So, you're dreaming of owning a home in Tampa, but a less-than-perfect credit score has you feeling like you're on the outside looking in. Here's the good news: getting Tampa home loans bad credit ok isn't just a long shot—it's completely achievable when you know where to look. At Residential Acceptance Corporation (RAC Mortgage), we specialize in these exact situations, helping aspiring homeowners navigate the path forward.

Your Path to Tampa Homeownership with Bad Credit

It's a frustrating spot to be in. You feel locked out of the housing market because of some financial bumps in the road. A lot of potential buyers assume a few credit mistakes mean they're permanently on the sidelines. We're here to show you that's just not true.

This guide is your roadmap. We're going to walk you through the entire process, cutting through the confusion and giving you clear, actionable steps to take.

Here at Residential Acceptance Corporation, we know a credit score is just one part of your story. It doesn't tell us everything about your ability to be a responsible homeowner. Our job is to look beyond the number and find a solution that actually fits your life.

What You Will Learn in This Guide

We designed this guide to give you a complete picture of your options and how to tackle them with confidence. We’ll be covering a few key areas:

- Specialized Loan Options: We’ll dive into programs like FHA and Non-QM loans. These were specifically created with flexible credit requirements to open the door for more people.

- Credit Improvement Strategies: You’ll get practical, effective tips to help strengthen your financial profile, both before and during your loan application.

- The Application Journey: We’ll break down the mortgage application from start to finish. You’ll know exactly what to expect when you team up with RAC Mortgage.

The reality is that not everyone has perfect credit, or even good credit. There is always a way to get financing. It's about getting connected with the right lending team and evaluating your specific situation to find a solution.

Why Your Credit Score Is Not the Final Word

Think of this guide as your partner in making your homeownership goals a reality. A lower credit score just means you need a more personalized game plan—and that's exactly what specialists like us at RAC Mortgage provide. We're committed to finding the right path for your unique circumstances.

Financial trouble can hit anyone. It could be unexpected medical bills, a job loss, or any number of life's curveballs. These things shouldn't permanently disqualify you from the stability and wealth-building that comes with owning a home in beautiful Tampa.

By the time you finish this guide, you’ll have the know-how to take that next confident step toward your new front door.

How Lenders See Bad Credit (And What It Means For You)

Before we jump into the specific home loans available in Tampa for folks with less-than-perfect credit, it’s helpful to get inside a lender’s head. Why do they care so much about that three-digit number?

Think of your credit score as a quick financial snapshot. For a lender, it’s the fastest way to get a feel for the risk involved in loaning someone a huge chunk of money for a house. A lower score, generally anything under 620, flashes a warning sign of higher potential risk.

But here's the thing: that number almost never tells the full story. It can't explain the context behind a past foreclosure, a mountain of unexpected medical debt, or that sudden job loss that threw your finances for a loop.

If this sounds familiar, you're not alone. Far from it. Many communities around Tampa have a significant number of people with subprime credit profiles, which makes getting a standard home loan tough. In fact, early 2025 data from Equifax shows that in nearby Pinellas County, the subprime credit population is about 20.45% of the total—a number that's held pretty steady.

This means a lot of aspiring homeowners are running into roadblocks that call for a different kind of lending.

The Role of Risk-Based Pricing

When a lender sees a lower credit score, they often turn to something called risk-based pricing. It’s just a fancy term for adjusting the loan's terms—usually the interest rate—to offset the perceived risk.

Picture two people applying for the same loan. One has a stellar credit score, the other has a bruised one. The lender might approve both, but the borrower with the lower score will almost certainly get a higher interest rate. It's the lender's way of balancing the scales for the higher chance of a late or missed payment down the road.

What Goes Into a "Bad" Score Anyway?

Your credit score isn't just pulled out of thin air. It’s a calculated grade based on a few key parts of your financial history. Getting a handle on these is the first step to taking back control.

- Payment History (35%): This is the big one. It's all about paying your bills on time. Just one or two late payments can really drag your score down.

- Amounts Owed (30%): This looks at how much of your available credit you're using. If your credit cards are maxed out, it signals to lenders that you might be overextended.

- Length of Credit History (15%): A longer track record of responsible borrowing usually helps your score.

- New Credit (10%): Applying for a bunch of new credit cards or loans in a short time can look risky to lenders.

- Credit Mix (10%): Lenders like to see that you can handle different kinds of debt, like credit cards, auto loans, and student loans.

The most important thing to remember is that your credit score is a reflection of your past, not a prediction of your future. It doesn't have to define your ability to buy a home.

This is where finding the right kind of lender changes everything. Big banks might see a low score and just say "no." But specialists in Tampa home loans where bad credit is ok know how to dig deeper and look at your whole financial picture.

A lender like Residential Acceptance Corporation (RAC Mortgage) has the experience to see beyond the numbers. Before anything else, it’s helpful to understand what credit score is needed for a mortgage in general.

Once you understand how lenders think, you're in a much better position to build a strong case for yourself. RAC Mortgage can help you play up your strengths and connect you with a loan that actually fits your life.

Want to see what's possible? Reach out to a Tampa mortgage lender for bad credit for a consultation that’s tailored to you.

Government-Backed Loans for Tampa Homebuyers

For a lot of Tampa homebuyers staring down a challenging credit history, government-backed loans are a fantastic and very real starting point. These aren't loans handed out directly by the government. Instead, federal agencies like the Federal Housing Administration (FHA) act as an insurer on these loans. This gives lenders like us at Residential Acceptance Corporation (RAC Mortgage) the confidence we need to work with borrowers who have a less-than-perfect credit past.

Think of it as having a powerful co-signer with a flawless financial record. The government's guarantee lowers the risk for the lender, which in turn opens doors for buyers who might otherwise be told "no." These programs were built from the ground up to make homeownership more achievable, offering flexible credit score minimums and much lower down payments than you'd find with a conventional mortgage.

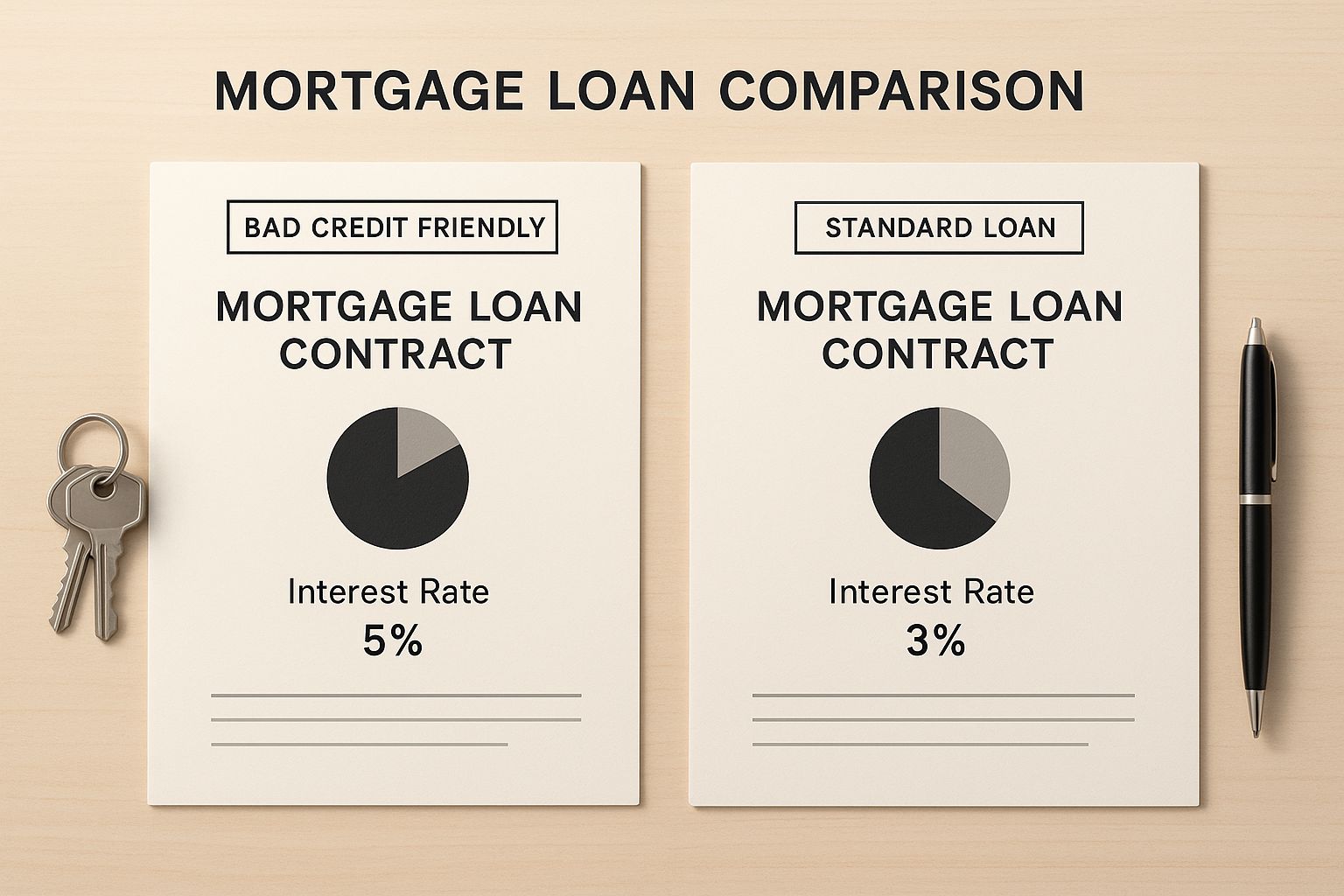

The image below really highlights the difference between these bad-credit-friendly options and the hurdles of standard loans.

As you can see, specialized loan programs carve out a clear path to owning a home that might seem completely blocked off by traditional lending rules. Let’s break down the main government-backed options RAC Mortgage offers so you can see which one might be the right fit for you.

FHA Loans: A Popular Choice for Credit Flexibility

The FHA loan is easily one of the most common routes for first-time homebuyers and anyone whose credit score doesn't quite clear the bar for conventional financing. Because the FHA is insuring the loan, RAC Mortgage can help Tampa residents get into a home with a credit score as low as 500.

Here’s the general breakdown:

- Credit Score 580+: You can often qualify for a down payment as low as 3.5%. This is huge because it dramatically lowers the amount of cash you need to bring to the closing table.

- Credit Score 500-579: You may still have a shot, but you'll likely need a 10% down payment. It's a bit higher, but it keeps the dream of homeownership alive for many.

A key piece of the FHA puzzle is the Mortgage Insurance Premium (MIP). Every FHA loan has it, no matter how much you put down. It includes an upfront premium and an annual premium that's paid monthly. This insurance is precisely what protects the lender and makes these flexible terms possible.

VA Loans: Honoring Our Military Service Members

If you're a veteran, an active-duty service member, or an eligible surviving spouse, the VA loan program is an absolutely incredible benefit. Backed by the U.S. Department of Veterans Affairs, these loans are designed to make buying a home exceptionally accessible for those who have served our country.

The standout features are hard to beat:

- No Down Payment Required: This is the game-changer. For most who qualify, you can finance 100% of the home's purchase price.

- No Private Mortgage Insurance (PMI): Unlike other loans with small down payments, VA loans don't have that costly monthly mortgage insurance. This can save you hundreds of dollars every single month.

- Flexible Credit Requirements: The VA doesn't set a hard credit score minimum. This allows lenders like RAC Mortgage to work with scores starting in the low 600s—and sometimes even lower, depending on your complete financial profile.

Instead of PMI, VA loans typically have a one-time VA funding fee. The cost of this fee depends on your service, down payment (if any), and whether you've used the benefit before.

USDA Loans: For Homes in Eligible Rural Areas

The United States Department of Agriculture (USDA) also gets in the game with a home loan program aimed at helping low-to-moderate-income families purchase homes in designated rural areas. And you might be surprised at what the USDA considers "rural"—many suburban spots just outside Tampa proper are often eligible.

The benefits look a bit like what the VA offers:

- No Down Payment Required: USDA loans also offer up to 100% financing, knocking down one of the biggest barriers for homebuyers.

- Lenient Credit Guidelines: A score of 640 is the typical target, but at RAC Mortgage, we can often explore options for applicants with lower scores through a process called manual underwriting, where we look at your entire financial story, not just the number.

Of course, these loans have specific income limits and the property must be in an eligible location. Our team at RAC Mortgage can quickly help you figure out if your income and the home you love meet the USDA's criteria for the Tampa Bay area.

Finding a path to a Tampa home loan even with bad credit is okay when you have the right partner showing you the way through these excellent programs.

To help you see how these options stack up, we've put together a simple comparison table.

Comparing Government-Backed Home Loans for Bad Credit

This table breaks down the key features of FHA, VA, and USDA loans available through RAC Mortgage, giving Tampa homebuyers a clear, side-by-side look at what each program offers, especially for those with credit challenges.

| Loan Feature | FHA Loan | VA Loan | USDA Loan |

|---|---|---|---|

| Minimum Credit Score | As low as 500 | No official minimum (lender discretion) | Typically 640, flexible options available |

| Minimum Down Payment | 3.5% for scores 580+; 10% for 500-579 | 0% for most qualified borrowers | 0% for qualified borrowers |

| Mortgage Insurance | Yes (Upfront & Monthly MIP) | No (one-time VA Funding Fee instead) | Yes (Upfront & Annual Guarantee Fee) |

| Who It's For | First-time buyers, low-credit borrowers | Veterans, active military, eligible spouses | Low-to-moderate income buyers |

| Location Requirement | Any location | Any location | Must be in a designated rural/suburban area |

Each of these loans provides a unique pathway to homeownership. The best choice really depends on your personal circumstances—your service history, income, and where in the Tampa area you want to live. Our job is to help you navigate these options to find the perfect fit.

Non-QM Loans: The Flexible Alternative for Bad Credit

What happens when your financial story doesn't quite fit inside the standard lending box? Government-backed loans like FHA and VA are powerful tools, but they still have strict rules that not everyone can meet. This is where a Non-Qualified Mortgage (Non-QM) becomes a true game-changer for anyone looking for Tampa home loans with bad credit.

Think of conventional and government loans as having a rigid checklist. If you can't tick every single box—perfect W-2 income, a specific credit score, zero recent credit hiccups—you’re often out of luck. Non-QM loans, the kind of lending we specialize in at Residential Acceptance Corporation (RAC Mortgage), throw that rigid checklist right out the window.

Instead, they focus on a common-sense approach to your actual ability to repay the loan. It’s this flexibility that makes them an essential alternative when other doors have slammed shut.

How Non-QM Loans Create Opportunity

Non-QM loans are specifically designed for borrowers with unique circumstances. At RAC Mortgage, we use these products to solve problems that standard mortgages simply can't touch. They are especially powerful for people who are otherwise financially sound but have a situation that automated underwriting systems just don't get.

Here are a few real-world scenarios where a Non-QM loan is the perfect fit:

- Self-Employed Borrowers: If you're a freelancer, gig worker, or small business owner in Tampa, your tax returns might not show your true cash flow because of all the business write-offs. A Non-QM loan can use 12 or 24 months of bank statements to verify your income, skipping the traditional tax docs entirely.

- Recent Credit Events: Many conventional and FHA loans have mandatory waiting periods after a bankruptcy or foreclosure. Some Non-QM programs let you qualify much, much sooner—sometimes as little as one day after a major credit event.

- Asset-Based Lending: Have significant assets but lower documented income? An asset depletion loan can be a great option. This method calculates a qualifying income based on your assets, opening a path to homeownership for retirees or savvy investors.

A Non-QM loan isn’t a "subprime" loan like you might remember from the past. It's a carefully underwritten mortgage for a strong borrower whose financial picture is simply non-traditional. It’s all about verifying your ability to pay in a way that actually makes sense for your life.

The History of Alternative Lending in Florida

The idea of creating loans for borrowers with weaker credit isn't new. In fact, Florida has a long and storied history with this type of financing. During the housing boom of the early 2000s, subprime mortgage originations exploded from around 300,000 in 1998 to nearly 2,000,000 by 2005.

Florida was right at the center of it, with about 6 subprime originations per 100 housing units in 2005—almost double the national metropolitan average.

But today's Non-QM loans are a different beast entirely. They are built on a foundation of stronger regulations focused squarely on ensuring a borrower's ability to repay. They provide a safe, structured way for those with complex financial situations to secure a Tampa home loan even when bad credit is ok.

Is a Non-QM Loan Right for You?

This type of financing is a powerful tool, but it's important to know if it fits your specific situation. That's where we come in. RAC Mortgage can help you figure out if it's the best path forward.

You might be a strong candidate if:

- You are self-employed with income that's inconsistent or hard to document on paper.

- You have a recent credit event, like a foreclosure, that’s getting you denied for other loans.

- You have a lot of assets but don't show a high monthly income.

- You're an investor looking to buy a property based on its rental income potential (this is called a DSCR loan).

These loans prove that a past financial stumble or an unconventional career path shouldn't lock you out of owning a home in Tampa. To see a more detailed breakdown of what's involved, you can learn more about our Non-QM loan requirements and see how we can customize a solution for you. At RAC Mortgage, our expertise is in looking at your complete financial story to find the mortgage that actually works.

Actionable Steps to Improve Your Credit Score Now

Improving your credit score is one of the most powerful things you can do on your journey to buying a home. It can feel like a huge mountain to climb, but it’s really just a series of small, manageable tasks.

Think of it this way: small, consistent efforts add up over time to create a much stronger credit profile. This is exactly what a lender like Residential Acceptance Corporation (RAC Mortgage) wants to see, and it helps us offer you better loan terms. This isn't about getting a perfect score overnight. It's about making steady progress that proves you’re a reliable borrower.

Every single point you add to your score strengthens your application for a Tampa home loans bad credit ok solution. Let’s jump into the practical steps you can start taking today.

Review Your Credit Reports Thoroughly

First things first: you need to know exactly where you stand. You’re entitled to a free copy of your credit report every year from each of the three major bureaus—Equifax, Experian, and TransUnion. Make sure you pull all three and go over them with a fine-tooth comb.

You're looking for errors, no matter how small they seem. Common mistakes include:

- Accounts listed that don't actually belong to you.

- Late payments that were reported incorrectly.

- Old negative information that should have already been removed.

If you spot an error, dispute it with the credit bureau immediately. Getting these inaccuracies corrected is often the single fastest way to give your score a boost.

Focus on Consistent On-Time Payments

Your payment history is the heavyweight champion of your credit score, making up about 35% of the entire calculation. Lenders are looking for a consistent track record of you paying your bills on time, every single time. It's a tough pill to swallow, but just one late payment can undo months of hard work.

An easy way to stay on top of this is to set up automatic payments for all your recurring bills—credit cards, car loans, utilities, you name it. If you have some past-due accounts, make it your top priority to get them current as fast as you can. This kind of consistent behavior is a huge green light for mortgage lenders.

Lower Your Credit Utilization Ratio

The second most important factor is your credit utilization ratio. This is just a fancy way of saying how much credit you're using compared to your total available credit. Maxed-out credit cards are a major red flag for lenders.

A good rule of thumb is to keep your balance below 30% of the limit on each individual card.

Your goal is to show lenders you aren't overextended. Paying down balances is a direct and effective way to lower your utilization and improve your score, sometimes in as little as 30-45 days.

Beyond these traditional credit repair methods, it’s crucial to address any outstanding financial issues. For instance, getting expert help with back taxes and IRS debt can dramatically improve your overall financial picture and open up homeownership doors that you thought were closed for good.

For a deeper dive into credit-building strategies aimed specifically at getting a mortgage, RAC Mortgage has a detailed guide. You can learn more about how to improve your credit score for a mortgage and get more targeted advice. Taking these empowering steps now puts you on a clear path to qualifying for the Tampa home you deserve.

Navigating the Loan Application with RAC Mortgage

You've looked at the options and found a loan that seems to fit. Now comes the application, and let's be honest—it can feel like a mountain to climb, especially if you've had credit issues in the past. But when you work with Residential Acceptance Corporation (RAC Mortgage), you’re not going it alone. We’re here to make the whole thing as clear and simple as possible.

Our entire approach is built on being upfront and guiding you through. We get that securing Tampa home loans when bad credit is ok is about more than just forms. It's about telling your complete financial story, and we’re here to help you present the strongest case possible for approval.

Getting Your Paperwork in Order

First things first, let's get your documents ready. Having everything gathered ahead of time makes the process so much faster and a whole lot less stressful. Think of it as putting together your financial resume.

You'll generally need to pull together:

- Proof of Income: This usually means your last 30 days of pay stubs and your W-2 forms from the past two years.

- Asset Verification: Lenders want to see you have the money for a down payment and closing costs. You'll need your bank statements for the last two months from any checking and savings accounts.

- Tax Returns: Grab your federal tax returns, including all the schedules, from the last two years.

- Identification: A simple copy of your driver’s license and Social Security card will do.

Being totally open about your credit history is huge. Trying to hide past bumps in the road only creates bigger problems down the line when the underwriters dig in. Our loan officers are here to help you explain any credit challenges, not to judge them. That kind of open communication is exactly how we find a path to a yes.

What to Expect During Underwriting

After you submit your application, it heads to underwriting. This is where an underwriter takes a fine-tooth comb to all your documents to make sure you can repay the loan. They’ll be looking closely at your debt-to-income (DTI) ratio, which is a major factor. Florida's own history shows how crucial this is; back during the housing bubble, the average borrower's DTI jumped from 33% to 38%, which left many people with credit challenges in a tough spot when the market turned. You can actually read more about Florida's mortgage market history on predatorylending.duke.edu.

As you work through the application, it's also smart to compare what's out there to make sure you're getting the best deal. For example, it’s worth taking time to understand the different fixed-rate mortgage options from banks versus brokers.

At RAC Mortgage, our underwriters look beyond just the numbers on a page. They consider the whole story—including things like letters of explanation for credit dings—to make a common-sense decision. Our team is here to guide you, answer every question, and help you get past any hurdles together.

Your journey to owning a home is a partnership. We're ready to help you take that first step with confidence. Let's get started with your personalized consultation at RAC Mortgage today and we'll demystify this process for you.

Your Tampa Bad Credit Home Loan Questions, Answered

Working through the home financing process can feel like a maze, especially if you're worried about your credit history. It brings up a lot of questions. We get it. Here at Residential Acceptance Corporation (RAC Mortgage), we hear them all the time. Let's tackle some of the most common ones we get about Tampa home loans bad credit ok.

What's the Real Minimum Credit Score to Get a Mortgage?

This is the number one question we're asked, and the honest answer is: it depends. There isn't a single magic number. For a government-backed option like an FHA loan, we at RAC Mortgage can often get approvals for scores as low as 500.

But that's not the end of the story. A Non-QM loan might provide even more wiggle room if you have other strengths, like a solid down payment or other assets. The real key is that we look at the whole picture, not just a three-digit score.

Can I Still Buy a Home After a Recent Bankruptcy?

Yes, you absolutely can. While a conventional loan might make you wait several years after a major credit event like a bankruptcy or foreclosure, some of our Non-QM loan programs were built for exactly this scenario. We've seen people get back into the housing market much, much sooner than they ever thought possible.

The most important thing to remember is that a past credit issue doesn't have to be a life sentence for renting. When you have the right lender and the right loan, there's almost always a path forward. Our entire business is built on finding that path for you.

How Much Will I Actually Need for a Down Payment?

The down payment you'll need is tied directly to your credit score and the loan program you end up using. It's not one-size-fits-all.

Here are a few real-world examples we see every day:

- FHA Loans: If your credit score is 580 or better, you could be looking at a down payment as low as 3.5%. For scores between 500 and 579, the requirement is typically 10%.

- VA and USDA Loans: These are incredible programs. For military members, veterans, and those buying in eligible rural areas, it's often 0% down, period. Even with a less-than-perfect credit score.

- Non-QM Loans: With these flexible loans, the down payment can vary quite a bit. It’s often used to balance the risk of a lower credit score, so you might see requirements of 20% or more, depending on your situation.

Is My Interest Rate Going to Be Sky-High?

Interest rates are all about risk. From a lender's perspective, a lower credit score means more risk, and that usually translates to a higher interest rate than someone with an 800 score would get. It's just a fact of the business.

However, even a small improvement in your score before you apply can make a noticeable difference in the rate you're offered. Our job at RAC Mortgage is to fight for the most competitive rate your profile can get, making sure that your monthly payment is something you can actually live with.

Ready to see what’s truly possible for your dream of homeownership? The team at Residential Acceptance Corporation is ready to give you a clear, no-pressure consultation. We'll look at your specific circumstances and lay out a real plan to get you a Tampa home loan, even if your credit has a few bumps.

Start your application today at https://racmortgage.com.