Getting a mortgage when you're self-employed in Tampa just hits different. It has to. The standard way of verifying income simply doesn't work for the entrepreneurial grind. The secret is finding local experts, like us at RAC Mortgage, who know how to paint the real picture of your financial health using alternative documentation. It makes all the difference, and it makes homeownership completely achievable.

The Reality of Tampa Home Loans for Entrepreneurs

If you're an entrepreneur, freelancer, or small business owner in Tampa, that independent streak naturally extends to wanting to own your own home. But let's be honest, the path to a mortgage can feel like an uphill battle when you don't have a W-2. The biggest hurdle isn't your success—it's proving that success in a language traditional lenders can understand.

At the end of the day, lenders just need to feel confident you can repay a massive loan over many years. For a W-2 employee, that's easy to see. For a business owner, income can ebb and flow, and that makes lenders nervous.

Why Income Verification Is So Different

The number one challenge for self-employed folks trying to get a home loan in Tampa is verifying income. You don't have pay stubs; you have 12 to 24 months of tax returns and business bank statements. Lenders will typically average the net income you report over that time, but all those smart business deductions can actually lower the income they'll use to qualify you.

This is exactly where specialized expertise is non-negotiable. Here at Residential Acceptance Corporation, we know your tax returns rarely tell the full story of what you're actually bringing in.

We see it all the time. A successful Tampa entrepreneur writes off every legitimate business expense possible to lower their tax bill. It’s a smart business move, but it can crush your qualifying income in the eyes of a lender, creating a really frustrating roadblock.

Key Factors Lenders Look At

It's not just about your income, though. Lenders are piecing together your entire financial puzzle to see if you're a solid borrower. Getting a firm grip on these elements before you apply can dramatically boost your chances of getting approved.

Here are the key metrics they're looking at:

- Credit Score: A strong credit history is your best friend. It shows you're a reliable borrower and helps balance out the perceived risk of your variable income.

- Debt-to-Income (DTI) Ratio: This is a big one. It's a simple calculation comparing your total monthly debts to the monthly income you can prove. Keeping this ratio as low as possible is crucial.

- Cash Reserves: Lenders love to see that you have accessible funds left over after closing. It's a safety net that proves you can handle unexpected income dips, which makes you a much more attractive applicant.

- Down Payment: The more you can put down, the better. A larger down payment lowers the lender's risk and shows your financial strength. It also directly impacts your loan-to-value ratio, a vital part of every lending decision.

How to Organize Your Financial Documents for Success

When you're self-employed in Tampa, your financial documents are more than just paperwork. They tell the story of your business's journey and its success. For a mortgage application, organizing them correctly is less about ticking boxes on a checklist and more about building a powerful case that proves your stability and earning power to an underwriter.

At Residential Acceptance Corporation, we know to look beyond the surface of a tax return. We want to understand the real health of your business, and a well-organized file is the fastest way to show us. It demonstrates professionalism and just makes the entire approval process quicker and smoother for everyone involved.

Crafting Your Financial Narrative

The foundation of any solid mortgage application is two years of complete tax returns—both personal and business. This isn't just a hoop to jump through; it’s our window into your financial consistency. An underwriter is specifically looking for stable or, even better, increasing net income over this period.

Think of each document as a piece of the puzzle. A Profit & Loss (P&L) statement, for instance, needs to be current and detailed. It has to clearly break down your revenue streams and expenses, painting an accurate picture of your business's recent performance.

A well-crafted P&L statement can be a game-changer. It provides the recent context that older tax returns might miss, showing an underwriter that even if last year had its challenges, your business is on a strong upward trajectory right now.

For example, a Tampa-based marketing consultant with fluctuating project income should make sure their bank statements show consistent deposits, even if the amounts vary. On the other hand, a local restaurant owner needs to present statements reflecting steady daily sales, which proves the business is healthy despite any seasonal dips.

Key Documents and What They Reveal

A huge part of organizing your finances is understanding how to present your income and expenses clearly for the loan application. While it’s always smart to learn how to optimize your tax deductions as a self-employed individual, for mortgage purposes, the goal is total clarity and consistency. Your ability to present a clean, understandable financial history is what really matters.

Here are the core documents you'll need and why they are so important:

- Two Years of Tax Returns (All Schedules): These provide the long-term view of your income trend. You have to include every single page and schedule, like a Schedule C or K-1s. Don't leave anything out.

- Year-to-Date Profit & Loss Statement: This is your "right now" document. It shows your business’s current financial health and is critical for demonstrating positive momentum.

- Business Bank Statements (12-24 Months): These back up the numbers on your P&L and tax returns. They verify the actual cash flow your business is generating.

- Business License or Formation Documents: This establishes the legitimacy and history of your company, adding another layer of credibility to your application.

Getting these documents ready is about more than just compliance. It's about building a rock-solid case for your financial reliability. For a complete list, check out our guide on what documents are needed for a mortgage to make sure you have everything in order. This level of preparation proves you’re a serious, organized borrower who is ready for homeownership.

Comparing Your Best Mortgage Options

If you're a self-employed homebuyer in Tampa, you might feel like the mortgage world wasn't built for you. The good news? You have far more options than just a one-size-fits-all conventional loan. The key is knowing which path to take for your specific financial picture.

For many entrepreneurs, the biggest hurdle is that their tax returns don't tell the whole story of their income. After all those smart, legal business write-offs, the number on your tax forms can look a lot smaller than what you actually bring in. We need to focus on loan programs that look at your real financial health, not just your taxable income.

This is where understanding the different loan types becomes your biggest advantage.

As you can see, that income verification stage is where the road forks for self-employed applicants. Picking the right loan from the start makes all the difference.

The Power of Bank Statement Loans

For countless business owners I've worked with, the Bank Statement Loan is an absolute game-changer. This is our go-to solution when your tax returns, thanks to all those necessary deductions, show an income that's too low to qualify for the home you know you can afford.

Instead of getting hung up on tax documents, we simply analyze your actual cash flow. These loans use 12 or 24 months of your business bank statements to calculate a qualifying income. It's a common-sense approach that looks at the real money moving through your business, which is critical here in Tampa where so many entrepreneurs are savvy about minimizing their tax liability.

Conventional and FHA Loans

Now, while bank statement programs are powerful, they aren't your only choice. Conventional and FHA loans are definitely on the table for self-employed borrowers, but they play by a different set of rules. With these loans, your tax returns are the star of the show.

Lenders will look at the net income you reported to the IRS—after all business expenses—to figure out your debt-to-income ratio. If you've been aggressive with your write-offs, this can seriously limit how much you can borrow. But, if your tax returns show strong, consistent net profits for the last two years, these can be fantastic options with very competitive rates. You can dig deeper into the specifics in our guide to Non-QM loan requirements.

The fundamental difference is the source of truth for your income. Conventional and FHA loans rely on what you reported to the IRS, while a Bank Statement Loan from RAC Mortgage looks at what your business actually deposited into its accounts.

Side-by-Side Loan Comparison

So, which path is right for you? It really comes down to how your business is structured and how your income shows up on paper. This table breaks down the core differences to help you see which option fits your financial profile.

Comparing Self-Employed Loan Programs from RAC Mortgage

| Loan Feature | Bank Statement Loan | FHA Loan | Conventional Loan |

|---|---|---|---|

| Primary Income Doc | 12-24 months of bank statements | 2 years of tax returns | 2 years of tax returns |

| Best For | Entrepreneurs with high deductions | Borrowers with lower credit scores | Borrowers with strong credit and financials |

| Typical Down Payment | Often 10-20% or more | As low as 3.5% | Can be as low as 3% |

| Credit Score Hurdle | Generally flexible, but varies | More lenient requirements | Stricter credit standards |

| Key Advantage | Qualify based on real cash flow | Lower down payment and credit score flexibility | Potentially better rates and terms |

By seeing the options laid out like this, you can walk into a conversation with a loan officer at Residential Acceptance Corporation feeling confident and prepared. We're here to make sure you pursue the mortgage that makes the most sense for your business and your homeownership goals.

Proven Strategies to Strengthen Your Loan Application

Organizing your documents is one thing, but proactively shaping your financial profile is what really moves the needle. Think of it as taking the wheel of your financial story. Here at Residential Acceptance Corporation, we’ve seen countless times how a few smart moves can flip a potential denial into a confident approval for a self-employed home loan in Tampa.

These aren't some hidden industry secrets. They're the fundamentals that prove you’re stable and ready for homeownership. By zeroing in on these key areas before you apply, you’re showing the underwriter that you're the kind of low-risk, reliable borrower they love to see.

Boost Your Credit Score

For a self-employed borrower, your credit score is one of the most powerful assets you have. A strong score is a clear signal to lenders that you have a solid history of managing your debts, which helps offset the perceived risk of an income that isn't a simple W-2.

Honestly, aiming for the highest score you can get is always the right play. Even a small jump can mean better interest rates and more favorable loan terms down the line.

Want to give your score a quick lift before applying? Try these:

- Tackle your credit card balances. Lowering your credit utilization—that's the percentage of your available credit you're actually using—can boost your score surprisingly fast.

- Scan your credit reports for errors. Pull your reports from all three major bureaus. If you spot any mistakes, dispute them right away.

- Become an authorized user. If you have a trusted family member with a long, perfect payment history, being added to their account can sometimes give your own score a nice bump.

Master Your Debt-to-Income Ratio

Your Debt-to-Income (DTI) ratio is a huge deal for underwriters. It’s a simple comparison of your total monthly debt payments against the qualifying monthly income we can use from your tax returns. Keeping this number low is critical.

A small adjustment here can have a massive impact. For example, paying off a personal loan with a $300 monthly payment before you apply for a mortgage could potentially add $50,000 or more to your borrowing power. It shows you have more cash flow to comfortably handle the new mortgage payment. A strong financial foundation is paramount for loan approval. Consider these essential tips for building a stable financial future that will bolster your application.

We often advise Tampa entrepreneurs to pay off smaller debts like a credit card or a car loan right before they apply. The temporary cash outlay is often well worth the long-term benefit of qualifying for a better loan or a higher amount.

The Power of Cash Reserves and a Stronger Down Payment

Nothing says "I'm financially solid" quite like cash in the bank. Lenders at RAC Mortgage get a lot more comfortable when they see you have cash reserves—that’s money left over after you've covered your down payment and closing costs. It's your safety net, proving you can handle a slow month in business without ever missing a mortgage payment.

A larger down payment does more than just lower your monthly payment, too. It immediately reduces the lender's risk, which makes your application look a whole lot better. It shows you’ve got serious skin in the game and demonstrates a level of financial discipline that really makes you stand out in Tampa's competitive housing market.

Navigating the Mortgage Process from Start to Finish

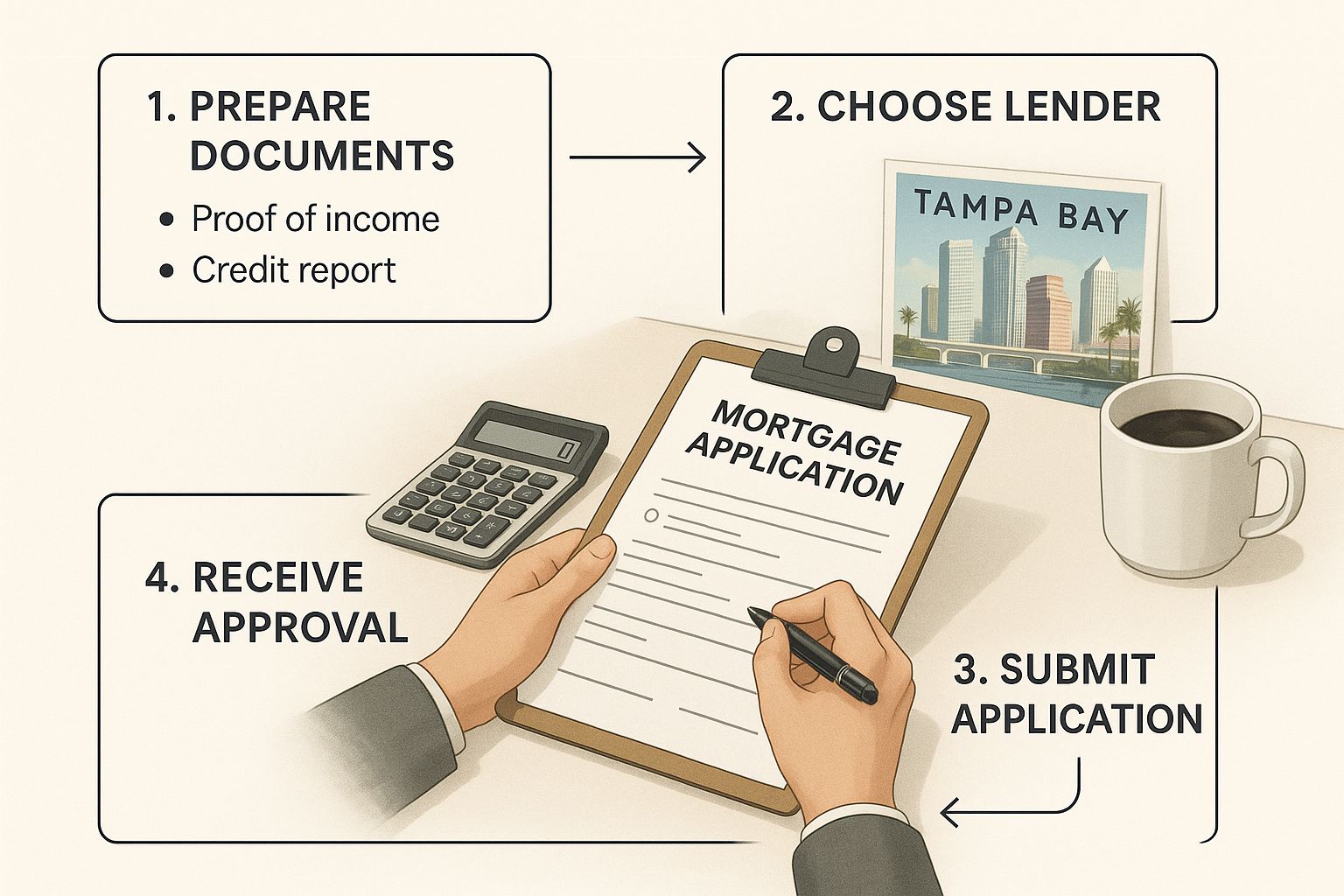

Let's walk through the entire mortgage journey, from your first chat with us at Residential Acceptance Corporation to the moment you’re holding the keys to your new Tampa home. Knowing the roadmap ahead is always a good idea, but for a self-employed borrower, it’s absolutely critical.

Each stage comes with its own level of scrutiny, and understanding what’s coming next removes the stress and any unwelcome surprises. It’s all about moving forward with confidence.

The whole thing kicks off with your initial application and consultation. This is our chance to sit down and talk through your financial picture, your business setup, and what you’re looking for in a home. Being completely upfront about your income, debts, and business history from day one helps us set realistic expectations and find the perfect loan program for your situation.

The Underwriting and Appraisal Stages

Once we’ve got your application, it heads into underwriting. This is the most intensive part of the process, no question. An underwriter will meticulously go through your tax returns, bank statements, and profit-and-loss statements. Their job is to verify every single detail to make sure your financial story is solid and proves you can handle the loan.

This is often where self-employed applicants can hit a snag. The underwriter might have questions about large, irregular deposits or a dip in revenue from one year to the next. The key is to be proactive. Providing letters of explanation for these kinds of things right away can prevent major delays down the line.

The underwriting process isn't about finding reasons to say no. It’s about building a complete, verifiable financial picture. Your best tools during this critical stage are clear documentation and transparent communication with your RAC Mortgage loan officer.

While the underwriter is doing their thing, a licensed appraiser will head out to the property. They’ll assess its value to ensure it's worth at least what you’re borrowing. In a dynamic market like Tampa, a professional appraisal is a non-negotiable step that protects both you and the lender.

The Final Steps to Closing

After the underwriter gives the thumbs-up and the appraisal comes in solid, you’ll get your “clear-to-close.” That’s the green light we’ve all been working toward. It means all conditions have been met and the loan is ready to be finalized. From there, we’ll get your closing day on the calendar.

Here in Florida, self-employed homebuyers often find success with different kinds of loans. FHA loans are a popular choice because of their flexible credit and down payment options. You can get into a home with as little as 3.5% down, but you’ll need extensive proof of stable income through tax returns and financial statements.

To get a handle on all the complex paperwork, you might consider using a tool like a real estate mortgage document analyzer.

Finally, on closing day, you’ll sign the last of the loan documents, pay your closing costs, and officially become a homeowner. Our goal at RAC Mortgage is to make this whole journey feel predictable and manageable, turning your hard-earned entrepreneurial success into a new home address.

Questions We Hear All The Time From Tampa Entrepreneurs

Even with the best game plan, you're going to have questions when you're navigating the world of self-employed home loans here in Tampa. Let's dig into some of the most common ones we hear at Residential Acceptance Corporation and give you the straight answers you need to move forward.

What if I've Been Self-Employed for Less Than Two Years?

This is a big one, and the answer is usually better than people expect. While that two-year history is what most lenders love to see, it’s not always a hard and fast rule. We can often work with borrowers who have a solid, consistent background in the same industry.

Think about it this way: if you were a salaried architect for five years and then launched your own successful Tampa firm 18 months ago, that continuity is huge. It shows a proven track record. In cases like this, we look for other strengths in your file to build the case for approval, like:

- Excellent credit: A high score always speaks volumes about your financial habits.

- A low DTI ratio: This shows you can easily manage the new mortgage payment.

- Significant cash reserves: Having that extra cushion in the bank proves you’re prepared for anything.

It really comes down to painting a clear picture of consistent earning power, even if your LLC is still relatively new.

How Do You Calculate My Income from Bank Statements?

When we do a bank statement loan, we’re essentially setting your tax returns to the side. The whole point is to look at your actual cash flow, which is perfect for entrepreneurs whose income looks much different after all the business write-offs.

We'll analyze either 12 or 24 months of your business bank statements to get a clear picture of your average monthly gross deposits. From there, we apply a standard expense factor to figure out your qualifying monthly income. This number can vary by industry, but it's often around 50%. This method lets us qualify you based on the real money your business is bringing in month after month.

Do My Business Debts Impact My Personal Home Loan Application?

Yes, they absolutely can. An underwriter needs to see the full picture of your financial obligations, both on the personal and professional side. But how they're treated is what really matters.

The key is proving that a business loan or credit card is paid directly from your business account. If you can show at least 12 consecutive months of those payments on your business bank statements, we can often exclude that debt from your personal debt-to-income (DTI) ratio.

Being transparent is everything here. Tell your RAC Mortgage loan officer about all your business debts right from the start. That allows us to structure your application in the smartest way possible to get you to the closing table.

Ready to turn your entrepreneurial drive into a Tampa address? The team at Residential Acceptance Corporation specializes in finding the right mortgage solutions for business owners just like you. Start your application online today!