Ever wonder if you could get a mortgage based on what you own, not just what you earn? That's the core idea behind an asset-based mortgage loan. It's a financing option where lenders look at the value of your assets—like real estate or investments—as the main reason to approve your loan, rather than scrutinizing your pay stubs and tax returns.

For Tampa borrowers whose financial stories don't fit into a neat little box, this can be a game-changer. If you're an entrepreneur, a real estate investor, or someone with a less traditional income stream, an asset-based loan provides a direct route to securing the funding you need.

Tapping Into Your Property’s Potential

Think of it this way: a traditional mortgage application feels a lot like a strict job interview for your bank account. Lenders want to see a long, steady history of W-2s and predictable income. If you're self-employed, have fluctuating income, or most of your net worth is tied up in property, that rigid process can quickly become a frustrating dead end.

An asset-based mortgage loan completely flips that script. Lenders like us here at Residential Acceptance Corporation in Tampa shift the focus from your income to the equity you’ve already built in your properties and other significant assets.

The Key Difference: What Lenders Look At

The entire approach is less about your monthly paycheck and more about the value of what you already own. It's a practical solution built for people with substantial assets who might not have the conventional paperwork to prove a consistent salary. The loan is secured by the asset itself, which just makes sense in many situations.

This shift in focus brings some major advantages for Tampa homebuyers:

- Equity Is King: The value of your property is what truly matters for qualification.

- Less Paperwork Hassle: You can forget about digging up years of income verification documents.

- Quicker Closing: With a simpler verification process, approvals often happen much faster.

To really see the difference, let’s compare how lenders view your application for both loan types side-by-side.

Asset Based vs. Traditional Mortgage at a Glance

| Qualification Focus | Asset Based Mortgage | Traditional Mortgage |

|---|---|---|

| Primary Factor | Value and equity of your assets (e.g., property, investments). | Verifiable, consistent income and employment history. |

| Documentation | Bank statements, asset appraisals, and property valuations. | W-2s, tax returns, pay stubs, and debt-to-income ratio calculations. |

| Ideal Borrower | Self-employed individuals, real estate investors, retirees with high net worth. | Salaried employees with a stable, documented income stream. |

Ultimately, an asset-based loan recognizes that your financial strength isn't just about what's on a bi-weekly paycheck.

This type of financing falls under a broader category known as Non-Qualified Mortgages (Non-QM), which are designed to offer more flexibility than standard loans. To see if this path is right for you, it's worth taking a closer look at the typical Non-QM loan requirements. Here at Residential Acceptance Corporation, we specialize in helping Tampa residents explore these powerful alternatives.

Why Asset-Based Lending Makes More Sense Than Ever in Tampa

The financial world is constantly in motion, and the most successful borrowers are the ones who adapt. In fast-paced markets like Tampa, where opportunities don't wait, asset-based mortgage loans have emerged as a go-to strategy for savvy homeowners and investors. This isn't just a backup plan anymore; it's a modern, intelligent way to approach financing in today's economy.

Let's be honest: traditional banks have gotten a lot more conservative since the major economic shifts of the last decade or so. They've tightened their belts, rolling out stricter rules and more complicated requirements that can sideline even highly qualified people. This has created a huge gap in the lending world, particularly for anyone whose financial story isn't told by a simple W-2.

A Modern Answer to a Changing Market

Think about how many people work for themselves these days. With the rise of the gig economy and entrepreneurship, more and more people have significant—but fluctuating—income. Tampa, in particular, is a magnet for consultants, small business owners, and real estate investors who just don’t fit neatly into a traditional lender's box.

This is where asset-based lending steps in. It solves the problem by looking at your proven net worth instead of getting hung up on perfectly documented monthly paychecks.

And this isn't some tiny, niche trend. Since the 2008 financial crisis, asset-based finance has exploded as a major alternative to old-school bank loans. As big banks deal with tighter regulations, the private global asset-based finance market is projected to blow past $6.1 trillion in 2025. It's even forecasted to hit an incredible $9.2 trillion by 2029, which is nearly triple what it was back in 2006. If you want to dive deeper into this growth, the global investment firm KKR published some fascinating insights.

That kind of explosive growth tells you one thing: using your assets to secure financing is now a mainstream financial strategy, not a last resort.

How RAC Mortgage Gives You an Edge in Tampa

For anyone in the Tampa Bay area, this modern approach offers a straight line to your financial goals without all the usual headaches. It’s built on a simple, powerful idea: your real wealth is in the portfolio you've built, not just the paycheck you bring home.

At Residential Acceptance Corporation (RAC Mortgage), we work with this reality every single day. Our clients are smart people who have built substantial equity and need a lender who gets how to make that equity work for them. We help them skip the frustrating paperwork and the endless income-verification loops that have become standard practice at the big banks.

An asset-based loan doesn’t just see a snapshot of your last two pay stubs. It looks at the entire financial foundation you've spent years building, giving a much more accurate picture of your true borrowing power.

This strategic shift means you can get the funding you need faster and with a lot less hassle. It's the perfect fit for:

- Real Estate Investors: Need to move quickly to snap up properties in Tampa's hot market? This is how.

- Business Owners: Unlock the capital tied up in your personal real estate to fuel your business's growth.

- Retirees: Access cash from your home's equity without having to sell off your investment portfolio.

By focusing on what you own, RAC Mortgage delivers a smarter, more efficient path to financing your next big move. It’s a method built for today’s dynamic world, empowering you to capitalize on the success you’ve already created.

Who Is a Good Fit for an Asset-Based Loan in Tampa?

So, could an asset-based mortgage be the right key to unlock your next property? This isn't your standard, one-size-fits-all loan. It’s built for a specific kind of Tampa borrower—someone whose financial story is better told by their balance sheet than their W-2.

Instead of getting bogged down in theory, let's look at who actually uses these loans. When you see real-world examples, it’s easier to figure out if this path makes sense for you. Many of our clients right here at RAC Mortgage in Tampa fit these profiles, finding that asset-based lending opens doors that conventional financing slams shut.

This approach is a game-changer for people who have built serious wealth but whose income doesn't fit into a neat, traditional box.

The Self-Employed Professional or Business Owner

Picture this: you own a thriving contracting business here in Tampa. Some months are fantastic, with big project payments rolling in. Other months are slower while you're lining up the next job. This kind of "lumpy" income can make traditional lenders nervous, even when your business is incredibly healthy.

An asset-based mortgage loan cuts through that noise. A lender like RAC Mortgage isn't going to get hung up on your fluctuating monthly profits. Instead, we’ll look at the real value you’ve built—the equity in your properties or your other liquid assets.

The Savvy Real Estate Investor

Tampa's real estate market doesn't wait for anyone. When a great investment property comes up, you have to move fast. If you're stuck waiting weeks for a conventional loan approval that demands stacks of income paperwork, you'll lose out to cash buyers every time.

This is where asset-based loans give you a massive advantage. The approval process is laser-focused on the value of your existing real estate portfolio, which makes it much, much faster. It gives you the power to make offers with the speed and confidence of a cash buyer, letting you snap up opportunities and grow your portfolio without the usual headaches.

The High-Net-Worth Retiree

Think about a retired couple living well in the Tampa Bay area. They might be sitting on a multi-million-dollar investment portfolio and a paid-off home, but their actual taxable income from pensions and Social Security is modest. If they want to buy a vacation home, a traditional lender will likely take one look at their debt-to-income ratio and say no.

For retirees, asset-based lending is a practical and respectful way to secure financing. It acknowledges that true financial strength isn't just about a monthly paycheck—it's about the wealth you've carefully built over a lifetime.

At Residential Acceptance Corporation, we specialize in understanding these kinds of financial pictures. We know how to look past the standard forms to see your real financial standing, clearing a path to the funding you deserve.

The Strategic Edge of an Asset Based Loan in Tampa

Opting for an asset-based mortgage is more than just a way to skip a mountain of income paperwork. It's a calculated move that can give you a serious competitive advantage, especially in a hot market like Tampa. The perks go well beyond simple convenience—they translate directly into real-world wins for Tampa investors and homebuyers who need to move fast.

The biggest game-changer? Speed. In a real estate scene like Tampa's, where great properties get snapped up in days, time is everything. A traditional mortgage can get stuck in underwriting for weeks, bogged down in income verification. An asset-based mortgage loan, on the other hand, puts the focus squarely on the property's value, which slashes the approval timeline.

This speed essentially turns you into a cash-like buyer. When a seller is looking at multiple offers, the one that can close quickly and with certainty often jumps to the top of the pile. For an investor trying to build a portfolio, that's invaluable.

Unlock Your Capital and Keep Your Finances Private

Beyond sheer speed, these loans offer a smarter way to manage your capital and maintain your financial privacy. Because the lender is focused on your existing assets, the application process is far less intrusive.

With an asset-based loan, the conversation isn't "How much do you earn?" It's "What are your assets worth?" This simple shift streamlines the entire lending experience and respects your financial privacy.

This straightforward approach delivers some powerful strategic benefits:

- Free Up Your Capital: You can tap into the equity in your current real estate holdings to fund new investments, all without having to sell off other assets.

- A Simpler Process: The required documents are all about asset valuation, not years of personal or business tax returns. This makes the whole application far less of a headache.

- Greater Confidentiality: The private nature of the deal is a huge plus for high-net-worth individuals who'd rather not lay out their entire income history for a lender.

This isn't a niche product anymore; it's a major shift in the lending world. The asset-based loan market grew to roughly USD 542 billion by the end of 2024. To put that in perspective, it was under USD 400 billion back in 2018. That kind of growth shows just how many borrowers are turning to asset-backed financing as traditional bank loans become more restrictive. The London Stock Exchange Group offers a great in-depth analysis of these lending trends if you want to dig deeper.

For those whose income comes from business revenue rather than a simple paycheck, RAC Mortgage has other specialized options, too. Our guide on bank statement home loans in Tampa explains how we can help you get financed without traditional W-2s. Here at Residential Acceptance Corporation, we see these loans as powerful tools for empowering our Tampa clients to hit their goals with confidence and efficiency.

Navigating the Application Process with RAC Mortgage

Getting an asset-based mortgage in Tampa shouldn't be a confusing ordeal. At Residential Acceptance Corporation, we’ve built our entire process around transparency and simplicity. From our first chat to closing day, we want you to feel confident and in control, focusing on what truly matters: your assets.

Let’s walk through a real-world example. Imagine a seasoned real estate investor in Tampa who just found the perfect flip. They give us a call at RAC Mortgage. That first step, what we call the Initial Conversation, is all about understanding their goals and making sure an asset-based loan is the right strategy for this particular property.

The Four Key Stages to Funding

Once we've established a good fit, we move through four clear-cut stages designed for speed.

- Property Valuation: This is the cornerstone of an asset-based mortgage. We immediately schedule a professional appraisal of the Tampa property. Its current market value is what determines the foundation of the entire loan.

- Document Submission: Forget the mountains of W-2s and tax returns. The investor just needs to provide statements proving their assets, like a portfolio of their other real estate holdings or bank and brokerage accounts. It’s that straightforward.

- The Loan Proposal: As soon as the appraisal is in and we’ve reviewed the asset documents, our team puts together a loan proposal. It lays everything out in plain English—the loan amount, interest rate, and terms. No jargon, no hidden fees.

- Closing Day: After the investor gives the proposal a thumbs-up, we head straight for the finish line. The whole timeline is designed to be significantly faster than a conventional mortgage, which can give our clients a serious advantage in a competitive market.

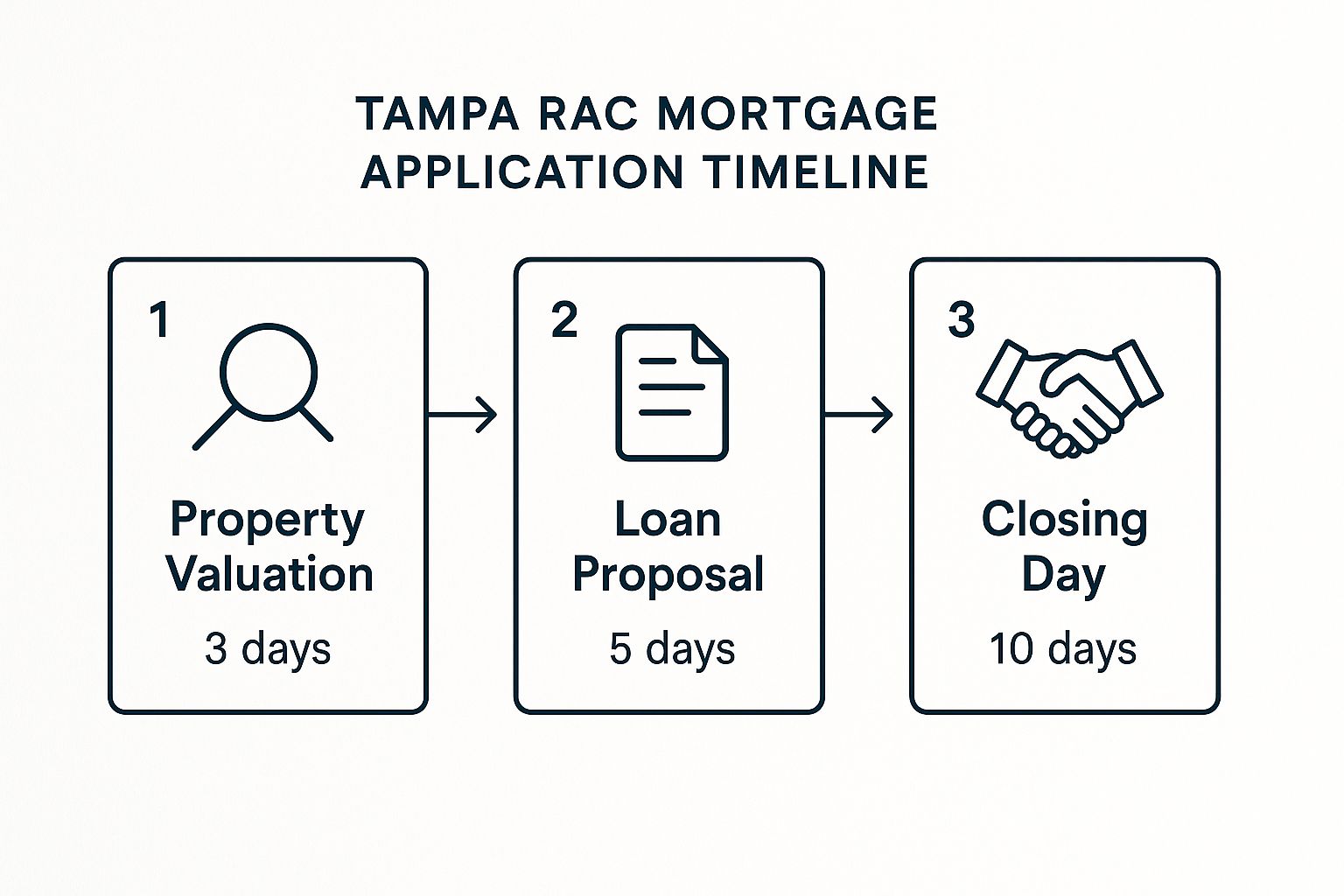

This simple infographic gives you a snapshot of how we keep things moving at RAC Mortgage.

As you can see, the process is built for speed. It’s not uncommon for everything to wrap up in as little as 10 business days.

Because we're looking at your assets instead of your income, this type of loan opens doors for people with unique financial situations. If this sounds like it might be a good fit for you, it's worth seeing how it stacks up against other options. You can learn more about the Tampa alternative documentation mortgage programs we have available.

Here at RAC Mortgage, our mission is to turn the application process from a roadblock into a clear path toward your next big real estate win in Tampa.

Why Your Tampa Lender Makes All the Difference

When you're looking for an asset based mortgage loan, picking a lender is more than just a business deal—it's about finding the right partner. And in a unique real estate market like Tampa's, local expertise isn't just a nice-to-have; it's your biggest asset. A Tampa-based lender feels the city's pulse in a way a giant national bank never could.

That local insight is absolutely critical. Here at Residential Acceptance Corporation (RAC Mortgage), we have a real, on-the-ground understanding of Tampa's different neighborhoods and what properties are actually worth. This isn’t just about pulling data from a screen. It’s the kind of know-how that guarantees your property valuation is both accurate and fair, which is the cornerstone of any asset-based loan.

The Advantage of a Local Partner

Working with a local expert like RAC Mortgage means you can actually talk to the people making the decisions. You won't get lost in a call center or deal with a faceless underwriter halfway across the country. We’re part of the Tampa community, so we're genuinely invested in helping our clients succeed.

This direct connection makes the whole process faster and more personal. We know the market, we know the best appraisers, and we have relationships with the local title companies, which allows us to move quickly. That’s a level of service and speed that larger, out-of-state lenders just can't compete with.

Choosing a local lender means you're not just a file number. You're a neighbor. This personal commitment from a lender who understands Tampa is what provides true peace of mind.

There's no denying that asset-based lending is growing. The global market was valued at about USD 815.3 billion in 2025 and is expected to soar to USD 2.3 trillion by 2035. As this type of financing becomes more common, having a lender who truly understands your local market is more crucial than ever.

You can learn more about these market growth findings to see why a specialized approach is so important. At RAC Mortgage, we believe your success is our success.

Common Questions About Asset-Based Mortgages in Tampa

Even after getting the rundown on asset-based mortgage loans, it's totally normal to have a few questions pop up. Here at Residential Acceptance Corporation, we've helped countless Tampa clients navigate this process, and we've found that a few key questions come up time and time again. Let's tackle them head-on.

Can I Qualify with a Low Credit Score?

This is probably the number one question we get. While your credit score isn't completely ignored, it takes a backseat in asset-based lending. Think of it this way: traditional lenders are obsessed with your past payment history, but we're focused on the strength and value of your assets right now.

A lower-than-ideal credit score won't slam the door shut. If you have solid assets to back the loan, that’s what really matters. We look at your complete financial situation, but the property and your other assets are the stars of the show.

What Types of Assets Can I Use?

The main asset, of course, is the property you're buying or refinancing in Tampa. But other liquid assets can seriously bolster your application and show us you have strong financial footing.

We can often consider assets like:

- Other real estate you own that has significant equity

- Stocks, bonds, and mutual funds held in a brokerage account

- Retirement funds such as a 401(k) or an IRA

- Substantial cash reserves sitting in savings or money market accounts

The crucial factor is that these assets must be verifiable with a clear market value. A more robust and diverse asset portfolio simply makes you a stronger borrower in our eyes.

Are the Interest Rates Higher?

It's a fair question. Sometimes, the interest rates on asset-based loans can be a touch higher than what you'd see on a conventional, government-backed mortgage. This is because the lender is offering a much more flexible product and taking on a different kind of risk.

But for many of our Tampa clients, the trade-off is well worth it. The speed, privacy, and ability to get a deal done when traditional banks say "no" often outweigh a small difference in the rate. It’s all about unlocking capital you already have.

It's also not a one-size-fits-all answer. Your specific rate will depend on factors like the loan-to-value (LTV) ratio and the quality of the assets you're bringing to the table.

At RAC Mortgage, our job is to find the most competitive terms for your unique scenario. We believe in total transparency, so you'll understand every line of your loan proposal. Our mission is to structure financing that fits your overall financial strategy, giving you a powerful advantage in Tampa's dynamic real estate market.

Ready to see how your assets can open new doors in Tampa's real estate market? The expert team at Residential Acceptance Corporation is here to provide the clear, personalized guidance you need. Explore your financing options with a lender who understands your unique financial story.

Start your journey at https://racmortgage.com today.