Getting a mortgage in Tampa after a bankruptcy isn't just a possibility—it's something I see clients achieve all the time with the right game plan and a knowledgeable lender. The secret isn't some magic trick; it's about connecting with a specialist like Residential Acceptance Corporation (RAC Mortgage) who genuinely understands the underwriting guidelines for post-bankruptcy home loans.

Your path forward is about hitting a few key milestones: observing the mandatory waiting periods, rebuilding your credit the smart way, and picking the loan program that fits your comeback story.

Your Path to a Tampa Home After Bankruptcy

Looking at the Tampa real estate market after a bankruptcy can feel daunting, but I promise you, homeownership is still very much on the table. A common myth is that bankruptcy shuts the door on buying a home forever. That's simply not true.

In reality, lenders have well-defined pathways for borrowers who have put in the work to get back on their feet financially. This guide is here to clear up the noise and show you the actual steps to take.

This process isn't about finding loopholes. It's about showing lenders a clear story of financial recovery and stability since your bankruptcy was discharged. Think of it as your financial comeback story, with you as the hero.

Building Your Post-Bankruptcy Game Plan

Your journey starts with understanding exactly what underwriters will be looking at. It’s so much more than just a single credit score—they want to see the whole picture of your current financial health. A specialized mortgage lender in Tampa after bankruptcy will zero in on helping you strengthen every part of your application.

Your plan needs to tackle a few critical areas:

- Understanding Timelines: First things first, you need to know the mandatory waiting periods for different loan types.

- Strategic Credit Rebuilding: This is more than just paying bills on time. It's about strategically establishing new lines of positive credit that underwriters want to see.

- Choosing the Right Loan: FHA, VA, and other programs have specific rules that can play to your advantage. We'll find the one that fits.

- Partnering with an Expert: Working with a lender who lives and breathes these types of loans is non-negotiable for success.

Navigating the mortgage process after a financial setback requires more than just filling out forms. It requires a partner who can translate complex underwriting guidelines into a clear, actionable plan for your specific situation.

The Role of a Specialized Lender

This is where having a lender like Residential Acceptance Corporation (RAC Mortgage) in your corner makes all the difference. Unlike the big, impersonal banks, we know the ins and outs of post-bankruptcy financing right here in the Tampa market.

Our expertise is in walking you through the specific requirements, helping you get all your documents in order, and presenting your story of financial recovery in the strongest light possible. This isn't just about getting you a loan; it's about setting you up for sustainable, long-term success as a homeowner.

Consider this your roadmap to putting financial setbacks in the rearview mirror and stepping confidently into your new Tampa home.

Understanding Mortgage Waiting Periods After Bankruptcy

So, you've been through a bankruptcy. The first question that’s probably on your mind is, "How long until I can actually buy a home?" It's a fair question, and the answer revolves around something called a "waiting period" or "seasoning period."

This isn't just some arbitrary timeline lenders made up. From their point of view, a bankruptcy is a major red flag. They need to see that you've turned a corner and can handle your finances responsibly before they'll feel comfortable lending you hundreds of thousands of dollars. This waiting period is their observation window to see how you manage your money with a fresh start.

Each loan program has its own specific timeline, which is set by the big players who back them, like the FHA, VA, or Fannie Mae. Understanding these timelines is the first real step in mapping out your path to homeownership in Tampa.

Chapter 7 vs. Chapter 13: The Timelines are Different

The type of bankruptcy you filed makes a big difference in how long you'll have to wait. A Chapter 7 bankruptcy, which wipes the slate clean by liquidating assets, usually comes with a longer waiting period. In contrast, a Chapter 13, which involves a structured repayment plan, often has a shorter path back.

Think of it this way: with a Chapter 13, you're actively demonstrating your ability to make consistent payments over several years, which gives lenders a bit more confidence sooner.

This is a hard-and-fast rule, but what you do during that waiting period is what really sets you up for success.

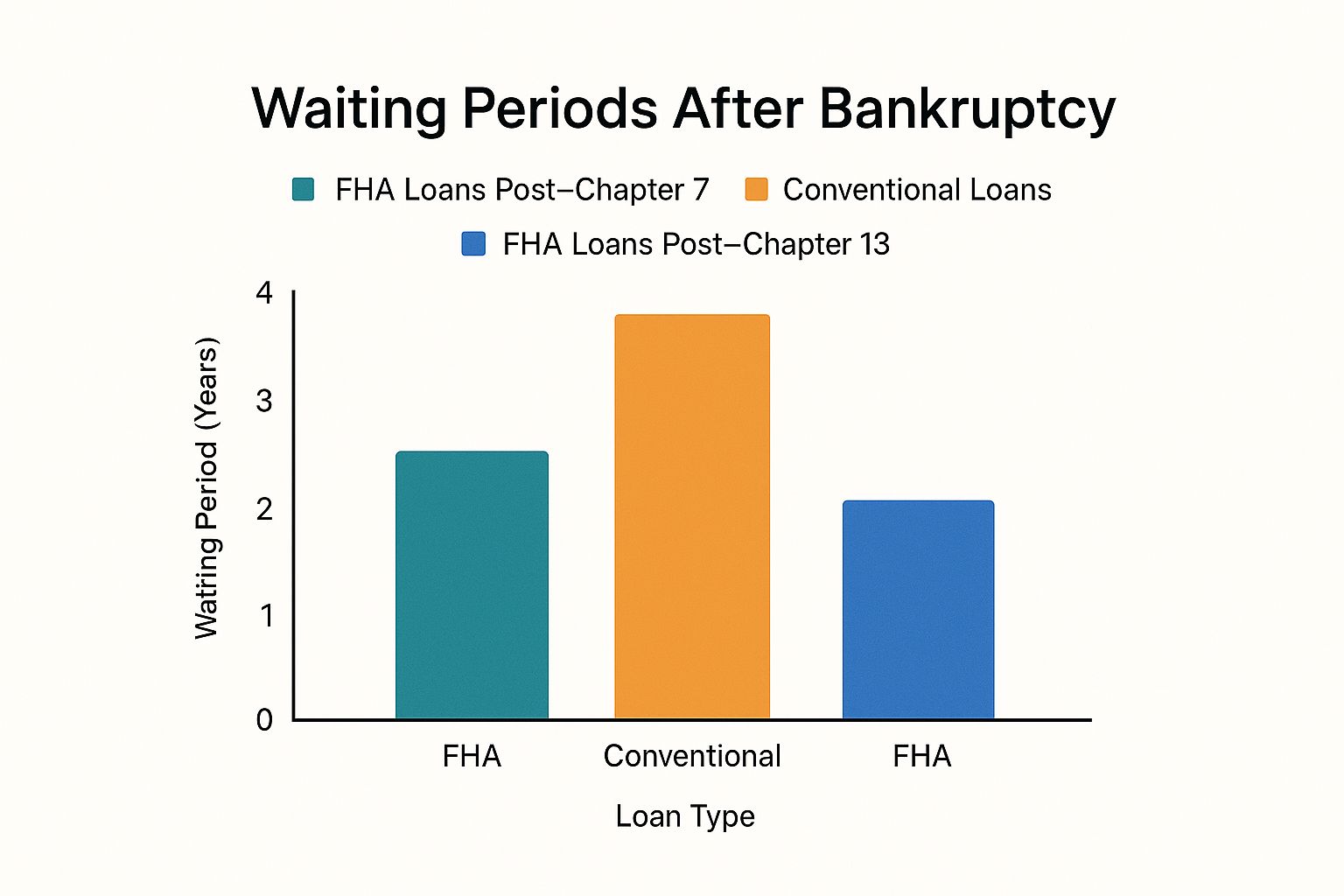

As you can tell, government-backed loans like FHA and VA loans often give you a much quicker route to getting a mortgage compared to conventional loans.

Here’s a more detailed breakdown of what to expect for each loan type.

Mortgage Waiting Periods After Bankruptcy

| Loan Type | Chapter 7 Waiting Period | Chapter 13 Waiting Period | Key Considerations |

|---|---|---|---|

| FHA Loan | 2 years from discharge date. | 1 year of on-time plan payments may be sufficient. Some lenders may require discharge. | Shorter waiting periods and flexible credit requirements make this a popular option post-bankruptcy. Extenuating circumstances can sometimes shorten the wait. |

| VA Loan | 2 years from discharge date. | 1 year of on-time plan payments and court trustee approval. | Reserved for eligible veterans, service members, and surviving spouses. VA loans also have lenient credit guidelines. |

| USDA Loan | 3 years from discharge date. | 1 year of on-time plan payments and court trustee approval. | For homes in eligible rural areas. It also requires meeting specific income limits for the area. |

| Conventional Loan | 4 years from discharge date. | 2 years from discharge date, or 4 years from dismissal date. | Backed by Fannie Mae/Freddie Mac, these have the strictest guidelines and longest waiting periods. |

These timelines provide a clear roadmap. Now, the key is to use that time wisely.

Making the Waiting Period Work for You

This isn't just a countdown clock. It's your prime opportunity to build a rock-solid mortgage application. Don't just sit on the sidelines waiting for the calendar to turn.

This is the time to aggressively rebuild your credit. Open a secured credit card, make every single payment on time (no exceptions!), and keep your balances low. At the same time, you should be socking away money for your down payment and closing costs.

Working with a specialized mortgage lender in Tampa after bankruptcy like Residential Acceptance Corporation during this phase can be a game-changer. We've been down this road with countless Tampa families. We can help you build a clear, step-by-step plan to polish every part of your financial profile that underwriters will be looking at.

Your waiting period is your preparation period. It's the time to demonstrate financial stability and rebuild the trust that lenders need to see before approving your home loan.

By the time your mandatory waiting period is up, you don't want to be just eligible—you want to be a strong, well-prepared applicant. A healthy savings account, a perfect post-bankruptcy payment history, and a file that’s ready for underwriting can make all the difference. This proactive approach transforms your waiting time from a penalty into a powerful head start.

Rebuilding Your Credit for Mortgage Approval

Getting a mortgage after bankruptcy isn't just about waiting for a certain amount of time to pass. It’s about showing lenders a story of your financial comeback. They need to see that you’ve not only moved past the old issues but have also developed new, solid financial habits. Think of this period as your chance to prove you’re a responsible borrower who learned from the experience.

The journey starts with a simple but powerful first step: opening new lines of credit and managing them perfectly. I'm not talking about racking up a bunch of new debt. This is about strategic, small-scale credit building.

This is especially true right here in the Tampa area. Florida’s Middle District, which includes Tampa, has one of the highest bankruptcy filing rates in the country. In fact, it's the third busiest federal bankruptcy court out of 90 districts. So, what does that mean for you? Local lenders are very familiar with post-bankruptcy applications, but it also means they scrutinize them closely. Your credit-rebuilding efforts are absolutely critical. You can learn more about these local financial trends over at Fox 13 News.

Actionable Steps for Credit Recovery

When an underwriter at a specialized lender like Residential Acceptance Corporation (RAC Mortgage) looks at your file, they're searching for consistent, positive patterns after the bankruptcy. They look past the old credit score and focus heavily on what you've done since.

Here are a couple of tried-and-true strategies I've seen work time and time again:

- Open a Secured Credit Card: This is probably the best tool in your toolbox. You put down a cash deposit—say, $500—which then becomes your credit limit. Use it for a small, recurring bill like Netflix or your gym membership, and then pay the entire balance off every single month. It’s a fantastic way to build positive payment history.

- Look into a Credit-Builder Loan: Many banks and credit unions offer these. The lender "lends" you money but puts it into a locked savings account. You make small monthly payments, and once the loan is paid off, the money is yours. It’s like a forced savings plan that reports all your on-time payments to the credit bureaus.

The goal isn’t just to get new credit; it's to demonstrate impeccable payment behavior. An underwriter is looking for 12-24 months of flawless payment history on new accounts post-bankruptcy.

Managing Your Overall Financial Picture

Building new credit is just one piece of the puzzle. You also need to get your entire financial house in order. Every mortgage lender is going to zoom in on these two areas.

Your Debt-to-Income Ratio

Your Debt-to-Income (DTI) ratio is a big one. It's the percentage of your gross monthly income that goes toward paying your monthly debts. For lenders, it’s a quick way to gauge your ability to handle a mortgage payment. After a bankruptcy, keeping this number as low as possible is non-negotiable.

- Avoid New Major Debt: I know it's tempting, but hold off on financing a new car or taking out other large loans while you're in rebuilding mode.

- Increase Your Income: If you can, finding ways to boost your income—even with a side gig—can make a huge difference and will automatically lower your DTI.

Savings for a Down Payment

Nothing shows financial stability like a healthy savings account. It proves you can manage your money and reduces the lender's risk. Start putting money aside consistently for your down payment and closing costs. This tells an underwriter you’re serious and prepared for homeownership.

For a deeper dive into specific tactics, check out our guide on how to improve your credit score for a mortgage. By focusing on these key areas, you'll build a strong application that clearly shows you're ready and responsible.

Finding the Right Loan Program in Tampa

Not all home loans are created equal, and that’s never truer than when you’re on the other side of a bankruptcy. Picking the right program isn't about chasing the lowest advertised rate online. It’s about finding a loan structured for your specific financial recovery story.

The key is to immediately look past conventional loans, which almost always have the tightest rules. Instead, you'll want to pivot toward government-backed loan programs. These are, by far, the most accessible options for Tampa homebuyers in your shoes. They were designed to make homeownership a reality for more people, which means more forgiving credit requirements and shorter waiting periods after a bankruptcy.

Focusing on Government-Backed Loans

When I sit down with clients who have a bankruptcy in their past, FHA and VA loans are almost always the first options we discuss. They represent the clearest path to getting a mortgage after a financial reset.

-

FHA Loans: Insured by the Federal Housing Administration, these are incredibly popular for a good reason. They offer competitive interest rates and, most importantly, flexible underwriting guidelines. This means they're more understanding of lower credit scores and past credit issues like bankruptcy.

-

VA Loans: If you're a veteran, an active-duty service member, or a surviving spouse, a VA loan is an incredible benefit you've earned. These loans often require no down payment at all and have some of the most lenient guidelines out there when it comes to bankruptcy.

The mortgage world, both here in Tampa and nationally, is still shaped by the fallout from the 2007–2009 recession. That period led to much tighter lending conditions, and lenders remain cautious, especially with borrowers recovering from bankruptcy. You can see just how much the industry has changed in this overview of mortgage lender shifts. This is exactly why government-backed programs, with their clear, established rules, are so valuable.

Your best move is to partner with a lender who truly specializes in these government programs. They know the little details that can make the difference between getting approved and getting denied.

What About Other Loan Options?

While FHA and VA loans are your best bet, they aren't the only possibilities. In some unique situations, a Non-Qualified Mortgage (Non-QM) could be an alternative. These loans are designed to live outside the box of traditional lending standards and can sometimes work for borrowers with more complex financial situations.

But let's be clear: for the vast majority of homebuyers rebuilding their financial lives in Tampa, government-backed loans provide the most reliable path forward.

An expert mortgage lender in Tampa after bankruptcy like our team at RAC Mortgage lives and breathes this stuff. We're skilled at digging into your specific situation—your income, your credit history since the bankruptcy, your savings—to find the program that gives you the highest odds of success. We can walk you through all the details, and you can get a head start by reading our guide on how to qualify for an FHA loan. The goal isn't just to get you into a house, but to find a loan that fits comfortably into your new financial reality.

Why Your Choice of Lender Matters Most

When you're trying to get a mortgage after a bankruptcy, the lender you pick can make or break your dream of owning a home. This is not the time to go to a massive national bank where your application is just one in a pile, easily dismissed because of your credit history. You need a specialist—a mortgage lender in Tampa after bankruptcy who gets the nuances of what you've been through and where you're headed.

Choosing the right partner is, without a doubt, the most important decision you'll make in this entire process. A specialized lender won't see a red flag on your file; they'll see a person who hit a reset button. They understand that bankruptcy wasn't the end of your financial story.

This is where a dedicated local lender like Residential Acceptance Corporation (RAC Mortgage) becomes your greatest ally. Our loan officers don't just know the post-bankruptcy underwriting guidelines; they live and breathe them every day. We know exactly what an underwriter needs to see to give you the green light.

The Specialist Advantage in Post-Bankruptcy Lending

A lender who focuses on post-bankruptcy mortgages offers a completely different experience. They're not just box-checkers. They roll up their sleeves and work with you to build the strongest application possible.

A perfect example is your Letter of Explanation (LOX). This document is your chance to speak directly to the underwriter, explaining what happened, why it happened, and, most importantly, what you've done to ensure it never happens again. A specialist from RAC Mortgage can guide you in writing a LOX that is factual, compelling, and addresses an underwriter's potential concerns before they even become questions.

They also know how to package your entire file to highlight your strengths—things like your stable job since the bankruptcy, your consistent savings, and the new positive credit you've been building.

Your lender should be your advocate. Their job is to translate your story of financial recovery into the language of underwriting, ensuring your strengths are clearly communicated and understood.

This expert guidance is crucial, especially here in Tampa. Florida has a history of high mortgage delinquencies. At one point, a staggering 26% of Florida mortgages were past due, making local underwriters understandably cautious. Having a seasoned advocate on your side is non-negotiable. You can learn more about Florida's mortgage delinquency history on TheTampaRealEstateInsider.com.

Navigating the Documentation with an Expert

Getting all the right paperwork together can feel overwhelming, but it's half the battle. A good specialist will give you a clear, simple list of everything you need, helping you avoid those last-minute fire drills that can delay your closing.

Here’s a look at what you’ll almost certainly need to provide:

- Complete Bankruptcy and Discharge Papers: Make sure you have every single page.

- Recent Tax Returns and W-2s: Typically, they'll ask for the last two years.

- Pay Stubs: The most recent 30 days of pay stubs are standard.

- Bank Statements: This is to verify your savings and down payment funds.

At RAC Mortgage, we don't just hand you a checklist and walk away. We review your documents with you to spot potential issues before your file ever gets to an underwriter. This proactive approach smooths out the entire process and dramatically boosts your chances of approval.

We're able to do this because we're a mortgage lender with no overlays in FL. That means we don't add extra, rigid rules on top of the actual loan program guidelines. We give you a fair shot, focusing on seeing you as a future homeowner, not just a past bankruptcy.

Common Questions on Post-Bankruptcy Mortgages

Working your way back to homeownership after a bankruptcy can feel like navigating a maze. It's completely natural to have a lot of questions. Here in Tampa, we help people find clarity on these exact issues every day, so let's tackle some of the most common ones we hear.

Will My Interest Rate Be Much Higher?

This is usually the first question people ask, and it's a valid concern. The short answer is: maybe, but not necessarily as high as you might think. A bankruptcy doesn't automatically stick you with an astronomical interest rate.

Lenders, including us at Residential Acceptance Corporation (RAC Mortgage), are really looking at what you’ve done since the bankruptcy. Your rebuilt credit score, the size of your down payment, and your current debt-to-income ratio are huge factors. In fact, government-backed programs like FHA loans can offer surprisingly competitive rates for borrowers with a past bankruptcy. The key is to show you’ve established solid, responsible financial habits since the discharge. That’s your most powerful tool for securing a good rate.

Can I Get a Mortgage if My Spouse Filed Bankruptcy but I Did Not?

This situation comes up all the time. The good news is, yes, you can absolutely still get a mortgage. The real question is how you should apply.

One path is to apply for the loan solely in your name, using only your income and credit profile. This keeps the bankruptcy completely out of the picture, but it might limit how much you can borrow. Alternatively, you could apply together, which means the underwriter will have to consider your spouse's credit history, including the bankruptcy. Each approach has its own set of pros and cons, and the right choice isn't always obvious. Talking it through with a loan expert who can model both scenarios is the best way to figure out the smartest move for your family.

A well-crafted Letter of Explanation (LOX) is more than a requirement; it's your opportunity to provide crucial context to the underwriter and demonstrate your renewed financial responsibility.

What Is a Letter of Explanation?

Think of the Letter of Explanation (LOX) as your chance to tell the human on the other side of the desk—the underwriter—the story behind the numbers. It’s not an emotional letter, but a clear, factual account of what led to the bankruptcy. Maybe it was a major medical event, a sudden job loss, or another circumstance beyond your control.

Just as important, your LOX is where you detail the concrete steps you’ve taken to get back on solid ground and prevent it from happening again. A well-written, honest LOX can truly make or break an approval. Our team at RAC Mortgage has guided countless clients in drafting compelling letters that satisfy underwriting requirements and paint a clear picture of financial recovery.

Your journey to homeownership after a bankruptcy is possible with the right guidance. The experts at Residential Acceptance Corporation are here to provide the specialized support you need. Contact us today to start your path to a new home in Tampa.