When you're navigating the path to homeownership in Tampa, you’re going to hear a lot of new terms. "Escrow" is one you'll want to get comfortable with right away.

So, what is a mortgage escrow account?

Think of it as a dedicated savings account that your lender manages for you. Instead of you having to save up for big, sometimes unpredictable annual bills, a small, manageable piece is collected with your monthly mortgage payment. That money is then held safely in this special account.

Demystifying Your Mortgage Escrow Account

It’s really just a financial safety net—a smart budgeting tool built right into your home loan. The whole point is to simplify your life by bundling your major housing costs into one predictable monthly payment. No more surprises.

For most Tampa homeowners, this is a huge relief. You won't get hit with a massive property tax bill from Hillsborough County once a year because the money is already set aside. The same goes for your annual homeowners insurance premium. Your mortgage servicer, like us here at Residential Acceptance Corporation (RAC Mortgage), takes on the job of paying those bills on your behalf, and on time.

To give you a clearer picture, let's break down what an escrow account really does.

Mortgage Escrow Account at a Glance

This table offers a quick snapshot of the key pieces of an escrow account and why they matter.

| Component | Purpose |

|---|---|

| Principal & Interest (P&I) | This is the core of your loan repayment—it's not part of escrow but is paid alongside it. |

| Property Taxes | Your contribution to local services; escrow ensures this is paid to the county on time. |

| Homeowners Insurance | Protects your home from damage; escrow handles the annual premium payment. |

| Mortgage Insurance (PMI/MIP) | If required, these premiums are also collected and paid through your escrow account. |

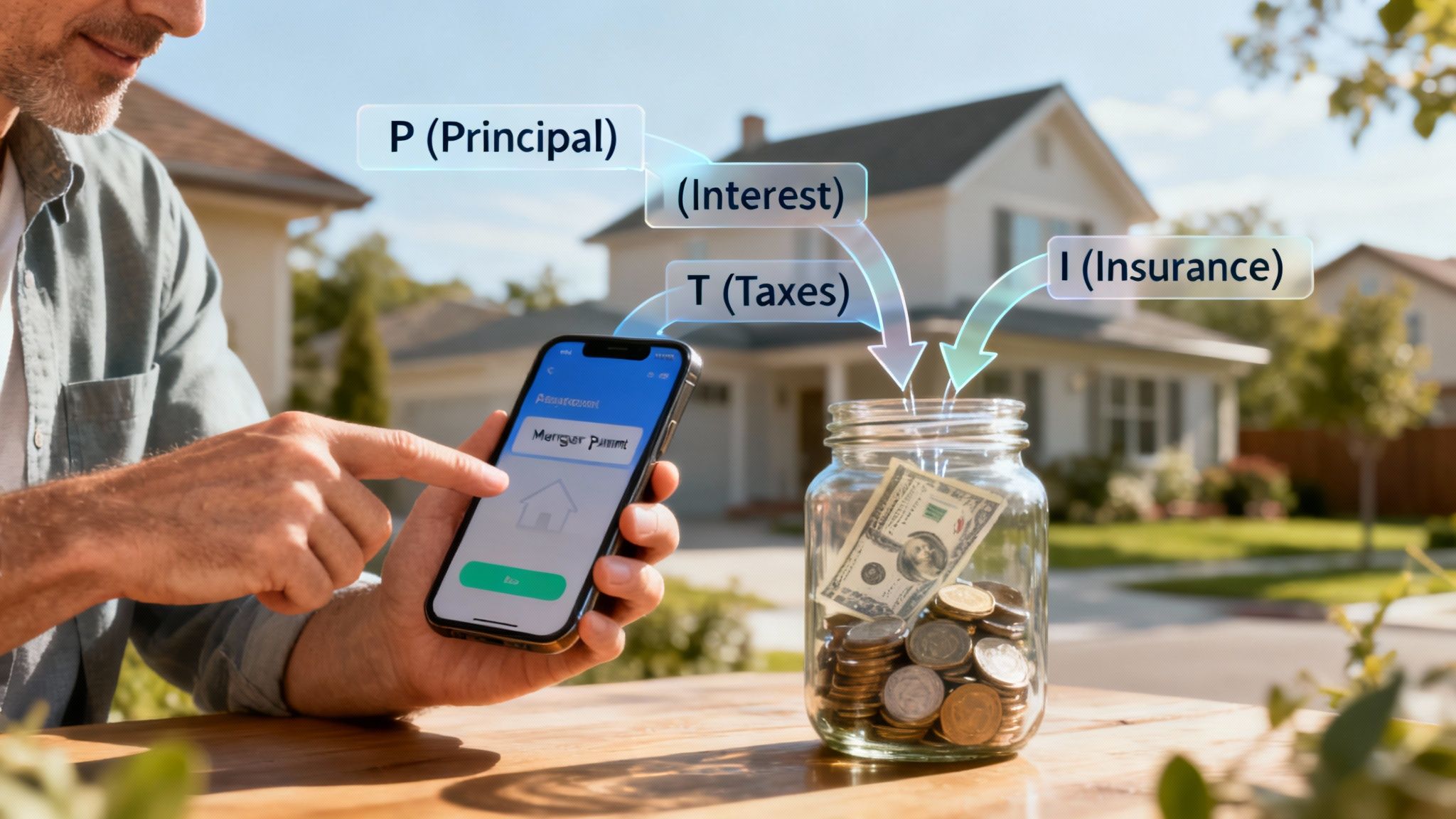

Essentially, your single monthly mortgage payment (often called PITI) covers your loan and funnels the necessary funds into escrow to cover the other essential costs of homeownership.

What Goes Into an Escrow Account

The main goal here is making sure the most important bills tied to your property get paid without a hitch. This system protects you from late fees or even a lien on your home, and it also protects the lender's investment. It's a win-win.

Here are the core components typically paid from an escrow account:

- Property Taxes: These are the local taxes based on your home’s value that fund public services like schools, roads, and fire departments. An escrow account handles payments for your property taxes so you don't have to worry about the deadline.

- Homeowners Insurance: Lenders require this policy to protect your property against damage from things like fires, storms, or theft.

- Mortgage Insurance (if applicable): If you have a loan like an FHA loan or a conventional loan with less than a 20% down payment, your Private Mortgage Insurance (PMI) or Mortgage Insurance Premium (MIP) will likely be paid from escrow, too.

In short, an escrow account is a managed holding account. A slice of your monthly mortgage payment is set aside specifically to cover property taxes and homeowners insurance premiums, ensuring these significant expenses are paid promptly for you.

Getting a handle on this process is a huge part of being prepared for your home loan. Of course, gathering the right paperwork is another crucial step. To get organized, you can check out our simple guide on the documents needed for a mortgage application.

Why Escrow Accounts Are a Standard Part of Mortgages

Think of an escrow account as a way to hit the easy button on some of your biggest homeownership expenses. It’s a simple but powerful tool that helps manage risk for both you, the Tampa homeowner, and your lender, Residential Acceptance Corporation (RAC Mortgage). At its heart, an escrow account breaks down huge, once-a-year bills into small, predictable monthly chunks.

If you're in Hillsborough County, this means you don’t have to stress about saving up a massive lump sum for your property taxes each year. The same goes for Florida’s homeowner's insurance premiums, which can often be complex and expensive. Instead, a little piece of those costs is collected with your mortgage payment each month, totally automating the process.

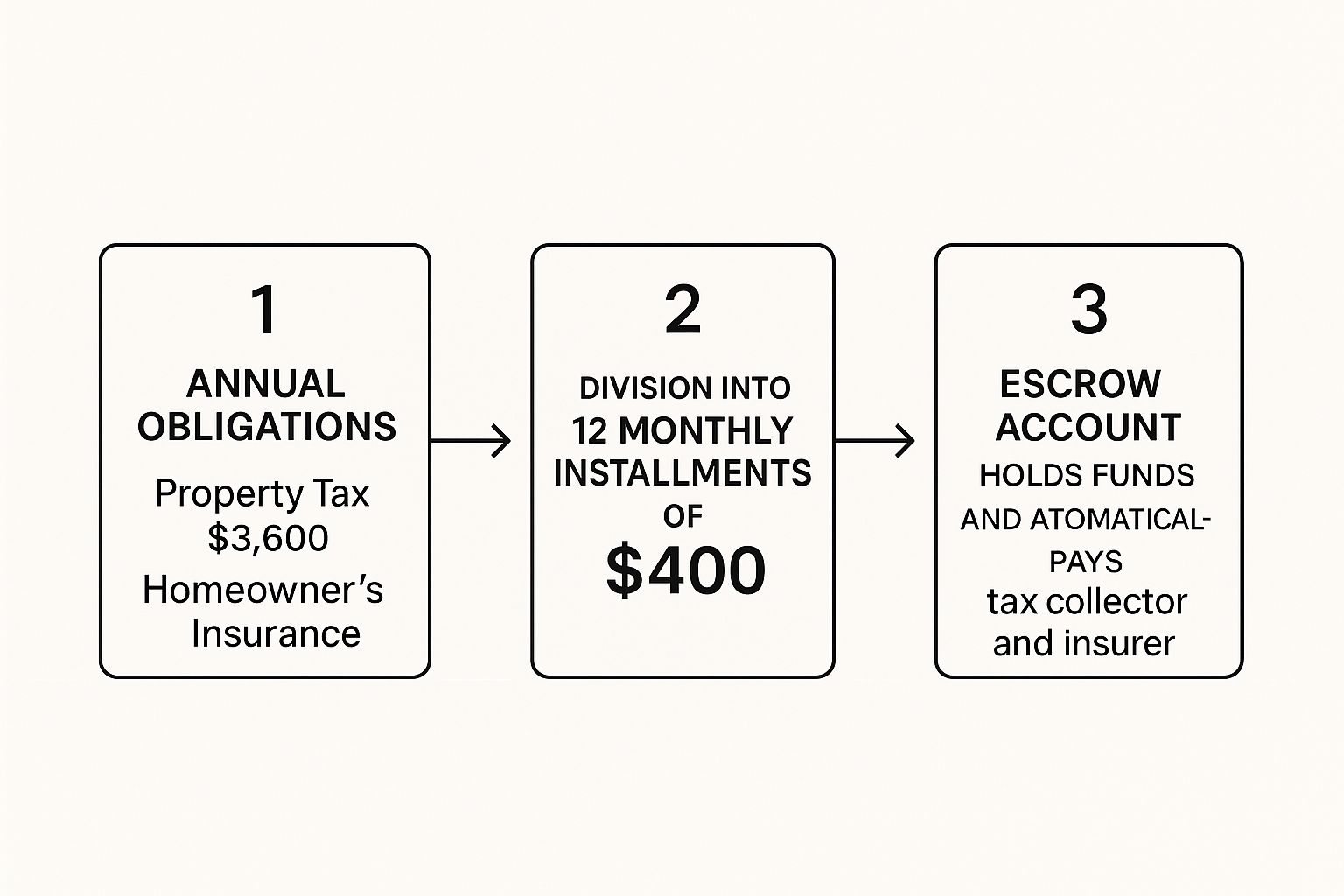

This system takes overwhelming annual bills and turns them into something you barely have to think about. The infographic below breaks down how those big yearly payments get divided up and paid out through your escrow account.

As you can see, the account just smooths everything out over the course of the year. This ensures the money is always sitting there, ready to go, when your property tax and insurance bills finally come due.

A Layer of Protection for Everyone

For a lender like RAC Mortgage, an escrow account is a crucial guarantee that these critical bills get paid on time, every time. It prevents serious problems like a tax lien being slapped on your property for unpaid taxes or a lapse in your homeowner's insurance. Either of those situations would put your home—and the lender's investment—in jeopardy.

An escrow account is fundamentally about creating financial predictability. It’s a shared safeguard that protects the homeowner from surprise bills and protects the lender from the risks of unpaid taxes or lapsed insurance.

This setup works so well that it's become a standard requirement for many types of home loans. It's more than just a convenience; it's a core piece of responsible homeownership that makes sure the most important financial obligations tied to your property are handled without any of that last-minute panic.

When an Escrow Account Is Required

While tons of homeowners opt for an escrow account just for the peace of mind, it’s often required depending on your loan type and how much you put down. In fact, about 80% of mortgaged homeowners in the U.S. use an escrow account, which shows you just how common they are.

For example, homeowners with FHA-backed loans are required to have one, no matter their equity. If you have a conventional loan, you’ll almost certainly need one if you put down less than 20%. You can discover more about homeowner escrow trends to get a better sense of how widely this practice is used across the country.

How Your Escrow Account Works Day to Day

So, how does this escrow thing actually work in the real world? It's a lot simpler than it sounds, and it all kicks off the day you close on your home.

On closing day, you’ll make an initial deposit to "seed" the account. This creates a starting balance, a little cushion to make sure there's enough cash on hand to pay your first round of property tax and insurance bills. These often come due before you’ve had a chance to build up much of a balance through your monthly payments.

From there, it's a smooth, predictable cycle every single month. You'll make one combined mortgage payment, which you’ll often hear called PITI.

That single payment gets split up automatically. The Principal and Interest (P&I) chip away at your loan balance, while the Taxes and Insurance (T&I) get deposited straight into your escrow account. Think of Residential Acceptance Corporation (RAC Mortgage) as the manager for these big-ticket items.

From Your Payment to the Final Bill

Once the "T" and "I" portions land in your escrow account, they just sit there and accumulate, month after month. We keep a close eye on the due dates for your Hillsborough County property taxes and your homeowner's insurance policy. This is where the real magic of escrow happens.

When those big bills are due, we take care of them for you, paying them directly from the funds you've been setting aside all year.

- Property Tax Payment: When the county tax bill shows up, RAC Mortgage pays it on your behalf using the money in your escrow account.

- Homeowner's Insurance Premium: In the same way, when your insurance policy is up for renewal, we send the payment directly to your insurance company.

This hands-off process ensures your most important housing bills are always paid on time. It protects you from nasty late fees, or worse, a tax lien from the county or a lapse in your insurance coverage. You can see how all these pieces fit together in our guide on how to calculate your total mortgage payment.

The day-to-day function of an escrow account is straightforward: collect small amounts monthly to pay large bills annually. It transforms overwhelming lump-sum payments into manageable, automated transactions.

By managing your funds this way, our goal is to help you feel confident as a homeowner. Knowing these huge financial responsibilities are being handled reliably frees you up to focus on what matters—enjoying your Tampa home without the stress of tracking and saving for those large, looming expenses.

Decoding Your Annual Escrow Analysis

Once a year, you’ll get a document in the mail from Residential Acceptance Corporation (RAC Mortgage) called an annual escrow analysis. It can look a little confusing at first, but its job is simple: it’s a yearly check-up to make sure your escrow account is on the right track.

Think of it as balancing the checkbook for your property taxes and homeowner’s insurance.

This annual review is more than just a good habit—it’s a legal requirement designed to protect you. The analysis compares the money we collected for your escrow account over the past year with the actual bills we paid for you. Because property taxes and insurance premiums can change from year to year, this review ensures your monthly payment gets adjusted to match.

For homeowners in Tampa, this is a big deal. Hillsborough County property tax rates can fluctuate, and the Florida insurance market is known for premium adjustments. The annual analysis is how we make sure your escrow payments line up with these real-world costs, so you don’t get hit with a massive surprise down the road.

Understanding Shortages and Surpluses

After we compare the projected costs with what was actually paid, your analysis will show one of two things: a shortage or a surplus. Neither is a reason to panic; they just mean the actual costs were a little different than what we estimated.

An escrow shortage happens when your property taxes or insurance premiums ended up being higher than we expected. This means there wasn't quite enough money in the account to cover the bills, so RAC Mortgage fronted the difference to make sure they were paid on time.

On the flip side, an escrow surplus happens if those costs were lower than we thought. This leaves extra cash in your account after all the year’s bills are paid.

Your annual escrow analysis is a transparency tool. It provides a clear, detailed breakdown of where your money went and adjusts your payments to accurately reflect your actual tax and insurance costs for the coming year.

The Role of the Escrow Cushion

Federal law also lets lenders keep a small buffer in your account, which is known as a cushion. This cushion is usually equal to two months' worth of escrow payments. It’s basically a safety net to cover any unexpected hikes in your tax or insurance bills without immediately creating a shortage.

This is a key part of managing a mortgage escrow account. Under the Real Estate Settlement Procedures Act (RESPA), lenders have to perform this annual analysis and can only maintain a cushion that doesn't exceed one-sixth of the total yearly payments. The law also says that if a surplus of more than $50 is found, it has to be refunded to you.

How Adjustments Affect Your Payment

So, what happens if there’s a shortage or a surplus? You’ve got options.

If you have a shortage, you can usually:

- Pay the amount back in one lump sum.

- Spread the shortage out over your next 12 monthly mortgage payments, which will temporarily increase your payment.

If you have a surplus of $50 or more, RAC Mortgage will simply mail you a check for the extra amount. Your monthly mortgage payment will then be recalculated for the next year based on the new, lower tax and insurance estimates, which will likely result in a slightly smaller payment.

How to Proactively Manage Your Escrow Account

Even though your escrow account is set up to run on autopilot, taking a hands-on approach is the best way to dodge surprises and keep your housing budget steady. As a Tampa homeowner, staying in the loop is your most powerful tool. Think of yourself as the co-pilot, working alongside Residential Acceptance Corporation (RAC Mortgage) to steer your home finances.

Your first move? Actually read your annual escrow statement. Don't just file it away—dig in. Compare the numbers for property taxes and homeowner's insurance with your own records from Hillsborough County and your insurance agent. It's always easier to fix a small discrepancy now than a big one later.

This simple habit helps you see changes coming long before they hit your bank account, giving you a real sense of control.

Spotting Potential Escrow Changes

Life happens, and when it does, it can ripple through to your escrow payment. Did you just finish a major home renovation? That could boost your property's assessed value, which means a higher tax bill is on the way. Keeping us informed about major upgrades helps us get your escrow estimates right.

It’s a similar story with insurance, especially here in Florida where the market is always shifting. If your premium goes up, your monthly mortgage payment will need to adjust to cover it.

Staying ahead of the game with your escrow really comes down to knowing what local factors drive your costs. When you actively keep an eye on your property tax and insurance bills, you can work with your lender to keep your mortgage payment as stable and predictable as possible.

When you know what to look for, that annual escrow analysis from your lender becomes less of a surprise and more of a confirmation of what you already knew. That's a huge part of truly understanding what is a mortgage escrow account from a practical, real-world perspective.

Your escrow payment isn't set in stone, and several common factors can cause it to go up or down.

Common Reasons for Escrow Payment Changes

| Factor | Potential Impact on Your Payment | Action You Can Take |

|---|---|---|

| Property Tax Increases | Increase. Your local municipality (like Hillsborough County) may raise tax rates to fund schools or infrastructure. | Review your annual assessment. If it seems too high, you have the right to appeal it. |

| Home Value Reassessment | Increase. If your home's assessed value goes up due to market trends or renovations, your tax bill will rise. | Ensure you're claiming all eligible exemptions, such as the Florida Homestead Exemption. |

| Homeowner's Insurance Premiums | Increase or Decrease. Premiums in Florida can change due to weather risks, claims history, or market competition. | Shop around for new insurance quotes annually before renewing your policy. Don't just accept the first renewal offer. |

| Escrow Shortage or Surplus | Increase or Decrease. A shortage from the previous year will raise your payment to catch up. A surplus may lower it or result in a refund check. | Review your annual escrow statement carefully to understand how your lender calculated any shortage or surplus. |

Understanding these drivers empowers you to anticipate and manage changes proactively rather than just reacting to them.

Taking Action to Control Costs

You have more influence over your escrow amount than you might realize. The two biggest levers you can pull are your property taxes and your homeowner's insurance premiums. A little effort here can make a real difference in your monthly budget.

Here are a few practical steps Tampa homeowners can take:

- Contest Your Tax Assessment: If you believe your Hillsborough County property tax assessment is out of line with your home's actual value, you have the right to appeal it. A successful appeal directly lowers your tax bill and, in turn, your escrow payment.

- Shop for Insurance: Never let your homeowner's policy renew automatically without getting a few competing quotes. Finding a better rate is one of the quickest ways to see significant savings reflected in your escrow.

- Look for Exemptions: Make absolutely sure you’re receiving every property tax break you're entitled to. The Homestead Exemption, for example, is a major money-saver for Florida homeowners.

Taking these steps can help keep your total housing costs in a more comfortable range. While managing your escrow is a key piece of the puzzle, it's also smart to understand the full financial picture, including how those initial expenses work. You can get more details by checking out our guide on whether closing costs can be rolled into a loan.

Frequently Asked Questions About Mortgage Escrow

When you’re dealing with a mortgage, it’s only natural for questions about your escrow account to pop up. The good news is, the answers are usually pretty simple. Let’s tackle some of the most common questions we hear from Tampa homeowners to give you the confidence you need.

Can I Remove My Escrow Account?

Yes, but only under certain conditions. For most conventional loans, you can typically ask to waive your escrow account once you've built up at least 20% equity in your home. In other words, your loan balance needs to be 80% or less of what your home is worth.

If you hit that mark, you can put in a request with Residential Acceptance Corporation (RAC Mortgage) to have the account removed. Before you do, think it through. While you get more control over your money, you also take on the full responsibility for saving up and paying your Hillsborough County property taxes and homeowner’s insurance in big lump sums.

What Happens if a Bill Is Higher Than My Escrow Balance?

This is exactly why your annual escrow analysis is so important. If a tax or insurance bill comes in higher than expected and creates a shortage, don't worry—RAC Mortgage will still pay the bill in full and on time. We'll typically cover the difference using your account's cushion or by advancing the funds for you.

This makes sure your home stays protected without any interruptions. We'll then sort out the shortage during your next annual escrow analysis. You'll usually have two choices: either pay the shortage back in one lump sum or have it spread out over your next 12 monthly payments, which will temporarily raise your monthly mortgage payment.

An escrow shortage isn't a sign you did anything wrong. It's just an adjustment to real-world costs. Your lender steps in to cover the bill and keep you protected, and the analysis process gets your payments back on track for the next year.

Does My Escrow Account Earn Interest?

That’s a fantastic question, and the answer really depends on where you live. A few states have laws that require lenders to pay interest on the money held in an escrow account, but Florida is not one of them.

Because of that, you shouldn't expect to earn interest on the funds in your RAC Mortgage escrow account. Its main purpose is to make managing your payments easier and more secure, not to act as an investment.

Ready to take the next step toward homeownership in Tampa with a team that simplifies the process? Residential Acceptance Corporation is here to guide you.

Start Your Application with RAC Mortgage Today