For a lot of Tampa-area entrepreneurs, trying to prove your income for a conventional mortgage feels like trying to fit a square peg in a round hole. It just doesn't work. This is where a bank statement mortgage in Tampa comes in—it’s a powerful, common-sense solution built specifically for self-employed folks whose tax returns don't tell the whole story about their cash flow.

This specialized loan, which we handle every day here at RAC Mortgage, cuts through the noise and focuses on the real financial health of your business.

Your Path to a Tampa Home as a Business Owner

Think of a traditional mortgage as a standard key, one that's cut to fit the simple shape of a W-2 employee's finances. It works perfectly if you have predictable, bi-weekly pay stubs. But for business owners? That key almost never turns the lock.

Why? Because you're smart. You take legitimate tax deductions to lower your tax bill. The problem is, those same deductions can accidentally shrink your qualifying income on paper, making it incredibly tough to get approved for the home you can actually afford.

This is where a bank statement mortgage completely changes the game. It’s less like a standard key and more like a custom one, crafted by a locksmith who really understands how your business operates. Instead of getting hung up on tax documents, we analyze 12 to 24 months of your business bank statements. This gives us a crystal-clear picture of your actual revenue and cash flow.

How Income Verification Compares for Tampa Homebuyers

It's crucial to see the fundamental difference in how traditional and bank statement mortgages assess your income. One looks at a snapshot after deductions, while the other sees the whole picture of your business's cash flow.

| Verification Method | Traditional W-2 Mortgage | Bank Statement Mortgage |

|---|---|---|

| Primary Documents | W-2s, pay stubs, and federal tax returns. | 12-24 months of personal or business bank statements. |

| Income Calculation | Based on Adjusted Gross Income (AGI) after all business expenses and deductions. | Based on the average monthly deposits over a 12 or 24-month period. |

| Ideal Applicant | Salaried or hourly employees with predictable, documented income. | Self-employed individuals, freelancers, and business owners with fluctuating but consistent cash flow. |

Essentially, the bank statement loan recognizes that your business's deposits are a far better indicator of your ability to pay than the bottom line on your tax return.

Navigating the Tampa Housing Market

Knowing the local market is a huge advantage for any homebuyer. Right now, Tampa’s housing scene is seeing more balanced home values and some shifts in mortgage dynamics. The typical home value in Tampa was recently around $374,105, with properties going under contract in about 33 days.

That pace means that while there's still competition, you have a reasonable window to find the right place. What's really interesting is that about 68.6% of homes sold below their list price, which signals that sellers are becoming more flexible. This creates a fantastic opportunity for well-prepared, self-employed buyers. Armed with a pre-approval from a bank statement loan, you can move quickly and confidently when you find the perfect home.

A bank statement mortgage isn't just an alternative; it's a validation of your entrepreneurial success. It acknowledges that your business's cash flow is the true measure of your ability to afford a home, not just the net income shown on a tax return.

Who Benefits Most From This Approach

This type of financing is a lifeline for a wide range of professionals who are the backbone of Tampa's economy. These are people who often have substantial, consistent income that just isn't captured by old-school underwriting methods.

This approach is perfect for:

- Small Business Owners: From the boutique shopkeepers in Hyde Park to the amazing restaurant owners in Ybor City.

- Freelancers and Consultants: This includes graphic designers, IT specialists, and marketing consultants who get paid project-by-project.

- Real Estate Agents and Brokers: Professionals whose income is based on commissions that can fluctuate month to month.

- Gig Economy Workers: Rideshare drivers, delivery personnel, and anyone else who operates as an independent contractor.

For business owners thinking even bigger—like building their dream home from the ground up—this complete guide on how to build a custom home in Florida can be a huge help in navigating the complexities. Here at RAC Mortgage, we provide the clear, straightforward guidance you need to turn your business success into your Tampa dream home.

How a Bank Statement Mortgage Actually Works

Think of a bank statement mortgage as a common-sense solution designed for the realities of running a modern business. It completely sidesteps the traditional lender's obsession with tax returns. We all know tax returns are strategically minimized through legitimate business write-offs, right? Instead, this loan zooms in on your consistent cash flow, giving a much clearer picture of what you can actually afford.

Let's say you're a successful marketing consultant here in Tampa. You've got business expenses—software, client travel, advertising—and you write them off. Smart. But after those valid deductions, your tax return might show a net income that looks pretty modest on paper. A conventional lender often stops right there, sees that lower number, and stamps "DENIED" on your file.

At RAC Mortgage, we look at the whole story. We dig into your business's real financial health by reviewing 12 to 24 months of your bank statements. This lets us calculate your qualifying income based on the actual money flowing into your business, not just the scraps left over after deductions.

Calculating Your Qualifying Income

So, how do we actually figure out that number? It's a pretty straightforward process that hinges on consistency and revenue. We'll look at all your regular deposits over a one- or two-year period to nail down a reliable average monthly income.

This method is built from the ground up for the self-employed world. We get it. A massive revenue month might be followed by a slower one. By averaging your income over a longer stretch, we smooth out those normal peaks and valleys to get a true measure of your earning power.

This approach provides a realistic and fair path to homeownership for Tampa’s thriving community of entrepreneurs, freelancers, and small business owners who deserve a mortgage that reflects their true financial success.

Why Cash Flow Is a Better Metric

For any business owner, cash flow is king. It's the lifeblood of your company and the single best indicator of your ability to handle a monthly mortgage payment. A bank statement mortgage in Tampa gets this.

Here’s why looking at your deposits tells a much better story:

- Reflects Gross Revenue: Bank deposits show the total cash your business is bringing in before you start subtracting expenses. It’s a pure look at market health and activity.

- Accounts for Growth: By analyzing statements over 24 months, we can see a clear growth trend that a single year's tax return might completely miss.

- Eliminates Penalty for Deductions: You're no longer punished for being a savvy business owner who uses every legal write-off to reinvest and grow your company.

Focusing on real cash flow is especially crucial in a dynamic market like Tampa. So many local businesses are exploding, and their bank statements are the best proof of that upward climb. To us, this is the only logical way to evaluate a Tampa mortgage lender for self-employed individuals.

The Role of Business vs. Personal Statements

When you apply, you can generally use either your business or personal bank statements—it just depends on how you have your finances set up. If you're a sole proprietor and run everything through a personal account, we can work with that. If you have a dedicated business account, we’ll use those statements.

What really matters most is clarity and consistency. Honestly, keeping your business and personal finances separate is always a good idea and definitely makes the income analysis a bit smoother. Our team has seen it all and is experienced in handling both setups, ensuring we build the strongest possible case for your loan approval. It’s this tailored approach that helps us turn the hard-earned success of Tampa entrepreneurs into a new set of house keys.

Is a Bank Statement Loan Right for You?

A bank statement loan isn't some catch-all product; it's a specific financial tool built for the kind of professionals driving Tampa's amazing economy. If your income doesn't show up in a neat W-2 paycheck every two weeks, this mortgage might just be the key you've been looking for. It's designed to see the real success of your business, not just what's left on paper after your accountant works their magic.

Think about the owner of that busy cafe in South Tampa. Their bank statements show a constant flow of cash and credit card deposits—a clear sign of a booming business. Or picture a freelance web developer in Ybor City, getting paid in big chunks as projects are completed. What about a top real estate agent whose commissions ebb and flow with the market?

Each of these pros has a profitable business, but their financial story just doesn't fit into the tight little boxes that conventional lenders use. A bank statement mortgage in Tampa is made for them. It offers a path to a home loan that actually reflects their financial reality.

If you see yourself in these scenarios, this loan program could be the perfect match for your unique journey.

Who Benefits the Most from This Loan?

This type of loan is perfect for a big slice of Tampa's workforce. The city’s entrepreneurial spirit means more people are working for themselves, and that creates a huge demand for flexible mortgage options. With Tampa's population sitting near 386,000 and growing at a rate of 3.3% since 2020, there's a steady stream of new homebuyers. Many of them are self-employed professionals who are ideal candidates for this loan. You can dig into Tampa’s housing and demographic data to see just how much this growth impacts the market.

If any of these sound like you, a bank statement loan could be your best bet:

- Business Owners: Entrepreneurs who plow profits back into their companies and have lots of write-offs.

- Independent Contractors: Gig workers, consultants, and freelancers with irregular but solid income.

- Commission-Based Professionals: Real estate agents, salespeople, and others whose paychecks vary but add up to a strong annual income.

- Seasonal Business Operators: People in tourism or other industries where business booms during certain parts of the year.

Core Qualifications for Approval

While these loans are flexible, they aren't a free-for-all. We still need to see strong signs of financial health to make sure you're ready for homeownership. Think of these qualifications not as hurdles, but as proof of your business's stability and your reliability as a borrower.

Think of the qualification process as a business health check-up. It's about confirming your cash flow is strong and your credit is solid. It sets you up for long-term success, not just a quick approval.

Here’s what you’ll typically need to show:

- Consistent Business Revenue: We'll look at 12 to 24 months of your bank statements to see a steady, predictable flow of deposits. A slow month here and there is fine, but the overall trend needs to show consistent business.

- Solid Credit History: A good credit score is key. The exact number can vary, but a higher score shows you're financially responsible and usually gets you better terms and a lower interest rate.

- Sufficient Down Payment: You'll generally need a down payment, often in the 10% to 20% range. Putting more money down lowers the lender's risk and shows you're serious.

- Proof of Business Operation: We need to see that your business has been up and running for at least two years. This is usually easy to verify with business licenses, professional certifications, or a quick letter from your CPA.

These requirements make sure the loan is a solid fit for everyone involved. By working with a specialist at RAC Mortgage, you can get a clear picture of where you stand and figure out the best way to put together a winning application for a bank statement mortgage in Tampa.

Your Application Roadmap with RAC Mortgage

So, you're ready to explore a bank statement mortgage in Tampa? It's not nearly as complicated as it might sound. At RAC Mortgage, we don't just process paperwork; we partner with you. We break down every stage into simple, manageable steps so you're never left in the dark. Our whole philosophy is built on being transparent and working together, making sure you feel confident from our first chat to the day you get the keys.

It all starts with a simple conversation. This is where we get to know your business, understand its rhythm, and hear about your homeownership goals. From there, we'll guide you through gathering the right documents, with your bank statements obviously taking center stage.

The Initial Consultation and Document Gathering

First things first, let's talk. This isn't an interrogation; it's a chance for us to understand what makes your business tick. We want to hear about your big wins, your seasonal trends, and where you're headed. This context is gold—it helps us build the strongest possible case for your loan.

After that chat, we'll move on to collecting documents. For a bank statement loan, this is pretty straightforward. Our team gives you a clear list of exactly what we need, so you're not left guessing. Getting this prep work done right is the foundation for a smooth and fast underwriting process.

Partnering with a specialist from RAC Mortgage early on is key. We help you present your financial story in the clearest, most compelling way possible, turning your business success into a powerful loan application.

To make things easy, we've put together a checklist of what you'll typically need to get your application ready to go.

Your Essential Document Checklist

This table lays out the core documents needed for a bank statement mortgage. Having these items organized and ready will seriously speed things up.

| Document Category | Specific Items Needed | Expert Tip |

|---|---|---|

| Income Verification | 12-24 consecutive months of business or personal bank statements. | Make sure you send all pages for each statement, even the blank ones. Consistency is everything, so provide a complete, unbroken set. |

| Business Confirmation | A business license, professional certification, or a letter from your CPA confirming you've been self-employed for at least two years. | Getting this sorted out ahead of time can shave significant time off the verification process. |

| Personal Identification | A valid, government-issued photo ID (like a driver's license or passport) and your Social Security number. | Double-check the expiration date on your ID. You don't want it expiring in the middle of the loan process. |

| Asset Documentation | Statements for any other asset accounts (like savings, investment, or retirement accounts) to verify funds for the down payment and closing costs. | If you have any large, recent deposits, be prepared to explain where they came from. This avoids unnecessary questions from the underwriter. |

Having these documents ready is the best way to ensure a smooth handoff to the underwriting team.

Underwriting and Income Analysis

Once we have your documents, our underwriters get to work. This is really where the bank statement loan shines. Instead of getting bogged down in tax returns, they dive deep into your bank statements to figure out your qualifying income based on your actual business cash flow.

They're looking for consistent deposits and a healthy average balance—the things that paint a true picture of your financial strength. This isn't some automated system spitting out a number; it's a careful review by pros who get the nuances of self-employed income. They are trained to see the success that traditional loan models often miss.

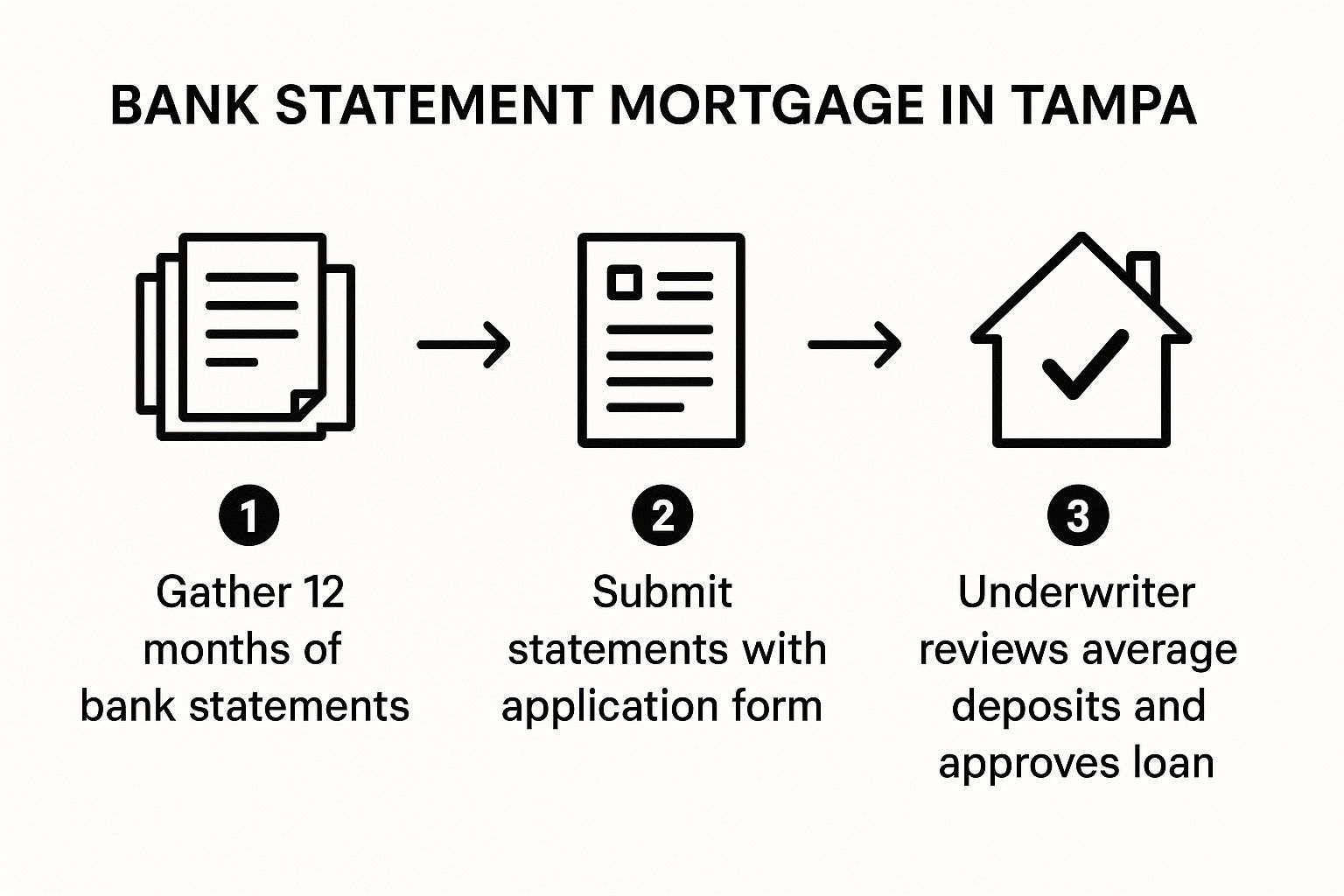

The path to approval is designed to be direct and make sense. This visual breaks down the simple flow, from getting your docs together to getting your loan approved.

As you can see, the whole process revolves around using your real cash flow—proven by your bank statements—as the main proof that you can afford your new home.

Final Steps to Closing

After the underwriter verifies your income and gives the green light on your loan amount, we head into the home stretch. This involves getting a property appraisal to confirm the home’s value and clearing up any final loan conditions.

Our team at RAC Mortgage is right there with you through this entire phase. We coordinate everything with the title company, the seller's agent, and anyone else involved to create a clear path to the closing table. Our goal is to make these final steps as stress-free as possible, giving you the support you need to sign the papers and buy your home with total confidence.

Strengthening Your Loan Application

Getting approved for a bank statement mortgage in Tampa is totally within reach, but a little prep work with your finances can make all the difference. Think of it like training for a race—the effort you put in beforehand is what really gets you across the finish line smoothly. By getting your financial house in order, you give us a crystal-clear picture of your business's health, which can directly boost your chances of approval and help you lock in better terms.

Just a few smart moves can take your application from decent to undeniable. Here at RAC Mortgage, we always tell our clients to start this "training" a few months before they plan to apply. That gives you plenty of time to clean up your records, show a solid pattern of income, and prove you can confidently handle a mortgage.

Maintain Clean and Consistent Deposits

If there's one thing underwriters want to see, it's consistency. Your bank statements are the heart of your application, and they need to tell a simple, steady story about your business revenue. Focus on making regular, predictable deposits that reflect how your business actually operates.

For instance, if you run a local shop, consistent daily or weekly deposits from sales are perfect. If you're a freelancer who gets paid by the project, those bigger, less frequent deposits are fine too, as long as they show up reliably over the 12 to 24-month period we’re reviewing. The idea is to establish a financial rhythm an underwriter can count on.

An underwriter wants to see a business that operates like a well-oiled machine. Consistent, documented deposits are the fuel that proves your business is not just surviving, but thriving.

This kind of consistency lets our team easily calculate a stable average monthly income, which is the bedrock of your loan qualification. It takes the guesswork out of the equation and builds a rock-solid case for getting you approved.

Avoid Large, Unexplained Cash Deposits

Cash is a part of doing business for many, but large, random cash deposits can throw up a red flag for an underwriter. An occasional cash drop is no big deal, but frequent, sizable cash transactions without a clear source just make it harder to verify your income.

A clear paper trail is always your best friend. If you do have to deposit a large amount of cash, keep detailed records explaining where it came from—think dated invoices or sales receipts. This documentation helps connect the dots and keeps your financial story clean.

By keeping those large, undocumented cash deposits to a minimum in the months leading up to your application, you present a much cleaner, more transparent financial profile that’s far easier for an underwriter to sign off on.

Separate Your Personal and Business Finances

One of the best things you can do to strengthen your application is to keep separate bank accounts for your business and personal expenses. It’s not a deal-breaker if you don’t, but it makes the whole income analysis process way simpler and more accurate for us.

When your business income is mixed with your personal spending in one account, it’s tough for an underwriter to tell a business deposit from, say, a birthday check from your aunt. A dedicated business account shows a clean ledger of your gross revenue. Even if your credit has a few bumps, showing this kind of financial organization can give you a major leg up. For those worried about credit, you can learn more about getting Tampa home loans even with bad credit.

When you partner with a specialist at RAC Mortgage early on, we can look at your unique situation and give you personalized advice. We'll help you get your finances organized to build the strongest application possible for a bank statement mortgage in Tampa, clearing the path to your dream home.

Frequently Asked Questions About Tampa Bank Statement Loans

Exploring a bank statement mortgage in Tampa is a smart move for any entrepreneur, but it’s a different world from traditional lending. It's totally normal to have questions. We’ve heard them all from self-employed homebuyers just like you, so we’ve put together the most common ones to give you clear, straight-up answers.

Are Interest Rates Higher for These Loans

This is usually the first question on everyone's mind. The short answer is: sometimes, but not always. While rates for bank statement loans can be a little higher than a conventional mortgage, it really comes down to risk. A strong, well-put-together application can land you a very competitive rate.

At RAC Mortgage, we're looking at the complete picture:

- Your Credit Score: A solid score shows you manage your finances responsibly, which can definitely help lower your rate.

- Down Payment Amount: The more you put down, the lower the risk for us. A bigger down payment often translates to better terms for you.

- Financial Strength: We look for consistent, healthy deposits that show your business isn't just surviving—it's thriving.

Bottom line, if you present a strong financial profile, you put yourself in the best position to get great terms.

How Do Lenders View Inconsistent or Seasonal Income

This is a huge one for Tampa business owners, especially if you're in tourism, construction, or any other project-based field. Traditional lenders get spooked by fluctuating income, but we get it. That's just the nature of being your own boss.

We don't just look at one or two months. Instead, we analyze 12 to 24 months of your bank statements to figure out a reliable average monthly income. This method smooths out the inevitable peaks and valleys, giving us a true picture of what your business really earns over time. As long as you can show a consistent pattern of business activity, month-to-month swings aren't a deal-breaker.

What if My Business Is Less Than Two Years Old

At RAC Mortgage, we really like to see a two-year history of self-employment. This isn't an arbitrary rule; it gives us enough data to see that your business is stable and has a proven track record of generating income. It shows you've made it past that tough startup phase.

While a two-year history is the standard, every situation is unique. The best first step is always to have a conversation with a mortgage specialist at RAC Mortgage who can review your specific circumstances and guide you on the best path forward.

What Is the Typical Approval Timeline

You might be surprised to learn that a bank statement mortgage can close just as fast as a standard loan, particularly when your team knows what they're doing. Here at RAC Mortgage, we've dialed in our process and often close loans in just 18 to 20 days once we have a complete application package.

The biggest factor influencing speed is you. Having all your documents—bank statements, business license, P&L, etc.—ready to go from day one is crucial. When you provide everything we need promptly, we can get your application through underwriting and to the closing table without any unnecessary delays.

If you're weighing all your options, our guide on the local FHA mortgage lender process in Tampa is another great resource for understanding different loan timelines.

Why Choose RAC Mortgage for Your Tampa Loan

We've spent this guide breaking down the 'what' and 'how' of getting a bank statement mortgage in Tampa. But when you're a self-employed professional, the 'who' you work with can make all the difference. You need a local partner who actually gets it.

That's where Residential Acceptance Corporation (RAC Mortgage) comes in. We aren't some faceless national lender—we specialize in the Tampa market because we live and work here. We understand the hustle of local entrepreneurs because we're part of the same community. We're skilled at seeing the real success behind your business, not just what a standard tax return shows.

A Partnership, Not a Process

Big, impersonal banks often rely on rigid algorithms that don't have a clue how to handle a business owner's finances. If your numbers don't fit perfectly into their tiny box, you're out. We take a completely different approach.

Our mission is to build a genuine partnership with you. It's about crafting a mortgage solution that actually makes sense for your business's true cash flow. We don't just shuffle papers; we build relationships and listen to the story behind your bank statements—a story of hard work, risk-taking, and success.

At RAC Mortgage, we're more than just lenders. We're advocates for Tampa's entrepreneurs, providing the hands-on expertise you need to turn your business success into a new set of house keys.

We guide you through every step with total clarity and support, making sure you feel confident and in control from our first chat to closing day. The entire process is built around you, the business owner. Your win is our win.

Ready to see how a local expert can change the game for you? Let's talk. Reach out to the team at Residential Acceptance Corporation today to explore your bank statement mortgage options in Tampa. https://racmortgage.com