Picture this: you've found the perfect home, but the thought of saving up a massive down payment feels like a mountain you can't climb. For most people, that's the single biggest barrier to buying a home. But for eligible veterans and active-duty service members, the VA loan no down payment benefit knocks that mountain down to a molehill.

This isn't just a small perk; it's a game-changing feature baked right into the VA home loan program, specifically designed to get our nation's heroes into homes of their own.

Your Path to Homeownership with Zero Down

Let's be real—the down payment is a huge financial hurdle. Saving up 10-20% of a home's price can feel like a marathon, taking years and putting homeownership goals on the back burner. In a lot of today's markets, that initial savings target can seem downright impossible.

The VA loan no down payment option completely rewrites the rulebook. It's a benefit you've earned through your service that allows you to finance 100% of a home's purchase price. That means no more waiting years to save. You can move into your new home as soon as you're ready, without wiping out your savings account.

Think of it as a financial head start—a tangible "thank you" for your service that directly helps you build wealth through real estate. You get to skip the years of saving and start building equity right away.

Why This Benefit Is a Bigger Deal Than Ever

In the current housing market, every advantage counts. Home prices and interest rates have made things tough for a lot of buyers. Being able to skip the down payment is a massive leg up.

For example, on a $400,000 home, a conventional loan could easily demand a down payment between $20,000 and $80,000. A VA loan lets you keep that cash in your pocket for other important things.

Working with a trusted lender like Residential Acceptance Corporation (RAC Mortgage) makes the whole zero-down process clear and straightforward. The benefits of not needing a down payment are huge:

- Own a Home, Faster: You can buy a home as soon as you're ready for the monthly payments, without the long wait.

- Keep Your Cash: Your savings stay right where they are. You can use that money for closing costs, moving expenses, furniture, or just to build up a solid emergency fund.

- More Buying Power: When you don't have to carve out a huge chunk of cash for the down payment, you might find you have more options in your price range.

This guide is your roadmap to understanding and using this incredible benefit. We'll show you how the VA loan's zero down payment feature works, helping you move from renter to owner sooner than you thought possible.

With an expert partner like RAC Mortgage, the process is anything but intimidating. We'll break down every single step, from checking your eligibility all the way to getting the keys, so you can take this life-changing step with total confidence.

Understanding the VA Loan Zero Down Advantage

How is it that veterans and active service members can often buy a home with zero money down while most others can't? It's not some secret trick; it's a powerful benefit you've earned through your dedicated service to our country. The va loan no down payment feature is the cornerstone of the VA home loan program, built specifically to tear down the single biggest barrier to homeownership.

At the heart of it all is the VA loan guarantee. The simplest way to think about it is that the Department of Veterans Affairs is "co-signing" a part of your loan. This tells the lender—like us at Residential Acceptance Corporation (RAC Mortgage)—that you're a reliable borrower backed by the full faith of the U.S. government.

This guarantee dramatically lowers the lender's financial risk. Because of that government backing, lenders get the confidence they need to finance 100% of the home's value. This direct financial support is exactly what unlocks the zero down payment advantage for you.

How Zero Down Compares to Other Loans

To really see the power of this benefit, you have to put it side-by-side with other common loan types. For most people, scraping together a down payment is a massive financial challenge that can take years.

- Conventional Loans: These almost always require a down payment. It usually starts at 5% but can easily climb to 20% if you want to avoid extra costs. On a $400,000 house, that's a minimum of $20,000 you need in cash.

- FHA Loans: Even these government-insured loans, which are known for being more accessible, still require a minimum of 3.5% down. On that same $400,000 home, you'd need to come up with $14,000 at closing.

The VA loan lets you sidestep these huge upfront costs completely. It's a massive head start, freeing up your savings for other essentials like closing costs, moving expenses, or just building a solid emergency fund. For countless veterans, this is the key that makes buying a home possible years sooner than they ever thought.

VA Loan vs Conventional & FHA Loans At a Glance

Let's break down the core financial differences in a simple table. It really highlights how the VA loan's no down payment and no PMI features create a significant advantage right from the start.

| Feature | VA Loan (with RAC Mortgage) | Conventional Loan | FHA Loan |

|---|---|---|---|

| Minimum Down Payment | 0% | 3-20% | 3.5% |

| Private Mortgage Insurance (PMI) | None | Required <20% Down | Required (MIP) |

| Funding Fee | Yes (can be financed) | None | Upfront & Annual MIP |

| Who It's For | Eligible Veterans & Service Members | General Public | Borrowers Needing Flexibility |

As you can see, the ability to get into a home with zero down and no monthly mortgage insurance puts VA loan borrowers in a uniquely powerful financial position.

The Hidden Savings of No PMI

Beyond the down payment, there’s another huge cost-saver baked into VA loans that seriously boosts your buying power: no Private Mortgage Insurance (PMI).

PMI is basically an insurance policy that protects the lender, not you. On conventional loans, if you put down less than 20%, you’re almost always stuck paying this extra monthly fee until you've built up enough equity in your home. FHA loans have a similar charge called a Mortgage Insurance Premium (MIP), which often sticks around for the entire life of the loan.

The absence of PMI is not a small perk. It can easily save you hundreds of dollars every single month. That money goes straight back into your pocket, lowering your total mortgage payment and increasing how much home you can comfortably afford.

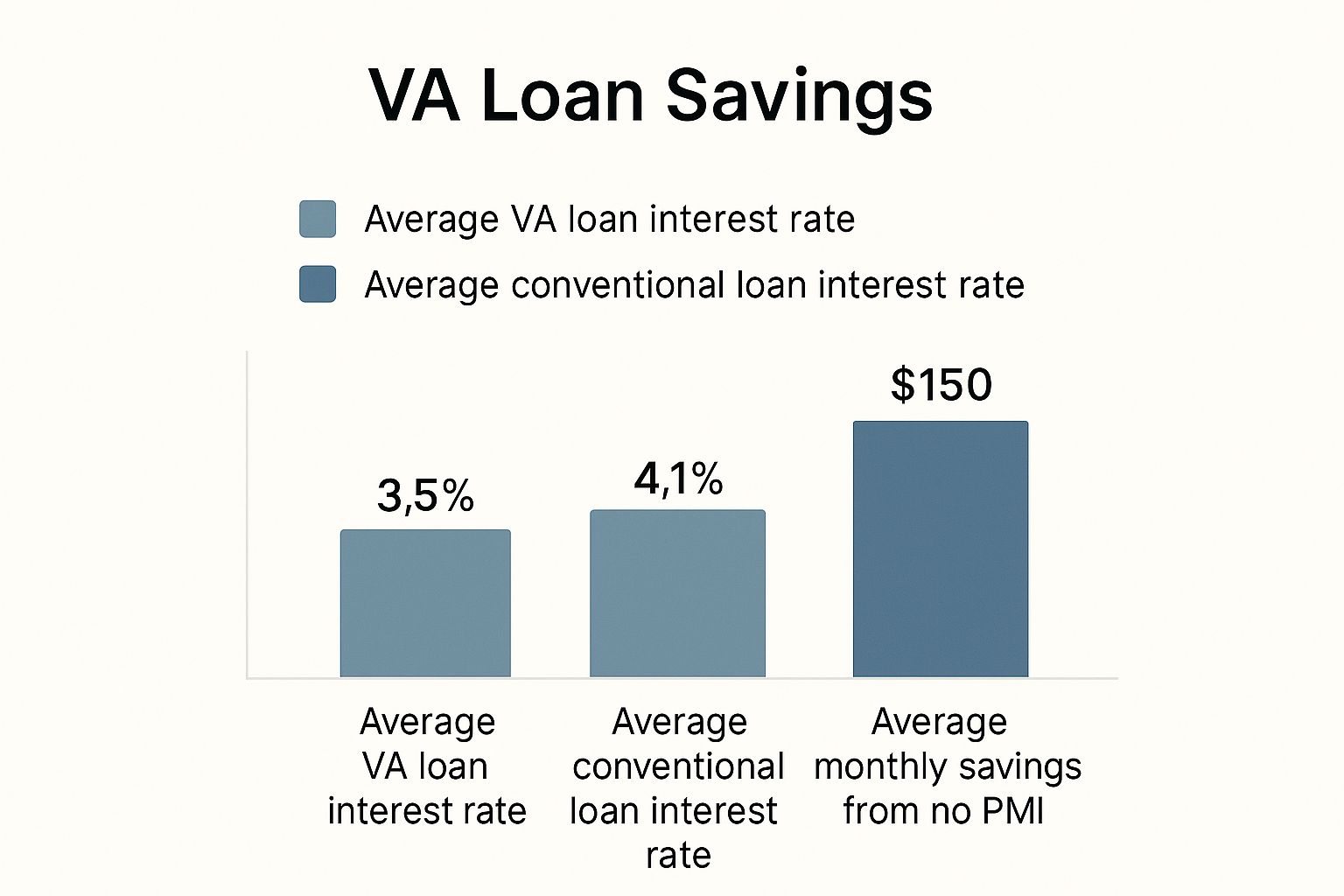

This infographic shows just how competitive VA loan rates are and hammers home the impact of dodging PMI.

The numbers don't lie. When you combine a great interest rate with no monthly PMI, the result is major long-term savings. It's a one-two punch that makes homeownership more affordable from day one. Of course, having strong credit can improve your terms even more, so feel free to check out our guide on how to improve your credit score for a mortgage to get started.

Confirming Your Eligibility for a Zero Down Loan

The VA loan no down payment benefit is a massive advantage, but it's one earned specifically by those who have served our country. The first step is simply confirming that your service record lines up with the VA's requirements. This isn't about jumping through bureaucratic hoops; it's about verifying the very service that earned you this incredible homebuying tool.

Eligibility isn't one-size-fits-all. The VA has specific time-in-service criteria that change depending on when and how you served. Here at Residential Acceptance Corporation (RAC Mortgage), we walk veterans through these requirements every single day to make sure there are no surprises down the road.

Who Qualifies for This Benefit

The path to eligibility is open to most of the military community, though the specific service time can differ. Generally, you're likely eligible if you meet one of these conditions:

- Veterans and Active-Duty Service Members: You typically need 90 continuous days of active service. For those who served during peacetime, the bar is usually set at 181 days of continuous active service.

- National Guard and Reserve Members: The standard requirement here is six years of honorable service. But, if you were called to active duty, that 90-day or 181-day rule may apply instead.

- Surviving Spouses: Certain surviving spouses of service members who passed away in the line of duty or from a service-related disability may also be eligible for this home loan benefit.

These guidelines cover the vast majority of service members and veterans. The key is having the right paperwork to prove it, which brings us to the single most important document in the entire VA loan process.

Your Golden Ticket: The Certificate of Eligibility

Think of the Certificate of Eligibility (COE) as your official hall pass for a VA home loan. It's the one piece of paper that tells lenders like RAC Mortgage that you've met the minimum service requirements and are good to go. Without it, a VA loan simply isn't possible.

Getting your COE might sound like a headache, but it’s usually pretty straightforward. Better yet, you don't have to tackle it alone. An experienced, VA-approved lender like us can typically request and get your COE for you in minutes. This is a critical first step you'll cover when you learn how to get preapproved for a mortgage. It saves you time and gets everything started on the right foot.

Understanding Your VA Loan Entitlement

Once you have your COE, the next big concept is your VA loan entitlement. Picture entitlement as the exact dollar amount the VA is willing to "co-sign" for you. This is the guarantee we mentioned earlier, and it’s what gives lenders the confidence to offer a VA loan no down payment.

Entitlement has two layers:

- Basic Entitlement: This is usually $36,000.

- Bonus Entitlement: Also called second-tier entitlement, this adds another layer of guarantee, allowing veterans to buy homes for much more than the basic amount would cover.

For most veterans buying their first home, having "full entitlement" is the goal. This means you've either never used your VA loan benefit before, or you've paid off a previous VA loan and had your entitlement restored.

Having your full entitlement is the key that unlocks the 100% financing, zero-down-payment option. It signals to the lender that the VA is providing the maximum possible guarantee on your loan, putting you in the strongest possible position to buy a home with no money down.

You can't argue with the numbers. In Fiscal Year 2023, about 66% of all VA purchase loans closed with zero down payment. In fact, around 80% of all VA borrowers put no money down, making it the top reason they choose this loan. The surprising part? Only about 30% of veterans even knew this benefit was available to them. You can discover more about these VA loan statistics and see just how powerful the zero-down feature truly is.

Working Through the VA Loan Process with RAC Mortgage

Buying a home can feel like you're trying to put together a 1,000-piece puzzle without the box top. But it doesn't have to be that way. With a clear map and an expert guide, it becomes a simple, step-by-step path. At Residential Acceptance Corporation (RAC Mortgage), our loan officers are here to be that guide, making sure you feel confident and in control the whole way through.

We see the entire process as a team effort. We work right alongside you, breaking down the complex financial jargon into straightforward, actionable items. This partnership transforms what could be a stressful experience into a smooth homebuying adventure, all while you get to use your hard-earned va loan no down payment benefit.

Kicking Things Off with Pre-Qualification

Your very first move is getting pre-qualified. Think of it as a no-pressure conversation that gives you a clear snapshot of where you stand financially. It’s like checking your fuel gauge before a long road trip—it tells you exactly how far you can go.

During this step, one of our RAC Mortgage loan officers will take a look at your income, assets, and credit. This initial review helps set a realistic price range for your house hunt, so you don't waste time or get your hopes up on a home that's out of reach. It’s the foundation for everything else.

Right after that, we help you get your Certificate of Eligibility (COE). Like we mentioned, this is your golden ticket, and our team can often pull it for you in minutes, officially confirming you're good to go for the zero down payment benefit.

From House Hunting to Appraisal

Once you have that pre-qualification letter in your hands, you can start shopping for a home with real confidence. It’s a signal to real estate agents and sellers that you're a serious, prepared buyer. After you find the house and your offer is accepted, we move into a unique and crucial phase: the VA appraisal.

Now, this isn't your typical appraisal that just determines the home's market value. The VA appraisal goes a step further by including a thorough inspection to make sure the property meets the VA's Minimum Property Requirements (MPRs).

The VA appraisal is really a safeguard for you, the veteran. It ensures the home you’re buying is not only fairly priced but also safe, sound, and sanitary, protecting your investment from day one.

This dual-purpose appraisal is a standout feature of the VA loan program. It adds an extra layer of protection and gives you some serious peace of mind as you get closer to closing.

The Final Steps: Underwriting and Closing

With the appraisal complete and the home meeting all the requirements, your loan file heads to underwriting. This is the final checkpoint. An underwriter performs a deep dive into all your financial documents to give the loan its final seal of approval.

Our team at RAC Mortgage works behind the scenes to make sure your file is buttoned-up and complete, which helps head off any last-minute snags. We keep you in the loop the entire time, so you're never left wondering what’s going on.

Finally, it's closing day! This is the moment you sign the last of the paperwork, the funds are transferred, and you get the keys to your new home. It’s the finish line—the moment your dream of homeownership, achieved with a va loan no down payment, becomes your reality.

Beyond the Down Payment: Other Financial Considerations

While the VA loan no down payment benefit is the headline feature, it’s not the whole story. To get the full financial picture before you sign on the dotted line, you have to look past the sticker price.

Think of it like buying a car—the price on the window is just the beginning. Even with a zero-down loan, there are other costs to consider. The great news is the VA loan program has features built right in to help you manage these, and an expert partner like Residential Acceptance Corporation (RAC Mortgage) can walk you through every single one.

The VA Funding Fee Explained

First up is the VA Funding Fee. This is a one-time fee paid directly to the Department of Veterans Affairs. It's what keeps the entire VA loan program running for future generations of service members.

This fee is a small percentage of your total loan amount and helps the VA offset any potential losses from loans that might default. This is the secret sauce that makes the zero-down payment benefit sustainable.

The exact percentage you'll pay depends on a few things:

- Your service type (e.g., Regular Military vs. Reserves/National Guard)

- Your down payment amount (if you decide to make one)

- If it's your first time using the VA loan benefit

Here's a huge piece of good news: many veterans are completely exempt from this fee. If you receive VA compensation for a service-connected disability, or you're a surviving spouse of a veteran who died in service or from a service-connected disability, you do not have to pay the funding fee. This exemption alone can save you thousands of dollars.

For those who do have to pay it, the VA Funding Fee doesn't have to be an out-of-pocket expense. Most borrowers simply roll the fee into their total loan amount. You'll barely notice it, as you'll pay it off gradually over the life of your mortgage.

Covering Your Closing Costs

Next, let's talk about closing costs. These are totally separate from the down payment and cover all the services needed to finalize the loan—things like the appraisal, title insurance, and various processing fees.

While these are typically out-of-pocket expenses, the VA loan gives you a powerful tool to handle them: seller concessions.

Seller concessions are exactly what they sound like. The seller agrees to pay for some, or even all, of your loan-related closing costs. This is a key point of negotiation when you make an offer on a home. If you negotiate successfully, you can dramatically reduce the cash you need to bring to the closing table.

The ability to finance 100% of a home's value is a huge reason the VA loan has been so successful. Since 1944, it has helped over 28 million veterans and their families become homeowners.

In a state like Washington, where the average VA loan is around $500,000, avoiding a typical 10% down payment means saving over $56,000 right off the bat. You can learn more about the impact of new VA loan bills and see how the program continues to evolve. When you combine the zero-down benefit with seller concessions, the path to owning a home becomes much clearer. You can also look into down payment assistance programs, which can sometimes be used to help with these costs.

Common Questions About No Down Payment VA Loans

Even after walking through all the details, it's totally normal to have a few questions about how the VA loan no down payment benefit really plays out. Here at Residential Acceptance Corporation (RAC Mortgage), we field these questions every single day. We believe in giving you clear, straight-up answers so you can move forward with confidence.

Let's tackle some of the most common things we hear from veterans and service members who are ready to start looking at their homeownership options.

Is a VA Loan Always the Best Option?

For the vast majority of eligible borrowers, a VA loan is an unbelievably powerful tool. It’s hard to beat the zero-down payment feature and the lack of monthly mortgage insurance.

But is it always the "best" loan? That really depends on your specific financial picture.

In certain situations, a borrower with a sky-high credit score and a hefty down payment might find a conventional loan's terms just as competitive. The experts at RAC Mortgage can crunch the numbers for you, putting all your options side-by-side. This way, you can make the most informed decision for your family and your wallet.

Can I Get a VA Loan With Bad Credit?

VA loans are well-known for their flexible credit guidelines, but there's no magical minimum score set by the VA itself. Instead, lenders like us at RAC Mortgage will have their own credit requirements.

The good news? These requirements are often way more forgiving than what you'll find with conventional loans. Even if your credit history has a few bumps and bruises, you could still qualify for a VA loan. We work with veterans all across the credit spectrum and can give you solid advice on your specific situation.

The whole point of the VA loan program is to make owning a home more accessible for those who have served our country. Don't just assume your credit history knocks you out of the running; the best first step is always a simple conversation with a loan officer.

Are There Limits on How Much I Can Borrow?

One of the biggest myths out there is that the VA puts a hard cap on loan amounts. As of 2020, eligible veterans with their full entitlement can borrow as much as a lender is willing to approve—all with no down payment required.

This is a game-changer, especially in pricier housing markets. It means you aren't stuck with a specific loan size. Your actual borrowing power comes down to your income, credit, and overall financial health, not some arbitrary VA loan limit. Our team at RAC Mortgage can help you figure out your maximum borrowing capacity.

Ready to put your VA loan benefits to work? The path to owning a home with zero down is much clearer than you might think. Contact the dedicated team at Residential Acceptance Corporation today to get personalized advice and start your application. Let us show you how your service earned you this incredible opportunity.

Get Started with RAC Mortgage