Think of your home like a piggy bank you've been putting money into for years. A cash-out refinance is like opening a little hatch to take some of that built-up value—your home equity—without needing to sell the whole bank. You simply get a new, larger mortgage and pocket the difference in cash.

What Is A Cash Out Refinance

Simply put, a cash-out refinance pays off and replaces your current home loan with a new, larger one. Once your old mortgage is settled, you receive the leftover funds as a tax-free lump sum. It’s a powerful strategy for tapping into the wealth tied up in your property.

Of course, this isn't free money—it’s a loan secured by your house. Since the new loan balance will be higher, understanding the cash out refinance requirements is your first and most important step. Lenders need to be confident you can comfortably handle the new, larger payments.

Why Homeowners Choose This Option

Homeowners often go this route to tackle major financial goals. The cash is incredibly flexible and can be used for just about anything.

Some of the most common uses include:

- Home Renovations: Funding that dream kitchen remodel or adding a new bedroom can seriously boost your property's value.

- Debt Consolidation: You can pay off high-interest credit cards or personal loans with your new, lower-interest mortgage, saving you money and simplifying your monthly bills.

- Major Life Expenses: Covering college tuition, unexpected medical bills, or even getting a new business off the ground suddenly becomes manageable.

A cash-out refinance is all about liquidity. It turns your illiquid home equity—money that's stuck in your house—into cash you can actually use. This gives homeowners the flexibility to handle immediate needs or invest in long-term projects.

Partnering For Success

Navigating a cash-out refinance isn't something you want to do without a clear plan. Here at Residential Acceptance Corporation, our job is to make sure you understand every angle of the transaction.

We'll walk you through all the requirements, explore your financial goals, and help you figure out if this is truly the right move for you. Our goal is to make sure your journey from application to closing is a clear and confident one.

The Four Pillars Of Cash Out Refinance Approval

When you’re looking to get a cash out refinance, lenders like Residential Acceptance Corporation need to see the full picture of your financial health. Think of it like a four-legged stool—if one leg is shaky, the whole thing can get wobbly. We look closely at four key areas to make sure you’re in a solid position to handle the new, larger loan.

This isn’t just a simple rate-and-term refinance; you’re increasing your loan amount to pull cash out. Because of that, the requirements are a bit tighter. We will check everything from your credit history to how long you've owned the home. If you want a full rundown of the whole process, our guide on how to refinance your mortgage is a great place to start.

For now, let's break down the big four requirements.

Your Credit Score And History

The first thing we will look at is your credit score. It’s the quickest way to gauge how you’ve managed debt in the past. A higher score signals that you're reliable and have a track record of paying your bills on time.

For most cash-out refinances, you’ll generally need a credit score of at least 620. Keep in mind, a stronger score usually means a better interest rate, which saves you money in the long run. We don't just stop at the number, though; we'll review your full credit report for any red flags like recent late payments or defaults. A clean payment history makes the approval process much smoother.

Loan-to-Value And Home Equity

Next up is your home equity, which is measured using the Loan-to-Value (LTV) ratio. It’s a simple comparison of what you owe on your mortgage versus what your home is actually worth. When you take cash out, we want to be sure you still have a good amount of skin in the game.

Most lenders will cap the LTV for a cash-out refinance at 80%. In plain English, this means you need to keep at least 20% equity in your home after the new loan is finalized. That 20% acts as a safety net for both you and the lender if the market ever takes a dip.

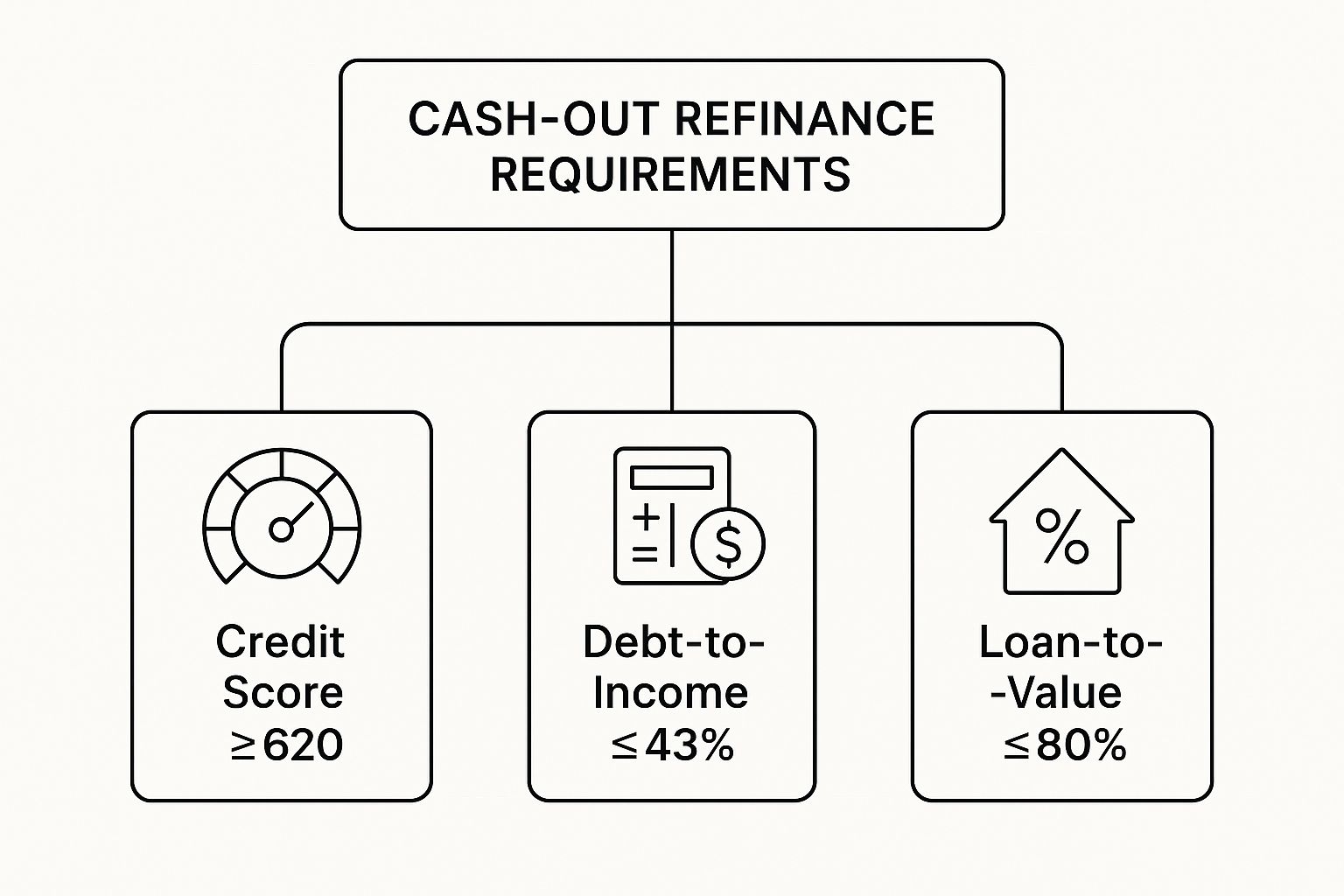

This infographic breaks down the core benchmarks we use to evaluate an application.

As you can see, having solid numbers for your credit, debt, and equity is what a successful application is built on.

Debt-to-Income Ratio

The third pillar is your Debt-to-Income (DTI) ratio. This number shows us what percentage of your gross monthly income goes toward paying your debts—including what your new, higher mortgage payment will be. It’s a critical piece of the puzzle because it shows if you can comfortably afford the new loan.

As a general rule, we like to see a DTI of 43% or lower. Some loan programs might be more flexible, especially if you have other strengths like a great credit score or a lot of cash in savings. A low DTI tells a lender you won’t be stretched too thin financially.

Income And Employment Stability

Finally, we need to see that you have a steady, predictable income to cover your new mortgage payment. This is all about proving you have a stable financial foundation. You'll typically be asked to provide documents like:

- Recent pay stubs

- W-2 forms from the last two years

- Federal tax returns

- Bank statements showing consistent income

If you're self-employed, you might need to show some extra paperwork, like profit and loss statements. It all boils down to one thing: proving you have the reliable income needed to support the loan.

To give you a quick summary, here’s a checklist of the main requirements you’ll need to meet.

Key Cash Out Refinance Requirement Checklist

| Requirement | Typical Benchmark (Conventional Loan) |

|---|---|

| Minimum Credit Score | 620+ |

| Maximum Loan-to-Value (LTV) | 80% |

| Minimum Home Equity | 20% |

| Maximum Debt-to-Income (DTI) | 43% |

| Income Verification | W-2s, Pay Stubs, Tax Returns |

Meeting these benchmarks is the first step toward a successful cash-out refinance. Every lender is a little different, but these are the core pillars they will all be looking at.

How Your Property Impacts Qualification

While your personal finances are a huge piece of the puzzle, the property itself plays an equally crucial role in whether you qualify for a cash-out refinance. Lenders aren't just looking at you; they're evaluating the asset that secures the entire loan—your home—to make sure it’s a sound investment on their end.

One of the first property rules you’ll run into is the seasoning requirement. Think of it as a waiting period. Lenders typically require you to own the home for a minimum amount of time, usually six to twelve months, before you can pull cash out. This rule exists to prevent risky property flipping and helps ensure the market stays stable.

Property Type And Usage

How you use your home makes a big difference in the eyes of a lender. Different property types are viewed with varying levels of risk, which means the goalposts for qualification can move.

- Primary Residence: This is your home base, where you live full-time. It’s almost always the easiest type of property to get a cash-out refi for, and you'll typically get the best terms.

- Second Home: Got a vacation spot or a weekend getaway? Expect stricter guidelines. We might ask for more equity in the home or a higher credit score to approve the loan.

- Investment Property: A rental property is seen as the highest risk for a lender. Because of that, you'll face the toughest requirements, including a lower maximum Loan-to-Value (LTV) ratio. For any property type, understanding how we view your ability to pay is key—you can learn what the debt-to-income ratio is and why it's so important on our website.

The Home Appraisal Process

This is the make-or-break moment for your property's role in the loan. The home appraisal isn't just a formality; it's the official, independent valuation that determines your home's current market worth. At Residential Acceptance Corporation, we rely on this report to calculate your exact home equity.

An appraiser will look at everything: your home's condition, size, and features, plus what similar, comparable properties have recently sold for in your neighborhood. Their final number is what we use to figure out how much cash you can actually get.

This valuation is what confirms you meet the 80% LTV threshold. If the appraisal comes in low, it can shrink your borrowing power or even stop the process in its tracks. It's a pivotal step in any cash-out refinance journey.

Understanding The True Cost Of Your Loan

Tapping into your home's equity can be a fantastic financial move, but it's crucial to look at the whole picture before you jump in. A cash-out refinance isn't just about the check you walk away with; there are real costs involved in the transaction. Knowing what these are from the get-go helps you make a truly smart decision.

One of the first things you'll notice is the interest rate. Rates for cash-out refinances are almost always a touch higher than what you’d see for a standard "rate-and-term" refinance. This isn't random—it's how lenders offset the added risk of increasing your loan amount against your home's value.

Breaking Down The Expenses

On top of the interest rate, you'll have closing costs, which typically run between 2% to 6% of your new, larger loan amount. These fees are what pay for all the services needed to get the loan finalized.

You can expect to see fees like:

- Appraisal Fee: This pays a professional appraiser to come out and determine your home's current market value.

- Origination Fee: A fee charged by the lender for the work of processing and underwriting your new loan.

- Title Insurance: This is a big one. It protects both you and the lender from any old claims or issues with your property's title that might pop up down the road.

- Attorney and Recording Fees: Covers the legal review and the cost of officially recording your new mortgage with the local government.

The good news is you don't always have to bring a big check to the closing table. At Residential Acceptance Corporation, we can often structure your loan to absorb these expenses. You can learn more about how closing costs can be rolled into your loan in our detailed guide.

Think of a cash-out refinance as a strategic tool. You just need to be sure you're weighing the immediate cash benefit against the long-term cost. When you see it all clearly, you can make sure the decision lines up perfectly with your financial goals.

Even with slightly higher rates, cash-out refinances are incredibly popular, especially when homeowners are sitting on record levels of equity. The average rate might be 0.125% to 0.5% higher than a standard refi, which simply reflects the lender managing that increased risk. You can discover more insights about these mortgage trends and their impact.

Your Step-By-Step Application Guide With RAC Mortgage

Knowing the cash-out refinance requirements is one thing, but what does the journey from application to getting your cash actually look like? The path to unlocking your home's equity can feel intimidating, but at Residential Acceptance Corporation, we break it down into a clear and straightforward process. We're here to guide you at every turn.

Your journey starts with a simple conversation. We'll sit down with you to talk about your financial goals—whether you're looking to consolidate debt, finally tackle that kitchen renovation, or fund another major life expense. This initial chat makes sure a cash-out refinance is truly the right move for you before you go any further.

Document Collection and Submission

Once we've mapped out a clear goal, the next step is getting your financial documents together. Think of it like gathering your ingredients before you start cooking; having everything ready from the start makes the whole process smoother and faster. We'll give you a simple checklist to keep you organized.

You’ll generally need to provide:

- Proof of Income: This usually means your most recent pay stubs and your W-2 forms from the last two years.

- Asset Verification: Bank statements are needed to show you have the reserves to handle any related costs.

- Existing Debt Information: Details on your current mortgage and any other loans help us see the complete financial picture.

After you've collected your documents, you’ll fill out the formal loan application. Our team is right here to help with any questions you have during this step.

Appraisal and Underwriting Review

With your application submitted, we'll get a professional home appraisal on the books. An independent appraiser will assess your property's current market value. This is a crucial step for confirming the equity you have available and locking in your final loan amount.

The underwriting stage is where our team does a deep dive into your entire file—your credit, income, assets, and the appraisal report—to confirm all cash-out refinance requirements are met. This is the final checkpoint before we can issue a "clear to close."

Finally, we head to the closing table. You'll sign the final loan documents, and after a short three-day waiting period, the funds are sent directly to you. From start to finish, our goal at RAC Mortgage is to make your experience as seamless as possible.

Still Have Questions About Cash-Out Refinancing?

Even after you've got a good handle on the cash-out refinance requirements, it’s completely normal to have a few lingering questions. Getting these common points ironed out can give you the final bit of confidence you need to move forward.

Let's dive into some of the most frequent things homeowners ask.

One of the biggest questions is always, "How much cash can I actually get?" The answer is tied directly to two things: your home's current value and what you still owe on your mortgage. Most lenders, like us at Residential Acceptance Corporation, will let you borrow up to 80% of your home's appraised value.

Think of it this way: if your home appraises for $400,000 and you have a $250,000 mortgage balance, you could potentially walk away with up to $70,000 in cash.

A Few Key Questions Answered

Another popular one is about what you can do with the money. The great news here is the flexibility. The cash is yours to use for almost anything you can think of—home improvements, consolidating high-interest credit card debt, paying for college, you name it. There are very few strings attached.

Homeowners also worry if their monthly payment will increase. In most scenarios, yes, it will. You're borrowing more money, so your new loan balance is naturally going to be higher, which usually means a bigger monthly payment. The key is to make sure that new payment still fits comfortably within your budget.

What about the timeline? From the moment you apply to the day you close, the whole process typically takes around 30 to 45 days. This window accounts for the appraisal, underwriting review, and signing the final documents.

Getting these questions answered upfront means you won't run into any surprises. When you have the full picture—the process, the costs, and the timeline—you can take the next step feeling completely sure of your decision.

Ready to see what's possible with your home's equity? The expert team at Residential Acceptance Corporation is here to walk you through the entire process, step by step. Get started with your application today!