Being an entrepreneur in Tampa is exciting, but getting a mortgage with non-traditional income can feel like hitting a brick wall. That’s where finding the right partner makes all the difference. As a specialized lender, Residential Acceptance Corporation (RAC Mortgage) gets that your tax returns don't paint the full picture. We focus on alternative documentation loans that look at your real cash flow.

The Entrepreneur's Path to a Tampa Home Loan

Let's be honest: securing a mortgage when you're self-employed in Tampa's hot market can be a major headache. Traditional lenders often get stuck when they don't see a neat W-2, leading to endless frustration and roadblocks for business owners.

This guide is designed to cut through that confusion. We'll show you a mortgage process built specifically for entrepreneurs. The real secret is partnering with a lender who sees beyond the standard paperwork and understands the true financial health of your business.

A Different Way to Look at Income

Instead of getting hung up on tax returns—which are almost always structured to maximize your business deductions—a forward-thinking lender digs into your actual cash flow. This is where programs like bank statement loans become a game-changer. At Residential Acceptance Corporation (RAC Mortgage), this is our bread and butter. We specialize in evaluating your business's revenue to figure out what you can truly afford.

This approach opens doors to homeownership that many self-employed people in Tampa thought were locked shut. It gives you a clear, direct path to getting approved based on the success you've actually built.

What's Happening in the Tampa Market

The local market dynamics make finding the right lender even more important. Recently, Florida's median home sales price was sitting around $405,000, with average 30-year fixed mortgage rates hovering near 6.56%. For self-employed borrowers, these numbers really highlight the need to balance what you can afford with what you can qualify for—a challenge a specialized lender is built to solve.

This focus on alternative documentation isn't just a loophole; it’s a recognition that a successful business owner's finances simply look different. Your ability to repay a loan is based on consistent revenue, not just the net income you show after all your write-offs.

Entrepreneurs structure their businesses in all sorts of ways. For those who operate as a limited company, understanding the unique factors involved in buying a house through a limited company can offer some valuable perspective. The key is working with a lender who gets these nuances and can make your journey to a new home a smooth one.

How Bank Statement Loans Work For You

If you're self-employed in Tampa, you've probably felt the frustration of a traditional mortgage application. The second a lender asks for W-2s and tax returns, you know there's a problem. Your real financial story isn't in your tax filings—it's in your business's cash flow. This is exactly where a bank statement loan becomes your best bet.

Instead of getting bogged down in tax documents, this program lets a lender see your business's true financial health. Here at RAC Mortgage, we look at either 12 or 24 months of your business bank statements. This lets our team calculate a real, qualifiable income based on the revenue you're actually generating. It’s a common-sense approach that looks at the reality of your cash flow, not just your tax strategy.

Bypassing Traditional Hurdles

This method completely sidesteps the biggest obstacle for entrepreneurs: tax returns. You're smart to minimize your tax liability with legitimate write-offs, but that lower taxable income makes conventional lenders think you can't afford a home. Bank statement loans bridge that gap.

A professionally prepared Profit and Loss (P&L) statement can also be a huge asset to your application. This document gives underwriters a clean, organized look at your recent business performance, adding another layer of confidence. For Tampa’s business owners, having these alternative ways to show your income is a game-changer.

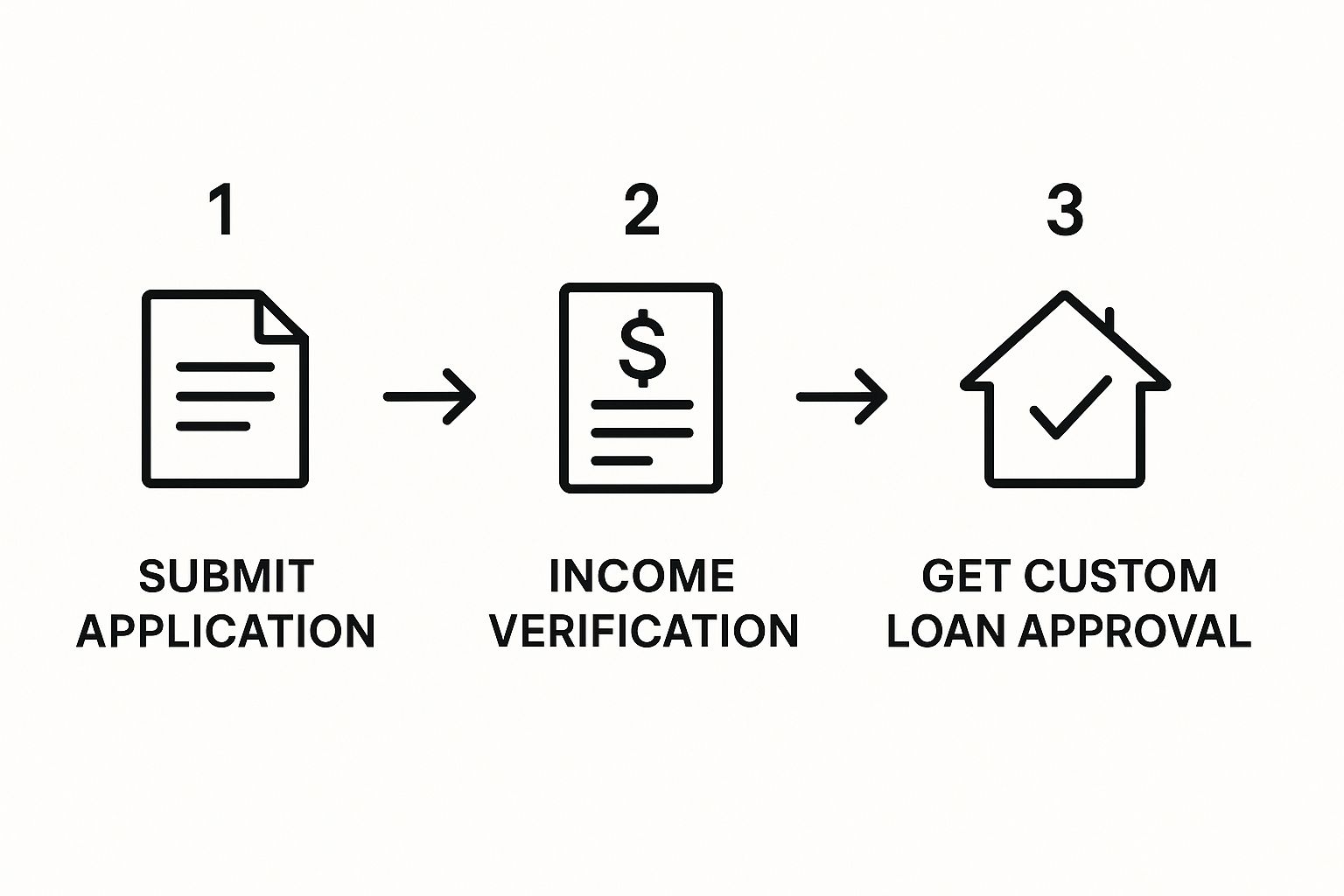

The whole process is built to be straightforward for busy entrepreneurs like you.

As you can see, the focus shifts from tax docs to your actual bank deposits. It's a custom path to loan approval based on what you really make.

To give you a clearer picture, let's compare the paperwork needed for a conventional loan versus a bank statement program. The difference is night and day for a business owner.

Loan Document Needs W-2 vs Self-Employed

| Requirement | Conventional Loan (W-2 Employee) | RAC Mortgage Bank Statement Loan (Self-Employed) |

|---|---|---|

| Primary Income Proof | W-2s, pay stubs, and federal tax returns | 12-24 months of business bank statements |

| Tax Returns | Required (Typically the last 2 years) | Not Required for income verification |

| Underwriting Focus | Adjusted Gross Income (AGI) after deductions | Gross deposits and consistent cash flow |

| Additional Docs | Letter of employment, standard asset statements | Profit & Loss (P&L) statement (often required) |

The table makes it clear: bank statement loans are designed from the ground up to understand how a successful business operates.

Understanding Your Options

As the market has recognized the needs of entrepreneurs, specialized products have become available. You'll hear terms like Bank Statement Loans and Non-Qualified Mortgages (Non-QM) thrown around. These loans are specifically for self-employed individuals and use alternative documentation—like 12-24 months of bank statements and P&Ls—to verify income.

This is critical because business owners often have fluctuating income and high write-offs. Find out more about how a Tampa mortgage lender can help without tax returns in our detailed guide.

The core idea is simple but powerful: your true business revenue should be the key to unlocking your home loan. With the right program, you can gain the confidence that comes from knowing your hard work is being properly evaluated.

Assembling a Winning Loan Application

A strong mortgage application isn't something you throw together overnight. For a self-employed borrower in Tampa, the real work starts long before you submit anything to us at RAC Mortgage. It's all about preparation and painting the clearest possible picture of your business's health.

Underwriters are trained to look for consistency and stability. One of the single most important things you can do is maintain separate bank accounts for your business and personal finances. When you co-mingle funds, you create a massive headache for everyone trying to verify your income, and it's a huge red flag for lenders.

Your Essential Document Checklist

Getting your paperwork in order ahead of time is a game-changer. It will dramatically speed up the process. Think of it as building a portfolio that proves you're a successful business owner.

Here's what you'll need to start gathering:

- Business Bank Statements: Plan on providing 12 to 24 months of statements. This is how we show consistent cash flow and regular deposits.

- Personal Bank Statements: We'll look at these to understand your personal spending habits and, just as importantly, verify you have the assets for your down payment and closing costs.

- Profit & Loss (P&L) Statement: A current, year-to-date P&L gives a perfect snapshot of your recent business performance. Having it prepared by a CPA is a major plus.

- Business Licenses and Registrations: These official documents prove your business is legit and actively operating.

Your goal is to make the underwriter's job as easy as possible. A well-organized, comprehensive file screams professionalism and financial responsibility. It makes you a much more attractive borrower right from the start.

Here's another crucial habit to get into: avoid making large, undocumented cash deposits in the months leading up to your application. Every significant deposit has to be sourced, so a clean paper trail is your best friend.

Taking these steps not only makes your file stronger but also gives you the confidence to understand the steps for getting preapproved for a mortgage.

To really round out your application, you need to present your entire financial picture accurately. Take the time to learn how to calculate net worth the right way so every asset and liability is accounted for. Transparency makes all the difference.

Why Tampa Entrepreneurs Choose RAC Mortgage

Picking the right Tampa mortgage lender when you're self-employed is about way more than just grabbing the lowest interest rate. It’s about finding a partner who actually gets the entrepreneurial grind. At RAC Mortgage, we're all-in on supporting Tampa’s incredible community of business owners, freelancers, and independent contractors.

Our loan officers specialize in looking at income that doesn't come from a W-2. We know the local business scene inside and out, whether you’re a consultant in South Tampa, a general contractor over in Brandon, or launching a tech startup in the Heights. That local know-how means we can see the real story behind your business—something a giant, national lender’s algorithm just can't do.

A Process Built for Business Owners

We know your time is money. That's why we’ve built our mortgage process to be straightforward and efficient, cutting out the fluff so you can stay focused on running your company. Forget the endless back-and-forth and confusing industry jargon. Our whole approach is built on clear communication and a predictable path to closing.

When you work with RAC Mortgage, you get:

- Specialized Knowledge: Our team lives and breathes the details of bank statement loans and other flexible Non-QM solutions.

- Local Underwriting: Real people who understand the Tampa Bay economy are making the decisions, not some faceless computer program.

- Dedicated Support: You’ll have one person guiding you from the first call to the closing table. No getting passed around.

This focus on the self-employed community helps us serve a wide range of clients. In fact, Tampa shows a Hispanic lending rate of 28.1%, which points to solid access to homeownership across our city's diverse population. We are perfectly set up to handle the complex income verification needed for self-employed borrowers from all backgrounds, making sure everyone gets a fair shot at financing. You can dig deeper into these mortgage lending trends in American cities to see the bigger picture.

Ultimately, working with RAC Mortgage means you're partnering with a lender that sees your business success as clearly as you do. We turn a complex process into a confident step forward toward your homeownership goals.

Common Mistakes Self-Employed Borrowers Make

Navigating the mortgage process when you're self-employed in Tampa isn't just about what you do—it's also about what you don't do. We've seen a few simple, avoidable missteps unfortunately delay an application or even lead to a flat-out denial. Knowing these common pitfalls is your best defense for a smooth ride to the closing table.

One of the most frequent errors we see here at RAC Mortgage is mixing business and personal funds. When your business revenue and personal spending are all swirling around in the same account, it creates a tangled mess for underwriters. Their entire job is to verify a stable, predictable income, and commingled accounts make that nearly impossible.

Keeping Your Financials Clean

Another critical mistake is making a major credit purchase before your loan closes. That new truck for the business or even a personal vehicle might seem essential, but the new monthly payment will absolutely alter your debt-to-income (DTI) ratio. This can instantly disqualify you, even if you’ve already been pre-approved.

Here are a few key areas to watch like a hawk:

- Inconsistent Revenue: Major dips and spikes in your monthly deposits raise red flags. Lenders are looking for stability, so try to keep things as consistent as possible in the months leading up to your application.

- Large, Mysterious Cash Deposits: Avoid making large, undocumented cash deposits. Every significant deposit has to be sourced, and a missing paper trail can bring your application to a screeching halt.

- Sloppy Bookkeeping: Simple accounting errors can have a surprisingly big impact. Beyond just your mortgage application, avoiding common accounting mistakes for small business owners makes your entire financial picture stronger.

The period between pre-approval and closing is not the time for any financial changes. Your lender approved you based on a specific snapshot of your finances; it's essential to maintain that exact picture until you have the keys in hand.

These issues become even more important when you're looking at flexible loan options. Getting familiar with the specific Non-QM loan requirements ahead of time can help you prepare a much cleaner, stronger application from the very start. By dodging these common mistakes, you present yourself as the reliable borrower you are and keep your homeownership goals right on track.

Answering Your Self-Employed Mortgage Questions

Even with the best game plan, it's natural for questions to pop up when you're an entrepreneur trying to get a mortgage. Let's tackle some of the most common ones we hear from self-employed folks right here in Tampa. We want to give you straight, clear answers so you can move forward with total confidence.

Do I Need Perfect Credit For a Self-Employed Mortgage in Tampa?

While a great credit score always helps, you absolutely don't need a perfect one. At Residential Acceptance Corporation (RAC Mortgage), we work with a wide range of loan programs designed to be flexible for different credit profiles. For our popular bank statement loans, we look at your entire financial story.

What this really means is that your business's consistent income and solid financial health can be just as important, if not more so, than your FICO score. We're focused on finding a real-world solution that fits your unique situation, not trying to squeeze you into a rigid, one-size-fits-all box.

How Many Months of Bank Statements Does RAC Mortgage Need?

Typically, we'll ask for either 12 or 24 months of your business bank statements to get a clear picture of your income. Handing over a full two-year history often lets our underwriters build a much stronger case for your long-term income stability. That can sometimes translate into better loan terms for you.

But for many business owners, a 12-month program is a fantastic option. Our experienced team will sit down with you, look at your specific numbers, and figure out which path gives you the clearest shot at a smooth approval.

The choice between a 12 or 24-month program isn't random—it's a strategic decision based on your business history and what you're trying to achieve. We'll help you pick the one that makes the most sense.

Can I Get a Mortgage if My Business Is Fairly New?

That old "two-year history" guideline is common, but it's not a deal-breaker. If you have a strong, documented track record in the same industry before you went out on your own and you can show at least 12 months of consistent revenue, RAC Mortgage likely has a program that can work. We believe in backing Tampa's entrepreneurs, and we look at every single scenario on its own merits.

Are Interest Rates Higher For Bank Statement Loans?

You might see slightly higher interest rates on bank statement loans compared to conventional, W-2 loans. That’s because they're a Non-QM (Non-Qualified Mortgage) product, which is what allows for the flexible income proof that entrepreneurs like you need.

Think of that small premium as the key that unlocks the door to homeownership for so many self-employed people whose tax returns don't reflect their true, day-to-day cash flow. Here at RAC Mortgage, our mission is to hunt down the most competitive rates out there for your specific financial profile.

Ready to see how your hard work can land you the keys to your dream home? The team at Residential Acceptance Corporation is here to guide you through a mortgage process built for Tampa's entrepreneurs. Get started today!