It's a question we hear all the time: Can I actually get a home loan from a Tampa mortgage lender without my tax returns?

The short answer is yes, absolutely. For the self-employed, freelancers, and small business owners who power Tampa's economy, there's a smarter way to show your financial strength. It involves using alternative documents, like your bank statements, to prove your real income.

This approach, a specialty of lenders like Residential Acceptance Corporation (RAC Mortgage), focuses on your actual cash flow—the money coming in and out of your business—not just the net income you show the IRS after all your legitimate deductions.

The Problem with Mortgages for Tampa's Entrepreneurs

If you're one of Tampa's thriving entrepreneurs, you know that a strong, consistent income doesn't always make for a smooth mortgage approval. The real issue is the disconnect between how you run your business and how traditional lenders verify your finances.

The entire conventional process is built for W-2 employees. It's rigid.

This system revolves almost entirely around tax returns. But for any savvy business owner, tax returns are strategic tools. You use them to legally minimize your tax liability with legitimate deductions and write-offs. That's just smart business, but it throws a huge wrench in the works when you're trying to get a mortgage.

Why Tax Returns Don't Tell the Whole Story

Think about a successful marketing consultant right here in Tampa. Their business is pulling in substantial revenue every month. But after they deduct necessary expenses—software, business travel, home office costs, maybe even a vehicle—the net income on their tax forms looks much more modest.

A conventional underwriter looks at that lower number and might just stamp "denied" on the application. They completely miss the robust cash flow that truly reflects the business's health and the owner's actual purchasing power.

It's a common and incredibly frustrating scenario. You're essentially penalized for using the tax code exactly as it was intended. Your financial reality is strong, but the paperwork tells a completely different, and far less impressive, story.

The biggest hurdle for self-employed borrowers is that their qualifying income is almost always based on the adjusted gross income after all business expenses are subtracted. That net figure, not your gross revenue, is what conventional lenders use to decide how much you can borrow.

This system has locked far too many entrepreneurs out of the very real estate market they're helping to build. With Tampa's population growing by around 3.3% since 2020, the demand for housing—and for smarter mortgage solutions—has never been higher. You can dig into more of Tampa's mortgage market trends over on ncrc.org.

A Different Approach to Lending

Fortunately, the mortgage industry has started to catch up. A specialized Tampa mortgage lender no tax returns expert like Residential Acceptance Corporation (RAC Mortgage) gets it. We understand this gap because we work with business owners every single day.

Instead of getting hung up on tax documents that paint an incomplete picture, we know how to look beyond the standard forms.

RAC Mortgage focuses on what really matters for an entrepreneur:

- Consistent Cash Flow: We analyze your bank statements to see the real money coming into your business accounts.

- Business Viability: We take the time to understand the health and stability of your enterprise.

- True Financial Health: We build a complete financial profile that accurately reflects your ability to repay a loan.

This common-sense approach opens doors for Tampa's business community, offering a fair and accurate assessment of your ability to buy a home.

How No Tax Return Mortgages Actually Work

Getting a mortgage without tax returns might sound like a long shot, but it's more common than you think, especially here in Tampa. It really just comes down to looking at your income a different way. Instead of handing over a W-2 or a tax filing, a specialist Tampa mortgage lender no tax returns expert at RAC Mortgage uses other documents to prove you can afford the home.

These kinds of loans fall under the Non-Qualified Mortgages (Non-QM) umbrella. Think of them as the flexible, common-sense alternative to conventional loans. While big banks have rigid, one-size-fits-all rules, Non-QM loans are built for people whose financial lives don't fit neatly into a standard box.

Bank Statement Loans The Entrepreneur's Choice

For self-employed folks in Tampa, the go-to option is almost always a Bank Statement Loan. It’s a game-changer for business owners whose tax returns don't tell the whole story because of legitimate business write-offs and deductions.

Here’s how we break it down at RAC Mortgage:

- Income Analysis: We'll look at 12 to 24 months of your personal or business bank statements. No tax documents needed.

- Deposit Verification: Our focus is on the consistency of your deposits. We want to see the real cash flowing into your accounts to calculate a reliable monthly income.

- A Realistic Picture: This process shows us the true revenue your business is pulling in, not just what’s left after you’ve deducted every possible expense.

I see this all the time. A local Tampa restaurateur, for example, might show a pretty modest profit on their tax return after accounting for food costs, payroll, and new kitchen gear. But their bank statements paint a much brighter picture, with strong, steady deposits coming in every single day. A Bank Statement Loan uses that actual cash flow, not the "paper" profit, to get them qualified.

To get a better feel for this, you can learn more about how a Non-QM mortgage lender in Florida approaches these unique financial situations.

Which No Tax Return Loan Fits Your Profile?

Choosing the right program is key. This simple table breaks down our most popular options to help you see where you might fit.

| Loan Type | Best For | How Income is Verified | Common Down Payment |

|---|---|---|---|

| Bank Statement | Self-employed, freelancers, small business owners | 12-24 months of bank statement deposits | 10-20% |

| Asset-Based | Retirees, investors, high-net-worth individuals | Liquid assets (stocks, bonds, retirement funds) | Varies based on assets |

| Stated Income (DSCR) | Real estate investors | Property's rental income (must cover mortgage) | 20-25% |

Each loan serves a different purpose, but they all solve the same problem: getting you a mortgage without relying on traditional income documentation.

Asset-Based Loans For High-Net-Worth Borrowers

Another fantastic option is the Asset-Based Loan, which you might also hear called an asset depletion loan. This is perfect for borrowers who have significant liquid assets but maybe not a steady, traditional paycheck.

Instead of looking at income, we qualify you based on your wealth. We can use assets like your stock portfolio, bonds, 401(k), and other investments to calculate a qualifying "income" figure. It's an ideal solution for retirees living off their nest egg, savvy investors, or anyone whose financial strength lies in their portfolio.

These specialized loans are surprisingly competitive and accessible. They often lead to faster approvals because the paperwork is more straightforward than a traditional loan file. Of course, a lot of factors go into any approval, and it helps to understand what affects your mortgage loan qualification from the start.

When you partner with RAC Mortgage, you're not just another application. You get a team that knows exactly how to frame your unique financial picture to get you approved.

Gathering Your Alternative Loan Documentation

Moving away from tax returns and toward alternative documents might sound complicated, but with the right game plan, it’s pretty straightforward. When you work with a specialist like us at Residential Acceptance Corporation (RAC Mortgage), we know how to look past the usual paperwork to see your real financial picture. That means focusing on documents that show your actual cash flow.

Instead of tax forms, the entire foundation of a no-tax-return mortgage rests on your bank statements. This is the primary evidence a Tampa mortgage lender no tax returns expert will use to build a strong case for your loan approval.

What Underwriters Look for in Your Bank Statements

At RAC Mortgage, our underwriting team dives deep into 12 to 24 months of your business or personal bank statements. We're not just glancing at the final balance; our job is to analyze the consistency and sources of your deposits. From there, we can calculate a dependable monthly income figure.

Here's a quick breakdown of what we're looking for:

- Complete Statements: We need every single page for the required period. Yes, even the blank ones. It’s a compliance thing.

- Consistent Deposits: A predictable pattern of revenue coming into your accounts is what underwriters love to see. A few massive, random deposits are much harder to verify than steady, recurring income.

- Clear Separation of Funds: If you can, keep your business and personal finances in separate accounts. This makes the review process infinitely smoother and shows you’ve got a good handle on your finances.

To help get your financial records in order, a bank statement converter can be a surprisingly useful tool. It helps turn those clunky PDF files into formats that are easier to work with and analyze.

Preparing Your Financial File

Beyond your bank statements, a couple of other key documents help us paint the full picture of your financial health. Getting these ready ahead of time will seriously speed up your approval.

A Profit & Loss (P&L) statement prepared by your CPA is often essential. This document gives context to the deposits we see on your statements by providing a clear summary of your revenues and expenses.

Pro Tip: Be prepared to explain any large, non-business deposits. An underwriter is absolutely going to ask about them. Documenting where that money came from—maybe the sale of an asset or a family gift—saves a ton of back-and-forth and prevents last-minute headaches.

Finally, knowing exactly what to gather is half the battle. You can get a more comprehensive checklist by checking out our guide on what documents are needed for a mortgage. The goal is simple: present a clean, organized file that proves you can repay the loan. At RAC Mortgage, we have a proven system to help you do just that.

How to Win in Tampa's Housing Market With Your Loan

So, you have your financing lined up. But how does a no-tax-return mortgage really stack up in Tampa's white-hot real estate market? It's a common worry for many self-employed buyers—the fear that a non-traditional loan might get pushed to the bottom of the pile when sellers are looking at offers backed by conventional financing.

Believe it or not, the opposite is often true when you work with the right specialist.

A rock-solid pre-approval from a Tampa mortgage lender no tax returns expert, like us at Residential Acceptance Corporation (RAC Mortgage), can actually make your offer shine. We give sellers the peace of mind they’re looking for by showing that your finances have been meticulously vetted by professionals who live and breathe complex income scenarios.

Gaining That Competitive Edge

Picture this: A local business owner is trying to buy a home in a sought-after Tampa spot like Hyde Park or Seminole Heights. They’ve found their dream property, but they’re going head-to-head with multiple offers, including one from a W-2 employee with a pre-approval from a big national bank.

Their secret weapon? Preparation.

Long before they even thought about making an offer, they worked with RAC Mortgage to nail down a pre-approval using 24 months of their business bank statements. When their real estate agent submits the offer, it includes our pre-approval letter and a quick note explaining that the buyer’s income has already been fully documented and verified.

This completely changes the game. The seller and their agent don't see a question mark; they see a serious, well-prepared buyer who is ready to go.

A pre-approval from a specialized lender like RAC Mortgage signals to sellers that you are a credible and financially sound buyer. It demonstrates that your non-traditional income has been professionally analyzed and approved, often making your offer just as strong, if not stronger, than a conventional one.

Putting Seller Concerns to Rest

Sellers usually have two big worries: closing times and financing falling through. They get nervous that a non-traditional loan will drag on for weeks or collapse at the eleventh hour.

An experienced lender like RAC Mortgage tackles these fears from the get-go. Our entire process is built for speed, and we often close loans in just 18 to 20 days once we have a complete file. That efficiency is a massive advantage in any negotiation.

Of course, being a prepared buyer goes beyond just the loan. Understanding the full picture of Florida homeownership shows sellers you’re serious. This includes knowing your estimated property taxes and getting a handle on how much hurricane insurance costs in Florida. Having these ducks in a row proves you're ready for the long-term commitment.

The Tampa real estate scene has shifted dramatically. Between March 2022 and early 2025, the Tampa-St. Petersburg-Clearwater area saw housing inventory explode by a staggering 528%. This boom has made lenders more eager to work with the area's growing class of entrepreneurs, embracing products like no-tax-return loans.

With RAC Mortgage, you’re not just getting a loan. You’re getting a strategic partner who knows exactly how to position you to win.

Why Choose RAC Mortgage for Your Tampa Home

Trying to navigate the Tampa housing market as an entrepreneur is tough enough. You need more than just a loan; you need a financial partner who actually understands your world.

Big banks tend to see your tax returns as the be-all and end-all. We see them as just one page in a much bigger story. At Residential Acceptance Corporation (RAC Mortgage), we’ve built our entire process around the financial realities of being self-employed.

We don't just offer no tax return mortgages—we specialize in them. This isn't a side product for us; it's our main focus. That means you get to work with a team that has deep, firsthand expertise in evaluating complex income streams. We know exactly what to look for in your bank statements and how to build a rock-solid loan file that shows your true purchasing power.

A Process Built for Entrepreneurs

Forget the rigid, one-size-fits-all approach you’ll find at a traditional lender. Our system is designed from the ground up for alternative documentation, which means a faster, smoother journey for you. No jumping through endless hoops.

- Local Market Insight: We are a Tampa mortgage lender that lives and breathes the local real estate market, giving you a serious competitive edge.

- Direct Communication: You’ll get personalized, hands-on guidance from a loan officer who speaks your language—not a call center agent reading from a script.

- Speed and Efficiency: We're committed to closing loans in 18 to 20 days once we have a complete file. In a market that moves this fast, that's a game-changer.

This is about more than just getting a loan. It's about getting the right loan with a partner who respects the blood, sweat, and tears you’ve poured into your business.

Even if your financial picture has some bumps, like a lower credit score, our specialized knowledge can often find a path forward. You can learn more about how we help in those situations here: Tampa mortgage lender for bad credit.

Working with a specialist means you're not trying to fit a square peg into a round hole. RAC Mortgage already has the right tools and experience to understand your business finances, eliminating the frustration of educating a lender on how entrepreneurial income works.

Your Partner in Homeownership

Your success as a business owner should be a key that unlocks the door to your dream home, not a barrier that keeps you out. We believe in the entrepreneurs driving Tampa's economy forward, and we've created a mortgage experience that proves it.

Choosing RAC Mortgage means partnering with a team that sees your financial strength the way you do. We look beyond the tax forms to what really matters: your consistent cash flow and business stability.

It's time to work with a Tampa mortgage lender no tax returns expert who is truly invested in your success. Schedule a consultation today and let's start your journey toward homeownership with a partner who finally gets it.

Your Top Questions About No Tax Return Mortgages

Even when you know there’s a path forward, it’s completely normal to have questions. As a Tampa mortgage lender that specializes in no tax returns financing, we at Residential Acceptance Corporation (RAC Mortgage) believe in giving you direct, honest answers. We want you to feel confident every step of the way.

Here are some of the most common questions we hear from self-employed and entrepreneurial home buyers all across Tampa.

What Kind of Credit Score Do I Need?

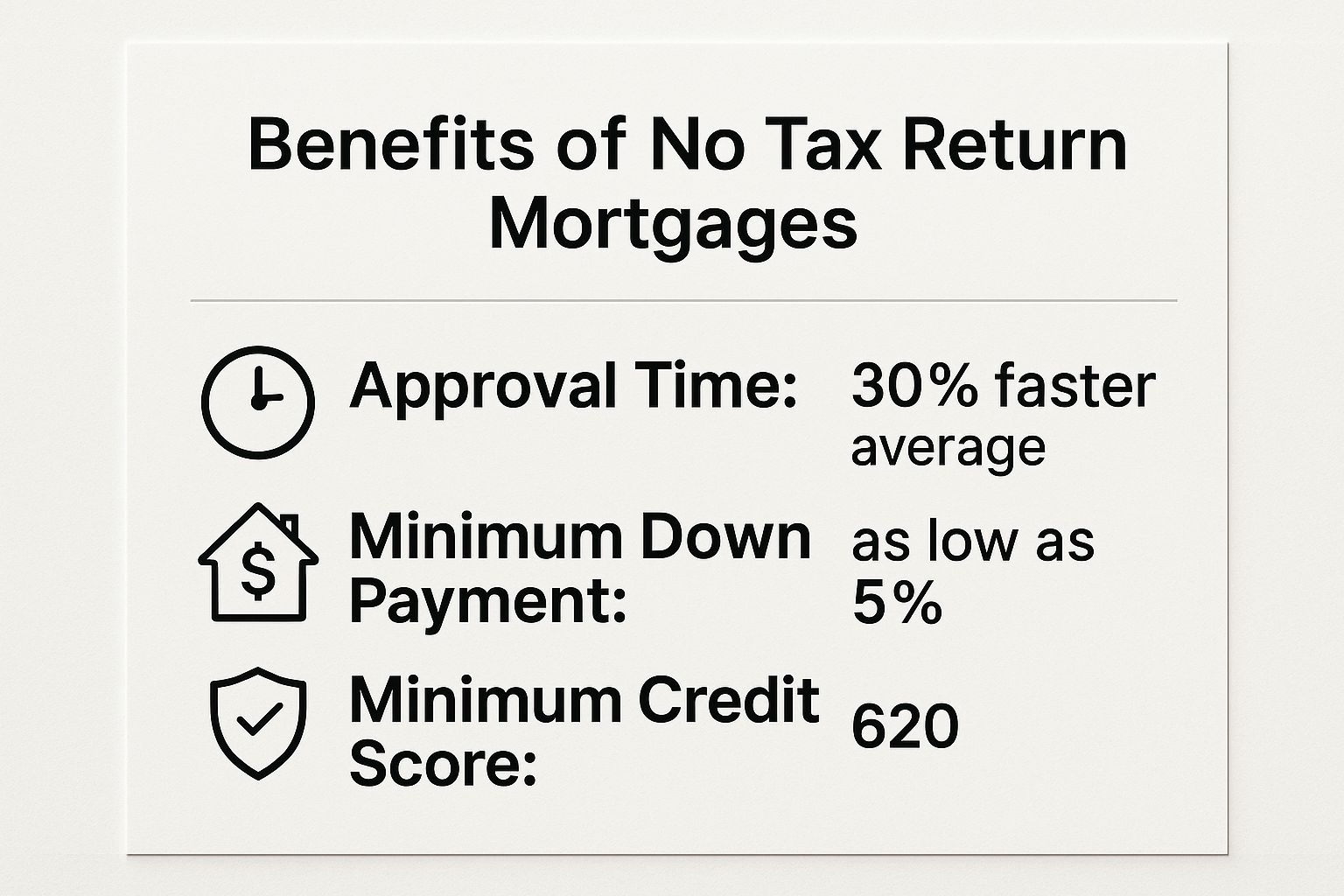

This is usually the first thing people ask, and it makes sense. While every borrower’s situation is a little different, having a decent credit history is really important when you’re not using traditional income documents.

At RAC Mortgage, we generally start looking at credit profiles in the mid-600s or higher. A strong score shows a track record of managing your debts responsibly, which helps underwriters feel more comfortable with a loan that doesn't rely on tax returns. Think of it as another way to prove you’re a reliable borrower.

Are the Interest Rates Way Higher?

That’s a fair question and it deserves a straight answer. Yes, rates for no tax return mortgages can be slightly higher than what you’d see on a conventional or government-backed loan. This just reflects the different kind of risk involved with using alternative income verification.

But "slightly higher" doesn't mean it's going to be a deal-breaker. RAC Mortgage works hard to lock in the most competitive rates out there for qualified Tampa borrowers. We have a network of investors who get the financial realities of being an entrepreneur, which lets us find great terms that fit your goals.

The whole point is to create a realistic, accessible way for you to own a home. The rate might be a tick higher than a conventional loan, but it’s a small price to pay for being able to qualify with your actual cash flow instead of your tax-adjusted income.

Can I Get a Bank Statement Loan if I’m Not Self-Employed?

You bet. Bank statement loans are a lifesaver for entrepreneurs, but they aren't only for them. These programs are really designed for anyone whose income is hard to document or doesn't come from a typical 9-to-5 paycheck.

Just look at a few scenarios where a bank statement loan from RAC Mortgage is the perfect solution:

- Real Estate Investors: If you've got a portfolio of rental properties, your income is coming in from all different places that don't fit neatly on a W-2.

- Sales Professionals with Big Commissions: Someone in sales might have a small base salary but bring in the bulk of their income from huge, irregular commissions. Their W-2 doesn't tell the whole story of what they can afford.

- Gig Economy Pros: Think about people who drive for rideshare companies or juggle multiple freelance projects. Their bank deposits are the only true measure of their income.

In every one of these cases, bank statements paint a much clearer and more accurate picture of their real financial situation.

Ready to see how your unique financial picture fits into a no tax return mortgage? The team at Residential Acceptance Corporation has the expertise you need. Let us show you a smarter, more sensible way to buy your next Tampa home. Start your journey with us today.