Thinking about buying a home in Tampa with 1099 income? It's absolutely possible, but you have to go about it the right way. The single biggest factor is working with a mortgage lender who genuinely understands the world of self-employment. At Residential Acceptance Corporation (RAC Mortgage), we look past the standard tax returns to see your real financial picture and true buying power.

Getting a Tampa Mortgage with 1099 Income

If you're a self-employed professional, freelancer, or business owner in Tampa, the whole homeownership journey can feel a bit overwhelming. The typical mortgage application process was designed for W-2 employees with steady, predictable paychecks. That rigid system just doesn't work for the dynamic finances of a successful 1099 earner.

Let's cut through that confusion. This guide will walk you through how specialized loan programs let you qualify based on your actual cash flow, not just what's on your tax returns. This is a game-changer because, as any smart business owner knows, you take deductions to lower your tax bill. While great for your bottom line, it can unfortunately be a roadblock for a conventional loan.

Understanding the 1099 Advantage

The good news is that the lending market has caught up to the modern workforce. Forward-thinking lenders now offer programs built specifically for self-employed borrowers. These 1099 mortgage loans are designed for freelancers and contractors, allowing them to qualify for a home without having to rely on tax returns that often don't show their full earnings.

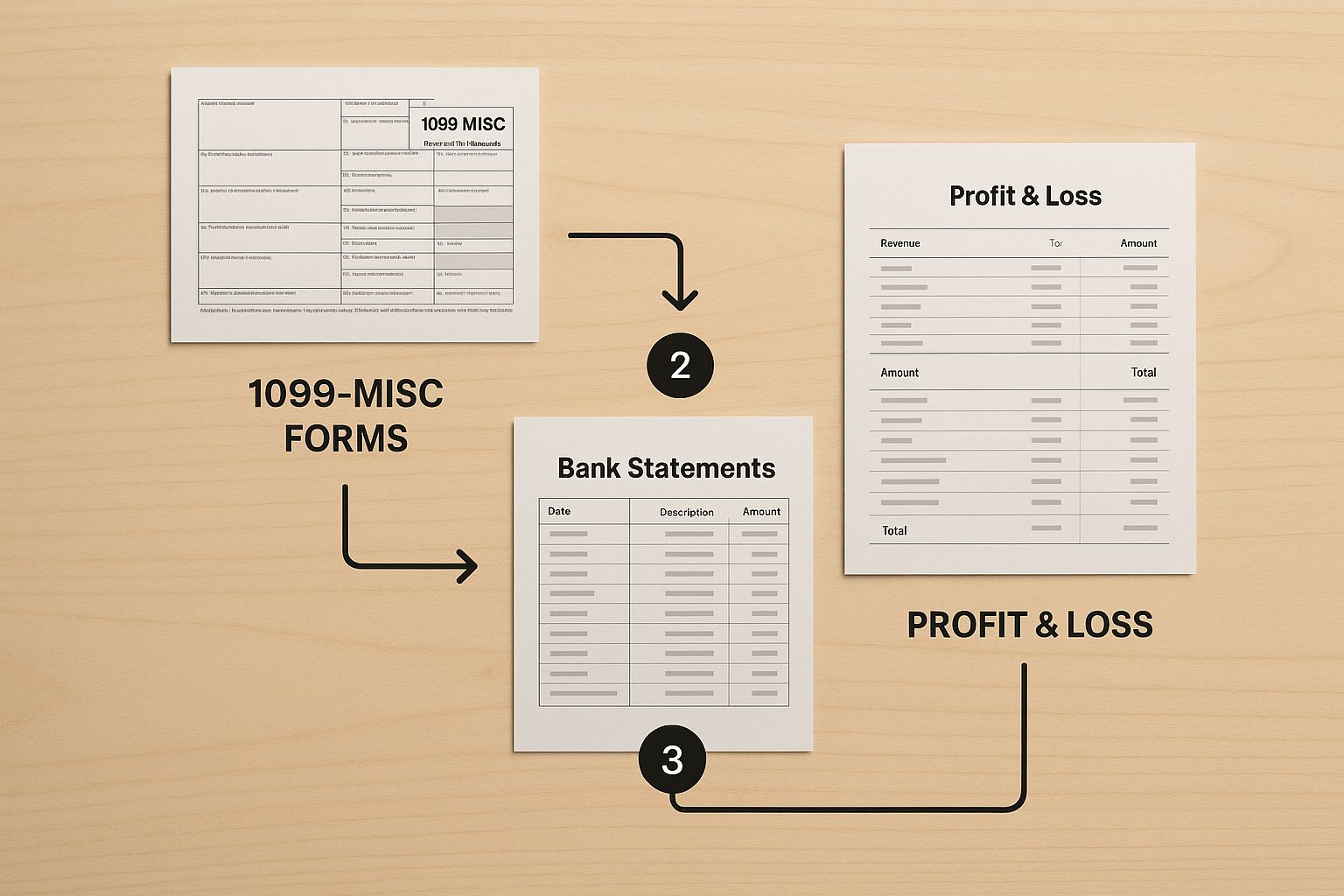

At RAC Mortgage, this is the world we live in. We get that your 1099 forms, business bank statements, and profit and loss (P&L) statements paint a much more accurate picture of your financial health.

By focusing on your consistent deposits and actual business revenue, we piece together a comprehensive financial profile. This ensures your hard work and success are fully recognized in the loan process.

This approach is how we get loans approved for so many deserving Tampa homebuyers who might get turned away by traditional banks. Our extensive experience as a mortgage lender for self-employed individuals in Tampa gives us a unique edge in navigating these exact scenarios.

1099 Income Loan vs Traditional W-2 Loan

So, what's the actual difference in practice? Let's break down the two main paths to a mortgage. The table below really highlights the key distinctions in how income is documented and evaluated. It makes it crystal clear why a specialized lender is non-negotiable for anyone earning 1099 income.

1099 Income Loan vs Traditional W-2 Loan

| Qualification Factor | Traditional W-2 Mortgage | RAC Mortgage 1099 Program |

|---|---|---|

| Primary Documentation | W-2 forms and pay stubs | 12 or 24 months of bank statements, P&L |

| Income Calculation | Based on gross income from W-2 | Based on gross deposits or revenue |

| Tax Return Impact | Minimal impact on gross income | Heavy deductions can reduce AGI, making this route difficult |

| Flexibility | Rigid, automated underwriting | Flexible, common-sense manual underwriting |

As you can see, the 1099 program completely changes the game by shifting the focus from tax-reported income to actual cash flow. This common-sense approach is what opens the door to homeownership for so many entrepreneurs in Tampa.

Why Standard Mortgages Don't Work for Gig Workers

If you've ever felt like the traditional mortgage system wasn't built for you, you’re not wrong. It’s a rigid framework designed for the predictable rhythm of a W-2 paycheck, not the dynamic income of a freelancer, consultant, or small business owner here in Tampa.

The real problem almost always boils down to one thing: tax write-offs.

As a smart 1099 earner, you do what you're supposed to do—you use business deductions to lower your taxable income. While that’s a fantastic move for your finances, it throws a huge wrench in the works for conventional lenders. They’re trained to calculate your qualifying income based on one number: the adjusted gross income (AGI) on your tax returns.

This means every single legitimate business expense you claim—from your home office and software to marketing costs—ends up working against you, shrinking the very income figure they use to approve your loan.

The AGI Trap for Tampa's Self-Employed

Picture this: a successful Tampa web developer pulls in a great six-figure income. They diligently track every business expense, which significantly lowers their AGI. When they apply for a standard mortgage, the lender’s automated system only sees that lower, post-deduction income.

The result? A quick denial that completely ignores their strong, consistent cash flow.

This isn't a rare occurrence; it's a frustratingly common story that highlights the disconnect between old-school lending and modern self-employment. The system, in effect, penalizes you for running your business efficiently.

The problem isn't your income. It's the outdated lens traditional lenders are forced to look through. They see tax deductions as a loss of earnings, not as the sign of a healthy, well-managed business.

We see this flaw every single day at RAC Mortgage. It’s why we intentionally sidestep those outdated roadblocks. We use alternative income verification methods to see the real financial picture and assess your true ability to afford a home.

A Modern Solution for 1099 Income

Recognizing this huge gap in the market, our mortgage lender tampa 1099 income programs bypass tax returns completely.

Instead, we allow you to qualify using 12 or 24 months of business bank statements or a Profit & Loss statement. This is a game-changer. It acknowledges that 1099 workers reduce taxable income for smart tax reasons, which messes up the standard debt-to-income math. To understand how specialized non-qualified mortgages work, you can learn more about the mechanics behind these flexible loan products.

Our team at RAC Mortgage lives and breathes these types of loans. We look at your consistent deposits and actual revenue to understand your business's true financial health, making sure your hard work is finally valued correctly.

Assembling Your 1099 Mortgage Application

Putting together a strong mortgage application is all about telling the story of your financial health. This isn't just about grabbing a stack of papers; it's about strategically showing your consistent, reliable income as a 1099 earner in Tampa. At Residential Acceptance Corporation (RAC Mortgage), we need to see the complete picture, and believe me, a well-organized file is the fastest way to an approval.

Think of it from our perspective as a mortgage lender for Tampa 1099 income earners. We’re looking for stability. I remember a Tampa-based consultant who organized two years of bank statements using highlighters to show recurring client payments. It was a simple trick, but it instantly demonstrated predictable cash flow and helped us get her a pre-approval in under 48 hours.

Little details like that make a huge difference.

The process really flows from your core earning documents to proof of your business's legitimacy. Together, they create a complete financial narrative that an underwriter can easily follow.

To make things crystal clear, here’s a breakdown of exactly what you’ll need to pull together for your application with RAC Mortgage.

Your 1099 Mortgage Application Checklist

| Document Type | What to Provide | Pro Tip |

|---|---|---|

| 1099 Forms | Complete 1099-NEC, 1099-MISC, or 1099-K forms from the last 2 years. | Organize these chronologically. Having them in order makes the review process much faster for our team. |

| Bank Statements | 12 to 24 months of business and personal bank statements. | Highlight recurring deposits from key clients to visually demonstrate stable income streams. |

| Profit & Loss (P&L) | A detailed, year-to-date P&L statement. | Your P&L should be clean and professional. Consider using accounting software to generate it for accuracy. |

| Proof of Business | Your business license, articles of incorporation, or even letters from long-term clients. | Anything that officially proves your business is real and operational adds a layer of trust to your file. |

| Accountant Letter | A letter from your CPA or accountant verifying your self-employment and how long you've been in business. | This third-party verification is incredibly powerful and adds significant weight to your application. |

| Tax Returns | 2 years of complete personal and business tax returns (including all schedules). | While not always required for our specialized 1099 programs, having them ready can prevent last-minute delays. |

Getting these documents in order ahead of time is the single best thing you can do to ensure a smooth and quick process. Now, let's dig into a couple of key areas.

Your Core Income Documents

This is the foundation—where you show the money coming into your business before any deductions.

- Two Years of 1099 Forms: These are non-negotiable. They establish the history of your self-employment income, client by client.

- Business & Personal Bank Statements: We typically need 12 to 24 months of statements. This is where we verify your deposits and cash flow.

- Profit & Loss (P&L) Statement: A year-to-date P&L is essential. It needs to be accurate and ready for an underwriter's review.

For busy gig workers, it's a huge help to automate your bookkeeping. This keeps your records accurate and ready to go at a moment's notice.

Supporting Business Verification

Beyond just your income, we need to verify that your business itself is legitimate and stable. These documents prove that you’re established and operating professionally.

Lenders need assurance that despite income variations, your business is fundamentally stable and sufficient to cover mortgage payments long-term. Your documentation provides that proof.

This is where you solidify your application.

- Proof of Business Existence: This could be your business license, articles of incorporation, or even a few testimonial letters from long-standing clients.

- CPA or Accountant Letter: A letter from your accountant verifying your self-employment status and the length of time you've been in business is worth its weight in gold.

- Personal and Business Tax Returns: While some of our specialized programs don't require tax returns, having two years of complete returns (with all schedules) ready is always a smart move.

When you assemble this complete package, you’re giving our underwriting team everything they need to see the true financial strength of your business. It paves the way for a smooth and efficient path to owning a home here in Tampa.

How We Calculate Your Self-Employed Income

This is where working with us at Residential Acceptance Corporation (RAC Mortgage) really makes a difference. The biggest headache for 1099 earners is having their actual success—proven by strong, consistent revenue—completely ignored by traditional lenders. They often only glance at the adjusted gross income (AGI) on a tax return and say "no."

We flat-out reject that outdated model.

Forget about your AGI. Our underwriters look past the bottom line of your tax return to see the real story of your business's health. Instead of penalizing you for taking legitimate business deductions, we focus on what truly matters: your cash flow.

Beyond the Tax Return

We build your qualifying income profile by digging into the documents that show what's really going on with your money. This isn't an automated process; our team meticulously reviews your:

- Bank Statement Deposits: We analyze 12 or 24 months of deposits to see a consistent, reliable income pattern.

- Profit & Loss (P&L) Statements: A well-prepared P&L gives us a clear picture of your gross revenue and helps us understand the seasonality and real profitability of your business.

This common-sense approach lets our team see the financial strength of your Tampa-based business. It’s a level of understanding that big-bank algorithms just can't offer. We see a thriving business and the person behind it, not just a number on a tax form.

A Holistic Income Assessment

Our analysis goes much deeper than just adding up deposits. We look at the whole picture to build the strongest possible case for your home loan.

We consider your business's history, the stability of your industry right here in the Tampa Bay area, and the consistency of your cash flow. Is your income trending up? Are you keeping your key clients? These details are just as important as the numbers on your bank statements.

Of course, optimizing your net income is still key. It's smart to understand how to leverage your 1099 tax deductions for self-employed individuals to present the best possible financial profile.

We don’t just look at what you’ve earned; we look at the stability and sustainability of those earnings. This is how we confidently approve loans for Tampa's self-employed professionals when others won't.

This thoughtful evaluation is a crucial part of the lending process. While some mortgage programs have finally started adjusting their underwriting standards, this newer approach, which can include digital perks like e-signing, means faster approvals—something you absolutely need in Tampa's competitive market. By exploring these updated 1099 mortgage programs, you can see how the industry is evolving. For us at RAC Mortgage, though, this isn't some new trend. It’s how we’ve always done business.

Finding the Right Loan for Your Tampa Business

Once we have a clear picture of your income, we can start zeroing in on the perfect loan program for you. Here at Residential Acceptance Corporation (RAC Mortgage), we've built our name on creating powerful, flexible options made specifically for Tampa's self-employed community. Instead of shoving you into a pre-made box, our job is to find the loan that actually fits your financial life.

This is where the dream of owning a home starts to feel real. We take your unique business situation and connect it to a loan that works, whether you're eyeing your first place in Seminole Heights or an investment property over in Ybor City.

Bank Statement Loans: The Gold Standard for 1099 Earners

There's a reason our Bank Statement loan program is the most popular choice for entrepreneurs. It’s designed from the ground up for established business owners and freelancers who have strong, consistent cash flow but are also smart about maximizing their tax deductions.

If your tax returns don't show your true buying power, this is almost certainly the best path forward for you.

We see this program work wonders for:

- Established Consultants and Freelancers: You have steady monthly deposits coming in from different clients and have been in business for at least two years.

- Small Business Owners: A quick look at your business bank account shows healthy, predictable revenue, month after month.

- Real Estate Agents and Sales Professionals: Your income is all about commissions, which means you have large but regular deposits hitting your account all year.

With this loan, we analyze 12 to 24 months of your business or personal bank statements. From there, we calculate a qualifying income based on your gross deposits. It’s a common-sense approach that proves you can repay the loan without ever needing to see a tax return.

This program is a total game-changer. It shifts the entire focus from your tax-reported income to your actual cash flow. We get to see the money your business is truly making, which lets us approve loans that other lenders would turn down flat.

Profit and Loss (P&L) Loan Programs

For some business setups, a Profit and Loss (P&L) statement tells a much clearer story than bank statements alone. This option is a fantastic fit for business owners who keep well-organized books and can get a clean P&L from their CPA.

A P&L loan might be right for you if:

- You run a more complex operation with different income streams and well-documented expenses.

- Your bank deposits don't tell the whole story, maybe because of how you transfer funds or pay yourself.

- You have a solid relationship with an accountant who can vouch for your business's financial health.

If you want to dig deeper into how we qualify borrowers without traditional tax documents, our guide on securing a Tampa mortgage without tax returns breaks it all down.

What About Credit and Down Payments?

One of the biggest myths out there is that 1099 borrowers need flawless credit and a massive down payment. While having a strong financial profile never hurts, our programs are built for real-world flexibility.

For our Bank Statement and P&L loans, down payment requirements are highly competitive, often starting in the 10-20% range.

Your credit score definitely matters, but we're committed to looking at the whole picture. Our human-centered underwriting means we can consider "compensating factors," like having significant cash reserves or a long, successful history in your business. Our goal is to find a way to say "yes" by understanding the full story of your financial success.

Common Mistakes 1099 Homebuyers Make

Getting a mortgage when you're self-employed in Tampa has its own set of rules. It’s not harder, necessarily, but you do have to be more careful. Even small, innocent-looking financial moves can throw a wrench in the works, causing big delays or even getting your application denied.

Think of us at Residential Acceptance Corporation (RAC Mortgage) as your guide through this process. We're here to help you sidestep the common pitfalls so your path to closing day is as smooth as possible.

One of the most frequent hangups we see is co-mingling personal and business funds. When you run all your money through one bank account, it creates a massive headache for the underwriter. Their job is to verify your income, and a jumbled account makes it nearly impossible to tell what’s business revenue and what's a personal deposit.

Do yourself a huge favor: keep your business and personal finances in separate, dedicated bank accounts. This one simple step shows you're organized and professional, and it makes the income verification part of any mortgage lender tampa 1099 income review a breeze.

Watching Your Financial Moves During the Loan Process

Once you’ve applied for a loan, your finances are under a microscope until the day you close. Certain actions, even if they seem completely harmless, can raise red flags and put your approval at risk.

A classic example is making large, undocumented cash deposits. Federal law requires underwriters to source any significant deposit that isn't from your regular payroll. A sudden chunk of cash showing up without a clear paper trail is one of the fastest ways to stall out your application.

We actually had a client whose closing was delayed for weeks over this. He had several large Venmo transfers from friends paying him back for a group trip. It was all perfectly legitimate, but sourcing the funds officially was a nightmare for underwriting.

The bottom line is that every dollar in your account needs a story. While your loan is in process, it's best to avoid any unusual financial activity you can't back up with clear, simple documentation.

Other Critical Errors to Avoid

Beyond keeping your bank accounts clean, a few other missteps can derail your homebuying plans. Staying away from these is key to a low-stress experience.

- Opening New Lines of Credit: Don’t even think about applying for a new car loan, credit card, or personal loan. Any new debt changes your debt-to-income (DTI) ratio, and that could trigger a last-minute denial.

- Changing Your Business Structure: Now is not the time to switch from a sole proprietorship to an LLC or make any other big changes. This creates paperwork inconsistencies and makes lenders nervous about your income stability.

- Maximizing Deductions Right Before Applying: It feels great during tax season, but aggressively writing off every single expense in the year or two before you apply will crush your net income on paper. Lower net income means less borrowing power.

At RAC Mortgage, our job is to be proactive. By helping you avoid these common mistakes, we can help you present the strongest, cleanest file possible. That's the secret to a smooth and successful closing on your new Tampa home.

Got Questions About 1099 Mortgages? We Have Answers.

If you're self-employed and diving into the Tampa mortgage market, you've probably got questions. That's a good thing. We hear a lot of the same excellent inquiries from freelancers, consultants, and local business owners. Here are some quick, clear answers to the most common questions we get.

Can I Get a Mortgage with Only One Year of 1099 Income?

This is a big one. While the industry standard is typically a two-year history of self-employment, it’s not always a hard and fast rule. We know great businesses can be young, and at Residential Acceptance Corporation (RAC Mortgage), we look at the bigger picture.

We have flexible programs that can potentially work with just one year of consistent 1099 income. Approval often hinges on other strengths in your application—things like a great credit profile, solid cash reserves, or even if you have years of experience in your field before you went out on your own.

What’s the Minimum Credit Score for a 1099 Loan?

There's no special, higher credit score just for 1099 earners. That's a myth. Your credit score requirement is tied to the specific loan program you choose, not your employment type.

Our specialized 1099 and bank statement loan programs are built to be adaptable. We work with a wide range of credit profiles all the time and are happy to walk you through the options that make the most sense for your financial situation.

The key takeaway is this: We look at your entire financial story. A strong credit history is definitely important, but it's just one piece of the puzzle we use to put your application together.

Do I Really Need a Bigger Down Payment as a 1099 Borrower?

Not necessarily. This is a common misconception that unfortunately stops a lot of self-employed buyers from even trying. While putting more money down always strengthens an offer, it’s not always required.

RAC Mortgage offers 1099 loan programs with competitive down payment options, many starting in the 10-20% range. That's right in line with what you'd see for many conventional loans.

How Long Does the 1099 Mortgage Approval Process Take?

Because we live and breathe this stuff, our process is built for speed. Funding loans for Tampa's self-employed community is our specialty. Our team knows exactly what underwriters are looking for in your documentation, which helps us sidestep the common delays and back-and-forth you might find at a traditional bank.

If you come to us with a complete and well-organized application, we can often move you from pre-approval to the closing table in 30 days or less. Our whole goal is to make this as smooth and fast as humanly possible.

Ready to see how your 1099 income can open the door to your dream home in Tampa? The team at Residential Acceptance Corporation has the expert guidance you need.

Get Started with Your Application Today