So you're getting ready to close on your FHA loan—congratulations! But before you pop the champagne, it's crucial to understand the final set of costs you'll encounter. Beyond your down payment, you'll need to cover what are known as closing costs.

Think of them as the final administrative fees for getting your home purchase across the finish line. In most cases, you can expect FHA closing costs to fall somewhere between 3% to 6% of the total loan amount.

What Exactly Are FHA Closing Costs?

When you buy a home with an FHA loan, the down payment gets all the attention, but it's not the only check you'll be writing. FHA closing costs are a bundle of separate fees paid to all the different people and companies that helped make your home purchase happen.

Here’s a simple analogy: imagine buying a new car. The sticker price is the main event, but you still have to pay for taxes, title transfer, and registration before you get the keys. Closing costs are the real estate equivalent—all the necessary service fees to legally transfer the home's ownership to you.

Breaking Down the Costs into Three Main Buckets

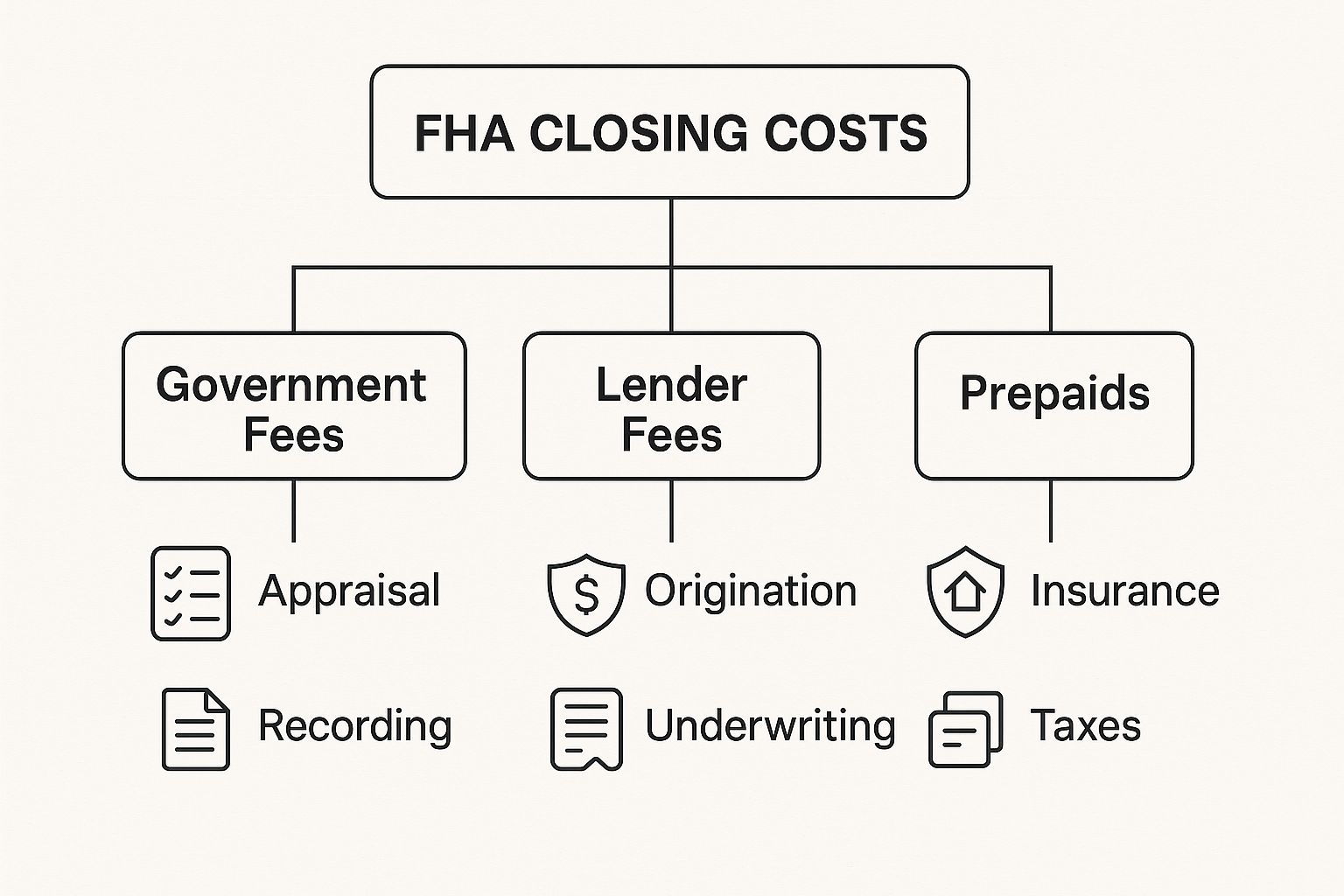

It’s a lot easier to wrap your head around closing costs when you see where the money is actually going. Generally, all the different line items can be sorted into three distinct buckets.

Working with a transparent lender like Residential Acceptance Corporation means you'll get a clear breakdown of every single charge, but they'll typically fall into these categories:

- Lender Fees: These are the charges from your mortgage company for originating, processing, and funding your loan. Think of things like origination and underwriting fees.

- Third-Party Services: This covers the costs for all the other professionals involved. You'll see fees for the appraiser, the title insurance company, credit reporting agencies, and more.

- Prepaid Expenses: These are costs you pay upfront for future bills. You'll typically prepay your first year of homeowners insurance and set aside a few months of property taxes in an escrow account.

FHA closing costs are really the last financial hurdle standing between you and the keys to your new home. By budgeting for an extra 3% to 6% of the home's price, you can walk into closing day with confidence and no surprises.

Quick Look at Typical FHA Closing Costs

To give you a clearer picture, let's summarize these fees in a simple table. This is a high-level look at the main categories you'll see on your closing documents, helping you anticipate what's coming.

| Fee Category | What It Covers | Typical Cost Range (% of Loan) |

|---|---|---|

| Lender Fees | Loan origination, underwriting, processing, and application fees. | 0.5% – 1.5% |

| Third-Party Fees | Appraisal, title search, title insurance, credit report, and attorney fees. | 1.0% – 2.5% |

| Prepaid Items | Homeowners insurance premium, property taxes, and prepaid interest. | 1.0% – 2.0% |

Keep in mind these are just general estimates. Your specific costs will depend on your loan amount, property location, and the service providers you choose.

Why Do Closing Costs Vary So Much?

Closing costs aren't a one-size-fits-all number. They fluctuate based on your home’s price, where you live, and the specific services your transaction requires.

Unfortunately, these costs have been on the rise. In 2021, the average mortgage closing cost for a single-family home hit $6,905, which was a significant 13.4% jump from the year before, largely because home prices themselves were climbing.

Because FHA closing costs have so many moving parts, getting clear, well-organized information is key. If you're interested in how to break down complex topics, you might find these general strategies for creating how-to guides that drive results useful. With a partner like RAC Mortgage, you’ll have an expert to help you navigate every fee and figure with total clarity.

Breaking Down Your FHA Loan Fees

Getting your FHA Loan Estimate can feel a little like deciphering a cryptic code. The long list of fees and charges might seem overwhelming at first glance, like looking at an itemized receipt for a massive, complicated purchase. But once you understand what each line item means, you'll feel much more in control of the process.

Think of these costs as falling into a few main buckets, each with a specific job. Here at Residential Acceptance Corporation, we make it a point to walk you through every single charge, so you know exactly where your money is going.

This diagram gives you a clear visual of how these FHA closing costs are typically organized into three main groups: lender fees, third-party charges, and prepaid items.

As you can see, the final number is a mix of costs from different players in the homebuying game, not just your lender.

Lender-Specific Fees

First up, let's talk about the fees your lender charges directly for creating, processing, and managing your loan. These are often the most negotiable, so it really pays to know what you’re looking at.

- Origination Fee: This is what the lender charges for the work of putting your loan application together. It's usually a percentage of the loan amount, typically somewhere around 0.5% to 1%.

- Underwriting Fee: This fee covers the cost of having a professional underwriter comb through your financial documents to verify everything and officially approve the loan. It’s a crucial step that ensures you meet all the FHA guidelines.

Third-Party Service Fees

Next, you'll see a section of charges from other companies involved in the transaction. Your lender lines up these services for you, but the fees themselves go to these outside professionals.

These include payments for essential steps like the FHA-required appraisal, which confirms the home's value and makes sure it meets FHA safety standards. This isn't optional for an FHA loan, and getting the right pros on the job is key. For more on this, check out our guide on how to choose an appraisal management company for your needs.

Another big third-party cost is for title services.

Title insurance is your financial safety net. It protects both you and the lender from any old ownership claims, hidden liens, or other legal headaches tied to the property's history. You pay this one-time fee for some serious long-term peace of mind.

You'll also see other common third-party costs for things like credit reports, flood certifications, and sometimes attorney fees, depending on your state’s laws. These costs have even caught national attention for how much they can affect affordability. The White House has pointed out that total closing costs can hit anywhere from 7% to 11% of a home's price, with inflated fees for services like title insurance being a major issue.

Prepaid Items and Escrow Funds

Finally, we have what are called "prepaids." These aren't really fees for services you've already received. Instead, they are payments you make upfront for future bills related to your home.

- Homeowners Insurance: At closing, you'll typically pay for your first full year of your homeowners insurance policy.

- Property Taxes: You'll also deposit a few months' worth of property taxes into a special savings account called an escrow account. Your lender will then use the money in this account to pay your tax bills for you when they're due.

- Prepaid Interest: This covers the mortgage interest that accrues from the day you close on the house until the date your first official mortgage payment is due.

Getting a handle on this breakdown will help you review your Loan Estimate with confidence. You'll be able to ask smart questions and make sure there are absolutely no surprises waiting for you on closing day.

Using Seller Concessions to Your Advantage

One of the most powerful tools in the FHA loan toolkit is getting the seller to help cover your closing costs. This is what we in the industry call a seller concession, and it can seriously reduce the amount of cash you need to bring to the closing table.

This is a massive advantage of FHA financing that puts homeownership within reach for more people. The Federal Housing Administration gives sellers the green light to contribute up to 6% of the home's final sales price toward your closing costs.

How Seller Concessions Work in Practice

Let’s put that percentage into real-world dollars so you can see the impact. Say you’ve found your dream home and agreed on a price of $300,000. Under FHA rules, the seller could chip in up to $18,000 to help with your closing expenses.

Think about that for a second. With FHA closing costs typically running between 3% and 6% of the home's price, a generous seller could potentially cover every single one of your fees. This frees up your own cash for things that really matter after you get the keys—like moving expenses, new furniture, or just beefing up your emergency fund.

A seller concession is a negotiated agreement where the seller pays for some or all of the buyer's closing costs. For FHA loans, this contribution is capped at 6% of the sales price, offering a significant way to lower your upfront cash requirement.

What Can Concessions Cover?

Now, it's crucial to know what this money can and can't be used for. The FHA is pretty specific about this to make sure the funds are applied correctly.

Here’s what seller contributions can be used for:

- Lender Fees: This includes things like the loan origination fee and underwriting fee.

- Third-Party Fees: The money can go toward the appraisal, title insurance, credit report, and other required services from outside vendors.

- Prepaid Expenses: You can even use concessions to pay for your homeowners insurance premium and the initial deposits into your escrow account for property taxes.

But there's one big rule you can't bend: seller concessions cannot be used for your down payment. The FHA requires that your down payment comes from your own pocket, a gift, or an approved assistance program.

Still, having the seller cover your closing costs makes saving for that down payment a whole lot easier. If you need a hand with that initial investment, checking out different down payment assistance programs is a fantastic next step.

Successfully negotiating these concessions is a team sport—it takes your real estate agent and your lender working together. An experienced lender like Residential Acceptance Corporation knows exactly how to structure the purchase agreement to include these concessions correctly, ensuring everything goes off without a hitch on closing day.

Practical Ways to Lower Your Closing Costs

While getting the seller to cover your closing costs is a fantastic strategy, it's not the only move in the playbook. You can absolutely take the reins and find ways to lower the final bill, potentially keeping thousands of dollars in your pocket.

The most important thing to remember is that you have options. Too many buyers see the first loan offer and think that’s the end of the story. But that’s rarely the case. Being a savvy, informed homebuyer is your best defense against overpaying.

Shop Around for the Right Lender

Here's one of the most powerful things you can do to reduce your FHA closing costs: find the right lender for you. Seriously. Every mortgage company has its own fee structure and interest rates, and the difference from one to the next can be night and day.

Don’t just get fixated on the interest rate. You need to dig into the Loan Estimate form and look at the lender-specific charges.

When you start comparing, keep an eye on these:

- Origination Fees: Some lenders might charge a full percentage point of the loan amount, while others have a more reasonable flat fee.

- Underwriting and Processing Fees: These are the administrative costs, and they can vary wildly from one company to another.

- Interest Rates: Of course, a lower rate is a huge win, saving you money every single month and over the entire life of the loan.

A good lender, like Residential Acceptance Corporation (RAC Mortgage), will be upfront and transparent about their fees. The goal is to get multiple quotes so you can pick the absolute best deal for your financial situation.

Negotiate Lender Fees and Explore Assistance

Once you have a few offers in hand, don't be afraid to negotiate a little. You can't change third-party costs like the appraisal fee, but you might have some wiggle room on the lender’s own charges, like the origination or application fee. It never hurts to ask if they can match a competitor's lower fee.

And don't forget to look in your own backyard. Many state and local governments offer down payment assistance programs, and some of those funds can actually be used for closing costs, too. These programs are specifically designed to help people get into homes, and they can be a massive help.

A "no-closing-cost" mortgage isn't really free. What happens is the lender pays those costs for you, but they charge you a higher interest rate in return. You're trading a lower upfront cost for a higher monthly payment and more interest over time.

Consider a No-Closing-Cost Option

If coming up with thousands of dollars in cash is the biggest hurdle standing in your way, a "no-closing-cost" FHA loan might sound pretty good. With this setup, the lender pays your closing costs, but—and it's a big but—you'll get a higher interest rate in exchange.

This can be a smart move if you're short on cash or you know you won't be in the home for more than a few years. But if this is your long-term home, that extra interest can easily add up to way more than what you saved on closing costs. You have to weigh the immediate relief against the long-term expense. To help you sort through it, check out our guide on whether closing costs can be rolled into a loan.

Trying to pin down your exact closing costs can feel like guesswork. One minute you think you have a solid number, and the next it seems to change. Thankfully, the process isn't a total black box—there are official documents designed to bring clarity and prevent any sticker shock on closing day.

Your best first look comes from the Loan Estimate, or LE. This is a standard, three-page form your lender is required to give you within three days of your application. Think of it as the first official preview of your FHA closing costs, interest rate, and what your monthly payment will look like.

From Percentage to Dollars

So, what does that 3% to 6% rule of thumb actually mean for your wallet? On a $350,000 home, you can expect your closing costs to land somewhere between $10,500 and $21,000. The Loan Estimate breaks this down, so you're not just looking at a huge number; you'll see an itemized list of lender fees, third-party services, and other charges.

When you get your LE, zero in on the "Estimated Cash to Close" section. It’s usually right there on the first page. This is your magic number—it takes your down payment, adds in the estimated closing costs, and then subtracts any credits you’re getting from the seller.

Understanding Your Loan Estimate

It’s crucial to remember that the Loan Estimate is just that—an estimate. Some costs, like the appraisal fee or title insurance, can shift a bit as things move forward. Others, like transfer taxes, are pretty much set in stone, and certain lender fees can’t increase at all.

This is where having a good partner makes all the difference. For professionals looking to better guide their clients, digging into these essential mortgage broker tips can provide great insight for managing expectations. Here at Residential Acceptance Corporation, our experienced loan officers will walk you through your LE line by line, pointing out which figures are firm and which ones might wiggle.

The Final Step: The Closing Disclosure

A few days before you head to the closing table, you'll get another, more concrete document: the Closing Disclosure (CD). This five-page form lays out the final, official numbers for your loan. No more estimates.

By law, you must receive your Closing Disclosure at least three business days before your scheduled closing. This isn't just a suggestion; it's a mandatory cooling-off period for you to review everything, compare it to your original Loan Estimate, and ask questions.

This three-day window is your last chance to make sure every number is correct. It's also worth noting that closing costs aren't one-size-fits-all. A U.S. Department of Housing and Urban Development study that analyzed 7,560 FHA loans found that costs can vary widely based on loan amount, credit, and even what’s happening in the local market. You can read the full research about these findings to see just how much these factors matter.

Your RAC Mortgage loan officer will make sure your CD is 100% accurate, setting you up for a smooth and predictable closing day with no surprises.

Got Questions About FHA Closing Costs? We've Got Answers.

As closing day gets closer, it’s completely normal for a flood of questions to pop up about the final costs. Let's tackle some of the most common ones we hear from homebuyers just like you.

Can I Roll My FHA Closing Costs Into The Loan?

This is probably the number one question we get, and the short answer is: not directly. You can’t just add the closing costs on top of your loan amount. But don't worry, there are a couple of smart, and very common, ways to get to a similar place.

The most popular strategy is using seller concessions. Here, the seller agrees to pay a portion of your closing fees—up to 6% of the home's sale price. This is a huge help and a frequent point of negotiation in real estate deals.

Another great option is to ask for a lender credit. How does that work? We, the lender, would cover some or all of your closing costs for you. The trade-off is that you'd have a slightly higher interest rate on your loan. This is a fantastic move if you're a bit short on cash for closing day but are comfortable with a slightly higher monthly mortgage payment.

Are FHA Closing Costs Tax Deductible?

For the most part, no. The IRS views most FHA closing costs—things like the appraisal, title insurance, and inspection fees—as part of what it costs to buy the house. They get added to your property's "cost basis," which isn't a bad thing! It can actually help lower your tax bill from capital gains when you eventually sell the home down the road.

However, there are two big exceptions you'll want to pay attention to:

- Prepaid Mortgage Interest: You'll often see this listed as "points" on your documents. This is generally deductible in the same year you pay it.

- Prepaid Property Taxes: Any property taxes you pay upfront at the closing table are also usually deductible.

Every homebuyer's tax situation is unique. To make sure you’re getting every deduction you're entitled to, it's always a good idea to chat with a tax professional. They can give you advice tailored specifically to you.

How Do I Actually Pay My FHA Closing Costs?

When closing day arrives, you'll need to have your funds ready. You’ll typically pay the final amount with either a cashier's check or a wire transfer from your bank. Don't worry about the details yet—your title company or closing agent will give you crystal-clear instructions on exactly how much to bring and which payment method to use.

You'll know the final number well in advance. At least three business days before you sign the papers, you’ll receive your Closing Disclosure (CD). This official document spells everything out, including the one big number you need: the "cash to close." This figure is your down payment plus all your closing costs, minus any credits you've already received (like your earnest money deposit). A loan officer here at Residential Acceptance Corporation will walk you through this document line by line to make sure you're comfortable and ready for the big day.

Ready to take the next step toward homeownership with clarity and confidence? The expert team at Residential Acceptance Corporation is here to guide you through every part of the FHA loan process, from application to closing day. Start your journey with us today!