So, you're wondering, "how much house can I really afford?" It’s the biggest question on every homebuyer's mind. A classic rule of thumb you’ll hear tossed around is the 28/36 rule. The idea is that your housing costs shouldn't top 28% of your gross monthly income, and all your debt payments combined shouldn't go over 36%.

While that's a decent starting point for a quick gut check, your actual purchasing power is much more nuanced. It’s about digging into the real numbers that make up your financial life.

Finding Your Home Affordability Baseline

Before you fall in love with a house online or start mapping out open houses for the weekend, you need to ground yourself in reality. Let's figure out a solid baseline for what you can comfortably afford.

Think of your home buying power not as a single magic number, but as a careful balancing act. It's about how your income, debts, savings, and credit history all work together. When you apply for a loan, lenders like us at Residential Acceptance Corporation (RAC Mortgage) look at this complete picture to see what you qualify for.

The process might seem intimidating, but it really just comes down to a few core pieces of your financial puzzle. Once you get a handle on these, you'll have a much clearer, more realistic idea of your budget, and the whole lending process will feel a lot less mysterious.

Key Pillars of Affordability

When we talk about affordability, we're really looking at four main things. Getting these numbers in order is your first step toward figuring out your price range.

- Gross Monthly Income: This is the big one—your total earnings before any taxes or deductions are taken out. It’s the foundation for everything else.

- Monthly Debt Payments: Tally up everything you owe on a recurring basis. We're talking car payments, student loans, personal loans, and the minimum payments on your credit cards.

- Down Payment and Savings: How much cash do you have ready to go? The amount you’ve saved for a down payment and closing costs has a huge impact on your loan size and, ultimately, your monthly mortgage payment.

- Credit History: Your credit score is a major player. It directly influences the interest rate you'll be offered, which can change your monthly payment and total loan cost by thousands over the life of the loan.

These factors don't exist in a vacuum. A high income can be held back by significant debt, while a hefty down payment might help you qualify for more house even on a more modest salary. It's all connected.

A recent report on international housing affordability threw a spotlight on the widening gap between what homes cost and what the average family earns. This makes it absolutely critical for you to know your personal financial limits before you even think about making an offer.

This is exactly why starting with a personal financial check-up is non-negotiable. When you understand these key areas, you can walk into your home search with the confidence that you're looking at homes that truly fit your budget. That's how you set yourself up for a smooth and successful experience with a lender like RAC Mortgage.

To give you a clearer picture, here's a quick look at how income and debt levels can affect what you might be able to afford.

Home Affordability Snapshot by Income and DTI

This table provides estimated home affordability ranges based on annual income and Debt-to-Income (DTI) ratios, assuming a 20% down payment and a standard interest rate.

| Annual Gross Income | Low DTI (e.g., 36%) Estimated Home Price | High DTI (e.g., 43%) Estimated Home Price |

|---|---|---|

| $60,000 | ~$250,000 | ~$285,000 |

| $85,000 | ~$350,000 | ~$400,000 |

| $120,000 | ~$495,000 | ~$565,000 |

| $150,000 | ~$620,000 | ~$710,000 |

As you can see, even with the same income, a lower DTI (meaning less existing debt) gives you more buying power. These are just estimates, of course—your specific situation will depend on interest rates, property taxes, and other factors. The best way to get a precise number is to work with a lender who can analyze your full financial profile.

Mastering Your Debt-to-Income Ratio

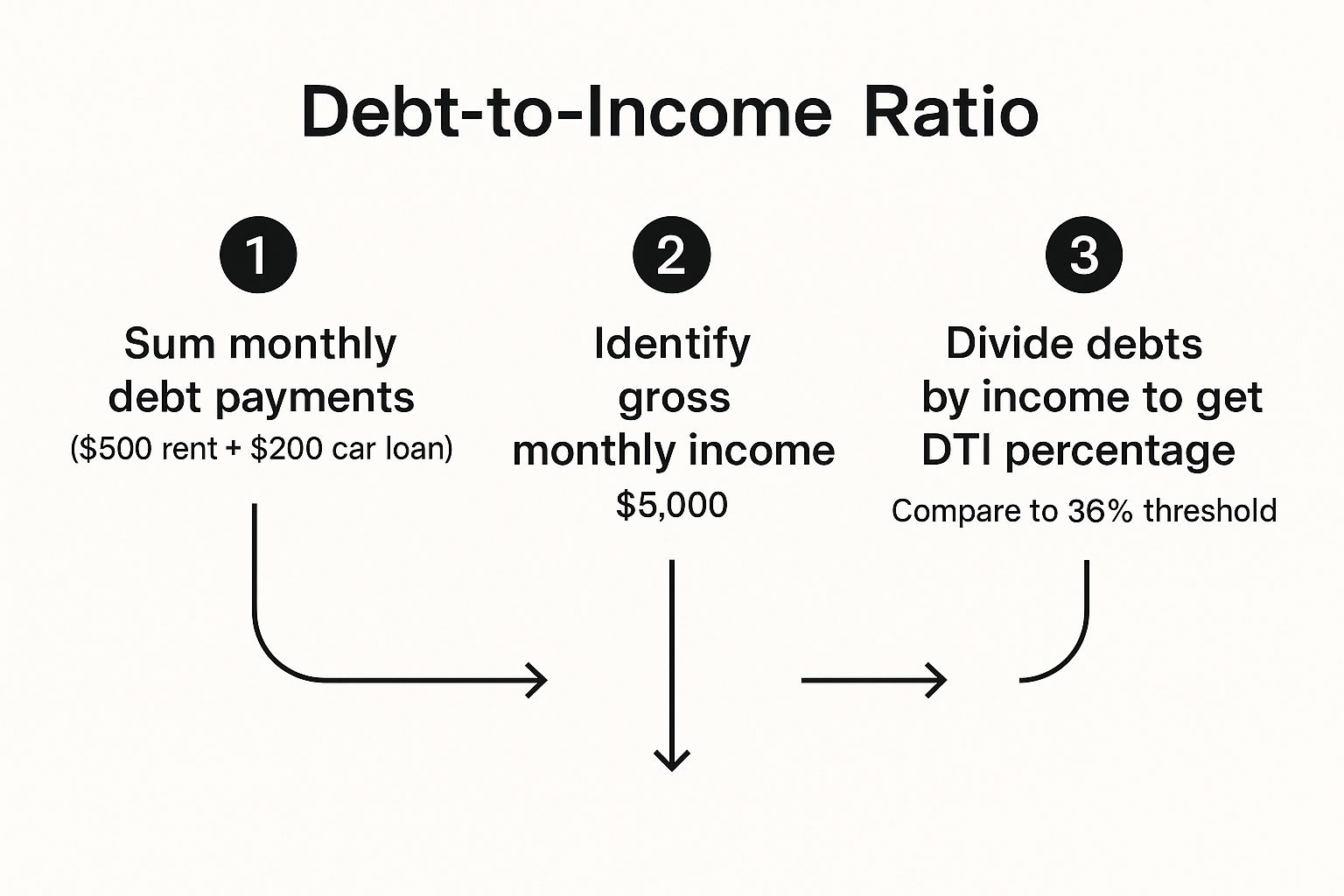

When a lender is deciding how much house you can afford, your debt-to-income ratio (DTI) is pretty much the most important number they’ll look at. It’s a simple percentage that stacks up your total monthly debts against your gross monthly income.

If you understand how lenders like Residential Acceptance Corporation (RAC Mortgage) crunch these numbers, you get a serious advantage in managing what you can borrow.

What Counts as Debt

To figure out your DTI, the first thing you need to do is add up all your regular monthly debt payments. This isn't just about the big stuff; it's every single recurring payment that shows up on a credit report.

Lenders are very specific about what they include here. Getting this list right is crucial for an accurate picture of where you stand.

- Housing Payments: This means your current rent or mortgage payment.

- Loan Payments: Tally up any car loans, student loans, and personal loans.

- Credit Card Payments: Here’s a key detail—use the minimum monthly payment your credit card company requires, not the full amount you might pay off each month.

- Other Obligations: This bucket includes any other court-ordered payments, like child support or alimony.

It’s important to note what isn't included. Everyday expenses like groceries, your electric bill, or gas for your car don't count in this calculation. Lenders are focused strictly on your fixed debt obligations.

Your DTI ratio is a direct reflection of your capacity to take on new debt. A lower DTI signals to lenders that you have enough room in your budget to comfortably handle a new mortgage payment, making you a more attractive borrower.

Let's look at a quick example. Say your gross monthly income is $6,000. Your debts add up to a $400 car payment, a $250 student loan payment, and $100 in minimum credit card payments. That's a total of $750 in monthly debt.

Your DTI would be 12.5% ($750 divided by $6,000). That's a great spot to be in.

The graphic below breaks down how to calculate your own DTI and see where you fall.

As you can see, keeping your total debts under that ideal 36% threshold is a major step toward maximizing your borrowing power.

Why Your DTI Is a Big Deal

Different loan programs have their own rules, but most lenders really prefer to see a "back-end" DTI (the one that includes your potential new mortgage payment) of 43% or less.

Here at RAC Mortgage, we consistently see that borrowers with lower DTIs don't just get approved more easily—they often get much better loan terms and interest rates.

If you find your ratio is on the higher side, don't panic. A great first move is to aggressively pay down high-interest credit card balances. It’s one of the quickest ways to drop your DTI and strengthen your financial profile before you formally apply for a mortgage.

Leveraging Your Down Payment and Savings

When figuring out how much house you can truly afford, your down payment is one of your most powerful tools. It's a direct lever on how much you need to borrow, which can bring down your monthly payments and make you a much stronger applicant in the eyes of lenders like Residential Acceptance Corporation (RAC Mortgage).

So many aspiring homeowners get hung up on the old 20% down myth. I see it all the time. But let's be clear: while putting down 20% is a great way to avoid Private Mortgage Insurance (PMI)—that extra fee protecting the lender—it is absolutely not a hard-and-fast rule.

In reality, there are tons of loan programs out there that require much less cash upfront. We're talking down payments as low as 3%, and in some cases, even 0% for certain government-backed loans. Exploring these can open doors you might have assumed were locked tight.

Beyond the Down Payment

Now, don't forget that your down payment isn't the only cash you'll need at the finish line. You also have to budget for closing costs. These are all the fees for the services needed to finalize the mortgage, and they typically run between 2% to 5% of the home's final sale price.

A larger down payment not only reduces your monthly mortgage payment but also demonstrates financial stability to your lender. This can lead to better loan terms and a smoother approval process, ultimately strengthening your position as a homebuyer.

Let's put that in perspective. For a $300,000 home, your closing costs could fall anywhere between $6,000 and $15,000. That’s a significant chunk of change you need to have ready.

Building Your Savings Strategy

To make sure you're fully prepared, you need a solid savings plan that covers both the down payment and those closing costs. Here are a few practical tips that have worked for countless buyers I've helped:

- Automate Your Savings: The easiest trick in the book. Set up automatic transfers from your checking account to a dedicated high-yield savings account every single payday. You won't miss what you don't see, and your fund will grow consistently.

- Look for Assistance: Don't leave free money on the table. Seriously. Many states and local governments offer help. You can find more information about down payment assistance programs at RAC Mortgage to see what might be available in your area.

- Track Your Spending: Get a clear picture of where your money is actually going. Use a simple budgeting app or even a spreadsheet. Once you identify where you can cut back, you can redirect that cash straight toward your homeownership goal.

Making Sense of the Current Housing Market

Figuring out your personal budget is a huge first step, but it’s only half the story. To really know how much house you can afford, you have to get a feel for the market you’re jumping into. The constant tug-of-war between housing supply and buyer demand is what really sets home prices, dictates how much competition you’ll face, and ultimately, how much negotiating power you have.

Right now, in a lot of places, the market is defined by one thing: tight inventory. When you have more people looking for homes than there are homes for sale, it’s a recipe for intense competition. This often spirals into multiple-offer scenarios and bidding wars, which can send the final sale price soaring past what the seller was asking. Simply being able to afford the list price might not cut it anymore.

Regional Differences Matter

You have to remember that all real estate is local. What’s considered affordable can change dramatically from one town to the next, even within the same county. A budget that gets you a big single-family house in one area might only stretch to a small condo just a few miles down the road.

It's a classic story: coastal cities almost always have much higher housing costs than areas further inland. Things like job growth, local zoning rules, and population shifts all create these unique micro-markets. That's why getting a handle on your local market is so important for setting expectations that are actually realistic.

The housing market is facing a major supply crunch on a global scale, and it's a huge reason why affordability is such a widespread problem. One analysis found a need for 6.5 million more homes to meet demand in key markets. This just goes to show how a lack of supply keeps pushing prices higher for everyone. You can read more about these housing market findings on Hines.com.

This supply-and-demand problem is exactly why getting pre-approved with a lender like Residential Acceptance Corporation (RAC Mortgage) is a non-negotiable first step. It proves to sellers that you're a serious, qualified buyer who is ready to make a move in a market that doesn't wait around.

While a packed market full of competition can feel daunting, it also creates its own opportunities. Keeping an eye out for new construction can be a really smart move. New developments can help ease some of that inventory pressure locally and often come with more straightforward pricing, letting you sidestep the whole bidding war circus. Staying informed about these trends gives you a real strategic advantage.

Securing Your Pre-Approval with RAC Mortgage

After running the numbers on your DTI and taking a hard look at your savings, it’s time for the moment of truth. The next step is getting a definitive answer to the question, "how much house can I afford?" This isn't just an estimate; it's a mortgage pre-approval, and it transforms your budget from a spreadsheet into real-world buying power.

Going through the pre-approval process with Residential Acceptance Corporation (RAC Mortgage) gives you a verified loan amount you can shop with confidently. It’s a world apart from a simple pre-qualification, which is really just a rough guess. A pre-approval involves a serious financial check by an underwriter who has dug into your finances.

The Power of a Pre-Approval Letter

In a competitive housing market, you can think of a pre-approval letter as your golden ticket. It's solid proof to sellers that you aren’t just window shopping—you’re a serious, financially vetted buyer whose offer has a lender's backing. This can give you a major leg up, especially when a seller is looking at multiple offers on their home.

To get the ball rolling, you’ll need to pull together a few key documents. This is pretty standard stuff, but having it ready will speed things along.

- Your most recent pay stubs

- W-2s from the last two years

- Recent bank statements

- Valid identification documents

A pre-approval from RAC Mortgage does more than just tell you your budget. It signals your credibility to sellers and their agents, which can often be the one thing that gets your offer accepted over someone else's.

Once this step is complete, you can start making offers with the confidence that comes from knowing exactly what your financial limits are. To get a detailed look at the process, check out our guide on how to get pre-approved for a mortgage.

Still Have Questions About Home Affordability?

Even after you've crunched the numbers, it's completely normal to have a few more questions rattling around. Let's walk through some of the most common ones that come up when you're trying to figure out your true homebuying budget.

How Much Does Credit Score Really Matter?

Your credit score isn't just a number; it's a huge piece of the affordability puzzle. A stronger score, particularly one climbing above 740, signals to lenders like Residential Acceptance Corporation (RAC Mortgage) that you're a low-risk borrower.

This is where it gets good. A high score often unlocks a lower interest rate on your mortgage, which means a lower monthly payment. That lower payment directly boosts your buying power, letting you qualify for a larger loan. On the flip side, a lower score usually means higher rates, which can shrink your budget considerably.

Think of your credit score as the key that opens the door to better financing. A few points can honestly be the difference between getting into your dream home and settling for something less. Making small improvements to your score before you apply can lead to huge savings over the life of your loan.

Should I Put My Partner's Income on the Application?

This is a big one. You should only include income from the people who will be officially named on the mortgage application and loan documents. Lenders are only legally allowed to consider the income and debts of the actual applicants when they're putting together your financial profile.

So, if you need your partner's income to qualify for the home you really want, they absolutely must be a co-borrower on the loan application.

What Other Costs Should I Plan For?

Your main mortgage payment—what we call PITI for Principal, Interest, Taxes, and Insurance—is just the starting line. Getting a true feel for affordability means budgeting for all the other costs of owning a home. For anyone new to this, our first-time homebuyer guide dives deep into these hidden expenses.

Here are some of the big ones to plan for:

- HOA Fees: A common expense if your new place is in a managed community or condo building.

- Regular Maintenance: Most experts suggest setting aside 1-2% of your home's value every single year for general upkeep. It adds up.

- Surprise Repairs: A leaky roof, a busted water heater—these things happen. Having a separate emergency fund is non-negotiable.

- Utilities: Your bills for gas, electricity, and water will likely be a step up from what you paid while renting.

Ready to get a real answer on how much house you can afford? The expert team at Residential Acceptance Corporation is here to give you a clear, no-strings-attached pre-approval so you can start house hunting with total confidence. Start your application with RAC Mortgage today!