So, you’re looking to buy your first home in Tampa but you’re worried about your credit. Is it even possible? Absolutely. The idea that a less-than-perfect credit score is an automatic "no" is one of the biggest myths out there.

Think of your credit score as just one chapter in your financial story. Lenders who know the Tampa market, like us at Residential Acceptance Corporation (RAC Mortgage), are used to looking at the whole book. We focus on your complete financial picture to find a way to get you into a home.

Your Path to Homeownership in Tampa with Bad Credit

It’s easy to feel like you're on the outside looking in when you dream of owning a home in a place as vibrant as Tampa, especially when credit issues are weighing you down. You're not alone in feeling this way. So many hopeful homebuyers get stuck on that one number and assume they’re disqualified before they even start.

That’s where this guide comes in. We’re here to give you a clear, no-nonsense starting point. Forget the confusing jargon and discouraging rumors. Let's talk about the real first steps, from figuring out where your credit stands today to discovering loan options designed for people in your exact situation.

Breaking Down the Process

Let’s be honest—the mortgage process can seem daunting, particularly when you’re worried about your credit history. The trick is to break it down into manageable pieces. Lenders who work with non-traditional situations look at more than just that three-digit score.

They’re trying to understand your real ability to handle a mortgage. This means they often look at other indicators of financial stability, such as:

- A Steady Income: Can you show a reliable work history? A consistent paycheck is a huge green flag for lenders, proving you have the cash flow to cover monthly payments.

- A Healthy Debt-to-Income (DTI) Ratio: Even if your score is low, having few other debts (like car loans or high credit card balances) works strongly in your favor.

- A Decent Down Payment: It’s not always a deal-breaker, but having a larger down payment saved up can significantly strengthen your application by lowering the lender's risk.

The single most powerful move you can make is simply deciding to see what's out there. Don't let the fear of being turned down keep you from discovering what's truly possible for you and your family.

Getting yourself ready for the Tampa real estate market is all about having a solid plan. A great way to stay organized and make sure you don't miss anything is to follow a first-time house buying checklist.

To help you get started on the right foot, we’ve put together a quick table outlining the first few crucial actions.

Initial Steps for Tampa First-Time Homebuyers with Bad Credit

| Action Step | Why It's Important | Key Focus Area |

|---|---|---|

| Get Your Credit Report | You can't fix what you don't know. This is your baseline. | Identifying errors, understanding negative items. |

| Talk to a Specialist | A mortgage pro experienced with bad credit can offer tailored advice. | Finding a lender who sees your potential. |

| Create a Simple Budget | Shows you and the lender that you can manage your finances. | Tracking income vs. expenses, finding savings. |

| Start Saving | Even a small down payment or closing cost fund strengthens your file. | Building a "house fund," no matter how small. |

Following these initial steps will build the foundation you need for a successful home purchase.

And when you're ready for a more detailed look at the journey, our team at RAC Mortgage has also created an in-depth first-time homebuyer guide that walks you through everything. Taking the time to understand these key pieces is the first real step toward building confidence and turning that dream into your new address.

How to Navigate Tampa's Housing Market

Stepping into the Tampa real estate scene, especially as a first time home buyer with bad credit, requires a solid game plan. It’s not just about scrolling through Zillow; it’s about getting a firm grip on the financial realities here and figuring out how to put together an offer that sellers will take seriously.

The first thing you’ll notice is the pace. Tampa is a hot market, and that energy is reflected in how quickly homes sell. When you find a place you love, you have to be ready to move on it. In this market, being prepared isn't just a good idea—it's your single biggest advantage.

Understanding What You Can Afford in Tampa

A huge piece of the homebuying puzzle is getting a feel for local home values. With median home prices often sitting around $370,000, your budget and loan pre-approval are everything. That number is what dictates your down payment and gives you a ballpark idea of your monthly mortgage payment.

Now, if you're a first time home buyer in Tampa with bad credit, don't let that number scare you. Think of it as a realistic starting point. It helps you and your lender—like us here at Residential Acceptance Corporation (RAC Mortgage)—zero in on the right neighborhoods and properties that actually fit your financial picture.

Tampa's market has its own unique rhythm. While the national market has been on a rollercoaster, some local forecasts suggest a slight dip in Tampa home prices. For a buyer dealing with the higher interest rates that often come with credit challenges, this could open up a small but significant window of opportunity. You can get a deeper dive into these 2025 Tampa Bay housing predictions to see what the experts are saying.

Making an Offer That Stands Out

In a market where many homes get snapped up quickly, a strong offer is about more than just the dollar amount. Sellers are looking for confidence and a smooth, certain closing. This is where having a solid pre-approval from a lender who knows what they're doing really makes a difference.

When you work with RAC Mortgage, we don't just pre-approve you; we help you build an application that screams "ready to buy." It gives sellers the assurance that your financing is locked in, making your offer much more compelling—even when you're up against buyers with flawless credit.

A strong pre-approval letter is like a golden ticket in a competitive market. It tells sellers you are a serious, qualified buyer ready to close the deal, which can be just as persuasive as the offer amount itself.

At the end of the day, you want to present yourself as the most reliable choice for the seller. Here are a few things I always tell my clients to do to strengthen their position:

- Get Pre-Approved ASAP: Don't even start looking at houses. The very first step should be getting pre-approved with us at RAC Mortgage so you know your exact budget.

- Keep Contingencies Clean: Offers with fewer conditions—like needing to sell your current home first—are way more attractive to sellers. Keep it as simple as you can.

- Flaunt Your Financial Stability: A pre-approval is key, but showing you have steady income and have saved up for closing costs can make a powerful impression.

Navigating the Tampa market with less-than-perfect credit is absolutely doable. It just takes the right preparation and the right guide. By understanding the local trends and showing up with a strong, pre-approved offer, you can compete with confidence and finally make that homeownership dream a reality.

Finding the Right Mortgage with Bad Credit

Think of your credit score as just one part of your story, not a permanent roadblock to owning a home in Tampa. The real secret for a bad credit first time home buyer in Tampa isn't about having a perfect score; it's about knowing which doors to knock on.

Let's set aside conventional loans for a minute. There are specific government-backed mortgage programs out there designed specifically for people with less-than-perfect credit histories. These loans exist to make homeownership a reality for more people, often coming with lower down payments and a more understanding view of past financial bumps. Getting to know them is your first real step toward finding a loan that actually works for you.

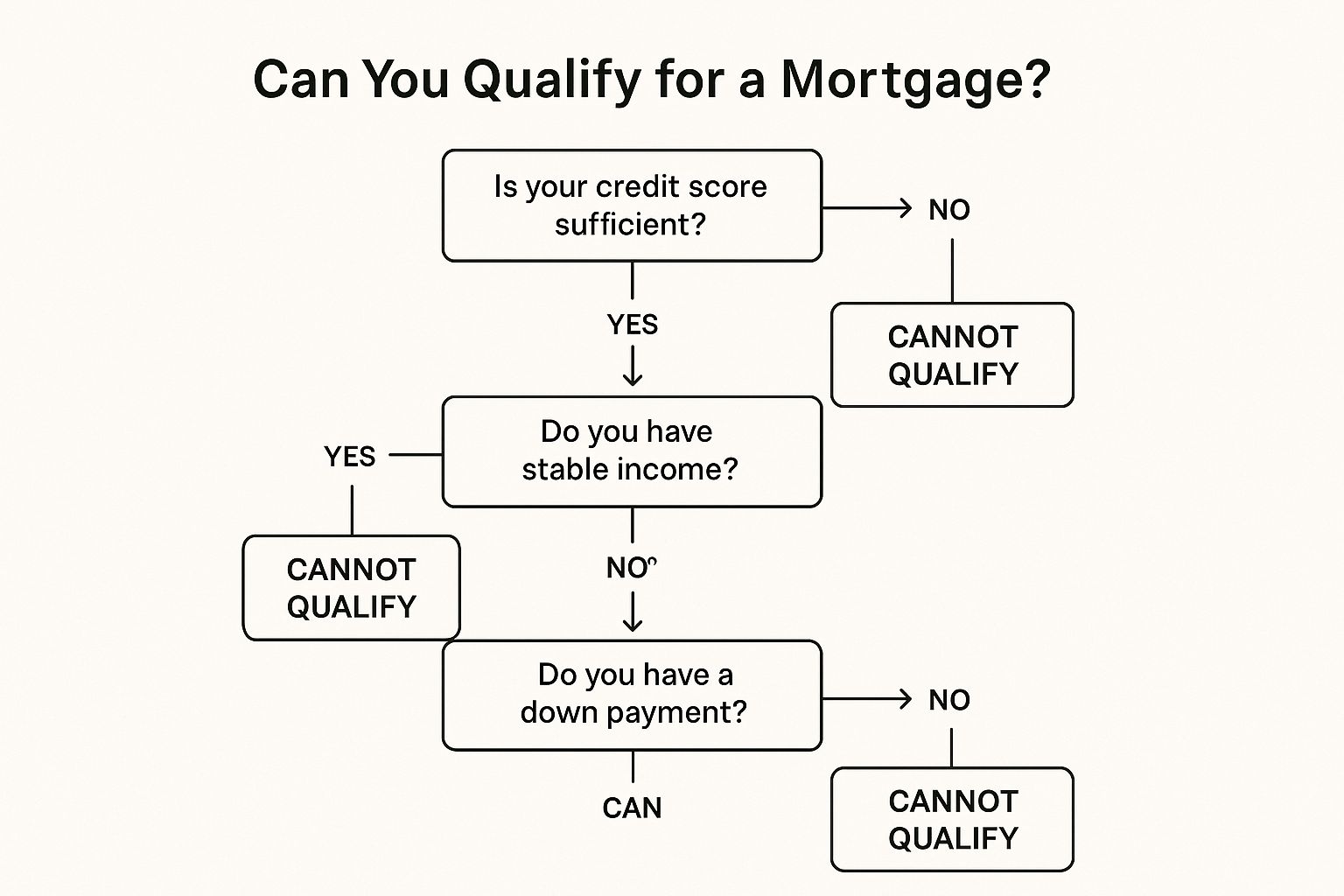

This image shows just how important it is to sit down with a professional and map out your options.

Navigating the world of mortgages with a lower credit score feels complicated, but having an expert in your corner to break it all down makes a world of difference.

Your Best Loan Options in Tampa

When your credit score is on the lower side, some loan types are simply a better fit and give you a much higher chance of getting approved. At Residential Acceptance Corporation (RAC Mortgage), we've built our reputation on helping Tampa buyers secure these kinds of mortgages.

Two of the strongest options on the table are:

- FHA Loans: This is the MVP for many buyers with credit challenges. Because the Federal Housing Administration insures them, lenders are much more comfortable working with applicants who have lower scores.

- VA Loans: An incredible benefit for veterans, active-duty service members, and eligible surviving spouses. VA loans often require no down payment at all and are famously flexible when it comes to credit history.

These programs have been game-changers for so many first-time buyers right here in Tampa. FHA loans, in particular, are incredibly popular because their guidelines can accommodate scores as low as 580 with just a 3.5% down payment. In some cases, you can even qualify with a score of 500 if you can put down 10%. You can learn more about Florida's home buying options for bad credit and see just how achievable this can be.

The biggest mistake you can make is disqualifying yourself before you even start. So many people I talk to assume their credit is a dealbreaker, only to find out they're a perfect fit for an FHA loan. You'll never know for sure until you have a conversation with a specialist.

So, how do you choose? It all comes down to your unique situation. An FHA loan might be the slam dunk for one buyer, while a VA loan is the clear winner for another. The team at RAC Mortgage will sit down with you and do a side-by-side comparison, digging into the details of interest rates, mortgage insurance, and what your long-term costs will look like. Our goal is to find the loan that doesn't just hand you the keys but also sets you up for financial success for years to come.

Boosting Your Credit Score for Better Loan Terms

If you're a first time home buyer in Tampa with bad credit, improving your credit score is the single most powerful move you can make. This isn't just about getting a 'yes' from a lender; it's about getting a lower interest rate that could literally save you tens of thousands of dollars over the life of your mortgage.

Think of it this way: a little bit of focused effort now can lead to a massive financial win down the road. Every point you can nudge your score upward makes your application stronger. Here at Residential Acceptance Corporation (RAC Mortgage), we’ve guided countless clients from a shaky, borderline application to a confident approval just by focusing on a few key strategies.

Zeroing In on High-Impact Actions

When you need to raise your score, some actions give you a much bigger bang for your buck, especially when you're trying to buy a home soon. The very first thing to do is get your hands on your full credit report from all three bureaus—Equifax, Experian, and TransUnion. You need to see exactly what lenders are going to see.

With your reports in front of you, put your energy here first:

- Tackle High-Interest Debt: Revolving debt, especially credit card balances, has a huge impact on your score. The key metric is your credit utilization ratio—how much you owe versus your total available credit. Your goal should be to get every single card balance below 30% of its limit.

- Hunt for and Dispute Errors: You’d be shocked at how common mistakes are. A Federal Trade Commission study found one in five people had an error on at least one of their reports. Scour your reports for late payments you know were on time, accounts you don't recognize, or incorrect balances. Dispute them immediately.

A single, small mistake on your credit report can be an anchor, dragging your score down. Cleaning up these errors is often the fastest way to get a meaningful score bump, and it costs nothing more than your time.

Focusing on these two areas can deliver the quickest, most significant improvements and put you in a much stronger position to apply for your mortgage.

Building a Positive Credit History

Once you’ve handled the urgent stuff, it’s all about building a solid, positive track record. Lenders are looking for consistency and proof that you can manage credit responsibly over time. This isn’t about making big, drastic moves; it’s about developing good, steady financial habits.

The most important habit? Making every single payment on time. Your payment history makes up a whopping 35% of your FICO score, making it the biggest piece of the puzzle. The easiest way to nail this is to set up automatic payments for all your recurring bills.

Also, resist the temptation to open new credit cards or take out other loans right before or during the home buying process. Every application triggers a "hard inquiry," which can cause a temporary dip in your score. You want to show stability by managing the credit you already have, not by taking on more.

For a more detailed walkthrough, our team at RAC Mortgage put together a complete guide on how to improve your credit score for a mortgage that dives even deeper. These are the very strategies we share with our clients to help them secure the best possible loan terms.

Taking Advantage of Tampa's Homebuyer Assistance Programs

Don't let the idea of a huge down payment and thousands in closing costs scare you off. For a bad credit first time home buyer in Tampa, I've seen these upfront costs feel like the final, impossible hurdle. But here’s the good news: you don't have to come up with all that cash on your own.

Tampa has some fantastic assistance programs designed specifically to help buyers—especially those with some credit bumps—get over that financial hump. These resources can seriously slash the amount of money you need on closing day, pulling your homeownership dream much closer to reality.

A Closer Look at Tampa's 'Dare to Own the Dream' Program

One of the most powerful tools in our local toolbox is the 'Dare to Own the Dream' Homeownership Program. This isn't just another loan; for many first-time buyers, it's a genuine lifeline. The program offers up to $40,000 in assistance as a 0% interest, deferred-payment loan.

What does that mean for you? It means you get the money you need for your down payment or closing costs without adding another monthly payment to your budget. It works like a silent second mortgage that you only pay back when you eventually sell the house, refinance, or move out.

Getting into a program like this usually comes down to a few core requirements:

- Income Limits: Your household income needs to be below a certain level, which is based on the area's median income.

- Property Location: The house you're buying must be within Tampa city limits.

- Homebuyer Education: You'll almost certainly need to complete an approved homebuyer education course (which is a great idea anyway!).

These programs are so important because they level the playing field. They give hardworking folks who might have stumbled with their credit in the past a real shot at building equity and a stable future through homeownership.

Trying to line up one of these programs while also going through your main mortgage application can feel like juggling chainsaws. This is where having an experienced lender who knows the local landscape, like us at Residential Acceptance Corporation (RAC Mortgage), really pays off. We know these programs inside and out and can help you weave them into your financing strategy without the headache. Our team can help you find out more about these fantastic down payment assistance programs.

The Real-World Impact of Assistance Programs

When you're staring at Tampa's median home prices, local assistance becomes more than just helpful—it's often essential.

Let’s put it in perspective. On a $370,000 home, even a small 3% down payment is over $11,000. That's a tough number for a lot of people to save up. Programs like 'Dare to Own the Dream' are designed to knock down that exact barrier.

When you pair this local money with a flexible federal loan that accepts lower credit scores, it’s a complete game-changer for Tampa’s first-time buyers. You can discover more insights about Florida's homebuyer programs to see just how much they can help. Suddenly, that seemingly impossible financial mountain becomes a manageable step toward getting the keys to your own front door.

Common Questions from Tampa Homebuyers

Jumping into the Tampa real estate market for the first time, especially when you're worried about your credit, is bound to stir up a lot of questions. If you're looking for a home as a bad credit first time home buyer in Tampa, you probably want to cut through the noise and get to the real numbers and rules.

Let's walk through some of the most common questions we hear every day here at Residential Acceptance Corporation (RAC Mortgage). Getting these answers straight is the first step to swapping that feeling of uncertainty for a clear, confident path forward.

What Is the Absolute Minimum Credit Score Needed?

There isn't one single "magic number" that works for everyone, but you'll be glad to know some government-backed loans are incredibly flexible. For instance, an FHA loan can sometimes be an option with a credit score as low as 500, provided you can bring a 10% down payment to the table.

If you can get your score up to 580 or higher, that down payment requirement often drops to just 3.5%. Here at Residential Acceptance Corporation (RAC Mortgage), we've seen it all. We can sit down with you, look at your specific financial picture, and figure out which loan options are actually within reach.

Can I Get a Home Loan in Tampa with a Past Bankruptcy?

Yes, you absolutely can. The key things that matter are the type of bankruptcy and, most importantly, how long it's been. Lenders have required waiting periods after major financial events like a bankruptcy or foreclosure before they can approve you for a new mortgage.

For an FHA loan, for example, you generally need to be two years past a Chapter 7 bankruptcy discharge. What's just as important is showing that you've been responsible with credit since then. The best move is to talk with a loan specialist at RAC Mortgage who can map out a timeline based on your specific situation and get you ready for a mortgage.

A financial stumble in your past doesn't have to define your future. Lenders are often more focused on your recent credit habits and how you've handled your money since the event.

How Much Money Do I Actually Need for a Down Payment?

It varies, but it's probably less than you think. With an FHA loan and a credit score of 580+, your down payment could be as low as 3.5% of the home's price. On a typical $370,000 home in Tampa, that comes out to $12,950.

Don't forget about closing costs, which usually add another 2% to 5% of the loan amount. The good news is that local programs like Tampa's 'Dare to Own the Dream' can offer a huge helping hand with these costs. An advisor at RAC Mortgage can help you crunch the numbers and find assistance programs to keep your out-of-pocket costs as low as possible.

As you budget for homeownership, remember to think about ongoing costs like utilities. Getting familiar with home energy audit tips can uncover ways to save money and help you plan for the true cost of owning a home.

Will My Interest Rate Be Extremely High?

It's true that your interest rate will probably be higher than what someone with perfect credit would get—that's how lenders price for risk. But it doesn't have to be sky-high.

The final rate you're offered is a mix of several factors: your exact credit score, the loan program you choose, the size of your down payment, and your debt-to-income ratio. The single best thing you can do is work on boosting your credit score before applying. Even a 20-point jump can make a real difference in your monthly payment. Working with RAC Mortgage means we'll hunt down the most competitive options out there for your specific situation.

Ready to take the next step toward owning your first home in Tampa? The team at Residential Acceptance Corporation is here to guide you through every question and challenge. Visit us online to connect with a mortgage expert who specializes in helping homebuyers with bad credit.