Alright, let's get down to business. Getting preapproved for a mortgage is your first real step toward buying a home, and it’s a critical one. This is where you formally apply with a lender like RAC Mortgage, and we dig into your financials—verifying your income, checking your assets, and pulling your credit history—to figure out exactly how much you can responsibly borrow.

The result? You get a concrete budget for your house hunt and a letter that tells sellers you're a serious, ready-to-go buyer. In today's market, that’s a massive advantage.

Why Mortgage Preapproval Is Your First Real Step

Think of mortgage preapproval as your power play in the real estate game. It’s not some casual estimate. It's a conditional commitment from a lender like Residential Acceptance Corporation (RAC Mortgage) confirming you're qualified to borrow a specific amount.

This is a world away from a simple pre-qualification, which is usually just based on numbers you give over the phone or plug into an online calculator—none of it verified. A formal preapproval means we've done a thorough review of your financial background. It proves to sellers and real estate agents that you're not just kicking tires; you’ve already cleared a major hurdle in the mortgage process, making your offer incredibly strong.

A preapproval letter transforms you from a window shopper into a serious contender. It demonstrates your financial readiness and gives you the confidence to make a firm offer on a home you love.

To give you a clearer picture, it's helpful to see how these two initial steps stack up against each other. They sound similar, but in the eyes of a seller, they are worlds apart.

Pre-Qualification vs. Preapproval at a Glance

| Aspect | Pre-Qualification | Preapproval with RAC Mortgage |

|---|---|---|

| Information Basis | Self-reported, unverified financial info | Verified income, assets, and debt |

| Credit Check | Basic or no credit check (soft pull) | Formal application and hard credit inquiry |

| Lender Commitment | An estimate of borrowing power; not a commitment to lend | Conditional commitment to lend a specific amount |

| Strength of Offer | Minimal impact; shows initial interest | Major advantage; signals you are a serious, capable buyer |

| Process | Quick, often done online or over the phone in minutes | Involves submitting documents and formal underwriting review |

Ultimately, a pre-qualification is a good starting point to gauge affordability, but a preapproval is the tool that gets your offer taken seriously.

The Advantage in a Competitive Market

In a busy real estate market, walking in with a preapproval letter can be the single thing that makes your offer stand out. It signals that you’re ready to move forward without delay, which is exactly what sellers want to hear. For them, it means a faster, smoother closing with fewer chances of the deal falling through. Knowing how to get preapproved is the key to unlocking this power.

This proactive approach is becoming the norm. Even as the market shifts, recent data showed an 11.9% increase in digital preapproval applications in just one quarter. This tells us that smart buyers know it’s essential for strengthening their negotiating position and getting to the closing table faster. You can discover more about these homebuyer trends and preapproval growth to see why it's a non-negotiable step.

When you work with RAC Mortgage to get preapproved, you get a clear, verified budget. This saves you from the headache of falling for a house you can't afford and makes your search focused and efficient right from the start.

Assembling Your Financial Documents For Preapproval

Getting your paperwork together for a mortgage pre-approval can feel like a lot of work, but trust me, getting everything in order upfront makes the entire process incredibly smooth and fast. You're essentially creating a complete financial snapshot for your lender. Here at Residential Acceptance Corporation (RAC Mortgage), we review these documents to verify your ability to handle a home loan, which lets us give you an accurate pre-approval amount.

The first big piece of the puzzle is your proof of income. This is how you show us you have a steady, reliable source of cash to make those monthly mortgage payments. For most borrowers, this means your most recent pay stubs (usually covering a 30-day period) and your W-2 forms from the last two years.

If you're self-employed or have different kinds of income streams, you'll generally need to provide your full federal tax returns for the past two years. This gives RAC Mortgage a clear view of your earnings history and shows us that your income is stable over time.

Verifying Your Assets And Debts

Next up, you'll need to show us your assets—that’s the money you have ready for a down payment and closing costs. This just means gathering statements from your various financial accounts.

- Bank Statements: We'll need to see the last two months of statements for all your checking and savings accounts.

- Investment Accounts: Have recent statements ready from any 401(k)s, IRAs, stocks, or other investment accounts you hold.

- Gift Letters: Is a family member helping you out with the down payment? You'll need a signed letter from them confirming the money is a gift, not another loan you have to pay back.

At the same time, we need to document your existing debts. This is how we figure out your debt-to-income (DTI) ratio, which is a make-or-break number in the pre-approval process. You'll need to provide recent statements for any car loans, student loans, and credit cards. Being completely upfront here helps avoid any last-minute surprises. If you want a full checklist, you can find a complete overview in our guide on what documents are needed for a mortgage.

By putting together a complete and organized file, you give your loan officer everything they need to move quickly. That organization directly leads to a faster and much more predictable pre-approval timeline.

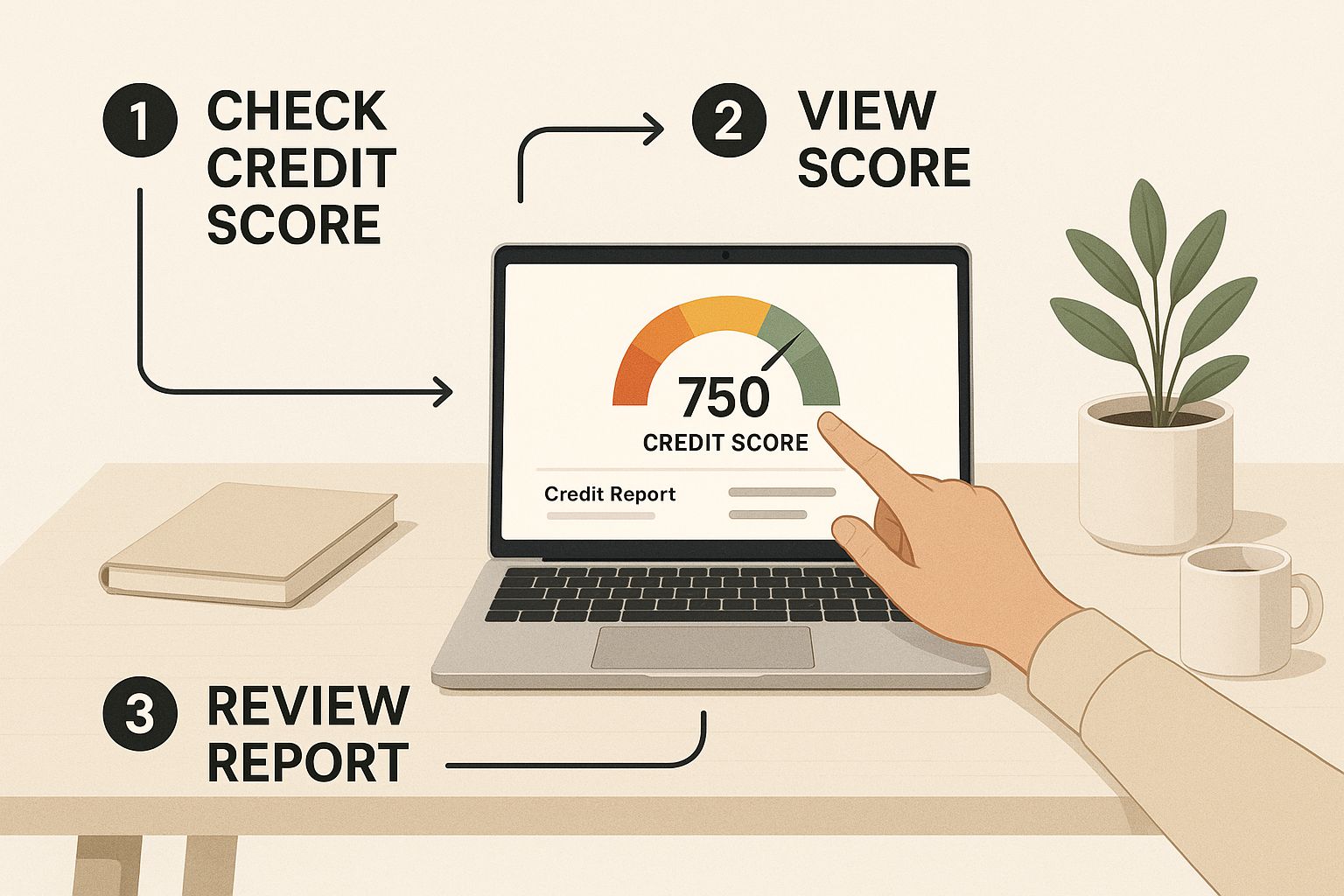

This image shows how lenders look at your entire financial picture, including your credit, to see if you're ready for a mortgage.

As you can see, a solid credit score, backed up by all the verified financial documents we've talked about, is at the heart of a successful pre-approval. Getting your paperwork in order is truly the first step toward getting the green light on your home loan.

What Lenders Are Really Looking For

When you hand over your pre-approval application, a lender like Residential Acceptance Corporation (RAC Mortgage) is really just trying to answer one big question: can you reliably pay back the loan? It’s not some big secret. They figure this out by looking at a few specific parts of your financial life, and knowing what they are ahead of time is your best advantage.

The first thing everyone thinks of is the credit score. That three-digit number is just a quick snapshot of your borrowing history. You don't need a perfect score, but a higher one tells lenders you've got a good track record of paying your debts on time.

The Core Financial Pillars

In the industry, lenders talk about the "Three C's" of underwriting: Credit, Capacity, and Collateral. For a pre-approval, all the focus is on the first two: your credit history and your capacity to handle the payments.

Your credit score is the first pillar. Every loan program has different requirements, but a good-to-excellent score will almost always unlock better terms and lower interest rates. If your score isn't quite where you'd like it, don't panic—it's not set in stone. There are absolutely things you can do to give it a boost. In fact, RAC Mortgage offers specific guidance on how to improve your credit with our borrower tips to help you get on the right track.

The second pillar is your capacity to pay, which we measure with your Debt-to-Income (DTI) ratio.

Your DTI ratio is one of the most critical numbers in your application. We calculate it by taking your total monthly debt payments and dividing them by your gross monthly income. This tells us how much of your paycheck is already committed to other bills.

A lower DTI shows there’s plenty of wiggle room in your budget for a new mortgage payment. RAC Mortgage will analyze this closely to make sure the proposed housing payment won't stretch you too thin.

Stability and Market Conditions

Beyond just the raw numbers, we look for stability. A consistent employment history, especially working in the same field for at least two years, is a great sign of reliable income. Lenders aren't just looking at a single moment in time; they’re trying to understand your financial trajectory and what it might look like in the future.

Finally, the larger economy always plays a role. Current mortgage interest rates have a direct impact on how much house you can afford. For instance, while rates in 2025 have settled a bit, they are still higher than the historic lows we saw back in 2021. That means the cost of borrowing money is a bigger piece of the puzzle, making a strong financial profile more important than ever.

How to Navigate the Application Process

Okay, you've got your financial paperwork in order. Now comes the part where we put it all together and officially apply. This is the moment you've been working towards, and thankfully, modern technology has made it a lot less painful than it used to be.

At Residential Acceptance Corporation (RAC Mortgage), we've streamlined our online portal to be as straightforward as possible. You'll simply walk through each section, plugging in the personal, income, asset, and debt details you've already gathered. The system lets you securely upload your documents—like W-2s and bank statements—directly into your file, keeping everything neat and tidy.

Submitting Your Application

Think of the application form as telling your financial story in a structured way. You'll be asked for specifics about your job history, any property you already own, and where your down payment is coming from. Accuracy here is key; it’s what keeps the process moving smoothly without unnecessary delays.

Here’s a quick rundown of what to expect when you submit through the RAC Mortgage portal:

- Filling Out Key Sections: The form is broken down into simple parts like "Borrower Information," "Income & Assets," and "Liabilities & Debts."

- Secure Document Upload: There's a dedicated spot to drop your prepared files, ensuring they stay connected to your application.

- Final Review and Consent: Before you hit submit, you get one last chance to look everything over and give us the green light to run a credit check.

Once you send it off, your application lands with our underwriting team. This is where a real loan professional dives in, verifying all the information you provided against the documents you uploaded. It's a vital step on the path to getting that official preapproval letter in your hands.

What Happens After You Apply

Once you hit "submit," our work begins. A loan officer from RAC Mortgage will go through your entire file with a fine-tooth comb. Don't be surprised if they reach out with a quick question or a request for one more document—it’s a totally normal part of the process. This little back-and-forth just ensures every detail is spot-on.

You can typically expect to hear back from us within a few business days. This quick turnaround is really a testament to how much digital platforms have improved mortgage lending. In fact, mortgage originations recently hit $2.3 trillion in the U.S., and a huge chunk of that is thanks to this kind of efficiency. To learn more, you can read more on how the mortgage process is evolving in 2025. Our number one goal is to get that preapproval letter to you fast so you can start shopping for a home with confidence.

So, You're Preapproved. What Comes Next?

Getting that preapproval letter from Residential Acceptance Corporation (RAC Mortgage) feels incredible—it's the official starting gun for your house hunt. But hold on, your work isn't quite over. Think of this letter as your golden ticket. Now, you need to know how to use it and, just as importantly, how to protect it.

Take a close look at your letter. It will clearly state the loan amount you're qualified for, which nails down your budget. You’ll also see an expiration date, usually 60 to 90 days out. It’s crucial to keep an eye on this date. If you haven't found a home by then, don't sweat it. Renewing your preapproval with RAC Mortgage is typically a straightforward process of providing some updated documents.

Protecting Your Preapproval Status

Once you have that letter in hand, your number one job is to keep your financial life as boring as possible. Seriously. The approval you received is a snapshot in time, based on your finances at that exact moment. Any big moves could throw a wrench in your final loan approval.

Think of it like this: from preapproval to closing day, you're in a financial "quiet period." Your lender has already done the heavy lifting of verifying your credit, debt, and income. They expect things to stay that way until you have the keys to your new home.

To make sure your journey to the closing table is a smooth one, stick to these simple rules:

- Don't Take On New Debt: This is the big one. Now is not the time to finance a new car, open a new credit card, or go on a furniture shopping spree on credit. Any of these can throw your debt-to-income ratio out of whack.

- Keep Your Job Stable: Making a major career change, especially if you're switching fields or moving from a salaried job to a commission-based one, can send up red flags for underwriters. If a job move is absolutely unavoidable, talk to your RAC Mortgage loan officer first.

- Leave Your Money Where It Is: Lenders need to be able to trace all the funds you're using for the purchase. Avoid making large, undocumented cash deposits or shuffling big sums of money between accounts.

Following this simple roadmap keeps your preapproval on solid ground. This lets you make offers with confidence and cruise smoothly toward closing on the home you've been dreaming of.

Common Preapproval Questions Answered

Even when you have a clear game plan for getting preapproved, it's totally normal to have some questions pop up. Let's be honest, this part of the homebuying process can feel a little complicated, and getting straight answers is the only way you'll move forward with real confidence.

We hear a lot of the same questions from homebuyers at Residential Acceptance Corporation (RAC Mortgage), so let's tackle a few of the most common ones right now.

Will Preapproval Hurt My Credit Score?

This is probably the number one concern we hear, and it’s a great question. Yes, applying for a mortgage preapproval requires a hard credit inquiry, which can knock your credit score down by a few points temporarily. It's usually a very small dip.

However, the good news is that the small, temporary dip is a tiny price to pay for the huge advantage a preapproval letter from RAC Mortgage gives you at the negotiating table. It signals to sellers that you are a serious, financially-vetted buyer, which can make all the difference in a competitive situation.

What Happens If My Application Is Denied?

Getting a "no" can feel like a major setback, but I want you to see it as a detour, not a dead end. It's absolutely not the final word on you becoming a homeowner. The first and most critical step is to understand exactly why your application didn't make the cut. Your loan officer here at Residential Acceptance Corporation (RAC Mortgage) will walk you through the specific reasons.

More often than not, it comes down to a few common roadblocks:

- Your debt-to-income (DTI) ratio is just too high.

- Your credit score is a bit below the minimum for the loan program you wanted.

- There are inconsistencies in your employment history or not enough documentation for your income.

Once you know what the issue is, you can create a laser-focused plan to fix it. That might mean getting aggressive about paying down credit card debt to lower your DTI, taking steps to boost your credit score, or saving up for a larger down payment. A denial is just feedback—it gives you a clear roadmap of what to work on.

A mortgage preapproval is typically valid for 60 to 90 days. Lenders use this window because your financial picture—your income, debts, credit, and savings—is just a snapshot in time. It can change.

If your preapproval from RAC Mortgage happens to expire before you find that perfect house, don't sweat it. Getting it renewed is usually pretty simple. You'll just need to provide some updated financial documents to show that your situation is still solid. After that, you're clear to get back to your house hunt. For more in-depth answers, you can always check out the official RAC Mortgage FAQ page.

Ready to take the first real step toward owning your new home? The team at Residential Acceptance Corporation is here to guide you through a clear and fast preapproval process. Get started with your application today!