So, you're thinking about buying your first home. It's a huge step—one of the biggest you'll ever take—and it's easy to feel a little overwhelmed. Between the jargon, the paperwork, and the sheer number of things to keep track of, it can feel like a complex puzzle. But it doesn't have to be.

This guide is designed to be your practical companion, a clear roadmap to take you from thinking about homeownership to actually holding the keys. We'll break it all down so you can move forward with confidence, not anxiety.

The truth is, today's housing market has its fair share of challenges, especially for first-timers. It helps to go in with a realistic perspective.

The Real Story on Today's Market

Let's not sugarcoat it: first-time homebuyers are up against some headwinds. The National Association of Realtors (NAR) recently highlighted a pretty stark trend. The number of first-time buyers has tumbled from nearly 3.2 million back in 2004 to just 1.14 million lately.

What's driving this? A combination of mortgage rates hovering near 7% and a national median home price north of $422,000. You can dig deeper into these housing market trends and what they mean for new buyers, but the big picture is that affordability is tight.

But don't let those numbers scare you off. Owning a home is absolutely still achievable, it just requires a solid plan. It all starts with getting a firm grip on the key financial pieces you'll need to budget for.

Key Insight: Those big national statistics are just part of the story. Your personal financial health, the specifics of your local market, and the assistance programs available to you are what really define what's possible.

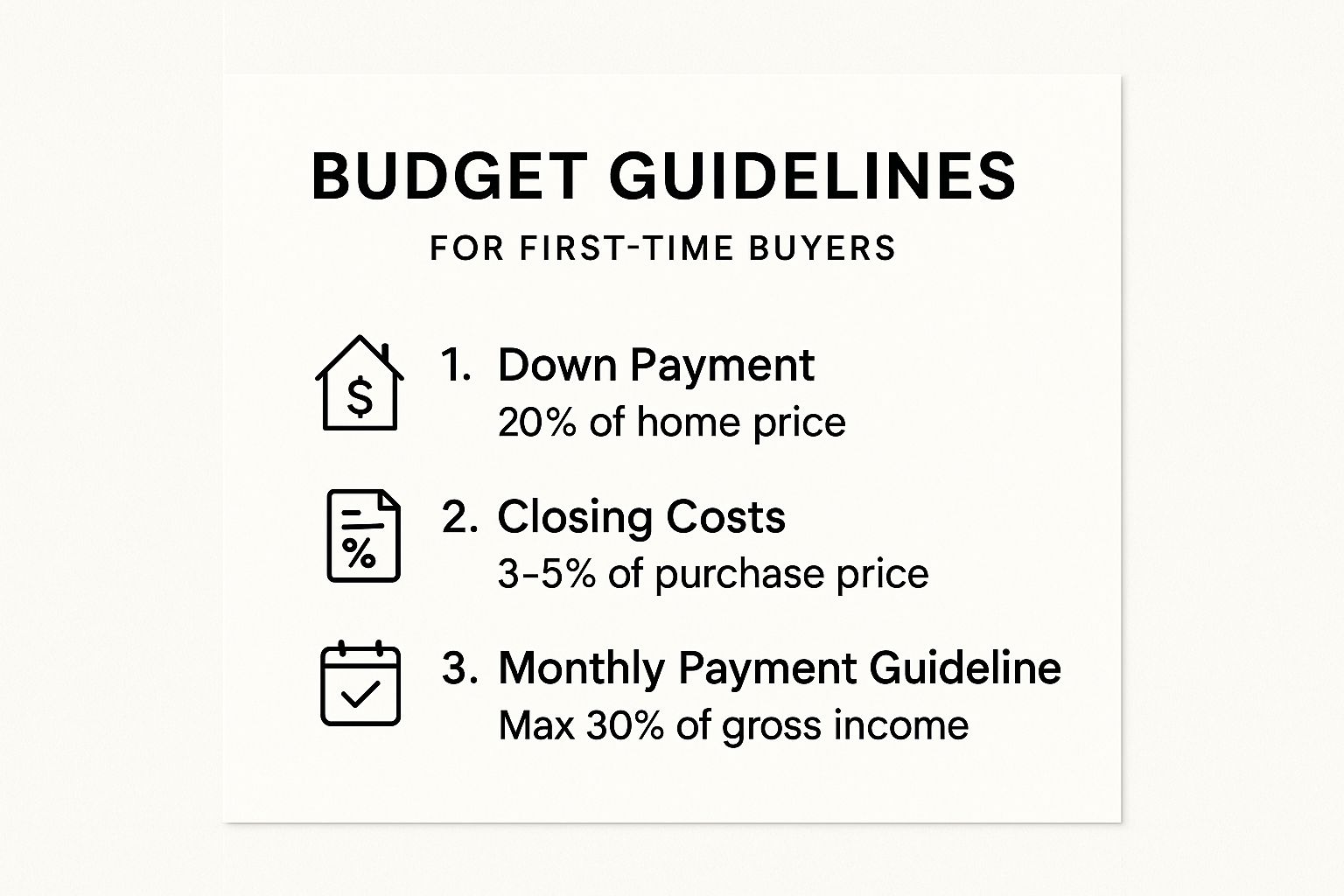

This image really helps break down the three core financial pillars of a homebuying budget.

Think of these percentages as a starting point. They give you a solid framework for figuring out both your upfront costs and what you'll be paying month-to-month, which is critical for setting a realistic savings goal.

A Bird's-Eye View of the Process

To help you get a clear picture of the road ahead, we've broken the entire journey down into its core stages. Think of this table as your high-level cheat sheet.

The First-Time Homebuyer's Core Roadmap

| Stage | Key Objective | Typical Timeline |

|---|---|---|

| Financial Prep | Assess your credit, build a budget, and save for the down payment and closing costs. | 3-12+ months |

| Mortgage Pre-Approval | Work with a lender to determine your borrowing power and get a pre-approval letter to make your offer strong. | 1-2 weeks |

| The House Hunt | Partner with a real estate agent, define your needs, and view properties that fit your budget. | 1-3 months |

| Offer to Closing | Make an offer, negotiate terms, and complete inspections, appraisal, and final loan underwriting. | 30-60 days |

Each of these stages involves its own set of tasks, from building a financial foundation to finally closing the deal. Let's dig into what each one really looks like.

Building Your Financial Foundation for a Mortgage

Before you even start looking at listings for that charming bungalow or sleek modern condo, the real work begins. It’s quiet, it happens at your desk, and it’s the non-negotiable first step to buying a home: building a rock-solid financial foundation. This is where the dream starts to feel real.

This isn’t just about "saving more money." It's about getting an honest, crystal-clear picture of your financial health and taking deliberate steps to make it stronger. Lenders are looking for stability and reliability, and what you do now will directly impact your ability to get pre-approved down the road.

Calculate Your True Homebuying Budget

First things first, you need to figure out how much house you can actually afford. I’m not talking about the maximum loan a bank might throw at you; I’m talking about what you can comfortably pay each month without feeling squeezed.

Start by looking at your income and all your existing debts—student loans, car payments, and credit card balances.

A great guideline to use is the 28/36 rule. It’s a simple but powerful way to gauge affordability. The rule suggests that your total housing costs (principal, interest, taxes, insurance) shouldn't be more than 28% of your gross monthly income. At the same time, your total debt, including that new mortgage payment, shouldn’t top 36% of your gross income.

For example, let's say your gross monthly income is $6,000:

- Housing Limit (28%): Your total monthly housing payment should ideally stay at or below $1,680.

- Total Debt Limit (36%): If you already have $400 in other monthly debt, your total debts (including the new mortgage) shouldn’t pass $2,160.

This simple calculation gives you a realistic ceiling for your house hunt and keeps you from becoming "house poor."

Polish Your Credit Score

Your credit score is one of the most powerful numbers in your financial life, especially when it comes to mortgages. Lenders use it to judge how reliable you are as a borrower, and it directly influences whether you get approved and what interest rate you'll lock in. A higher score can literally save you tens of thousands of dollars over the life of your loan.

Start by pulling free copies of your credit reports from all three major bureaus: Equifax, Experian, and TransUnion. Go through them with a fine-tooth comb. Look for errors, like a misspelled name or an account that isn't yours, that could be dragging your score down. Disputing and correcting these mistakes can give you a quick boost.

Key Takeaway: Consistent, on-time payments are the single biggest factor in your credit score, making up about 35% of the FICO model. Even one late payment can cause significant damage. Set up automatic payments wherever you can to make sure you never miss a due date.

If your score isn't where it needs to be, don't panic. There are ways to improve it. For some more targeted strategies, you can learn how to repair bad credit with these borrower tips to put yourself in a much stronger position.

Demystify the Down Payment

Saving up for a down payment can feel like the biggest hurdle for a first-time homebuyer. Many people are still stuck on the old myth that you absolutely need 20% down, which is enough to discourage anyone. The truth is, that's not always the case.

While putting 20% down is a great goal because it helps you avoid Private Mortgage Insurance (PMI), many excellent loan programs have much lower requirements.

Here are a few common options to look into:

- FHA Loans: These government-backed loans are a favorite for first-time buyers and can require as little as 3.5% down.

- Conventional 97: This is a conventional loan program that allows for a down payment of just 3%.

- VA and USDA Loans: If you're an eligible veteran or looking to buy in a designated rural area, these programs can offer 0% down.

Don't forget to explore state and local first-time homebuyer assistance programs. Many offer grants or low-interest loans specifically for down payments and closing costs, which can seriously shorten the time it takes you to save.

Navigating The Mortgage Maze To Get Pre-Approved

Alright, you've got your financial ducks in a row. Now it's time to step into the world of mortgages. This part can feel like a maze, but really, it’s just about finding the right loan and the right lender for your situation.

One of the most powerful moves you can make as a first-time homebuyer is getting pre-approved for a mortgage. Think of it as the dress rehearsal for your actual loan application. A lender will take a good, hard look at your financial profile—income, assets, debts, and credit history—to figure out exactly how much they’re willing to loan you.

Why does this matter? It shows sellers you're not just window shopping. You're a serious, qualified buyer who can back up an offer.

Pre-Qualification vs. Pre-Approval

It's easy to mix these two up, but they are worlds apart in the eyes of a seller.

A pre-qualification is a quick, back-of-the-napkin estimate of what you might be able to borrow. It's usually based on information you provide without much verification and doesn't involve a hard credit check. It’s a decent starting point but doesn’t carry much weight when you're ready to make an offer.

A pre-approval, on the other hand, is the real deal. This is where you submit a formal application with all your financial paperwork. The lender verifies everything and gives you a conditional commitment for a specific loan amount. This piece of paper is a massive advantage when it's time to negotiate.

Key Takeaway: A pre-approval letter is your golden ticket in the homebuying game. In a hot market, many sellers won't even look at an offer without one. It proves you're ready and able to close the deal.

Gathering Your Financial Documents

To get that pre-approval, your lender needs a complete picture of your financial health. Getting these documents organized before you even talk to a lender will make the entire process a whole lot smoother.

Here's what you'll generally need to have on hand:

- Proof of Income: Typically your most recent pay stubs covering a 30-day period, plus W-2s from the last two years.

- Tax Returns: Lenders will want to see your full federal tax returns for the past two years. This is especially critical if you're self-employed.

- Bank Statements: Grab statements for all checking and savings accounts from the last two or three months. Be ready to explain any large, out-of-the-ordinary deposits.

- Proof of Assets: This includes statements for any retirement or investment accounts, like a 401(k) or IRA.

- Identification: You'll need a copy of your driver’s license and your Social Security number.

Understanding Your Loan Options

Not all mortgages are built the same. There are different loan programs designed for different buyers, financial situations, and even different types of properties. Knowing the basics will help you have a much more productive conversation with your lender.

- Conventional Loans: These are the most common mortgages out there. They aren't backed by the government and usually require a decent credit score and a down payment of at least 3-5%.

- FHA Loans: Backed by the Federal Housing Administration, these are a huge favorite among first-time buyers. They come with more flexible credit requirements and allow for down payments as low as 3.5%.

- VA Loans: An incredible benefit for eligible veterans, active-duty service members, and some surviving spouses. These government-backed loans often require 0% down.

- USDA Loans: If you're looking in a designated rural (and sometimes suburban) area, these loans are worth a look. They also offer a 0% down payment option for borrowers who qualify.

The loan you pick directly affects your loan-to-value (LTV) ratio—basically, how much you're borrowing compared to the home's price. You can learn more about how loan-to-value ratios affect your mortgage to get a better handle on this key metric.

Most first-time buyers put down between 3-6% of the home's price. When the median home price is over $400,000, that's a significant chunk of change. These financial hurdles, along with credit score minimums, are a big reason why about 56% of first-time buyers are setting their sights on suburban areas to find more affordable homes.

Assembling Your Team and Finding the Right Home

With your finances lined up and a pre-approval letter ready to go, the real action begins. This is the exciting part, but it's also where having a seasoned professional in your corner can make or break your experience. You don't have to navigate this alone—in fact, you absolutely shouldn't.

A great real estate agent does a lot more than just unlock doors for showings. They’re your advocate, your local market guru, and your strategist all rolled into one. For any first-time homebuyer, their guidance is invaluable.

Finding the Right Real Estate Agent

Let's be clear: not all agents are the same, particularly when you need someone to guide you through your first purchase. You want an agent who is a patient educator, someone with a steady hand who won’t rush you.

Your best bet is to start by asking for referrals. Talk to friends, family members, or coworkers who have bought a home recently. Your lender is another fantastic resource; they work with agents every day and know who gets deals to the finish line without drama.

Once you have a shortlist, treat it like a job interview. After all, you’re hiring them for a critical role. Have a few questions ready to go:

- How many first-time buyers did you help last year?

- What’s your strategy for making my offer stand out in this market?

- How do you prefer to communicate—text, email, or phone calls?

- Can you walk me through the key sections of a purchase contract?

Their answers will tell you everything you need to know about their experience and, more importantly, their commitment to helping you understand the process. A truly great agent will spend more time listening to your goals than talking about themselves.

From Wish List to Reality: The House Hunt

Here comes the fun part—finding the house. It’s incredibly easy to get lost in dreamy Zillow listings with perfect kitchens and manicured lawns. The trick is to translate that online fantasy into a practical, real-world search.

The key is to separate your “must-haves” from your “nice-to-haves.”

- Must-Haves: These are your absolute deal-breakers. Think about the things you can’t easily change, like the neighborhood, school district ratings, your commute time, or the number of bedrooms.

- Nice-to-Haves: These are the features you’d love but could live without for now, or maybe even add later. This list might include things like a finished basement, a specific brand of appliance, or hardwood floors.

By zeroing in on your must-haves, you'll stay grounded and avoid getting distracted by shiny objects that don't actually fit your life.

Pro Tip: Learn to look at the "bones" of a house, not the seller's furniture. Staging is designed to create an emotional pull, but you need to see past it. Focus on the layout, the condition of the roof and windows, and the age of the furnace. Those are the things that have a real impact in the long run.

Navigating Today's Market Inventory

It’s crucial to start your house hunt with a dose of reality. The housing market is a classic tale of supply and demand, and that directly affects your search. While we've seen a small uptick in overall housing inventory, the number of existing single-family homes on the market is still hovering near historic lows—around 20-30% below what we've seen in previous market lulls.

This dynamic really limits the options for many first-time buyers. You can learn more about how current housing market dynamics will shape your search.

This is exactly why having that clear list of priorities is so critical. When there are fewer homes to choose from, knowing what you’re willing to compromise on can open up a world of possibilities. Sometimes, the "perfect" home is one that just needs a little paint but checks every single one of your major boxes.

To get a clearer picture of your options, it helps to understand the pros and cons of the different property types you'll likely come across.

Comparing Property Types for First-Time Buyers

Deciding on the type of home is just as important as the location. Each option comes with its own set of trade-offs that can impact your lifestyle, budget, and future plans.

| Property Type | Key Advantages | Potential Downsides |

|---|---|---|

| Single-Family Home | Total privacy, your own yard, and complete freedom to renovate. | You're on the hook for all maintenance, repairs, and associated costs. |

| Townhouse | Often more affordable than a single-family home, with some shared amenities. | You'll have shared walls, HOA fees, and rules that might limit renovations. |

| Condo | Typically the most affordable entry point with minimal exterior maintenance. | Can come with high HOA fees, less privacy, and a longer list of rules. |

Keeping an open mind about different property types can dramatically increase your available options. A townhouse might strike that perfect balance of space and affordability you're looking for, while a condo could be the ideal, low-maintenance way to get your foot in the door of homeownership. In this market, flexibility is your greatest asset.

From Making an Offer to Closing Day

You found it. After all the financial prep, the pre-approval paperwork, and what feels like a million weekend showings, you’ve finally walked into a house that just feels right.

This is the big moment. The search is over, and now it's time to secure the property. You need to put together a compelling offer that the seller can't ignore.

The Anatomy of a Strong Offer

Crafting a winning offer is more art than science. It's not just about throwing out the highest number; it's about presenting a complete, attractive package that shows you're a serious, reliable buyer. Your real estate agent is your guide here, but knowing the moving parts empowers you to make smarter decisions.

So what goes into a formal offer? It’s a legal document outlining the exact terms under which you’re willing to buy. A well-put-together offer gives the seller confidence and paves the way for a much smoother transaction.

The core pieces always include:

- The Purchase Price: This is what you’re offering to pay. Your agent will pull recent comparable sales (we call them "comps") to help you land on a price that's both fair and competitive in the current market.

- Earnest Money Deposit: Think of this as your "good faith" deposit. It’s typically 1-2% of the purchase price, and it shows you're truly committed. The money is held in an escrow account and gets applied to your down payment or closing costs when the deal is done.

- Contingencies: These are your safety nets. They are crucial clauses that let you walk away from the deal and get your earnest money back if certain conditions aren’t met. The most common ones are for the inspection, appraisal, and your financing.

- Proposed Closing Date: This is your target date to finalize the sale and get the keys. It’s usually 30 to 60 days after the seller accepts your offer.

After you submit the offer, the seller has a few choices: they can accept it as-is, reject it flat out, or come back with a counter-offer. Don't get discouraged by a counter; it's a completely normal part of the process and a good sign they want to work with you.

A strong offer is all about balance. You need to be competitive enough to get the seller’s attention, but you also have to include the right contingencies to protect yourself. This is where leaning on your agent’s experience is absolutely vital.

Clearing the Inspection and Appraisal Hurdles

Once your offer is accepted—congratulations!—you are officially "under contract." This kicks off a whirlwind period known as due diligence. Two of the biggest hurdles you need to clear are the home inspection and the appraisal.

The home inspection is entirely for your benefit and protection. You'll hire a professional inspector to do a deep dive into the property's condition, looking at everything from the roof down to the foundation. They'll pinpoint any existing issues, potential future problems, and necessary repairs. For a first-time buyer, this step is non-negotiable.

After the inspection, you get a detailed report. If it uncovers some major problems, you generally have three moves:

- Ask the seller to make the repairs before you close.

- Negotiate for a lower price or a credit at closing to cover repair costs.

- If the issues are just too big, you can use your inspection contingency to walk away.

The appraisal, on the other hand, is for your lender’s protection. The bank needs to be sure the house is actually worth what you've agreed to pay for it. They'll send a licensed appraiser to evaluate the home and its value based on what similar properties have recently sold for.

If the appraisal comes in lower than your offer price, it can create a financing gap. You’ll have to work with your agent to negotiate with the seller on lowering the price, find the extra cash to cover the difference yourself, or, if you have an appraisal contingency, you may be able to exit the contract. Getting past these final hurdles is the last major step before you head to the closing table.

Common Questions from First-Time Homebuyers

The homebuying journey is loaded with new lingo and massive decisions, so it's completely normal to have a million questions. You're basically learning a new language and process from scratch. Getting straight answers to the most common sticking points can build your confidence and help you dodge a ton of stress.

We've pulled together some of the questions we hear constantly from first-timers. These are the real-world, practical issues that always seem to crop up somewhere between getting pre-approved and finally getting the keys.

How Much Do I Really Need for Closing Costs?

This is one of the biggest budget shockers for new buyers. The down payment gets all the glory, but closing costs are a separate, and very real, expense you absolutely have to plan for.

Think of closing costs as the grand total of fees you pay to all the different people who help make your real estate deal happen. This includes your lender, the title company, appraisers, inspectors, and a few others.

On average, you can expect closing costs to be between 2% and 5% of the home's purchase price. For a $350,000 home, that means you'll need to budget an extra $7,000 to $17,500 on top of whatever you're putting down.

These costs aren't one single bill; they're a bundle of individual line items. Some of the usual suspects include:

- Loan Origination Fee: This is what your lender charges for actually creating and processing your mortgage.

- Appraisal Fee: The cost to have a licensed appraiser verify the home's market value.

- Title Insurance: Protects you and the lender from any old claims or ownership issues tied to the property's history.

- Home Inspection Fee: What you pay your inspector to give the home a thorough top-to-bottom review.

- Prepaid Expenses: You'll often need to pay a certain amount of your property taxes and homeowners insurance upfront into an escrow account.

Don't worry, you won't be blindsided. Before closing, your lender gives you a "Closing Disclosure" document that spells out every single one of these fees. Read it line by line so you know exactly what you're paying for.

What Is an Escrow Account and Why Do I Need One?

Once you own the home, your monthly payment is usually more than just the loan's principal and interest. It almost always includes two other major expenses: property taxes and homeowners insurance. An escrow account is just a special savings account your mortgage lender manages for you to handle these bills.

It’s pretty simple:

- Every month, a piece of your total mortgage payment gets funneled into your escrow account.

- When your property tax or homeowners insurance bills come due, your lender pays them for you using the money in that account.

This whole setup is really a safety net for everyone involved. For you, it means you don't have to save up for a massive tax bill once or twice a year. For the lender, it guarantees the property is insured and the taxes are paid, protecting their investment. Most lenders will require an escrow account, especially if your down payment is less than 20%.

Can I Back Out of the Deal After My Offer Is Accepted?

The short answer is yes, you can—but only under specific conditions that are written into your purchase contract. This is exactly why contingencies are your best friend. They are your contractual escape hatches.

For example, if you have an inspection contingency and the report comes back showing a cracked foundation you're not willing to fix, you can usually walk away and get your earnest money deposit back. The same goes for the financing contingency; if your loan gets denied for reasons you couldn't control, you're protected.

But here’s the catch: if you try to back out for a reason that isn't covered by a contingency—like you just get cold feet or find a different house you like more—you will almost certainly lose your earnest money deposit.

These are just a handful of the questions that will pop up. For a much deeper dive, you can always check out our detailed first time homebuyer FAQ page for more answers.

At Residential Acceptance Corporation, we believe an informed buyer is an empowered buyer. If you're ready to take the next step with a team that provides clear answers and one-on-one support, start your application with us today.