When you're trying to get a conventional loan, your credit score is the star of the show. Lenders have a magic number they look for, and for most conventional mortgages, that number is 620.

Think of this score as your financial handshake. It’s the first thing a lender sees, giving them a quick snapshot of how you’ve handled debt in the past.

What Credit Score Unlocks a Conventional Loan

That three-digit number is far more than just a number—it’s the main tool lenders use to figure out how risky it is to lend you a large sum of money. It’s basically a grade on your financial report card, summing up how you've done with paying bills on time. Hitting 620 gets your foot in the door, but it's really just the starting line.

Getting to that minimum is the first hurdle, but the higher you can push your score, the better off you'll be. Lenders love to see financial responsibility, and they reward it with better terms. A strong credit profile can literally save you thousands of dollars over the life of your loan. For a deeper look at this, check out our guide on the ideal credit score for a mortgage.

How Lenders View Different Credit Score Tiers

Lenders don't just see a single number; they group scores into different tiers to quickly assess a borrower's risk level. That 620 minimum for a conventional loan is the standard set by the big players, Fannie Mae and Freddie Mac. This score usually lands you in the "fair" credit category, which is often just enough to get approved.

However, once you get your score up to 670 or higher, you’re generally considered to have "good" credit. That’s when you start unlocking better loan terms and, most importantly, lower interest rates.

A higher credit score doesn’t just boost your approval odds—it directly impacts how much you can borrow and what your home will truly cost you in the long run. It’s one of the single most powerful factors in your mortgage application.

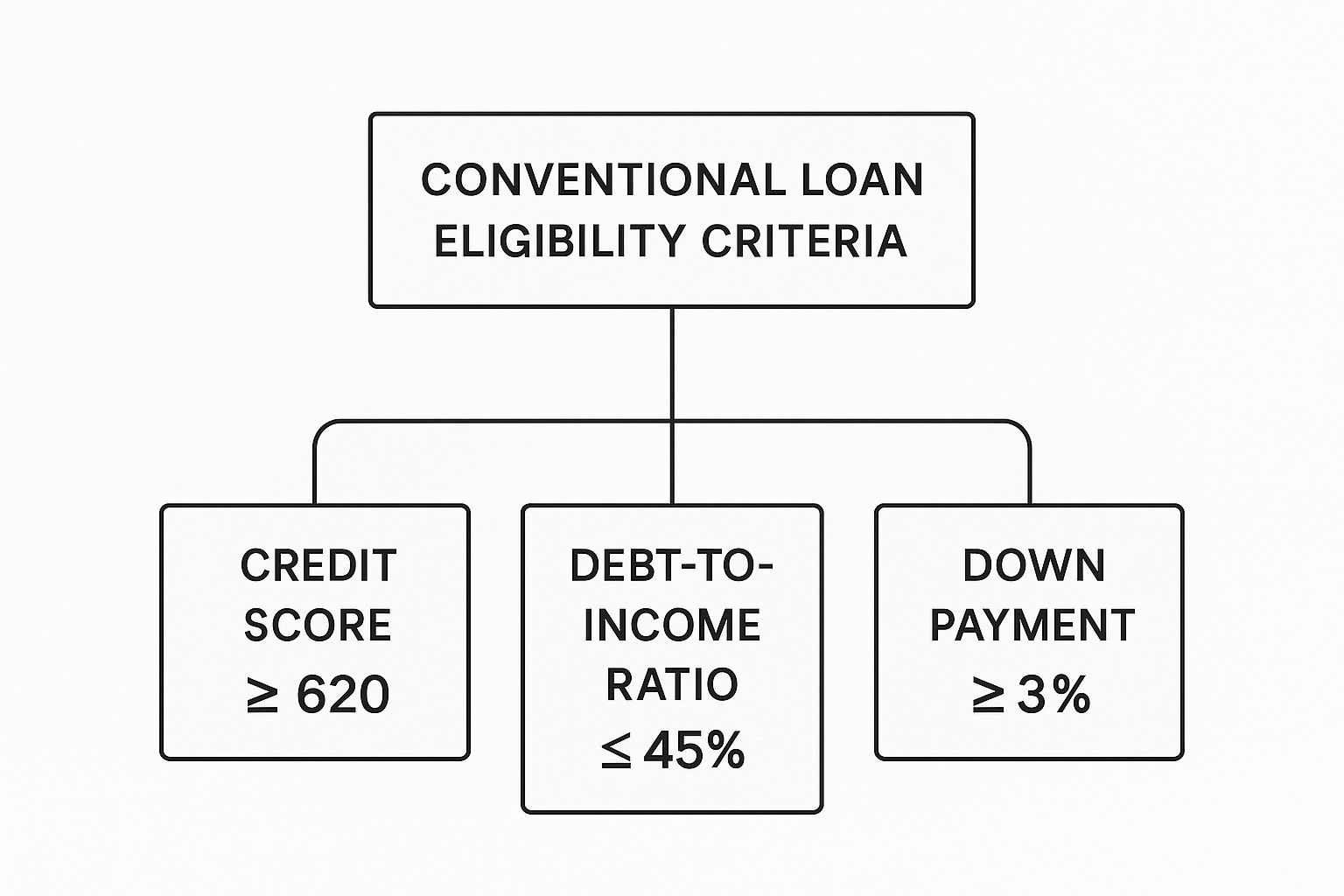

This infographic lays out the key pieces a lender looks at for a conventional loan.

As you can see, hitting that minimum credit score is a big deal, but it works alongside other critical factors like your debt-to-income ratio and how much you have for a down payment.

To make it clearer, here’s how lenders generally categorize FICO scores and what each level means for your conventional loan prospects.

Credit Score Ranges and Conventional Loan Implications

| Credit Score Range | Credit Tier | Typical Loan Eligibility |

|---|---|---|

| 800 – 850 | Exceptional | Best chance of approval with the lowest interest rates and most favorable terms. |

| 740 – 799 | Very Good | Strong likelihood of approval with very competitive interest rates. |

| 670 – 739 | Good | Generally considered a solid candidate for conventional loans. Good interest rates. |

| 620 – 669 | Fair | Meets the minimum threshold for eligibility, but may face higher interest rates or fees. |

| Below 620 | Needs Improvement | Unlikely to qualify for a conventional loan. May need to explore other loan types. |

Understanding where you fall on this chart is the first step toward getting mortgage-ready. If your score isn't where it needs to be, don't worry—there are always steps you can take to improve it.

How Lenders See More Than Just a Number

Think of your credit score as the cover of a book. It gives you a quick first impression, but it doesn't tell the whole story. Lenders like us at Residential Acceptance Corporation (RAC Mortgage) always flip through the pages before making a decision. That three-digit number is just the beginning; the real substance is in the details of your credit report.

When you apply for a mortgage, we pull your reports from all three major bureaus—Experian, Equifax, and TransUnion. We don't just grab the highest or lowest number. Instead, we typically use the middle score of the three for your application. This gives us a balanced, fair look at your credit profile, so a single reporting error doesn't throw everything off track.

Breaking Down Your Credit Profile

Your credit report is basically a financial biography, detailing how you've handled debt over the years. We look closely at this history to see patterns of responsible behavior. It's less about a single number and more about the habits that built it.

Here are the key chapters lenders read:

- Payment History: This is the big one, making up about 35% of your FICO score. A solid track record of on-time payments is the best sign that you'll pay your mortgage on time, too. Simple as that.

- Credit Utilization: This is just a fancy term for how much of your available credit you're using. If you keep your balances below 30% of your limits, it shows lenders you aren't overextended and can manage your money well.

- Length of Credit History: Time is on your side. A longer history of well-managed accounts shows stability and experience, which can give your score a nice boost.

Why Your Day-to-Day Financial Habits Matter

Beyond those core factors, we also look at the types of credit you have (like credit cards, car loans, and student loans) and whether you've been applying for a lot of new credit recently. A healthy mix of different credit types managed over a long period paints a picture of a borrower who is a safe bet.

Your credit score isn't some random number pulled out of thin air; it’s a direct reflection of your financial habits. Every bill paid on time, every balance you pay down, and every account you keep in good standing helps build a stronger case for your mortgage approval.

For example, a late payment from last year will carry more weight than one from five years ago. Lenders are most interested in your recent behavior because it’s the best predictor of what you'll do in the future. The team here at Residential Acceptance Corporation (RAC Mortgage) takes the time to look at the whole picture, helping you find the absolute best loan options for your situation.

How Your Credit Score Impacts Your Wallet

Your credit score is way more than just a three-digit number that gets you approved for a loan. It’s a powerful financial lever that directly affects your monthly budget and long-term wealth. Think of it this way: a higher score doesn't just get you a "yes," it gets you a "yes" with a much better deal.

This is where your financial habits truly pay off. A better score unlocks lower interest rates, which means smaller monthly payments and massive savings over the life of your mortgage.

The gap between a "fair" score and a "very good" one can be eye-opening. A single percentage point on your interest rate might not sound like much, but when you spread that over a 30-year loan, we’re talking about tens of thousands of dollars.

The Real Cost of Interest Rates

Let's put this into real-world terms.

Imagine two different homebuyers are both trying to get the same $300,000 conventional loan. One has a 640 credit score, and the other has a 740. Their financial futures are about to look very different.

A lender sees the 740 score as a sign of a reliable, low-risk borrower, so they'll reward them with a great interest rate. The person with the 640 score, while they might still qualify, is seen as a slightly higher risk and will get a higher rate to match.

Let's look at how this difference plays out in their monthly payments and total interest paid.

Credit Score vs. Monthly Payment A Hypothetical Example

Here's a breakdown based on that hypothetical $300,000 loan.

| Credit Score | Example Interest Rate | Monthly Principal & Interest | Total Interest Paid Over 30 Years |

|---|---|---|---|

| 740 | 6.5% | $1,896 | $382,633 |

| 640 | 7.5% | $2,098 | $455,148 |

Look at those numbers. The borrower with the higher credit score saves $202 every single month. Over 30 years, that adds up to a staggering $72,515 in savings. That's money that could go toward college funds, retirement, or a dream vacation—not just interest payments.

The Hidden Costs of Lower Credit Scores

It doesn't stop with the interest rate. Your credit score also has a major impact on Private Mortgage Insurance (PMI).

If you put down less than 20% on a conventional loan, you have to pay PMI. This is an insurance policy that protects the lender, not you, and the premium gets tacked right onto your monthly mortgage payment.

Just like with your interest rate, a higher credit score can lead to a lower PMI premium. Lenders view you as less of a risk, which reduces the cost of insuring your loan.

This is another huge reason to work on your credit before you start shopping for a home. Getting your financial house in order is a critical first step. Before you even look at listings, understanding how to get preapproved for a mortgage will give you a clear picture of what you can actually afford and show you where you can improve. Taking this step with Residential Acceptance Corporation (RAC Mortgage) can save you a ton of money and stress, setting you up for a much better home-buying experience.

The Other Pieces of the Mortgage Puzzle

While your credit score is definitely the star player on your mortgage application, it isn’t playing the game alone. Lenders like Residential Acceptance Corporation (RAC Mortgage) look at your whole financial situation to make a decision. Think of it like a puzzle—your credit score is a huge piece, but you need all the other pieces to form the complete picture.

Understanding these other conventional loan requirements gives you a massive advantage. It helps you see your application the way a lender does and lets you spot any weak areas before you even apply. These factors all work together to prove you’re ready for homeownership.

Your Down Payment Contribution

Your down payment is simply the part of the home's price you pay upfront. It's your skin in the game, your initial investment, and it directly affects your loan amount and how much you'll pay each month. For years, the gold standard for a conventional loan has been a 20% down payment.

Putting down 20% is great because it means you get to dodge Private Mortgage Insurance (PMI), which can save you a pretty penny every month. But let’s be real—many homebuyers don't have that kind of cash saved up, and that’s perfectly okay.

The idea that you absolutely must have 20% down is one of the biggest myths in real estate. Many conventional loan programs are built specifically for first-time buyers and allow for much smaller down payments.

At Residential Acceptance Corporation (RAC Mortgage), we have conventional loan options that require as little as 3% down. This kind of flexibility makes owning a home a reality for so many more people, especially those with good income and credit who just haven't had a decade to build up a huge savings account.

Your Debt-to-Income Ratio

Your Debt-to-Income (DTI) ratio is another critical piece of this puzzle. It’s a straightforward calculation that compares your total monthly debt payments to your gross monthly income (what you make before taxes). This number gives lenders a quick snapshot of your ability to handle a new mortgage payment on top of everything else you owe.

Here’s the breakdown:

- Add Up Your Debts: Tally up all your monthly debt payments. This includes car loans, student loans, minimum credit card payments, and any personal loans.

- Divide by Your Income: Take that total and divide it by your gross monthly income.

- That's Your Ratio: The result, as a percentage, is your DTI ratio.

For example, if your monthly debts come out to $2,000 and your gross monthly income is $6,000, your DTI is around 33%. For the most part, lenders like to see a DTI ratio no higher than 43% for conventional loans, though there can be some wiggle room depending on the rest of your financial profile.

Stable Employment History

Finally, lenders need to see that you have a steady, reliable source of income to actually make your mortgage payments. A stable employment history, which usually means about two years in the same job or at least the same field, gives them confidence in your financial future.

It shows that your income isn't a fluke and is likely to continue. It's normal to change jobs, of course, but lenders will be looking for a logical career path, not a history of frequent and unexplained gaps in your employment.

Actionable Steps to Boost Your Mortgage Readiness

That gut-sinking feeling when you see a lower-than-ideal credit score? We’ve all been there. But here’s the thing: it’s not a permanent roadblock.

Think of your credit score less like a final grade carved in stone and more like a live snapshot of your financial health. And you’re the one holding the camera. Improving your mortgage readiness is all about taking deliberate, consistent action.

With a focused game plan, you can strengthen your financial profile and put yourself in a much better position to meet conventional loan requirements. Many of the most effective strategies are surprisingly straightforward and can show results faster than you might think.

Start With a Credit Report Checkup

Before you can fix anything, you have to know what you’re working with. Your first move is to pull your credit reports from all three major bureaus: Experian, Equifax, and TransUnion. You’re entitled to free copies every year, so take advantage of it.

Go through each report, line by line. You’re playing detective, looking for any inaccuracies—accounts that aren’t yours, payments marked late that were actually on time, or incorrect balances. A 2021 study from Consumer Reports found that over a third of volunteers found at least one error on their reports. Disputing these mistakes isn’t just your right; it can give your score a significant, and sometimes immediate, boost.

Tackle High-Balance Credit Cards

One of the biggest levers you can pull to influence your credit score is your credit utilization ratio. In simple terms, it’s the percentage of your available credit that you're currently using. Lenders really like to see this number stay below 30%. If your cards are maxed out, it looks like you're under financial strain.

A quick way to improve your score is to pay down credit card balances, especially those closest to their limits. This single action lowers your utilization ratio and demonstrates to lenders that you can manage debt responsibly without being overextended.

For example, say you have a card with a $5,000 limit and a $4,500 balance. That’s a sky-high 90% utilization. But if you pay that down to $1,500, your utilization drops to a much healthier 30%. Credit scoring models love to see that kind of change.

Reinforce Positive Payment Habits

This is the big one. Your payment history is the single most important piece of your credit score puzzle, making up about 35% of the FICO model. The most powerful thing you can do for your credit is beautifully simple: pay every single bill on time, every time.

- Set Up Autopay: Automate at least the minimum payments for all your accounts. It’s the easiest way to guarantee you never miss a due date.

- Create Reminders: If you don’t like autopay, use your phone’s calendar or a reminder app to keep track of payment deadlines.

- Focus on Consistency: Even a single late payment can ding your score. Making on-time payments a non-negotiable habit is the key to building a rock-solid credit profile.

Finally, as you get ready to apply for a mortgage, pump the brakes on opening any new lines of credit. Each new application triggers a hard inquiry, which can cause a temporary dip in your score. Plus, lenders get nervous when they see a borrower taking on new debt right before asking for a huge loan.

For more in-depth strategies, our team at Residential Acceptance Corporation (RAC Mortgage) put together a detailed guide on how to improve your credit score for a mortgage. By focusing on these steps, you can walk into a lender's office with your best financial foot forward.

Start Your Homeownership Journey with Confidence

Trying to figure out conventional loan requirements can feel overwhelming, but you don't have to go it alone. We've shown that getting a handle on the 620 credit score minimum, what a higher score can do for you, and the rest of your financial picture is the critical first step. The next is finding an expert who can walk you through the rest.

At Residential Acceptance Corporation (RAC Mortgage), we specialize in helping aspiring homeowners make sense of all their options. We know the details behind the conventional loan requirements credit score and can translate that industry-speak into a clear, simple plan just for you.

Your dream of owning a home is closer than you think. The right guidance can turn a confusing process into a confident journey toward getting the keys in your hand.

Whether your credit is in great shape or you're working to get it there, our team is ready to sit down and create a personalized plan. We can build a clear roadmap to get you from where you are today into your new home. Don't let uncertainty stand in your way.

The whole journey starts with a simple conversation. Reach out to the team at Residential Acceptance Corporation (RAC Mortgage) today and take that first confident step toward your new front door. We're ready to help you succeed.

Got Questions? We've Got Answers.

When you're diving into the world of conventional loans, a lot of questions pop up. It's completely normal. We've put together some of the most common ones we hear to give you straight-up, clear answers and help you get a better handle on how your credit score plays into the whole process.

What's The Absolute Rock-Bottom Credit Score For A Conventional Loan?

The industry-standard, bare-minimum credit score for a conventional loan is 620. This isn't just a random number; it's the benchmark set by the big players, Fannie Mae and Freddie Mac, who back most of these mortgages. If your score is dipping below that 620 mark, getting approved is going to be a tough uphill battle.

So, A 620 Score Means I'm Automatically Approved, Right?

Not quite. Hitting that 620 minimum is a crucial first step—it gets your foot in the door—but it's not a golden ticket. Lenders are looking at your entire financial picture, not just one number.

Think of the 620 score as the key that starts the engine. The car won't go anywhere if you don't have gas in the tank. You still need to prove you have a steady income, a manageable amount of debt, and the cash for a down payment.

How Much Do Rates Really Improve With A Higher Credit Score?

The difference is huge. We're talking about a real impact on your wallet. A borrower with a solid score in the mid-700s could easily snag an interest rate that's a full percentage point lower than someone hovering in the low 600s.

That might not sound like much, but over the life of a 30-year mortgage, it can add up to tens of thousands of dollars in savings. It's a massive difference.

Can I Get A Conventional Loan If I've Had A Recent Bankruptcy?

It's definitely possible, but it takes time. Lenders need to see that you're back on solid financial ground, so there are mandatory waiting periods.

Typically, you'll have to wait at least four years after a Chapter 7 bankruptcy is discharged. For a Chapter 13, it's generally a two-year wait after the discharge. During that waiting period, your main job is to focus on rebuilding a positive credit history to show lenders you're a reliable borrower again.

Ready to stop guessing and start planning? The expert team at Residential Acceptance Corporation can look at your specific situation and map out a clear path to homeownership. We're here to guide you every step of the way. Start your homeownership journey with us today!