Feeling the heat from your monthly mortgage payment? It's a common stressor, but you're not stuck. The quickest ways to see some relief often involve either refinancing your loan to snag a better interest rate or recasting it after making a significant principal payment. These two strategies cut right to the heart of what determines your monthly bill.

Finding a Lower Mortgage Payment That Fits Your Budget

When that mortgage bill feels like it’s eating up too much of your income, it’s easy to feel trapped. The good news is, you have some powerful options at your disposal to bring that number down.

The secret is figuring out which strategy makes the most sense for your finances right now—and for your long-term goals. For a lot of people, housing costs have simply outpaced their wages, making a lower payment less of a "want" and more of a "need."

Your journey to a more manageable mortgage starts by exploring the most effective methods. Each one has its own set of pros, cons, and requirements, so what works wonders for your neighbor might not be the right move for you.

Key Strategies to Lower Your Mortgage Payment at a Glance

To give you a clear picture, let's break down the most common strategies homeowners use. Think of this table as your starting point—a quick-reference guide to see which path might be your best fit before we get into the nitty-gritty details of each one.

| Strategy | Best For | Potential Impact | Key Consideration |

|---|---|---|---|

| Mortgage Refinancing | Homeowners with good credit and enough equity, especially when interest rates have dropped since they got their loan. | Can dramatically lower your monthly payment and the total interest you'll pay over the years. | This is a brand-new loan, which means going through the application process and paying closing costs. It's usually worth it if you can get a rate 0.5% to 1% lower than your current one. |

| Loan Recasting | Homeowners who come into a chunk of cash (like a bonus, inheritance, or sale of an asset) and want to lower payments without the hassle of a refi. | Your principal balance shrinks, and your lender recalculates your payment based on the new, lower balance for the rest of your term. | It's much simpler and cheaper than refinancing, but you need a substantial lump sum to make a real dent. |

| Challenging Property Taxes | Homeowners who have a strong reason to believe their property has been assessed for more than it’s actually worth. | Successfully appealing can lower the tax portion of your escrow payment, which in turn reduces your total monthly housing cost. | You'll need to file a formal appeal with your local tax assessor and come prepared with evidence to back up your claim. |

This quick comparison should help you zero in on the strategy that aligns with your current financial reality.

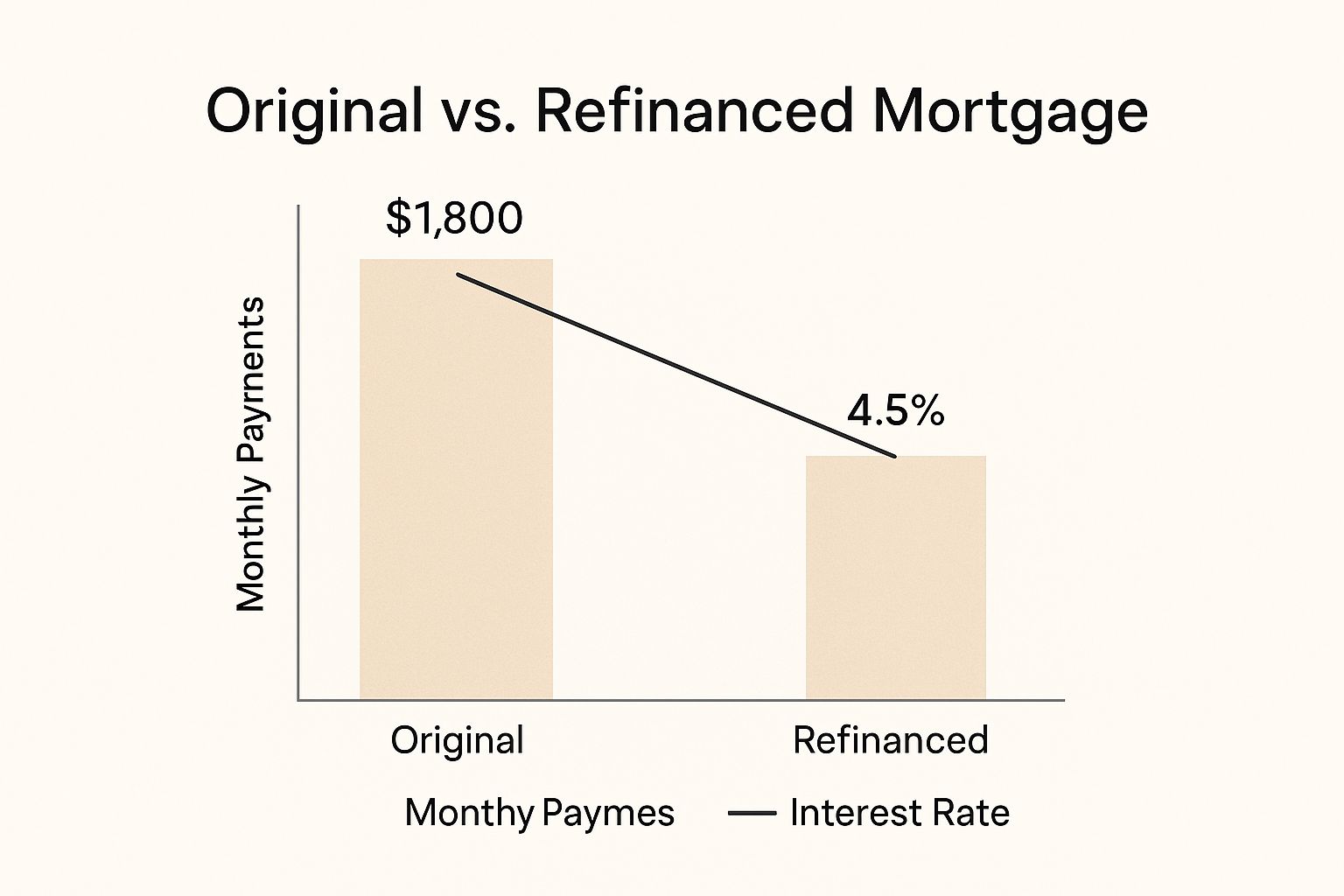

This image really drives home just how much a successful refinance can change your monthly budget and long-term savings.

As you can see, even a seemingly small drop in your interest rate can free up hundreds of dollars every single month.

Key Takeaway: The right move really depends on your specific situation. If interest rates are attractive and your credit is in good shape, refinancing with a trusted lender like Residential Acceptance Corporation (RAC Mortgage) often delivers the biggest bang for your buck. But if you've got extra cash ready to deploy, recasting is a simpler, faster way to get that payment down.

Refinancing for a Better Rate and Term

When it comes to lowering your mortgage payment, refinancing is often the most powerful tool in your arsenal. In simple terms, you’re swapping out your current home loan for a brand-new one. The goal is straightforward: secure better terms and a lower monthly payment that fits your life today.

Most homeowners who refinance do it for one big reason—to snag a lower interest rate. Even a seemingly small drop in your rate can lead to huge savings over time, giving you some much-needed breathing room in your budget right away.

The Power of a Lower Interest Rate

Your interest rate is the single biggest factor that dictates the size of your monthly mortgage payment. It’s pretty simple: a lower rate means more of your money goes toward paying down your loan balance and building equity, and less goes into the lender's pocket as interest.

Getting the timing right is everything. Historically, one of the best ways to slash a mortgage payment has been to refinance when market interest rates take a dive. For example, during the pandemic, rates hit historic lows. Some lucky homeowners were able to lock in rates as low as 2.65% in early 2021.

Let's look at the numbers. A homeowner with a $400,000 mortgage at that 2.65% rate had a principal and interest payment around $1,612 per month. Fast forward to late 2023, when rates shot up to 7.79%. The payment on that exact same loan amount jumped to $2,877—a staggering difference. This really shows how refinancing in a low-rate environment can be a game-changer for your finances.

Even a half-point drop can make a real difference, freeing up cash you can put toward other important goals.

Real-World Example: Let's say Sarah has a $350,000 mortgage on a 30-year term with a 6.5% interest rate. Her principal and interest payment is about $2,212 a month. A few years later, market rates have fallen, so she refinances with Residential Acceptance Corporation (RAC Mortgage) into a new 30-year loan at 5.5%. Her new payment is now $1,987. That's an extra $225 in her pocket every single month, adding up to $2,700 a year.

Adjusting Your Loan Term for Immediate Relief

While getting a lower rate is the main event, refinancing also gives you the chance to change your loan term. This is another lever you can pull to adjust your monthly payment.

If your top priority is getting your payment as low as possible right now, you could extend your loan term. For instance, if you're already ten years into a 30-year loan, you could refinance back into a fresh 30-year term. This spreads your remaining balance over a much longer period, which shrinks your monthly bill.

Be aware of the trade-off, though. While extending the term provides immediate relief, you will almost certainly pay more in total interest over the life of the new loan. It's a strategic choice you have to weigh carefully.

Your Refinancing Roadmap with RAC Mortgage

The idea of refinancing might sound like a lot of work, but when you break it down into steps, it becomes much more manageable. Working with a dedicated lender like Residential Acceptance Corporation (RAC Mortgage) helps streamline the whole thing.

Here are the key things we'll look at to make sure your refinance is a success:

- Your Credit Score: The better your score, the better the interest rate you'll be offered. A strong credit history is a sign you're a reliable borrower.

- Home Equity: This is the difference between what your home is worth and what you still owe. Most lenders want to see about 20% equity to avoid Private Mortgage Insurance (PMI).

- Loan-to-Value (LTV) Ratio: Lenders pay close attention to this metric, which compares your loan amount to your home's value. You can learn the ins and outs with this guide on how loan-to-value ratios work.

- Closing Costs: A refinance isn't free. Expect to pay closing costs, typically between 2% and 5% of the new loan amount. We'll help you calculate your "break-even point"—the month when your savings officially outweigh these costs—to make sure the numbers work in your favor.

The team at RAC Mortgage is here to walk you through all of these factors. We’ll help you figure out if refinancing is the right move and guide you toward locking in that new, lower payment to help you hit your financial goals.

Recasting Your Mortgage as a Simpler Alternative

While refinancing gets all the attention, there’s another incredibly useful but often overlooked strategy for homeowners who want to lower their monthly payments. It’s called mortgage recasting (or re-amortization), and it’s a much simpler way to get monthly savings, especially if you've recently come into a chunk of cash.

Instead of going through the whole process of getting a new loan, recasting works with your current one. You keep your existing mortgage, its interest rate, and its term. The magic happens when you make a large, one-time payment directly to your principal balance.

Once that payment clears, your lender, Residential Acceptance Corporation (RAC Mortgage), simply recalculates your monthly payments based on the new, smaller loan balance. Those payments are then spread out over the rest of your original loan term, which means a lower bill in your mailbox each month.

When Does Recasting Make the Most Sense?

Recasting is perfect for very specific situations. It's the ideal move for homeowners who don't need a new interest rate (maybe you already have a great one!) but want to use a windfall to create some breathing room in their monthly budget.

This approach is especially powerful if you have:

- Received a substantial bonus or commission from work.

- Gotten an inheritance or a financial gift.

- Sold off other assets like property, stocks, or a business.

Think of it this way: you’re essentially hitting the fast-forward button on building equity. By slashing a piece of your principal all at once, you immediately shrink the debt that your future payments are calculated on. This is a fantastic way to boost your monthly cash flow without the paperwork and underwriting of a full refinance.

Key Takeaway: Recasting is all about cutting your payment by shrinking the loan balance, not by chasing a new interest rate. If you locked in a great low rate years ago, recasting lets you keep that rate while still enjoying a smaller monthly payment.

Recasting vs. Refinancing: A Direct Comparison

It’s crucial to understand how these two options differ. While both can result in a lower mortgage payment, they take completely different roads to get there.

Let's put them side-by-side to see how they stack up.

| Feature | Mortgage Recasting | Mortgage Refinancing |

|---|---|---|

| The Process | You make a lump-sum principal payment, and we recalculate your monthly bill. It’s straightforward and quick. | You apply for a brand-new loan to pay off and replace your old one, requiring a full application and underwriting process. |

| Cost | Much cheaper. There's usually just a small administrative fee, typically a few hundred dollars. | Significantly more expensive. Closing costs can run from 2% to 5% of the total new loan amount. |

| Interest Rate | Your interest rate and the end date of your loan do not change. | The main goal is to secure a new, lower interest rate and potentially a different loan term (e.g., 15-year vs. 30-year). |

| Credit Impact | Little to none. There is no new loan application or hard credit inquiry hitting your report. | It involves a hard credit check, which can cause a temporary dip in your credit score. |

Ultimately, the choice comes down to your primary financial goal. If you're looking to take advantage of today's lower market rates, refinancing is your best bet. But if you have cash ready and a great existing rate, recasting with RAC Mortgage is a more direct and cost-effective path to a smaller payment.

How to Start the Recasting Process

Getting a mortgage recast started is a pretty painless process. Your first move should be to get in touch with your loan servicer—in this case, the expert team right here at Residential Acceptance Corporation (RAC Mortgage). We can confirm your loan is eligible and walk you through the specific requirements.

Most lenders will ask for a minimum lump-sum payment, often around $5,000, to qualify. It's also important that your loan is current and in good standing. A solid payment history is key, and if you have any worries about your credit, it can't hurt to review some borrower tips for repairing bad credit to make sure everything is in top shape.

Once you connect with us, we'll guide you through the next steps, from making the principal payment to seeing that new, lower monthly bill show up on your statements.

Exploring Alternative Loan Structures

While refinancing and recasting are solid strategies, they aren't the only tools in the shed for tackling a high mortgage payment. Sometimes, the best way forward is to think differently about the loan itself. Looking into alternative loan structures can unlock some serious monthly savings, especially if your life or financial picture has changed since you first signed on the dotted line.

That 30-year fixed-rate loan might have been the perfect fit when you bought your home, but it's not a life sentence. Moving beyond the standard loan types can open up new avenues for lowering your payment, whether for a short-term boost or for the rest of your loan.

The trick is knowing what's out there and having an expert partner to walk you through it. At Residential Acceptance Corporation (RAC Mortgage), we help homeowners dig into different structures to find one that truly matches their current needs and future goals.

Understanding Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages, or ARMs, sometimes get a bad rap because of their perceived risk. But honestly, for the right borrower in the right situation, they can be an incredibly powerful tool. An ARM usually kicks off with a lower, fixed interest rate for an initial term—often three, five, or seven years.

After that intro period, the rate adjusts up or down based on a market index. That initial low-rate phase is where you find the savings. If you know you're likely to move or refinance before the fixed period is up, an ARM could save you a huge chunk of change every month.

Example Scenario: Let's say you're a medical resident who knows you'll be relocating for a permanent job in four years. Grabbing a 5/1 ARM could give you a much lower payment than a 30-year fixed loan for the whole time you own the house. You get the benefit of the savings and sell before the rate ever has a chance to change.

Interest-Only Loan Options

Another way to dramatically lower your mortgage payment, at least for a while, is with an interest-only loan. Just like the name says, this structure lets you pay only the interest on your loan for a set period, typically the first five to ten years.

Since you're not chipping away at the principal balance, your monthly payments are significantly smaller. This can be a smart play for people with commission-based or fluctuating incomes. It gives them lower fixed costs, and they can make big principal payments when they land a bonus or a big contract. The key thing to remember, though, is that your principal balance isn't shrinking, and your payments will jump up significantly once the interest-only period ends.

Globally, the popularity of different loan structures can vary a lot based on market conditions. For instance, interest-only loans are more common in markets with stable or low interest rates. This is just one of many ways to manage mortgage payments, reflecting a diverse international landscape where mortgage debt to GDP can be as low as 38% in Japan or over 100% in Switzerland. You can dive deeper into these trends by exploring the full research on international mortgage comparisons.

Finding the Right Fit with RAC Mortgage

Picking the right loan structure is a huge financial decision that demands a hard look at your personal situation. There's no single "best" answer.

- Your Financial Goals: Are you after short-term payment relief or long-term stability? Your answer points you toward whether a fixed-rate, ARM, or something else is the right move.

- Your Risk Tolerance: How do you feel about your payment potentially changing down the road? This is the core question when you're thinking about an ARM.

- Your Future Plans: Is this your "forever home," or do you see yourself moving in the next five to ten years? Your timeline is a make-or-break factor.

The team at Residential Acceptance Corporation (RAC Mortgage) is here to help you sort through these options. We can analyze your situation, lay out the pros and cons of each structure, and help you find a loan that gives you the payment relief you're looking for without putting your long-term financial health at risk.

Your monthly mortgage payment is more than just principal and interest. The total check you write each month, often called PITI, also covers property taxes and homeowners insurance. These are usually held in an escrow account, and your lender pays them for you.

But here's something a lot of homeowners miss: you can tackle these other costs to bring down your monthly payment. It's another powerful way to make your budget work better for you, chipping away at your total housing expense from multiple angles.

Challenging Your Property Tax Assessment

Did you know your property tax bill is directly tied to what your local tax authority thinks your home is worth? If you suspect they've overvalued your property, you have the right to appeal it. A successful appeal means a lower tax bill and less money going into your escrow account each month.

First, get your hands on your property tax card from the local assessor's office. This document lists all the details they have on your home—square footage, lot size, number of bedrooms, etc. Go over it with a fine-tooth comb. A simple mistake here could be the reason your assessment is too high.

Next, you'll need to do a little homework. Find "comps," or comparable properties in your neighborhood that have sold recently. You're looking for homes similar to yours in size, age, and condition that sold for less than your home's assessed value. This is the evidence you need to build a solid case.

Every town has its own process and deadlines for filing an appeal, so make sure you follow their instructions to the letter. When you present clear, factual evidence, you have a real shot at a favorable outcome.

Shopping for More Affordable Homeowners Insurance

It's easy to set up your homeowners insurance when you buy a house and then completely forget about it. Big mistake. Insurance rates are always changing, and you might be missing out on a much more competitive deal. It's just smart money management to shop your policy around every so often.

Start by getting quotes from several different insurance providers. Just make sure you're comparing apples to apples by asking for the same coverage limits you have now. You might be surprised to find the same level of protection for a much lower price.

A few strategies can help you lock in a better rate:

- Bundle Your Policies: Most insurers give you a nice discount for bundling your home and auto insurance together.

- Increase Your Deductible: If you're comfortable with a higher out-of-pocket cost on a claim, raising your deductible will almost always lower your monthly premium.

- Improve Home Safety: Things like security systems, new smoke detectors, and even deadbolt locks can often earn you a discount.

Found a better deal? Making the switch is simple. Your new insurer will handle the paperwork, and you just need to let your mortgage servicer, Residential Acceptance Corporation (RAC Mortgage), know about the change. We'll get your escrow account updated to reflect your new, lower premium.

Removing Private Mortgage Insurance (PMI)

If you put down less than 20% when you bought your home, you're almost certainly paying for Private Mortgage Insurance (PMI). This insurance doesn't protect you; it protects the lender if you default on your loan. PMI can easily add $50 to $200 or more to your payment every single month.

The good news is that PMI isn't forever. The Homeowners Protection Act is a federal law that gives you the right to request cancellation once your loan-to-value (LTV) ratio hits 80%. In other words, once you've paid down your mortgage to 80% of what your home was originally worth.

To get rid of PMI, you'll need to:

- Put your request in writing to your lender.

- Have a good payment history with no late payments.

- Be current on your loan.

Lenders are legally required to automatically cancel PMI when your LTV gets to 78%, but why wait? Being proactive and asking at 80% can save you months, or even years, of extra payments. And if your home's value has shot up, you might be able to get rid of PMI even sooner based on its current market value, though you may need a new appraisal. The first step is to contact RAC Mortgage—we can see if you qualify to ditch this extra cost and lower your payment for good.

Common Questions About Lowering Your Mortgage Payment

Deciding on the best path to lower your mortgage payment can feel overwhelming, and it always brings up important questions. Getting clear, straightforward answers is key to moving forward with confidence. Let's tackle some of the most frequent concerns homeowners have when they start exploring their options.

How Much Equity Do I Need to Refinance

Home equity is the absolute cornerstone of any refinancing discussion. Think of it as the slice of your home you truly own—the difference between its current market value and what you still owe on the mortgage. For lenders like Residential Acceptance Corporation (RAC Mortgage), a healthy amount of equity signals financial stability.

As a general rule, you need at least 20% equity in your home to approve a refinance without requiring you to pay for Private Mortgage Insurance (PMI). This works out to a Loan-to-Value (LTV) ratio of 80% or less. Calculating your LTV is simple: just divide your loan amount by your home's appraised value.

For instance, if your home is valued at $400,000 and your mortgage balance is $320,000, your LTV is exactly 80%. You've hit the sweet spot for a standard rate-and-term refinance.

Key Insight: The more equity you have, the stronger your application becomes. An LTV well below 80% not only helps you dodge PMI but also positions you to snag the most competitive interest rates offered by RAC Mortgage.

The equity benchmark can also change based on the type of refinance you're after.

- Rate-and-Term Refinance: The goal here is simple: get a better interest rate or change your loan term. That 80% LTV mark is still the gold standard for securing the best possible deal.

- Cash-Out Refinance: Want to tap into your home's equity for cash? The rules get stricter. For a cash-out refinance, you generally must leave at least 20% of your equity in the home.

Knowing where you stand with your equity is the first, most critical step in figuring out if a refinance makes sense for you.

Will Lowering My Mortgage Payment Hurt My Credit Score

This is a totally valid concern, but the good news is the answer really depends on how you lower your payment. Different strategies have different effects on your credit report.

When you refinance your mortgage, you're applying for a brand-new loan. That process involves a "hard inquiry" from the lender, which can cause a small, temporary dip in your score—usually just a few points.

This slight drop is almost always short-lived. Your score typically bounces back within a few months as you start making consistent, on-time payments on the new, more affordable loan. The long-term savings almost always outweigh this minor, temporary blip. If you want to get your credit in peak condition before applying, check out our guide on how to improve your credit score for a mortgage.

Here's the great part: many other powerful strategies for slashing your payment have absolutely no impact on your credit.

- Mortgage Recasting: You're not applying for new credit, so there’s no hard inquiry. Recasting just re-amortizes your existing loan, leaving your credit score completely untouched.

- Removing PMI: This is another move that has zero effect on your credit. It's simply an adjustment based on your original loan agreement and a positive financial milestone.

- Appealing Property Taxes: This is a conversation between you and your local tax authority. It has no connection whatsoever to your credit report.

The bottom line? Only actions that involve a new credit application, like refinancing, will affect your score, and even then, the impact is usually minimal and temporary.

What Is the First Step if I Am Struggling with My Payments

If you find yourself in a tight spot where making your mortgage payment is becoming a real challenge, the single most important thing you can do is act immediately. Waiting and hoping the problem solves itself can lead to much more serious, long-term consequences.

Your very first move should be to proactively contact your lender. Honest, open communication is your best ally when facing financial difficulty. Before you even think about missing a payment, reach out to the team here at Residential Acceptance Corporation (RAC Mortgage).

We are here to help, not to judge. Lenders would much rather work with a homeowner to find a solution than go down the costly and difficult road of foreclosure. By getting in touch early, you keep every possible option on the table.

Proactive Communication is Key: Don't wait for a late notice to show up in the mail. The moment you see a problem on the horizon, pick up the phone. This shows you're responsible and serious about your obligations, which makes lenders far more willing to work with you.

When you call us, we can walk you through potential hardship options that might be available. These programs are designed to give you temporary relief and help you get back on solid ground.

A few of these options might include:

- Forbearance: This allows you to temporarily pause or reduce your mortgage payments for a set period. While you'll still have to pay back the missed amounts later, it provides immediate breathing room.

- Loan Modification: This is a more permanent change to your loan's terms to make your monthly payment more manageable for the long haul. It could involve extending the loan term, lowering the interest rate, or in some situations, even forgiving a portion of the principal balance.

The key takeaway is that you have allies. Facing financial hardship can feel isolating, but remember that RAC Mortgage has dedicated teams and programs designed specifically to help homeowners navigate tough times. Taking that first step to communicate is the most powerful move you can make.