If you're a non-U.S. citizen looking to buy property in the United States, you’ve probably realized it's not as simple as it is for American buyers. Traditional mortgages often slam the door shut because they demand things you just don't have—like a U.S. credit history, a Social Security Number, or income that's easy to verify stateside.

This is exactly where foreign national mortgage programs come in. These are specialized home loans, offered by lenders like RAC Mortgage, built specifically for international buyers. Think of them as a financial bridge connecting your financial life back home to the U.S. real estate market you want to enter.

Unlocking The Door To US Real Estate Ownership

Imagine trying to buy a vacation home in a country where the banking rules are completely different. The paperwork is a maze, and you don't even know who to ask for help. That's the challenge these specialized mortgage programs solve every day.

These aren't your run-of-the-mill home loans. A standard mortgage application is rigid, checking boxes for things like W-2 income statements and U.S. credit scores. A foreign national loan flips the script, using different methods to confirm that a borrower has the financial strength to handle the loan.

Who These Programs Are Built For

These loans are tailored for a wide range of international clients. The one thing they all have in common is their status as non-U.S. citizens who want to own a piece of American real estate but don't have permanent residency.

This often includes:

- Global Investors: Buyers looking to diversify their portfolios with U.S. rental properties.

- Vacation Home Buyers: People wanting a second home in a prime U.S. location for personal use.

- Professionals on Work Visas: Many professionals on visas like the H-1B or L-1 find these programs are a better fit for their unique financial situation.

- Future Retirees: Individuals who plan to retire in the U.S. and want to lock down their property ahead of time.

In short, these programs are for anyone living outside the U.S. who is locked out of the traditional mortgage system but sees the opportunity in the American property market.

The Core Purpose of a Foreign National Loan

The main goal here is simple: create a straightforward path to buying a home for international buyers. Lenders who specialize in this niche, like RAC Mortgage, get the complexities of international finance and documentation.

The key is flexibility. Instead of a hard "no" for not having a Social Security Number, these programs look at the whole financial picture using documents from your home country.

To get a broader view of how this fits into your overall financial life, understanding cross-border financial planning is a smart move. This kind of big-picture strategy goes hand-in-hand with securing property in another country.

Ultimately, these mortgages take something that seems out of reach—buying a U.S. home while living abroad—and make it a realistic and achievable goal when you have the right team on your side.

Who Is Eligible for a Foreign National Mortgage?

For a non-U.S. citizen, navigating property ownership in the United States can feel like a maze. The good news is that foreign national mortgage programs are specifically designed to clear a path for you. Eligibility isn't about ticking off a rigid list of requirements; it's about giving a specialized lender, like us at RAC Mortgage, a complete picture of your finances.

Unlike conventional loans, which are heavily dependent on U.S.-specific data like a Social Security Number or a FICO score, these programs look at who you are from a global financial perspective. The whole idea is to verify your identity and confirm your financial stability using the documents you already have from your home country.

Defining the Borrower Profiles

So, who are these loans for? Eligibility for foreign national mortgages covers a few key groups of international buyers. While each person's reason for buying is unique, they all want to invest in U.S. real estate without being a permanent resident.

Here are the most common types of borrowers we work with at RAC Mortgage:

- International Professionals on Work Visas: Many skilled professionals are in the U.S. on visas like the H-1B or L-1. They're living and working here but often don't have the deep credit history needed for a standard loan. A foreign national program is the perfect solution to bridge that gap.

- Global Real Estate Investors: These are savvy individuals looking to add U.S. properties to their investment portfolios. They’re often buying homes for rental income, so we evaluate them based on the property's potential cash flow and their overall international wealth.

- Vacation Home Seekers: We also see many families and individuals who simply want a second home in the U.S. to enjoy. Their primary income and residence are abroad, which makes a specialized mortgage the ideal fit.

Core Eligibility Criteria

Even though these programs are flexible, they still have some essential requirements. This ensures the loan is a secure investment for both you and the lender. Here at RAC Mortgage, we look at a few key pillars to assess your application, all of which fall under our broader Non-QM loan requirements.

The process is less about fitting into a predetermined box and more about demonstrating financial reliability through alternative, internationally recognized documentation.

This common-sense approach recognizes that a strong financial history isn't limited by borders. It’s all about showing a track record of fiscal responsibility, no matter where you're from.

Here are the key factors we evaluate:

- Valid Visa Status: If you're living in the U.S., a valid visa is a must. For buyers living abroad, a visa usually isn't necessary, but a valid passport is essential to verify your identity.

- Credit History Verification: No U.S. credit score? No problem. We can often use international credit reports from your home country or even letters of reference from your foreign banks.

- Substantial Down Payment: Down payments are typically higher than for conventional loans, usually in the 25% to 40% range. This shows your commitment to the investment and provides extra security.

- Proof of Income and Assets: We'll need to see documents like bank statements from your foreign and U.S. accounts, employment verification letters, and other proof of assets to confirm you can comfortably handle the loan.

Getting a handle on these requirements is your first step toward putting together a winning application. It gives you a clear roadmap of what to gather to make your dream of owning a home in the U.S. a reality. Globally, different countries have their own rules. For instance, Canada might require foreign buyers to put down at least 35% and pay interest rates 0.25% to 0.5% higher than residents. As you can read in this global market analysis, these policies show how different nations try to balance foreign investment with their own housing markets.

Essential Documents for Your Application

Applying for a foreign national mortgage program shouldn't feel like a treasure hunt. At RAC Mortgage, we want the process to be clear and straightforward, so you can focus on what matters—finding that perfect U.S. property.

Think of it this way: your application is building a case for your financial stability. The right documents are the evidence that makes your case rock-solid.

A well-organized file doesn't just make our lives easier; it puts your entire approval on the fast track. When you gather the necessary paperwork ahead of time, you show us you're serious and help us quickly verify everything we need to. Let's break down exactly what you'll need.

Verifying Your Identity

First things first, we need to prove you are who you say you are. Since you're not a U.S. citizen, the required documents are a bit different from a standard loan application. This is a foundational step, and having these items ready from the start is absolutely crucial.

We'll need clear, unexpired copies of the following:

- Valid Foreign Passport: This is the main ID for any foreign national applicant. No exceptions.

- U.S. Visa (if applicable): If you're living in the U.S. on a work visa (like an H-1B or L-1), we'll need a copy to confirm your legal status. This typically isn't necessary for investors living abroad.

Demonstrating Your Financial Strength

This is where you get to paint the picture of your financial health. Because you won't have the usual U.S. credit and income reports, we rely on international documents to see how you've handled your finances. Don't worry, RAC Mortgage has seen it all and has tons of experience evaluating these types of documents from all over the globe.

To show your income and creditworthiness, get ready to provide:

- Employment Verification Letter: A letter from your employer, on official company letterhead, confirming your job title, salary, and how long you've worked there.

- International Credit Report: A credit report from your home country gives us a clear look at your history of managing debt.

- Bank Statements: We'll typically ask for 6-12 months of statements from your main bank accounts (both foreign and U.S.) to see a steady income flow and your available assets.

Your financial story isn't confined to one country, and your mortgage application shouldn't be either. We look at your global financial profile to get a true sense of your qualifications, rather than just what a U.S.-based system can see.

For a deeper dive into the required paperwork, you can find more details in our complete guide on what documents are needed for a mortgage with RAC Mortgage. This resource provides an even more granular look at the documentation process.

Confirming Your Assets and Down Payment

Finally, we need to see that you have the cash for the down payment and closing costs, plus some reserves. Foreign national mortgage programs often require a larger down payment, usually between 25% to 40%, so having clear proof of these liquid assets is a must.

Here is a simple table that outlines the essential documents required for your foreign national mortgage application, organized by category to streamline your preparation.

Document Checklist for Foreign National Mortgage Applicants

| Document Category | Specific Documents Required | Key Purpose |

|---|---|---|

| Proof of Assets | Statements from checking, savings, or investment accounts. | To verify you have enough money for the down payment, closing costs, and required financial reserves. |

| Source of Funds | A paper trail showing where large deposits came from (e.g., sale of property, savings accumulation). | To comply with anti-money laundering laws and confirm your down payment funds are legitimate. |

| Gift Letter | If family is helping, a signed letter stating the funds are a gift, not a loan. | To ensure the gifted funds don't create an extra debt that could impact your loan qualification. |

Gathering these documents is the single most important thing you can do to ensure your application sails through smoothly. With a complete file, the team at RAC Mortgage can push your application through underwriting and get you to a successful closing that much faster.

How to Navigate the US Real Estate Market

Jumping into the U.S. real estate market as a foreign national is a huge financial move. It's packed with unique challenges, but also some incredible opportunities. This is way more than just a simple transaction; it's about getting a handle on a whole new world of investment, culture, and regulations. But with the right game plan, you can turn a potentially confusing process into a smart, profitable venture.

Think of the U.S. market like a massive, diverse ecosystem. Every state, city, and even neighborhood has its own economic vibe and property quirks. Your success really boils down to knowing where to look and what to look for. That's why solid market intelligence is your best friend.

Understanding Key Market Trends

The U.S. real estate market is always in motion, and foreign investment is a big piece of that puzzle. Recent numbers show a major uptick in activity from international buyers. Between April 2024 and March 2025, foreign buyers scooped up a staggering $56 billion worth of existing U.S. homes. That’s a 33.2% jump from the year before.

This surge involved 78,100 properties, marking a 44% increase in the number of deals. What's really eye-opening is that a full 47% of these buyers paid all cash, way more than the average for all homebuyers. As you learn more about these foreign investment statistics, you'll see how things like where buyers are from and what they plan to do with the property really shape the market.

For buyers using foreign national mortgage programs, understanding this context is crucial. It helps you make smarter decisions, from picking a location all the way to negotiating the final price.

Popular Hotspots for Foreign Investment

Some states just consistently pull in the lion's share of foreign investment, and for good reason. They offer a great mix of economic growth, lifestyle perks, and solid rental income potential. Knowing where these hotspots are—and why they're so popular—is the first step to narrowing down your search.

The top destinations for international buyers usually include:

- Florida (21%): You can't beat the weather, the lack of state income tax, and the booming tourism. This makes it a go-to for both vacation homes and rental properties.

- California (15%): It's got a powerful economy, diverse culture, and high-value properties that appeal to investors looking for long-term growth.

- Texas (10%): The Lone Star State is known for its business-friendly climate, strong job market, and more affordable real estate compared to other big players.

- New York (7%): As a global hub for finance and culture, New York City is still a top target for high-end homes and investment properties.

- Arizona (5%): The warm climate, growing population, and popular retirement communities make Arizona a big draw for buyers.

At RAC Mortgage, our team has deep roots in these key regions. We get the local nuances and can offer the specialized guidance you need to hit your investment goals in these high-demand areas.

Choosing the Right Professional Team

Trying to navigate this market on your own isn't just tough; it's a bad idea. Your success really depends on the team you build, and that starts with a great real estate agent. It's absolutely critical to find an agent who has specific experience working with international clients.

An experienced agent does more than just find properties. They're your cultural and procedural translator, guiding you through local customs, negotiation tactics, and the often-confusing closing process.

Equally important is a lender like RAC Mortgage, which specializes in foreign national mortgage programs. We get the unique documentation and financial verification hurdles you're facing and have built our entire process to handle them smoothly. To really dig in and assess potential properties, using a comprehensive due diligence checklist is a must. It ensures you’ve covered all your bases before you commit.

By putting together the right team, you arm yourself with the local knowledge and financial expertise needed to make a smart, secure, and successful U.S. property investment.

The RAC Mortgage Application Process Step by Step

Trying to figure out how to get a foreign national mortgage can feel overwhelming. But it doesn't have to be. Here at Residential Acceptance Corporation (RAC Mortgage), we’ve dialed in our application process to make it as straightforward and supportive as possible for our international clients. This guide will walk you through the entire journey, step by step, from our first chat to you getting the keys to your new U.S. property.

Think of this process less like a series of hurdles and more like a partnership between you and our team. Every step is designed to build on the last one, making sure we gather and check everything needed in a smart, efficient way. Our promise is to keep you in the loop and feeling confident the whole way through.

Step 1: Initial Consultation and Pre-Qualification

It all starts with a simple conversation. This is where we learn about you, your financial situation, and what you’re looking for in a property. It’s your chance to ask us anything and our chance to understand what makes your situation unique as a non-U.S. citizen.

During this first chat, we’ll talk about your income, assets, and the kind of home you want to buy. With that info, we can point you toward the right foreign national mortgage programs and give you a pre-qualification estimate. This gives you a solid idea of your borrowing power so you can start house hunting with real confidence.

Step 2: Formal Application and Document Submission

Found a property? Great! Now it's time to make things official with the formal application. This is where you'll fill out the loan application and start sending over the documents we talked about.

Having your paperwork organized really pays off here. You’ll need to provide things like:

- A copy of your valid foreign passport and U.S. visa (if you have one).

- Proof of your income, like a letter from your employer or statements from your accountant.

- Bank statements from your home country and any U.S. accounts to show your assets and where the down payment is coming from.

- An international credit report or other credit references.

Our team at RAC Mortgage knows how to handle international documents, and we’ll guide you on the best way to present your financial history. Getting ready for this stage is key, and you can learn more about the prep work by checking out our guide on how to get preapproved for a mortgage.

The whole point of the documentation phase is to paint a clear, complete picture of your finances. We team up with you to make sure your application tells the full story of your creditworthiness, using documents from your home country to fill in the gaps that a typical U.S. lender wouldn't know how to handle.

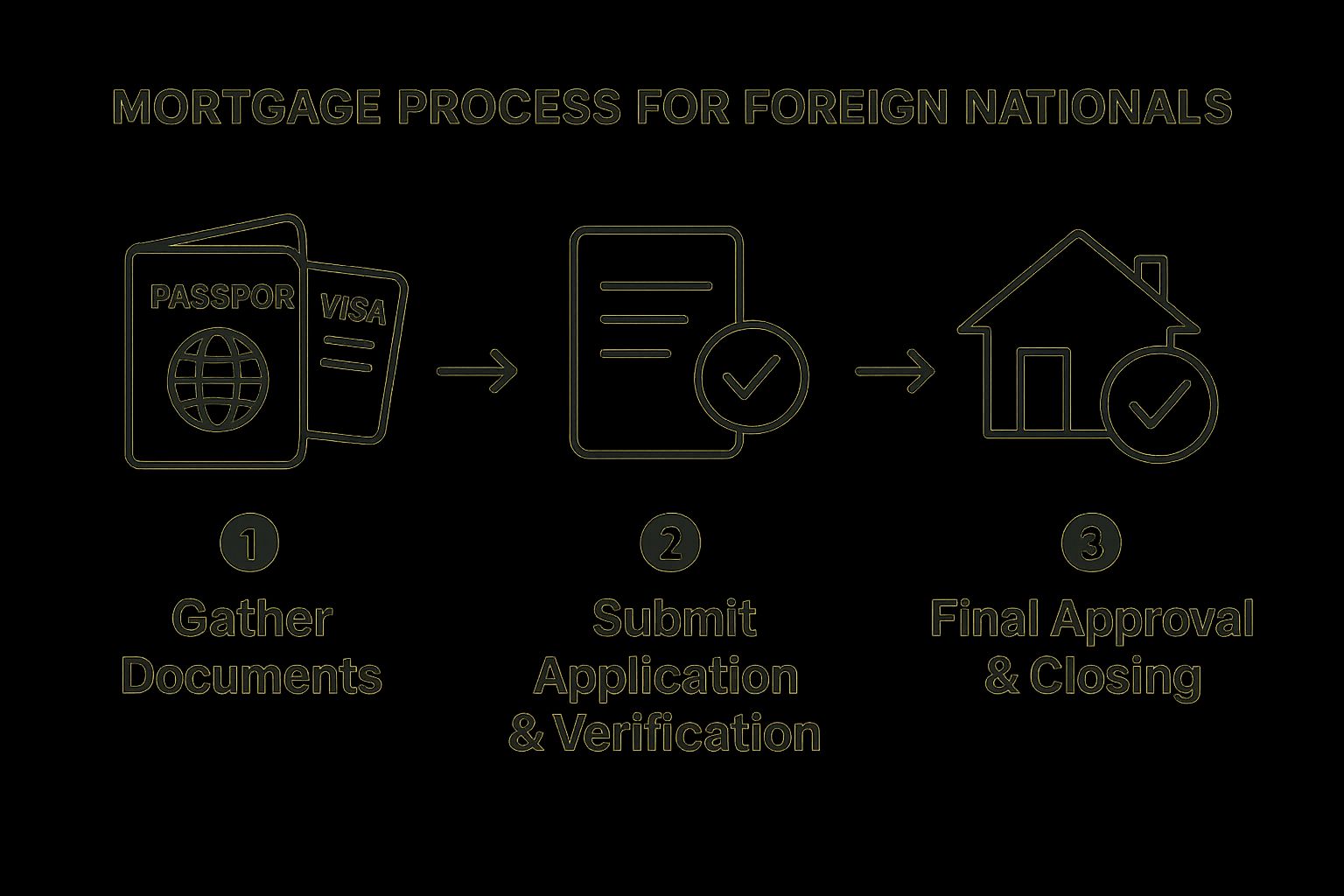

This flowchart breaks down the main steps for getting a foreign national mortgage with us.

As you can see, the path is a logical one from getting prepared to getting it done, with our team right there with you at every turn.

Step 3: Underwriting and Property Appraisal

Once we have your complete application and all your documents, the file goes to our underwriting team. An underwriter’s job is to do a deep dive into your financial profile to confirm it lines up with the guidelines for our foreign national mortgage programs. They’ll double-check your income, assets, and credit to make the final call.

At the same time, we'll order a professional appraisal on the property. An independent appraiser will figure out the home's market value to make sure the price you're paying is fair. This is a crucial step that protects both you and us, confirming the property is a solid investment. We’ll keep the lines of communication wide open during this phase and give you updates as they come in.

Step 4: Final Approval and Closing

When the underwriting is done and the appraisal is approved, we issue a "clear to close." That’s the green light you’ve been waiting for! It means your loan is fully approved and we're ready to set up the closing.

The closing is the last step. You'll sign the final legal documents, the money gets transferred, and the property officially becomes yours. For many of our international clients who can't be here in person, we can arrange a remote closing or have a power of attorney sign for them. At RAC Mortgage, our goal is to make this final step as smooth as possible, finishing off your successful U.S. property purchase.

Your Top Questions About Foreign National Mortgages, Answered

Jumping into the U.S. property market from another country can feel like a maze. It’s natural to have a lot of questions. We get it.

At Residential Acceptance Corporation (RAC Mortgage), we talk to international buyers every day. Here are the most common questions we hear—and the straight-up answers you need to move forward with confidence.

Do I Need a US Credit Score to Qualify?

This is the big one, and the answer is refreshingly simple: not necessarily.

One of the biggest advantages of working with a specialist like us is that we know most foreign nationals won't have a U.S. credit history. That's not a deal-breaker. We're set up to use international credit reports from your home country to get a clear picture of your creditworthiness.

In some cases, we can even look at other documents, like a solid history of rent or utility payments. We look at your whole financial story, so a missing U.S. credit score is a hurdle we know exactly how to clear.

What Is the Typical Down Payment for a Foreign National?

You should expect the down payment to be higher than what a U.S. buyer would pay. This is just how lenders balance out the perceived risk. Typically, you're looking at a down payment in the range of 25% to 40% of the home's purchase price.

The final number really depends on your financial profile, how much you're borrowing, and the type of property you’re buying. We’ll give you a totally transparent breakdown of all the costs, down payment included, so you can plan your investment without any surprises.

Can I Buy an Investment Property or Vacation Home?

Yes, absolutely. In fact, a huge number of our clients use foreign national mortgage programs for exactly that—buying properties to generate rental income or to have a personal vacation spot.

These loans were built to be flexible and aren't just for primary homes. The terms might shift a little depending on whether it’s an investment or a second home, but we’ll work with you to find the loan that perfectly matches your goals.

The ability to finance different kinds of properties is a key advantage of these specialized loans. They open up the entire U.S. market for your investment or personal plans, not just for a place to live.

Are Interest Rates Higher for Foreign National Loans?

The short answer is yes, they can be slightly higher than rates for standard U.S. loans. This small difference accounts for the extra legwork and perceived risk involved in handling an international application.

But "higher" doesn't mean "unfair." The rates are still very competitive. At RAC Mortgage, we're committed to finding you the best possible terms by looking at your entire financial strength, not just one number on a page. You'll get a fair, transparent rate that makes sense for your investment.

What Kind of Properties Can I Purchase?

You’ve got a lot of flexibility here. Foreign national mortgage programs aren't restrictive when it comes to property types.

You can generally get financing for:

- Single-family homes (for personal use or as rentals)

- Condominiums (though some buildings may have their own rules)

- Multi-unit properties with 2-4 units, which are fantastic for investors

- Townhouses and homes in planned unit developments (PUDs)

This variety means you can chase just about any real estate strategy you have in mind for the U.S. market.

How Long Does the Loan Process Take?

Every situation is different, but a well-prepared buyer can see things move surprisingly fast. Here at RAC Mortgage, we pride ourselves on closing loans in about 18 to 20 days once we have a complete file.

Preparation is everything. If you have all your documents ready to go from the start—passport, income verification, bank statements, and international credit reports—it speeds up the entire timeline. Our team is here to guide you every step of the way to avoid delays and get you to the closing table smoothly.

Ready to make your move in the U.S. real estate market? The team at Residential Acceptance Corporation lives and breathes this stuff. We specialize in making homeownership a reality for international buyers and have the know-how to navigate the complexities for you.

Start your journey to U.S. homeownership with RAC Mortgage today!