So, you’re a veteran in the Tampa area and you’re worried a low credit score might kill your dream of owning a home with a VA loan. Let's clear the air on this one. It's a common misconception that past financial hiccups automatically disqualify you from this incredible benefit.

The truth is, your path to homeownership in Tampa is about way more than just one three-digit number.

Your Path to Homeownership with a VA Loan

At Residential Acceptance Corporation (RAC Mortgage), we specialize in helping Tampa veterans navigate this exact situation. We see your credit score as a starting point, not the final word. Our job is to look at the whole picture.

Understanding the Lender's Perspective

Here's the key: the VA itself doesn't actually set a minimum credit score for its home loan guarantee program. They leave that decision up to the private lenders, like us in Tampa, who are actually funding the loan.

Most lenders draw a line in the sand, typically requiring a FICO score of 620 or higher for a VA loan. If you do manage to get approved with a score under 620, you're often looking at significantly higher interest rates. You can learn more about VA loan credit score requirements and see how they impact your rate.

This is where working with a specialized Tampa lender like RAC Mortgage really pays off. We know how to look for what we call "compensating factors"—the positive parts of your financial life that tell a much bigger story.

We're looking for things like:

- A steady job and consistent employment history in the Tampa Bay area.

- A low debt-to-income (DTI) ratio, which shows you handle your current debts responsibly.

- Enough residual income left over each month after all your bills are paid.

Your credit score might show where you've been, but things like your income, savings, and on-time payment habits show us your current financial strength. As a Tampa lender that understands poor credit VA loans, RAC Mortgage knows how to weigh these factors to build a strong case for your approval.

VA Loan Credit Score Myths vs Reality

There's a lot of confusing information out there. Let's debunk some common myths and focus on what really matters for Tampa veterans.

| Common Myth | The Reality for Tampa Veterans |

|---|---|

| "You can't get a VA loan with a score below 620." | While 620 is a common benchmark, RAC Mortgage looks at your whole financial picture, not just the score. |

| "A single late payment will get you denied." | One mistake isn't a deal-breaker. A pattern of late payments is a concern, but a strong recent history can overcome past issues. |

| "The VA sets the minimum credit score." | The VA doesn't have a minimum score requirement; individual lenders in Tampa do. |

| "My low score means I'll pay a ridiculously high interest rate." | While your rate might be higher, a strong overall application can help you secure a competitive rate, even with a lower score. |

The bottom line is that a low credit score doesn't have to be a roadblock.

This guide is designed to walk you through the factors that really matter, give you some concrete ways to make your application stronger, and show you how to get ready for a successful home purchase right here in Tampa, even if your credit has seen better days.

How Lenders See Beyond Your Credit Score

That three-digit credit score? It doesn't tell the whole story of your financial life, and at Residential Acceptance Corporation (RAC Mortgage), we know that. We use a 'holistic review' process, which is just our way of saying we look at your actual financial health, not just a number. It gives us a true picture of your ability to succeed as a homeowner here in Tampa.

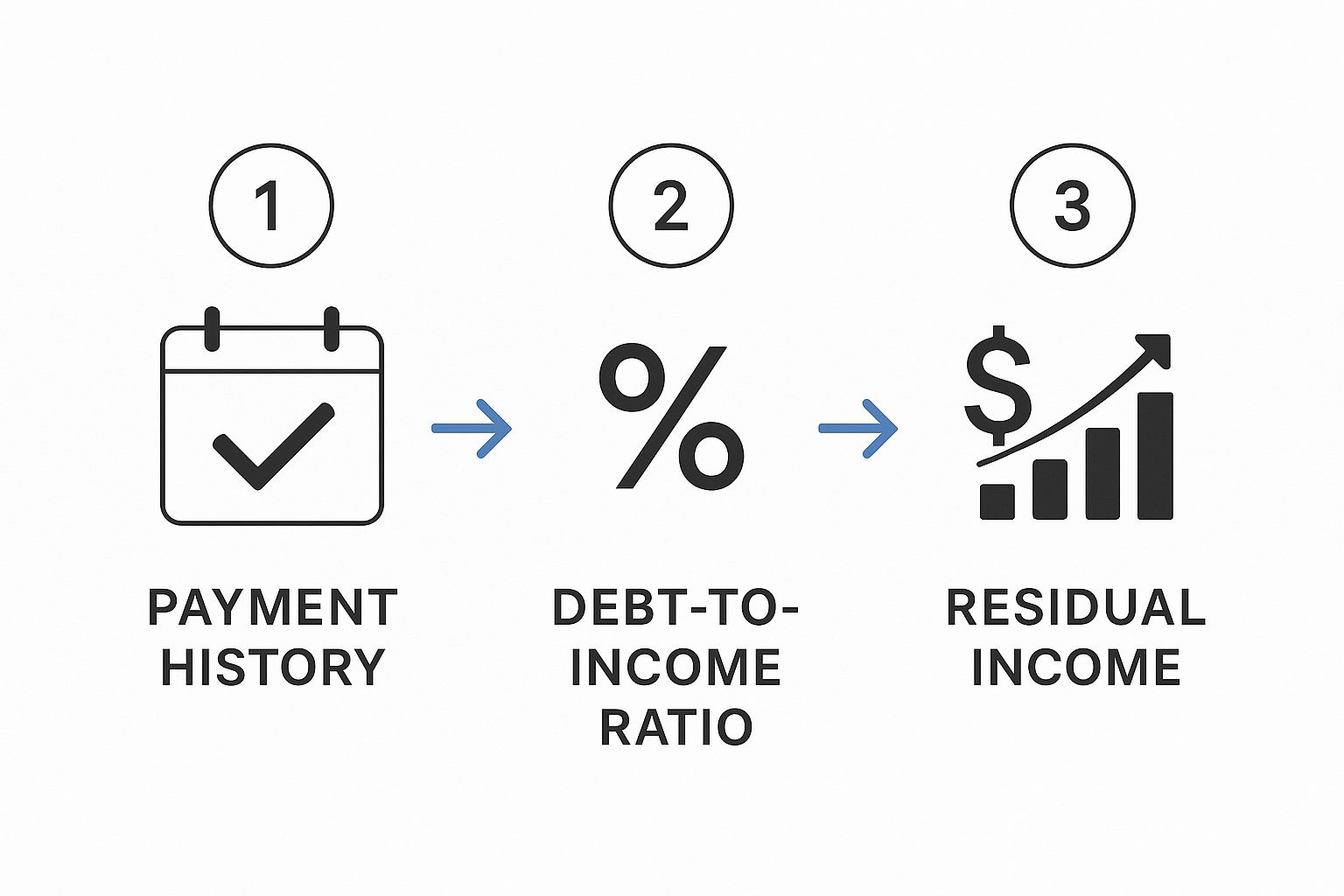

We dig into your entire profile. This means looking at your recent payment history, your debt-to-income (DTI) ratio, and—this is a big one—your residual income. That's the cash you have left over each month after every single bill is paid. These pieces of the puzzle are often way more telling than a score that might just reflect some challenges you had in the past.

The Power of Compensating Factors

Picture this: a Tampa veteran with a 590 credit score applies for a loan. An automated system would probably spit out an instant denial. But what if that same veteran has a stable job at MacDill Air Force Base, next to no credit card debt, and a healthy savings account?

Those are what we call powerful compensating factors. They show real-world financial responsibility that a simple credit score could never capture.

This is exactly where a dedicated Tampa lender makes all the difference. Instead of letting a computer make the call, our team at RAC Mortgage digs deeper. We actively look for the strengths in your application that an algorithm would miss, building a solid case for your approval based on your current stability. You can learn more about how our specialists handle these situations in our guide on Tampa manual underwriting for mortgages.

This infographic highlights the key things lenders look at beyond your score.

As you can see, things like a reliable payment history, a manageable DTI, and enough leftover income are the real cornerstones of a strong application.

Why Residual Income Is a Game-Changer

In a competitive market like Tampa, residual income is absolutely crucial. It’s the ultimate proof that you can comfortably afford your mortgage payment without stress. The VA even sets specific minimums for this, but exceeding them sends a very strong signal to our underwriters.

A strong residual income shows that you aren't just scraping by—you have a financial cushion. For a lender, this significantly reduces the perceived risk of approving a poor credit VA loan.

Even though the VA doesn't have a minimum credit score requirement, your residual income and overall financial picture are what truly matter. For example, the 2025 residual income minimum for a family of four in the Tampa area is around $1,203 per month.

VA data from fiscal year 2023 shows that fewer than 5% of all VA loan recipients had scores below 600. Nearly every single one of them made up for it with strong compensating factors, like a low DTI and, you guessed it, solid residual income. It just goes to show your financial reliability is about so much more than a single score.

Practical Steps to Boost Your Loan Readiness

Ready to get proactive and strengthen your application for a poor credit VA loan? Improving your loan readiness isn't about just waiting around and hoping for the best—it's about taking specific, targeted actions. Forget the generic advice you see everywhere. We're talking about real strategies that make a difference for Tampa veterans who are serious about homeownership.

Here at Residential Acceptance Corporation (RAC Mortgage), we walk veterans through this exact process every single day. Our Tampa loan officers can build a personalized plan just for you, but here are a few powerful tactics you can start using right now.

Target High-Impact Debts First

Not all debt carries the same weight on your credit score. One of the biggest factors is your credit utilization ratio—that’s the amount of revolving credit you're using compared to your total available limit. Because of this, paying down high-interest credit cards is often the fastest way to see a positive jump in your score.

We really want to see your utilization stay below 30%. If you’re juggling multiple cards with high balances, don't try to pay a little on each one. Instead, focus your efforts on paying down the card with the highest utilization percentage first. This single move can often lift your score more effectively than spreading small payments around.

Picture this: a Tampa veteran has a credit score of 595. They have two credit cards, both with a $5,000 limit. Card A is nearly maxed out at $4,900 (98% utilization), while Card B has a $1,500 balance (30% utilization). By aggressively paying down Card A to get it under that $1,500 mark, they could see their score climb by 20 to 40 points in just a couple of months. That puts them in a much stronger position.

This kind of strategic debt management sends a clear signal to our underwriters that you're taking control of your finances. It’s a huge plus for any loan application.

Scrutinize and Dispute Credit Report Errors

You’d be shocked how often credit reports have mistakes that are unfairly dragging down your score. We see it all the time with our Tampa clients—from incorrect late payment dings to accounts that don't even belong to them. It's crucial to get your free reports from all three main bureaus: Equifax, Experian, and TransUnion. Go through them with a fine-tooth comb.

If you spot an error, dispute it with the credit bureau immediately. Getting these inaccuracies corrected can give you a significant and relatively fast boost. The process can feel a bit intimidating, but it's a non-negotiable step to ensure your score is an accurate reflection of your history.

To build a solid foundation, you need to know exactly what's influencing your score.

Consider a Credit-Builder Loan

Is your credit history a little thin? Or maybe you just need to establish a fresh pattern of on-time payments. If so, a credit-builder loan can be a really smart move.

These work a bit differently than a normal loan. You don't get the money upfront. Instead, you make consistent monthly payments into a locked savings account. Those payments get reported to the credit bureaus, building a positive payment history month after month. Once the loan is paid off, the funds are released to you.

This is a fantastic way to prove to RAC Mortgage that you can handle consistent payments, which is one of the most important things we look for in a responsible borrower.

Preparing Your Documents for a Smooth Process

When you're applying for a poor credit VA loan, a well-prepared application does more than just check a box. It sends a clear message to the underwriter: you are organized, serious, and a responsible borrower.

Getting your paperwork in order upfront with Residential Acceptance Corporation (RAC Mortgage) is one of the best ways to speed up your approval. It shows you're committed to your homeownership goals right here in Tampa and minimizes the frustrating back-and-forth that can slow everything down.

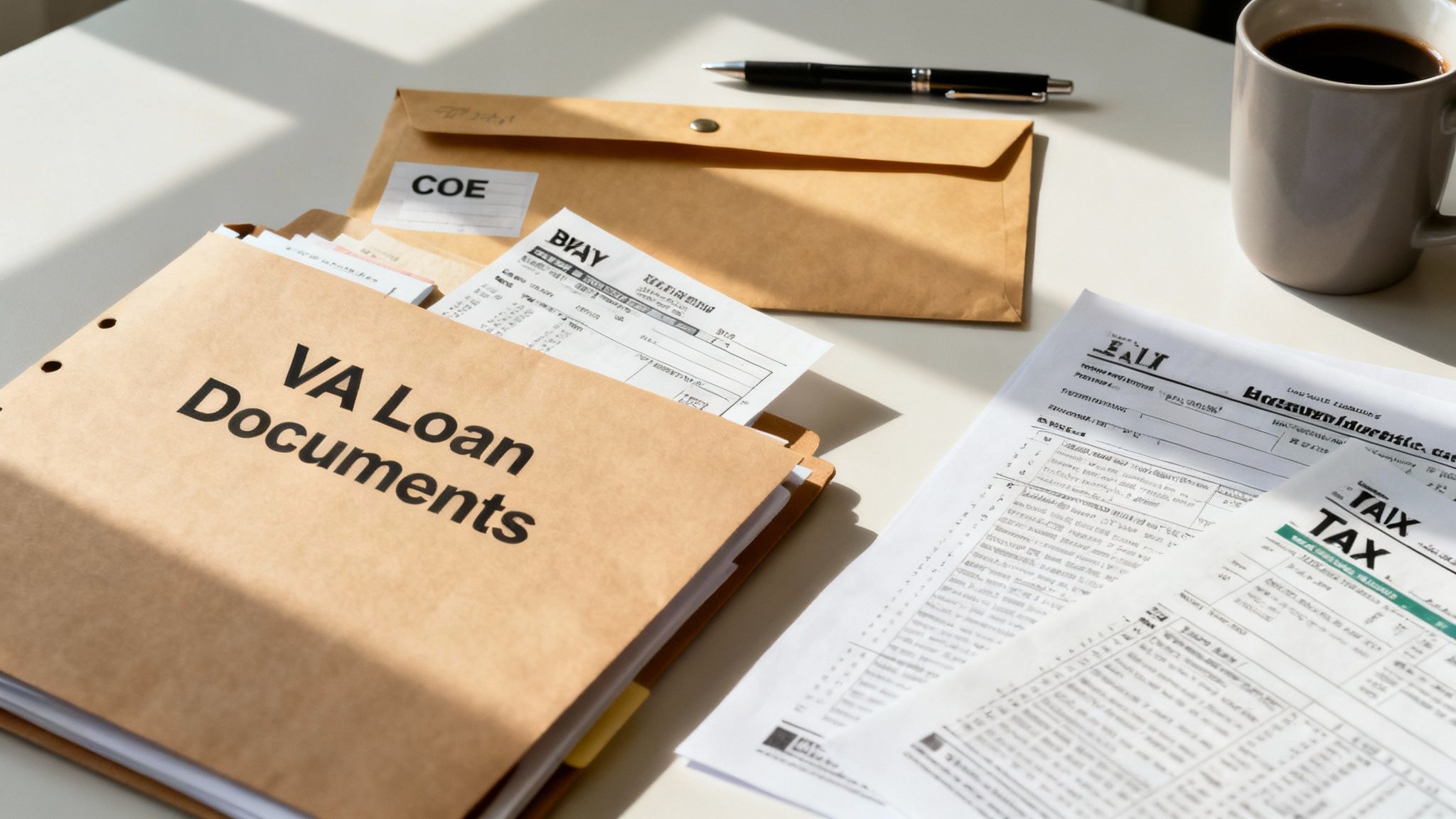

Your Core Document Checklist

Every VA loan application is built on a foundation of standard documents. These are the non-negotiables that verify who you are, what you earn, and your eligibility for this incredible benefit.

Having these files ready before your first call with one of our Tampa loan officers puts you way ahead of the game.

To make it easy, we've put together a quick checklist of the essentials you'll need to gather for your application with RAC Mortgage. Think of this as your pre-flight check before we take off.

Essential Document Checklist for Your VA Loan Application

| Document Category | Specific Items Needed | Pro Tip from RAC Mortgage |

|---|---|---|

| Military Service | Your Certificate of Eligibility (COE) is the key that unlocks your VA loan benefit. | Don't have your COE? No problem. Our Tampa team can typically help you get it in a flash, so don't let that stop you. |

| Income Verification | W-2s from the last two years and your most recent pay stubs covering a 30-day period. | Consistency is what underwriters look for. Make sure your pay stubs are consecutive and easy to read. |

| Financial Statements | Bank statements from the last two months for all checking, savings, and investment accounts. | Be ready to explain any large, unusual deposits. Sourcing these funds is a standard part of the process. |

| Personal ID | A clear, unexpired copy of a government-issued photo ID (like a driver's license or passport). | Make sure the name on your ID exactly matches the name on your other application documents to avoid delays. |

Getting these core documents organized from the start allows your RAC Mortgage loan officer to get a clear picture of your file right away. It helps us spot any potential hurdles early and gives us more time to work through them together.

Addressing Credit Blemishes Head-On

Let's be direct: when you have some dings on your credit report, transparency is your superpower. The underwriter is going to see everything anyway, so it’s much smarter to get ahead of the story.

This is where a Letter of Explanation (LOE) becomes your most valuable tool.

An LOE isn't about making excuses. It's your chance to provide context for negative marks like late payments or collections. Was there a medical emergency that threw your finances off track? A sudden job loss? Explaining the why behind a credit issue shows it was a specific event, not a habit of financial carelessness.

Here’s a simple way to structure an effective LOE:

- State the Issue Clearly: "This letter is to explain the late payment on my auto loan from July 2022."

- Explain What Happened: Briefly and factually describe the circumstances. "I was hospitalized unexpectedly and missed the payment due date."

- Show How You Recovered: Detail the steps you took to get back on track. "I immediately contacted the lender, paid the account current, and set up automatic payments to ensure it never happened again."

This simple act transforms a red flag on your credit report into a story of resilience—a powerful statement when you're pursuing a poor credit VA loan in the Tampa area.

Why a Specialized Local Lender Matters

Trying to get a poor credit VA loan in Tampa can feel like an uphill battle, especially when you're up against the big, faceless national lenders. Their entire business model is often built around automated underwriting systems that make a snap judgment based on one thing: your credit score.

If your score doesn't fit neatly into their pre-programmed box, you can get an instant denial. A human being might never even lay eyes on your file.

That’s just not how we operate at Residential Acceptance Corporation (RAC Mortgage). As a specialized lender right here in Tampa, we know a credit score is just one piece of a much larger puzzle. We don't believe in letting an algorithm make life-changing decisions for the veterans in our community.

The Advantage of Manual Underwriting

Instead of relying on a computer to say "no," our underwriters perform a manual review of your entire financial situation. This means a real person, an expert in VA loans, will carefully go through your application. They're trained to look for the strengths and compensating factors that automated systems are specifically programmed to ignore.

This hands-on, human approach lets us see you as a person, not just a number. We're looking for positive patterns that tell the real story of your financial habits, like:

- A solid history of paying your rent or utilities on time.

- A stable job and reliable income, something we see all the time with service members stationed near Tampa.

- A healthy amount of residual income left over each month after all your bills are paid.

- A low amount of overall debt, outside of the new mortgage.

These things show true financial responsibility, which frankly means a lot more than a score that might be held down by challenges from your past.

Local Expertise That Makes a Difference

When you work with a Tampa lender like RAC Mortgage, you get a real-world advantage. Our loan officers live and work right here in the same communities you do. We have a deep understanding of the local housing market, from South Tampa to New Tampa, and we are personally invested in seeing our neighbors succeed in their homeownership goals.

When you partner with us, you’re not just another application in a massive queue. You're a neighbor. Our team is dedicated to finding a clear, actionable path to get you to "yes."

While it's true the VA itself doesn't set a minimum credit score, many lenders impose their own rigid cutoffs. The data doesn't lie: over the last five years, less than 1% of all VA-backed loans went to borrowers with a credit score under 500. Why? Because very few lenders are actually set up to handle these more complex cases.

If you're dealing with credit issues, our guide for Tampa mortgage lenders for credit issues offers more specific local insights.

Choosing a specialized local lender means you get a partner who will personally guide you through every single step. We’ll help you understand exactly what underwriters are looking for and work with you to build an application that puts your best foot forward. It’s about creating a strong case for your approval, together.

Common Questions on Poor Credit VA Loans

Walking the path to a poor credit VA loan definitely brings up a lot of questions. For veterans here in Tampa, getting straight answers is the first step toward feeling confident about buying a home. We get these questions all the time at Residential Acceptance Corporation (RAC Mortgage), so let's clear up some of the most common ones.

Our job is to give you the clarity you need to move forward.

What Is the Lowest Credit Score RAC Mortgage Considers

Honestly, there isn't some magic number that gets you an automatic "yes" or "no." At RAC Mortgage, we've always found it's better to look at your whole financial story rather than just fixating on a single score. We consistently help Tampa veterans with scores in the high 500s and low 600s get the keys to their new homes.

So, how does that work? We look at the bigger picture for what we call compensating factors.

- Stable Income: A steady job history in Tampa speaks volumes about your reliability.

- Low Debt: Keeping your debt-to-income ratio in a healthy range is a huge plus.

- Healthy Residual Income: This just shows you have enough cash left over each month to comfortably handle your mortgage payment.

These things tell a much more complete story than a credit score ever could. The absolute best way to know exactly where you stand is to have a conversation with one of our Tampa loan specialists.

Does Bad Credit Mean a Higher Interest Rate

It's true that a lower credit score can mean a higher interest rate, as lenders see it as a bit more risk. But here's the key thing to remember about VA loans: because they're backed by the government, the rates are often way more competitive than what you'd find on a conventional loan, even with some dings on your credit report.

At RAC Mortgage, our whole mission is to find you the absolute best terms we can. We'll always be upfront about how your credit impacts your rate and can even map out a few strategies to help you boost your score for better terms in the future.

Can I Get a VA Loan After a Bankruptcy

Yes, you can. This is a huge point of stress for many Tampa veterans, but the path forward is much clearer than you might think. There are just some waiting periods you have to respect.

Typically, you need to be two years past the discharge date of a Chapter 7 bankruptcy or a foreclosure. For a Chapter 13 bankruptcy, you might be eligible after just 12 months of on-time, verified payments. The most important thing in either scenario is showing that you've gotten back on your feet and established good credit since then. Our team at RAC Mortgage can look at your specific timeline and walk you through what's required.

Is a Down Payment Required If I Have Poor Credit

The 0% down payment is the absolute cornerstone of the VA loan benefit. Your credit score doesn't change your eligibility for this incredible advantage. It's one of the most powerful parts of the program, put in place specifically to make homeownership easier for those who served our country.

Now, some lenders might get nervous with very low scores and ask for a down payment to feel more secure. But here at RAC Mortgage, we are dedicated to helping veterans achieve that zero-money-down goal whenever we possibly can. We believe in honoring the true spirit of the VA loan program for our Tampa community.

Ready to see what your VA loan options look like in Tampa, even if your credit isn't perfect? The team at Residential Acceptance Corporation is here to give you the one-on-one guidance you deserve. Contact us today to start your journey to homeownership.