Getting a conditional mortgage approval is a huge step forward in buying your home. It’s a major milestone.

Think of it as your lender, Residential Acceptance Corporation (RAC Mortgage), giving you a green light, but with a few final conditions attached. It means they've gone through your finances with a fine-tooth comb and are ready to move forward, pending just a final check on some specific details.

Understanding Your Conditional Mortgage Approval

So, what does conditional mortgage approval mean in simple terms? It’s not the final, absolute "yes," but it's incredibly close. A good analogy is getting a job offer that’s contingent on a successful background check. It's a standard—and very positive—part of the mortgage process.

This approval is a critical checkpoint in the loan underwriting journey, sitting right between pre-approval and the final clear-to-close. It signifies that your lender has done a deep dive into your financial documents—your credit reports, pay stubs, bank statements, the works—and decided you’re a strong candidate for the loan. Now, they just need a few more items to tie up the loose ends before giving you the final thumbs-up.

Essentially, conditional approval tells you, the seller, and the real estate agents that your loan is very much on track. It removes a massive piece of uncertainty from the homebuying puzzle.

With this status, you know exactly where you stand. The lender has made a serious commitment to finance your home, as long as you can satisfy the remaining conditions. This stage is crucial no matter what type of loan you’re getting. For instance, you can learn more about how to qualify for an FHA loan with our guide to see how the specifics can vary between different loan programs.

The Role of Underwriting in Your Approval

Behind every conditional approval, there's a real person doing some serious detective work: the mortgage underwriter. Here at Residential Acceptance Corporation (RAC Mortgage), our underwriters are the financial sleuths who verify every single detail of your application. Their job is to make sure the loan is a safe bet for us and, just as importantly, a manageable commitment for you.

While automated systems might give your application an initial green light, it’s the human expert who makes the final call. They're the ones who comb through your file, which is what leads to that list of conditions you need to satisfy. This process is a lot more buttoned-up than it used to be. Before the 2008 financial crisis, approvals were often based on self-reported info that wasn't deeply checked. Today, things are much more rigorous. You can discover more insights about mortgage approval history and see just how much has changed.

Breaking Down the Four Cs of Underwriting

To figure out the risk involved, underwriters lean on a tried-and-true framework known as the "Four Cs." If you can get inside their heads and understand what they're looking for, you'll be able to handle their requests like a pro.

-

Capacity: This is the big one: can you actually afford to pay back this loan? Underwriters dig into your income, how stable your job is, and your debt-to-income (DTI) ratio to make sure the monthly mortgage payments won't stretch you too thin.

-

Capital: This is all about the cash you're bringing to the table. They want to see you have the money for the down payment and closing costs, plus some reserves left over. It proves you have a financial cushion and some skin in the game.

-

Collateral: The house you're trying to buy is the collateral for the loan. A professional appraiser will determine its market value to confirm the lender isn't loaning you more money than the property is actually worth.

-

Credit: Your credit history is your financial report card. It shows how you've handled debt in the past. Underwriters look at your credit score and the details on your report to get a feel for how reliable you are as a borrower.

By looking at these four key areas, the underwriter gets a complete financial picture. Every single condition they ask for is designed to tick a box in one of these categories before they can stamp your loan with that final, official approval.

Common Conditions You Might Encounter

Once an underwriter at Residential Acceptance Corporation (RAC Mortgage) gives you a conditional approval, you'll get a list of final items needed to get your loan over the finish line. Don't worry—these conditions aren't roadblocks. Think of them as the final checkpoints to make sure every detail on your application is double-checked and that the house is a solid investment for everyone involved.

Most of these requests fall into just a few main categories. If you know what the underwriter is looking for and why, you can often get your documents ready ahead of time and keep everything moving smoothly.

Income and Employment Verification

First up, the underwriter needs to confirm your financial situation is still stable. Even if you sent in paperwork at the beginning, they’ll want the most current information to ensure nothing has changed since you first applied.

- Recent Pay Stubs: This is straightforward proof that your income is consistent right up to your closing date.

- Written Verification of Employment (WVOE): Your RAC Mortgage loan officer might reach out to your employer directly, just to confirm your job title, start date, and salary are all still accurate.

- W-2s or Tax Returns: If there are any questions about your income history or gaps in employment, you might be asked to provide your tax documents for the last two years.

These simple checks give the underwriter confidence that you can comfortably handle your mortgage payments for the long haul.

Asset and Debt Documentation

Next, the focus turns to the money you're bringing to the closing table and any other debts you have. Underwriters need to see a clear paper trail for any funds being used in the transaction.

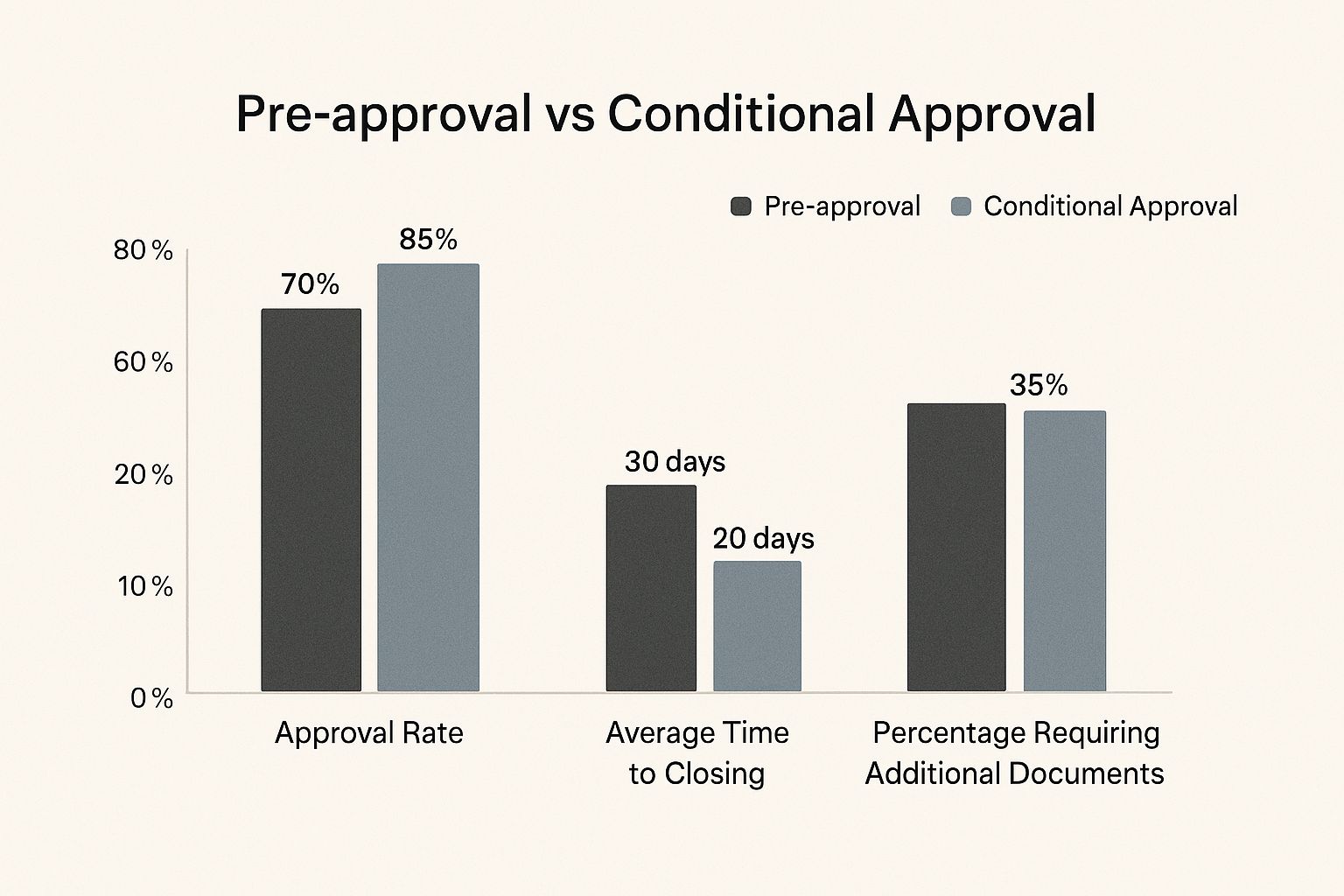

This chart shows how conditional approval is a major step forward from pre-approval, bringing you much closer to getting the keys to your new home.

As you can see, hitting this milestone dramatically boosts your chances of closing and can help shorten the overall time it takes to finalize your loan.

Property-Specific Requirements

A big piece of the puzzle is the property itself. Since the home is the collateral for the loan, its value and legal standing have to be thoroughly vetted. For lenders like us, these conditions are a critical part of managing risk. It's pretty common for property-related items to pop up; in fact, appraisal issues cause around 20% of closing delays, while simple things like missing pay stubs from the borrower account for about 40% of all conditions. You can learn more about these mortgage approval statistics to get a better sense of how normal these requests are.

To give you a clearer picture, here’s a look at some common underwriting conditions and why we ask for them.

| Condition Category | Example Document | Why We Need It |

|---|---|---|

| Income & Employment | Letter of Explanation for a recent job change | To confirm your income source is stable and reliable. |

| Assets & Down Payment | Sourced gift letter for down payment funds | To verify that the gifted money is not a loan that needs to be repaid. |

| Credit History | Proof of paid collection or judgment | To ensure your credit report is accurate and old debts are resolved. |

| Property & Title | Homeowners insurance policy declaration | To prove the property (collateral) is protected against damage. |

| Legal & Ownership | Signed divorce decree or separation agreement | To clarify any potential claims on the property or financial obligations. |

This table covers just a few examples, but it shows that every request has a specific purpose designed to protect both you and us.

Key property conditions often include a satisfactory home appraisal to confirm the property is worth the loan amount and a clear title search to ensure there are no outstanding liens or ownership disputes.

By tackling these common conditions quickly and providing the right documents, you'll be well on your way to getting that final "clear to close" and sealing the deal on your new home.

From Conditional Approval to Clear to Close

So, you've got your conditional approval from Residential Acceptance Corporation (RAC Mortgage)—congratulations! You're in the final leg of the race. The next big milestone is getting your "clear to close" status, which is the ultimate green light before you're sitting at the closing table, signing the final papers.

How quickly and smoothly this last part goes really comes down to you. Think of it as a partnership between you and your loan officer. Being organized and quick to respond can seriously speed things up, often turning what could be weeks of waiting into just a few days.

Your Action Plan for Clearing Conditions

The second you get that list of conditions, it's go-time. Don't let it sit in your inbox. The best thing you can do is review it immediately with your RAC Mortgage loan officer to make sure you know exactly what they need for every single item.

A fast response shows the underwriter you’re a serious, organized borrower. It builds confidence and helps keep your file right at the top of their stack.

The path from conditional approval to clear to close is paved with clear communication and prompt documentation. Your responsiveness directly impacts how quickly you get to the closing table.

To keep everything straight, make a simple checklist for yourself. This will help you gather all the documents efficiently without missing any crucial details. For a good overview of what underwriters typically look for, check out our guide on what documents are needed for a mortgage to get a head start.

Steps to Get Cleared for Closing

Your journey to the closing table can be broken down into a few straightforward steps. Just follow this game plan to navigate this final stage with confidence.

-

Review the List Immediately: The moment it arrives, go through each condition with your loan officer. Ask questions about anything that seems confusing to ensure you're providing the exact document they’re asking for.

-

Gather Documents Promptly: Start collecting the required paperwork right away. The sooner you can hand over a complete package, the faster the underwriter can do their final review and sign off.

-

Maintain Open Communication: Stay in close touch with your RAC Mortgage team. If you hit a snag trying to find a specific document, let them know immediately. They can often help you figure out a solution or an alternative.

By tackling these steps one by one, you turn what can feel like a stressful waiting game into a clear, manageable process. Your diligence right here is what gets you the keys to your new home.

Critical Mistakes to Avoid After Conditional Approval

Getting that conditional approval notice feels incredible, but don't start celebrating just yet. This is a fragile stage in the homebuying process, a time when your entire financial picture needs to stay completely frozen. One wrong move now could put your final approval in jeopardy, so it's vital to know what not to do.

Think of it like walking a tightrope. You're almost to the other side, but any sudden lurches—like racking up new debt or switching jobs—can throw everything off balance. At Residential Acceptance Corporation (RAC Mortgage), we always run a final credit check right before closing. Any new, unexpected information is a major red flag.

Don't Make Any Major Credit Changes

The single biggest mistake borrowers make is changing their credit profile. Your conditional approval was granted based on a specific snapshot in time, and if that picture changes, it can create a last-minute fire drill for your underwriter. The key is to keep your finances as consistent as possible until the keys are in your hand.

Be sure to steer clear of these specific actions:

- Making Large Purchases on Credit: That new car or living room set can wait. Taking on a new loan will spike your debt-to-income (DTI) ratio, and that could easily push you out of our qualifying guidelines.

- Opening New Credit Accounts: Even if it’s just a store card to get a 10% discount, applying for new credit triggers a hard inquiry on your report. This can dip your score and complicate your file right before the finish line.

- Co-signing a Loan for Someone Else: It might seem harmless, but that debt is legally yours in our eyes. It will be added to your DTI calculation, even if you never plan on making a single payment.

Your credit score is a huge piece of the puzzle. For a deeper dive, check out our guide on the ideal credit score for a mortgage to see just how much it matters.

The golden rule after conditional approval is simple: Freeze your finances. Don't change jobs, move large sums of money around without a clear paper trail, or do anything that messes with the information we used to approve you in the first place.

By sidestepping these common slip-ups, you'll set yourself up for a smooth and stress-free path to closing day.

Your Questions Answered: What Happens After Conditional Approval?

Getting through the final steps of the mortgage process can feel like the home stretch of a marathon. You're close, but a few questions always pop up. Let's clear the air so you can move forward with total confidence.

The number one question we get is, "How long until I get the final green light?" While there's no magic number, the timeline is mostly in your hands now. It typically takes about one to two weeks to go from conditional approval to a final "clear to close." But here's the catch: that timeline depends entirely on how fast and accurately you can get the underwriter the documents they've asked for.

From "Almost There" to "Closing Day"

It's really important to understand the difference between getting a conditional approval and being cleared to close. A conditional approval means your loan is approved as long as you meet a few specific conditions. A "clear to close" is the final thumbs-up—it means you've checked all the boxes, satisfied every condition, and the lender is ready to fund your loan.

So, can a loan actually get denied after you've been conditionally approved? The short answer is yes, it's possible. It's not common if you follow the instructions, but your loan could hit a wall if there's a big negative change to your finances. We're talking about a sudden drop in your credit score, losing your job, or taking on a big new car loan. It can also be denied if you just can't provide the documents the underwriter needs.

If you're struggling to track down a specific document or meet a condition, the absolute worst thing you can do is go silent. Being proactive and communicating with your loan officer is the best way to get over any bumps in the road.

Don't panic if you hit a snag. The very first thing you should do is call your Residential Acceptance Corporation (RAC Mortgage) loan officer. Trust us, they've seen it all before. They can often suggest an alternative document you could use or work directly with the underwriter to figure out a solution. Your loan officer is your biggest advocate, and their main goal is to get you to that closing table.

Ready to take the next step toward your new home with a team that has your back every step of the way? Residential Acceptance Corporation is here to guide you through the mortgage process with clear communication and support you can count on. Start your application today!