Refinancing your mortgage just means you’re swapping out your current home loan for a brand-new one. Most homeowners do this to snag better terms, like a lower interest rate or a shorter payoff timeline. It’s really a strategic financial play—one that can lower your monthly payment, help you own your home outright faster, or let you tap into your home's equity for other big life goals.

Deciding if Now Is the Right Time to Refinance

The biggest question on every homeowner's mind is simple: "Should I refinance now?" The answer isn't just about what you see in the news about interest rates. It’s a deeply personal decision that has everything to do with your specific financial situation and what you're trying to achieve.

Before you even start looking at rates, you need to get crystal clear on why you're considering a refinance in the first place.

Maybe you're feeling the squeeze and want to lower that monthly mortgage payment to free up some cash. Or perhaps you're in a great spot financially and want to get aggressive, switching from a 30-year loan to a 15-year to pay the house off sooner. For many others, it’s about using the equity they’ve worked hard to build to fund a major renovation, consolidate high-interest debt, or pay for college tuition.

Core Motivations for a Mortgage Refinance

Getting your primary goal straight is crucial because each one leads you down a slightly different path. The right loan product for someone looking to lower their payment might not be the best fit for someone wanting to do a cash-out. This is where working with a dedicated lender like Residential Acceptance Corporation (RAC Mortgage) makes a huge difference—we help you match your goals to the right strategy.

Most of the time, the reason you're looking into how to refinance your mortgage will fit into one of these common scenarios:

- Securing a Lower Interest Rate: This is the classic reason. Locking in a lower rate than your current one can translate to serious savings over the life of your loan, sometimes shaving off tens of thousands of dollars in interest.

- Changing Your Loan Term: You might want to ditch your 30-year mortgage for a 15-year to build equity faster and pay less total interest. On the flip side, you could refinance from a 15-year to a 30-year to reduce your monthly payment and improve cash flow.

- Accessing Home Equity: A cash-out refinance lets you borrow against the value you've built up in your home. It’s a powerful tool for getting funds for big-ticket items like a new roof, a kitchen remodel, or paying off credit card debt.

- Switching Loan Types: If you have an adjustable-rate mortgage (ARM), you might be losing sleep over potential rate hikes. Refinancing into a fixed-rate loan gives you the stability and peace of mind of a predictable monthly payment.

Here's a quick breakdown of the most common goals people have when they decide to refinance with us.

Top Reasons to Consider a Mortgage Refinance with RAC Mortgage

| Refinancing Goal | How It Works | Potential Benefit |

|---|---|---|

| Lower Monthly Payment | Secure a lower interest rate or extend your loan term. | Frees up monthly cash flow for other expenses or savings. |

| Pay Off Loan Faster | Switch from a 30-year to a 15- or 20-year term. | Build equity quicker and save significantly on total interest paid. |

| Tap Into Home Equity | Borrow more than you currently owe and receive the difference in cash. | Access funds for home improvements, debt consolidation, or investments. |

| Gain Payment Stability | Convert an adjustable-rate mortgage (ARM) to a fixed-rate loan. | Lock in a predictable payment that won't change over time. |

Ultimately, the best reason to refinance is the one that aligns perfectly with your personal financial picture.

Understanding Market Conditions

The mortgage market is always moving, and refinancing activity is very sensitive to what's happening with interest rates and the broader economy.

For example, data from Fannie Mae's Refinance Application-Level Index (RALI) showed that while the dollar volume of refi applications saw a week-over-week dip of 9.9% as of August 22, 2025, it was still up 17.3% compared to the same time last year. This tells us that even with some weekly volatility, homeowners are still very interested in taking advantage of favorable conditions when they pop up.

The key takeaway here is simple: while market trends are important, they shouldn't be the only thing you look at. Your own financial situation and long-term goals should always be what drives your decision to refinance.

Getting Your Financial House in Order for a Refi

Before you even think about filling out an application, the first move in any successful refinance is a serious financial self-assessment. It’s like checking the foundation of a house before you start remodeling. Knowing exactly where you stand with your credit, your debt, and your home’s equity will make the entire process smoother and put you in the best position to lock in great terms.

Residential Acceptance Corporation (RAC Mortgage) will zoom in on a few key numbers to get a picture of your financial health. These metrics tell the story of how you manage your money and what kind of risk you represent as a borrower. The big three are your credit score, your debt-to-income ratio, and your home's equity.

Your Credit Score Is King

Let’s be honest: your credit score is one of the biggest factors in a refinance. It directly impacts the interest rates you'll get offered. A higher score often means lower rates, and that can save you thousands—sometimes tens of thousands—over the life of the loan.

Generally, a score of 740 or higher is considered top-tier and will put you in the running for the most competitive rates out there. But don't sweat it if you're not there yet. Many programs are designed for borrowers with scores in the 600s. If your score isn't quite where you want it to be, there are practical steps you can take to give it a boost before you apply.

It’s amazing what a few points can do. Bumping your score from 680 to 720 could easily lower your interest rate enough to make a real difference in your monthly payment and your long-term savings.

In the months leading up to your refi, get disciplined. Make every single payment on time, focus on paying down those high-interest credit card balances, and avoid taking on any new debt. For a more detailed game plan, you can check out our guide on how to improve your credit score for a mortgage.

Calculating Your Key Financial Ratios

Next up are two critical numbers that every lender will crunch to understand your financial standing:

- Debt-to-Income (DTI) Ratio: This one is simple. It’s your total monthly debt payments (including what your new mortgage payment would be) divided by your gross monthly income. This is used to see if you can comfortably afford the new loan. The magic number is usually a DTI below 43%.

- Loan-to-Value (LTV) Ratio: This ratio stacks your mortgage balance up against your home's current market value, which tells the lender how much equity you have. For most refinances, you'll want at least 20% equity in your home (that’s an LTV of 80% or less) to steer clear of paying for private mortgage insurance (PMI).

It's also worth noting how the market is changing. We’re seeing a lot more younger homeowners get into the game. In early 2025, for example, Gen Z buyers made up about one in four first-time homebuyer loans. As these new owners build equity, they’ll become perfect candidates for refinancing down the road to optimize their loans. You can discover more insights about these homeownership trends on Ginnie Mae's site.

Getting Your Refinance Paperwork Together

Let’s be honest—hunting down paperwork is probably the least exciting part of refinancing. But a little organization upfront can make a huge difference, turning a potential headache into a smooth, fast-moving process.

Think of it as setting the stage for a successful application with Residential Acceptance Corporation (RAC Mortgage).

When you have all your documents ready before you apply, it shows our team you're a serious, prepared borrower. That simple step can shave days, or even weeks, off the time it takes to get from application to closing. It lets our underwriters verify your financial details quickly and keep your file moving without hitting any snags.

Here’s a pro tip: create a dedicated folder on your computer just for your refinance. As you find each document, scan it and save it with a clear, simple name like "April Pay Stub" or "W-2 2024." This bit of digital organization will be a lifesaver when it’s time to upload everything.

Your Essential Document Checklist

While every borrower’s situation is a little different, the documents needed for a refinance generally fall into a few key categories. At RAC Mortgage, we just need a clear picture of your income, your assets, and your existing debts to get your new loan approved. Getting these items together now puts you way ahead of the game.

Here’s a straightforward list of what you’ll typically need to have on hand:

- Proof of Income: This is just to verify you have a steady cash flow to support the new mortgage payment. You’ll want your most recent pay stubs (usually covering a 30-day period) and your W-2s from the last two years.

- Asset Information: We need to see that you have the funds for any closing costs and reserves. The easiest way is to gather bank statements for your checking and savings accounts from the last two months.

- Current Debt Details: This includes statements for any current mortgages, auto loans, student loans, or credit cards. It helps us get an accurate read on your debt-to-income ratio.

- Identification: A clear copy of your driver's license or another government-issued photo ID is all that’s required here.

Preparing these documents ahead of time is one of the most effective ways you can streamline your own refinance journey. It shows our team you’re organized and helps us process your application with greater speed and efficiency.

For a complete and detailed breakdown, you can review our full guide on what documents are needed for a mortgage application. This preparation is a crucial step when learning how to refinance your mortgage, ensuring you’re ready for a seamless experience.

Choosing the Right Loan and Comparing Rates

Once you've got your financial documents in order, the real work begins—exploring your refinance options. This isn’t a one-size-fits-all situation; the best loan for you hinges entirely on what you want to accomplish.

At Residential Acceptance Corporation (RAC Mortgage), our job is to match you with a loan that makes sense for your life. Are you trying to lower that monthly payment? Pay off the house ahead of schedule? Maybe you want to tap into your home's equity. Whatever the goal, there’s a loan strategy for it.

The first big decision comes down to understanding the two main types of loans. You'll be choosing between the predictability of a fixed-rate mortgage and the lower initial payments of an adjustable-rate mortgage (ARM). Each one has its place.

Fixed-Rate vs. Adjustable-Rate Mortgages

A fixed-rate mortgage is as straightforward as it gets. Your interest rate is locked in for the entire life of the loan. That means your principal and interest payment won't ever change, which is fantastic for budgeting and gives you serious peace of mind. If you see yourself staying in your home for the long haul and don't want to gamble on future rate hikes, this is your best bet.

An adjustable-rate mortgage (ARM) works a little differently. It usually starts with a lower interest rate for a set number of years (often five or seven). After that introductory period, the rate can change based on what the market is doing. An ARM can be a really smart financial move if you think you might sell the house or refinance again before that initial fixed period is over. You get to pocket the savings from that lower initial rate.

Finding the Right Loan Term

Next up is the loan term—how long you have to pay it back. Most people land on either a 15-year or 30-year term.

- 15-Year Term: You’ll have a higher monthly payment, no doubt about it. But the trade-off is massive: you pay way less in total interest over the years and build equity at lightning speed. This is a powerful option for homeowners who can comfortably handle the payment and are focused on becoming debt-free sooner.

- 30-Year Term: This is the go-to for a reason. It gives you the lowest possible monthly payment, which frees up cash for everything else life throws at you. You will pay more in interest over the full three decades, but for many families, the monthly flexibility is worth it.

Your loan term is a huge lever for your monthly cash flow and your long-term wealth. A RAC Mortgage loan officer can run the numbers for you, showing exactly how each scenario impacts your budget and overall savings. It's not just theory; it's your actual bottom line.

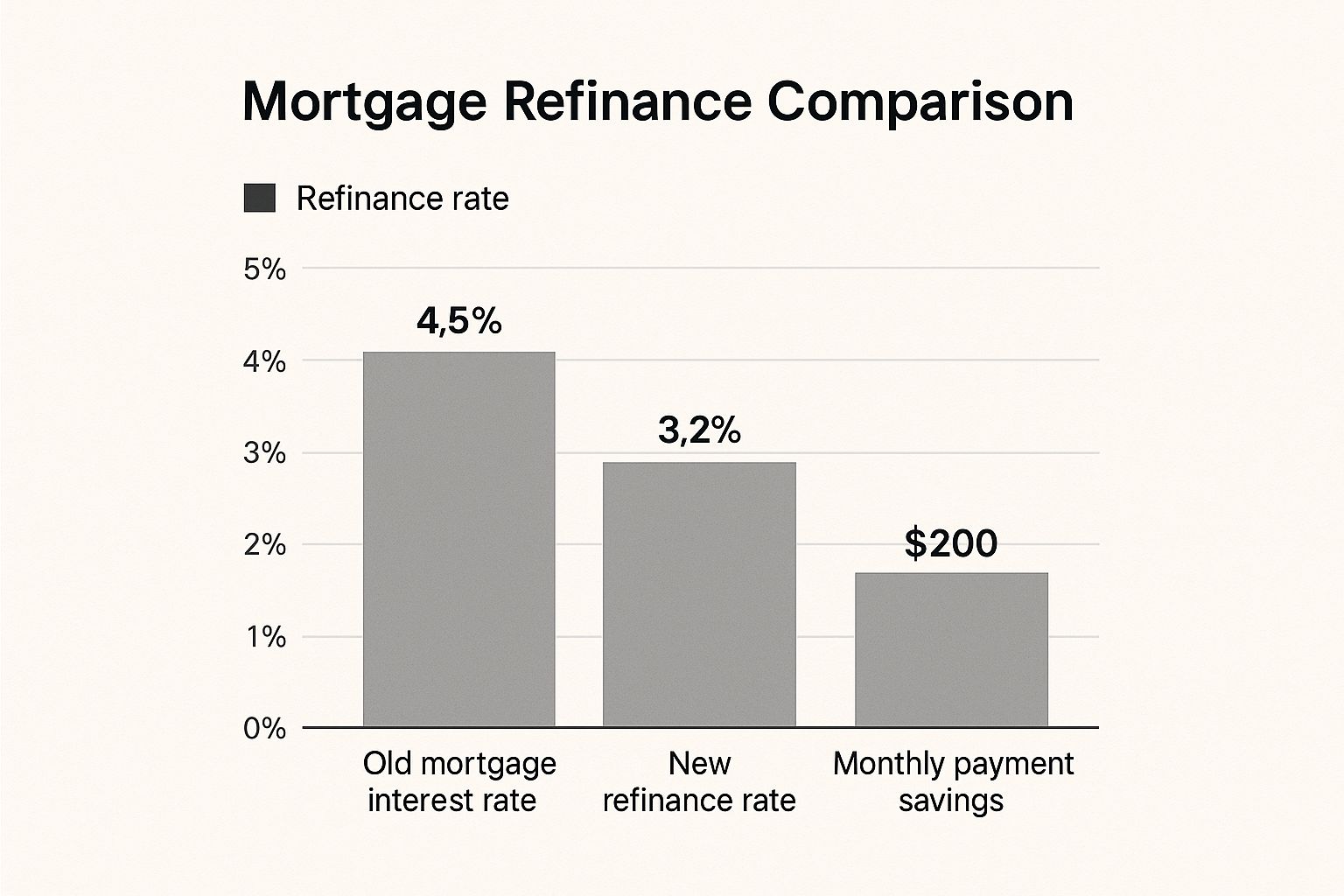

A quick visual can really drive home how a lower rate translates directly into monthly savings. This is what we're aiming for.

This infographic shows a classic example where refinancing from 4.5% down to 3.2% creates a significant drop in the monthly payment.

As you can see, what might seem like a small rate change can have a huge impact on your wallet every single month.

To give you a clearer picture of how loan terms affect your payments and total cost, let's look at a simple comparison for a hypothetical $300,000 loan.

Comparing Common Refinance Loan Terms

| Loan Term | Example Interest Rate | Estimated Monthly Payment | Total Interest Paid |

|---|---|---|---|

| 30-Year | 6.5% | ~$1,896 | ~$382,633 |

| 20-Year | 6.0% | ~$2,149 | ~$215,830 |

| 15-Year | 5.75% | ~$2,492 | ~$148,541 |

(Note: These are illustrative examples. Your actual rate and payments will vary.)

The table makes it obvious: a shorter term means a higher monthly payment, but you save a fortune in interest over time. It's all about balancing your immediate budget with your long-term financial goals.

Understanding Rate Variations

Interest rates are the engine behind any refinance, and they're always in motion. For example, recent data from August 2025 showed average 30-year fixed refinance rates hovering around 6.62%.

But not all loans had that rate. Shorter-term 15-year loans were averaging closer to 5.69%, and FHA loans were around 6.15%. These differences come from factors like the loan's risk level and how long you're borrowing the money for. You can read the full research about current mortgage rates on Fortune.com to see how the market is trending.

The Application to Closing Journey with RAC Mortgage

You’ve done the heavy lifting—comparing rates, choosing the perfect loan, and getting your docs in order. Now you’re on the home stretch of your refinance with Residential Acceptance Corporation (RAC Mortgage). This is where all that prep work pays off as we get your application through the final checks and to the closing table.

Don't worry, this part of the process is actually pretty straightforward. Our team is here to walk you through every milestone, starting with underwriting.

Navigating the Underwriting Process

Once your application and documents are submitted, your file lands on an underwriter's desk. Their job is to be the ultimate fact-checker. They'll meticulously review your entire financial profile—income, assets, debts, and credit—to make sure every detail aligns with the loan program's guidelines.

During this phase, it is absolutely critical to keep your finances as stable and boring as possible. Seriously, this is not the time to make any big money moves.

To keep things running smoothly through underwriting, stick to these rules:

- No New Debt: Don't even think about opening a new credit card, financing a car, or co-signing a loan for anyone. Any new debt can throw off your debt-to-income ratio and put your approval at risk.

- Steady Employment: If you can help it, stay with your current employer. A sudden job change adds a bunch of extra verification steps and can really slow things down.

- Keep Your Money Put: Avoid making any large, random cash deposits or shifting big sums of money between your accounts. A clear, consistent financial picture is needed, not a flurry of activity that can't be explained.

The Home Appraisal and Final Figures

While the underwriter is busy with your file, we’ll also order a home appraisal. We bring in an independent, licensed appraiser to determine your property’s current market value. This is a standard step for any refi, and it’s crucial for making sure the home's value supports the new loan amount.

After the appraisal is in and your loan gets a conditional approval, you'll receive a Closing Disclosure. Pay close attention here—this is one of the most important documents you’ll see. It lays out a final, detailed breakdown of your loan terms and all the associated costs.

The Closing Disclosure is your final chance to review everything. It will spell out your exact interest rate, your new monthly payment, and the total cash you might need to bring to closing. Federal law mandates you get this document at least three business days before your scheduled closing, so you'll have plenty of time to look it over.

A lot of homeowners ask how they can manage those final costs. If you're weighing your options, you can learn more about rolling closing costs into your new loan and see if that’s a smart move for your financial situation.

Your Big Day: Signing the Final Papers

With the final approval locked in, all that’s left is the closing itself. You'll meet with a closing agent or attorney to sign the last stack of loan documents. Just be sure to bring a government-issued ID and get your signing hand ready.

This is the moment it all becomes official. Once the ink is dry and the funds are sent, your old mortgage gets paid off, and you're officially on your way with your new, better loan.

Congratulations! You’ve successfully navigated the refinance process and locked in a better financial future.

Answering Your Top Mortgage Refinance Questions

Even after you've got the basics down, it's completely normal to have a few more questions pop up. Deciding to refinance your mortgage is a major financial move, and honestly, the little details are what count.

We get a lot of the same questions here at Residential Acceptance Corporation (RAC Mortgage), so we’ve put together some clear, direct answers to help you out.

What’s This Going to Cost Me?

Refinancing isn't free, so it's smart to plan for the expenses involved. You should expect to see closing costs that look a lot like what you paid for your original home loan. Typically, this falls somewhere between 2% and 5% of your new loan amount.

What are you paying for, exactly? These costs cover all the necessary services to get your new loan finalized. Think of things like:

- Appraisal fees: To get a current, accurate value of your home.

- Title insurance: This protects both you and the lender from any future claims on the property.

- Loan origination fees: This covers the administrative work of processing your application.

At RAC Mortgage, we're all about transparency. You'll get a detailed Loan Estimate right from the get-go that breaks down every single cost. No surprises. A lot of borrowers choose to roll these costs right into their new loan principal to avoid paying cash upfront, and that’s definitely an option we can talk through.

Can I Still Refinance If My Credit Score Isn't Perfect?

While a top-tier credit score always unlocks the best interest rates, a lower score doesn't automatically take you out of the running. Not by a long shot.

At RAC Mortgage, we look at your whole financial story, not just a single number. We take your income, home equity, and your total debt into account. For a conventional refi, 620 is often the minimum credit score you'll see. But some government-backed programs, like FHA and VA loans, have much more flexible credit requirements.

Don't just assume you won't qualify because your score is on the lower end. The best move is to talk to a loan officer. One of our experts at RAC Mortgage can dig into your specific situation, find programs you might be eligible for, and map out a path forward.

How Long Does This Whole Refinance Thing Take?

The timeline can shift a bit depending on the situation, but most homeowners find the whole process takes about 30 to 45 days. That’s from the day you submit your application to the day you’re signing the final papers.

A few things can speed up or slow down the process. How quickly the home appraisal comes back, how complex your finances are, and how fast you can get us the required documents all play a big part.

The best thing you can do to keep things on track is to be organized and responsive. At RAC Mortgage, we make it our job to keep you in the loop every step of the way. You’ll always know where your application stands and what's next, so you can feel confident all the way to the closing table.

Ready to see what refinancing could do for you and how much you might save? The team at Residential Acceptance Corporation is here to walk you through it with expert advice and support that’s tailored to you. Get started on your application today!