The Guide to Choosing The Best Mortgage Lender With No Overlays in FL When Denied For Mortgage

Choosing a mortgage lender with no overlays in FL can be difficult if you don’t know where to find them. When it comes to mortgage lending, many home buyers are told they do not qualify for FHA Loans because their credit scores are not 620. Just because the home buyer needs to qualify for FHA, USDA, VA or Conventional Loans does not mean they can qualify with all mortgage lenders.

More often the case is that the lender they went to fails to tell them they don’t meet FHA Guidelines and that the borrowers can qualify for FHA loans just not with that particular lender.

FHA guidelines on credit score requirements are 580. Many lenders will have higher credit score requirements called overlays. Lender overlays are additional lending requirements above and beyond the minimum agency requirements of FHA, VA, USDA, Fannie Mae and Freddie Mac.

No Lender Overlays – Mortgage Overlays Discourage Borrowers

Looking for mortgage options or looking for a lender with no lender overlays? Some lenders have tougher guidelines than others due to having an internal guideline on top of agency guidelines. Working with a mortgage lender with no overlays in FL can save time, money, and increase the chances of a mortgage approval.

Some of The Common Overlays To Watch Out For

Often borrowers are discouraged by mortgage lender overlays by being denied because a bank has an internal set of guidelines on top of FHA, VA, USDA, conventional (Fannie Mae and Freddie Mac) guidelines. Some common lender overlays:

- Requiring a minimum credit score.

- Debt-to-income caps.

- Bankruptcy and foreclosure seasoning.

- Co-borrowers.

- Types of properties.

- Cash reserve requirements.

- Insufficient funds on bank statements.

- Collections and charge offs.

- Medical collections.

There are Non-QM mortgages that take a more common-sense approach to underwriting. One example would be the fresh start, which allows a day out of foreclosure and day out of bankruptcy.

The Importance of Choosing a Mortgage Lender With No Overlays in FL

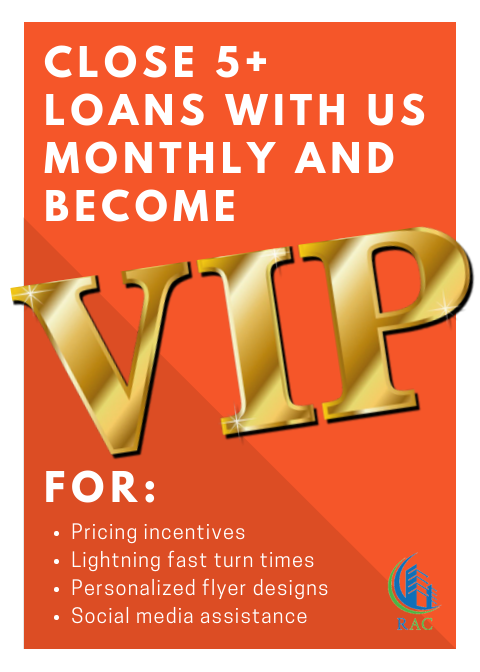

Residential Acceptance Corporation is a mortgage lender with no overlays in FL. Lender overlays get in the way of thousands of Americans obtaining mortgages. Overlays are extra guidelines set by financial lending institutions above and beyond the HUD, VA, USDA, Fannie Mae, and Freddie Mac guidelines. It is important for borrowers with less than perfect credit or other credit/income issues to consult with a direct lender with no overlays.

Feel free to give us a call to discuss your loan options. We are a broker first mortgage lender here to service all your mortgage needs.

Check us out on Facebook, Google and TrustPilot.