When you're trying to get a mortgage, it can feel like you're juggling a dozen different things. But if there’s one number that really matters, it's your credit score. You can think of it as your financial report card. It’s the main tool lenders, including us at Residential Acceptance Corporation (RAC Mortgage), use to get a quick read on how you’ve managed debt and whether you're a reliable borrower.

Your Credit Score Is Your Key to Homeownership

When you sit down to apply for a home loan, that three-digit score is the cornerstone of the whole conversation. It gives lenders a snapshot of your financial habits, telling them at a glance how you've handled things like credit cards, car loans, and other bills. This history is everything because it helps them predict how likely you are to make your mortgage payments on time.

This single number doesn't just decide if you get a "yes" or "no"—it shapes the very terms of your loan. A stronger score usually translates to a lower interest rate, which can literally save you tens of thousands of dollars over the life of your mortgage. It’s what separates a good loan from a great one.

Beyond a Simple Pass or Fail

A lot of people think there's a single magic number you have to hit to get a mortgage. That's just not how it works. The reality is much more flexible. Different loan programs are built for borrowers with different credit histories. So, your specific score doesn’t just get you in the door; it determines which doors are open to you.

For instance, some loan options are designed to be more forgiving, while others might offer fantastic interest rates but demand a higher score. Your score essentially places you on a map, showing which paths to homeownership are available to you right now.

A higher credit score signals lower risk to lenders. This not only increases your chances of approval but also gives you more negotiating power for better loan terms and a lower annual percentage rate (APR).

Building Your Foundation for Success

The first step on this whole journey is simply understanding where you stand. Your score gives you a baseline, a starting point to plan your next moves. It helps you and your loan officer at Residential Acceptance Corporation (RAC Mortgage) figure out which loan products are the best fit for your situation.

Here’s why having that foundation is so critical:

- Sets Clear Expectations: Knowing your score helps you understand what to expect when you apply. No surprises.

- Identifies Opportunities: It immediately points you toward the mortgage programs that are a strong match for your financial profile.

- Creates a Roadmap: If your score isn’t quite where you want it to be, it gives you a clear target to aim for and a plan to get there.

Don't think of your credit score as some final judgment etched in stone. It's a living, breathing number. It shows your financial health today, but more importantly, it gives you the power to shape your homebuying future. Armed with this knowledge, you can move forward with confidence and get those keys to your new home.

Matching Your Credit Score to the Right Mortgage

Finding the right mortgage isn't a one-size-fits-all deal. Think of it like this: your credit score is the key, and each mortgage program is a unique lock. Some locks, like Conventional loans, need a very specific key—a higher credit score. Others, like FHA loans, are designed to work with a wider range of keys, offering more flexibility.

Knowing where your score stands is the first step. It instantly clarifies which loan programs you can realistically shoot for. At Residential Acceptance Corporation (RAC Mortgage), our job is to help you find that perfect match and open the door to your new home.

Conventional Loans: The Standard for Strong Credit

Conventional loans are the workhorses of the mortgage world. They aren't backed by a government agency, which means lenders are taking on more risk themselves. Because of that, they look for borrowers with a solid credit history.

To get in the door, you'll generally need a minimum credit score of 620. But the real magic happens with a higher score. Push into the 700s, and you’ll unlock much better interest rates. If your score is 740 or above, you're in the VIP section, often securing the most competitive rates available and saving a ton of money over the life of the loan.

FHA Loans: Flexible for Broader Access

FHA loans, insured by the Federal Housing Administration, are a fantastic option, especially for first-time homebuyers or anyone whose credit isn't picture-perfect. These loans were created specifically to make homeownership more accessible to more people.

The credit requirements are much more forgiving. With a credit score of 580 or higher, you could qualify for an FHA loan with a down payment as low as 3.5%. If your score is between 500 and 579, you might still get an FHA loan, but you'll likely need to bring a 10% down payment to the table. This flexibility is a game-changer for many aspiring homeowners.

VA Loans: A Benefit for Service Members

VA loans are an incredible benefit for eligible active-duty service members, veterans, and surviving spouses. These loans are backed by the U.S. Department of Veterans Affairs and come with some powerful perks, like the potential for no down payment and no private mortgage insurance (PMI).

Here's the interesting part: the VA itself doesn't actually set a minimum credit score. However, lenders like RAC Mortgage, who fund the loans, do have their own standards. Most lenders look for a minimum score of around 620. A strong credit profile will still help you land the best possible interest rate on your VA loan.

USDA Loans: Supporting Rural Homebuyers

USDA loans, which are guaranteed by the U.S. Department of Agriculture, are geared toward helping moderate-to-low-income families buy homes in designated rural and suburban areas. Just like VA loans, they offer the huge advantage of requiring no down payment at all.

For a USDA loan, lenders generally want to see a credit score of 640 or higher. A score at this level often smooths the way for streamlined processing through the USDA’s automated underwriting system. Getting your ducks in a row is crucial, and you can learn more about how to get preapproved for a mortgage to kickstart your planning.

To bring it all together, let's look at how these common loan types stack up side-by-side. This table gives you a quick snapshot of what to expect based on your credit profile.

Credit Score Guidelines for Common Mortgage Types

| Loan Type | Typical Minimum Credit Score | Best For | Key Feature |

|---|---|---|---|

| Conventional | 620+ | Borrowers with good to excellent credit and a stable financial history. | Lower interest rates for high-score applicants and no upfront mortgage insurance premium. |

| FHA | 580+ (for low down payment) | First-time homebuyers or those with lower credit scores. | Low down payment requirement and flexible credit guidelines. |

| VA | 620+ (lender-specific) | Eligible veterans, active-duty service members, and surviving spouses. | No down payment requirement and no private mortgage insurance. |

| USDA | 640+ | Borrowers with moderate to low income purchasing in eligible areas. | No down payment requirement and subsidized interest rates for some. |

Understanding these different credit score requirements is the first real step in building a clear path forward. It helps you see which loans you can aim for today and what you might need to work on to qualify for an even better deal tomorrow.

The Five Pillars of a Strong Credit Score

Your credit score isn't some arbitrary number that lenders pull out of a hat. Far from it. It's a direct reflection of your financial habits and history, all rolled into a single, powerful number. Lenders like Residential Acceptance Corporation (RAC Mortgage) look at this score to gauge how risky it might be to lend you a significant amount of money for a home.

Think of it like building a house. You need a solid foundation and strong supports to make sure it stands the test of time. These five pillars are the core components that hold up your credit score. Once you understand how each one works, you're in a much better position to build the kind of excellent credit that gets you the best mortgage terms possible.

Pillar 1: Payment History — The Concrete Foundation

This is the big one. Your payment history is the single most important factor, making up a massive 35% of your FICO score. It’s the concrete foundation of your financial house. If the foundation is weak or cracked, everything built on top of it is at risk.

Every on-time payment you make—whether for a credit card, car loan, or student loan—is like pouring another layer of steel-reinforced concrete. On the flip side, a single late payment can create a serious crack. A bill that's just 30 days late can cause a noticeable drop in your score, and the damage only gets worse the longer it goes unpaid.

Pillar 2: Credit Utilization — The Framing

Next up is credit utilization, which accounts for about 30% of your score. This simply measures how much of your available revolving credit (like credit cards) you're actually using. Think of this as the framing of your house. You want it to be sturdy and well-spaced, not creaking under too much weight.

For example, if you have a credit card with a $10,000 limit and you're carrying a $5,000 balance, your credit utilization rate is 50%. Most experts suggest keeping this number below 30%, and if you can get it under 10%, even better. A high utilization rate sends a signal to lenders that you might be relying too heavily on credit, which they see as a potential risk.

A low credit utilization rate shows that you can manage credit responsibly without maxing out your limits. It's a powerful sign of financial stability that mortgage lenders really value.

Pillar 3: Length of Credit History — The Landscaping

The length of your credit history is the third pillar, influencing about 15% of your score. Picture this as the mature trees and established garden surrounding your house. The longer you've responsibly managed credit, the more stable and appealing your financial profile looks.

This factor looks at the age of your oldest account, your newest account, and the average age of all your accounts combined. This is exactly why financial advisors often recommend keeping old, unused credit cards open, especially if they don't have an annual fee. Closing an old account can actually shorten your credit history and ding your score.

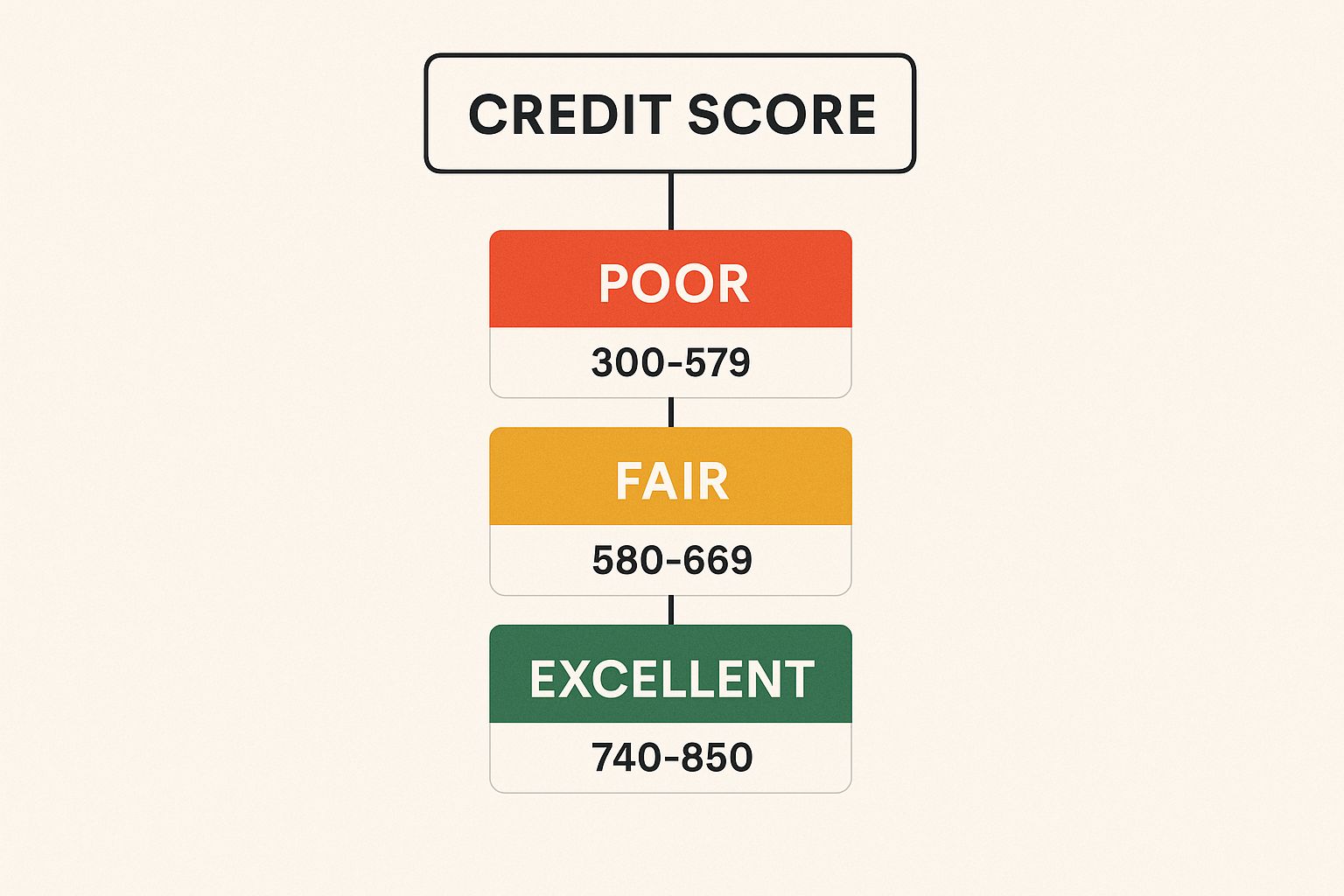

This infographic shows the typical credit score ranges that lenders use when evaluating mortgage applicants.

As you can see, jumping from one tier to the next, like from "Fair" to "Good," can make a huge difference in your mortgage options and the interest rate you'll be offered.

Pillar 4: Credit Mix — The Interior Design

Your credit mix contributes around 10% to your overall score. This is all about the variety of credit you have, such as revolving credit (credit cards) and installment loans (mortgages, auto loans, student loans). Think of it as the interior design of your house—a good mix of different elements shows sophistication and experience.

Lenders like to see that you can handle different types of debt successfully. It proves you're financially versatile. But don't go opening new accounts just to try and improve your mix! This pillar carries less weight and tends to develop naturally over your financial life.

Pillar 5: New Credit — The Fresh Paint

Finally, new credit makes up the last 10% of your score. This pillar tracks how many new accounts you've opened recently and how many "hard inquiries" have been recorded on your report. A hard inquiry happens any time a lender pulls your credit after you've applied for a new loan or credit card.

Applying for a bunch of new credit in a short time can look like a red flag, kind of like a house with too many fresh coats of paint trying to hide something. To a lender, it might suggest you're in some kind of financial trouble. Each hard inquiry can knock a few points off your score, so it’s smart to only apply for credit when you truly need it, especially in the months leading up to a mortgage application.

How to Improve Your Credit Score for a Mortgage

Knowing what goes into a credit score is one thing, but putting that knowledge into practice is where the real work begins. Boosting your credit score for a mortgage is absolutely achievable, and you can get started today. Think of this as your personal credit-building toolkit—full of practical moves to make you a much stronger borrower in the eyes of lenders like Residential Acceptance Corporation (RAC Mortgage).

We're going to focus on the strategies that deliver the most bang for your buck. Not all actions are created equal; some give you a much bigger lift than others, especially when you’re on a timeline to buy a home.

Strategy 1: Check Your Credit Reports for Errors

Before you do anything else, you need to work from a clean slate. Your very first move should be to pull your credit reports from all three major bureaus: Equifax, Experian, and TransUnion. The law entitles you to a free report from each one every year.

Go through these reports with a fine-toothed comb. According to the Consumer Financial Protection Bureau (CFPB), errors on credit reports are a surprisingly common problem. A simple clerical mistake, a debt you've already paid off showing as outstanding, or an account that isn't even yours could be dragging your score down unfairly.

If you spot an error, dispute it with the credit bureau immediately. Getting inaccuracies corrected is one of the fastest ways to see a potential jump in your score, clearing a major hurdle on your path to a mortgage.

Strategy 2: Focus on On-Time Payments

Your payment history is the undisputed heavyweight champion of credit score factors. Making every single payment on time, every time, is non-negotiable. A single payment that is 30 days late can send your score into a nosedive that takes months, if not longer, to recover from.

To make sure you never miss a due date, try these simple but incredibly effective tactics:

- Set up automatic payments for at least the minimum amount due on all your accounts.

- Create calendar alerts on your phone a few days before each bill is due.

- Use a budgeting app that sends payment reminders and keeps all your due dates in one place.

This kind of consistent, reliable behavior is exactly what lenders are looking for. It’s proof that you can handle the responsibility of a monthly mortgage payment.

Strategy 3: Lower Your Credit Utilization Ratio

Right behind payment history, the amount you owe—specifically your credit utilization—is the next biggest deal. This is simply the percentage of your available credit you're currently using. As a rule of thumb, you want to keep this ratio below 30% on all your credit cards.

For instance, if you have one credit card with a $10,000 limit, you should aim to keep your balance under $3,000. The same logic applies if you have multiple cards; it's about the total combined balance versus your total combined limit. Paying down cards with high balances is a powerful strategy to boost your score, and it can work surprisingly fast.

Strategy 4: Consider Becoming an Authorized User

If you have a trusted family member with a long history of stellar credit, asking to become an authorized user on their well-managed credit card can be a savvy move. When they add you to their account, their positive payment history and low utilization can actually be added to your credit report.

This tactic is especially helpful for those with a "thin" credit file or who are just starting out. You essentially get to "piggyback" on their good financial habits to build up your own profile. Just remember, this street goes both ways—if the primary account holder misses payments, that will show up on your report, too. For more direct advice, check out these borrower tips for repairing bad credit.

Why a Higher Score Saves You Thousands

Getting approved for a mortgage is a huge first step, but it's not where the story ends. The real power of a strong credit score truly shows itself over the long run, specifically in how much money it keeps in your wallet. A higher score isn't just about getting a lender to say "yes"—it's about locking in the best possible financial terms for what's likely the biggest purchase of your life.

Your credit score is your negotiating power, plain and simple. The higher it is, the more lenders like Residential Acceptance Corporation (RAC Mortgage) want to work with you. This translates directly into a lower annual percentage rate (APR), which is the interest you pay on your loan. Even a tiny dip in your APR can save you tens of thousands of dollars over the life of your mortgage.

The Power of a Lower Interest Rate

Let's look at a real-world scenario to see how this plays out. Imagine two different homebuyers, both wanting to finance a $300,000 home with a standard 30-year fixed-rate mortgage.

- Homebuyer A (Good Credit – 670 score): They manage to qualify for a 6.5% interest rate. This puts their monthly principal and interest payment at around $1,896. Over the full 30 years, they’ll end up paying about $382,632 in total interest.

- Homebuyer B (Excellent Credit – 760 score): With a stronger score, they secure a 5.5% interest rate. Their monthly principal and interest payment is about $1,703. Over the same 30 years, their total interest paid comes out to around $313,184.

By having an excellent credit score, Homebuyer B saves $193 every single month. But here's the kicker: over the entire loan term, they will save an incredible $69,448 just in interest payments. That's money that could go toward retirement, college funds, or anything else.

Dodging Private Mortgage Insurance (PMI)

There's another massive financial perk to having a higher credit score: its effect on Private Mortgage Insurance (PMI). PMI is an insurance policy that protects the lender if you stop making payments, and it's usually required on conventional loans when your down payment is less than 20%.

A stronger credit profile can mean much lower PMI premiums. In some situations, an excellent score can even help you qualify for loan programs with reduced or no PMI at all, even without a hefty down payment. When you combine a great score with other tools, like those we cover in our guide to down payment assistance programs, your mortgage can become dramatically more affordable right out of the gate.

This isn't just a local phenomenon; credit scores are a critical factor for borrowers everywhere. For instance, recent market shifts showed a significant year-over-year jump in mortgage refinances after an interest rate cut, with investors making up a large part of that activity. This just goes to show how a strong credit profile empowers borrowers to act quickly when financial conditions turn in their favor.

Navigating the Current Mortgage Market

It's no secret that the economy and the mortgage industry are tied at the hip. When the economy shifts, it has a direct ripple effect on everything from interest rates to how carefully lenders scrutinize a home loan application. Getting a handle on these market conditions is key—it helps you show up as the low-risk, highly qualified applicant every lender wants to see.

In a climate of fluctuating interest rates and economic question marks, one thing becomes your most powerful tool: a strong credit score. It's the stabilizing force that gives lenders like Residential Acceptance Corporation (RAC Mortgage) the confidence they need to say "yes" and offer you great terms.

Why Your Credit Score Is More Critical Than Ever

When things feel unpredictable, lenders naturally get a bit more cautious. It's just smart business. They put a much bigger emphasis on a borrower's proven track record of managing debt responsibly. Your credit history is that track record—it’s the proof in the pudding. It's not just about hitting some minimum number; it's about painting a picture of financial stability.

A solid credit profile tells a lender that you're a reliable bet, even when the bigger economic picture is a little shaky. This is exactly why putting in the work to build and protect your credit is the single best thing you can do to prepare for buying a home, no matter what the market is doing.

Think of a high credit score as your financial anchor in a sea of economic change. It demonstrates to lenders that you're prepared and financially sound, which can unlock better loan options and more competitive interest rates, regardless of market conditions.

Current Trends and What They Mean for You

Recent data really drives home just how vital a good credit score for a mortgage is right now. According to a report from TransUnion, even with borrowing costs staying up there, the demand for mortgages is actually showing sustained growth. Projections show mortgage originations could jump from 4.6 million in 2024 to 5.7 million in 2025—that's a year-over-year pop of over 23%. This proves that despite some economic headwinds, people are still determined to buy homes. You can dig into the specifics by checking out the insights from TransUnion's industry report.

What this upward trend really means is that while lenders are definitely open for business, they are sticking to their guns on prudent underwriting and solid credit standards. They have to manage their risk carefully, and your credit score is their number one tool for the job.

How to Position Yourself for Success

In this market, being prepared is your biggest advantage. The team here at Residential Acceptance Corporation (RAC Mortgage) specializes in helping clients navigate these dynamics, making sure they’re set up for a win.

Here are a few key moves you can make:

- Keep a Close Eye on Your Credit: Stay on top of your credit report and score in the months before you apply. No surprises.

- Make Debt Reduction a Priority: Zero in on paying down those high-balance credit cards. This will do wonders for your credit utilization ratio.

- Show Stable Employment: Lenders love to see a consistent income and job history. It screams stability.

- Build Up Your Savings: Having an extra cushion for closing costs and those inevitable post-move expenses shows you're financially ready.

By understanding the lay of the land and the super-sized importance of your credit score, you can walk into the mortgage process with real confidence. A strong credit history isn't just a number—it's your ticket to getting the keys to your new home, even when the economic landscape looks a little complicated.

Your Top Mortgage Credit Score Questions, Answered

When you're gearing up to buy a home, questions about credit scores seem to pop up everywhere. It's easy to feel like you're drowning in a sea of confusing rules and numbers, but getting clear answers is the first step to feeling confident and ready.

Let's tackle some of the most common credit questions we hear from homebuyers. For advice tailored to your unique situation, the experts at Residential Acceptance Corporation (RAC Mortgage) are always here to help.

Can I Get a Mortgage with a Collection on My Credit Report?

The short answer is yes, you absolutely can. It’s a common myth that a single collection account is an automatic deal-breaker. Lenders like RAC Mortgage look at your whole financial story, not just one negative mark.

Here's what underwriters really care about:

- Age and Amount: An old, small collection from years ago is a lot less concerning than a large, recent one.

- Paid vs. Unpaid: Taking care of the debt and getting it marked as "paid" shows responsibility. It looks much better to an underwriter.

- Your Overall Profile: If the rest of your credit report shows a solid history of on-time payments, that strength can easily outweigh the blemish of a collection.

The best move is always to chat with a loan officer. We can dig into the specifics and show you what’s possible.

How Long Does It Take to Improve a Credit Score for a Mortgage?

This really depends on what needs fixing. The timeline for boosting your credit score can vary a lot—some fixes are quick wins, while others are more of a long game.

For instance, if you pay down a big credit card balance, you could see your score jump in as little as 30 to 45 days. That's how long it typically takes for the card company to report your new, lower balance to the credit bureaus. Getting an error removed from your report can also give you a pretty fast bump.

On the other hand, building a long-term track record of positive payments or bouncing back from bigger financial hurdles can take several months, or even a year. That's why the best strategy is always to start working on your credit as early as you can.

How Much Does a 20-Point Credit Score Increase Help?

A 20-point bump might not sound like much, but in the mortgage world, it can be a game-changer. Those points can create a powerful ripple effect that impacts your loan options and how much you pay.

Think of it this way: a seemingly small jump could be all it takes to push you from a "fair" credit tier into a "good" one. That move alone could unlock a lower interest rate, which can save you thousands—sometimes tens of thousands—of dollars over the 30-year life of your loan. It could also mean qualifying for a better loan program or putting less money down. When it comes to your credit score for a mortgage, every single point counts.

Ready to take the next step toward homeownership? The experienced team at Residential Acceptance Corporation is here to answer all your questions and guide you through the process. Get in touch with us today to find the right mortgage for your future.