If you've heard "no" from a traditional lender, it’s easy to feel like owning a home in Tampa is off the table. But what if your unique financial story isn't a roadblock? What if you just need a different kind of lender?

The short answer is: you have options. A dedicated Tampa mortgage lender with exceptions, like us here at RAC Mortgage, is built specifically to help people in your exact situation.

Finding Your Place in the Tampa Mortgage Market

So many people in Tampa—from gig workers and freelancers to small business owners—don't fit into the neat little W-2 box that big banks love. A lender who specializes in exceptions, like RAC Mortgage, has built its entire business model around this reality. Think of this guide as your roadmap for when your finances don't tick all the standard boxes.

We’re going to break down what a mortgage exception really is, how you can build a standout application, and show you why having a non-standard profile is far more common than you’d think. It's time to stop hitting dead ends and find a partner who sees your complete financial picture.

A Growing Market Demands Flexibility

The Tampa housing scene is moving fast. Between March 2022 and early 2024, the housing inventory in the Tampa-St. Petersburg-Clearwater metro area exploded by a staggering 528%. This isn't just a random statistic; it means more homes are available, which in turn encourages lenders to be more flexible, even for borrowers needing non-standard loans.

The real secret is finding a lender that still practices manual underwriting. This means a real person—not an algorithm—reviews your entire file. They're trained to look for your strengths to balance out any potential weaknesses, instead of just letting a computer say yes or no.

And once you secure that loan, don't forget the next step. Understanding your mortgage protection options is a critical part of being a responsible homeowner. It protects your family and your investment. A good local lender won’t just get you the keys; they’ll guide you toward smart solutions that make sense for Tampa’s unique economy.

Common Scenarios Requiring a Lender with Exceptions

Many borrowers think their situation is a deal-breaker, but often it's just a matter of finding the right lender. We see these kinds of scenarios every day. Here’s a quick look at common situations where a lender that offers exceptions can make all the difference.

| Borrower Scenario | Traditional Lender Challenge | How an Exception-Based Lender Helps |

|---|---|---|

| Self-Employed for 18 Months | Fails to meet the standard 2-year history requirement. | Uses bank statements or a 12-month P&L to verify income, recognizing business potential. |

| Credit Score of 610 | Below the common lender "overlay" minimum of 620-640 for an FHA loan. | Works directly with FHA's 580 minimum, underwriting the file based on its overall strength. |

| Recent Job Change (Different Field) | The change in career path is seen as unstable income. | Focuses on the new, higher salary and career trajectory, not just the past. |

| High Debt-to-Income (DTI) Ratio | An automated system flags any DTI over 43% as too risky. | Manually underwrites the loan, considering compensating factors like high cash reserves. |

Ultimately, a lender with exceptions isn't just bending the rules; they're using common-sense underwriting to approve deserving borrowers who just don't fit the rigid mold.

What Mortgage Exceptions Actually Mean for You

The phrase "mortgage exception" sounds a bit like you're asking for a huge, rule-breaking favor, doesn't it? The reality is much simpler. It's really about finding a lender that has underwriting flexibility—one that looks past the automated approval systems to see your complete financial picture.

Instead of a computer algorithm just spitting out a "yes" or "no," a lender like RAC Mortgage uses manual underwriting. This means an actual person is reviewing your file, actively looking for reasons to say yes to your loan, not just hunting for reasons to deny it.

For a lot of Tampa homebuyers, this human-first approach makes all the difference.

Where Flexibility Makes a Difference

When you find a Tampa mortgage lender with exceptions, you're working with a team that can apply common sense to specific parts of your application. These aren't sneaky loopholes; they're reasonable adjustments based on your overall financial stability.

We see this come into play most often in a few key areas:

- Debt-to-Income (DTI) Ratios: If your DTI is a little on the high side but you’ve got significant cash reserves or a solid history of saving, that's a huge compensating factor.

- Varied Credit Histories: Life happens. A past credit hiccup shouldn't automatically disqualify you, especially if you can point to a strong, consistent payment history since then.

- Alternative Income Proof: In Tampa’s dynamic economy, not having traditional W-2s is incredibly common.

Let's say you're a freelance graphic designer. A traditional big bank might see the lack of W-2s and shut the door immediately. At RAC Mortgage, we can use 12 or 24 months of your bank statements to verify a stable, predictable income. Suddenly, a major roadblock becomes a simple paperwork step.

A mortgage exception isn’t about bending the rules; it’s about applying them with context and common sense to your unique financial situation. It’s about seeing you as a person, not just a credit score.

This kind of flexibility is a cornerstone of what are known as Non-Qualified Mortgage (Non-QM) loans. These products were built from the ground up for borrowers whose financial stories don't fit into a neat, conventional box. To see how it works, you can read through the specific Non-QM loan requirements that detail how different forms of documentation can get you approved.

How to Prepare a Compelling Mortgage Application

When your financial situation doesn't fit neatly into the standard borrower box, your application has to do more than just present the numbers. It needs to tell a story. Think of it as building a strong case to present to a Tampa mortgage lender with exceptions. Your main goal is to make the underwriter's job of saying "yes" as easy as possible.

A great place to start is with a powerful Letter of Explanation (LOX). This is your opportunity to get ahead of any potential questions or red flags. For instance, maybe you had a credit hiccup two years ago because of an unexpected medical bill. The LOX lets you explain exactly what happened, show how your finances have recovered, and prove it was a one-off event, not a pattern.

Organize Your Financial Story

Next, get all your financial paperwork in order, especially if your income is anything but traditional. If you're self-employed, this means having clean, easy-to-follow profit-and-loss statements or bank statements ready to go.

Presenting a clear financial narrative helps an underwriter see you as a responsible borrower, even if your income isn't coming from a standard W-2. It removes the guesswork for them.

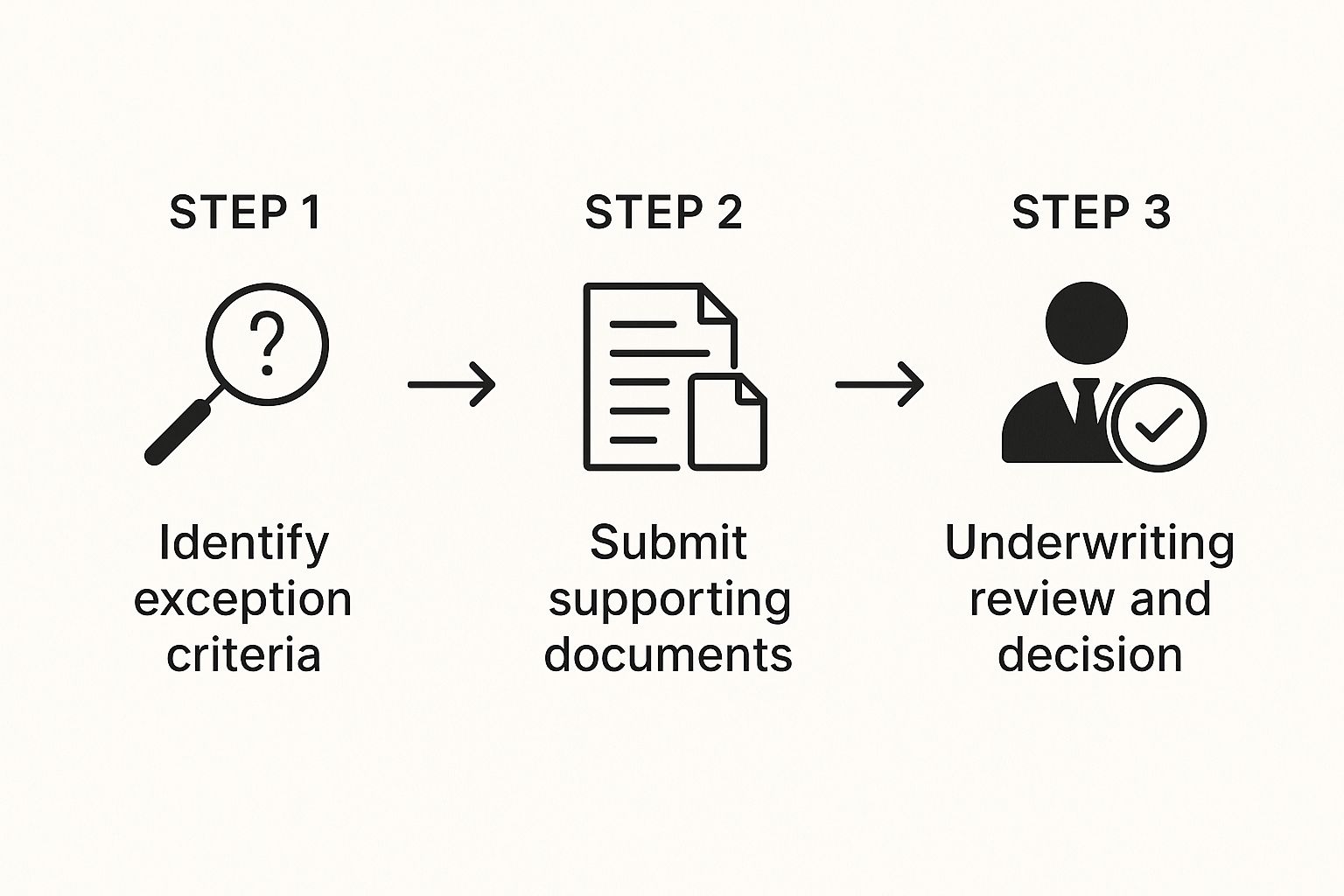

The path to getting an exception-based loan is actually pretty straightforward once you know the steps.

As you can see, once you know what exception you need, success really boils down to providing the right documents to back up your case during the underwriting review.

To make sure you've got everything covered, it's a huge help to know exactly what documents are needed for a mortgage. Having a complete package from the very beginning prevents frustrating delays and shows you’re a serious, prepared buyer.

Think of your application like a business proposal. You're not just asking for a loan; you're making a strong case for why you are a reliable investment. A well-organized file with clear, honest explanations speaks volumes.

By taking these extra steps, you turn a simple stack of forms into a persuasive argument. This sets you up for a much smoother approval process, especially with a lender who understands that not everyone's financial life looks the same.

How to Find the Right Tampa Lender for Your Needs

Let's be real—not all lenders are created equal. This is especially true when your financial picture doesn't fit neatly into a box. Finding the right lending partner from the get-go is the most critical step you can take. It saves you from wasting weeks, or even months, with big banks that simply can't help.

The secret is to look for a portfolio lender.

Unlike the giant retail banks that package up and sell their loans on the secondary market, a portfolio lender like RAC Mortgage actually holds onto the loans they make. This one difference gives them the power to set their own underwriting rules and make decisions based on common sense, not just an algorithm.

Asking the Right Questions Upfront

When you first talk to a potential lender, a few strategic questions can tell you everything you need to know. This initial chat is your chance to see if they’re just another rigid institution or a true partner who can offer a mortgage with exceptions.

Don't just ask if they can help. Get specific.

- "What kind of programs do you have for self-employed buyers or people with income that isn't a simple W-2?"

- "My credit score is a little below what conventional loans require. How do you approach that?"

- "Could you walk me through your manual underwriting process? What sort of compensating factors do you look for?"

Their answers will be incredibly revealing. If they stumble, give you vague responses, or sound unsure, they’re probably stuck using automated systems. But a lender like RAC Mortgage will have clear, confident answers because we've built our whole business to handle these exact situations.

Finding the right lender isn't about luck; it's about strategy. By focusing your search on a portfolio lender whose business model is designed for exceptions, you dramatically increase your chances of a successful and smooth home buying experience.

This strategy is more important than ever right now. While the national average for 30-year fixed mortgage rates has been hovering above 6%, Florida lenders often have access to more competitive regional rates. A good Tampa lender can use these conditions to help borrowers who don't tick every conventional box but are otherwise strong, reliable buyers.

Ultimately, your success comes down to partnering with the right expert. For a much deeper dive into what that looks like, check out our guide on finding a Tampa mortgage lender with flexible guidelines.

Why Tampa's Economy Demands Flexible Lending

Ever wonder why finding a Tampa mortgage lender with exceptions is such a big deal in our city? It's simple: Tampa’s economy isn't built on a foundation of 9-to-5s anymore.

Our city is a buzzing hive for entrepreneurs, consultants, remote workers, and gig economy pros. These are the people driving Tampa forward, but their income doesn't show up in a neat, predictable W-2 package every two weeks.

This reality creates a massive blind spot for traditional lenders. I've seen it happen time and again: a talented freelance web developer, making great money and building a thriving business, gets an instant denial from a big bank's algorithm. It's not because they can't afford the home—it's because their income doesn't fit into a rigid, outdated box.

That's precisely where a lender who understands our local market, like RAC Mortgage, comes into play. We fill a need that's absolutely vital for the community.

Lenders Have to Adapt to Tampa's Dynamic Job Market

The way people work in Tampa today demands a modern take on lending. Lenders who refuse to adapt are simply leaving a huge chunk of qualified, creditworthy homebuyers out in the cold. So if your financial situation looks a little different, know that you're not an outlier; you're part of a major economic shift happening right here in our backyard.

The need for flexibility isn’t just some passing trend. It's a direct response to the way Tampa actually works now. Smart lenders get this. They’ve adjusted their models to serve this dynamic and growing group, making sure they get the same shot at homeownership as everyone else.

This isn't just theory—you can see this adaptive mindset starting to pop up across the local lending scene. For example, Tampa's commercial mortgage trends show lenders are already willing to adjust their terms to meet the realities of the local market. It proves a broader understanding that making common-sense exceptions is how you succeed in an evolving economy like ours.

At RAC Mortgage, we live by this flexible approach. We provide the kind of common-sense underwriting that Tampa's unique economy and its hard-working residents deserve.

Common Questions About Tampa Mortgage Exceptions

When your financial picture doesn't fit neatly into a box, it's natural to have a few questions. I get it. Stepping outside the "standard" mortgage path can feel a little uncertain.

Let's clear the air and tackle some of the most common concerns we hear from borrowers looking for a Tampa mortgage lender with exceptions. My goal here is to give you the confidence that a different financial story shouldn't stop you from owning a home.

Will I Have to Pay a Higher Interest Rate?

Not necessarily. It's a common misconception. While rates are certainly tied to risk—and something like a lower credit score can play a role—a lender that handles exceptions, like us at RAC Mortgage, looks at your entire financial profile. We don't just zero in on one number.

Strong compensating factors can make all the difference. Things like a substantial down payment, plenty of cash reserves, or a long, stable history of self-employment can often land you a very competitive rate. Our manual underwriting process means we see the strengths an automated system would miss.

The real beauty of working with an exception-based lender is that we assess your complete financial health. A higher down payment of 20% or more, for instance, can often completely offset other perceived risks and lead to much better loan terms.

How Long Does This Whole Process Take?

Honestly, the timeline can sometimes be a bit longer than a fully automated loan. That’s because it involves a real person—an actual underwriter—who is carefully piecing together your full story from all your documents.

But here’s the key: being prepared makes a massive difference. Having all your paperwork organized and ready from the get-go can dramatically speed things up. For many of our borrowers at RAC Mortgage, the total time from a complete application to closing is often between 30-45 days, which is right in line with a typical mortgage.

What’s the #1 Reason People Need an Exception in Tampa?

Hands down, it's non-traditional income. Tampa is a hotspot for entrepreneurs, gig workers, independent contractors, and even retirees whose income comes from investments or pensions.

We see so many creditworthy people who simply don't have a standard W-2 to show for their hard work. That's where we come in. Lenders like RAC Mortgage specialize in using alternative documents, like 12 or 24 months of bank statements, to verify income. It’s how we help these deserving buyers get the keys to their new home.

Ready to talk to a Tampa lender who sees more than just the numbers? The team at Residential Acceptance Corporation is here to listen to your story and find a real solution that works for you. Start your journey by visiting us at https://racmortgage.com today.