If you want to get your credit score in shape for a mortgage, it really boils down to a few key habits. Focus on paying all your bills on time, keeping your credit card balances low, and regularly checking your credit reports for any errors. Sticking to these habits shows lenders you're financially reliable, which is exactly what they want to see when you're asking for a home loan.

Why Your Credit Score Is Key for a Mortgage

Before we jump into the how-to, it’s crucial to get why your credit score carries so much weight in the home-buying process. The easiest way to think about it is as your financial resume. Lenders, including us here at Residential Acceptance Corporation (RAC Mortgage), use this three-digit number to get a quick, standardized snapshot of how you've handled credit in the past.

That single number has a massive impact on your mortgage application. It's not just about getting a "yes" or "no"—it directly shapes the quality of the loan you'll be offered.

A higher score can unlock some serious advantages:

- Lower Interest Rates: Even a tiny difference in your interest rate can save you tens of thousands of dollars over the life of your loan. It’s a huge deal.

- Higher Borrowing Amounts: A strong credit profile tells lenders you can responsibly manage a larger loan.

- More Favorable Loan Terms: This could mean a lower down payment or even avoiding expensive private mortgage insurance (PMI).

The Real-World Impact of Your Score

The difference between a "good" score and an "excellent" one isn't just a few points; it's thousands of dollars. Picture two different people applying for the exact same loan. One has a 680 credit score, while the other has a 760. The borrower with the 760 will almost always be offered a lower interest rate, leading to a smaller monthly payment and incredible long-term savings.

This isn't just a hypothetical scenario. The bar for mortgage borrowers is set pretty high. In the second quarter of 2024, the average credit score for a U.S. mortgage borrower hit 758, which is well above the national average. It just goes to show that lenders are putting a premium on applicants who have a proven history of managing credit well.

Think of it this way: every point you add to your credit score is like building equity in your financial reputation. A higher score makes you a more attractive applicant, giving you more negotiating power and better options.

What Lenders Are Looking For

Lenders rely on specific credit scoring models, usually from FICO, to figure out their risk. Different loan programs have different requirements, but if you're aiming for the best possible outcome, you want to be in the "very good" range—that's typically a score of 740 or higher. This puts you in the strongest position to get approved with great terms. To learn more about the specific numbers you should be aiming for, take a look at our guide on the ideal credit score for a mortgage.

Knowing this benchmark is your first step. It gives you a clear target to work toward as you start improving your credit. Your journey to owning a home really begins with building a credit history that tells a story of reliability and financial discipline.

Conduct a Deep Dive Into Your Credit Reports

Alright, your first real move toward getting that mortgage is giving your credit report a serious health check. Don't just give it a quick glance; this needs to be a detailed audit of your entire financial past. Think of it as cleaning your financial house from top to bottom before you let any lenders come in for a look.

The whole process kicks off when you get your credit reports from the big three credit bureaus: Equifax, Experian, and TransUnion. Thanks to federal law, you’re entitled to a free copy from each of them every single week. The only place to go for this is their official, government-approved website.

Here is a look at the official site where you can request your free reports.

Using this centralized site is the safest and most direct route to get your hands on this information, and it won't ding your credit score.

What to Look for When Auditing Your Reports

Once those reports are in your hands, it's time to put on your detective hat. Lenders rely on this data to make their decisions, so every detail has to be accurate. You'd be surprised how even tiny errors can throw a wrench in your plans to get your credit score ready for a mortgage.

Go through each report with a fine-tooth comb, keeping a sharp eye on these specific areas:

- Personal Information: Is your name spelled right? Are your address and Social Security number correct? A simple typo can create major headaches.

- Account Status: Make sure all your accounts are listed correctly. That car loan you proudly paid off should be marked "closed" and "paid in full," not as an open account with a balance.

- Payment History: Check for any payments you made on time that are incorrectly flagged as late. A single 30-day late payment can cause a significant drop in your score.

- Unfamiliar Accounts: See any credit cards, loans, or collection accounts you don't recognize? This is a huge red flag and could point to identity theft.

A study by the Federal Trade Commission discovered that one in five consumers had an error on at least one of their credit reports. This just goes to show how common mistakes are and why you absolutely cannot skip a detailed review.

Disputing Errors Effectively

Spotting an error is just the first step. To actually fix it, you have to formally dispute it. The Fair Credit Reporting Act (FCRA) gives you the power to challenge mistakes with both the credit bureau and the company that provided the incorrect information.

First, gather up any proof you have that the information is wrong. This could be anything from a bank statement showing you paid on time, a letter from a creditor confirming an account is closed, or even a police report if you think you're a victim of fraud.

Then, you'll need to submit a formal dispute through each credit bureau's website. Clearly explain what the error is, why it’s wrong, and upload your supporting documents. The bureau generally has about 30 days to investigate and get back to you. Getting a negative mark like a bogus late payment or an incorrect collection account removed is one of the fastest ways to give your credit score a real boost.

Build an Unbeatable Payment History

When you're trying to get your credit in shape for a mortgage, your payment history is the undisputed heavyweight champion. It’s easily the most important factor in your credit score, and for good reason. Lenders see it as a direct reflection of how reliable you are with your finances.

A consistent record of on-time payments tells a lender like RAC Mortgage that you’re a responsible borrower who can handle a mortgage. The goal sounds simple: pay every bill on time, every single time. But life happens, so having a solid system in place is what truly makes the difference.

Automate Your Way to Perfection

One of the smartest moves you can make is to take human error out of the picture entirely. Go ahead and set up automatic payments for all your recurring bills—think credit cards, car loans, and even utilities. It’s a game-changer.

You can set it to pay the minimum due or the full balance. Either way, this simple step ensures you never miss a due date. That's critical, because even one slip-up can have a real impact on your score.

A single payment that is just 30 days late can cause a significant drop in your credit score, and that negative mark can stick around for years. It gets even more serious for payments that are 60 or 90 days late, creating major red flags for any mortgage underwriter.

Communication Is Your Best Defense

So, what happens if you know a payment is going to be late? Don't just sit back and let it happen. Being proactive can make a world of difference. The moment you realize you might miss a due date, pick up the phone and call your creditor.

Explain your situation honestly. Ask if they can offer any help, like a one-time "goodwill" adjustment or a temporary payment plan. If you’ve been a good customer, many lenders are willing to work with you, especially if you get ahead of the problem. This one call can sometimes stop the late payment from ever being reported to the credit bureaus.

The Power of Consistent Payments

The long-term effect of a perfect payment history is incredibly powerful, especially once you have a mortgage. An analysis of 1 million mortgages revealed that borrowers who never missed a payment saw their FICO scores climb by an average of 7.68 points over their origination score. The study also showed that longer, more consistent payment histories led to even bigger score improvements. This proves that paying your mortgage on time is a fantastic tool for building your credit.

This just goes to show that the good habits you build now will keep paying dividends long after you get the keys to your new home. For anyone dealing with past credit struggles, it’s important to know there are clear paths forward. Creating a rock-solid payment history is your most critical step toward proving you're financially reliable and getting the mortgage you want.

Lower Your Credit Utilization Strategically

Once you’ve nailed down making every payment on time, your next big mission is tackling your credit utilization ratio. It sounds complicated, but it’s really just the amount of revolving debt you have—think credit card balances—compared to your total credit limits. Lenders pay close attention to this number because it gives them a pretty clear picture of how much you rely on credit to get by.

A high utilization ratio can scream "financial stress" to a lender, so getting it under control is absolutely critical when you’re prepping for a mortgage. The great thing is, bringing this ratio down can give your score one of the fastest boosts possible.

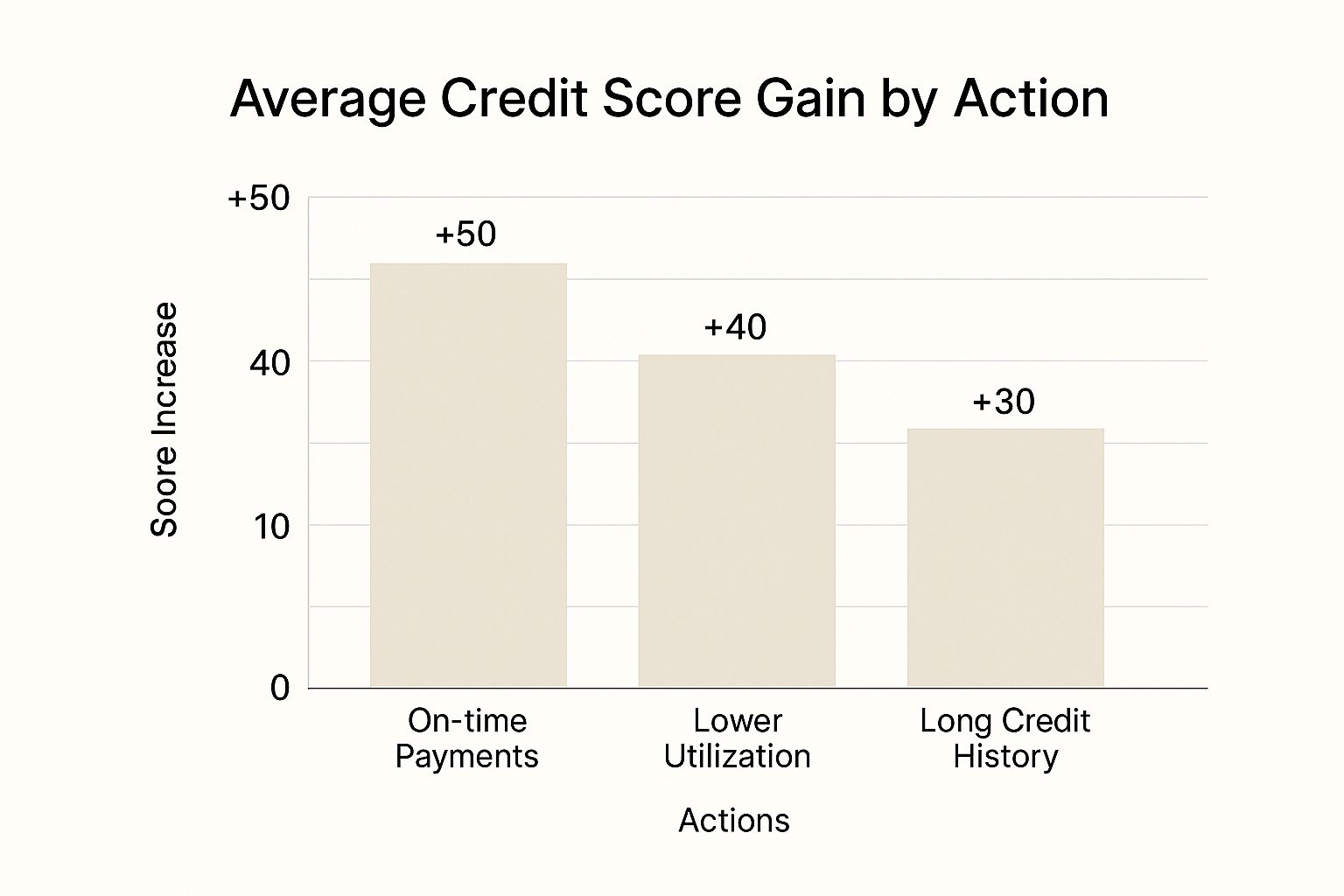

This image really drives home which actions give you the most bang for your buck when improving your credit score.

As you can see, lowering your credit utilization is a high-impact move. It’s second only to a perfect payment history in its power to raise your score.

The Magic Number for Utilization

There isn't an official, hard-and-fast rule, but the common wisdom is to keep your overall credit utilization below 30%. But if you're serious about getting a mortgage, you'll want to be more aggressive. Aiming for under 10% can make a huge difference in the eyes of a mortgage underwriter at RAC Mortgage. It shows them you have your finances completely under control.

Let's say you have three credit cards that give you a combined credit limit of $15,000. To hit that sweet spot, you’d want to keep your total balances under $1,500.

Choosing Your Debt Pay-Down Strategy

To get those balances down, you need a game plan. You can have great success with two popular methods, and the best one really depends on what motivates you.

- The Avalanche Method: With this strategy, you throw every extra dollar at the card with the highest interest rate while making minimum payments on everything else. From a purely financial standpoint, this saves you the most money on interest.

- The Snowball Method: Here, you focus on paying off the card with the smallest balance first, no matter the interest rate. This approach gives you quick, satisfying wins that build momentum and keep you fired up to continue.

Honestly, neither one is "better" than the other. The best method is the one you’ll actually stick with. The end goal is the same: systematically crush your balances and slash that utilization ratio.

A quick but important tip: The goal is to pay down your debt, not get rid of the accounts. Closing old credit cards can actually backfire. It lowers your total available credit (hurting your utilization) and can shorten the average age of your accounts. It's almost always smarter to pay a card off and just keep it open.

To give you a clearer idea of how lenders see these numbers, I've put together a table showing how different utilization levels are perceived.

Impact of Credit Utilization on Your Score

This table breaks down how your credit utilization ratio—that is, the percentage of available credit you're using—can influence both your credit score and how lenders view your financial health.

| Credit Utilization Ratio | Credit Score Impact | Lender Perception |

|---|---|---|

| 0% – 9% | Excellent | Seen as a very low-risk borrower who manages credit exceptionally well. |

| 10% – 29% | Good | Viewed as a responsible credit user, meeting the standard for ideal financial health. |

| 30% – 49% | Fair | May raise some concerns, suggesting you might be slightly overextended. |

| 50% or Higher | High-Risk | A major red flag for lenders, indicating a heavy reliance on credit. |

Making a real effort to bring down your credit utilization is one of the smartest things you can do before applying for a home loan. It directly targets a key metric lenders care about and can deliver a fast, significant improvement to your credit score.

Of course. Here is the rewritten section, crafted to sound like an experienced human expert and match the provided examples.

Cultivate a Diverse and Mature Credit Profile

A strong credit profile is about more than just dodging late payments. It's about showing lenders you can responsibly handle different kinds of credit over a long haul. When you're trying to improve your credit score for a mortgage, lenders like RAC Mortgage are looking for a well-rounded financial history, not just one that's perfect but brand new.

This really boils down to proving you're reliable with various credit products. Lenders want to see you can juggle both revolving credit (like your credit cards) and installment loans (like a car or student loan). Having a healthy mix sends a clear signal that you're a versatile and experienced borrower.

The age of your accounts is another huge piece of the puzzle. A longer credit history almost always leads to a better score. This is exactly why closing your oldest credit card is usually a terrible move, even if it's just collecting dust in a drawer. That account's age is a valuable asset, anchoring your credit history length.

Leveraging Trusted Relationships and New Tools

What if your credit history is a little "thin" or short? You've got some powerful options. A really effective strategy is to become an authorized user on a credit card belonging to a family member or partner with a stellar credit history. Their track record of on-time payments and smart credit use can get added to your report, often giving your score a nice bump.

You can also get credit for bills you're already paying anyway. Newer services now let you report on-time rent and utility payments to the major credit bureaus. This is a game-changer for adding positive payment history, especially if you don't have many traditional loans or credit cards.

Every one of these moves works toward a single goal: proving your financial stability to a mortgage lender. There’s hard data to back this up. Between 2012 and 2024, U.S. banks saw the median credit score for new mortgages climb from 718 to 791. During that same time, serious delinquencies plummeted from 9.1% to just 0.4%. It's a clear link: better credit directly translates to lower risk for the lender. You can check out the full Philadelphia Fed report for more on that trend.

By diversifying your credit and letting your accounts mature, you're not just playing a numbers game. You are building a financial resume that tells a compelling story of trustworthiness and consistency, which is exactly what mortgage lenders need to see.

At the end of the day, a mature and varied credit profile shows you're a low-risk borrower. When you combine a good mix of credit types with a long history of paying your bills on time, you create a powerful strategy to improve your credit score for a mortgage and lock in the best possible loan terms.

Answering Your Top Questions About Mortgage Credit

Even with a solid game plan, you're bound to have questions when you're working on your credit for a mortgage. The details can get a little tricky, but getting straight answers is the only way to move forward with confidence on your path to owning a home.

Let's dig into some of the most common questions we hear from borrowers.

How Long Does It Take to Improve My Credit Score for a Mortgage?

The timeline for seeing real improvement really depends on what you’re doing. If you spot an error on your credit report and get it removed, you could see a score jump in as little as 30 to 45 days.

Paying down a big chunk of your credit card debt can also work surprisingly fast. As your credit utilization drops, your score can tick up within a month or two.

Building a positive payment history, on the other hand, is more of a long game. Lenders want to see a consistent track record. It often takes six to twelve months of perfect, on-time payments to see a significant impact from that alone. The real key is to start as early as you can before you actually plan to apply for a loan.

Should I Close Old Credit Card Accounts I Don’t Use?

It’s a common thought, but you should almost always resist the urge. Closing old credit card accounts can actually backfire and hurt your score in two big ways.

- It pushes your credit utilization ratio up. When you close a card, you lose its credit limit. This makes your existing balances seem larger in comparison to your total available credit.

- It can shorten your credit history. The average age of your accounts is a key scoring factor. Closing your oldest accounts can bring that average down, which can ding your score.

It's almost always better to just keep those accounts open. If you're worried about an account being closed for inactivity, just use it for a small, recurring purchase—like a streaming service—and set up an autopay to clear the balance immediately.

Will Applying for a Mortgage Hurt My Credit Score?

When a lender pulls your credit for a mortgage application, it triggers what’s called a hard inquiry. Yes, this can cause a small, temporary dip in your score, but it’s usually less than five points.

But here’s the good news: scoring models are smart. They know people shop around for the best mortgage rates. Any mortgage-related inquiries that happen within a short period—usually 14 to 45 days—are bundled together and treated as a single event.

This built-in feature lets you compare offers from different lenders without taking a major hit to your credit. It's a completely normal part of getting pre-approved for a mortgage.

What Is a Good Score to Get the Best Mortgage Rates?

Different loan programs have different minimums, but if you're chasing the most competitive interest rates, a higher score is your best friend. A FICO score of 740 or higher is typically seen as "very good" and puts you in the best position to get top-tier rates and terms.

Lenders like Residential Acceptance Corporation (RAC Mortgage) use your score to gauge risk. A higher score tells them you're a lower-risk borrower, which translates directly into a better loan offer for you. You can learn more about how this all works by checking out our guide on how to get preapproved.

At Residential Acceptance Corporation, we’re here to help you navigate every step of your home financing journey. From understanding your credit to closing on your dream home, our team provides the guidance and support you need.

Start your application with RAC Mortgage today