Getting a conditional mortgage approval is a huge step forward in your home-buying journey. It’s the strongest signal you can get from a lender before the final "clear to close," putting you leagues ahead of a simple pre-qualification. This means a real-life underwriter has actually gone through your file and has given it the thumbs-up, pending just a few last-minute items.

Understanding Your Conditional Approval

Think of the mortgage process like a series of checkpoints. You start with pre-qualification, which is really just a rough guess of what you might be able to borrow. Conditional approval, on the other hand, is much more solid.

When a lender like Residential Acceptance Corporation (RAC Mortgage) gives you conditional approval, it means an underwriter has dug into your paperwork and likes what they see. Your financial profile looks strong enough for them to commit, but they need you to satisfy a few outstanding conditions first. These are the final pieces of the puzzle.

To see where this fits in the bigger picture, let's break down the main stages of getting a mortgage.

Mortgage Approval Stages at a Glance

This table maps out the journey from your initial inquiry to getting those keys in hand. Conditional approval is that critical middle ground where the deal starts to feel real.

| Approval Stage | Level of Review | Lender Commitment | Next Step |

|---|---|---|---|

| Pre-Qualification | Basic financial overview (often self-reported). | Low. It’s an estimate, not a promise. | Submit a formal loan application with documents. |

| Conditional Approval | In-depth review by an underwriter of your credit, income, and assets. | High. The lender is likely to fund the loan if all conditions are met. | Satisfy all outstanding conditions from the lender. |

| Full Approval / Clear to Close | Final verification that all conditions have been met and the property appraisal is solid. | Very High. The loan is ready to be funded. | Schedule your closing date! |

As you can see, hitting the conditional approval stage is where things get serious. You've moved from being a "maybe" to a "very likely."

What This Means for You

Landing this approval means you’ve officially passed a detailed financial exam. The lender has checked your income, looked at your assets, and pulled your credit. They're on board. Now, they're just waiting for those last few verifications to tie everything up. These aren't surprise requests; they are standard procedure to protect both you and the lender.

A conditional approval transforms you from a potential homebuyer into a highly qualified one. It provides confidence to both you and the seller that the financing is on a clear path to completion.

Planning Your Financial Future

While you're working on getting that final approval, it's a great time to map out your budget. A comprehensive mortgage calculator is an incredibly useful tool for this. It can help you estimate your monthly payments and see how the numbers really stack up, so you can plan effectively while you gather the last documents for your lender.

Working with the team at RAC Mortgage means you've got an expert guide to help you navigate these final steps. We'll walk you through each condition, help you get the right paperwork together, and keep things moving forward so you can get the keys to your new home without any unnecessary headaches.

Decoding the Underwriter’s Checklist

So, you've got a conditional mortgage approval. What happens next? You'll get a list of outstanding items from the underwriter. This isn't a pop quiz or some trick to trip you up; it's the final leg of the race where they double-check everything you've provided.

Think of the underwriter as a meticulous fact-checker for the lender. Their entire job is to make sure your financial story adds up exactly as it appears on paper. It’s about protecting everyone involved—you, the seller, and the lender—from any potential risk. Every single condition on their checklist is just another piece of your financial puzzle they need to snap into place.

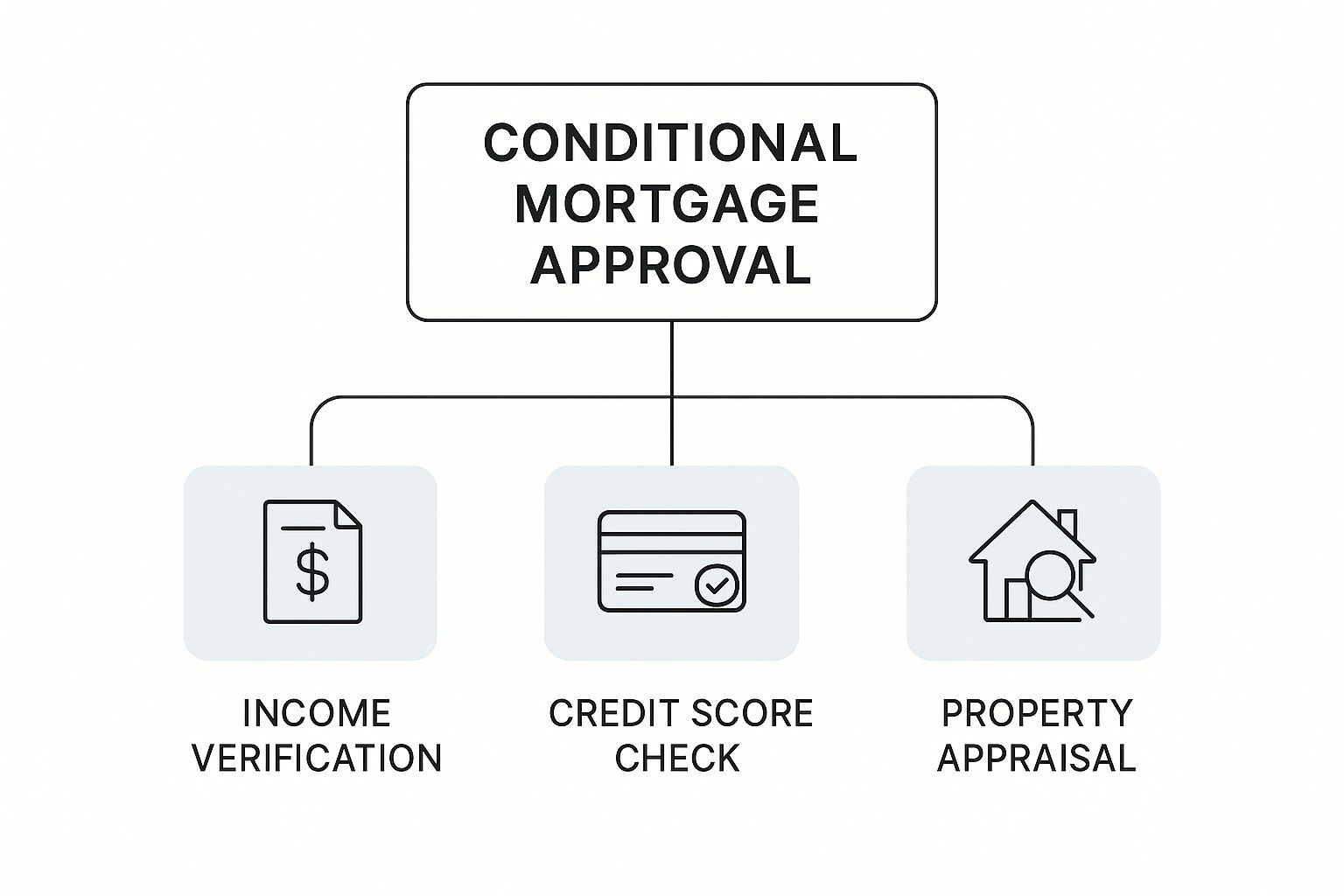

This infographic gives you a great visual breakdown of what an underwriter is zeroing in on at this point.

As you can see, the conditions almost always boil down to three key pillars: your income, your credit history, and the property itself. Each one needs a final, solid verification before your loan gets the green light for closing.

Financial and Employment Verification

The most common conditions you'll see are tied to your money and your job. You might be thinking, "I already sent all this in weeks ago!" And you did. But underwriters need the absolute latest information to confirm nothing significant has changed in your financial situation.

That's why they'll almost always ask for:

- Updated Pay Stubs: They want to see your most recent paychecks to confirm you're still employed and your income is stable right before you close.

- Recent Bank Statements: They're looking at these to verify you have the cash for your down payment and closing costs. They'll also check for any large, out-of-the-ordinary deposits that might need a quick explanation.

- Verification of Employment (VOE): It's standard practice for your loan officer at Residential Acceptance Corporation (RAC Mortgage) to call your employer one last time just to confirm you still work there.

Again, these requests are completely normal. The goal is to get a crystal-clear, up-to-the-minute snapshot of your financial health. If you're ever fuzzy on what's needed, our guide on what documents are needed for a mortgage is a great resource to have handy.

Property-Specific Conditions

The next big chunk of conditions revolves around the home you're buying. The lender is about to invest a lot of money in this property, so they need to be sure it's a solid asset and properly insured.

The underwriter's job is not to find reasons to deny your loan, but to build a strong, verifiable case to approve it. Every condition is a step toward achieving that goal.

Here are the key property-related items they'll need to check off the list:

- The Property Appraisal: This is a big one. An independent appraiser has to confirm that the home's market value is at least what you're borrowing.

- Proof of Homeowners Insurance: You’ll need to show what’s called an insurance "binder." It’s proof that you have a policy ready to go live the day you close.

- Title Search and Insurance: A title company dives into public records to make sure there are no surprise ownership claims or outstanding debts (liens) on the property.

Credit Clarifications

Finally, don't be surprised if the underwriter asks for a bit more detail about something on your credit report. This is pretty common if there's been any recent activity, like new credit inquiries.

For instance, you might be asked to write a Letter of Explanation (LOE) to clarify why you recently applied for credit or to explain the source of a large deposit in your bank account. When it comes to these requests, being direct and honest is always the best approach. It’s the fastest way to get your file stamped "Approved!"

Why the Property Appraisal Is So Important

Of all the conditions an underwriter lays out, the property appraisal often carries the most weight. It’s far more than a formality; this is a non-negotiable step that can literally make or break your loan. Why? Because the house itself is the collateral for the mortgage.

The appraisal has one critical job: to give an independent, professional opinion of the property's fair market value. It’s how the lender makes sure they aren't loaning you more money than the home is actually worth. Your agreed-upon purchase price is a starting point, but the appraiser’s valuation is the number that really matters for clearing your conditional approval.

When the Appraisal Goes Smoothly

The best-case scenario is simple. The appraiser visits the property, compares it to similar homes that have sold recently in the area, and determines its value.

A successful appraisal confirms that the home’s market value is equal to or greater than your purchase price. This gives the lender the confidence to move forward, checking off a major condition for your loan.

When the appraisal "comes in at value," your loan keeps moving smoothly toward the closing table. It’s a great outcome because it verifies you're making a sound investment and not overpaying—which protects both you and your lender.

Navigating a Low Appraisal

But what happens if the appraisal comes in lower than the price you agreed to pay? This creates what’s known as an "appraisal gap," and it immediately puts the loan on pause. Let's say you offered $350,000 for a home, but it only appraises for $335,000. The lender will only finance a loan based on that lower value.

A low appraisal can feel like a huge setback, but it doesn't have to kill the deal. When this happens, you have several clear options on the table:

- Renegotiate with the Seller: You can go back to the seller with the appraisal report in hand and ask them to lower the purchase price to match the new value.

- Cover the Difference: If you have the extra cash and you’re still set on the home, you can pay the difference out of pocket. In our example, you'd need to bring an additional $15,000 to closing.

- Challenge the Appraisal: This is less common, but you can work with your loan officer at Residential Acceptance Corporation (RAC Mortgage) to submit an appeal if you believe there were obvious errors or better comparable sales were missed.

- Walk Away: Most purchase agreements include an appraisal contingency. This clause allows you to back out of the deal without penalty if the home doesn't appraise for the contract price.

The appraisal management company is key to ensuring a fair and unbiased valuation. For brokers interested in the nuts and bolts, you can learn how to choose an appraisal management company for your needs and understand their role in the industry. The bottom line is, having a plan for any appraisal outcome is essential.

So, you've got your conditional approval. Take a breath—the finish line is officially in sight.

This is the final sprint before you get the keys to your new home. Your main goal now is simple: get the documents the underwriter asked for over to your team at Residential Acceptance Corporation (RAC Mortgage) as quickly and accurately as you can.

Think of this phase as a partnership. Your loan officer is your guide, and the underwriter is the final checkpoint. Responding to their requests promptly and thoroughly is the fastest way to move from conditional status to “clear to close.”

Your Step-by-Step Action Plan

The key here is organization and speed. Don't procrastinate on gathering the documents; start as soon as you get that list of conditions. A methodical approach will keep delays at bay and your closing right on schedule.

Just follow these steps for a smooth process:

- Review the List Immediately: Go through every single condition with your loan officer. You need to be 100% clear on what’s being asked for each item.

- Gather All Documents: Collect every single piece of paper on that list. If they ask for your two most recent pay stubs, provide two—not one. Sending incomplete documents is one of the most common reasons for delays.

- Submit Everything at Once: Whenever possible, package all your documents together and send them in one organized batch. This makes life way easier for the underwriter and helps them review your file efficiently, rather than trying to piece together information from five different emails.

Honestly, a systematic approach like this shows the underwriter you’re a prepared and serious borrower. It can genuinely help move your file to the top of their stack.

The time between conditional approval and closing is what I call a financial quiet zone. The golden rule is simple: maintain the status quo. Any major change to your financial picture can throw up a red flag and put your final approval at risk.

The Golden Rule: Maintain the Status Quo

An underwriter’s conditional approval is based on a snapshot of your finances at a very specific moment in time. Their final sign-off depends on that picture staying the same. Any sudden moves can derail the whole process.

This means you absolutely must avoid:

- Applying for New Credit: Don't even think about opening a new credit card, financing a houseful of furniture, or taking out a car loan. Any new debt will change your debt-to-income ratio, which is a critical number for getting approved.

- Changing Your Job: Lenders need to see stability. A job change, even if it’s for a higher salary, can complicate your employment verification and might even force the underwriting process to start all over again.

- Making Large, Undocumented Deposits: Avoid depositing large sums of cash into your bank account. Every dollar needs to have a clear paper trail, and undocumented money is a huge red flag for underwriters.

At the end of the day, a conditional approval means the lender has done a deep dive into your finances and feels good about your ability to repay the loan—they just need to tie up a few loose ends. To see another perspective on this, you can find more great insights on conditional approval from Pennymac.com.

Of course, your property's appraisal is also a huge piece of the puzzle, as it directly impacts the final loan amount. The relationship between the loan and the property's value is critical, a concept we break down in our guide explaining the loan-to-value ratio. Stick to these simple rules, and your journey to the closing table should be smooth and predictable.

Common Mistakes That Can Derail Your Final Approval

The time between getting a conditional approval and your closing day is a critical quiet period. You should think of your financial profile as being completely frozen in place. Any sudden or unapproved changes can throw up major red flags, creating last-minute problems or even putting the entire loan in jeopardy.

Honestly, understanding what not to do is just as important as knowing what you need to do. A lot of buyers make innocent mistakes during this time, not realizing just how big of an impact they can have. Getting through this period successfully is all about keeping your finances stable and maintaining open communication.

So many setbacks in the mortgage approval journey come down to simple miscommunication or delays. This is where professional services focusing on efficient client communication for mortgage brokers can make a huge difference, cutting down the risk of errors and missed information that can derail your final approval.

Making Major Financial Changes

The biggest and most damaging mistake you can make is changing your financial picture. An underwriter’s approval is based on the specific credit, income, and asset information they already reviewed. Any change from that snapshot forces them to re-evaluate everything.

The underwriter approved the borrower you were, not the borrower you might become. Maintain the financial profile you submitted until after you have the keys in hand.

Avoid these specific actions like the plague:

- Opening New Lines of Credit: This is a classic blunder. Financing new furniture for the house or buying a new car before closing is a bad idea. Every new credit inquiry and account can ding your credit score and, more importantly, increase your debt-to-income (DTI) ratio—a key metric for getting qualified.

- Changing Jobs: Believe it or not, even getting a promotion or a higher-paying job can cause underwriting headaches. Lenders value stability above all else, and a change in your employment status means new verification, which can cause significant delays.

- Making Large, Undocumented Deposits: Depositing a big chunk of cash that isn't from your regular paycheck is a major red flag. Lenders have to source all your funds, and undocumented money will lead to a lot of questions about where it came from.

Communication and Documentation Gaps

Beyond the big financial moves, smaller missteps with communication and paperwork can also create friction. Not responding quickly or failing to provide the exact documents requested can slow the whole process to a crawl.

Your loan officer at Residential Acceptance Corporation (RAC Mortgage) is your main point of contact. Keeping them in the loop is absolutely essential if you want a smooth process.

Here are a few communication pitfalls to watch out for:

- Ignoring Requests: When an underwriter asks for documentation, respond as quickly as you possibly can. Delays in getting them your pay stubs or bank statements will directly delay your closing.

- Submitting Incomplete Paperwork: If the underwriter asks for two months of bank statements, give them all pages of both statements. Sending partial documents will only lead to more follow-up requests.

- Failing to Disclose Changes: If something unavoidable happens—like a change in your work hours or a necessary large expense—tell your loan officer immediately. Trying to hide it will only make things worse when the underwriter discovers it during their final verification.

Here’s how to get a competitive edge with a conditional approval.

In a hot housing market, a conditional approval isn't just another piece of paperwork—it's your secret weapon.

When you slap a conditional approval letter down with your offer, you immediately jump to the front of the line. It tells the seller you’re not just a window shopper; you're a serious, qualified buyer whose financing is already well on its way.

This isn’t your garden-variety pre-qualification, either. A conditional approval means a real-life underwriter, like the ones here at Residential Acceptance Corporation (RAC Mortgage), has already taken a magnifying glass to your finances. They’ve verified your credit, your income, and your assets. The lender is basically saying, "We're ready to fund this loan as soon as the last few conditions are met."

Making Your Offer The One They Can't Refuse

Put yourself in the seller's shoes for a minute. They're looking at a stack of offers. One has a basic pre-qualification letter, which is better than nothing. But yours? Yours comes with a conditional approval.

Right away, your offer looks stronger and carries way less risk. The seller can breathe a little easier knowing your financing is unlikely to collapse at the last minute. It gives everyone involved the confidence that this deal is built on solid ground.

This status provides reassurance to buyers that they are moving forward in the purchasing process but must remain attentive to meeting all outlined conditions to finalize their loan. You can learn more about what conditional approval means on Experian.com.

Ultimately, that peace of mind can be the deciding factor. It might even make your offer the winning one, even if it’s not the highest bid on the table.

Common Questions We Hear About Conditional Approval

As you get closer to the finish line, a few last-minute questions always seem to pop up. It's totally normal. Getting clear answers is the best way to move forward with confidence and avoid any unnecessary stress. Let's tackle some of the most common things homebuyers ask about what conditional mortgage approval really means for them.

How Long Does Final Approval Take After Getting Conditional Approval?

This can be a nail-biting time, but it's usually pretty quick. You can expect to get the final green light anywhere from a few days to about two weeks.

The biggest variable here? You. The single most important factor is how fast you can get the underwriter all the documents they've asked for. If you want to speed things up, send every item over to your loan officer at Residential Acceptance Corporation (RAC Mortgage) as soon as you get the list. Keep in mind, the property appraisal is often the one piece that takes the longest to get back.

Can My Mortgage Get Denied After I Have Conditional Approval?

Yes, it's possible. It doesn't happen often, especially if you follow your lender's instructions to the letter, but a loan can still fall through at this stage.

Here are the most common reasons why:

- You Can't Meet the Conditions: If for some reason you can't provide the paperwork or information the underwriter needs, they can't move forward.

- Your Financial Picture Changes: This is a big one. A sudden job loss, taking on a new car loan, or a big drop in your income can absolutely put your approval in jeopardy.

- The Appraisal Comes in Low: If the home appraises for less than what you agreed to pay, it creates a gap that needs to be resolved. If you and the seller can't come to an agreement, the loan might not go through.

The most important thing to remember is to keep your finances as stable as possible. Don't make any big money moves until after you've closed on the house. Staying in close contact with your loan officer is your best defense against any last-minute surprises.

What's the Real Difference Between Conditional Approval and Pre-Approval?

They sound alike, but they're worlds apart in terms of how much weight they carry.

A pre-approval is really just an early-stage estimate. It's based on a quick look at your credit and the income you've told the lender you make. It’s a great way to know your budget, but it is not a firm promise to lend you money.

Conditional approval, on the other hand, is the real deal. It means a human underwriter has done a deep dive into your financial life—they've gone through your pay stubs, bank statements, tax returns, and credit history with a fine-tooth comb. This is a genuine commitment from the lender to fund your loan, provided you can clear those last few remaining conditions.

Ready to take the next step toward homeownership with a team that has your back? The experts at Residential Acceptance Corporation are here to guide you through every stage, from application to closing.

Start Your Application with RAC Mortgage Today