Filing for Chapter 7 bankruptcy might feel like the end of the road for homeownership, but it's often the exact opposite. For many people in Tampa, it’s the fresh start they need. The most common path back to buying a home is through an FHA loan after a Chapter 7 discharge, and you can often get there in just two years.

Your Path to Homeownership After Bankruptcy

Let's be real—the future can feel a bit hazy after a Chapter 7 bankruptcy. But that's exactly what bankruptcy is for: to wipe the slate clean and let you rebuild. While it does take a hit on your credit, it absolutely does not shut the door on buying a home.

The secret is knowing the specific rules of the road for getting a mortgage in Tampa. This is where government-backed loan programs, especially FHA loans, become your best friend.

Unlike conventional loans, which can be incredibly strict, FHA loans were designed for people who've had life throw them a curveball. They offer a clear, structured path for borrowers to get back into the housing market. For anyone rebuilding in Tampa, this means a new home could be much closer than you think.

Why an FHA Loan Is Often the Smartest Move

After a bankruptcy, an FHA loan is usually the go-to choice, and for good reason. It’s built with flexibility in mind.

- Forgiving Credit Rules: Lenders look at your recent financial habits more than your past mistakes. A bankruptcy isn't an automatic "no."

- A Shorter Wait: You’re typically looking at a two-year waiting period, which is a lot better than the four years often required for conventional loans.

- Low Down Payment: You can still get in the door with a 3.5% down payment, which makes saving up much more manageable.

This is exactly why FHA loans are a lifeline for so many people rebuilding their finances. They're a practical tool that helps people get back on their feet. If you want to dig deeper, you can find more great insights about FHA loans after bankruptcy on LendingTree.

Navigating the FHA process after a bankruptcy isn't something you should do alone, though. You need someone who knows the system inside and out. A specialized lender like Residential Acceptance Corporation (RAC Mortgage) gets the specific FHA guidelines and can help you build a rock-solid application, giving you the confidence to move forward.

Understanding The FHA Waiting Period

One of the first questions I hear from Tampa residents after a Chapter 7 bankruptcy is, "How long do I actually have to wait to buy a house?" The good news is, it's often much sooner than you think.

The standard FHA waiting period is two years from your bankruptcy discharge date. It’s critical to remember that the clock starts on the discharge date, not the day you first filed.

This two-year window is more than just a waiting game; it's your opportunity for a financial comeback. Lenders aren't just looking at the calendar. They want to see that you've spent this time wisely, re-establishing financial stability and building a new, positive credit history.

Can You Shorten the Wait? The Extenuating Circumstances Exception

What if your bankruptcy was triggered by a major life event that was completely out of your control? The FHA gets it. If you can prove your Chapter 7 was a direct result of these kinds of "extenuating circumstances," the waiting period can be cut in half to just 12 months.

This isn't a loophole; it’s a specific exception for situations that were truly beyond your influence. Here are a few examples of what typically qualifies:

- A serious illness or injury that resulted in overwhelming medical debt.

- The unexpected death of a primary wage-earning spouse.

- A sudden job loss from a company-wide layoff or closure that you had no hand in causing.

Getting approved for this exception takes more than just telling your story—you need to back it up with solid proof. At RAC Mortgage, we work with clients in Tampa to gather the necessary documents, like medical bills, termination letters, or divorce decrees, to present a clear and compelling case to the underwriter. We'll help you write a powerful Letter of Explanation that connects the dots for them.

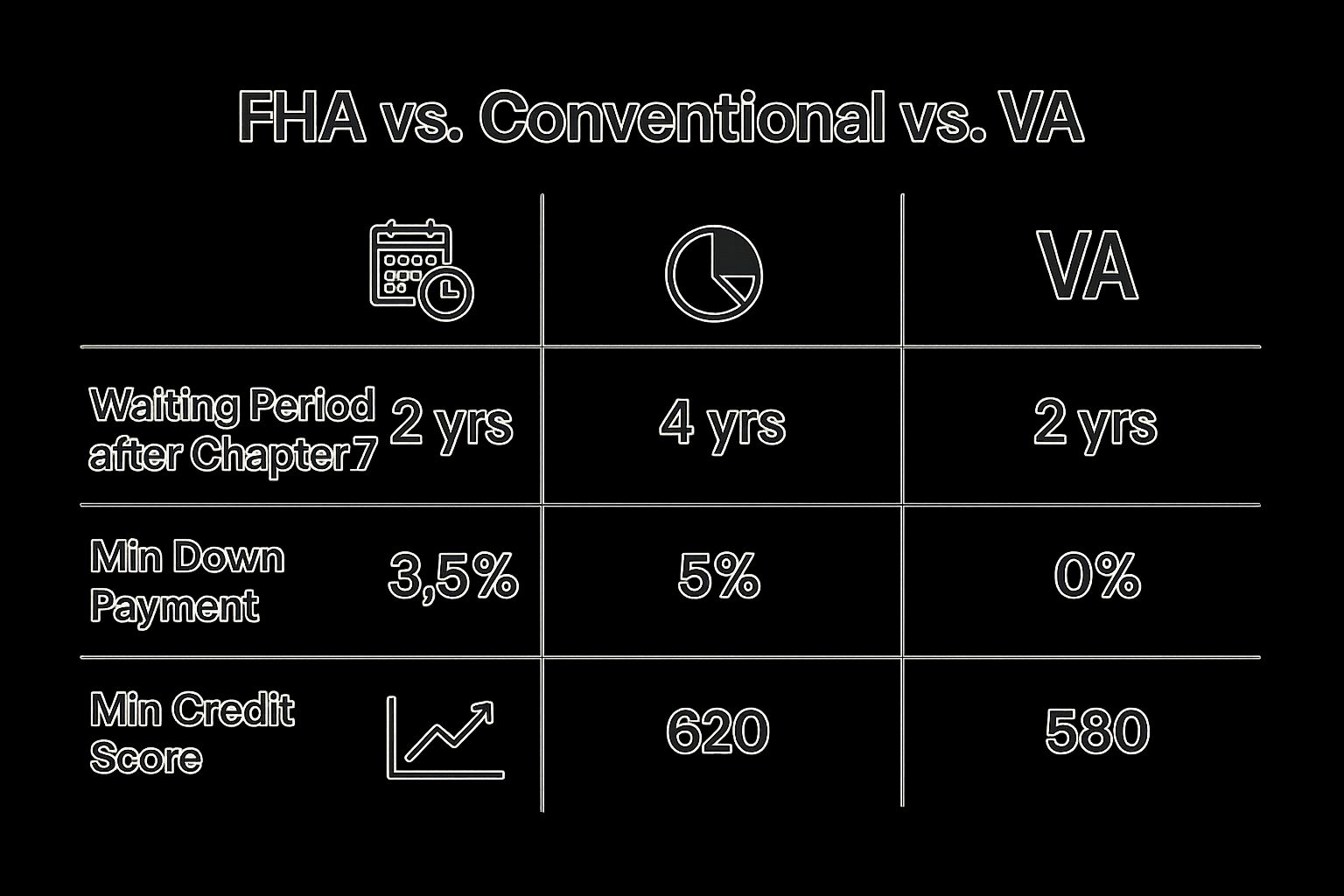

FHA vs Conventional Loan Waiting Periods After Bankruptcy

When you're looking at loan options after bankruptcy, the waiting periods can differ significantly. FHA loans are often the most accessible path back to homeownership, but it helps to see how they stack up against conventional loans.

| Loan Type | Standard Waiting Period | Waiting Period with Extenuating Circumstances | Typical Minimum Credit Score |

|---|---|---|---|

| FHA Loan | 2 Years from Discharge | 1 Year from Discharge | 580+ |

| Conventional Loan | 4 Years from Discharge | 2 Years from Discharge | 620+ |

As you can see, the FHA guidelines provide a much shorter timeline, giving you a faster route to buying a home if you meet the credit and income requirements.

The Two-Year Rule Is A Guideline, Not A Guarantee

It’s crucial to understand that hitting the two-year mark doesn't automatically mean you're approved. This waiting period is simply the minimum eligibility requirement set by the FHA.

The real test is what you do during that time. You have to demonstrate to lenders that you've learned from the past and are now a responsible, credit-worthy borrower. Consistent on-time payments and smart financial habits are non-negotiable.

Whether you're on the standard two-year path or aiming for the 12-month exception, the actions you take right now will pave the way for your success. To get a full picture of the journey ahead, take a look at our complete guide on how to qualify for an FHA loan. The team here at RAC Mortgage is ready to help you create a clear, actionable plan to get you into your new Tampa home.

Proven Ways to Rebuild Your Credit After Bankruptcy

Think of your credit report as the official story of your financial comeback. After a Chapter 7 discharge, lenders need to see a whole new chapter—one that clearly shows you’ve adopted responsible financial habits. This is more than just watching a score tick upward; it’s about proving you’re ready for the long-term commitment of a mortgage on a new Tampa home.

This rebuilding process kicks off the day after your discharge. The mission is to create a fresh, spotless history of on-time payments and smart credit management that FHA underwriters can look at and confidently approve.

Open New, Positive Credit Lines

You can't build a new credit history without having some credit to manage. The trick is to start small and be incredibly strategic. Lenders aren't looking for you to take on massive debt; they just want to see that you can handle new obligations responsibly.

-

Secured Credit Cards: This is usually the best place to start. You’ll put down a small cash deposit, maybe $300, which then becomes your credit limit. My advice? Use it for a tiny, recurring expense like Netflix or Spotify and set up autopay to pay the balance in full every single month. After 6 to 12 months of flawless payments, many issuers will upgrade you to a regular, unsecured card and refund your deposit.

-

Credit-Builder Loans: These are unique tools that work in reverse of a traditional loan. A lender puts a small amount, say $500, into a locked savings account for you. You make fixed monthly payments on that amount, and once it's paid off, the money is yours. Every single one of those on-time payments gets reported to the credit bureaus.

These tools are built specifically for one purpose: creating a positive payment history, which makes up a whopping 35% of your FICO score.

Manage Your New Credit Flawlessly

Once you have those new lines of credit, how you manage them is everything. Lenders are watching for consistency and discipline. Your primary goal is to show them that whatever led to your bankruptcy is firmly in the rearview mirror.

The golden rule is simple: Pay every single bill on time, every single time. I always tell clients to set up automatic payments for at least the minimum amount due. This is your safety net against accidental late payments, which can be absolutely devastating to your rebuilding efforts.

It's also crucial to keep your credit utilization—the amount of credit you're using compared to your limit—as low as humanly possible. The standard advice is to keep balances below 30% of your limit, but honestly, under 10% is where you'll see the best results for your score.

Monitor and Scrub Your Credit Report

Mistakes happen, and your credit report is no exception. It’s surprisingly common after a bankruptcy for accounts that were included in the discharge to still show a balance or be reported incorrectly. These errors can weigh down your score and raise serious red flags for underwriters.

You need to pull your free credit reports from all three major bureaus—Equifax, Experian, and TransUnion. Go through each report with a fine-tooth comb and look for:

- Accounts from your bankruptcy that aren't marked as "discharged in bankruptcy" with a $0 balance.

- Any late payments reported after your bankruptcy filing date on accounts that were discharged.

- Accounts that you don't recognize at all.

If you spot an error, dispute it with the credit bureau immediately. Cleaning up your report is a critical step in presenting the most accurate and positive financial picture possible. For specific questions on what underwriters look for, our team at Residential Acceptance Corporation (RAC Mortgage) can walk you through a post-bankruptcy credit report and point out what needs attention.

Getting Your Paperwork in Order for a Smooth Application

When you've got a Chapter 7 bankruptcy in your past, a well-organized loan application isn't just helpful—it's essential. Think of your loan file as the story you're telling the underwriter. Every document you provide adds a critical piece to that narrative. For anyone looking to get an FHA after Chapter 7 in Tampa, having a complete, clear package ready from day one can make a world of difference and seriously speed things up.

This is about more than just checking off a list. Each piece of paper helps us at RAC Mortgage build the strongest possible case for you, showing lenders you've bounced back and are more than ready for homeownership.

Your Essential Document Checklist

On top of the usual mortgage paperwork, you'll need a few extra documents that speak directly to your bankruptcy. Getting these together early shows you're on top of your game and serious about buying a home.

Here's the core list of what you'll need:

- Proof of Income and Assets: Lenders will want to see your last two years of tax returns and W-2s, your most recent pay stubs covering a 30-day period, and bank statements from the last two months.

- Complete Bankruptcy Paperwork: This is a big one. You'll need every single page of your Chapter 7 filing and, crucially, your official discharge papers from the court.

- Identification: A clear copy of your driver’s license and Social Security card.

For a deeper dive into everything you'll need, check out our full list of https://www.racmortgage.com/what-documents-needed-for-mortgage/. Keeping it all in one place is a game-changer. Learning some good habits for organizing your digital financial documents can make this whole process a lot less stressful.

Crafting a Powerful Letter of Explanation

One of the most important documents you'll prepare is your Letter of Explanation, or LOX. This is your chance to tell your story and add the human element that the numbers on your application can't convey. A good LOX doesn't make excuses; it provides honest context for why the bankruptcy happened.

Your Letter of Explanation is your voice in the loan file. It should be a concise, factual narrative that connects the past event to your present financial stability, showing a clear line of positive change.

Your letter needs to explain the "why" behind the bankruptcy. Was it a sudden job loss, a medical crisis, or another major life event? Just as important, it must detail the concrete steps you’ve taken since the discharge to get back on solid ground. This is where you talk about rebuilding your credit, making every payment on time, and growing your savings. Here at RAC Mortgage, we work with our Tampa clients to frame this letter effectively, making sure it tells a powerful story of recovery and responsibility to the underwriter.

Finding the Right Lender is Half the Battle

When you're ready to get an FHA loan in Tampa after a Chapter 7, the lender you choose is probably the single most important decision you'll make. It’s a common misconception that all lenders follow the same rulebook.

The truth is, many big-name banks and national mortgage companies have their own internal rules, which we in the industry call “overlays.” These are extra layers of requirements stacked on top of the official FHA guidelines, and they’re often much, much stricter.

This is where so many deserving applicants get stuck. You could meet every single FHA requirement to the letter, but still get a fast "no" from a lender who has an internal policy against lending to anyone with a recent bankruptcy. They don’t dig into your story of recovery; they just see a red flag and shut the door. It’s frustrating, and it’s why finding a specialist is so critical.

The Specialist Advantage: Why Experience Trumps Everything

Partnering with a mortgage professional who has deep experience in FHA loans after Chapter 7 bankruptcy completely changes the game. An expert team understands that a bankruptcy isn’t the end of the road—it's a financial reset. They know exactly what FHA underwriters are looking for and, just as importantly, what they’re not.

Instead of just being a paper-pusher, a specialist acts as your guide and your advocate. Here at Residential Acceptance Corporation (RAC Mortgage), this is precisely our focus. We’ve helped countless Tampa residents navigate this exact journey. Because we live and breathe the FHA handbook, we can:

- Shape Your Narrative: We know how to structure your application to highlight your financial recovery, turning a potential weakness into a story of resilience and renewed responsibility.

- Go to Bat for You: If an underwriter has questions, we don't just pass the message along. We get on the phone, provide context, and explain your situation—a level of advocacy you rarely get from a generalist.

- Prevent Roadblocks: By knowing what documents will be requested and addressing potential issues from the start, we keep the process from getting bogged down in delays.

This kind of dedicated support takes the stress and uncertainty out of the equation. You can learn more about what to look for by checking out our guide on finding the right mortgage lender in Tampa after bankruptcy.

Working with a specialist isn't just about getting an approval; it's about partnering with a team that believes in your comeback story and has the expertise to make your homeownership goal a reality. They see the person behind the file, not just the past event.

At the end of the day, your lender can be the difference between a stressful, dead-end process and a clear, supportive path to getting the keys to your new home. For something as specific as an FHA loan after a Chapter 7 in Tampa, working with a knowledgeable local expert gives you the best possible shot at success.

Got Questions About Getting a Tampa FHA Loan After Bankruptcy? We've Got Answers.

Going through a Chapter 7 bankruptcy can feel like a major setback, and the thought of buying a home afterward might seem out of reach. It’s natural to have a ton of questions. We hear them all the time from people right here in Tampa, and the good news is, there's a clear path forward.

Let's tackle some of the most common concerns we help our clients navigate.

Can I Really Get an FHA Loan with a Credit Score Under 600?

Believe it or not, yes. The official FHA guidelines are more flexible than most people think. They technically allow a credit score as low as 580 for the popular 3.5% down payment program. If your score is between 500 and 579, approval is still possible, but you'll need to bring a 10% down payment to the table.

Now, here’s the real-world perspective: after a Chapter 7 bankruptcy, lenders like us at Residential Acceptance Corporation (RAC Mortgage) are going to look beyond just the score. We're looking for what we call "compensating factors." This means showing a solid track record of on-time payments since your bankruptcy, proving you have stable employment, and keeping your other debts in check.

Your post-bankruptcy credit history is your chance to write a new story. Even if your score is still on the mend, a strong pattern of responsible payments speaks volumes.

When Does the FHA Waiting Period Actually Start? Filing or Discharge?

This is a huge point of confusion, so let's clear it up. The FHA’s two-year waiting period clock starts on the discharge date of your Chapter 7 bankruptcy—not the day you first filed.

Think of the discharge date as your official financial fresh start. It's the day the court legally wipes the slate clean on your eligible debts, and it's the date lenders use as their starting line.

Make sure you have a copy of your discharge paperwork handy. It's a non-negotiable document you'll need for your loan application.

Will Getting a Co-Signer Help My Chances of Approval?

A co-signer can definitely be a good strategic move, but it’s not a golden ticket. Bringing on a non-occupant co-borrower who has excellent credit and a solid income adds significant strength to your loan file because their financial stability is considered right alongside yours.

However, the FHA has some hard rules. A co-signer can't erase the mandatory waiting period after your bankruptcy. You, the primary borrower, still have to meet that requirement and prove you've gotten your own credit back on track.

A co-signer acts as a powerful supplement to your application, but they don't replace the core requirement for your own financial recovery. You’re still the star of the show.

The best way to know if this strategy makes sense is to talk it over. A loan expert at RAC Mortgage can look at your specific numbers and see if a co-signer is the right play for you.

What if My Bankruptcy Was Caused by a Medical Crisis?

This is what the FHA calls an "extenuating circumstance," and it can make a big difference. If you can clearly show that your bankruptcy was a direct result of a major, one-time event that was out of your control—a serious medical emergency, an unexpected layoff, a divorce—you might qualify for a shorter waiting period of just 12 months.

Of course, you'll need to back it up with documentation. This could mean providing medical bills, a termination letter from your former employer, or other official records. You also have to demonstrate that your financial situation has completely stabilized since the event.

Working with an experienced team like RAC Mortgage is critical here. We know how to package this information to build a compelling case for the underwriter and argue for that exception.

The road to owning a home after a Chapter 7 bankruptcy is more straightforward than you might imagine. At Residential Acceptance Corporation, we specialize in guiding Tampa residents through every single step of the FHA loan process. Get started on your journey home today.