If you've been told your credit score puts the dream of owning a home on hold, I'm here to tell you that's not the whole story. It can feel like a dead end, but it's really just a different path—one that requires a specialized guide.

That's where bad credit mortgage lenders like Residential Acceptance Corporation (RAC Mortgage) come in. We exist specifically to help people in this exact situation.

Your Path to Homeownership with Bad Credit

Let's get one thing straight: a low credit score doesn’t automatically slam the door on buying a home.

What it does mean is that your journey will require a more focused approach. You need to work with a lender who sees you as more than just a three-digit number. While a traditional bank might see a score below 620 as too risky, a dedicated lender like RAC Mortgage has a process designed to look at your entire financial picture.

This guide is your roadmap. We’re going to cut through the noise and give you a clear, actionable plan for navigating the world of bad credit mortgages. Forget the myths—homeownership is absolutely achievable, and we’ll show you how.

What This Guide Covers

Our goal here is simple: to give you the confidence and know-how to take the next step. We'll walk you through the entire process, from understanding the fundamentals to the day you finally get the keys to your new home.

You'll get a crystal-clear picture of what actually matters to lenders who specialize in these types of home loans.

Here’s a quick look at what we'll dive into:

- A Lender's Perspective: We'll start by helping you see your finances the way a lender does, so you can understand how they evaluate risk and what they really care about.

- Strengthening Your Application: You'll get practical, real-world steps to make your mortgage application as strong as it can possibly be, even with some credit bumps and bruises.

- Exploring Real Loan Options: We’ll break down the specific loan programs available from RAC Mortgage that you may actually qualify for.

- Navigating the Process: Finally, we’ll guide you through the application and approval maze, pointing out key milestones and potential hurdles along the way.

The journey to buying a home with bad credit isn't about having a perfect financial history. It's about demonstrating responsibility now and finding a lending partner who gets your unique story.

This guide gives you the tools you need to build a compelling case for your home loan. With the right preparation and the right partner, you can turn that homeownership dream into a reality.

How Lenders Really View a Low Credit Score

To work with bad credit mortgage lenders, you first have to understand how they think. A low credit score isn't an automatic deal-breaker; it’s a signal for the lender to roll up their sleeves and look at the whole story behind the number.

That "bad credit" label, typically for scores under 620, is just one piece of a much bigger puzzle. Lenders like Residential Acceptance Corporation (RAC Mortgage) are experts at digging deeper. They look at your entire financial narrative, moving beyond that single score to really get the context of your situation.

Beyond the Three-Digit Number

When a lender pulls your file, they're not just glancing at a number—they're assessing risk. They need to know if you have both the ability and the willingness to repay a home loan. A low score might point to some rough patches in the past, but it doesn't define your financial habits today.

To build a complete picture, RAC Mortgage will examine several key areas:

- Payment Consistency: Do you have a recent history of making payments on time, even if you had trouble a few years ago? A solid track record over the last 12-24 months carries a lot of weight.

- Debt-to-Income (DTI) Ratio: This shows how much of your monthly income goes toward debt. A lower DTI tells a lender you have enough cash flow to comfortably add a new mortgage payment.

- Length of Credit History: A longer credit history, even one with a few blemishes, gives lenders more data to see your long-term patterns.

- Type of Debt: Lenders look at different kinds of debt differently. For example, student loan debt is often seen as less risky than maxed-out, high-interest credit cards.

This holistic review is absolutely crucial. The wider economic environment also plays a role in how lenders manage risk. The landscape has definitely evolved, especially after recent economic pressures. The FDIC's Risk Review noted that delinquency rates for some mortgage-backed securities climbed to 6.57%, reflecting broader stress in real estate financing that can make credit tighter for everyone. As conditions shift, specialized lenders adapt their strategies to keep serving this market. You can learn more about these lending conditions in the full FDIC risk analysis.

The Power of Compensating Factors

This is where you can really make your application shine. Compensating factors are the positive elements in your financial profile that help offset the risk of a low credit score. They prove your stability and commitment.

Think of compensating factors as your financial strengths. They are the proof points that show a lender you're a reliable borrower, even if your credit score doesn't fully reflect that yet.

A skilled lender like RAC Mortgage will actively hunt for these positives to build a strong case for your approval. Presenting these factors clearly can make all the difference.

Here are some common examples that work:

- A Substantial Down Payment: Putting more money down instantly lowers the lender's risk and shows you have serious skin in the game.

- Stable Employment History: A long-term job in the same industry is a huge green flag, indicating a reliable income source.

- Significant Savings or Reserves: Having cash reserves left over after closing shows you can handle unexpected repairs or job loss without missing a mortgage payment.

- A Recent History of Renting Responsibly: A clean record of on-time rent payments can act as a powerful alternative form of credit history.

When you understand this risk assessment process, you gain control. By knowing exactly what lenders are looking for, you can highlight your strengths and build a compelling case for getting that approval.

Strengthening Your Finances Before You Apply

Getting a mortgage isn't just about filling out an application. The real work starts long before you ever speak to a lender. If you're coming in with less-than-perfect credit, taking some smart steps beforehand can completely change the game. It can mean the difference between a denial and an approval, and it can save you thousands in interest. This is your roadmap for getting your financial house in order.

First things first: you need to see exactly what the lenders will see. You're entitled to a free credit report from each of the three main bureaus—Equifax, Experian, and TransUnion. Don't just give them a quick glance. Comb through every single line item looking for mistakes.

It's more common than you'd think. According to the Consumer Financial Protection Bureau (CFPB), errors on credit reports can have major financial consequences. You might find accounts that aren't yours, old debts that were paid off but are still showing a balance, or even simple typos in your personal information.

Find and Fix Credit Report Errors

If you spot something that isn't right, you need to dispute it. Immediately. File a formal dispute with the credit bureau reporting the error. Thanks to the Fair Credit Reporting Act (FCRA), they are legally required to investigate your claim and remove any proven inaccuracies.

This isn't a step you can afford to skip. Getting just one negative mistake removed can give your credit score a noticeable bump, making you a much stronger candidate in the eyes of a lender like RAC Mortgage.

A clean credit report is the foundation of a strong mortgage application. It ensures lenders are evaluating your actual financial history, not one clouded by someone else's mistakes or outdated information.

High-Impact Moves to Boost Your Score

While you’re waiting for those disputes to get sorted out, there's plenty you can do to actively improve your credit. The two biggest factors in your score are your payment history and how much debt you're carrying. Focus your energy there.

- Never Miss a Payment: This is the single most important factor. Period. The easiest way to nail this is to set up automatic payments for all your bills.

- Attack Your Credit Card Balances: Lenders pay close attention to your credit utilization ratio—that’s the percentage of your available credit you’re using. The goal is to keep this ratio below 30%. So, if your total credit limit is $10,000, you want your combined balances to be under $3,000.

- Don't Open New Accounts: In the months leading up to a mortgage application, avoid applying for new credit cards, car loans, or anything else. Every application creates a "hard inquiry" that can temporarily ding your score.

Build Up Your Savings and Down Payment

Finally, it's time to build up your cash reserves. Having a larger down payment is a powerful signal to lenders that you're financially disciplined and a lower risk. While many loan programs exist with low down payment options, bringing more of your own money to the deal can help you secure a much better interest rate.

And don't forget about closing costs. These fees typically run between 2% to 5% of the home's purchase price. When a lender like RAC Mortgage sees you have the funds for both the down payment and closing costs—plus some extra cash left over for emergencies—it builds a huge amount of confidence. These steps aren't complicated, but they are crucial for building the strongest application possible.

Exploring Your Loan Options with RAC Mortgage

Just because you have a lower credit score doesn't mean you're boxed into a single, high-rate loan. Far from it. When you work with specialized bad credit mortgage lenders like Residential Acceptance Corporation (RAC Mortgage), you get access to a whole portfolio of solutions built for unique financial pictures. The real goal is to find the program that actually fits your life.

A lot of borrowers find their way to homeownership through government-backed loans. These are insured by a federal agency, which takes some of the risk off the lender's shoulders. That insurance is what allows them to offer more forgiving qualification rules. The FHA loan is probably the most well-known of the bunch, famous for its flexible credit requirements and tiny down payment minimums. We've walked countless borrowers through the FHA process, making sure every 'i' is dotted and 't' is crossed.

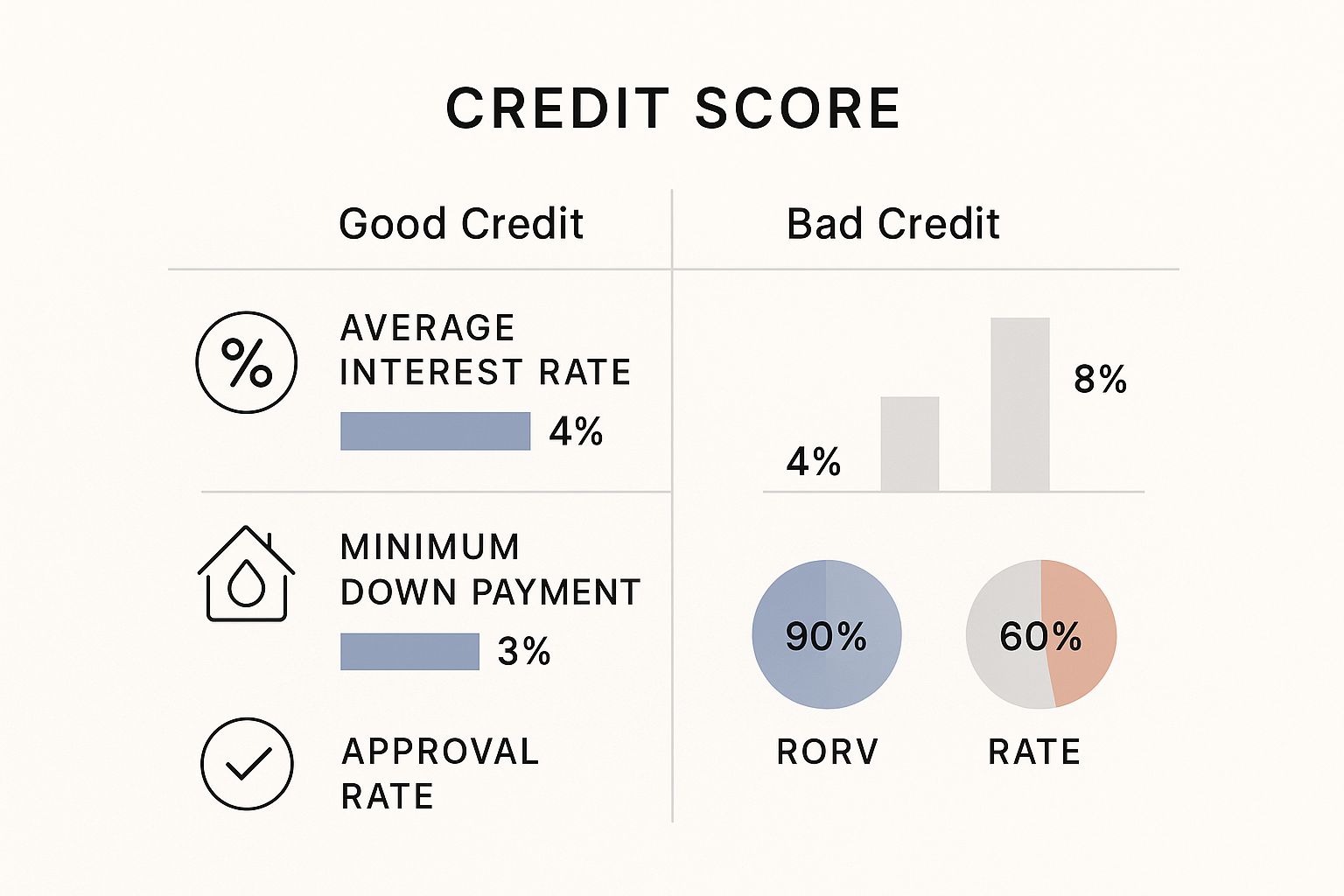

This graphic really puts into perspective how a credit score can change the game for interest rates and down payments.

As you can see, a lower score can mean paying more over the life of the loan, which is exactly why finding the right program is so important. It's not just about getting a 'yes'—it's about getting a 'yes' that makes financial sense.

Tailored Programs for Unique Situations

Beyond the standard government programs, we also offer specialized solutions that look past the three-digit credit score. These are perfect for the self-employed, gig economy hustlers, or anyone whose income doesn't fit into a neat conventional box.

Some of these loans, for instance, can use alternative data to prove you're a good risk. Think about your history of paying rent and utilities on time—that shows financial responsibility, and some programs recognize that. It gives us a much clearer, more complete picture of you as a borrower.

Historically, this kind of flexibility has been a game-changer. Some programs we work with can accept credit scores as low as 540, provided the borrower can put 10% down. If you can get that score up to 580 or higher, the down payment can drop to just 3.5%. That's the kind of flexibility that turns renters into homeowners.

To give you a clearer idea of the landscape, we've put together a table comparing some of the most common loan programs available to borrowers with less-than-perfect credit. This can help you see where you might fit in.

Common Loan Options for Borrowers with Bad Credit

| Loan Type | Typical Minimum Credit Score | Minimum Down Payment | Best For |

|---|---|---|---|

| FHA Loan | 580+ (or 500-579 with 10% down) | 3.5% | First-time homebuyers and those with lower credit scores. |

| VA Loan | No official minimum (lenders often set it around 580-620) | 0% | Eligible veterans, service members, and surviving spouses. |

| USDA Loan | No official minimum (lenders often look for 640+) | 0% | Borrowers buying in eligible rural and suburban areas. |

| Non-QM Loan | Often as low as 500-540 | Varies (often 10-20%) | Self-employed individuals, investors, or those with recent credit events. |

This table is just a starting point, of course. The best way to know for sure is to have a conversation about your specific situation. Every borrower's story is different.

Understanding Non-QM Loans

What happens when your financial profile just doesn't line up with the strict rules of government or conventional loans? For many, the answer is a Non-Qualified Mortgage (Non-QM). These loans are specifically designed for creditworthy people who might get overlooked by traditional underwriting.

Non-QM loans can be a total lifeline in a few key scenarios:

- Self-Employed Borrowers: You can often use bank statements to prove your income instead of wrestling with tax returns.

- Real Estate Investors: There are programs built for investors that make it much easier to qualify for rental properties.

- Recent Credit Bumps: They can provide a path to homeownership much sooner after a bankruptcy or foreclosure than a traditional loan would allow.

These options show that a good lender does more than just offer a single product. At RAC Mortgage, our focus is on finding the loan that fits your story. You can dive deeper into the specifics by exploring our Non-QM loan requirements. By looking at every possible path, you dramatically boost your odds of finding a mortgage that sets you up for success.

What to Expect During the Application Process

Applying for a mortgage, especially when you have a few credit blemishes, can feel like you’re staring up at a mountain of paperwork and uncertainty. But knowing the steps ahead of time takes the mystery out of it. It turns the entire journey into a manageable partnership with your lender.

Think of it as having a clear plan. With that in place, you and your Residential Acceptance Corporation (RAC Mortgage) team can work together toward the real goal: getting the keys to your new home.

The whole thing kicks off with an initial consultation and pre-qualification. This is really just the opening conversation where your loan officer gets to know your story—your income, your debts, and what you’re looking for in a home.

Getting Your Financial Documents in Order

To make that first step as smooth as possible, it’s a smart move to gather your key financial documents before you even call. Trust me, having these ready shows you’re organized and serious, and lenders always appreciate that.

You'll typically need to have these on hand:

- Proof of Income: This usually means your most recent pay stubs covering a 30-day period, plus your W-2s from the last two years.

- Tax Returns: Lenders will almost always want to see your federal tax returns from the past two years.

- Bank Statements: Be ready with the last two to three months of statements for all your checking and savings accounts.

- Asset Information: If you have other assets, like retirement or brokerage accounts, details on those can be helpful, too.

This part is all about verifying the numbers. A complete and accurate file is the fastest way for us to get a clear picture of what you can comfortably afford and which loan programs are the right fit.

From Application to Underwriting

Once you’ve found a home you love and the seller accepts your offer, your loan file moves into underwriting. This is the official verification stage where an underwriter—the person who gives the final thumbs-up—combs through every last detail. They’ll double-check your income, employment history, and credit report. They also carefully review the property's appraisal to make sure its value supports the loan amount.

The underwriting stage isn't a test; it's a verification process. The goal is just to confirm that all the information is accurate and that the loan meets all the necessary guidelines. Clear communication with your RAC Mortgage loan officer during this time is key.

This is a critical time, and it’s important to avoid any big financial changes. It's interesting to note that first-time homebuyers, who often have less-than-perfect credit, are making up a bigger piece of the mortgage market. Recent data shows they've hit a record share of agency lending as higher rates have sidelined some repeat buyers. This has opened up opportunities for new buyers, with FHA loans becoming a popular tool for affordability. You can discover more about these homebuyer trends from ICE Mortgage Technology.

Pro Tips for a Smooth Closing

To keep things from getting derailed at the last minute, there are a few golden rules to follow while your loan is in process. Breaking these can delay your closing or—in the worst-case scenario—even lead to a denial.

- Don't Make Large Purchases: Hold off on buying a new car, furniture, or anything else on credit. This can throw your debt-to-income ratio out of whack.

- Don't Change Jobs: Lenders love stability. Switching jobs, even if it’s for a higher salary, can create new verification hurdles we have to jump through.

- Don't Open or Close Credit Accounts: Just keep your credit profile looking exactly as it did when you first applied.

- Do Respond to Requests Quickly: If your loan officer asks for an extra document, get it to them as fast as you can.

That debt-to-income ratio is a crucial number in all of this. You can get the full rundown in our guide on what the debt-to-income ratio is.

By following these simple rules, you’re helping us ensure a smooth journey from application to closing day.

Your Questions About Bad Credit Mortgages Answered

Walking through the home loan process with a less-than-perfect credit history can feel overwhelming. It’s totally normal to have a lot of questions and feel a bit uncertain. Here at Residential Acceptance Corporation (RAC Mortgage), we hear these concerns all the time, so we’ve put together some straight answers to give you the clarity you need to move forward.

What Kind Of Interest Rate Should I Expect?

This is usually the first question on everyone's mind. The honest answer is that with a lower credit score, you should expect a higher interest rate than what you see advertised for borrowers with pristine credit. Lenders use higher rates to offset the perceived risk of a lower score.

But a number is just a number. A specialized lender like RAC Mortgage is going to look at your entire financial story. Things like a solid down payment, a low debt-to-income ratio, or a long, stable employment history can make a huge difference and positively influence the terms you're offered. Your final rate is based on your unique profile, not just one part of it.

Is A Larger Down Payment Required?

It's not always a strict requirement, but it absolutely helps your case. While some government-backed loans available through bad credit mortgage lenders have options for down payments as low as 3.5%, bringing a larger down payment to closing really strengthens your application.

Think of it from the lender's perspective: a larger down payment lowers their risk. That can translate directly into a better interest rate and, of course, a lower monthly payment for you. It also demonstrates financial discipline, a powerful compensating factor that can help make up for a lower credit score.

Your homebuying journey is a long-term financial commitment. While getting approved is the first step, securing a loan you can comfortably afford for years to come is the ultimate goal.

Can I Refinance Later For A Better Rate?

Yes, and you absolutely should plan on it! Think of your first mortgage not as a life sentence, but as a stepping stone. Getting a loan with a higher rate today is your entry into homeownership, not your final destination.

After you've made 12-24 months of consistent, on-time payments, you'll almost certainly see your credit score improve. Combine that with a year or two of home appreciation, and you'll be in a prime position to refinance into a new loan with a much better interest rate and more favorable terms. This is a path we help many of our clients navigate at RAC Mortgage.

How Do I Know What I Can Realistically Afford?

Figuring out a realistic budget is probably the most critical step you can take. A great starting point is calculating your debt-to-income (DTI) ratio, which is simply your total monthly debt payments divided by your gross monthly income. Most lenders want to see a DTI below 43%, though some programs we offer at RAC Mortgage have more wiggle room.

But don't stop there. You need to look at your whole budget, factoring in future homeowner costs like property taxes, insurance, and inevitable maintenance. A good lender won’t just push you to your maximum approval amount; they’ll work with you to find a monthly payment that actually fits your life without making you "house poor."

Ready to get clear answers for your specific situation? The team at Residential Acceptance Corporation is here to guide you through every step. Start your journey to homeownership today.