For a lot of Tampa's entrepreneurs, freelancers, and small business owners, trying to get a mortgage can feel impossible. You know you make good money, but when a traditional lender looks at your tax returns, they don't see the whole picture. This is where a Tampa alternative documentation mortgage comes in. It's a commonsense solution that uses documents like bank statements to prove your income, not just your tax returns.

This is exactly the kind of lending we specialize in at RAC Mortgage. We built our process for driven, self-employed people who deserve a path to homeownership that actually reflects their financial reality.

Your Path to a Tampa Home with Non-Traditional Income

Owning a home in a place like Tampa shouldn't be off-limits just because you don't get a W-2 every two weeks. If you run your own business, work in the gig economy, or freelance, you know that your tax returns are designed to minimize your taxable income. Every legitimate business deduction and write-off, while smart for tax purposes, works against you when you apply for a standard mortgage.

It’s a frustrating catch-22. Your cash flow is strong and consistent, but the number on your tax forms makes it look like you can't afford the loan. That's a huge disconnect, and it's why a more flexible approach is so critical.

A Modern Solution for Tampa's Innovators

Think of a conventional mortgage like an old-school system that only accepts one form of ID: your tax returns. If that's not your best picture, you're out of luck. An alternative documentation mortgage, on the other hand, is designed for the way people actually work today. It looks at the real money flowing through your business bank accounts.

Instead of penalizing you for being a savvy business owner, this kind of loan focuses on your actual ability to generate revenue.

Here at Residential Acceptance Corporation (RAC Mortgage), this is our bread and butter. We know Tampa's economy thrives because of entrepreneurs like you, and our entire process is built to see the real financial strength of your business.

An alternative documentation mortgage closes the gap between your real-world cash flow and your on-paper taxable income. It's a more accurate way to assess what a self-employed borrower can truly afford.

What This Guide Will Cover

We put this guide together to be your complete roadmap. Our goal is to walk you through every step so you feel confident turning your business success into a new home in the Tampa Bay area. No jargon, no confusion—just straight answers.

Together, we'll break down:

- The core concept of an alternative documentation mortgage and why it exists.

- Who is the perfect candidate for this type of home loan.

- How your bank statements can be the key to getting mortgage approval.

- What the application process looks like when you work with a specialist like RAC Mortgage.

What Exactly Is an Alternative Documentation Mortgage?

Ever tried to explain your business's success using just your tax returns? For a ton of self-employed folks in Tampa, that document tells a story of smart deductions and minimized tax liability—not the full story of your actual, consistent cash flow.

A Tampa alternative documentation mortgage is the perfect solution for this exact problem. It's a home loan specifically designed to verify your income using documents that paint a much more accurate financial picture.

Instead of getting hung up on W-2s or tax returns, this type of mortgage lets lenders look at other kinds of financial proof. At Residential Acceptance Corporation (RAC Mortgage), we focus on your real cash flow, because we get that your taxable income doesn't always show your true ability to afford a home. It's a common-sense approach built for strong, creditworthy borrowers whose financial reality just isn't captured by traditional paperwork.

Looking Beyond the Tax Return

The most common and effective type of alt-doc loan out there is the bank statement mortgage. With this program, our underwriters will analyze 12 or 24 months of your business bank statements. By reviewing your consistent monthly deposits, they can lock in a reliable qualifying income based on the real revenue your business actually generates.

This method opens up a vital path to homeownership for Tampa’s booming community of:

- Small business owners

- Independent contractors and freelancers

- Consultants and gig economy workers

- Real estate investors

A Proven Lending Approach

Alternative documentation mortgages, or 'alt-doc' loans as they're often called, aren't some newfangled idea. They became a key piece of the U.S. mortgage market back in the early 2000s, created specifically to help self-employed borrowers and people with non-traditional income streams.

In dynamic markets like Tampa, where small business ownership is a huge part of the local economy, these loans are a necessary financing tool that understands how modern entrepreneurs actually make a living.

For a self-employed professional, an alt-doc loan is the difference between an approval based on real-world earnings and a denial based on tax-optimized income. It aligns the mortgage process with the reality of entrepreneurship.

At the end of the day, these loans simply bridge the gap between what your income looks like on paper and your actual cash flow. They don't penalize you for running your business smartly and efficiently.

For many Tampa entrepreneurs, this shift in perspective is what makes the dream of owning a home a reality. Find out more about how a Tampa mortgage lender can help you without requiring tax returns in our detailed guide. This flexible verification process is designed to see the financial strength that conventional lenders often miss, making it a perfect fit for the entrepreneurial spirit of the Tampa Bay area.

Who Is an Ideal Candidate for a Tampa Alt-Doc Loan?

So, is a Tampa alternative documentation mortgage the right move for you? It's not a one-size-fits-all solution, but for a certain kind of homebuyer, it's a game-changer. The perfect candidate is someone whose real financial picture isn't captured by a traditional tax return. Their strength lies in consistent cash flow, not just what's left over after deductions.

Imagine a freelance marketing pro working out of a Seminole Heights coffee shop. They have a great, steady income, but their tax documents are loaded with legitimate business write-offs—software, ad spend, a home office, you name it. Those deductions slash their taxable income, making a standard mortgage approval next to impossible. This is exactly the person an alt-doc loan was made for.

Common Profiles That Benefit from Alt-Doc Loans

It's not about a specific job title; it's about how your finances are structured. At Residential Acceptance Corporation (RAC Mortgage), we look past the conventional paperwork to see the genuine financial stability that old-school underwriting often misses.

Here are a few real-world examples of Tampa locals who are a perfect fit for these loans:

- The Gig Economy Driver: Think of an Uber or Lyft driver based in Ybor City. Their weekly pay might fluctuate, but they have a solid track record of substantial, consistent annual deposits.

- The Real Estate Investor: This is someone with multiple rental properties across the Tampa Bay area who uses depreciation and other write-offs to lower their taxable income on paper.

- The 1099 Contractor: A skilled tradesperson, an IT consultant, or anyone who gets 1099s instead of W-2s. Their gross earnings are high, but that’s before all the business expenses come off the top.

At its core, the ideal alt-doc candidate is simple: they can prove a strong, consistent ability to repay the loan using their actual cash flow, even when their tax returns tell a different story.

Key Characteristics of a Strong Applicant

While having a non-traditional income is the starting point, a strong applicant for a Tampa alternative documentation mortgage usually brings a few other key strengths to the table. These factors help paint a complete picture of financial responsibility for the lender, which lowers their perceived risk.

Successful applicants typically have:

- A Solid Credit Score: You don't need a perfect score, but a history of paying your bills on time shows you're reliable. A score of 620 or higher makes your application much stronger.

- Healthy Cash Reserves: Having a few months of mortgage payments tucked away in savings acts as a critical financial buffer.

- Consistent Business Deposits: Lenders want to see a predictable pattern of money coming into your business accounts over the last 12-24 months.

If you're a 1099 earner, it's vital to understand how lenders look at your income. You can dive deeper into this by checking out our guide for Tampa mortgage lenders specializing in 1099 income.

Ultimately, it’s not about squeezing into a traditional box. It’s about proving your financial strength through other reliable means.

How Bank Statements Become Your Key to Approval

For self-employed professionals in Tampa, your tax returns don't tell the whole story. The real proof of your business's success is hiding in plain sight: your bank statements. They show the actual money coming in, not just what's left after tax-season write-offs. With a Tampa alternative documentation mortgage, these statements are what get you to the closing table.

Here at Residential Acceptance Corporation (RAC Mortgage), we look past the minimized income on your tax return and focus on your true, consistent cash flow. It's simple: your tax return is a single snapshot after every possible expense is deducted. Your bank statements are the full-length movie, showing the month-after-month revenue your business is actually generating.

Calculating Your Qualifying Income

The process is pretty straightforward, but the details matter. Our underwriters will dig into either 12 or 24 months of your business or personal bank statements. We're looking for one thing above all: a consistent and predictable stream of business-related deposits.

We're not just totaling up the deposits; we're analyzing the pattern. This lets us establish a reliable average monthly income that paints an accurate picture of what you can really afford—something a tax return rarely does for a business owner.

Think about a freelance web developer right here in Tampa. She consistently deposits $12,000 a month into her business account. But after paying for software, marketing, and her home office, her tax return might only show a taxable income of $4,000 a month. A traditional lender would base her loan on that lower figure, but we can qualify her based on her actual gross revenue.

To make this clearer, let's compare the documentation side-by-side.

Traditional vs Alternative Documentation

| Requirement | Traditional Mortgage (W-2 Borrower) | Alternative Documentation Mortgage (Self-Employed) |

|---|---|---|

| Primary Income Proof | W-2s, Pay Stubs, Tax Returns | 12-24 Months of Bank Statements |

| Income Calculation | Based on Gross W-2 Income | Based on Average Monthly Deposits/Cash Flow |

| Business Deductions | Not a major factor | Ignored in favor of top-line revenue |

| Supporting Docs | Employment Verification | Profit & Loss Statement, Letter from CPA |

This table shows exactly why bank statement loans are a game-changer for entrepreneurs. The focus shifts from tax-minimized income to real-world cash flow.

Strengthening Your Financial Profile

While your bank statements are the star of the show, a few other documents can really bolster your application and give underwriters a crystal-clear view of your business's stability.

- Profit and Loss (P&L) Statement: This is a big one. A P&L, especially one prepared by a CPA, breaks down your revenue and expenses, adding a serious layer of credibility to your income claims.

- Balance Sheets: If your business is incorporated or a partnership, a current balance sheet provides a quick snapshot of your company’s assets and liabilities.

- A Letter from Your CPA: Sometimes, a simple letter from your accountant confirming how long you've been self-employed and the viability of your business is all it takes to add that extra bit of confidence.

For so many self-employed borrowers, the bank statement analysis is the turning point. It finally validates their true earning power in a language underwriters understand, moving them from a potential denial to a confident approval.

In Tampa's mortgage market, alternative documentation loans fill a crucial need for the self-employed. Instead of relying on W-2s or tax returns that often understate income due to business deductions, these mortgages analyze 12 to 24 months of deposits to get to the truth of your income. This method provides a far more accurate cash flow picture for small business owners and contractors. To see how this could work for you, you can learn more about bank statement mortgages in Tampa from our team.

Your Application Journey with RAC Mortgage

So, you're thinking about moving forward with a Tampa alternative documentation mortgage? It might feel like a complicated path, but here at Residential Acceptance Corporation (RAC Mortgage), we've made it a clear, simple journey. We designed our entire process specifically for self-employed professionals like you, making sure it’s a straightforward experience from our first chat to you getting the keys to your new Tampa home.

This whole journey starts by gathering the documents that tell your real financial story. Forget the tax returns that traditional loans fixate on. Your most important tools here are 12 to 24 months of bank statements. These, along with a Profit and Loss (P&L) statement, are what our underwriting team needs to get started.

From Paperwork to Underwriting

Once you have your statements ready, our specialized underwriters get to work. Their job isn't to pick apart your business write-offs; it's to see your actual cash flow. They'll carefully review your monthly deposits to establish a steady, qualifying income that truly shows what you can afford. This is where our deep experience with the fine points of alt-doc lending really makes a difference.

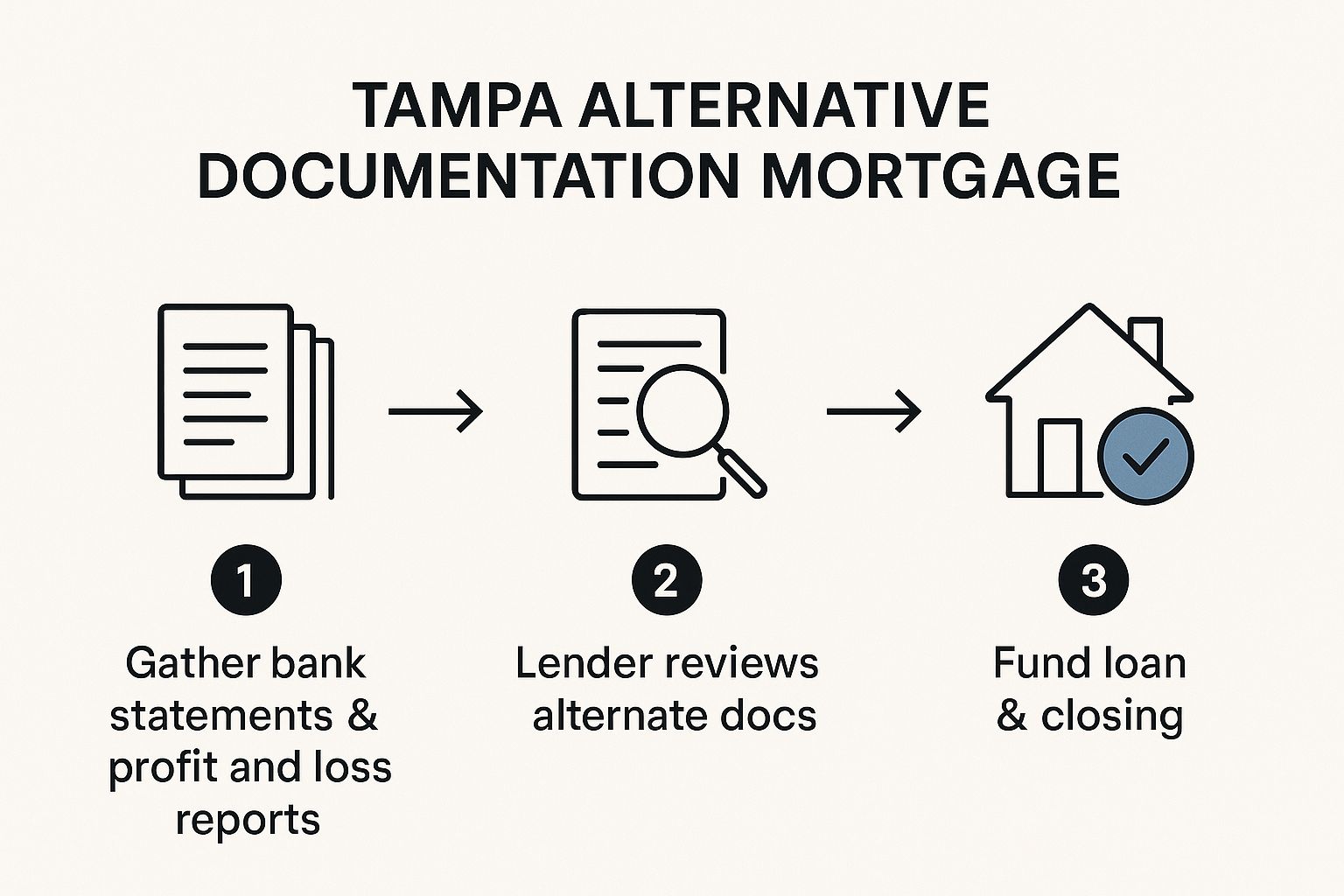

This simple visual breaks down the clear, three-stage process for getting your Tampa alternative documentation mortgage.

As you can see, the path flows logically from getting your documents together, to our analysis, and finally to a successful closing. We’ve taken what many people think is a complex process and made it easy to understand.

What to Expect at Each Stage

We believe in being completely open, which means you’ll always know what’s happening and how long things should take. Here's a quick look at the main phases you'll go through with your RAC Mortgage loan officer:

- Initial Chat and Document Collection: This is where we get to know you and your goals, and you learn about how it all works. We'll give you a simple checklist of what we need, which is mainly your bank statements and P&L.

- Underwriting and Income Review: Our team dives into your financial statements to calculate your qualifying income based on your cash flow. Once all your documents are in, this part usually moves pretty fast.

- Appraisal, Approval, and Closing: After we’ve verified your income, we'll order an appraisal for the Tampa property you've picked out. Once we have the final approval, we’ll work with the title company to get your closing on the calendar.

Working with a loan officer who deeply understands both alt-doc lending and the local Tampa market makes all the difference. It turns a potentially stressful process into a confident stride toward homeownership.

Benefits and Considerations of Alt-Doc Mortgages

Choosing the right home loan is a massive decision, and for many non-traditional borrowers, a Tampa alternative documentation mortgage can be a game-changer. But to make a smart choice, you have to look at both sides of the coin—weighing the clear advantages against the potential considerations. Getting this balanced view is the only way to ensure the loan you pick truly lines up with your financial goals.

The biggest benefit is obvious: it opens the door to homeownership for creditworthy people who just don't fit into the rigid box of conventional lending. If you're self-employed, a freelancer, or run your own business, this is how you qualify based on your actual cash flow, not just the income you show on your tax returns. It’s about getting a loan that reflects your real earning power.

Weighing the Pros and Cons

Here at Residential Acceptance Corporation (RAC Mortgage), we’re all about transparency. While alt-doc loans offer incredible flexibility, they aren't identical to traditional mortgages. Understanding these differences is key to building a solid financial foundation for your new home.

To make things simple, we've put together a straightforward comparison of the key benefits and factors to keep in mind when you're looking into a Tampa alternative documentation mortgage.

Pros and Cons of Tampa Alt-Doc Loans

| Advantages | Considerations |

|---|---|

| Income is Based on Real Cash Flow: Your business's health, not just your tax return, proves your ability to pay. | Potentially Higher Interest Rates: To offset the perceived risk, rates can be a bit higher than conventional loans. |

| A Clear Path to Homeownership: Opens doors for borrowers who would otherwise be locked out of the market. | Larger Down Payment May Be Needed: Lenders might require more skin in the game, often 10% to 20% or more. |

| Perfect for Entrepreneurs: Designed specifically for self-employed individuals and small business owners. | A Strong Credit Profile Helps: While flexible, lenders still want to see a solid credit history and a good score. |

| Often a Faster Qualification: Using bank statements can sometimes speed up the income verification process. | Requires Organized Financials: You'll need clean, well-kept bank statements or other records to make your case. |

Thinking about these loans in the right way is crucial.

"An alt-doc mortgage is not a 'subprime' loan; it's a 'prime' solution for a prime borrower with non-traditional income. It's about looking at the complete financial picture to assess true creditworthiness."

Partnering for the Best Terms

Don't see the "considerations" as roadblocks—think of them as factors to navigate. For instance, while the interest rate might be slightly higher than a conventional loan, the opportunity to buy a home now and start building equity often makes that small difference more than worth it.

The experts at RAC Mortgage are here to help you sort through it all. We’ll take a hard look at your unique financial situation against the backdrop of Tampa's dynamic housing market. Our goal is to find you the most favorable terms possible, making sure your mortgage is a tool for your long-term success, not a burden.

Common Questions About Tampa Alt-Doc Mortgages

Going through any mortgage process is going to bring up questions, and a Tampa alternative documentation mortgage is no exception. We get it. To give you some clarity, we've put together answers to the questions we hear most often from self-employed homebuyers right here in the Tampa Bay area. Our goal is to make sure you have the confidence you need to take the next step.

Each answer is straightforward and helpful, building on what we've already covered and showing how Residential Acceptance Corporation (RAC Mortgage) creates clear paths to homeownership for non-traditional borrowers.

Do I Need Perfect Credit for an Alt-Doc Mortgage?

While a high score is always a plus for getting better terms, you definitely don’t need perfect credit. At RAC Mortgage, we’re looking at your whole financial picture, not just a single number. Your credit history, your assets, and the consistency of your business income are all important pieces of the puzzle we put together.

Think of a strong credit score as a great head start, but it’s just one part of a solid application. The best move is always to chat with one of our specialists about your specific credit situation so we can give you personalized guidance.

Are Interest Rates for Alt-Doc Mortgages Much Higher?

It's true that interest rates for alt-doc loans can sometimes be a little higher than what you'd see on a conventional mortgage. That small difference is simply because of the non-traditional way we verify your income, which lenders view as carrying a bit more risk.

However, for most self-employed borrowers, the ability to finally qualify for a home loan that actually reflects their true earnings makes this a worthwhile trade-off. RAC Mortgage is committed to finding the most competitive rates out there for your unique financial scenario.

How Long Does the Approval Process Take?

The timeline for a bank statement loan is often pretty close to a traditional mortgage, usually taking around 30 to 45 days from application to closing day. The single biggest thing that keeps the process moving smoothly is being organized from the very beginning.

When you team up with an experienced lender like RAC Mortgage and get us your 12-24 months of bank statements and other documents quickly, we can push the underwriting and approval forward without any needless delays.

Ready to turn your business success into homeownership in Tampa? The team at Residential Acceptance Corporation specializes in alternative documentation mortgages designed for entrepreneurs just like you. Apply today and get a clear path to your new home.