Let's get one of the biggest home-buying myths out of the way right now: you absolutely do not need a 20% down payment for a conventional loan.

It’s an idea that’s been passed down for generations, but the reality is much more flexible. For qualified first-time homebuyers, the actual down payment requirement can be as low as 3%. That 20% figure is a powerful benchmark, but it's far from the only path to homeownership.

Debunking the 20% Down Payment Myth

For decades, the idea of needing a 20% down payment has felt like an unbreakable rule, scaring off countless aspiring homeowners. You hear it from family, friends, and all over the internet, but it simply doesn't tell the whole story. Think of it more as a financial goalpost than a hard-and-fast requirement.

So, why is 20% the number everyone talks about? It's the magic number to avoid an extra monthly cost called Private Mortgage Insurance (PMI). PMI is a policy that protects the lender—not you—in case you default on the loan. While avoiding PMI is a fantastic long-term financial goal, it is not a prerequisite for getting a loan and buying a house.

What’s a More Realistic Down Payment?

The truth is, conventional loan down payment requirements are far more accommodating than you might think. For most first-time homebuyers in the U.S., the average down payment actually lands somewhere between 8% and 13%. Even better, there are fantastic loan programs that allow for as little as 3% to 5% down. You can find more insights on down payment statistics and lender risk management to see how common smaller down payments are.

For a quick reference, here are some typical minimums you can expect for conventional loans.

Minimum Conventional Down Payment at a Glance

This table gives you a quick summary of the typical minimum down payment percentages you'll see for different conventional loan scenarios.

| Property Type | Typical Minimum Down Payment | Notes |

|---|---|---|

| Primary Residence (First-Time Buyer) | 3% | Specific programs are designed for this. |

| Primary Residence (Repeat Buyer) | 5% | This is the standard minimum for most repeat buyers. |

| Second Home | 10% | Vacation homes typically require a slightly larger down payment. |

| Investment Property | 15% – 20% | Lenders see this as higher risk, so the down payment is higher. |

Remember, these are just the minimums. Putting down more can help lower your monthly payment and avoid PMI sooner, but it's not a barrier to entry.

The path to homeownership is more accessible than you might think. With the right guidance, a smaller down payment can be a strategic first step toward building equity and achieving your financial goals.

At Residential Acceptance Corporation (RAC Mortgage), our team specializes in navigating these flexible options. We help you understand the real requirements and connect you with loan programs that actually fit your financial situation. Our mission is to show you that your dream home is attainable—often with far less cash upfront than you've been led to believe.

Why the 20 Percent Down Payment Myth Exists

So if a conventional loan down payment doesn't automatically require 20%, where did this persistent myth come from? The whole idea is wrapped up in a concept lenders use to manage their risk: Private Mortgage Insurance, better known as PMI.

Think of PMI not as a penalty, but as the lender’s safety net. When you put down less than 20% on a house, the lender is shouldering a bit more risk. PMI is simply an insurance policy that protects them in case a borrower can't keep up with their payments.

This insurance is actually what makes homeownership possible for so many more people. It gives lenders the confidence to approve loans for folks who haven't saved up a massive down payment, bridging the gap between the old 20% benchmark and what today's buyers can realistically afford.

How Private Mortgage Insurance Works

PMI is typically calculated as a small percentage of your loan amount and tacked onto your monthly mortgage payment. The exact cost will depend on a few things, like the size of your loan, how much you put down, and your credit score.

A stronger credit score, for example, usually gets you a lower PMI rate because it tells the lender you're a less risky borrower. It’s just one more reason why getting a handle on your credit is a huge part of the home-buying journey. You can learn more about how your finances affect your loan options by checking out our guide on conventional loan requirements and credit scores.

The most important thing to remember is that PMI isn't forever. It's a temporary cost that you can get rid of once you've built up enough equity in your home.

"PMI is a tool that opens the door to homeownership sooner. With a clear strategy, it becomes a temporary bridge to building long-term wealth, not a permanent financial burden."

The Path to Removing PMI

The best part about PMI? It has an expiration date. Once you hit 20% equity in your home—either by paying down your mortgage or because your home's value has gone up—you can officially ask your lender to cancel it.

In fact, lenders are required by law to automatically drop PMI once your loan-to-value (LTV) ratio hits 78% of the original purchase price. This gives every borrower a clear finish line to work toward.

Putting less money down doesn't have to be a long-term financial trap. With a knowledgeable partner like Residential Acceptance Corporation (RAC Mortgage), it can be a smart, strategic move. Our experts will help you map out a clear path to that 20% equity milestone, turning your initial investment into a powerful foundation for your financial future.

How Lenders Determine Your Down Payment Options

When you apply for a mortgage, your conventional loan down payment requirement isn't some arbitrary number pulled out of thin air. At Residential Acceptance Corporation (RAC Mortgage), we look at your entire financial picture to figure out which options are the best—and most sustainable—fit for you.

Think of it like putting together a financial puzzle. Lenders need to see how all the pieces of your history fit together to understand your reliability as a borrower. A few key factors tell almost the entire story.

Getting a handle on these elements helps you see your application from our perspective. It takes the mystery out of the approval process and puts you in the driver's seat as you prepare for one of life's biggest purchases.

Your Credit Score Is the Key

Your credit score is probably the most important piece of the puzzle. It’s essentially your financial report card, giving lenders a quick summary of how you’ve managed debt in the past. A higher score is a clear signal that you have a solid track record of paying your bills on time.

This history of reliability is what unlocks the best loan programs, especially those with the lowest conventional loan down payment requirement. For instance, if you're aiming for a conventional loan that only requires 3% down, having a strong credit score isn't just helpful—it's essential.

Recent data backs this up. Lenders are frequently working with borrowers who have great credit. In fact, nearly 79% of recent mortgages went to buyers with super-prime credit scores (above 720), showing just how many doors a solid credit history can open. You can dig deeper into the U.S. mortgage market and borrower trends to see the whole picture.

Understanding Your Debt-to-Income Ratio

Next up is your Debt-to-Income (DTI) ratio. It sounds technical, but it’s really just a simple check to see how much of your monthly income is already spoken for by existing debts.

To get this number, we add up all your monthly debt payments—things like car loans, student loans, and credit card bills—and divide that total by your gross monthly income. A lower DTI ratio tells us you have plenty of room in your budget to comfortably take on a new mortgage payment.

Your DTI ratio isn't just a number; it's a measure of your financial breathing room. A lower ratio gives lenders confidence that you can manage homeownership without stretching your budget too thin.

How Property Type Influences Your Options

Finally, the type of property you’re buying plays a huge role. Lenders see different properties as having different levels of risk, and that risk level directly impacts your down payment.

- Primary Residence: This is the home you’ll be living in day-to-day. Since you have every reason to keep up with payments, these loans are seen as the least risky and qualify for the lowest down payment options.

- Second Home: This might be a vacation home you use from time to time. These are a bit riskier for lenders, so they typically require a larger down payment, often starting at 10%.

- Investment Property: A home you plan to rent out is treated as a business venture. Lenders see this as a higher-risk loan, which is why the down payment requirement usually starts at 15% to 20% or even more.

By looking at these three core areas—your credit, DTI, and the property type—the team at RAC Mortgage can pinpoint the best conventional loan products for your unique situation.

Finding Your Low Down Payment Conventional Loan

Ready for some good news? That dream of owning your own home is a lot closer than you might think. Thanks to some powerful conventional loan programs, you don't need a massive savings account to get your foot in the door.

These programs were built specifically to help qualified buyers get into a home without needing a huge pile of cash upfront. The experts here at Residential Acceptance Corporation (RAC Mortgage) live and breathe this stuff—we specialize in matching aspiring homeowners like you with the perfect loan for your unique financial picture.

Spotlight on Low Down Payment Programs

Some of the best programs out there help back a huge chunk of the mortgage market. These options are absolute game-changers for many buyers.

What do they do? They open the door to a conventional loan down payment requirement of just 3%. That's a huge drop from the standard 5% minimum and light-years away from that old 20% myth that scares so many people off.

Think about it: a 3% down payment on a $300,000 home is just $9,000. Compare that to the $60,000 you'd need for a 20% down payment. That difference can make homeownership possible years sooner for many families.

Who Qualifies for These Options

So, what does it take to get one of these low down payment loans? Lenders are mainly looking at your financial profile to make sure the loan is a sustainable and comfortable fit for you long-term.

A few common requirements include:

- Income Limits: A lot of these programs are geared toward helping low-to-moderate-income borrowers. The exact income caps will usually depend on where you live.

- First-Time Homebuyer Status: While it's not always a deal-breaker, being a first-time buyer can open up certain benefits and helpful educational resources.

- Creditworthiness: A solid credit score is still key. It shows you're a reliable borrower and is your ticket to getting the best possible interest rate on your loan.

But these aren't the only ways to get in the door. Standard 97% LTV (Loan-to-Value) options also exist, giving you another path to a conventional loan with only 3% down. The trick is finding the right fit, which is exactly where getting professional guidance can save you time and stress.

Many homebuyers also combine these loans with other forms of financial aid. You can learn more about these opportunities by exploring our guide on down payment assistance programs.

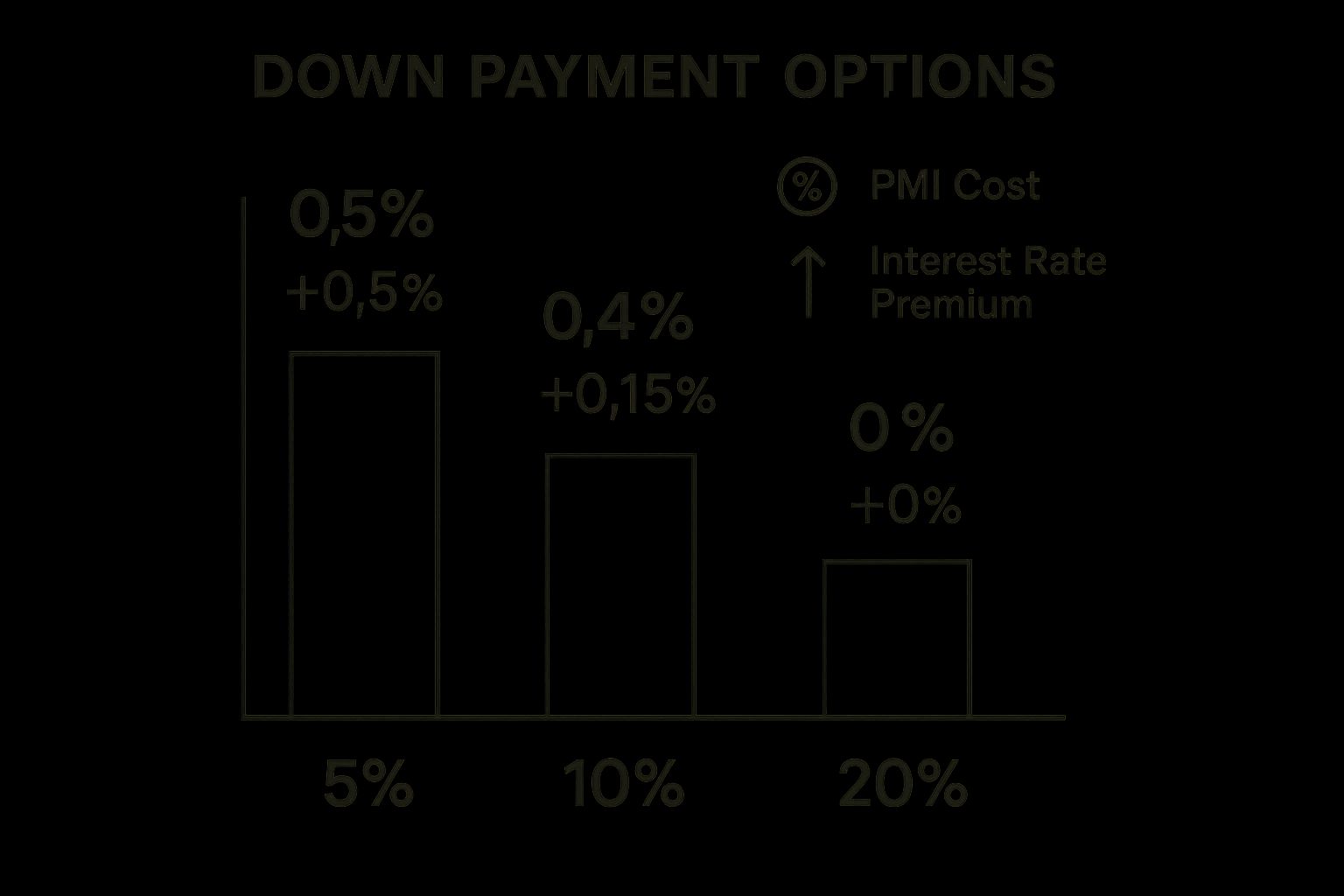

This infographic really helps visualize how different down payment amounts can impact your mortgage costs over time.

As you can see, a larger down payment doesn't just lower your monthly payment. It can also reduce or even get rid of PMI entirely, saving you a ton of money both every month and over the life of your loan.

Smart Strategies to Fund Your Down Payment

Saving up for a down payment is the classic approach, and it’s a great one. But it's not the only way to get the cash you need. A few clever, lender-approved strategies can help you hit that conventional loan down payment requirement way faster than you might think.

One of the most common ways people get a boost is with a little help from family. Many parents or relatives are happy to help the next generation get into a home of their own. Lenders are totally fine with you using gift money for your down payment and closing costs.

It’s not some complicated legal maneuver, either. Usually, all you need is a simple gift letter. This is just a signed document from the person giving you the money, stating that it's a genuine gift and not a sneaky loan they expect you to repay. This piece of paper gives your lender the clear proof they need that the funds are yours, free and clear.

Tapping into Assistance Programs

Beyond your own savings and family gifts, there's another powerful tool a lot of buyers overlook: Down Payment Assistance (DPA). These programs exist for one reason—to help people get over the hurdle of upfront home buying costs. They can make a huge difference.

DPA programs are usually run by state or local housing authorities and they come in a few different flavors:

- Grants: This is the best kind of money—the free kind you never have to pay back.

- Forgivable Loans: Think of this as a loan that disappears over time. As long as you live in the home for a certain number of years, the loan is completely forgiven.

- Second Mortgages: These are extra loans, often with very low or even no interest. Payments are often deferred, so you don't have to worry about them right away.

The whole point of DPA is to open the door to homeownership for more people. You can often stack these programs with a low down payment conventional loan, which could potentially cover most, or even all, of your upfront cash needs.

Figuring out which programs you qualify for can feel like a maze, but that's where we come in. The loan officers at Residential Acceptance Corporation (RAC Mortgage) have been down this road many times. We know the local DPA landscape and can help you find the programs that fit your situation and walk you through the entire process.

When you explore every avenue, you create a real, actionable plan to buy your home. With the right strategy and a little support, meeting your conventional loan down payment requirement becomes much less intimidating, putting that dream of owning a home squarely within your reach.

Budgeting for Costs Beyond the Down Payment

Getting financially ready for homeownership means looking at the whole picture, not just the number you’ve saved for a down payment. While hitting your conventional loan down payment requirement is a massive milestone, you have to account for the other upfront expenses you’ll face on closing day.

These are called closing costs, and they cover all the fees paid to the different professionals who help finalize your purchase. Think of it this way: your down payment is your investment in the house itself, while closing costs are the service fees for making it all official. These costs usually run between 2% to 5% of the home's sale price.

What Do Closing Costs Include?

This isn't one single bill but a bunch of different charges rolled together. Getting familiar with them now means you can have a confident, no-surprises conversation with your RAC Mortgage loan officer down the road.

Some of the most common closing costs you'll see are:

- Lender Fees: These cover the administrative work of creating and processing your loan, like application and underwriting fees.

- Appraisal Fee: A third-party appraiser has to confirm the home's value to make sure it's a sound investment for both you and the lender.

- Title Insurance: This is a crucial protection for you and the lender against any future ownership claims on the property.

- Prepaid Expenses: You’ll often prepay a few months of property taxes and homeowner's insurance to get your escrow account started.

While the final number can vary, recent data shows American homebuyers are putting serious skin in the game. The average down payment for a conventional loan recently climbed to 14.4% of the purchase price, with the median amount hitting a record $30,250. You can discover more insights about down payment trends to see how you stack up.

Budgeting for these extra expenses is non-negotiable for a smooth home-buying journey. Before you get too deep in the process, it’s a smart move to get a crystal-clear idea of your overall financial picture. A great place to start is this guide on how to determine how much house you can truly afford.

When you have a solid budget that accounts for both the down payment and the closing costs, you’re on a much less stressful path to getting those keys in your hand.

Your Down Payment Questions Answered

We get it. Navigating the world of home loans can feel like learning a new language. Let’s clear up some of the most common questions about conventional loan down payments so you can move forward with total confidence.

Can I Get a Conventional Loan with Less Than 3 Percent Down?

In the world of conventional loans, 3% down is pretty much the floor. You'll typically see this option tied to specific programs designed to help creditworthy buyers who fall within certain income limits.

For most standard conventional loans, lenders are really looking for a minimum of 5% down.

If you ever see an ad for less than 3% down, it’s almost certainly for a government-backed loan like an FHA or VA loan, not a conventional one. The best first move is always to chat with a loan expert right here at Residential Acceptance Corporation. We can walk you through exactly what you qualify for without any of the guesswork.

Does My Credit Score Affect My Down Payment Requirement?

Absolutely. Your credit score is a huge piece of the puzzle. While it won't magically change the absolute minimum—3% is still 3%—a higher score makes you a much more attractive candidate for those low down payment programs.

Think of it this way: a strong credit score unlocks the VIP room of lending. It gets you better loan terms, a lower interest rate, and more affordable Private Mortgage Insurance (PMI) premiums. A lower score, on the other hand, might mean you need to bring a larger down payment to the table to balance out the lender's risk.

How Quickly Can I Remove PMI on a Low Down Payment Loan?

You can officially ask your lender to cancel PMI once your loan balance hits 80% of your home's original value. This means you've successfully built up 20% equity, which happens over time as you make your mortgage payments and as your home (hopefully) appreciates in value.

Even better, lenders are required by law to automatically drop PMI once your loan balance reaches 78% of the original purchase price. When you work with the team at RAC Mortgage, we'll help you map out when you're likely to hit these equity milestones and guide you through the simple process of ditching that PMI payment for good.

Ready to explore your conventional loan options and figure out a down payment strategy that actually works for your wallet? The expert team at Residential Acceptance Corporation is here to give you clear, straightforward guidance and personalized support.

Start your homeownership journey with us today!