Your journey into Tampa's buzzing real estate market starts with one critical decision: choosing the right Tampa investment property mortgage lender. This isn't just about finding a good rate. You need a partner who lives and breathes this market, someone like Residential Acceptance Corporation (RAC Mortgage), who pairs deep local knowledge with financing built specifically for investors. Think of it less as a transaction and more as laying the groundwork for a profitable long-term venture.

Finding the Right Tampa Investment Lender

Let’s be clear: picking a mortgage lender is probably the most important choice you'll make when buying an investment property in Tampa. Getting a loan for an investment is a completely different ballgame than financing your own home. The rules, risks, and opportunities are unique, and you absolutely need a lender who gets it.

A big national bank might just see your application as another number in a queue. But a dedicated Tampa investment property mortgage lender like Residential Acceptance Corporation (RAC Mortgage) sees a business plan. We have the local savvy to see a property's true potential, looking far beyond a simple appraisal value.

Why Local Expertise Matters

Tampa isn’t a single, uniform market. It's a patchwork of unique neighborhoods—Seminole Heights, South Tampa, Ybor City—each with its own rental demand, growth curve, and local quirks. A lender with boots on the ground understands these critical differences.

This kind of local knowledge is gold for a few key reasons:

- Smarter Property Valuations: We have a real feel for a property's income potential in a specific area, which means more accurate appraisals and fewer snags.

- Navigating Local Hurdles: We're already familiar with Tampa-specific issues, like tricky flood zones or particular HOA rules, which helps you avoid nasty surprises right before closing.

- Closing Deals Faster: Our strong, existing relationships with local appraisers, title agents, and realtors can shave significant time off your closing process.

This deep-seated understanding allows a lender like RAC Mortgage to offer advice that a generic call center simply can't. We can help you structure your financing around the property's expected cash flow and your bigger investment goals, setting you up for success right out of the gate.

The right lender doesn’t just give you a loan; they become a strategic ally. Our local expertise can turn a good investment into a great one by helping you dodge common mistakes and jump on opportunities that others might overlook.

What to Look for in a Tampa Lender

When you are looking for a lender, you need to look past the advertised interest rates and focus on what truly matters for an investor's success.

To help you vet potential partners, here's a quick table outlining the most important attributes.

Key Lender Attributes for Tampa Investors

| Attribute | Why It Matters for Investors | How RAC Mortgage Delivers |

|---|---|---|

| Local Market Knowledge | Understanding Tampa's micro-markets leads to better investment decisions and smoother appraisals. | RAC Mortgage's team has deep roots in the Tampa Bay area, providing unparalleled local insight. |

| Investor-Focused Loans | Access to products like DSCR loans, which qualify based on property income, not just personal DTI. | We specialize in financing solutions tailored for real estate investors, not just standard homebuyers. |

| Clear Communication | Consistent and transparent updates are vital for managing timelines and coordinating with all parties. | Our loan officers provide proactive communication, ensuring you're always informed from application to closing. |

Choosing a lender that ticks these boxes makes the entire financing process smoother and more predictable. When you have a partner like Residential Acceptance Corporation on your side, you get the confidence to act quickly and decisively in Tampa's competitive market.

Getting to Know Tampa's Dynamic Real Estate Market

To really succeed as a real estate investor in Tampa, you need more than just cash on hand. You have to develop a feel for the local market's pulse. What makes Tampa tick is a powerful mix of a strong economy, a constant influx of new residents, and the unique character of its many neighborhoods. This is why choosing the right Tampa investment property mortgage lender is so critical. You need a partner who does more than just push papers—you need someone who provides genuine market intelligence.

That localized knowledge is where a lender like Residential Acceptance Corporation (RAC Mortgage) truly becomes an invaluable part of your team. Our expertise isn't just about rates and terms; it's about understanding which parts of the city are about to take off and which properties have the best shot at delivering strong rental income and long-term appreciation. This kind of insight is essential for crafting a mortgage that perfectly matches the property's potential and your overall investment strategy.

The Economic Engines Firing Up Tampa's Growth

Tampa's real estate market isn't booming by accident. It's fueled by a thriving, diverse economy that keeps pulling in new residents and businesses, which in turn creates a steady demand for housing.

A few key factors are really driving this momentum:

- A Hot Job Market: Major players in finance, healthcare, and tech have set up shop here, creating high-paying jobs that attract a skilled workforce from all over the country.

- A Rush of New Residents: Tampa consistently shows up on lists of the top cities people are moving to. They're drawn by the quality of life, great weather, and the fact that it's still relatively affordable compared to other big cities.

- Major Development Projects: You can see the confidence in the region's future everywhere you look, from the huge expansion at Tampa International Airport to the game-changing Water Street district downtown.

This strong economic base creates a resilient rental market, which is fantastic news for investors like us. A specialized lender who's paying attention, like RAC Mortgage, tracks these trends to help you find opportunities that are built on solid ground.

It's so important to understand the 'why' behind Tampa's growth. This isn't just about rising home prices; it's about the sustainable economic and demographic shifts that support those values. That's how you know your investment is on solid footing.

A Look at Recent Market Performance

The numbers really tell the story of Tampa's appeal to investors. The market has shown incredible growth and a surprising amount of resilience, making it a hotspot for anyone paying attention. Even with ups and downs happening nationally, Tampa has kept buyer confidence and demand high.

For instance, the Tampa housing market recently had over 15,000 homes for sale, giving investors plenty of inventory to choose from. Median listing prices hit around $455,000, which is a 3.4% jump from the previous year. Even more impressive, average home values shot up by nearly 11.8% in that same timeframe. This kind of consistent appreciation highlights the market's strength. For a deeper dive into these numbers, the analysis of the Tampa real estate market on Steadily.com is a great resource.

To a lender like RAC Mortgage, this data is more than just a bunch of stats; it's a roadmap. It helps us guide you in structuring a loan that can take advantage of a property's appreciation potential while making sure it's cash-flowing from day one.

Zeroing In on High-Potential Neighborhoods

Let's be real: not all Tampa neighborhoods are created equal when it comes to investing. An experienced local lender can give you the kind of nuanced insights a national company's algorithm will completely miss. We know the subtle differences between an up-and-coming area like Seminole Heights and an established, high-demand district like South Tampa.

This street-level expertise is crucial when you're:

- Figuring Out Rental Demand: Knowing the demographics and what's driving demand in a specific zip code helps you project your rental income way more accurately.

- Gauging Appreciation Potential: Local knowledge is key to spotting areas that are about to benefit from new development, better schools, or gentrification that could send property values soaring.

- Structuring the Smartest Loan: A property in a high-growth area might need a totally different financing approach than a stable, cash-cow property in a more mature neighborhood.

By tapping into this market intelligence, a partner like RAC Mortgage helps you see beyond the listing photos to the real investment potential of a property. It turns the financing process from a simple transaction into a strategic move toward building a profitable real estate portfolio here in Tampa.

Choosing the Right Investment Loan Program

Financing an investment property in Tampa isn't a one-size-fits-all deal. The loan that works for a seasoned investor flipping houses in Seminole Heights is totally different from what a first-timer needs for a long-term rental in South Tampa. Finding the right Tampa investment property mortgage lender means partnering with a specialist like us at Residential Acceptance Corporation (RAC Mortgage), who brings a whole playbook of financing options designed for investors.

Instead of trying to jam your goals into a standard home loan, it’s all about picking a program that actually supports your specific strategy. Let's break down the specialized loan programs we offer and see how they work in the real world.

The Power of DSCR Loans for Tampa Investors

One of the most valuable tools in an investor's belt is the Debt Service Coverage Ratio (DSCR) loan. Honestly, this program is a game-changer because it qualifies you based on the property's income potential, not your personal W-2 or tax returns.

Here’s the simple version of how it works: we look at the property’s expected monthly rental income and compare it to the total monthly mortgage payment (that’s principal, interest, taxes, and insurance). As long as the rent covers the debt, you’re on your way to approval. This is absolutely perfect for self-employed investors or anyone whose income is tied up in other ventures.

Think about it this way: say you find a great duplex in Ybor City. Your personal debt-to-income ratio is a little high because of your business, but that duplex is projected to bring in $3,500 in monthly rent, while the mortgage payment is only $2,800. A DSCR loan hones in on that positive cash flow, making the deal happen. To get a better feel for how these work, you can learn more about our DSCR loan programs in Tampa.

Conventional Loans for Investment Properties

Conventional loans are another solid option, especially for investors with strong credit and a straightforward, documented income. They can have stricter qualification rules than DSCR loans, but that trade-off often gets you some very competitive interest rates.

These loans are usually a great fit for investors who:

- Have a W-2 job with a consistent income history.

- Maintain a credit score typically above 700.

- Can comfortably make a down payment of at least 20-25%.

A conventional loan could be the perfect play for a doctor looking to buy a single-family rental near Tampa General Hospital. Their stable income and excellent credit make them an ideal candidate, letting them lock in fantastic financing terms for a long-term hold.

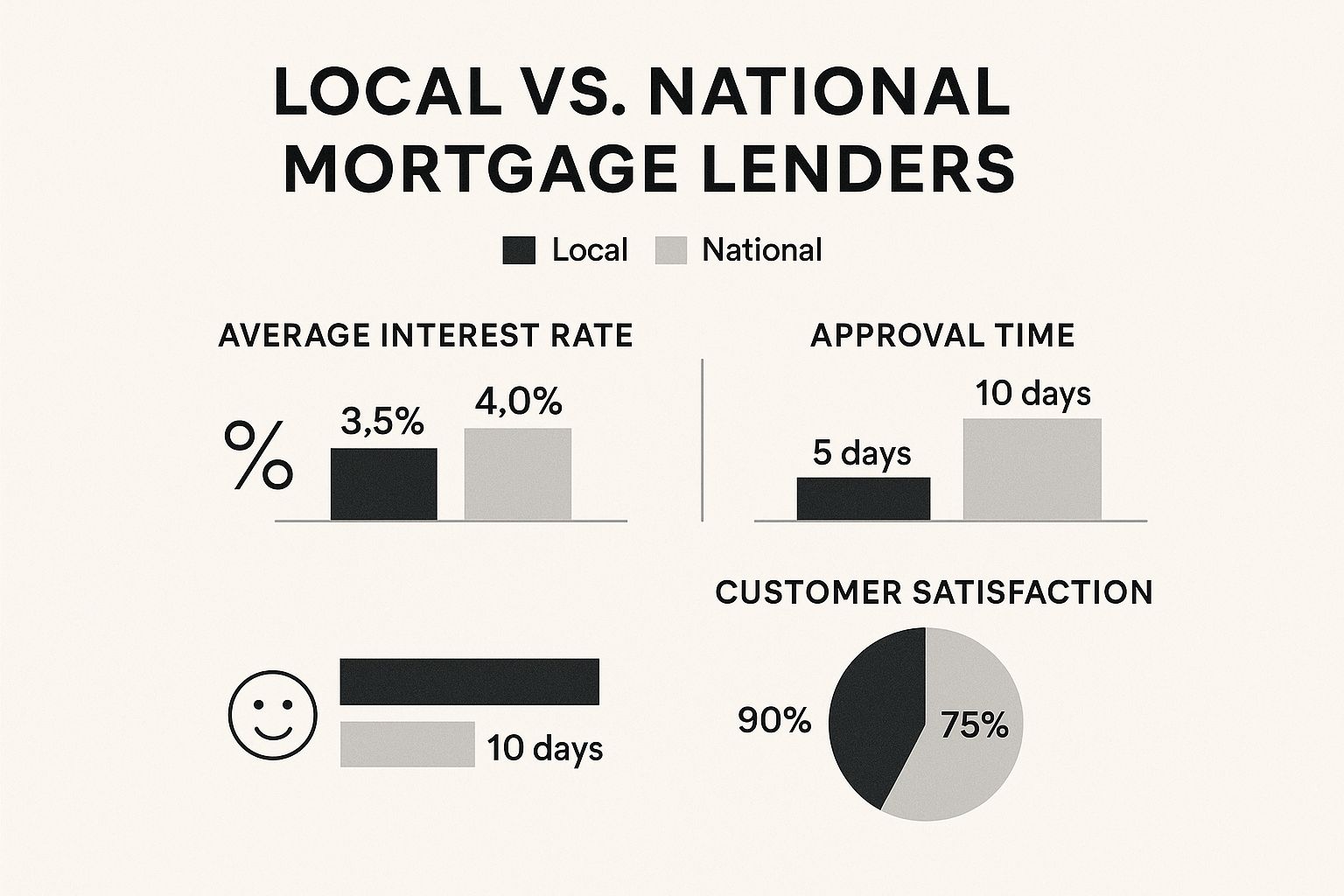

The image below really drives home the difference between working with a specialized local lender versus a big national bank.

As you can see, a local lender often comes out ahead on speed, cost, and the overall experience—all things that are critical in a fast-moving market like Tampa.

To help you see the options side-by-side, we've put together this quick comparison of the investment loan programs we offer at RAC Mortgage. It's a simple way to see which one might be the best fit for your next deal.

Investment Loan Program Comparison

| Loan Program | Best For | Key Feature | Typical LTV |

|---|---|---|---|

| DSCR Loan | Self-employed investors or those with complex income. | No personal income verification; based on property cash flow. | Up to 80% |

| Conventional Loan | Investors with W-2 income and strong credit. | Competitive interest rates and established guidelines. | Up to 80% |

| Portfolio Loan | Seasoned investors with multiple properties. | Consolidates multiple loans into one single payment. | Varies |

This table should give you a clear starting point. Each program is designed for a different kind of investor and a different kind of strategy. The key is to match your financing to your goals.

Portfolio Loans for Seasoned Investors

For investors juggling multiple properties, a portfolio loan is an incredibly efficient tool. Instead of wrestling with a dozen different mortgages, this loan lets you bundle several properties under a single loan with just one monthly payment.

This approach is really built for established investors who have a proven track record. At RAC Mortgage, we can work with you to consolidate your existing Tampa properties or finance a whole new package of rentals at once.

A portfolio loan simplifies your finances, improves your cash flow management, and can free up equity to acquire more properties. It's a strategic move for scaling your real estate business.

For example, an investor with five single-family rentals scattered across Hillsborough County could refinance them all into one portfolio loan. This doesn't just clean up their bookkeeping—it might also unlock better terms than they had on the individual loans, putting them in a great position to expand. Choosing the right program with a lender who gets it, like RAC Mortgage, makes all the difference in aligning your financing with your ambitions.

How to Prepare Your Mortgage Application

Think of your mortgage application not as a pile of paperwork, but as the business plan for your next Tampa investment property. A strong, well-organized application is the single best way to get a fast, smooth approval. When you walk into a lender like Residential Acceptance Corporation (RAC Mortgage) with everything in order, it immediately signals that you’re a serious, qualified investor who is ready to go.

This isn't just about filling out forms. It’s about telling a clear, compelling financial story. A meticulously prepared application package gives your loan officer at RAC Mortgage the full picture of your financial health, your track record as an investor, and your ability to manage this new property successfully.

Assembling Your Core Financial Documents

First things first, let’s get the foundational documents together. This is the paperwork that provides a verifiable snapshot of your income, assets, and debts. Having this organized from the jump can shave significant time off the underwriting process.

At a minimum, you'll need to have these items ready to go:

- Proof of Income: Typically, this means your last two years of W-2s, your most recent pay stubs, and federal tax returns.

- Asset Statements: Round up the statements for all of your accounts—checking, savings, 401(k)s, IRAs, and any brokerage accounts.

- Identification: You'll need a clear copy of your driver's license or another valid government-issued photo ID.

- Credit History: While we’ll pull a full credit report, it’s always a good idea to know your score beforehand. Be prepared to explain any dings or blemishes on your record.

For a more granular look at what to gather, a comprehensive mortgage pre-approval checklist breaks it all down. Honestly, having these things scanned and ready before you even make the first call shows you mean business.

Special Considerations for Real Estate Investors

Financing an investment property isn't quite the same as a standard home loan; it requires a bit more paperwork. As a Tampa investment property mortgage lender, we need to see the complete picture of your real estate portfolio. This helps us gauge the strength of your current holdings and your capacity to take on another property.

For seasoned investors, be ready to provide:

- A Schedule of Real Estate Owned (REO): This is just a neat list of every property you own. It should include the property’s value, any mortgage balance, and the rental income it generates.

- Lease Agreements: For your existing rentals, have the current lease agreements handy to verify that rental income.

- Property Tax and Insurance Statements: We'll need these for all your properties to accurately calculate your total existing obligations.

Presenting a clean, organized, and complete REO schedule is one of the most powerful things an investor can do. It screams professionalism and shows you have a firm handle on your business, which builds a ton of confidence with underwriters.

Before you hit "submit," it's worth running through a comprehensive pre-approval checklist. This one small step can save you from major headaches and delays down the road.

Navigating Income for Self-Employed Investors

If you're self-employed, documenting your income can feel a little more involved, but it's completely doable with some prep work. Instead of relying on W-2s, lenders will be zeroing in on your business's profitability and consistency over time.

You'll generally need to provide:

- Two Years of Business Tax Returns: This is the main document we use to verify your income.

- Profit and Loss (P&L) Statement: A recent P&L, usually for the current year-to-date, gives us a look at your business's current performance.

- Balance Sheet: This provides a quick snapshot of your company’s assets and liabilities.

What we’re really looking for is a history of stable or, even better, growing income. This is especially critical in Tampa's red-hot market. Zillow recently named Tampa one of the hottest housing markets for a reason—properties are moving incredibly fast.

With a median of just 29 days to go pending and nearly 19% of homes selling above the asking price, a bulletproof application is non-negotiable. It’s what makes your offer stand out in a sea of competitors. Getting your documents in order ahead of time makes the whole process faster and positions you as the kind of borrower RAC Mortgage wants to work with.

What Happens Between Approval and Closing

So you got the loan approval. That's a huge win, but don't pop the champagne just yet. Think of it more like reaching base camp before the final climb. There’s a critical period between that "yes" from the underwriter and the day you finally get the keys to your Tampa investment property, and it's packed with moving parts.

This is where having a seasoned Tampa investment property mortgage lender like us at Residential Acceptance Corporation (RAC Mortgage) really pays off. A great loan officer becomes your quarterback, coordinating with the appraiser, the title agent, and your insurance provider to make sure every 'i' is dotted and 't' is crossed. Our job is to keep things on track so you don't face any last-minute surprises that could derail your closing.

Key Milestones on the Path to Closing

Once your loan file moves out of initial underwriting, a whole new phase of third-party verifications kicks in. It's all about making sure the property's value is what you think it is and that its legal history is clean. Your main job? Be ready to respond quickly if we need anything from you.

Here’s a look at what’s happening behind the scenes:

- The Property Appraisal: We'll order an appraisal from a licensed pro who knows the Tampa market inside and out. This isn't just a box to check; it’s a crucial step that protects both you and the lender from overpaying for a property.

- The Title Search: A title company digs through public records to hunt down any potential issues—think old liens, ownership claims, or other legal snags. The goal is to ensure you get a "clear title" at the closing table.

- Securing Hazard Insurance: You'll need to lock in a homeowner's insurance policy for the new property. Lenders require proof of this coverage (often called hazard insurance) before they'll fund the loan.

It’s important to know that your initial approval is often a conditional one. It basically means, "we're good to go, if all these verifications check out." If you want to dive deeper into what that means, check out our guide on what conditional mortgage approval means.

The Appraisal and Its Impact

The appraisal is probably the biggest hurdle in this final stretch. An appraiser doesn't just look at the home; they analyze its condition, its features, and, most importantly, what similar properties have recently sold for in that specific Tampa neighborhood. Local market conditions can make or break an appraisal.

For instance, we're seeing a bit of a cooling trend in the Tampa market right now. Data from Zillow shows that while sale-to-list price ratios are still strong at 0.976, the time properties spend on the market is ticking up slightly. This means appraisers are being extra careful. Having a lender who understands these subtle market shifts is absolutely vital.

What if the appraisal comes in low? It happens, and it doesn't automatically kill the deal. When we see an "appraisal gap," we immediately start strategizing with you. We can often help you renegotiate with the seller or explore different loan structures to bridge the difference.

Preparing for the Final Signature

Once the appraisal is in, the title is clear, and insurance is secured, your file heads back to the underwriter for one last look. When they give the final nod, you'll get the three words you've been waiting for: "Clear to Close."

Soon after, a critical document will land in your inbox: the Closing Disclosure (CD). Federal law requires you to receive this at least three business days before you're scheduled to sign. This document is a complete financial breakdown of your loan.

It shows you:

- Your final interest rate and monthly payment.

- An itemized list of all your closing costs.

- The exact dollar amount you need to bring to closing.

Read this document carefully. Line by line. Compare it to the Loan Estimate you received when you first applied. If anything looks off or raises a question, call your loan officer at RAC Mortgage right away. That three-day window is there for a reason—to give you time to catch any errors and walk into closing day with total confidence.

Common Questions About Tampa Investment Loans

Getting into Tampa's real estate investment game is exciting, but it definitely brings up a lot of questions—especially about the money side of things. As a Tampa investment property mortgage lender, we at Residential Acceptance Corporation (RAC Mortgage) have heard them all.

Getting straight answers is the only way to make smart, confident moves. So, let’s dive into the questions we get asked every single day by investors just like you. Our goal here is to clear up the confusion and give you the confidence to take the next step.

What Credit Score Do I Need for an Investment Property Loan?

This is usually the first question on everyone's mind. While the exact number can shift depending on the loan program, a good benchmark for most investment property loans is a credit score of 680 or higher. A strong credit history really does open doors to better interest rates and terms, which makes a huge difference to your property's profitability over the long haul.

But here’s a crucial tip: don't let that number discourage you. Some of the best tools for investors, like our DSCR (Debt Service Coverage Ratio) loans, are built differently. They focus more on the property’s ability to generate income than on your personal credit. If the deal itself is solid, a lower credit score might not be a deal-breaker. The best thing you can do is have a quick chat with one of our loan officers to see where you stand.

Key Takeaway: A 680+ credit score is a great goal, but it's not the only path. At RAC Mortgage, we have specialized loans that prioritize the strength of the investment deal, giving you more ways to qualify.

How Much of a Down Payment Is Required?

Get ready for a bigger number than you’d see for your own home. For an investment property, you should budget for a down payment somewhere in the 20% to 25% range.

Why so much? Lenders see investment properties as a bit riskier, so a larger down payment shows you're serious and financially sound. It's also a smart play on your part. A bigger down payment often leads to a lower interest rate and a smaller monthly payment, which means better cash flow right from the start. We can walk you through the specific down payment needs for any loan program you're considering.

Can I Use a DSCR Loan for My First Investment Property?

Yes, you absolutely can! In fact, DSCR loans are fantastic for new investors. These loans qualify you based on the property’s expected rental income, not your personal W-2 earnings. This makes them a perfect fit if you're just starting out and don't have a long history of landlord income.

This is a game-changer for entrepreneurs, freelancers, or anyone with income that doesn't fit neatly onto a traditional pay stub. If you’ve found a great property in a hot Tampa neighborhood that's set to cash flow, a DSCR loan from RAC Mortgage could be your ticket in.

How Long Does It Take to Close on an Investment Property Loan?

In the Tampa market, you can generally expect the closing process to take between 30 and 45 days. This window gives everyone enough time to handle the essential steps like the appraisal, underwriting, and title search without cutting corners.

The best way to stay on the faster end of that timeline? Be prepared. Having all your financial documents organized and ready to go from day one can shave significant time off the process. It also helps to work with an experienced local lender like us. We know the Tampa market inside and out and have the relationships to keep things moving smoothly and sidestep common roadblocks.

Of course, getting the loan is just one part of the equation. As a future landlord, you'll have other things on your mind. It's a good idea to review these common questions asked by landlords to get ahead of the curve.

Ready to turn your Tampa real estate ambitions into a reality? The expert team at Residential Acceptance Corporation is here to provide the specialized financing and local market knowledge you need to succeed. Start your application today!