It's a frustrating but common myth: a low credit score means you can't buy a home in Tampa. The truth is, you absolutely can get a home loan, but it all comes down to finding the right Tampa mortgage lender for bad credit. This is where specialized lenders like Residential Acceptance Corporation (RAC Mortgage) come in. We were created specifically to help people who don't fit into the narrow boxes that traditional banks use, turning the dream of owning a home into a reality.

Your Path to a Tampa Home Loan Starts Here

Trying to get a mortgage with a challenging credit history can feel defeating, but it’s far from impossible. The secret is knowing that not all lenders play by the same rules.

Big banks often lean on automated underwriting systems that can reject an application in seconds just based on that three-digit number. A dedicated lender, on the other hand, takes a more personal, hands-on approach. Here at RAC Mortgage, we look beyond the score to see the whole person and understand the story behind your financial situation.

This is especially critical in Tampa's current economic climate. The Bay area has seen a significant jump in mortgage delinquencies, with about 5.5% of home loans now 30 or more days past due. That's a sharp increase from 3.3% just a year ago, highlighting the financial strain many families are under and the growing need for lenders who offer flexible, common-sense solutions.

Understanding Your Lending Options

Before you start your search, it’s worth your time to begin by understanding the key differences between a mortgage broker and a bank lender. Knowing who you're talking to empowers you to find the right partner for your journey. A specialized lender like us is focused on finding a clear path to "yes," while many traditional banks seem to be looking for reasons to say "no."

We believe in a manual, hands-on process that includes:

- A Personal Review: We manually underwrite every loan. This lets us consider compensating factors that automated systems ignore, like a solid job history or a decent down payment.

- Flexible Programs: Our loan options are specifically built for borrowers with imperfect credit—these are programs you simply won't find at most conventional banks.

- Local Market Expertise: We're deeply rooted in the Tampa community. We get the unique challenges and opportunities of our local housing market because we live here, too.

A credit score is just a snapshot of your past, not a prediction of your future. The right lender helps you build a bridge from where you've been to where you want to go—homeownership.

How RAC Mortgage Compares to Traditional Banks

See how a specialized lender like RAC Mortgage provides a different path to homeownership for borrowers with credit challenges compared to conventional banks.

| Lending Approach | RAC Mortgage | Traditional Banks |

|---|---|---|

| Credit Score Focus | Looks beyond the score to the full financial picture. Considers scores as low as 580. | Relies heavily on automated credit score screening. Often requires scores of 620 or higher. |

| Underwriting Process | Manual, hands-on review by a real person who can consider compensating factors. | Primarily automated, leaving little room for exceptions or personal stories. |

| Loan Programs | Offers specialized loan products (like Non-QM) designed for bad credit or unique income situations. | Limited to standard conventional, FHA, VA, and USDA loans with strict "overlays." |

| Flexibility | High. We find solutions and pathways to approval for complex financial situations. | Low. Adheres rigidly to a strict set of internal guidelines beyond agency minimums. |

| Goal | To find a responsible way to approve the loan. | To quickly identify and eliminate risk, often leading to denials. |

This comparison makes it clear: your choice of lender is one of the most important decisions in the homebuying process, especially when your credit isn't perfect.

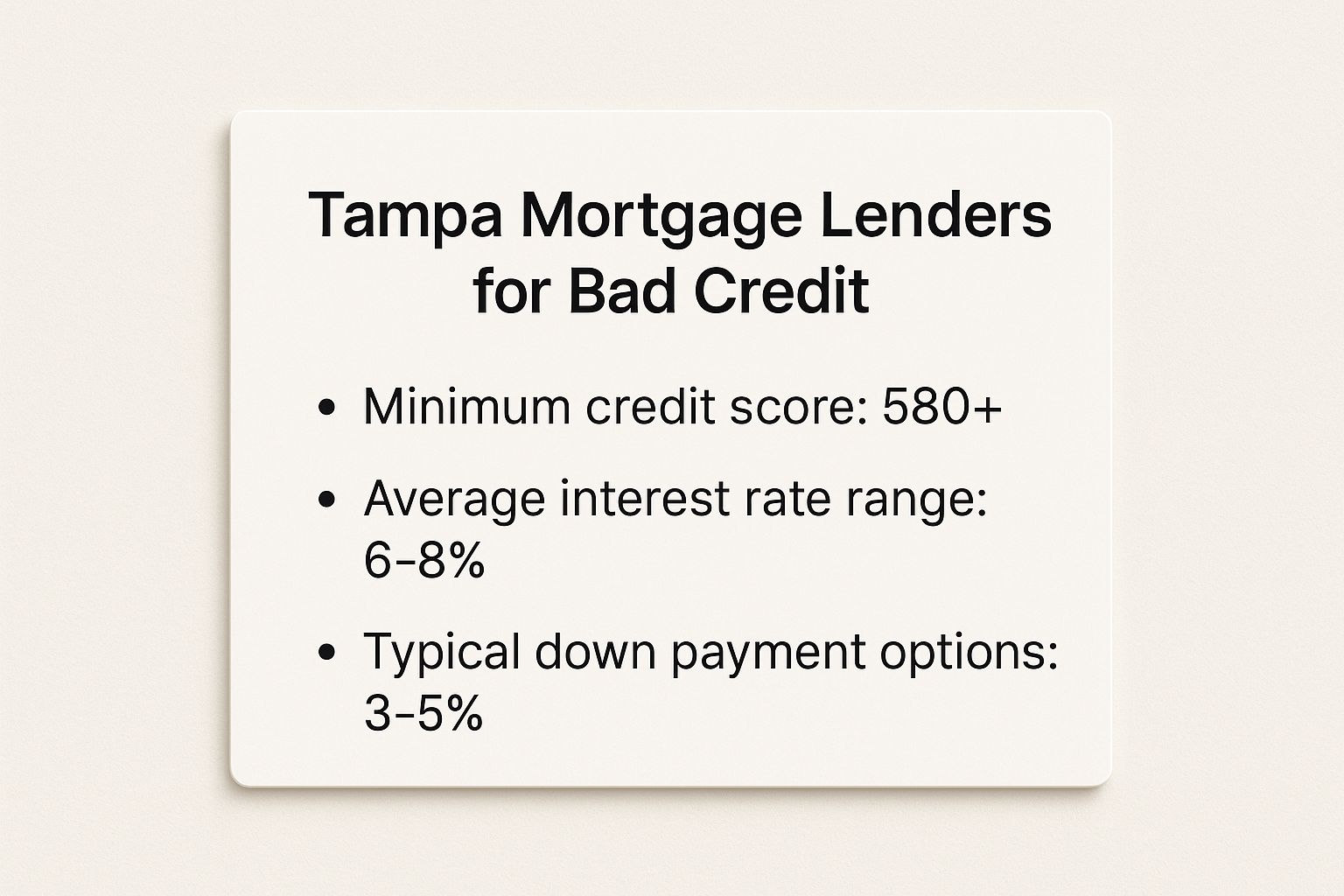

The infographic below outlines the typical qualifications for specialized mortgage programs in Tampa designed for borrowers with credit challenges.

These numbers show that homeownership is well within reach even if your credit score is in the 580s, with down payment options that are often far more manageable than people think.

Navigating Tampa's Complex Housing Market

Buying a home in Tampa with a less-than-perfect credit score isn't just a matter of getting a loan approved. It’s about truly understanding the unique and often tricky local market you’re about to jump into. This area is anything but static—property values can swing wildly depending on the neighborhood, the economy, and even the time of year.

These market swings bring up a critical concept every homebuyer needs to grasp: negative equity. It’s a scary-sounding term, and it should be. It happens when you owe more on your mortgage than your home is actually worth.

Picture this: you buy a house for $350,000, but a few months later the local market dips. Suddenly, your home's value drops to $325,000, while you still owe $345,000 on your loan. Just like that, you're "underwater."

This isn't just some hypothetical scenario. Negative equity is a real problem in Florida, with several metro areas having high rates of homeowners in this exact jam. In fact, startling data shows that over 82% of underwater mortgages across the country came from loans originated in 2022 or later. This is why any responsible Tampa mortgage lender for bad credit has to be extra careful—borrowers with credit challenges can be hit hardest by the financial strain of a falling home value. You can learn more about recent mortgage trends in this report.

Why Local Expertise Is Non-Negotiable

A huge national lender working out of a call center a thousand miles away isn't going to get the subtle differences between Seminole Heights, South Tampa, or New Tampa. To them, you're just numbers on a screen. They don't see the real-world factors that drive a property's long-term value.

At RAC Mortgage, our roots are planted deep in the Tampa Bay community. We don't just work here; we live here, too. That local knowledge lets us see beyond a credit score and spot real opportunities for our clients. We have our finger on the market's pulse, which is priceless when we're putting together a loan that actually protects your investment.

Choosing a lender who doesn't understand the local market is like hiring a tour guide who has never visited the city. They might have a map, but they don't know the best routes or the hidden dangers.

Our process always includes a careful look at the property and its specific location. We want to make sure the home you're buying is a solid long-term move. This is especially vital for buyers working to overcome credit issues, because a stable or appreciating home is your best defense against ending up underwater.

A Proactive Approach to Protecting Your Investment

A great mortgage lender doesn’t just hand you the keys and disappear. They help you build a secure future. For us at RAC Mortgage, that means we proactively structure loans to minimize the risks that come with a volatile market. We don't just see the potential problems; we map out the path around them.

Here’s how our on-the-ground expertise directly benefits you:

- Informed Property Appraisals: We partner with appraisers who have an intimate knowledge of Tampa's diverse neighborhoods. This ensures your home's valuation is accurate and reflects its true place in the market.

- Strategic Loan Structuring: We look at long-term market forecasts when recommending loan products. The goal is to find a mortgage that not only fits your budget today but also keeps you financially stable if property values shift down the road.

- Honest and Transparent Guidance: If we spot red flags with a property or see worrying trends in a neighborhood, we're going to tell you. Our mission is to get you into a home that builds your wealth, not one that becomes a financial albatross.

This commitment to protecting your investment is at the very core of what we do. While other lenders are just trying to close a deal, we're focused on your long-term success as a Tampa homeowner. By partnering with a dedicated local expert like RAC Mortgage, you get more than a loan—you get a trusted advisor who's committed to helping you make a smart, sustainable purchase, no matter what your credit history looks like.

Practical Ways to Strengthen Your Mortgage Application

Alright, let's get down to business. Moving from just thinking about a house to actually taking steps to get one is where the real work begins. If you're heading into this with less-than-perfect credit, your game plan needs to be smart and strategic, focusing on the moves that lenders actually care about.

We're going to skip the generic, fluffy advice. Instead, we'll concentrate on high-impact actions that build a stronger application from the ground up.

Taking these steps shows a Tampa mortgage lender for bad credit that you're not just another number—you're a responsible borrower who's serious about your financial future. When you take control of your story, you walk into our office at RAC Mortgage in the best possible position to get that approval.

Meticulously Review Your Credit Reports

First things first: you need to become an expert on your own credit history. Before you do anything else, pull your full credit reports from all three major bureaus—Equifax, Experian, and TransUnion. You can get a free copy from each one every year.

Don't just glance at them. Go through every single line item. You're looking for mistakes that could be pulling your score down without you even knowing it.

Keep an eye out for these common errors:

- Incorrect Personal Information: A simple typo in your name or an old address can cause major mix-ups.

- Accounts That Aren't Yours: This is a huge red flag for identity theft, but it can also be a simple clerical error. Either way, dispute it immediately.

- Negative Items Past the Reporting Limit: Most negative marks, like a late payment, are only supposed to stay on your report for seven years. Make sure old debts have fallen off.

- Duplicate Accounts: Sometimes, a single debt gets listed twice by mistake, making it look like you owe more than you actually do.

Finding and disputing these errors can give your score a surprisingly fast and significant boost. The Fair Credit Reporting Act (FCRA) is on your side here, giving you the right to an accurate report.

Create a Plan to Tackle High-Interest Debt

Nothing drags a credit score down quite like high credit card balances. Lenders look closely at your credit utilization ratio—that’s the percentage of your available credit that you're currently using. They really want to see this number below 30%. If you can get it under 10%, even better.

Let's say you have two credit cards, each with a $5,000 limit. That’s $10,000 in total available credit. If your combined balance is $4,000, your utilization is 40%, which is in the red zone for most lenders.

Look, the goal isn't to become debt-free overnight. It's to show a clear, consistent pattern of paying down what you owe. This proves you have the financial discipline lenders want to see in a borrower.

Make a simple, realistic plan. You could focus on paying off the card with the highest interest rate first (that's the "avalanche" method) or tackle the one with the smallest balance to get a quick win (the "snowball" method). Any consistent progress sends a strong signal. For more in-depth strategies, check out our guide with borrower tips for repairing bad credit.

Consider an Authorized User Account Carefully

This one can be a game-changer, but you have to be careful. Becoming an authorized user on a family member's credit card can give your score a nice lift if that account has a long, spotless history of on-time payments and a low balance.

We recently worked with a Tampa couple where this strategy made all the difference. The husband became an authorized user on his wife's well-managed, 10-year-old credit card. In just two months, his score jumped 40 points.

But here’s the warning: this can blow up in your face. If the main account holder misses a payment or maxes out the card, that negative activity hits your report, too. Only use this strategy with someone you trust completely—someone with a rock-solid financial track record. By taking these focused steps, you're no longer just hoping for a loan; you're actively building the profile of a homeowner.

Loan Programs Designed for Imperfect Credit

If you’ve been shot down for a mortgage before, it’s easy to think your options are limited. A lot of traditional lenders will stop the conversation right at "FHA loan." But a truly dedicated Tampa mortgage lender for bad credit understands that every borrower's situation is unique. You don't need a one-size-fits-all product; you need a solution that actually fits you.

At Residential Acceptance Corporation (RAC Mortgage), we keep a diverse portfolio of loan programs on hand, specifically for homebuyers facing credit challenges. Our philosophy is simple: find the right key for the right lock. That’s how we build a path to homeownership that’s not just achievable, but sustainable.

Beyond the Standard FHA Loan

Don't get me wrong, FHA loans are a fantastic tool, especially for first-time buyers. But they’re far from the only game in town. We regularly help borrowers who don't quite fit into that standard box, and that's where our other specialized programs make all the difference.

It's a common misconception that if your credit score is low, FHA is your only option. If you want to get into the nitty-gritty of those requirements, our guide on how to qualify for an FHA loan is a great resource. But just knowing other possibilities exist can be a huge relief.

This is especially true in Tampa's market right now. We've seen home prices cool off, with some reports showing a decline of around 5.6% over the past year. This is creating some great opportunities for new buyers to get in the door, but it also means lenders need to be savvy. That’s why having more than one tool in the toolbox is critical. You can learn more about the latest trends in the Tampa housing market to see what's happening.

Exploring Non-Qualified Mortgages (Non-QM)

One of the most powerful tools we have is the Non-Qualified Mortgage, or Non-QM loan. These are basically common-sense loans for people who don't meet the strict, cookie-cutter criteria of "qualified" mortgages like conventional or FHA loans.

A Non-QM loan can be a perfect fit if you're financially solid but have something specific holding you back, like:

- A recent credit event like a bankruptcy or foreclosure.

- Self-employment income that’s tough to prove with standard tax returns.

- A credit score that falls just shy of the usual minimums.

Think of a Non-QM loan not as a "subprime" loan from the past, but as a modern, flexible solution. It lets us look at your entire financial picture—assets, cash flow, the whole story—to make a responsible decision.

Just last month, we worked with a freelance graphic designer in Tampa. Her income was great, but she didn't have W-2s to prove it. A traditional bank couldn't touch her file, but we used a Non-QM program to get her into a new home.

Bank Statement Loans for Tampa Entrepreneurs

Tampa is a hotbed for entrepreneurs and the self-employed. If that's you, you already know the frustration of a lender asking for pay stubs you just don't have. Our bank statement loan program was designed to solve this exact problem.

Instead of getting bogged down in tax returns, which often show a lower net income because of business write-offs, we look at your actual cash flow. By analyzing 12 to 24 months of deposits from your business or personal bank statements, we can verify a consistent, reliable income stream.

This program is tailor-made for:

- Small business owners

- Independent contractors and gig economy workers

- Real estate agents and other commission-based pros

Using bank statements gives us a real-world picture of your earning power. It lets us provide financing that truly reflects your ability to afford a home. At RAC Mortgage, our whole goal is to find the program that fits your story and sets you up for success.

What to Expect in the RAC Mortgage Application

Let's be honest, applying for a mortgage can feel overwhelming, especially if your credit has a few bumps and bruises. You might be picturing mountains of paperwork and dealing with lenders who only see you as a number.

At Residential Acceptance Corporation, we’ve built our entire process to be the exact opposite. As a dedicated Tampa mortgage lender for bad credit, we believe in a real partnership. We're here to guide you from that first phone call all the way to closing day.

We see the person behind the credit score. Our mission is to make the journey to homeownership as clear and stress-free as possible. You'll have a dedicated loan officer who gets your situation and is focused on finding the clearest path to a "yes."

Getting Your Financial Story Organized

To get started, we need to understand your complete financial picture. The more prepared you are, the smoother and faster everything goes. We'll be crystal clear about what we need and why we need it.

Think of it like gathering the pieces of a puzzle. Once we have them all, we can see the full picture of your financial story. Here are the main documents you'll want to get in order:

- Proof of Income: This is usually your last 30 days of pay stubs and your W-2s from the past two years. If you're self-employed, we’ll look at your tax returns instead.

- Asset Verification: Grab your two most recent bank statements for every account you have (checking, savings, etc.). This simply shows us you have the funds ready for your down payment and closing costs.

- Identification: Standard stuff here—just a clear copy of your driver’s license and Social Security card.

Having these items ready to go from the start shows you’re a serious and organized buyer, which always makes a great impression.

How We Handle Past Credit Issues

Life happens. We get it. A past bankruptcy, a rough patch with late payments, or other credit blemishes aren't automatic deal-breakers here. This is where our hands-on, personal approach really makes a difference. Your file won't be kicked out by an algorithm; we'll actually take the time to understand what happened.

One of the most important tools for this is the Letter of Explanation (LOE). This is your chance to tell us what was going on, in your own words.

A well-written Letter of Explanation isn't about making excuses; it's about providing context. It demonstrates responsibility and shows that past financial struggles are truly in the past.

Maybe you lost a job or had a medical emergency that caused you to miss some payments. Your LOE is where you can briefly explain the situation, talk about the steps you took to get back on track, and show how your finances have stabilized. This letter turns a set of numbers into a human story, giving our underwriting team the context they need to make a common-sense decision.

Our Commitment to Partnership

Throughout the entire process, you can expect clear and constant communication from your RAC Mortgage team. We'll give you regular updates so you're never left wondering about the status of your loan.

This is a team effort. We'll work with you to gather every document, answer any questions from underwriting, and keep your application moving forward. We pride ourselves on efficiency, aiming to close loans in just 18 to 20 days once we have your complete file.

From our first chat to the final signature, our goal is the same: to be the supportive, expert partner you need to make your Tampa homeownership dream a reality.

Take the First Step to Your Tampa Home

So, you've seen that a less-than-perfect credit score doesn't have to kill your dream of owning a home in Tampa. Yes, the market has its challenges, but with the right game plan and flexible loan options, homeownership is absolutely within your grasp.

The trick is to partner with a lender who actually specializes in situations like yours. As you get started, understanding some essential mortgage broker tips can give you a behind-the-scenes look at how the pros get deals done.

Don't let what-ifs and uncertainty hold you back from your goal. The single most important thing you can do right now is reach out for a personalized consultation. It’s the first real step toward making it happen.

At Residential Acceptance Corporation, we want to be that partner for you. We've built our business on looking beyond the three-digit score to see the person behind the application. Our entire focus is on building a custom-fit plan that works for your unique financial picture and gets you to the closing table.

Let’s start the conversation today. Your new Tampa home is a lot closer than you think, and it all begins with this first step. We're ready when you are.

Common Questions About Bad Credit Mortgages

Going through the mortgage process with some credit bruises naturally brings up a lot of questions. We get it. Here are some clear, straight-shot answers to the most common concerns we hear from Tampa residents, designed to help you see the path forward.

What Is the Minimum Credit Score Needed for a Mortgage

Many traditional banks will tell you a 620 FICO score is the absolute floor. But that's not the whole story. Specialized lenders play by a different set of rules.

Here at Residential Acceptance Corporation, we can often work with scores dipping as low as 580. It’s crucial to remember that your credit score is just one piece of the puzzle. We look at the bigger picture—things like your income stability, how much you have for a down payment, and your overall financial health.

A higher score will almost always get you a better interest rate, but a lower one doesn't slam the door shut. We manually underwrite every single loan, which allows our team to see the real person behind the numbers and find a way to make it work.

How Long Does It Take to Get Approved

The approval timeline can definitely vary, but your preparation makes all the difference.

Once we have a complete application package in hand—that means income verification, bank statements, and all the other necessary docs—our team at RAC Mortgage can typically get a loan to the closing table in just 18 to 20 days.

The single biggest thing that speeds up or slows down the process? How quickly you can get us the paperwork we need. If you stay organized and responsive, we can keep things moving smoothly.

Can I Get a Mortgage After a Bankruptcy

Yes, getting a mortgage after a bankruptcy is absolutely possible. It’s a common misconception that a past bankruptcy closes the door on homeownership forever.

The key is understanding the required waiting periods. The exact timeframe depends on the type of bankruptcy you filed and the specific loan program you're aiming for.

Don't assume a past bankruptcy is a life sentence against homeownership. It's not. The trick is partnering with a lender who actually understands the guidelines and can map out a plan for when you'll be eligible to apply again.

We work with clients rebuilding their financial lives after bankruptcy all the time. A Tampa mortgage lender for bad credit like us can give you a clear roadmap based on your specific history. We cover many related topics for bad credit mortgage lenders on our blog if you want to dig deeper. We can help you navigate the waiting periods and figure out the best steps to strengthen your application while you wait.

Ready to get clear answers that apply to your unique situation? The team at Residential Acceptance Corporation is here to help you navigate the path to homeownership in Tampa.