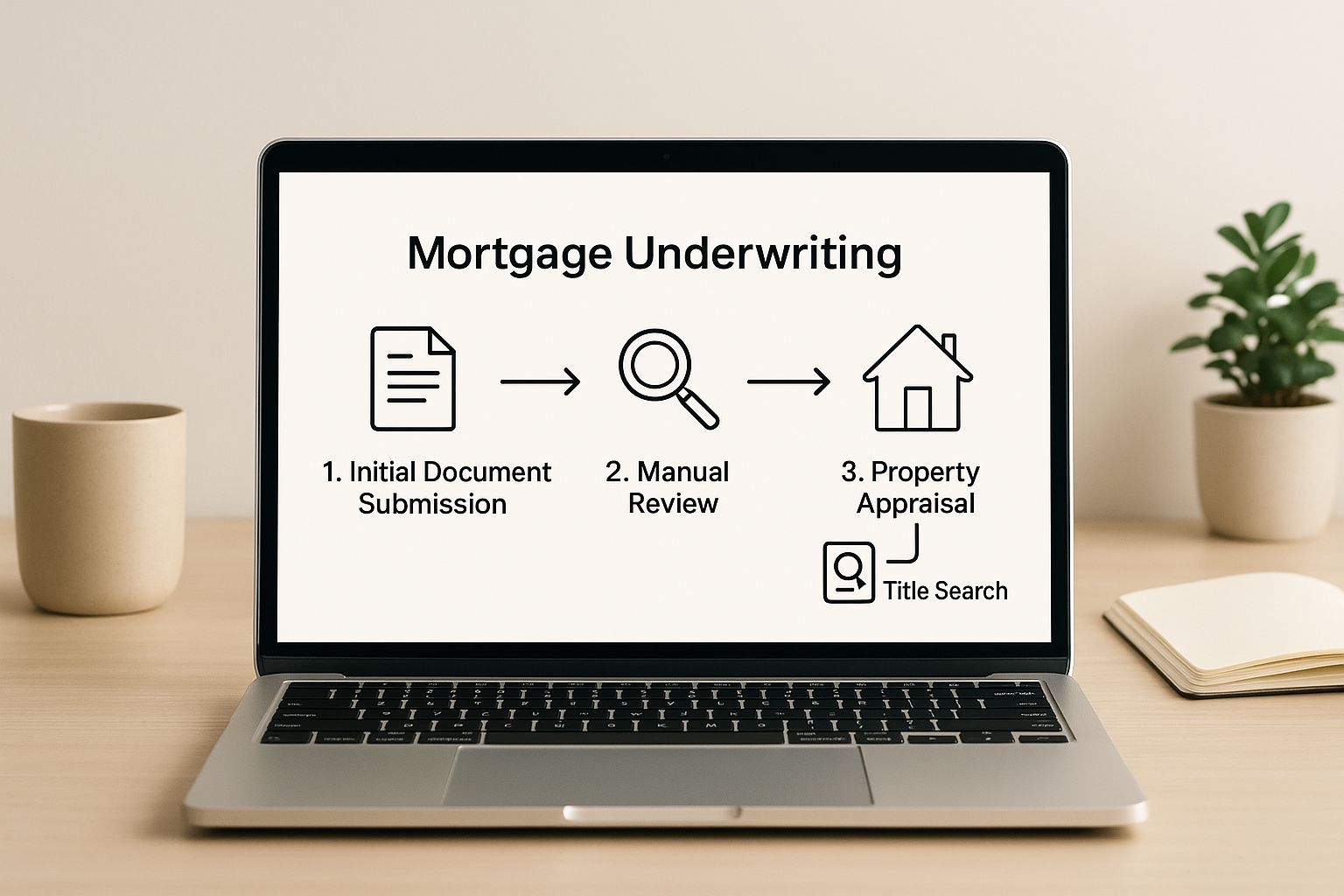

This visual breaks down the typical workflow, from the moment you submit your file to those final review stages.

As you can see, it's a linear path where each completed step unlocks the next. That’s why being thorough from the very beginning is so important.

Stage 1: Initial Document Submission and Automated Review

The underwriting process officially kicks off the second your loan officer submits your complete application package. This file has everything we’ve talked about—your income docs, asset statements, credit history, and all the details on the Tampa property you want to buy. The very first stop is usually an Automated Underwriting System (AUS).

Think of the AUS as a powerful, high-speed pre-screener. It uses sophisticated algorithms to check your financial data against standard lending guidelines. In just a few minutes, it spits out a preliminary recommendation, like "Approve/Eligible" or "Refer/Caution." Getting an "Approve/Eligible" finding is a fantastic start, but it's not the final word.

Stage 2: Manual Underwriting Review

Whether the AUS gives an initial thumbs-up or flags your file for a closer look, the next step is absolutely crucial: a manual review by a human underwriter here at RAC Mortgage. This is where real expertise and nuance come into play. An actual person, not just a program, is going to meticulously go through every single document you provided.

The underwriter’s job is to connect all the dots and make sure your financial story is consistent and makes sense. They will:

- Verify Your Income: The underwriter confirms that the income on your application is stable, reliable, and likely to continue. They'll scrutinize pay stubs, W-2s, and tax returns to ensure everything lines up perfectly.

- Analyze Your Assets: They're reviewing your bank statements to confirm you have the funds for your down payment and closing costs. They also look for any large, unusual deposits that might signal an undocumented loan from a friend or family member.

- Review Your Credit Report: An underwriter goes way beyond just the score. They look at your overall credit behavior, checking for red flags like recent late payments or a sudden jump in your debt.

This manual review is where an experienced underwriter can make sense of unique situations that an algorithm might miss, like a recent big promotion or income you’re earning from a side hustle.

The human underwriter’s role is to build a complete narrative of your financial reliability. While an automated system provides a data-driven snapshot, the underwriter adds context, ensuring a fair and comprehensive assessment of your ability to manage a home loan.

Stage 3: Property Appraisal and Title Search

While the underwriter is focused on your financial profile, a parallel process is happening to check out the property itself. After all, the Tampa home you're buying is the collateral for the loan. Two key things happen here.

- The Property Appraisal: RAC Mortgage orders an appraisal from an independent, licensed appraiser. This pro assesses the home’s condition, size, and features, then compares it to similar, recently sold properties nearby to determine its fair market value. For the loan to move forward, the home has to appraise for at least the purchase price.

- The Title Search: A title company dives into public records to make sure the property has a "clear title." This means confirming the seller has the legal right to sell it and that there are no outstanding liens, claims, or other legal issues that could mess with your ownership down the road.

Stage 4: Conditional Approval and Final Review

Once the underwriter finishes their initial review and the appraisal and title reports are back, you’ll likely get a conditional approval. This is fantastic news! It means the underwriter is ready to approve your loan, as long as you can satisfy a few final requests, or "conditions."

These conditions are usually just requests for more documents or some clarification. Common examples include:

- A more recent pay stub to show you're still employed.

- A letter explaining a large, recent deposit in your bank account.

- Proof that you've paid off a specific debt.

Once you provide everything needed to clear these conditions, your file goes back to the underwriter for one last look. They’ll sign off on everything, and you’ll get the coveted "clear to close." This is the ultimate green light, signaling that all underwriting requirements have been met and your loan is ready to be funded for your closing day.

Alright, let's talk about the dreaded paperwork. I know, I know—nobody’s favorite part. But trust me, getting your documents in order before the underwriter ever sees your file is the single best thing you can do to make this whole process a walk in the park.

Think of it like this: an underwriter with a complete file is a happy underwriter. A happy underwriter gets your loan approved faster. Being organized is your secret weapon, especially in a competitive market like Tampa.

When you hand over a neat, complete package to us at Residential Acceptance Corporation (RAC Mortgage), it does more than just speed things up. It sends a powerful message that you’re a serious, on-the-ball borrower. That first impression counts for a lot.

So, what exactly do you need to start gathering?

Your Essential Mortgage Underwriting Document Checklist

Use this checklist to gather all the necessary documents before you start the underwriting process to ensure a smoother experience.

| Document Category | Examples of What You'll Need | Pro Tip for Tampa Buyers |

|---|---|---|

| Income & Employment | ∙ Last 30 days of pay stubs ∙ W-2s from the last 2 years ∙ Full federal tax returns (2 years) ∙ Employer contact info |

Gig economy worker or own a business? Be ready with 2 years of business returns, a YTD Profit & Loss statement, and a balance sheet. |

| Assets & Down Payment | ∙ Bank statements (last 2 months) ∙ Investment/retirement account statements ∙ Gift letter (if applicable) |

Sourcing a down payment from a recent 401(k) loan or stock sale? Have that paper trail ready to go to connect the dots for the underwriter. |

| Credit & Debts | ∙ Recent statements for all loans (auto, student, etc.) ∙ Most recent credit card statements ∙ Alimony/child support orders (if applicable) |

Don't open any new credit cards or take out a car loan while you're in the underwriting process! It can throw your DTI ratio out of whack. |

Having all these items ready isn't just about checking boxes; it’s about building a rock-solid case for your loan approval. A well-documented file leaves no room for questions or delays.

For a deeper dive into the specifics of what's required, you can check out our complete guide on the documents needed for a mortgage.

By pulling these documents together early, you put yourself in the driver's seat. It’s the best way to get a quick, stress-free "yes" from underwriting and get one step closer to getting the keys to your new home in the Tampa Bay area.

How Technology Is Modernizing Mortgage Underwriting

If you think underwriting still involves a dusty room filled with towers of paper, think again. The whole mortgage process has seen a massive upgrade, ditching the slow, manual reviews of the past for a much faster, more accurate experience driven by modern tech.

For Tampa home buyers, this is great news. It means lenders like us at Residential Acceptance Corporation (RAC Mortgage) are putting powerful tools to work for you. Automation and artificial intelligence (AI) have become key players, making your journey from application to closing day a whole lot smoother.

The Rise of Automation in Underwriting

The days of an underwriter manually punching in every single number from your pay stubs and bank statements are quickly disappearing. Automated systems can now instantly verify your income and assets by connecting directly to payroll providers and financial institutions—with your permission, of course.

This shift to automation brings some huge advantages to the table:

- Speed: Tasks that used to take days of back-and-forth can now be wrapped up in minutes.

- Accuracy: It practically eliminates the chance of human error, like a simple typo that could throw a wrench in the works.

- Consistency: Automated systems apply the exact same rules to every file, which guarantees a fair and consistent review for everyone.

What does this mean for you? It means quicker approval times and fewer of those last-minute, frantic requests for more paperwork. This lets the human underwriter at RAC Mortgage zero in on the more complex parts of your file, applying their expertise where it truly counts.

How AI Is Making Smarter Decisions

Beyond just simple automation, AI adds another layer of intelligence to the underwriting process. Let's be honest, mortgage underwriting has historically been a time-consuming, manual slog. But that's changing fast with the help of AI, machine learning, and advanced data analytics.

AI-driven systems can analyze documents in real time, helping to shrink approval times from weeks down to just minutes. It also sharpens the precision of risk assessment and compliance checks.

The goal of technology isn't to replace the underwriter; it's to empower them. These tools take care of the repetitive, number-crunching tasks, freeing up our experts to provide the nuanced, human judgment needed to approve complex loans for Tampa buyers.

AI-powered document recognition is a perfect example. These systems can instantly scan your tax returns and other financial documents, pulling out all the relevant data in a flash. If you're curious about how this works behind the scenes, you can explore guides on an AI document management system. This peek behind the curtain shows just how underwriting is becoming more efficient and borrower-friendly.

Partnering with RAC Mortgage for Your Tampa Home Loan

Let's be honest, going through mortgage underwriting can feel like a marathon. But having the right team in your corner makes all the difference, turning a complex process into a clear, manageable path to your new home. This is where choosing a truly local Tampa lender like us at Residential Acceptance Corporation (RAC Mortgage) really pays off.

Our team's expertise in the Tampa housing market isn't just something we say—it’s a genuine advantage for you. We live and breathe this market, so we get the nuances of local property values and the fast pace of real estate here. That kind of on-the-ground insight, paired with our promise of clear and constant communication, makes for a much smoother, less stressful experience.

Why a Local Tampa Lender Matters

When you work with a local expert, you’re not just getting a loan; you’re getting a partner who’s invested in your success. We take pride in offering personalized service, which means you'll always know exactly where things stand.

Technology is great, but we believe the human element is still what matters most. For those situations that don't fit neatly into a box, our team excels at digging into the details. If you're curious about how we handle more complex files, you can learn more about what it means to work with a Tampa manual underwriting mortgage lender.

We also keep a close eye on industry changes to make sure you're getting the best experience possible. Looking ahead, it's clear that automation is playing a bigger role. New tools are helping to speed up things like document verification and risk analysis, which often leads to faster approvals and a more efficient and fair lending environment for everyone.

At RAC Mortgage, our goal is to blend modern efficiency with the personalized guidance our Tampa community deserves. We reinforce that while underwriting is meticulous, it's a straightforward process with the right support.

Ready to start your journey with a trusted expert who truly understands your community? Connect with the RAC Mortgage team today. We're here to guide you home.

Got Questions About Mortgage Underwriting? We've Got Answers.

The mortgage underwriting process can feel like a mysterious black box, especially for Tampa home buyers. It’s totally normal to have questions swirling around, and getting clear, straightforward answers is the best way to quiet that uncertainty and move forward with confidence.

We hear a lot of the same questions come up at Residential Acceptance Corporation (RAC Mortgage), so we’ve put together a quick rundown of the most common ones. Think of this as your personal FAQ for the underwriting endgame.

How Long Does Mortgage Underwriting Actually Take in Tampa?

This is the big one, isn't it? While every loan is a little different, the underwriting process here in Tampa usually takes anywhere from a few days to a couple of weeks.

What makes it faster or slower? It really boils down to a few things: the complexity of your finances, how complete your application was, and frankly, how busy the underwriters are at that moment. At RAC Mortgage, we do everything we can to streamline this, but the single best thing you can do for a speedy review is to be super responsive. If your underwriter asks for another document, get it to them right away. Quick replies keep your file at the top of the pile.

What Happens If My Mortgage Is Denied in Underwriting?

Getting a denial stings, there’s no sugarcoating it. But it is absolutely not the end of the road. Lenders are legally required to tell you exactly why you were denied. It could be a high debt-to-income ratio, a credit score that missed the mark for that specific loan program, or an issue that popped up with the property appraisal.

A denial is really just a chance to regroup and make a new game plan. When we have to deliver that kind of news at RAC Mortgage, we don't just leave you hanging. We’ll lay out a clear roadmap of what to do next. We can help you pinpoint the exact steps to take to strengthen your financial profile, putting you on a solid path to try again for your Tampa home.

A loan denial isn't a permanent "no"—it's a "not right now." Use that feedback as your guide to build a much stronger application for next time.

Should I Really Avoid Big Purchases or Job Changes During Underwriting?

Yes. 100% yes. This is non-negotiable. It is absolutely critical to keep your financial life on an even keel while your loan is in underwriting. Lenders do one last final check on your credit, your bank accounts, and your job right before you close.

Any sudden changes can throw a major wrench in the works. That means you need to avoid:

- Taking on new debt: Do not go finance a car, a boat, or a living room full of furniture. Any new monthly payment can disrupt your ratios.

- Running up your credit cards: A sudden jump in your credit card balances can shoot your DTI ratio into the danger zone.

- Changing jobs: Even if it’s for more money, a new job can be a red flag. Underwriters love stability and a proven income history.

- Making large, mysterious cash deposits: Every significant deposit has to be sourced and explained. Avoid moving big chunks of cash around unless you have a clear paper trail for it.

The golden rule is simple: just maintain your financial status quo. Don't change a thing until you're holding the keys to your new Tampa home.

Ready to navigate the mortgage process with a local expert you can trust? The team at Residential Acceptance Corporation is here to guide you every single step of the way. Contact us today and let's get you on the path to homeownership.