Think of a mortgage broker as your personal guide through the often-confusing world of home loans. They act as the crucial link between you—the homebuyer—and a whole network of different lenders. Instead of you having to knock on the door of every bank, one by one, a broker does all the heavy lifting and shops for the best loan for you. It’s an expert partnership designed to save you a ton of time and stress.

Your Personal Home Loan Shopper

Here’s a way to think about it. Imagine you’re looking for a new car. You could spend your weekends bouncing from dealership to dealership, haggling with salespeople, and trying to make sense of their complex financing offers. It’s exhausting.

Or, you could hire a personal car shopper who already knows every dealer in town, understands all the fine print, and has the expertise to negotiate the best possible price on your behalf. A mortgage broker does exactly that, but for what is likely the biggest purchase you'll ever make—your home in Tampa.

A broker isn't tied to the limited menu of loan products that a single bank offers. Instead, they give you access to a massive network of lenders. This includes big national banks, smaller regional banks, and even specialized lenders you might have never heard of. Each one has different loan programs and interest rates, and that variety is the key to finding a mortgage that actually fits your life.

How a Broker Simplifies the Process

This kind of guidance is especially valuable for homebuyers in a hot market like Tampa. Securing a home loan is about way more than just snagging a low interest rate. At RAC Mortgage, our job is to handle all those moving parts for you.

Here's a quick look at what a broker really does:

- Digs into Your Financial Profile: We’ll sit down and review your income, credit history, and down payment to get a clear picture of your borrowing power.

- Shops the Entire Market: We take your loan application and present it to multiple lenders, making them compete for your business to find the best rates and terms.

- Manages the Mountain of Paperwork: A single mortgage application can easily run into hundreds of pages. We manage this whole process from start to finish.

- Gives You Expert, Straight-Talk Advice: We explain all your options in plain English, so you understand every single step and feel confident in your decisions.

A mortgage broker is your dedicated ally in the homebuying process. Our loyalty is to you, not to any one bank. Our primary goal is to navigate the market and lock in a financial solution that puts your interests first.

When you boil it down, the main difference between a broker and a bank loan officer comes down to choice and allegiance.

Mortgage Broker vs Bank Loan Officer At a Glance

This table quickly breaks down the key differences between partnering with a mortgage broker like RAC Mortgage and going directly to a bank.

| Feature | Mortgage Broker (RAC Mortgage) | Bank Loan Officer |

|---|---|---|

| Lender Options | Access to dozens of lenders (banks, credit unions, etc.) | Limited to the single bank's own products |

| Allegiance | Works for you, the borrower | Works for the bank |

| Loan Variety | Wide range of programs for various financial situations | Only offers the bank's specific loan types |

| Flexibility | Can find solutions for unique credit or income scenarios | Must adhere to the bank's strict internal guidelines |

| Shopping Process | Submits one application to multiple lenders for you | You must apply individually at each different bank |

Partnering with an expert from RAC Mortgage gives you a real strategic advantage. We do the legwork, manage the chaos, and give you the clarity you need to make a solid decision on your path to owning a home in Tampa. That dedicated support doesn't just save you time—it can lead to some serious savings over the life of your loan.

Your Advocate in the Home Loan Process

Think of a great mortgage broker as more than just a middleman. They're your personal advocate in the home loan process, and their loyalty is to you, not a specific bank or financial institution.

From the moment you start looking for a home in Tampa until you're holding the keys, their main job is to represent your best interests. This relationship means you have an expert in your corner, fighting to get you the best possible deal.

At RAC Mortgage, our advocacy begins with a deep dive into your financial situation. We look at everything—your income, your credit, your long-term goals—to get a complete picture of what you need. We then translate all the confusing industry jargon into plain English, so you feel confident and in control every step of the way.

Securing Your Best Interests

Your broker is there to manage the mountain of paperwork that comes with getting a mortgage, a task that can easily overwhelm even the most organized person. They make sure every detail, from the first application to the final closing documents, is accurate and submitted on time.

This focus on the small stuff is what keeps things moving smoothly, especially when it comes to the mortgage underwriting process.

Maybe the most important part of their job is negotiating on your behalf. We use our established relationships with lenders to lock in favorable rates and terms you probably wouldn't find on your own. In a competitive Tampa market, this kind of advocacy can make all the difference.

Imagine a first-time homebuyer in Tampa, totally overwhelmed by all the loan options. By working with RAC Mortgage, they get an advocate who shops their application to dozens of lenders, finds a loan with a great rate, and handles all the back-and-forth communication. It turns a stressful ordeal into a well-managed, successful home purchase.

This role as an intermediary is a huge piece of the modern housing market. Having a trusted guide is essential for navigating the complexities of securing a mortgage today, especially for purchase transactions.

Navigating the Unique Tampa Mortgage Market

Anyone who's looked at property here knows it: the Tampa real estate market has a pulse all its own. Local knowledge isn’t just a nice little bonus—it’s the key to finding a home loan that actually fits your life. This is exactly where a Tampa-based mortgage broker makes all the difference.

Instead of trying to figure it all out on your own, you get to team up with an expert who genuinely understands the quirks of Hillsborough County. We’re talking about property values, neighborhood trends, and which lenders are friendliest to certain types of deals. An expert from RAC Mortgage brings those deep community roots and real relationships with local and regional lenders who are active right here in the Tampa Bay Area.

This local connection is a huge advantage. It often means we can uncover flexible financing solutions that a big, out-of-state bank might not even consider. We know which lenders are the go-to for historic bungalows in Seminole Heights versus new construction out in Wesley Chapel.

Your Strategic Partner for Tampa Homeownership

Knowing how to pair the right loan product with a specific area is a game-changer. For example, FHA loans are a fantastic option for many first-time homebuyers across Tampa's diverse neighborhoods. Why? Because they come with more flexible credit requirements and lower down payment options. A local Tampa broker knows precisely how to package your FHA application to get it approved by lenders who work with this program every day.

The national mortgage market is always shifting, especially with rising home prices and interest rates bouncing around. We’re seeing a big increase in home sales in Florida, which makes having an expert on your side more important than ever. In this kind of market, brokers are essential for connecting borrowers with the right products—like those popular FHA loans—that can make owning a home a reality.

A local Tampa mortgage broker is more than a loan facilitator; they are your strategic partner. They use their on-the-ground expertise to help you confidently overcome local hurdles and turn your dream of Tampa homeownership into a reality.

By understanding the little details of the local scene, from navigating property insurance challenges to knowing which lenders have an appetite for certain loans, your broker becomes your guide. To get started on the right foot, it’s a great idea to learn more about how to compare mortgage lenders and find the perfect fit. That knowledge, backed by a local pro, gives you a clear and confident path forward.

The Real Payoff of Working With RAC Mortgage

So, you know what a mortgage broker is, but what's the actual payoff for you? It's a fair question. Partnering with an expert from RAC Mortgage isn't just about handing off paperwork; it's about gaining real, tangible advantages that save you cash, time, and a whole lot of stress on your Tampa homebuying journey.

The single biggest win is access to more choices. Think about it: a traditional bank can only sell you their products. That's it. At RAC Mortgage, we're plugged into a huge network of different lenders, which throws the doors wide open to a much bigger menu of home loan options. This creates competition, and that’s fantastic for you. Lenders have to fight for your business, which often means better interest rates and friendlier terms than you'd ever find flying solo. We even have access to wholesale lending channels—the kind of stuff not available to the general public—unlocking even deeper savings for our clients.

Save Your Time, Spare Your Sanity

Let's be honest, the mortgage process can be a nightmare. It’s a mountain of paperwork, endless back-and-forth with underwriters, and a level of detail that can make your head spin. That’s our job. We shoulder that burden for you.

An RAC Mortgage broker takes all the grunt work off your plate:

- One Application, Dozens of Lenders: You fill out just one application with us. We then take that and shop it to our entire network to find the perfect match.

- Expert Quarterback: We run the entire play, managing all the communication between the lender, your real estate agent, and the title company to make sure your loan keeps moving smoothly down the field.

- Problem-Solvers on Standby: If a snag pops up during underwriting—and they often do—we have the experience to jump in, fix it, and keep things on track.

This means you can get back to focusing on the fun part: finding that perfect home in Tampa. You get all the benefits of our deep industry knowledge without any of the headaches.

Working with a mortgage broker turns a complex, often intimidating financial transaction into a guided, supportive experience. Our entire purpose is to cut through the complexity, fight for your best interests, and light up a clear path to the closing table.

Here’s a real-world example. Imagine you're a self-employed business owner here in Tampa. You walk into a big national bank, and they see your fluctuating income. Their rigid, one-size-fits-all rules might lead to a quick denial. This is exactly where we come in. We know which lenders actually like working with entrepreneurs and have programs built for them. We know how to package your financial story to showcase your strengths. This kind of personalized strategy can turn a frustrating "no" into a confident "yes" and get those house keys in your hand.

Your Mortgage Journey From Start to Finish

Getting a mortgage can feel like trying to solve a puzzle in the dark. There are so many pieces—paperwork, deadlines, weird financial terms—and it's hard to see how they all fit together. But it doesn’t have to be a confusing maze.

When you work with a mortgage broker, that confusing journey turns into a clear, step-by-step roadmap. Here at RAC Mortgage, our whole job is to light up the path to owning a home in Tampa, making it feel straightforward and totally manageable.

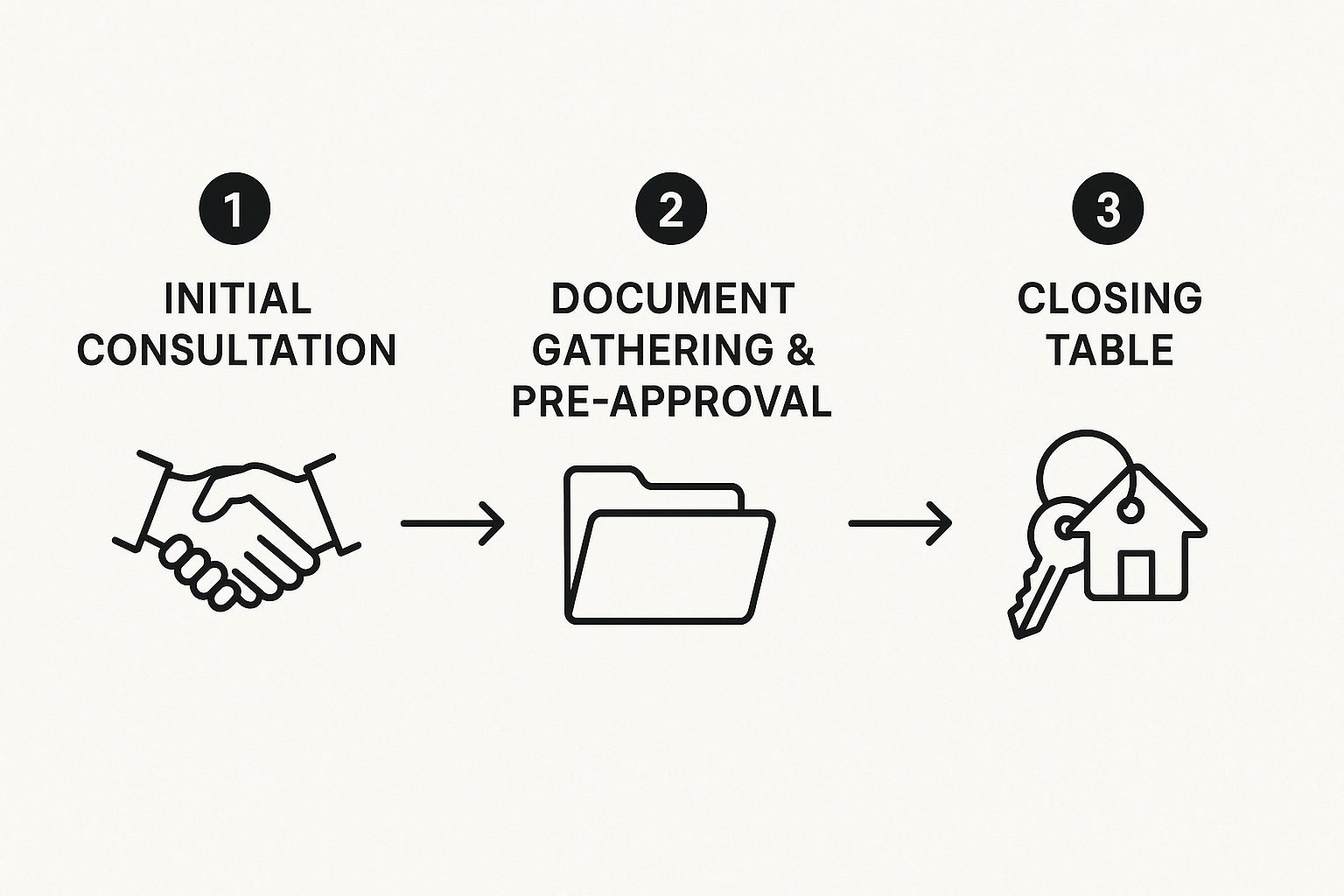

We're with you from the very beginning. It all starts with a simple conversation to understand what you're looking for. From there, we help you pull together the right documents, shop for the perfect loan, and guide you through underwriting all the way to the closing table.

This little infographic breaks down the core stages you'll go through with us.

As you can see, having an expert guide turns what seems like a complicated mess into a logical path toward getting the keys to your new home.

The Pre-Approval Phase

First thing's first: getting pre-approved. This is a huge milestone. It’s where we sit down with your financial documents—things like pay stubs, tax returns, and bank statements—to figure out exactly how much you can comfortably borrow.

Getting this part right from the get-go is absolutely crucial. A solid, well-documented application doesn't just prevent headaches and delays down the road; it shows sellers you're a serious buyer. In a competitive market like Tampa's, that gives you a massive advantage. If you want to get a jump on it, check out our guide on how to get preapproved for a mortgage.

Our team at RAC Mortgage is here to make sure your application is buttoned up and ready to impress.

From Underwriting to Closing

Once you've found a home in Tampa and the seller accepts your offer, your loan file heads into underwriting. Think of this as the lender's official fact-checking stage. They'll go through everything with a fine-tooth comb to verify all your information. We handle all the back-and-forth, answering any questions the underwriter has to keep things moving smoothly.

The final step is closing. We'll coordinate with the title company and your real estate agent to get it all scheduled. This is the moment you've been working for—signing the last bit of paperwork and officially becoming a homeowner. It’s a great feeling.

Your Top Tampa Mortgage Broker Questions Answered

When you're diving into the home loan process, it's natural to have questions. If you're buying a home in Tampa and wondering what a mortgage broker really does—and if using one is the right call—getting straight answers is key. Let's tackle some of the most common questions we hear every day.

How Does a Mortgage Broker Get Paid?

This is always one of the first and most important questions people ask. In most cases, mortgage brokers are paid by the lender who funds your loan. It’s a standard industry practice called lender-paid compensation.

Here at Residential Acceptance Corporation (RAC Mortgage), we operate with complete transparency. Our compensation is fully regulated and disclosed on your official loan documents right from the start. This setup actually puts us on the same team—our success depends entirely on finding you the best loan, not pushing a specific product to make a quick buck.

Is a Broker Better Than My Bank in Tampa?

Your bank might feel familiar, but it can only offer you its own handful of loan products. A mortgage broker, on the other hand, opens the door to a huge variety of loan options from many different lenders, both in the Tampa area and nationwide.

This immediately creates competition for your business, which almost always leads to better rates and more flexible terms. A broker is in your corner, not the bank's, giving you unbiased advice that fits your specific financial picture. For most Tampa homebuyers, that means more options and far more personalized service.

The key advantage of a broker is choice. Instead of being locked into one institution's rules, you get an expert who shops the entire market to find a loan that truly fits your needs, not the bank's.

Can a Broker Help If I Have Imperfect Credit?

Absolutely. This is where a great broker really shines. At RAC Mortgage, we’ve built strong relationships with a diverse network of lenders, including many who specialize in helping borrowers with less-than-perfect credit.

We can walk you through all the possibilities, from FHA loans to other government-backed programs, and connect you with lenders whose guidelines you're much more likely to meet. This can dramatically increase your chances of getting approved and finally getting the keys to your new home in Tampa.

Ready to get clear, expert answers to all your mortgage questions? The team at Residential Acceptance Corporation is here to guide you through every step of your Tampa home loan journey. Start your application today!