So, you're getting close to grabbing the keys to your new place. But before you do, there's one last step: the closing costs. These are the final administrative and service fees you'll pay to make the home purchase official. Even though FHA loans are famous for their low down payment options, you still have to account for these standard charges for things like the appraisal, title search, and processing the loan itself.

What Are FHA Loan Closing Costs

Think of closing costs as the final hurdle you have to clear before you cross the homeownership finish line. They're a collection of different fees paid to the various people and companies who helped make the sale happen. It’s important to remember these are completely separate from your down payment.

These fees aren’t just an FHA thing; they're a part of almost every real estate deal. But for FHA borrowers, especially first-time homebuyers who might be new to this whole process, getting a handle on them is absolutely critical. The final bill can swing pretty wildly depending on your location, the size of your loan, and a few other key factors.

The Purpose Behind the Fees

Every single fee on your closing statement has a job to do, usually to protect both you and the lender. For instance, the appraisal is there to confirm the home is actually worth what you're paying for it. Title insurance, on the other hand, protects you from any future disputes over who legally owns the property.

The sheer complexity of these costs has always been a tough pill for homebuyers to swallow. A major study by the U.S. Department of Housing and Urban Development looked at thousands of FHA loans and discovered that costs varied a ton based on the borrower's profile and loan details. This just goes to show how much transparency is needed in the process. You can dig deeper into the nuances of FHA loans by reading about the potential disadvantages of an FHA mortgage.

At Residential Acceptance Corporation (RAC Mortgage), we make it our mission to walk you through every single line item on your closing statement. Our goal is simple: no surprises on closing day. When you understand exactly what you're paying for, you can budget the right way and walk into that closing with total confidence.

A Breakdown of Common FHA Closing Costs

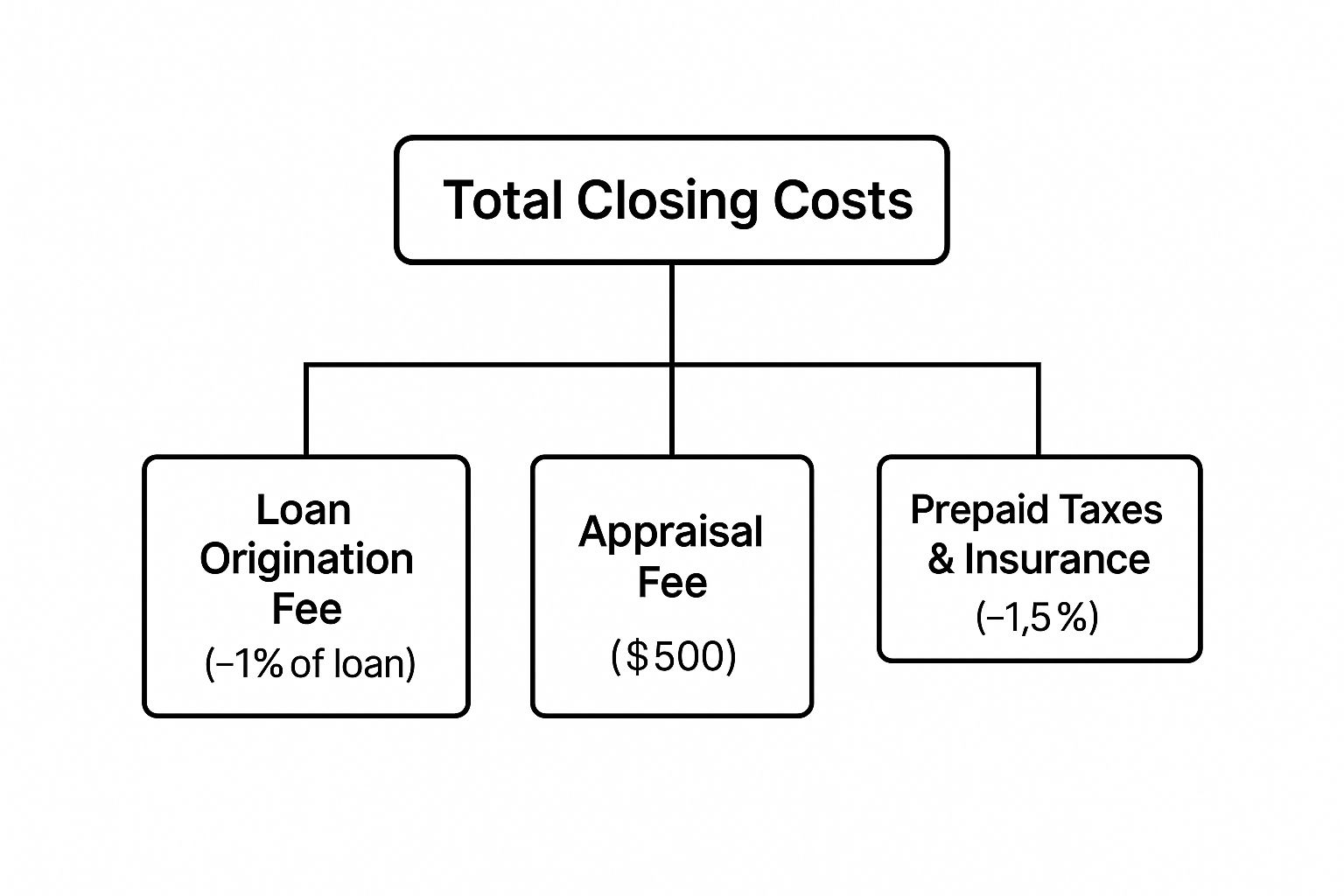

Getting your Loan Estimate can feel a bit like looking at a long, confusing receipt after a big shopping trip. But once you realize all those line items fall into just three main buckets, it starts to make a lot more sense. Think of it as a roadmap showing exactly where every dollar is going on your journey to homeownership.

This visual breaks down how your total closing costs for FHA loans are typically structured, highlighting the biggest pieces of the puzzle you'll see.

As you can see, while there are a bunch of smaller fees, the heavy hitters are usually the loan origination fee, the appraisal, and your prepaid expenses like taxes and insurance.

Let's take a closer look at the specific FHA closing costs you can expect to see on your final documents. The table below breaks down the most common fees, what they're for, and a typical cost range.

Typical FHA Closing Costs and Estimated Ranges

| Fee Type | Purpose of the Fee | Typical Cost Range (% of Loan Amount) |

|---|---|---|

| Loan Origination Fee | Paid to the lender for processing, underwriting, and preparing your loan. | 0.5% – 1.5% |

| FHA Appraisal Fee | Pays for an FHA-approved appraiser to verify the home's value and condition. | $400 – $600 (Flat Fee) |

| Credit Report Fee | Covers the cost for the lender to pull your credit history from the major bureaus. | $30 – $50 (Flat Fee) |

| Title Search & Insurance | Ensures the property has a clear title and protects you from future ownership claims. | 0.5% – 1.0% |

| Homeowners Insurance | Your first year's premium, paid upfront to ensure the property is protected. | Varies by location & coverage |

| Property Taxes | A few months of property taxes are collected to start your escrow account. | Varies by location & home value |

| Recording Fees | Paid to your local government to officially record the sale and your new mortgage. | Varies by county |

Keep in mind that these are just estimates. Your actual costs will be detailed on your official Loan Estimate and Closing Disclosure.

Lender Origination Fees

First up are the fees you pay directly to your lender for putting the loan together. This is commonly known as the loan origination fee. It’s what covers all the behind-the-scenes work: processing your application, underwriting (their process for assessing risk), and drawing up the final loan documents.

This fee is usually a small percentage of your loan amount, often hanging around 1%. At Residential Acceptance Corporation (RAC Mortgage), we make sure this fee is spelled out clearly so you know exactly what it covers right from the get-go.

Third-Party Service Fees

Next, you've got costs for services from independent, third-party companies. You can't close without them, as they are crucial for protecting both you and the lender.

- Appraisal Fee: An FHA-approved appraiser has to confirm the home’s value is at or above what you're borrowing. This is a safety net to make sure no one is overpaying.

- Title Search and Insurance: This is a big one. A title company digs into the property's history to ensure it has a "clean" title, meaning no old liens or surprise owners can pop up later. The insurance protects you if they do.

- Credit Report Fee: A small but necessary fee to cover the cost of the lender pulling your credit history and scores.

These third-party services aren't optional—they're required for any FHA loan. They provide essential checks and balances to make sure your home purchase is secure, legal, and sound for everyone involved.

Prepaids and Escrow Items

Finally, there are "prepaids." These aren't really fees for a service, but more like paying for recurring homeownership costs in advance.

This bucket includes paying your first full year of homeowners insurance and putting a few months' worth of property taxes into an escrow account. Your lender holds onto this money in escrow and pays your tax and insurance bills for you when they're due. It might feel like a big chunk of cash upfront, but it makes your monthly budgeting way simpler down the road.

How to Ballpark Your FHA Closing Costs

Alright, so you know what goes into the closing costs for an FHA loan. The next logical question is, how much cash should you actually have ready?

A solid rule of thumb is to budget somewhere between 2% and 6% of the home's final sale price. Think of this as your starting point, a safe range to begin your financial planning.

Let's put some real numbers to that. If you're buying a $300,000 home, you should expect your FHA closing costs to land somewhere between $6,000 and $18,000. That's a pretty wide gap, and it's because a few key things can nudge that final number higher or lower.

What Makes Your Closing Costs Go Up or Down?

The exact amount you’ll owe on closing day isn't set in stone. It's influenced by a handful of variables, with your location being one of the biggest drivers.

- Where You Live: State and local taxes, like transfer taxes and recording fees, can be wildly different from one county to the next.

- The Lender You Choose: Every lender has its own fee schedule for services like loan origination and underwriting.

- The Deal Itself: The specifics of your purchase matter. A higher sale price or a more complex title search will impact the final tally.

These regional differences are no joke. Data from 2021 showed the average closing cost for a single-family home was $6,905 — a 13.4% jump from the year before. Some places were incredibly expensive, like Washington, D.C. ($29,888), while others were much more affordable, like Missouri ($2,061). It really drives home how much location matters.

This is exactly why online calculators can only ever give you a rough estimate. For real-deal budgeting, you absolutely need a personalized estimate from a loan officer.

There's no substitute for working with an expert who can give you a clear, detailed breakdown. Here at Residential Acceptance Corporation (RAC Mortgage), we can walk you through a detailed Loan Estimate tailored specifically to your purchase. The best way to start is to understand how to get preapproved, which gives you a realistic financial picture and the confidence you need to start house hunting.

So, you're staring down the barrel of FHA closing costs and wondering how you'll cover them. Good news—FHA guidelines are surprisingly flexible. You've got more options than just draining your savings account.

Figuring out these payment strategies is key to keeping your out-of-pocket expenses manageable. While paying upfront with cash is the most direct route, let's dive into two other powerful strategies that can make a massive difference.

Smart Strategies to Cover Costs

One of the best tools in your negotiation toolkit is asking for seller concessions. FHA rules actually allow the seller to pitch in up to 6% of the home's sale price to cover your closing costs. On a $300,000 home, that’s a potential $18,000 from the seller, which could wipe out your closing costs entirely.

Another go-to option is using gift funds. FHA loans are great because they let you use money gifted from an approved source, like a close family member, to pay for some or all of your closing costs.

The secret to using gift funds without a hitch is documentation. Your lender will need a signed gift letter from the person giving you the money. This letter must state it's a true gift, not a loan, and they don't expect to be paid back. You'll also need to show proof of the money transfer.

Getting this paperwork right is non-negotiable for a smooth underwriting process. You can get a head start by checking our guide on the documents needed for a mortgage.

Lately, the high price of closing has caught national attention as a real barrier to buying a home. There's a push from both government and through major lawsuits to tackle inflated fees, like title insurance and broker commissions. The goal is more competition and transparency, which you can read more about in this piece on closing cost reform on furmancenter.org. Your Residential Acceptance Corporation (RAC Mortgage) loan officer is here to help you navigate all these options and find what works best for you.

Partner with RAC Mortgage for Your FHA Loan

Trying to figure out FHA loans and the maze of closing costs for FHA can feel overwhelming. It’s a journey you really shouldn't take alone. Think of this guide as your map—but a great partner is the experienced guide who knows all the shortcuts and helps you navigate the terrain to get where you're going, smoothly.

Here at Residential Acceptance Corporation (RAC Mortgage), our loan officers live and breathe FHA financing. We’re committed to being completely transparent with you through every step of your homebuying process.

Your Guide to a Confident Closing

We believe an empowered homebuyer is a happy homebuyer. Our team takes the time to sit down with you and walk through your entire Loan Estimate, patiently explaining what every single fee is for and why it’s there. We'll explore every strategy available to make your home purchase as affordable as it can be.

Our main goal is simple: make sure you understand every piece of your loan. We want you to walk up to that closing table with total confidence, knowing there are no curveballs or hidden surprises waiting for you.

This focus on education and personal service is what really sets RAC Mortgage apart. We don't just process paperwork; we build relationships and help you make smart financial moves for your future.

Ready to take the next step toward owning your own home? Get in touch with RAC Mortgage today for a personalized FHA loan consultation and let our experts guide you home.

Still Have Questions About FHA Closing Costs?

Even with everything broken down, you might still have a few questions swirling around about closing costs for FHA loans. That's completely normal. Let's tackle some of the most common ones so you can walk into closing day with total confidence.

Can I Roll FHA Closing Costs Into My Loan?

This is a big one. Generally, you can't roll most closing costs into your FHA loan. The main exception is the Upfront Mortgage Insurance Premium (UFMIP), which is often financed.

However, a savvy loan officer can show you some strategies that feel pretty similar, like negotiating for the seller to pay a portion of your closing costs. It's all about finding creative ways to reduce what you need to bring to the table.

What’s the Difference Between Closing Costs and a Down Payment?

Think of it this way: your down payment is your skin in the game. It's your initial investment in the house, a slice of the purchase price that goes straight toward your home equity.

Closing costs are totally separate. They're the service fees you pay to the lender and other companies for getting the deal done—think appraisals, title searches, and all the paperwork that makes the home officially yours.

How Can I Lower My FHA Closing Costs?

You've got more power here than you think. A great first step is to carefully review the Loan Estimate provided by your loan officer. You'd be surprised how much having a clear understanding of the fees can help you plan and budget effectively.

Don't be afraid to negotiate with the seller, either. Asking them to contribute toward your costs can massively reduce how much cash you need to close. It's a common part of the homebuying dance.

The real key is talking openly with your lender from the very beginning. Ask about every option, from seller concessions to lender credits, to make sure you're on the smartest, most affordable path to owning your new home.

At Residential Acceptance Corporation, we make it our job to help you explore every single one of those options.

Are you ready to stop dreaming and start owning? The experts at Residential Acceptance Corporation are here to guide you through a smooth, clear FHA loan process. Visit us today at https://racmortgage.com and let's get you started with a personalized consultation.