Ever wondered how lenders really decide if you can handle a mortgage? It's not magic. One of the single biggest factors is your Debt-to-Income (DTI) ratio. Think of it as a quick financial health checkup that simply compares what you owe each month to what you earn.

A lower DTI tells a lender that you can comfortably manage your payments, which instantly makes you a much more attractive borrower in their eyes.

Why Your DTI Ratio Matters for a Mortgage

Imagine your DTI ratio as a snapshot of your financial life. For mortgage lenders like us at Residential Acceptance Corporation (RAC Mortgage), it's one of the most important numbers we look at. It shows us how much of your monthly income is already spoken for by existing debts—things like car payments, student loans, and credit card bills.

This percentage gives us a clear idea of your capacity to take on a hefty new monthly payment: your mortgage. A lower DTI suggests you have plenty of breathing room in your budget, which lowers the risk that you might struggle to make payments down the road.

To put it simply, your DTI is a core piece of the mortgage application puzzle because it directly impacts a lender's decision. It helps determine not just if you can get a loan, but also how much you might be able to borrow.

Figuring out this number is often the very first step to understanding how much house you can afford.

DTI At a Glance

Your DTI is a straightforward yet powerful metric. This table breaks down the core idea and why it's so central to getting a mortgage.

| Concept | What It Measures | Why Lenders Use It |

|---|---|---|

| Debt-to-Income (DTI) Ratio | The percentage of your gross monthly income that goes toward paying your monthly debt obligations. | To quickly gauge your ability to manage a new monthly mortgage payment on top of your existing debts. |

| Financial Capacity | It reflects your available cash flow after you've paid all your recurring bills. | It helps predict the risk of default. A lower DTI suggests a lower risk, making you a more reliable borrower. |

| Loan Affordability | Your DTI directly influences the loan amount you can qualify for. | Lenders use it to set a borrowing limit, ensuring they don't lend you more than you can reasonably repay. |

Ultimately, a good DTI shows lenders that you're a responsible manager of your finances.

Historically, DTI has been a global benchmark for assessing risk. In many major housing markets, a DTI of around 36% has been the gold standard for mortgage affordability. That said, some lenders will consider ratios up to 43% or even higher if you have other strong financial factors, like a large down payment or high credit score.

Your DTI isn't just a number; it's a story about your financial habits. Lenders use it to predict your future ability to handle a mortgage, making it a critical piece of your homeownership journey.

In the end, a favorable DTI ratio opens doors. It can lead to more loan options, better terms, and more competitive interest rates.

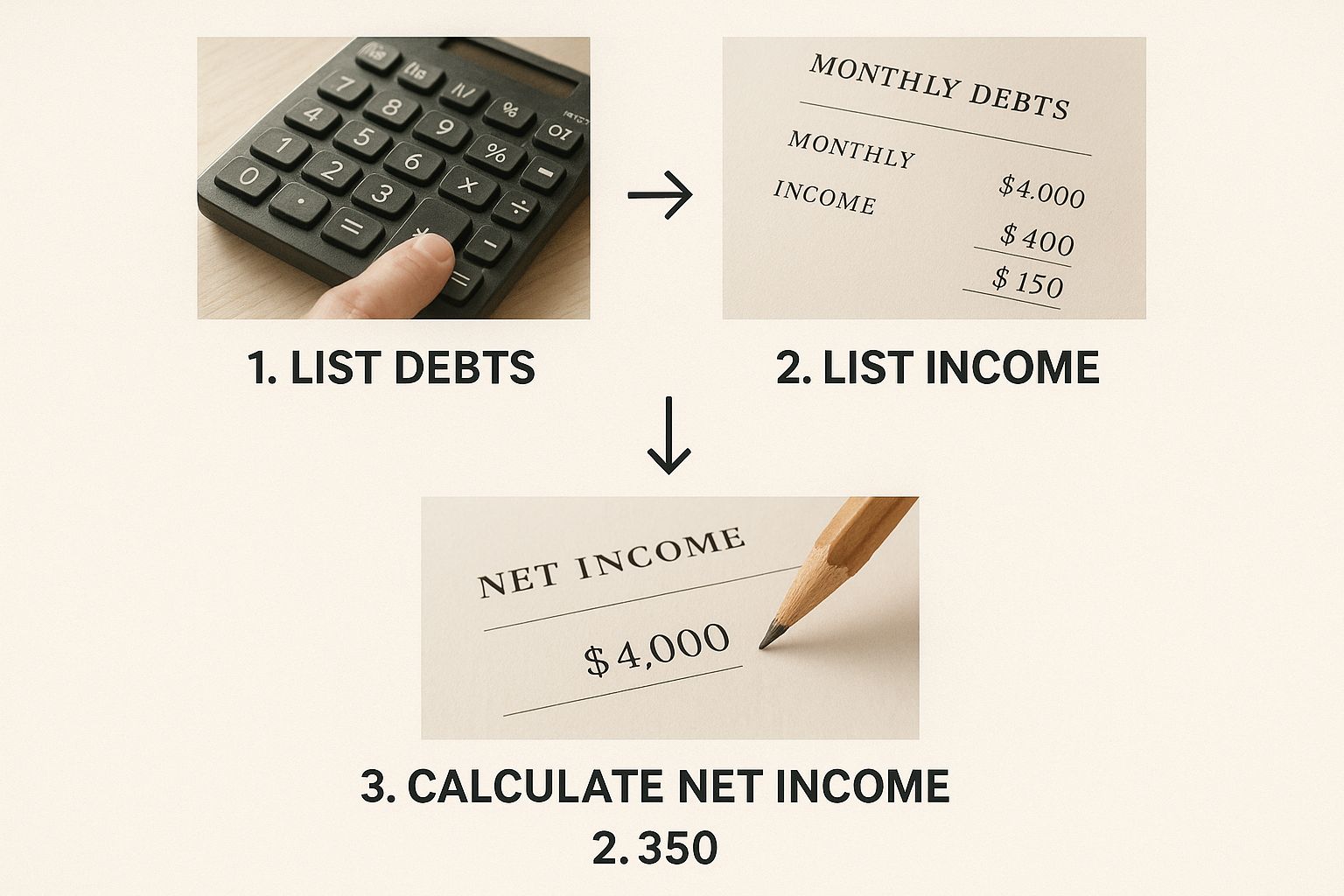

Figuring out your DTI is a lot less intimidating than it sounds. In fact, it's the very first step to getting a clear picture of your finances before you even think about applying for a mortgage. The whole thing comes down to one simple formula that shows exactly how much of your monthly income is already spoken for by debt.

Here's the basic math: Total Monthly Debt Payments ÷ Gross Monthly Income = DTI Ratio. Let's break down what those numbers are and where you'll find them.

This whole process is really about getting organized. You'll gather up a few documents, run a quick calculation, and you'll have your number.

As you can see, it's just a matter of pulling together your income details and your monthly bills.

Step 1: Add Up Your Monthly Debt Payments

First things first, you need a complete list of all your recurring monthly debt payments. Think of these as the fixed bills you have to pay every single month. You'll want to be thorough here—include everything a lender is going to see when they pull your credit report.

Your list of monthly debts should include things like:

- Housing Costs: This is your current mortgage payment or your monthly rent.

- Auto Loans: The full monthly payment for any car loans.

- Student Loans: Your required monthly payment, not what you might be overpaying.

- Credit Card Payments: For this calculation, use the minimum monthly payment required for each card.

- Personal Loans: Any payments for unsecured personal loans.

- Other Installment Loans: This could be for anything financed, like furniture or electronics.

- Alimony or Child Support: Any court-ordered payments you make.

It's important to know that things like your utility bills, groceries, cell phone plan, or insurance premiums are not part of this calculation. Lenders see those as everyday living expenses, not as fixed debts.

Step 2: Figure Out Your Gross Monthly Income

Next up is your gross monthly income. This is the big number—your total earnings before your employer takes out anything for taxes, health insurance, or other deductions.

Your income sources might include:

- Your main salary or hourly wages.

- Consistent overtime pay, bonuses, or commissions.

- Money you make from a side hustle or freelance gig.

- Social Security or disability benefits.

- Alimony or child support you receive.

Just add all those sources together to get your total monthly number.

Key Insight: Lenders like RAC Mortgage are primarily focused on your back-end DTI. This includes all your debts plus the potential new mortgage payment. It gives them the most realistic look at whether you can comfortably handle the costs of homeownership.

Front-End vs. Back-End DTI

When you start talking mortgages, you'll hear about two kinds of DTI. It’s a small distinction, but an important one.

- Front-End DTI: This number only looks at your potential housing costs—the new mortgage payment, property taxes, and homeowners insurance. It's a narrow view that just shows what percentage of your income would go toward the house itself.

- Back-End DTI: This is the one that really matters. It includes all of your monthly debts. We're talking about the new mortgage payment plus everything else: your car payment, student loans, credit cards, you name it.

Mortgage lenders lean heavily on the back-end DTI because it paints the full picture of your financial responsibilities. It answers the most critical question: can you genuinely afford this new house payment on top of all your existing obligations?

What Lenders Consider a Good DTI Ratio

So, you’ve done the math and now you have your DTI ratio. This one little number is a big deal when you're trying to get a mortgage. To a lender, your DTI is a direct signal of your financial health and your ability to comfortably take on a new home loan without overextending yourself.

Think of it this way: a low DTI is like a financial green light. It tells lenders you have plenty of breathing room in your budget. A high DTI, on the other hand, is more of a yellow or even red light, suggesting that adding a mortgage payment might stretch your finances too thin.

Lenders tend to look at DTI in a few key brackets, each one painting a different picture of you as a potential borrower.

Understanding DTI Brackets

While every lender has its own specific rules, these benchmarks give you a solid idea of where you stand in their eyes.

- Under 36% (Ideal): This is the sweet spot. A DTI in this range shows lenders you have significant income left over after your debts are paid. This makes you a very low-risk borrower, which often means you'll have more loan options and access to the best interest rates.

- 36% to 43% (Manageable): This is a very common range for homebuyers and is still considered a good DTI. You can typically qualify for most conventional loans, though lenders might take a closer look at other parts of your application, like your credit score or savings.

- Over 43% (High Risk): Once your DTI starts to climb past this point, lenders get much more cautious. While some government-backed loans have higher limits, a DTI in this zone often leads to fewer choices, potentially higher interest rates, and a tougher approval process.

The Lender's Perspective: A lower DTI ratio doesn't just improve your chances of getting approved; it directly impacts the terms of your loan. A stronger financial profile often unlocks more favorable interest rates, which can save you tens of thousands of dollars over the life of your mortgage.

To make this even clearer, here's a quick breakdown of how lenders typically interpret different DTI levels and what it could mean for your mortgage application.

DTI Levels and What They Mean for Your Mortgage

| DTI Ratio | Lender's Perspective | Potential Mortgage Impact |

|---|---|---|

| Below 36% | Ideal Candidate. You have plenty of disposable income and are seen as a very safe bet. | You'll likely qualify for the best loans with the lowest interest rates. Approvals are generally smooth. |

| 36% to 43% | Good Candidate. You are managing your debt well and can likely handle a mortgage. | You should qualify for most conventional and government loans. Other factors like credit score become more important. |

| 44% to 50% | Borderline/High Risk. Lenders are cautious. Your ability to repay is a concern. | Approval is possible, but often limited to specific government-backed loans. Expect stricter scrutiny. |

| Over 50% | Very High Risk. Most lenders will deny the application. | Getting a mortgage is very difficult. Significant compensating factors would be required. |

This table shows why keeping your DTI in check is so crucial. A few percentage points can make a world of difference in your home-buying journey.

How Loan Type Affects DTI Requirements

It's also important to know that DTI expectations aren't one-size-fits-all. The type of mortgage you apply for plays a huge role in what’s considered an acceptable ratio. For example, government-insured loans often have more flexible guidelines to help more people get into homes.

On a much larger scale, this same concept of balancing debt with resources is used to evaluate the financial health of entire countries. Instead of income, economists use a country's total economic output (GDP). For instance, Japan's public debt is 235% of its GDP, while the United States is at 123%, and Germany holds a lower 65%. Much like your DTI, these figures give a snapshot of a nation's ability to handle its financial commitments. You can see how different countries stack up by checking out this global debt visualization.

Ultimately, these numbers are just guidelines. A trusted partner like Residential Acceptance Corporation (RAC Mortgage) knows that you are more than just a ratio. We look at your entire financial picture—including your credit history, assets, and job stability—to find the best possible mortgage solution for your unique situation.

How Your DTI Directly Impacts Your Mortgage Approval

Your debt-to-income ratio is so much more than just a number on a form. In the real world, it’s a critical piece of the puzzle that directly shapes the mortgage you can actually get. For a lender, your DTI is one of the clearest signals of your financial health. A lower ratio tells them you can comfortably handle a new, large monthly payment—making you a much more attractive borrower.

This isn't a simple pass-fail test, though. Your DTI has a powerful cause-and-effect relationship with your loan terms. A lower DTI often unlocks a better interest rate, which can dramatically lower your monthly payments and save you thousands upon thousands over the life of the loan.

The Bigger Financial Picture

While your DTI is a major player, experienced lenders like Residential Acceptance Corporation (RAC Mortgage) know that a single number never tells the whole story. We look at your complete financial profile to make a smart, well-rounded decision. Think of your DTI as one key element that works alongside several others.

These other factors provide the context that can strengthen your application, even if your DTI is just in the "manageable" range instead of "ideal."

These include:

- Credit Score: A strong credit history is your proof of being a reliable borrower who pays back debts on time.

- Savings and Assets: Having cash reserves on hand for a down payment, closing costs, and unexpected emergencies demonstrates serious financial stability.

- Employment History: A consistent, verifiable income gives lenders the confidence they need in your ability to keep making payments down the road.

When you understand that your DTI works together with these other factors, you start to see it as a powerful tool you can actually control. By actively managing your debt, you improve your DTI and, in turn, boost your overall home-buying power.

Your DTI ratio is a direct line to your borrowing power. A lower DTI not only increases your chance of approval but can also unlock more favorable loan amounts and lower interest rates, making homeownership more affordable.

Ultimately, your DTI influences the very structure of the mortgage a lender will offer you. It affects the maximum loan amount you can get, the interest rate you'll be charged, and even the type of loan you might qualify for. For instance, a higher DTI might mean you have to pay for Private Mortgage Insurance (PMI) on a conventional loan, which adds to your monthly housing costs.

Getting a clear handle on your DTI and other financial numbers is a crucial first step before you even start an application. Taking the time now makes all the difference, and you can learn more about what to expect when you look into how to get preapproved for a mortgage.

Practical Strategies to Lower Your DTI Ratio

If your debt-to-income ratio is a bit higher than you'd like, don't sweat it. You're in the driver's seat. Getting your DTI down is completely doable and really just boils down to a two-pronged attack: cutting your total monthly debt and bumping up your gross monthly income.

Even small tweaks in these areas can make a huge difference in your ratio, turning you into a much more attractive borrower in a lender's eyes. Taking a few proactive steps now can completely change your home-buying journey. With a solid plan and a little guidance from a partner like Residential Acceptance Corporation (RAC Mortgage), you can make real progress toward getting those house keys.

Focus on Reducing Your Monthly Debt

The fastest route to a better DTI is to start chipping away at your monthly debt payments. This is all about tackling the "debt" half of the DTI equation head-on.

Here are a few proven tactics that work:

- Pay Down High-Interest Debt Aggressively: Throw any extra cash you can at high-interest credit cards or personal loans. Every dollar you knock off the principal balance lowers your minimum payment, which gives your DTI a direct, positive nudge.

- Consolidate Your Loans: Got a bunch of different high-interest debts? A debt consolidation loan can roll them all into one single payment, which is often lower than what you were paying before. This one move can make a surprisingly big dent in your DTI.

- Stop Taking on New Debt: This is a big one. As you're gearing up to apply for a mortgage, now is not the time to finance a new car or go on a shopping spree with your credit card. Any new monthly payment will send your DTI climbing in the wrong direction.

The importance of managing personal debt is a global issue. In fact, as of late 2024, total global debt soared to nearly $323 trillion. While that's a massive, hard-to-imagine number, it highlights a simple truth: keeping your debt manageable compared to your income is the bedrock of financial health. You can dig into these larger financial trends in this detailed global debt report.

Aim to Increase Your Verified Income

The other side of the DTI coin is your income. Giving this number a boost can be just as powerful as cutting debt, and there are a few ways to go about it.

The most important thing is making sure any extra income is consistent and well-documented. Lenders need to see it on paper to count it.

Pro Tip: Timing is everything. If you know a big raise or a new, better-paying job is on the horizon, it might be smart to wait until that higher income is showing up on your pay stubs before you apply for a mortgage.

Think about these strategies for beefing up the "income" part of your ratio:

- Document Every Source of Income: Don't forget about that part-time gig, freelance work, or regular bonuses. You need to gather the paperwork—like tax returns or 1099s—to prove this income to the lender.

- Time Your Application Strategically: Applying right after a promotion or raise can work wonders for your DTI. Just a couple of months of pay stubs at that higher rate can be a game-changer.

- Consider a Co-Borrower: If it makes sense for your situation, applying with a spouse or partner means you can combine your incomes. This can slash your collective DTI in a big way.

Lowering your DTI doesn't just help you get a better mortgage—it also frees up cash. That extra money could go straight toward your down payment, which is an area where a lot of buyers could use a hand. For example, looking into different down payment assistance programs can make getting into a home a lot more achievable.

Working With a Mortgage Partner to Navigate Your DTI

Getting a handle on your debt-to-income ratio is a huge step toward buying a home. You now have the tools to figure out what DTI is, how to run the numbers yourself, and some real-world strategies to bring it down. This knowledge puts you in the driver's seat.

But let's be honest, the mortgage process has a lot of moving parts. You don't have to go it alone. A good mortgage partner does more than just shuffle paperwork—they provide clarity when things get confusing and point you in the right direction.

A lender you can trust will help you look past the raw numbers. They’ll work with you to get the full picture of your finances and find the smartest path to getting you into a home.

At Residential Acceptance Corporation (RAC Mortgage), our loan officers are dedicated to being that kind of partner. We believe in taking the time to go over your DTI with you, talk about your financial goals, and find loan options that actually fit your life. Our goal is to give you clear, straight-up guidance from start to finish.

When you’re ready to take that next confident step toward homeownership, we’re here to help you get there. Connect with a RAC Mortgage loan officer today to start the conversation and make your dream of owning a home a reality.

Your Top DTI Questions Answered

As you start wrapping your head around the debt-to-income ratio, a few questions always seem to pop up. Getting solid, no-nonsense answers is key to feeling confident as you step into the mortgage process. We're tackling the most common questions we hear from borrowers right here.

Think of this as your practical cheat sheet. The goal is to clear up any confusion and make sure you understand exactly what lenders are looking at, so you know what to expect and who to talk to for real advice.

Does My Spouse’s Debt Count If I Apply Alone?

This is a huge one, and the short answer is usually no. If you're applying for the mortgage on your own, using just your income and your credit, then lenders will only factor in your individual debts. Your spouse's car payment, student loans, or credit card debt won't be part of the equation.

But there's a big exception to watch out for: community property states. In these states, any debts taken on during the marriage can be seen as a joint responsibility, no matter whose name is on the account. It's always a smart move to talk this over with a loan officer who knows the rules in your state.

What Debts Are Typically Excluded From DTI Calculations?

Lenders are really only focused on your fixed, recurring debt payments—the ones that show up on your credit report. A lot of your normal monthly bills are not part of the DTI formula.

These expenses are generally left out:

- Utilities like your electric, water, and gas bills.

- Monthly subscriptions like Netflix or Spotify.

- Groceries and other day-to-day living costs.

- Insurance premiums (auto, health, or life).

- Your cell phone bill.

Why? Lenders see these as variable living expenses, not fixed debts. They're kept separate from the main DTI calculation that determines your loan eligibility.

Is It Possible To Get a Mortgage With a High DTI?

Yes, it's possible, but it definitely gets tougher. Your loan options might shrink a bit. While most conventional lenders draw a line in the sand around a DTI of 43%, some government-backed programs offer more wiggle room. For example, some programs might go up to 57% if you have other strengths, like a great credit score or a lot of cash in savings.

A higher DTI means lenders will put your file under a microscope. They need to feel certain that other parts of your financial life are strong enough to balance out the risk.

This is where working with an experienced lender makes all the difference. They know which loan programs are more forgiving and can help you find a path forward or map out a plan to improve your numbers before you apply.

How Quickly Can I Improve My DTI Ratio?

How fast you can drop your DTI really comes down to your financial situation and your game plan. You can see an almost immediate impact just by paying off a small loan or a credit card with a pesky minimum payment. For instance, knocking out a $3,000 credit card balance could wipe a $100 monthly payment from your DTI literally overnight.

The same goes for your income. If you get a big raise, your DTI improves as soon as that new salary shows up on your pay stubs. For most people who get serious about paying down debt and stop adding new expenses, you can see real, meaningful progress in just two or three months.

Ready to take the next step? The mortgage process can seem complex, but with the right partner, it becomes much clearer. The team at Residential Acceptance Corporation is here to provide one-on-one support, helping you understand your DTI and find the perfect loan for your situation. Contact us today to start the conversation about your future home.