Trying to buy a house in Tampa's bustling real estate market can feel like an impossible dream, especially when you think about the huge down payment you're supposed to have saved. For a lot of people who want to own a home, an FHA loan is the key that unlocks the door. The very first step is finding the right fha mortgage lender in Tampa—and that's where we come in. Here at Residential Acceptance Corporation (RAC Mortgage), we make the whole process simple and get you on the path to owning your own home.

Your Path to Homeownership in Tampa with an FHA Loan

Let's be real—looking at home prices in Tampa can be intimidating. The thought of needing a massive down payment or having a perfect credit score is enough to make anyone give up before they even start. But that’s exactly why government-backed FHA loans exist. They’re a powerful tool designed to get you into a home.

Consider this guide your personal roadmap, put together by the local pros at Residential Acceptance Corporation (RAC Mortgage). We're here to walk you through every single step of the journey with confidence.

Breaking Down the Barriers to Buying a Home

So, what is an FHA loan? It's a mortgage insured by the Federal Housing Administration, and it's designed to make buying a home more realistic by lowering some of the usual financial roadblocks. Because the government is backing the loan, we can offer much more flexible terms. For you, that means real, tangible benefits.

Here’s what makes FHA loans so attractive:

- Lower Down Payments: Forget the traditional 20% down. FHA loans let you get in the door with as little as 3.5% down. That’s a game-changer.

- Flexible Credit Requirements: These loans are much more forgiving if your credit score isn't perfect. This opens up homeownership to a lot of buyers who wouldn't qualify for other types of mortgages.

- Competitive Interest Rates: The government insurance on the loan means less risk for us, and those savings get passed on to you through great interest rates.

An FHA loan isn’t just another mortgage—it’s a way to level the playing field. It helps hardworking people and families right here in Tampa invest in their future without needing a six-figure savings account or a flawless credit history.

Working with a dedicated FHA mortgage lender in Tampa who really knows the local scene, like RAC Mortgage, makes a huge difference. We understand the ins and outs of the Tampa market and can guide you from start to finish, turning that dream of owning a home into a reality. We're ready to show you how it all works and what you need to do to qualify.

How FHA Loans Empower Tampa Homebuyers

So, what’s the big deal with an FHA loan? You can think of it as a home loan that comes with a powerful government safety net. The Federal Housing Administration (FHA) basically insures your loan, giving a dedicated fha mortgage lender in Tampa like RAC Mortgage the confidence to offer terms that are way more flexible and accessible.

This government backing isn't just a technical detail—it translates into real, tangible benefits that can make all the difference, especially in Tampa's competitive market. These loans were specifically created to open the doors of homeownership to more people, not just first-time buyers, but anyone looking for a more practical path to buying a home.

The Game-Changing Benefits for Tampa Buyers

In a market where saving up a traditional 20% down payment can feel like climbing a mountain, the perks of an FHA loan are a huge relief. The three biggest advantages work together to seriously lower the barrier to entry.

Here's how they can help you:

- A Down Payment as Low as 3.5%: This is the most talked-about feature for a reason. Instead of needing tens of thousands of dollars just to get in the door, you can secure a home with a much smaller upfront investment. That frees up your cash for moving costs, new furniture, or other expenses.

- More Forgiving Credit Requirements: You don't need a perfect credit score. FHA guidelines were designed to be more understanding of past financial bumps in the road, opening up opportunities for buyers who might not qualify for a conventional loan.

- Competitive Interest Rates: Because the loan is insured, we can offer attractive interest rates. This helps keep your monthly mortgage payment more affordable over the long haul.

Across the country, FHA loans are a cornerstone of the housing market. Even with rate shifts, they continue to be a go-to option by requiring down payments as low as 3.5% for borrowers with credit scores of 580 or higher—a stark contrast to what many conventional loans demand. This accessibility is all thanks to the FHA's insurance fund, which helps lenders take on more risk. You can dig into more national FHA loan trends from originationdata.com.

A Practical Path to Your Tampa Home

When you combine a low down payment with flexible credit standards, you create a powerful opportunity. For many people right here in Tampa, this means the dream of owning a home is much closer than they ever thought possible. It takes the pressure off having a perfect financial history and lets you focus on what really matters: finding the right home.

An FHA loan is about creating opportunity. It recognizes that not everyone has a flawless credit score or a massive savings account, but that shouldn't stop them from building equity and investing in their future right here in Tampa.

At RAC Mortgage, our specialty is helping Tampa homebuyers navigate these loans. If you're wondering how your specific credit situation might fit into this picture, take a look at our guide on Tampa home loans even with bad credit to see just how we can help.

Qualifying for Your FHA Loan in Florida

So, you see the perks of an FHA loan. That's the easy part. Now, let's talk about what it actually takes to get one.

The good news is that the requirements are pretty straightforward, designed to open the door to homeownership for more people here in Tampa. We’ll walk through the big three: your credit, your income, and the property itself.

Working with a trusted fha mortgage lender in Tampa like us at RAC Mortgage means you’re not going into this blind. We're here to help you figure out exactly where you stand and what you need to do to get ready.

Your Credit Score and Down Payment

Your credit score is a big piece of the puzzle, but FHA loans are known for being much more forgiving than conventional mortgages. The score you have directly impacts the down payment you’ll need to bring to the table. Think of it like a seesaw—a better credit history means a lower down payment.

Here’s how it usually shakes out:

- Credit Score of 580 or Higher: If your score is 580 or better, you’re in a great spot. You can likely qualify for the headline feature of FHA loans: a tiny 3.5% down payment. This is what makes it such a game-changer for so many Tampa homebuyers.

- Credit Score Between 500-579: Got a score in this range? You're not necessarily out of the running. The FHA might still back your loan, but they'll ask for a larger down payment of 10% to balance out the risk.

Keep in mind, these are the minimums set by the FHA. Every situation is different, which is why we look at your whole financial story, not just one number.

To make things clearer, here's a quick look at the main eligibility points.

FHA Loan Eligibility at a Glance

This table breaks down the essential requirements for an FHA loan, giving you a quick snapshot of what we are looking for.

| Requirement | FHA Guideline | Why It Matters |

|---|---|---|

| Credit Score | 580+ for 3.5% down, 500-579 for 10% down | Your credit history shows us your track record with paying back debt. |

| Down Payment | Minimum 3.5% of the purchase price | A lower down payment makes homeownership more accessible for buyers without large savings. |

| Debt-to-Income (DTI) | Generally 43% or lower | We need to see that you can comfortably afford your new mortgage payment on top of existing debts. |

| Property Standards | Must meet minimum safety and soundness standards | The FHA appraisal ensures the home is a safe place to live and a secure investment for everyone involved. |

| Steady Employment | A consistent 2-year employment history is preferred | This demonstrates a stable income source to handle future mortgage payments reliably. |

Remember, these are guidelines, not rigid laws. Compensating factors can sometimes make a difference, so it’s always worth a conversation.

Understanding Your Debt-to-Income Ratio

Besides your credit, we will zoom in on your debt-to-income (DTI) ratio. It sounds technical, but it’s just a simple comparison of your total monthly bills (think car payments, student loans, credit cards) to your gross monthly income. This number tells a lender how much of your paycheck is already spoken for.

Basically, your DTI ratio gives us a quick look at your financial breathing room. A lower number shows you have a healthy buffer, making you a much stronger candidate for a home loan.

The FHA is flexible here, too. They generally allow for a DTI ratio up to 43%, and sometimes even higher if you have other strengths in your financial profile. To get into the nitty-gritty, our guide on how to qualify for an FHA loan breaks down exactly what lenders look for.

Property Requirements and the FHA Appraisal

Last but not least, the house itself has to pass the test. The FHA insists on an appraisal from one of their approved appraisers to make sure the property is safe, secure, and structurally sound.

This isn't just about figuring out what the home is worth; it's a basic health and safety checkup. The appraiser will look for issues like a leaky roof, faulty electrical systems, or peeling paint in older homes that could be a lead hazard. It’s a crucial step that protects both you and us from a bad investment.

Navigating the FHA Application Process Step by Step

Let's be honest, the mortgage process can feel like a maze of paperwork and confusing industry jargon. At Residential Acceptance Corporation (RAC Mortgage), our job is to hand you the map. We want to cut through the complexity and give you a clear, manageable path forward, turning anxiety into confidence. Think of us as your dedicated partner from the first phone call all the way to closing day.

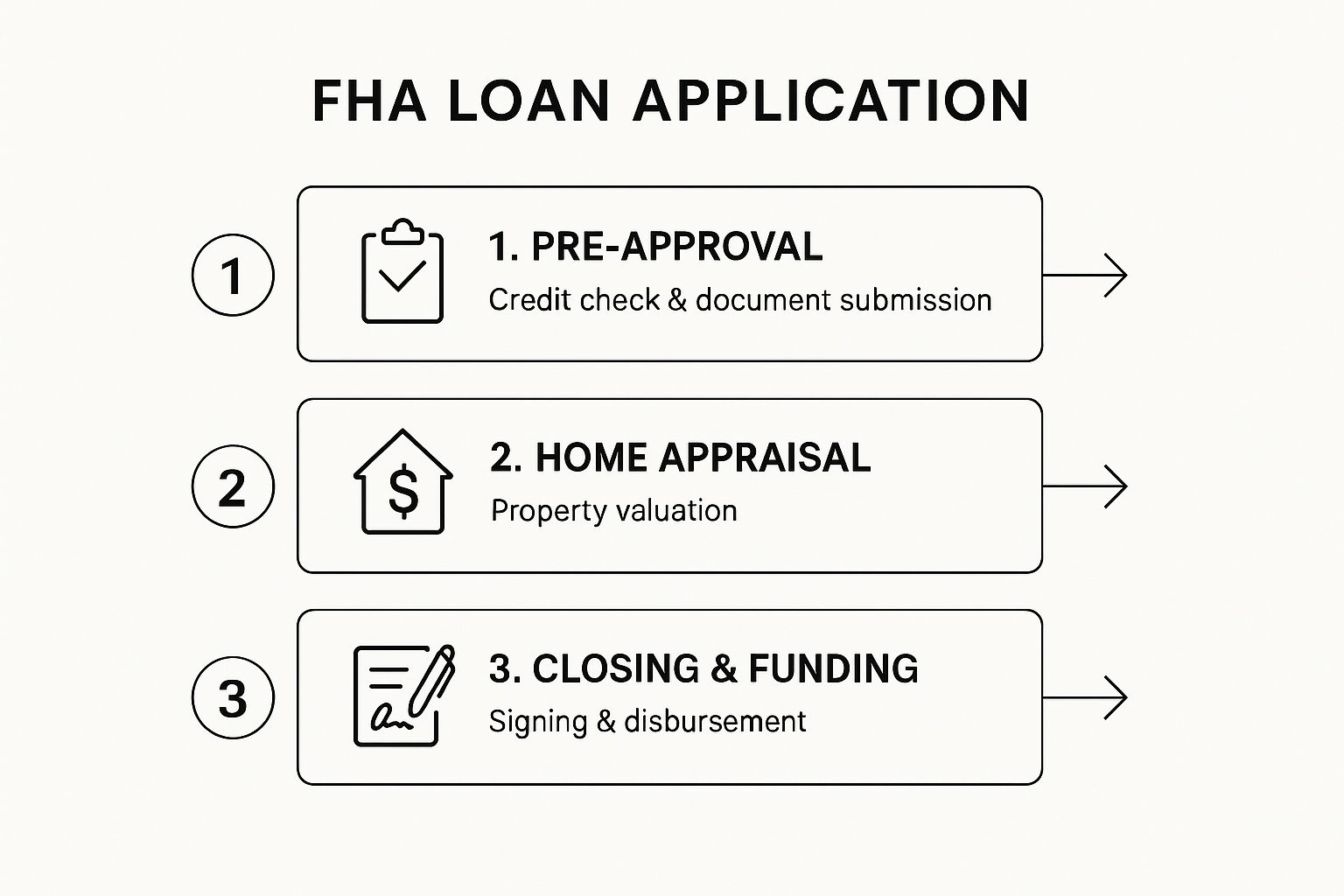

When you understand the entire process, you're in the driver's seat. We’ve broken down the FHA loan application into a simple, step-by-step journey so you know exactly what to expect when working with your fha mortgage lender in Tampa.

The Initial Consultation and Pre-Approval

It all starts with a conversation. This initial consultation is much more than just filling out a form; it's where we get to know your financial goals and you learn exactly how we can help you achieve them. We’ll talk about your budget, take a look at your financial history, and give you a clear list of the documents needed to get started.

The most important goal of this first stage is getting pre-approved. In Tampa's competitive housing market, a solid pre-approval letter from RAC Mortgage is your golden ticket. It tells sellers you're a serious, qualified buyer, which can give your offer a major advantage.

A pre-approval isn’t just a piece of paper—it’s your ticket to confidently shopping for a home. It clearly defines your budget, strengthens your negotiating position, and shows real estate agents you're ready to make a serious offer.

Once you're pre-approved, you can hunt for your new home with a real understanding of what you can afford, which makes the whole experience so much smoother.

From Appraisal to Underwriting

Found the perfect home? Offer accepted? Awesome! The next steps are all about verifying the property's value and your financial standing. This is where the FHA appraisal and underwriting process kick in.

- The FHA Appraisal: We'll bring in an FHA-approved appraiser to assess the home and determine its fair market value. But just as importantly, they make sure the property meets the FHA's minimum health and safety standards. This is a crucial protection for you, preventing you from buying a house with major hidden problems.

- Underwriting: Next, our underwriting team at RAC Mortgage does a final, deep dive into your financial documents and the appraiser's report. We meticulously check every single detail to confirm everything lines up perfectly with FHA guidelines, clearing the path for final approval.

This infographic breaks down the core stages of the FHA loan journey into a simple visual.

As you can see, the process flows logically from getting your finances in order and verifying the property all the way to the final legal transfer of ownership.

Reaching the Finish Line: Closing Day

Finally, the moment you've been waiting for—closing day! This is when you'll sign all the official documents to become the new owner of your Tampa home. Our team at RAC Mortgage coordinates closely with the title company to make sure the entire closing is smooth and error-free.

We’ll be right there with you to review the final paperwork, tackle any last-minute questions, and ensure you feel comfortable with every document you sign. Once the ink is dry and the funds are transferred, you get the keys. With RAC Mortgage, closing day isn't just the end of a transaction; it's the start of your new life as a homeowner.

Why Your Tampa Lender Makes the Difference

Choosing a mortgage lender is one of the most important calls you'll make when buying a home in Tampa. A huge, faceless national call center sees you as Loan #78432. An expert fha mortgage lender in Tampa like us at Residential Acceptance Corporation (RAC Mortgage)? We see you as a future neighbor.

That local connection isn't just a feel-good line—it's a real, strategic upper hand for you. We don't just work in Tampa Bay; we live here. That gives us a ground-level, firsthand knowledge of Tampa's wildly diverse neighborhoods that you just can't get from a desk in another state.

Local Expertise Is Your Advantage

Let's say you've found the perfect bungalow in Seminole Heights or a great family spot over in Carrollwood. A national lender probably doesn't have a clue about the specific market quirks that drive property values there. We do. Better yet, we have long-standing relationships with local appraisers who know these areas street by street.

This local network is a game-changer for keeping things smooth. It means your home appraisal is far more likely to be accurate, which helps you dodge those last-minute bombshells that can blow up a deal. A local lender also knows how to handle Tampa-specific curveballs that an out-of-state company would absolutely fumble.

These unique local hurdles can pop up anywhere:

- Navigating Flood Zone Requirements: We know exactly what insurance and paperwork you'll need for homes in Tampa's different flood zones—no guesswork involved.

- Handling Unique Property Types: From historic Ybor City homes to modern waterfront condos, we get the financing nuances for the types of properties common to our area.

- Understanding Local Closing Practices: Our experience means we know the local title companies and attorneys, which almost always leads to a faster, less stressful closing.

With RAC Mortgage, you aren't just getting an FHA loan; you're gaining a dedicated local advocate. We are committed to your success right here in the Tampa market because your success is our community's success.

The Tampa Bay area is a massive hub for FHA lending. In 2023 alone, the Tampa-St. Petersburg-Clearwater metro saw around 11,645 FHA loans get funded. With a median FHA-financed home value of about $335,000, these loans are the lifeblood for helping hard-working buyers find their place in our booming market. You can dig into more data on local FHA loan trends from smartasset.com.

Personalized Service Beyond the Application

At RAC Mortgage, you get real, personalized service. We actually take the time to sit down and understand your financial situation and your goals. We're with you every single step of the way, making sure you feel confident and clued-in.

This kind of one-on-one support is huge, especially when you're trying to wrap your head around all the costs that come with buying a home. For a deeper dive, check out our guide on closing costs for FHA loans. Choosing the right fha mortgage lender in Tampa isn't about finding the lowest rate online; it's about picking a partner who is genuinely invested in seeing you get the keys to your new home.

Common Questions About Tampa FHA Loans

Getting into the world of FHA loans can bring up a lot of questions, especially when you're trying to figure out how they fit into Tampa's unique housing market. As a dedicated FHA mortgage lender in Tampa, we hear these questions every single day here at Residential Acceptance Corporation (RAC Mortgage). We want to give you some clear, straightforward answers to help you move forward with confidence.

Our goal here is to pull back the curtain on the process, tackle your concerns head-on, and give you the knowledge you need to make smart decisions. Let's jump into some of the most common topics we discuss with Tampa homebuyers.

What Is Mortgage Insurance Premium and How Does It Work?

One of the first things people ask about is the Mortgage Insurance Premium (MIP). The easiest way to think of MIP is as the safety net that makes FHA loans possible in the first place. Because FHA loans let you get in the door with a lower down payment and have more forgiving credit standards, MIP is there to protect us in case a borrower, unfortunately, defaults on their loan.

MIP isn't just one thing; it actually has two parts:

- Up-Front Mortgage Insurance Premium (UFMIP): This is a one-time charge, usually 1.75% of your total loan amount. The good news is you don't have to scramble to find this cash at closing—it can be rolled right into your mortgage balance.

- Annual Mortgage Insurance Premium (MIP): This is the one you'll see every month as part of your regular mortgage payment. How much it costs and how long you have to pay it depends on your loan's term and how much you put down.

Getting a handle on MIP is a big deal because it's a key piece of your total monthly housing cost. We always make sure our clients see the full picture right from the very beginning.

Can I Get an FHA Loan for a Condo in Tampa?

You absolutely can! It's great news that you can use an FHA loan to buy a condominium in Tampa, especially with all the fantastic condo communities popping up across Hillsborough County. But there's one important catch: the condo complex itself has to be on the FHA's approved list.

The FHA keeps a running database of approved condominium projects to make sure they're on solid ground, both financially and structurally. This is another one of those moments where working with an experienced local lender really pays off. We can check a property's FHA-approval status in a snap and steer you toward condos that are actually eligible, saving you a ton of time and potential heartbreak.

The rising popularity of FHA financing really shows how vital it is to our local market. In fact, FHA loans made up 18.2% of all mortgaged home sales in Tampa as of December 2022. That’s a huge jump from just 11.9% a year earlier. This trend really drives home how essential these loans are for keeping housing affordable as prices climb. You can read more about what this means for the local market over at Florida Realtors®.

How Do FHA Loan Limits Affect My Search?

The FHA puts a cap on how much you can borrow, and these are known as loan limits. They aren't the same everywhere; they vary by county and get updated every year to keep up with local home values. For anyone buying a home in Tampa, this means the Hillsborough County FHA loan limit sets the maximum home price you can shoot for with this kind of financing.

Knowing the current FHA loan limit for Hillsborough County right when you start your home search is critical. It draws a clear line in the sand for your budget and helps you and your real estate agent focus only on properties that are realistically in play.

These limits are in place to make sure the FHA program keeps serving who it's meant to help: low- to moderate-income borrowers. Here at RAC Mortgage, we are always on top of these annual changes. We'll make sure your pre-approval amount lines up perfectly with the current local FHA guidelines so you can make an offer that is both competitive and compliant.

Ready to take that next step toward owning a home here in Tampa? The team at Residential Acceptance Corporation is ready to answer every question you have and walk you through a smooth, transparent FHA loan process. Visit us online to get started with your application today at https://racmortgage.com.