Getting your hands on an FHA loan can feel like navigating a maze, but it’s honestly one of the most straightforward ways to buy a home. This is especially true if you're a first-time buyer or have a credit history that isn't exactly perfect.

The whole process really just boils down to four key pieces of the puzzle: your credit history, how much you can put down, your income stability, and whether the house itself is up to snuff. Once you get a handle on these, the journey becomes a lot less intimidating.

Your Guide to FHA Loan Qualification

So, what is an FHA loan anyway? It’s a mortgage that’s insured by the Federal Housing Administration. This insurance protects lenders if a borrower defaults on their loan.

Because of this government backing, lenders like Residential Acceptance Corporation (RAC Mortgage) can offer loans with much more flexible requirements than you'd find with a typical conventional mortgage. It's important to know the FHA doesn't actually lend you the money—they just set the rules that approved lenders have to follow.

This guide will break down exactly how to qualify for an FHA loan, giving you the real-world info you need to move forward with confidence.

The Four Pillars of FHA Approval

When you apply, lenders are going to look closely at four main areas to figure out if you're a good fit for an FHA loan.

- Credit History: The FHA guidelines are pretty lenient here, but lenders still need to see that you have a history of borrowing responsibly.

- Down Payment: This is the cash you bring to the table upfront. The good news is the FHA allows for much smaller down payments than many other loan types.

- Income and Employment: No surprises here—you’ll need to prove you have a stable and reliable income to handle the monthly mortgage payments.

- Property Eligibility: The house you want to buy has to meet certain minimum health and safety standards set by the FHA. It can't be a fixer-upper in total disrepair.

The FHA keeps things pretty simple with clear benchmarks. For example, in 2025, if your credit score is between 500 and 579, you’ll need to put down at least 10%. But if you have a score of 580 or higher, you could qualify with a down payment as low as 3.5%. For a deeper dive into the numbers, check out NerdWallet's recent analysis of FHA requirements.

Before we get into the nitty-gritty, this table gives you a quick snapshot of the core requirements you'll need to meet.

FHA Loan Qualification at a Glance

Here’s a simplified breakdown of the main FHA guidelines. Think of this as your cheat sheet for getting approved.

| Requirement | FHA Guideline |

|---|---|

| Minimum Credit Score | 500 (with 10% down), 580 (with 3.5% down) |

| Minimum Down Payment | 3.5% of the purchase price |

| Debt-to-Income (DTI) Ratio | Generally 43% or lower (up to 50% with compensating factors) |

| Employment History | Typically two years of verifiable employment |

| Property Type | Must be your primary residence |

| FHA Appraisal | The home must meet FHA's minimum property standards |

| Mortgage Insurance | Upfront and monthly premiums are required |

Meeting these core guidelines is your first big step. A good lender will work with you to document everything properly and navigate any gray areas, making sure your application is as strong as possible.

Meeting Credit and Down Payment Milestones

When you start digging into how to qualify for an FHA loan, two things jump out right away: your credit score and your down payment. These aren't just numbers on a page; they're the foundation of your entire loan application. They influence everything from the interest rate you'll get to the specific terms of your mortgage.

The FHA designed its program to open doors to homeownership, and they've set up a pretty straightforward system. The magic number to keep in mind is 580. If your credit score is 580 or higher, you unlock the FHA's biggest perk: the incredibly low 3.5% down payment.

This is a massive advantage for so many homebuyers. On a $300,000 house, a 3.5% down payment is just $10,500. Compare that to the 20% down ($60,000) often required for conventional loans, and you can see why FHA is such a popular path.

What If Your Credit Score Is Below 580?

Don't panic if your score is a bit lower. The FHA loan program still has a path for you if your score is between 500 and 579, but the rules change slightly. To offset the higher risk, you’ll need to bring a larger down payment to the table—at least 10% of the home's purchase price.

It’s also important to remember that while the FHA sets these minimums, lenders like Residential Acceptance Corporation (RAC Mortgage) often look at the bigger picture. We want to see the story behind the score. A consistent history of paying your bills on time says a lot more than a single late payment from a couple of years ago.

A strong credit history tells a lender you're a reliable borrower. It's not just about the score; it's about the story your financial habits tell over time.

Sourcing Your Down Payment Funds

One of the best things about the FHA loan is how flexible it is with where your down payment money comes from. It doesn't all have to be from your own piggy bank. You've got options:

- Personal Savings: This is the most common route, using money you've saved up in a checking or savings account.

- Gift Funds: Family members can help out with a financial gift. The key is to document it correctly with a gift letter confirming it's not a loan that needs to be paid back.

- Down Payment Assistance (DPA) Programs: Many state and local governments offer grants or special loans to help buyers cover their down payment and closing costs.

An experienced loan officer can be a huge asset here. At RAC Mortgage, we help borrowers explore all their options and make sure the funds are documented perfectly for a smooth underwriting process. If your credit could use some work, it's always a good idea to focus on improving it. For some practical advice, check out our guide on how borrowers can repair bad credit.

Balancing Your Income and Debt for Approval

Beyond your credit score, lenders really dig into your income and existing debts. The big question they're trying to answer is simple: can you comfortably handle a new mortgage payment on top of everything else?

To figure this out, they use a key metric called the debt-to-income (DTI) ratio. It's just a percentage showing how much of your monthly gross income is already spoken for by recurring debt payments.

Think of it this way: your total monthly income is a pie. Your DTI shows how much of that pie is already claimed by things like car payments, student loans, and credit card bills. A smaller slice for existing debt means a bigger slice available for your new home.

Generally, the FHA likes to see a DTI ratio of 43% or less. In simple terms, this means no more than 43 cents of every dollar you earn should be going toward your total debt payments, including your potential new mortgage.

Calculating Your DTI Ratio

Figuring out your DTI is pretty straightforward. You just add up all your monthly debt payments and divide that number by your gross monthly income (your income before taxes).

Let's look at a real-world example. Say we have a graphic designer named Alex.

- Gross Monthly Income: $5,500

- Monthly Debts:

- Student Loan: $350

- Car Payment: $400

- Credit Card Minimums: $150

- Total Monthly Debt: $350 + $400 + $150 = $900

To find Alex's DTI, we divide the total debt by the income: $900 / $5,500 comes out to 0.163, or about 16%. With a DTI this low, Alex is in a fantastic position to get approved, as there's plenty of room for a mortgage payment.

If you want to dive deeper, you can learn more about what a debt-to-income ratio is and how it really affects what you can borrow.

What If Your DTI Is Higher Than 43%

Now, don't panic if your DTI is a bit over that 43% mark. It’s not an automatic deal-breaker. The FHA is known for its flexibility, and this is where something called compensating factors comes into play. These are positive elements in your financial profile that help offset the risk of a higher DTI, sometimes allowing for a ratio as high as 50%.

Compensating factors are your financial strengths. Think of them as extra credit that shows a lender you're a reliable borrower, even if your DTI is on the high side.

So, what counts as a compensating factor?

- Significant Cash Reserves: Having several months' worth of mortgage payments saved up after you close is a huge plus. It shows you have a solid financial cushion.

- Minimal Payment Shock: If your proposed new mortgage payment is very close to what you're currently paying in rent, it proves you're already used to managing that level of housing expense.

- A Strong History of Saving: A track record of consistently putting money into a savings account shows financial discipline and makes lenders feel more confident.

Verifying Your Employment History

Finally, lenders need to see that you have a stable and reliable work history. The standard requirement is two years of consistent employment. You’ll usually prove this with your most recent pay stubs, W-2s from the past two years, and your tax returns.

At Residential Acceptance Corporation (RAC Mortgage), we know that not everyone’s career path is a straight line. We work with borrowers in all sorts of situations—freelancers with fluctuating income, people who just switched careers, or even those with explainable gaps in their employment. The key is providing clear documentation to paint a full picture of your financial stability.

Finding a Home That Meets FHA Standards

It's a common misconception that getting an FHA loan is all about your personal finances. The truth is, the house you want to buy has to get approved, too. The FHA isn't just backing you; they're insuring the loan on the property, so they need to make sure it's a solid, safe, and secure investment.

This is where the FHA appraisal comes in. It’s not your run-of-the-mill appraisal focused solely on market value. An FHA-approved appraiser will conduct a thorough inspection to ensure the home meets the Department of Housing and Urban Development's (HUD) strict "minimum property standards." Think of them as the gatekeeper, checking for anything that could threaten your health, safety, or the home's structural integrity.

Common Red Flags in an FHA Appraisal

Knowing what an FHA appraiser looks for can save you a ton of time and heartache. You can learn to spot potential deal-breakers before you even think about making an offer.

Here are some of the big issues they’ll flag:

- A failing roof with obvious leaks or that's well past its prime.

- Outdated electrical systems that could be a fire hazard.

- Any sign of termites or other critters munching on the woodwork.

- Major structural problems, like a scary-looking crack in the foundation.

- Peeling or chipping lead-based paint in any home built before 1978.

Now, finding an issue doesn't mean the deal is dead on arrival. In many cases, the seller can agree to handle the required repairs before closing. This is where having an experienced team on your side, like the folks at Residential Acceptance Corporation (RAC Mortgage), becomes invaluable. They can help you navigate the negotiations and coordinate everything to keep the deal moving forward.

Understanding FHA Loan Limits in Your Area

Another crucial piece of the puzzle is the FHA loan limit. The FHA sets a cap on how much they're willing to insure for a loan, and these limits change dramatically depending on the county you're buying in. This is done to reflect the vast differences in local housing costs across the country.

Simply put, the max FHA loan you can get in a small rural town won't be the same as in a bustling city.

For example, the FHA loan limits in most parts of the country for a single-family home start at a baseline of $498,257. But in high-cost-of-living areas like parts of California or New York, that limit can soar to $1,149,825. This tiered system is what makes it possible for buyers in expensive markets to still use FHA financing and avoid needing a jumbo loan.

To see this in action, take a look at how different two counties can be.

Example FHA Loan Limits Standard vs High-Cost Areas

| Area Type | Example County | Single-Family Loan Limit |

|---|---|---|

| Standard-Cost Area | Polk County, Florida | $498,257 |

| High-Cost Area | Los Angeles County, California | $1,149,825 |

These limits directly define your purchasing power with an FHA loan, so knowing the exact number for your target county is a must. Your loan officer at RAC Mortgage can give you the specific limits for your area and help you figure out how that fits into your overall homebuying budget.

And if you find yourself needing a little extra to bridge the gap, it's always a good idea to see if you qualify for any down payment assistance programs.

Navigating the FHA Application from Start to Finish

You've done the legwork—checking your credit, running the DTI numbers, and getting a handle on FHA property standards. Now it’s time to bring it all home, literally. The FHA loan application might look like a mountain of paperwork, but when you break it down, it’s really just a series of manageable steps.

The journey starts with a simple conversation. When you connect with a loan officer here at Residential Acceptance Corporation (RAC Mortgage), we'll sit down and get a clear picture of your finances and what you're looking for in a home. This first chat is the key to getting pre-approved, which is what tells sellers you're a serious buyer ready to make a move.

Getting Your Documents in Order

Once you're pre-approved and have a home in your sights, the real paper chase begins. Trust me, being organized here is your best friend. Your loan officer will give you a specific checklist, but you can get a major head start by gathering these essentials.

- Proof of Income: Grab your two most recent pay stubs and your W-2 forms from the last two years.

- Tax Returns: You'll need your federal tax returns for the past two years—this is standard procedure.

- Asset Verification: Lenders need to see your two most recent bank statements to confirm you have the cash for the down payment and closing costs.

- Employment History: Jot down a list of your employers over the past two years, along with their contact info.

- Identification: A clear copy of your driver’s license or another government-issued ID will be required.

Having this stack of documents ready to go makes the whole process smoother. It shows your lender you're on top of things and sets a great tone for the rest of the application.

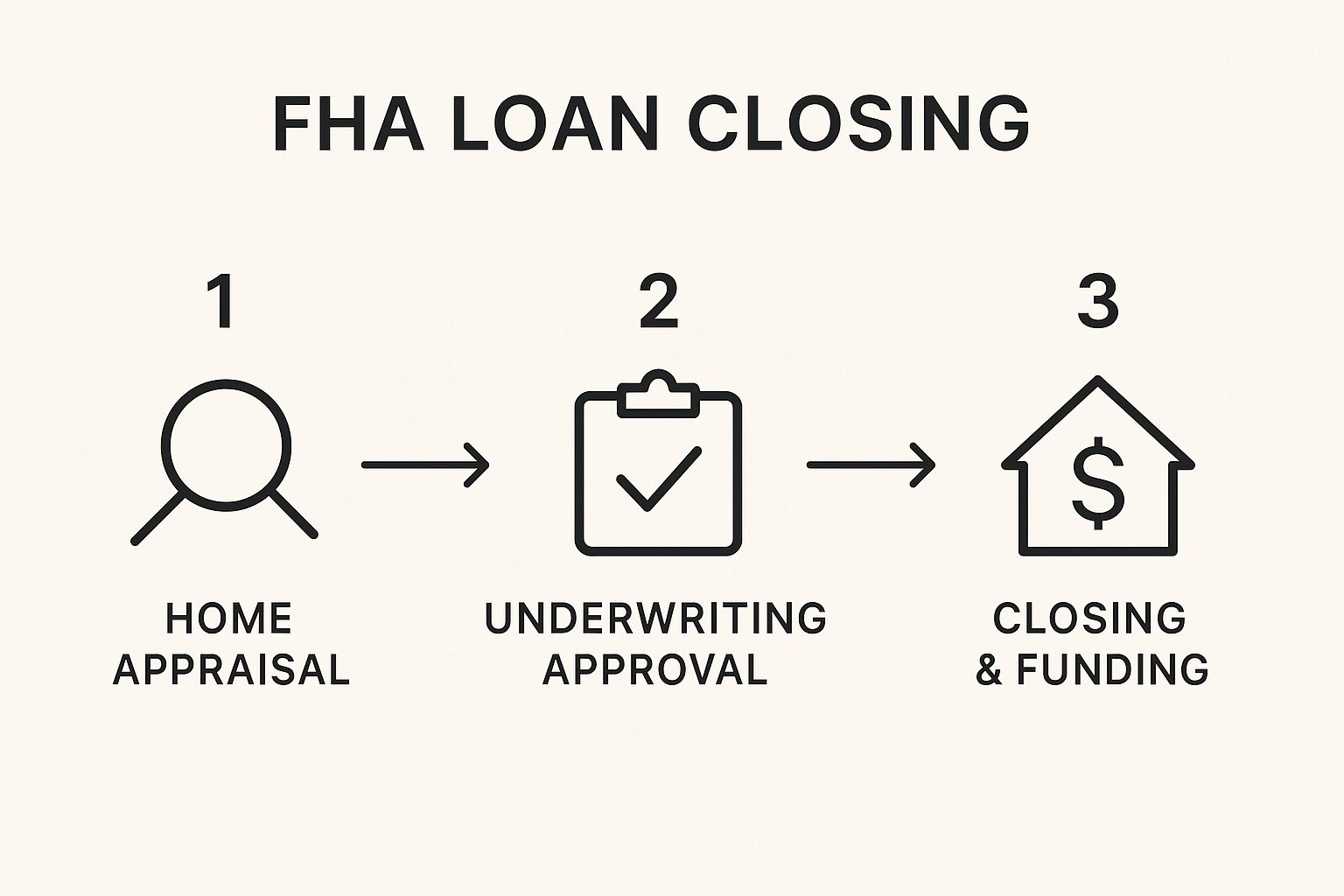

The Home Stretch: Underwriting and Closing

After you’ve submitted your documents and have a house under contract, your file heads to underwriting. This is where an underwriter combs through every single detail of your application to make sure it lines up perfectly with FHA guidelines. Think of it as the final green light before you get the keys.

This graphic gives you a simple visual of those final, crucial stages.

As you can see, the appraisal, the final underwriting approval, and the closing day itself are the last major hurdles. Each one has to be cleared before you can move on to the next.

While your loan is in underwriting, it's absolutely critical to keep your financial life as stable and boring as possible. This is not the time for big purchases or career moves.

One of the biggest mistakes borrowers make is changing jobs or financing a new car while their loan is in underwriting. Lenders do a final credit check right before closing, and any new debt can completely derail your approval at the last minute.

To keep everything on track, steer clear of these common pitfalls:

- Don't open new credit cards or apply for any other type of loan.

- Avoid making large, undocumented deposits into your bank accounts.

- Stay at your current job if you can possibly help it.

- Keep paying all your bills on time, without exception.

By following this roadmap and staying in touch with your RAC Mortgage loan officer, you'll be in a great position to navigate the entire process with confidence and get to the closing table without any surprises.

Answering Your FHA Loan Questions

Even with all the rules laid out, I know you probably have some "what if" questions running through your mind. It's completely normal. Aspiring homeowners often worry about how their unique financial situations will be viewed by lenders.

Let's dive into some of the most common concerns I hear from applicants. Think of this as clearing up the final bits of confusion so you can move forward with total confidence.

How Do Student Loans Affect My DTI Ratio?

This is a huge one for so many FHA applicants. The short answer is yes, student loan debt absolutely counts towards your debt-to-income ratio, and lenders have very specific ways of calculating it. Even if your loans are in deferment or you're on an income-based repayment plan showing a $0 payment, a monthly amount still has to be factored in.

Lenders will typically use one of two things:

- The actual monthly payment documented on your credit report.

- If that payment is zero, they must use 0.5% of your total outstanding loan balance.

So, if you owe $50,000 in student loans but aren't currently making payments, a lender will add a $250 monthly payment ($50,000 x 0.005) to your DTI calculation. This is non-negotiable and ensures your future ability to handle a mortgage is assessed accurately.

Can I Get an FHA Loan After Bankruptcy?

Yes, you can. A past bankruptcy doesn't have to be a roadblock to homeownership, but you will need to be patient. The FHA requires specific waiting periods to ensure you've had enough time to get back on your feet and re-establish good credit.

A past bankruptcy doesn't automatically disqualify you from homeownership. The FHA's waiting periods provide a clear timeline for when you can re-enter the housing market, giving you a second chance to achieve your goal.

Here are the timelines you need to know:

- Chapter 7 Bankruptcy: You must wait at least two years from the official discharge date.

- Chapter 13 Bankruptcy: You might be eligible after just one year of on-time plan payments, but you'll need the court's approval.

The key is what you do during that waiting period. You have to be diligent about managing your finances, paying every single bill on time, and avoiding new debt. This is how you prove to lenders like Residential Acceptance Corporation (RAC Mortgage) that you're financially stable and ready for a mortgage.

Can a Co-signer Help Me Qualify?

Absolutely. Bringing on a co-signer can be a game-changer, especially if your income or credit score is just on the edge of qualifying. FHA loans allow for a non-occupant co-borrower—usually a family member who won't live in the house but is willing to be equally on the hook for the loan.

The co-signer’s income, assets, and credit profile are essentially combined with yours, which can seriously boost the strength of your application. This strategy often helps applicants meet DTI requirements or even qualify for a larger loan. It's a common and effective path for many first-time buyers who just need a little extra support to get their foot in the door.

Ready to see if an FHA loan is the right fit for you? The team at Residential Acceptance Corporation is here to walk you through the process, answer every question you have, and help you get the keys to your new home.

Start your homeownership journey with RAC Mortgage today!