The fundamental difference between a USDA loan and a conventional loan is simple. USDA loans are government-backed mortgages that allow for a 0% down payment, but they're restricted to homes in designated suburban and rural areas. Conventional loans, on the other hand, are not backed by the government, typically require a down payment, and give you complete freedom on where you can buy.

Which one is right for you? It really boils down to three things: how much you have saved, where you want to live around Tampa, and your overall financial picture.

Choosing Your Path to Tampa Homeownership

Navigating the mortgage world in Tampa can feel overwhelming, but it gets much clearer once you understand your two main options: USDA and conventional loans. Each program is built for a different kind of homebuyer, and the "best" choice is the one that fits your personal situation like a glove. With a little expert guidance from us here at Residential Acceptance Corporation (RAC Mortgage), you'll be able to confidently pick the financing that matches your homeownership dreams.

Unpacking the Basics

At its core, deciding between a USDA and a conventional loan is all about weighing the perks against the requirements. A conventional loan is what most people think of as a "standard" mortgage, funded by private lenders like banks and credit unions. It's the workhorse of the industry, known for its flexibility—you can use it to buy almost any property, anywhere from a downtown Tampa condo to a house in the suburbs.

Then you have the USDA loan, which is a more specialized option backed by the U.S. Department of Agriculture. Its whole purpose is to encourage people to buy homes in less-populated communities. Because the government is insuring it, lenders like RAC Mortgage can offer some amazing terms, including the big one: 100% financing, meaning no down payment is needed.

The biggest myth I hear about USDA loans in Florida is that they're just for farmers. That couldn't be further from the truth. In fact, more than 95% of the country's landmass is technically eligible, which includes many of the charming suburban towns just outside of Tampa's city limits.

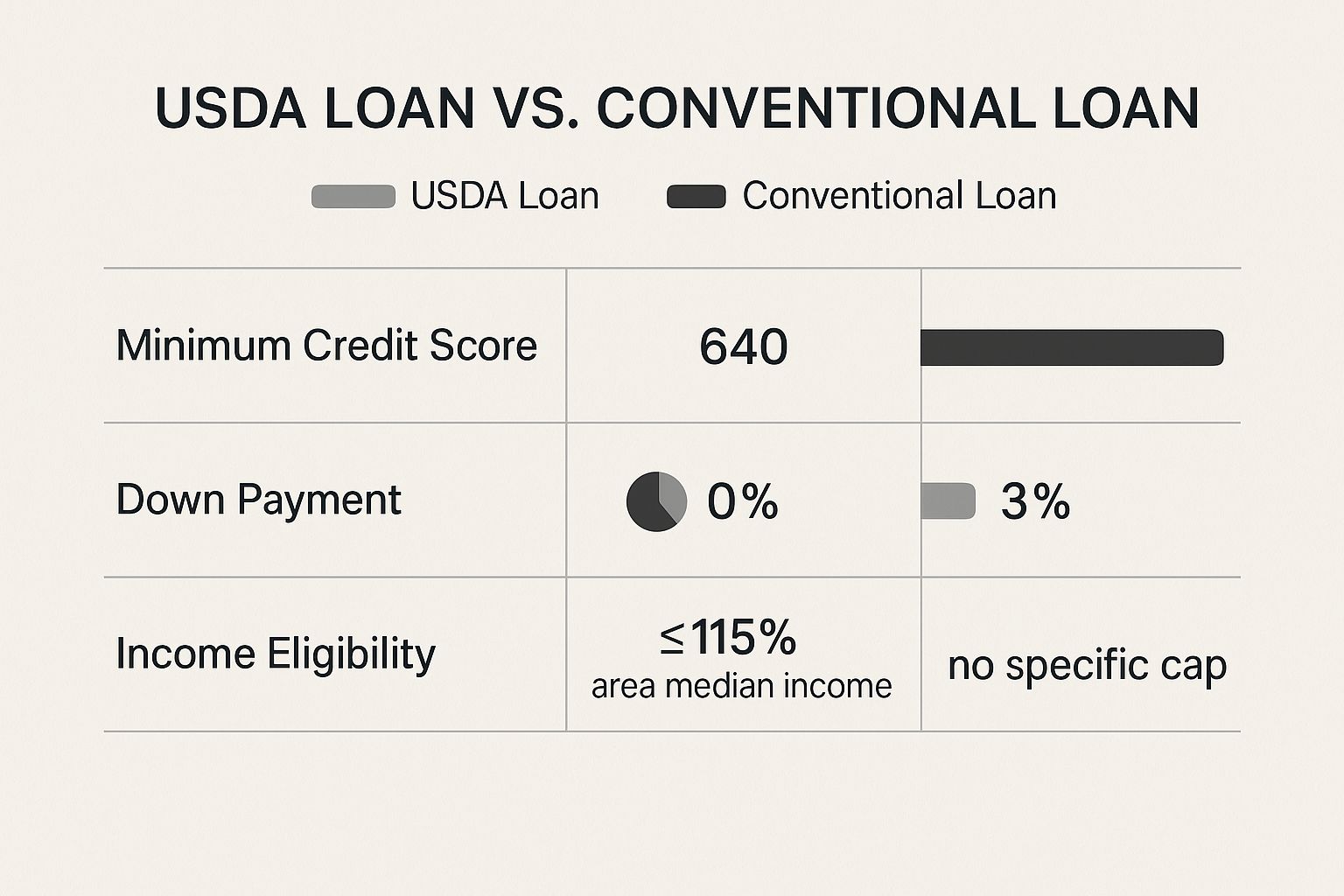

This quick table helps visualize the major differences right out of the gate:

| Feature | USDA Loan | Conventional Loan |

|---|---|---|

| Down Payment | 0% Minimum Required | 3% Minimum Required |

| Property Location | Must be in a USDA-eligible area | No geographic restrictions |

| Income Limits | Yes, based on household size and location | No, unless using a special program |

| Government Backing | Yes, insured by the USDA | No, privately funded |

Making the Right Choice for You

Ultimately, one loan isn't "better" than the other—they're just different tools for different jobs.

- A USDA loan could be a fantastic fit if you're light on savings for a down payment and have your eye on a home in one of the qualifying suburban areas surrounding Tampa.

- A conventional loan is usually the way to go if you have a down payment saved up, a solid credit history, and want the freedom to buy a home anywhere you please in Hillsborough County or beyond.

As we dig into the nitty-gritty of eligibility, costs, and property rules, you’ll start to see a much clearer picture of which loan is the right vehicle for your journey to owning a home in the beautiful Tampa Bay region.

Core Differences: A Side-By-Side Comparison

To really get to the bottom of the "USDA loan vs. conventional" question, you have to put them head-to-head on the details that actually matter to Tampa homebuyers. This isn't about which loan is universally "better," but which one fits your financial situation and goals right now. Let’s break down the main distinctions.

The biggest headline-grabber for the USDA loan is its 0% down payment requirement. This is an incredible advantage for buyers who have a steady income but haven't been able to sock away a huge chunk of cash for a down payment. A conventional loan, on the other hand, usually requires a minimum of 3% down, though putting down more can definitely help you lock in a better rate.

Location and Income: The Defining Lines

The most significant fork in the road comes down to geography and income. A conventional loan gives you total freedom. Want a condo in downtown Tampa? Go for it. A house anywhere in Hillsborough County? No problem. There are also no income caps, which makes it an option for a much broader spectrum of earners.

USDA loans are different. They're specifically designed to encourage people to buy homes in less populated areas. This means your new home has to be located in a USDA-approved rural or suburban zone. While this rules out the heart of Tampa, it includes many fantastic communities just outside the city. On top of that, your household income can’t be more than 115% of the area's median income, a rule that keeps the program focused on helping low-to-moderate-income families.

This infographic gives you a quick visual rundown of these key differences.

As you can see, the trade-offs are pretty clear. A conventional loan might let you get in with a lower credit score, but you'll need a down payment. The USDA loan's zero-down perk comes with strings attached in the form of income and location rules.

For a clearer picture, let's look at the core requirements in a simple table.

USDA Loan vs Conventional Loan At a Glance

| Feature | USDA Loan | Conventional Loan |

|---|---|---|

| Minimum Down Payment | 0% | 3% |

| Location Requirement | Must be in a USDA-eligible area | None |

| Income Limit | Cannot exceed 115% of area median income | None |

| Typical Minimum Credit | 640 | 620 |

| Mortgage Insurance | Upfront and annual fee (for life of loan) | PMI required under 20% down (can be canceled) |

| Property Types | Primarily single-family homes | Most property types (condos, multi-units, etc.) |

This table highlights the fundamental give-and-take. Your choice will depend on whether you prioritize a zero-down payment or the freedom to choose your location and earn a higher income.

Mortgage Insurance and Credit Score Expectations

Another critical piece of the puzzle is mortgage insurance. With a conventional loan, if you put down less than 20%, you’re going to be paying for Private Mortgage Insurance (PMI). The good news? You can ask to have your PMI dropped once you’ve built up 20% equity in your home.

USDA loans approach this differently. They require two types of mortgage insurance: an upfront guarantee fee, which you can often roll into the loan amount, and a smaller annual fee that’s paid monthly. This insurance stays with you for the entire life of the loan.

When comparing mortgage insurance, think long-term. Conventional PMI can eventually be canceled, potentially lowering your monthly payment years down the road. The USDA's annual fee is permanent but is often lower than PMI, especially for borrowers with lower credit scores.

Finally, let's talk credit scores. While official guidelines can vary by lender, here at Residential Acceptance Corporation, we typically look for a minimum credit score of 640 for a USDA loan. For conventional loans, the bar is often a little lower at 620. However, you’ll need a much stronger score to get the best possible interest rates on a conventional loan, making it more than just a numbers game.

A Deep Dive into Borrower Eligibility

When you start looking at mortgages, you'll quickly see that qualifying is about more than just your credit score. Comparing a USDA loan to a conventional one shows two very different paths for homebuyers in the Tampa area. Each loan is built for a different kind of borrower, so you really need to figure out which one fits your finances and your goals.

With a conventional loan, lenders are zeroed in on your financial stability. They'll dig into your credit history, see if you have funds for a down payment, and look closely at your debt-to-income (DTI) ratio. This ratio is just a simple way of seeing how much of your monthly income is already spoken for by other debts. Conventional loans give you a lot of freedom, but they definitely favor borrowers with a solid financial history.

USDA loans, on the other hand, have two unique deal-breakers you have to meet: household income limits and property location. These two rules are the heart and soul of the USDA program and what make it so different.

Understanding USDA Income and Location Rules

The whole point of the USDA loan program is to help low-to-moderate-income families buy homes in less crowded areas. Because of this mission, your entire household income can’t be more than 115% of the area's median income. And yes, that means the income of every adult living in the home, not just the people on the loan application.

The exact income cap changes from county to county, which is a big deal for anyone looking around Tampa. Our team at RAC Mortgage can help you pinpoint the specific limit for the county you're interested in.

Just as critical is where the house is located. It absolutely must be in a USDA-approved rural or suburban area. This means you can't buy in downtown Tampa, but it opens up a huge number of growing communities in places like Pasco, Polk, and Hernando counties. Your eligibility is literally tied to the property's address.

A lot of people hear "income limits" and immediately think they won't qualify for a USDA loan. The truth is, these limits are often surprisingly generous and adjust for your family size, which means many homebuyers looking in the Tampa suburbs are eligible.

Knowing these numbers before you start your search will save you a ton of time.

The Typical Conventional Loan Borrower

A conventional loan is usually the go-to for buyers who have a strong financial track record and want maximum flexibility. The ideal candidate for this loan usually has:

- A strong credit score, typically 620 or higher. The better your score, the better your interest rate will be.

- Money saved for a down payment, with at least 3% down being the standard minimum.

- A stable, provable income that shows you can comfortably handle the mortgage payment each month.

- A desire for total freedom in where they buy, letting them choose a home anywhere in the Tampa Bay area.

USDA loans have been a lifeline for rural buyers thanks to their zero-down payment feature and more affordable mortgage insurance. These are huge perks, but they come with the trade-off of those strict income and location rules that conventional loans simply don't have.

Ultimately, the best choice really comes down to your unique situation. A family with a steady but moderate income looking for a home in a community just outside Tampa might find the USDA loan is a perfect match. On the flip side, a buyer with significant savings and a high credit score will probably get more mileage out of the flexibility and wider property selection that comes with a conventional loan.

Analyzing the True Cost of Your Loan

The interest rate on your mortgage is just one piece of the puzzle. To really get a handle on what you'll be paying, you need to dig into the total costs—both what you owe at closing and what you'll pay month after month.

When you put a USDA loan and a conventional loan side-by-side, you'll see they have completely different fee structures. Understanding this difference is key to figuring out which one actually makes sense for your budget.

With a conventional loan, the costs are pretty straightforward. The biggest factor is your down payment. If you put down less than 20%, you’ll have to pay for Private Mortgage Insurance (PMI), which is an extra fee tacked onto your monthly payment to protect the lender.

A USDA loan, on the other hand, lets you skip the down payment entirely, but it has its own version of mortgage insurance. First, there's an upfront guarantee fee, which is usually 1% of the loan amount. The good news is you can often roll this right into your mortgage. Then, there's a smaller annual fee (paid monthly) that sticks around for the life of the loan.

Modeling the Costs in the Tampa Area

Let's ground this in a real-world example. Say you're looking at a $350,000 home in a USDA-eligible area just outside Tampa. Here’s how the numbers could shake out.

Scenario 1: USDA Loan (0% Down)

- Down Payment: $0

- Upfront Guarantee Fee (1%): $3,500 (this gets added to your loan)

- Total Loan Amount: $353,500

- Annual Fee (0.35%): Works out to about $103 extra per month.

The power of this option is obvious: you can get into a home without touching your savings for a down payment. That’s a massive win for anyone wanting to keep cash on hand for moving, furniture, or emergencies.

Scenario 2: Conventional Loan (5% Down)

- Down payment: $17,500

- Loan Amount: $332,500

- Estimated Monthly PMI: Could be anywhere from $150 to $250, depending on your credit.

Here, you need a good chunk of cash upfront. But the major advantage is that PMI isn't permanent. Once you've paid your mortgage down and have 20% equity, you can ask your lender to drop the PMI, which gives your monthly budget some breathing room. You can learn more about the specifics of the conventional loan down payment requirement in our detailed guide.

It really boils down to a trade-off: cash at closing versus long-term costs. A USDA loan saves you money upfront, while a conventional loan with a solid down payment can lead to lower monthly payments down the road once you get rid of PMI.

Long-Term Financial Implications

The decision you make today will echo for years. With a USDA loan, financing the guarantee fee means your loan balance starts a little higher, and the permanent annual fee means you'll carry that extra cost for the full 30 years. For many Tampa homebuyers, though, the ability to become a homeowner without draining their bank account is a trade-off they're happy to make.

Conventional loans, on the other hand, give you more freedom. There are no geographic restrictions, so you can buy anywhere. They also allow for higher seller concessions—up to 9% in some situations—which can be a huge help with closing costs. The catch? To get the best rates, lenders are typically looking for a credit score of 740 or higher and a down payment of at least 3% to 20%. This makes conventional loans a great fit for buyers with a strong financial track record and a little more cash saved up.

Ultimately, picking the right loan means looking past the advertised interest rate. Here at Residential Acceptance Corporation, we help Tampa buyers run the numbers on these scenarios to find the loan that truly fits their financial goals, ensuring there are no surprises on the way to closing day.

Finding a Home in the Tampa Bay Area

Before you even think about loan applications, you need a clear idea of where you want to buy. Knowing your target area first saves a ton of time and prevents you from getting attached to a home you can't finance with your chosen loan.

If you’re leaning toward a conventional loan, your options are wide open. You can look at practically any property in Hillsborough County and the surrounding areas—whether it's a downtown condo, a single-family home in the suburbs, or even a multi-unit investment property. There are no geographic fences.

A USDA loan, on the other hand, is specifically for properties in designated rural or suburban zones. The good news for Tampa Bay buyers is that many communities just outside the main city limits actually qualify.

- Pasco County neighborhoods with great highway access

- Polk County towns seeing new school expansions

- Suburban areas along the Gulf Coast in Manatee County

Figuring out which loan makes sense for you often comes down to the property's address. Jump the gun and start house hunting without checking eligibility maps, and you could be setting yourself up for disappointment.

That's why it's so important to use the USDA's eligibility map right from the start. This tool shows you exactly which areas qualify, so you can focus your search on homes that are actually eligible for that no-down-payment financing.

Using the USDA Eligibility Map

It’s simple to use. Just plug a property address into the USDA map’s search bar. The map will highlight all the approved rural and suburban zones, making it clear what's in and what's out.

Try zooming in on areas like Pasco, Polk, and Hernando counties. You’ll be surprised at how many up-and-coming suburbs are eligible for USDA financing. Many RAC Mortgage clients find hidden gems this way.

Before you even schedule a showing, check every potential property's address on the map. When you align your search with the USDA rules from day one, that zero-down payment dream becomes a realistic goal.

“Most buyers are surprised to discover large parts of Pasco qualify for USDA loans.”

Comparing Key Locations

Let’s look at a couple of real-world scenarios. Imagine Joe, who’s got his heart set on a low-maintenance condo right in downtown Tampa. A conventional loan gives him the freedom to choose any building he wants, even one right on Bayshore Boulevard.

Now meet Lisa. She loves the idea of a craftsman-style home in Zephyrhills. A USDA loan is perfect for her because she can buy with 0% down. This lets her use her savings for things like landscaping and new furniture instead of a hefty down payment.

As you narrow your search, think about the practical details—commute times, school districts, and access to shopping. Homes in more rural, USDA-eligible areas often give you more house for your money, but you might have a longer drive to work.

Also, keep in mind that things like maintaining a larger yard or having a private well are more common in USDA zones. You'll need to weigh these lifestyle factors against the convenience of city utilities.

| Location Focus | Loan Type | Benefit |

|---|---|---|

| Downtown Tampa Condo | Conventional | Unlimited geographic choice |

| Zephyrhills Residence | USDA | 0% down plus suburban space |

Aligning Your Search with Financing

When you view local listings through the lens of your loan's requirements, your house hunt becomes so much more efficient. You stop wasting time on properties that were never an option in the first place.

Working with a loan officer who really knows the Tampa Bay USDA boundaries is a huge advantage. Here at RAC Mortgage, our specialists can help you verify addresses and get preapproved without any of the usual headaches.

- Always confirm the sewer and water hookups in rural areas.

- Compare the property tax rates between different counties.

- Research local school ratings if that's a priority for your family.

Precise eligibility checks save buyers weeks of wasted search.

Looking at the bigger picture, in 2020, 73% of all mortgages were conventional loans, while USDA loans made up just 1%. This shows how widely available conventional loans are, but it also highlights the specific niche that USDA loans fill; learn more about these findings.

For a complete guide to mapping out neighborhoods and getting your budget in order, check out our House Hunting Checklist and Tips.

This smart approach keeps your search focused and productive. When you team up with a RAC Mortgage loan officer, we can help you refine your shortlist and get to the closing table faster.

The best first step is to get prequalified. It sets a clear budget and shows sellers you're a serious buyer. RAC Mortgage can help you get that decision letter in hand quickly, so you can start shopping with confidence.

Partner with RAC Mortgage for Your Home Loan

Deciding between a USDA and a conventional loan is a big deal, but you don't have to figure it out on your own. Having an experienced local guide in your corner makes all the difference. At Residential Acceptance Corporation (RAC Mortgage), we specialize in matching Tampa-area homebuyers with the perfect financing for their specific needs.

Our team lives and breathes the Tampa Bay community, which gives us an intimate understanding of the local market. We know the ins and outs of the "USDA loan vs conventional" debate as it plays out in neighborhoods across Hillsborough, Pasco, Polk, and Manatee counties. That kind of local insight is priceless.

Your Guide to Tampa Home Loans

Getting the right mortgage isn't about finding an off-the-shelf product; it's about getting personalized advice. We don't do cookie-cutter loans. Instead, we sit down with you to really understand your finances, your long-term goals, and where you want to put down roots. Only then can we recommend a loan that genuinely works for you.

Maybe that means finding a great school district in a USDA-eligible suburb or structuring a competitive conventional loan offer in a hot market. Whatever your goal, we're focused on helping you achieve it. We’re committed to giving you clear, straightforward guidance from pre-approval all the way to closing day, cutting through the confusion.

Choosing a mortgage is more than just a transaction; it's the foundation for your future. Our mission at RAC Mortgage is to give you the clarity and confidence you need to take that step successfully right here in the Tampa Bay area.

Take the Next Step with Confidence

Ready to see which loan program fits your dream of owning a home in Tampa? The next step is a simple, no-pressure chat with one of our loan officers. We can walk through your situation, answer your questions about USDA and conventional loans, and lay out a clear path forward.

Let our team at RAC Mortgage help make your homeownership goals a reality. We're here to make sure you get the right financing with terms that fit your budget, so you can move forward with total peace of mind.

- Expert Local Knowledge: We're specialists in the unique real estate landscape of Tampa Bay.

- Personalized Consultations: Your financial story is unique, and your loan should be, too.

- Clear, Simple Guidance: We break down the jargon and make the entire process easy to understand.

Connect with a Residential Acceptance Corporation loan officer today to begin your journey.

Got Questions? We've Got Answers

When you're comparing USDA and conventional loans, a lot of specific questions pop up. It's totally normal. Here are some of the most common things we get asked about here at Residential Acceptance Corporation, especially from folks looking to buy in the Tampa area.

Can I Refinance from a USDA Loan to a Conventional One?

Yes, and it’s a very common move. Many homeowners who start with a USDA loan eventually switch over to a conventional one once they've built up a good chunk of equity.

The main driver? Getting rid of the USDA's annual fee. Once you hit 20% equity in your home, refinancing into a conventional loan usually means you can say goodbye to private mortgage insurance (PMI) for good. That single change can drop your monthly payment by a surprising amount.

In Tampa, Which Loan Gets Me to Closing Faster?

Hands down, conventional loans almost always close faster. In a hot market like Tampa, speed is everything. With a complete file, we can often get a conventional loan closed in as little as 18 to 20 days at RAC Mortgage. A quick closing can make a seller take your offer much more seriously.

USDA loans just have an extra step built in. After our underwriters approve everything, the entire file has to go to the USDA for their final sign-off. That can easily add a week or more to your timeline. We push it through as fast as we can, but that final government review is part of the deal.

For a Tampa homebuyer in a multiple-offer situation, the faster closing time of a conventional loan can be a powerful negotiating tool. However, for those prioritizing the 0% down payment, the slightly longer wait for a USDA loan is often well worth it.

What About a Fixer-Upper? Can I Use a USDA Loan?

That's a definite "maybe." It really depends on what "fixer-upper" means. USDA has strict minimum property standards—the home has to be safe, sanitary, and structurally sound from day one. If a house just needs some fresh paint or new carpets, you're probably in the clear.

But if you're looking at a place that needs major work—like a new roof, foundation repairs, or a full HVAC replacement—it won't pass the USDA inspection. For those kinds of projects, you'd be better off looking at a conventional renovation loan, which is designed to roll the cost of the repairs right into your mortgage. Our team at Residential Acceptance Corporation can look at a specific property with you and tell you if it's likely to meet the USDA's requirements.

Ready to figure out the best path for your Tampa home purchase? Whether a USDA or conventional loan makes the most sense for you, the expert team at Residential Acceptance Corporation is here to give you straightforward advice and find the right mortgage for your situation.

Get started with your home loan application today!