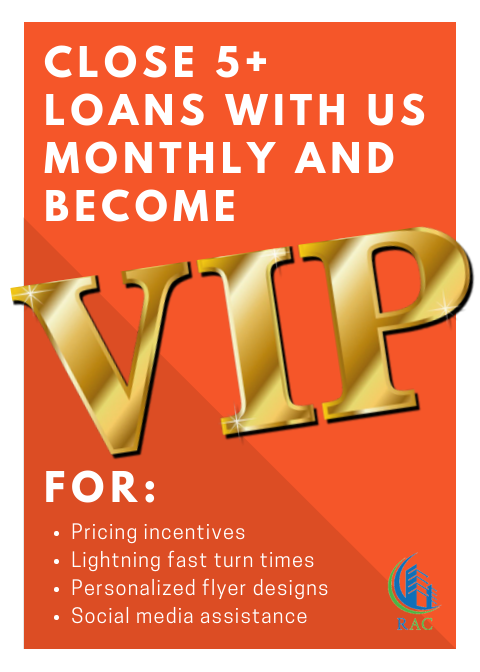

Updates and Promotions:

The Guide to Choosing The Best Mortgage Lender With No Overlays in FL When Denied For Mortgage

Choosing a mortgage lender with no overlays in FL can be difficult if you don’t know where to find them. When it comes to mortgage lending, many home buyers are told they do not qualify for FHA Loans because their credit scores are not 620. Just because the home buyer needs to qualify for FHA, USDA, VA or Conventional Loans does not mean they can qualify with all mortgage lenders.

More often the case is that the lender they went to fails to tell them they don’t meet FHA Guidelines and that the borrowers can qualify for FHA loans just not with that particular lender.

FHA guidelines on credit score requirements are 580. Many lenders will have higher credit score requirements called overlays. Lender overlays are additional lending requirements above and beyond the minimum agency requirements of FHA, VA, USDA, Fannie Mae and Freddie Mac.

No Lender Overlays – Mortgage Overlays Discourage Borrowers

Looking for mortgage options or looking for a lender with no lender overlays? Some lenders have tougher guidelines than others due to having an internal guideline on top of agency guidelines. Working with a mortgage lender with no overlays in FL can save time, money, and increase the chances of a mortgage approval.

Some of The Common Overlays To Watch Out For

Often borrowers are discouraged by mortgage lender overlays by being denied because a bank has an internal set of guidelines on top of FHA, VA, USDA, conventional (Fannie Mae and Freddie Mac) guidelines. Some common lender overlays:

- Requiring a minimum credit score.

- Debt-to-income caps.

- Bankruptcy and foreclosure seasoning.

- Co-borrowers.

- Types of properties.

- Cash reserve requirements.

- Insufficient funds on bank statements.

- Collections and charge offs.

- Medical collections.

There are Non-QM mortgages that take a more common-sense approach to underwriting. One example would be the fresh start, which allows a day out of foreclosure and day out of bankruptcy.

The Importance of Choosing a Mortgage Lender With No Overlays in FL

Residential Acceptance Corporation is a mortgage lender with no overlays in FL. Lender overlays get in the way of thousands of Americans obtaining mortgages. Overlays are extra guidelines set by financial lending institutions above and beyond the HUD, VA, USDA, Fannie Mae, and Freddie Mac guidelines. It is important for borrowers with less than perfect credit or other credit/income issues to consult with a direct lender with no overlays.

Feel free to give us a call to discuss your loan options. We are a broker first mortgage lender here to service all your mortgage needs.

Check us out on Facebook, Google and TrustPilot.

Introduction: Who is The Top Non-QM Mortgage Lender in Florida 2022?

A non-qualified mortgage – or non-QM – is a home loan that is not required to meet agency-standard documentation requirements as outlined by the Consumer Financial Protection Bureau.

Non-QM mortgage lender loans in Florida may encapsulate a wide variety of mortgages, including

- Home loans exceeding 30 year terms

- Home loans with negative amortization

- Home loans with interest only payments

Non-QM loans may also exceed the CFPB’s current price based thresholds:

- QM Safe Harbor APR equal or less than APOR + 1.5%

- AM Rebuttable Presumption: APR greater than APOR + 1.5%, but equal or less than 2.25%

Avoiding those agency-standard documentation requirements means lenders do not need to make a good faith determination on the borrower’s ability to repay a non-QM loan. In this case, “good faith determination” usually refers to checking W2 forms, pay stubs, bank statements and other documents that verify you make enough money to eventually pay back your home loan.

If you’re thinking that sounds pretty risky, then you would be absolutely right. Homebuyers who use non-qualified mortgages are not protected by the CFPB. But, because non-QM loans are not burdened by those CFPB rules, lenders are able to offer more flexible income requirements while setting higher interest rates to offset the added risk.

The Do’s of Finding a Non-QM Mortgage Lender in Florida

A non-QM mortgage is a type of mortgage loan that does not meet the guidelines of qualified mortgages. It is an alternative to a Fannie Mae or Freddie Mac backed loan. Non-QM loans are also called “jumbo” loans, because they are considered too large for the Federal National Mortgage Association (FNMA) or Federal Home Loan Mortgage Corporation (FHLMC).

Non-QM lenders can offer lower rates and more competitive terms than those available through a Fannie Mae or Freddie Mac backed loan.

Below are some tips on how to find a non-QM mortgage lender in Florida:

1) Do your research: There are many lenders that do not require QMS, so it’s important to do your research before you start contacting lenders. Start by looking for lenders

Why You Should Also Offer Non QM Mortgage Loans in Florida

Are you leaving money on the table by only offering conventional home loans? Non-QM loans have been increasing in demand since their inception in 2015. The Mortgage Bankers Association forecasted Non-QM originations will reach $3.85 trillion in 2021, a new record after 2020’s $3.83 trillion in origination. 2022 shows no signs of slowing down.

Predictions are the Non-QM market will grow to be 10% of the mortgage market in the new year. This indicates an opportunity for brokers to grow their business by offering a wider selection of loan products. If you’re unfamiliar with Non-QM, consider this a quick primer.

Non QM Mortgage Lender in Florida Loans Allow You To Work With A Variety of Borrowers

Offering Non-QM loan products allows you to tap into new markets of potentially underserved borrowers. How often do you hear about young professionals finding it difficult to obtain a home loan – or self-employed borrowers who lament their lack of conventional documentation to prove their income? If you’re not working with these borrowers now, offering Non-QM loan products could help you attract these borrowers. The U.S. Bureau of Labor Statistics cites there are ten million self-employed business owners. Wouldn’t you like to work with millions of new borrowers?

Because Non-QM loans have more flexible terms than conventional QM loans, they are a great solution for a wider range of buyers. In contrast to Non-QM loans, conventional QM loans come with very rigid underwriting guidelines; the A-paper underwriting matrix doesn’t allow for much flexibility, when needed, and that’s where Non-QM can help. Non-QM serves borrowers who may not fit the traditional box when viewed from the Conventional QM perspective. However, these same borrowers may be just as credit worthy as others. This group of borrowers includes self-employed investors who seek to qualify their ability to repay based on their rental income.

To tap into this new group of borrowers, brokers will need to become familiar with Non-QM loan products. Choose a Non-QM mortgage lender in Florida to partner with a variety of loan products and the expertise to help you match this new borrower base with the right one – Residential Acceptance Corporation is the partner you need.

Introduction: The Basics of a Quick Close Mortgage Lender in Florida

A mortgage is a loan that you take out to buy property. You can take out a mortgage to buy your own home, or to invest in a rental property.

The Basics of a Quick Close Mortgage Lender in Florida:

– A mortgage is an agreement between the borrower and the lender that specifies how much money the lender will lend, on what terms, and for what period of time.

– The borrower pays back the money lent with interest over the agreed period of time.

– The most common types of mortgages are fixed rate mortgages and adjustable rate mortgages.

– To qualify for a mortgage, you need to be able to show proof of income and have enough equity in your home (or real estate) that you want to purchase.

What is a Quick Close Mortgage Lender in Florida?

A quick close mortgage is a type of home loan that can be closed in as little as 10 days.

Quick close mortgages are popular among people who need to make a purchase quickly, whether it’s because they just found out about the opportunity or because they want to beat an upcoming deadline. It also makes sense for people who need to move out quickly and don’t want to wait for their loan approval.

How to Choose the Best Quick Close Mortgage Lender in Florida

A quick close mortgage lender is a lender that can close a loan in a short amount of time. Quick close mortgage lenders are usually more expensive than traditional lenders, but they can provide funds to you quickly if you need them.

There are many factors to consider when choosing the best quick close mortgage lender in Florida. You should compare interest rates, fees, and requirements. You should also read reviews from other customers to see how well the company responds to inquiries and resolves problems.

Tricks For Closing On-Time With a Quick Close Mortgage Lender in Florida

- Know your paperwork requirements – Common paperwork includes W-2 statements and federal tax returns from the last 2 years; your two most recent pay stubs and the last two months of bank statements.

- Don’t keep secrets from your lender – Be honest and open with your lender – even if you worry that you’ll harm your approval. There are reasons for this. Your mortgage lender will most likely uncover what you are electing to “hide” anyway.

- Use pre-approvals to speed closing times – Mortgage pre-approvals are among the most under used tools to speed a purchase up. Home buyers with pre-approvals in hand as of the date of the offer can reduce closing times by one week or more.

Let’s Close Some Loans

Residential Acceptance Corporation is a top quick close mortgage lender in Florida. We work with our brokers to get more loans closed and do it faster.

Feel free to give us a call to discuss your loan options. We are a broker first mortgage lender here to service all your mortgage needs.

Check us out on Facebook, Google and TrustPilot.

Introduction: What is An Appraisal Management Company?

An Appraisal Management Company (AMC) is a company that provides appraisal services to lenders. It can be a third-party company or the lender itself. AMC’s provide full service appraisals and sometimes they also offer appraisal review services, which are typically done by professionals with specialized education and experience in appraising.

The process of appraising varies depending on the type of property being appraised, but it usually includes:

– Gathering information about the property from the borrower

– Inspecting the property

– Comparing similar properties in an area

– Using comparable sales prices

– Making adjustments for improvements to the property

How to Evaluate a Property Appraisal Management Company?

Appraisal management companies provide a variety of services to their clients. They help them with appraisals, valuations, and property condition reports.

These are the 9 questions you should ask before choosing an appraisal management company:

1) What is the company’s experience?

2) What are the company’s credentials?

3) How can I contact them?

4) Who will be my contact person?

5) How do they handle conflicts of interest?

6) What is their fee structure?

7) Do they offer an appraisal guarantee or warranty on your work product?

8) Do they have a system for handling client requests and complaints?

9) How do they handle appraiser turnover rates and staff retention rates?

What You Should Know When Hiring An Appraisal Management Company For Your Real Estate Needs

An appraisal management company is a service that provides a wide range of services to the real estate industry. They can help with the valuation of properties, as well as provide various other services such as an audit and assessment.

The process of hiring an appraisal management company starts with developing a list of potential candidates. This can be done by using referrals, or by using search engines such as Google or Bing. Once you have your list, you will want to go through and compare each company’s services and prices to find the best one for your needs.

Choose Your Own Appraisal Management Company (AMC) With RAC

With us, you can bring your own appraisal management company (AMC) or pick one from our preferred list. The choice is yours! Check out RAC’s list of preferred AMCs. In addition to choosing your own AMC, we offer 24 hour underwriting, no overlays and 7 day closings.

Residential Acceptance Corporation is a direct lender that you can choose your own AMC with.

Feel free to give us a call to discuss your loan options. We are a broker first mortgage lender here to service all your mortgage needs.

Check us out on Facebook, Google and TrustPilot.

Podcasts by RAC:

“Title Brother and Their Path to Success”

“What the FLOOD”