Picture this: you're ready to buy your first home in the Tampa area, but the thought of scraping together a massive down payment feels completely out of reach. That’s the exact situation the USDA first time home buyer loan was created for. It’s a government-backed program designed to swing the doors of homeownership wide open, and this guide will show you how.

Your Zero Down Payment Path to a Tampa Home

For a lot of folks trying to buy a home in Tampa, it's not the monthly payment that’s the deal-breaker—it's the down payment. Trying to save up tens of thousands of dollars is a huge hurdle that can put the dream on hold for years.

This is where USDA first time home buyer loans come in. These loans offer 100% financing. Let that sink in: you can buy a home with zero money down. This isn't some kind of gimmick; it's a real program from the U.S. Department of Agriculture aimed at helping eligible suburban and rural areas around cities like Tampa grow.

Who Is This Loan For?

When you hear "USDA," you probably think of farms and open country, but the reality is much different. A surprising 95% of the U.S. landmass actually qualifies for USDA financing, and that includes plenty of great suburbs just outside Tampa.

This program is a game-changer for:

- First-time buyers who can't save a huge lump sum.

- Families with moderate incomes who are otherwise ready to own a home.

- Anyone looking to live in a growing community with a little more breathing room.

Think of it as the key that unlocks homeownership for people who have a steady income and decent credit but just don't have the big savings account that other loans demand. It truly levels the playing field.

Starting Your Journey with a Local Expert

Any mortgage process can get complicated, and a USDA loan has its own specific rules about location and income. That's why working with a local expert who knows the ins and outs is so important.

A lender like Residential Acceptance Corporation (RAC Mortgage) is based right here in Tampa and gets the local market. They know exactly which neighborhoods in Hillsborough, Pasco, and Hernando counties are eligible and can walk you through the entire process, step by step.

With a USDA loan, you're not just buying a property; you're investing in a community. The program’s zero down payment feature is specifically designed to remove the primary barrier to entry for countless families, opening doors that might otherwise remain closed.

Once you've got the keys to your new Tampa-area home, the fun part begins—making it your own. It can be a huge help to create detailed floor plans to figure out the best layout for your furniture and lifestyle. A solid plan from the start helps turn a new house into your home.

So, How Do USDA Loans Actually Work?

Let's get straight to it. What exactly is a USDA loan? I like to think of it as a special key the government created to unlock homeownership in growing communities. Many of these spots are surprisingly close to the heart of Tampa, in suburbs and developing areas where families want to plant roots. The whole point of the program is to encourage that growth.

For most folks looking into USDA first-time home buyer loans, we're really talking about the USDA Guaranteed Loan program. This is a common point of confusion, so let’s clear it up right now. The government doesn't actually hand you the money for the house.

Instead, a local, USDA-approved lender—like us here at Residential Acceptance Corporation (RAC Mortgage)—provides the financing. The USDA then steps in and backs up that loan with a powerful guarantee.

The Lender and USDA Partnership

That government guarantee is the secret sauce. It’s basically an insurance policy for the lender, which drastically cuts down their financial risk. Because the loan is much safer for us, we can turn around and offer you incredible benefits that you just won't find with most other mortgages.

Think of it like this: You ask a friend to lend money to someone they've never met. They'd probably be a bit hesitant, right? But what if you, a trusted mutual friend, promised to cover the debt if things went south? Your friend would feel a lot more comfortable making that loan.

That's exactly how this partnership works:

- You (The Home Buyer): You apply for the loan through a trusted, USDA-approved lender.

- RAC Mortgage (The Lender): We handle your application, manage all the paperwork, and provide the actual cash for your home purchase.

- The USDA (The Guarantor): They stand behind us, guaranteeing a huge chunk of the loan against any potential loss.

This three-way partnership is what makes the zero down payment possible. By taking most of the risk off the table, the USDA gives lenders like RAC Mortgage the confidence to help more Tampa-area families buy a home without needing to save for years and years.

The USDA guarantee isn't just a financial safety net; it's a direct investment in our communities. It allows lenders to confidently offer 100% financing, which is hands-down the most powerful tool for helping first-time buyers jump the down payment hurdle.

How This System Helps You Directly

This unique setup translates into real-world advantages that can make all the difference. With the government's backing, lenders can relax some of their tightest requirements, creating a much smoother path to homeownership for qualified buyers.

For example, the guarantee allows for more flexible credit guidelines than you'll see with many conventional loans. It also leads to seriously competitive interest rates, which can save you a massive amount of money over the 30-year life of your mortgage.

The entire system is built to support families with moderate incomes who are ready to own a home but just need a more forgiving way in. When you work with a Tampa expert like RAC Mortgage, you get a guide who knows exactly how to make this powerful partnership work for you.

The Unbeatable Benefits of Choosing a USDA Loan

The perks that come with USDA first time home buyer loans go way beyond just getting you the keys to a new house. They’re designed to set Tampa-area families up for long-term financial success. Everyone talks about the zero down payment, and for good reason, but that’s just the beginning. The real magic is how all the benefits work together to make owning a home genuinely affordable.

Without a doubt, the biggest game-changer is 100% financing. For most folks, scraping together a 5%, 10%, or even 20% down payment is the single tallest hurdle to buying a home. A USDA loan just knocks that barrier right down, which can get you into a home years sooner than you thought possible.

But the good news doesn't stop there. This program was built from the ground up for moderate-income families, and the benefits prove it.

Lower Costs Across the Board

Forget the down payment for a second. USDA loans often come with interest rates that are more competitive than what you'd find with many conventional loans. A slightly lower interest rate might not sound like a huge deal, but stretched out over a 30-year mortgage, it can literally save you tens of thousands of dollars. That saving directly lowers your monthly payment, giving your budget some much-needed breathing room.

On top of that, USDA loans let you roll your closing costs right into the loan amount, as long as the home appraises for enough. This is huge. It means even less cash you need to bring to the table on closing day, taking a massive amount of financial pressure off the whole process. It’s a powerful advantage you won’t find with most other mortgages. You can see a full breakdown in our guide on how USDA loans stack up against conventional options.

The mix of no down payment, great rates, and the option to finance closing costs makes the USDA loan one of the most powerful and accessible mortgage options out there for first-time buyers in the Tampa area.

How is all this possible? The USDA guarantees the loan. That guarantee gives lenders like us at Residential Acceptance Corporation (RAC Mortgage) the confidence to offer such incredible terms to buyers.

More Forgiving Credit Requirements

Another major plus is how the program looks at credit. A great credit score is always a good thing, but USDA guidelines are often much more flexible than what you'll find with conventional loans. RAC Mortgage can often work with applicants who have some bumps and bruises on their credit report, as long as they can show a steady income and a decent history of paying their bills on time.

This flexibility opens the door to homeownership for a lot of people who might have been told "no" somewhere else. The focus is more on your overall financial stability and your ability to handle the mortgage payment, not just one three-digit number.

For those with very low incomes, the USDA's direct loan program takes the support to another level. The Single Family Housing Direct Home Loan program offers fixed interest rates as low as 5.125%—which can be brought down to just 1% with payment assistance. They can even stretch the repayment terms out to 38 years to keep payments manageable. It's a lifeline that makes owning a home in a rural community a reality for many.

Checking Your USDA Loan Eligibility Near Tampa

This is where the rubber meets the road. Getting a zero-down-payment USDA loan in the Tampa Bay area isn't some big secret; it really just comes down to three things: where the house is, what your household makes, and your overall financial picture.

Let's unpack each one so you know exactly where you stand. Here at Residential Acceptance Corporation (RAC Mortgage), we walk Tampa-area buyers through these steps every single day. Knowing this stuff upfront is the key to moving forward with confidence.

The Myth of "Rural" Property Location

When people hear "rural," they immediately think of farms and wide-open spaces. But the USDA’s definition is way more flexible than you might realize. You'd be shocked at how many great suburban communities right around Tampa are in USDA-eligible zones.

This means you don't have to choose between affordability and convenience. Tons of growing neighborhoods in counties like Hillsborough, Pasco, and Hernando qualify for these amazing usda first time home buyer loans. We're talking about places with good schools, parks, and easy commutes to everything Tampa has to offer.

- Hillsborough County: Think about areas like Wimauma, Ruskin, and even parts of Riverview. Many spots there are eligible.

- Pasco County: Communities like Dade City, San Antonio, and chunks of Zephyrhills are classic USDA territory.

- Hernando County: A huge part of the county qualifies, including areas around Brooksville and Spring Hill.

The whole point of the program is to encourage growth in communities just outside the major city centers. We can pull up an official, up-to-the-minute eligibility map to check any address you're interested in.

Understanding the Income Requirements

Next up is your household income. USDA loans are built for moderate-income families, but that "moderate" number is usually a lot higher than people guess. The program looks at your total annual household income before taxes—that includes everyone in the home who earns money, not just the people whose names are on the loan.

And the good news? These income limits keep going up. For 2025, the USDA's main program generally caps income at $112,450 for households of 1-4 people and $148,450 for households of 5 or more. Some high-cost areas might even have higher limits. This change has opened the door for more Tampa families than ever to get usda first time home buyer loans.

Don't count yourself out before you even get started. We see so many working families in the Tampa area who are pleasantly surprised to find they fit comfortably within the USDA income rules.

It’s also worth noting that the USDA lets you deduct certain expenses from your gross income, like childcare costs, which can be a huge help in getting you qualified. For a deep dive into how these numbers work for our local market, check out our guide on USDA loan income limits.

Your Credit and Financial Picture

Finally, any lender will take a look at your credit and financial stability. The USDA itself doesn’t have a rock-solid minimum credit score, but RAC Mortgage is generally looking for a score of 640 or higher.

But that's not a hard-and-fast rule. USDA guidelines are known for being pretty flexible. If your score is a bit shy of that mark, other strengths can make up for it—things like a steady job, not too much other debt, and a good history of paying your bills on time can make all the difference.

Lenders will review your finances using documents like bank statements. Knowing how to read a bank statement can give you a better idea of what they're looking for. A good lender will work with you to build the strongest application possible, even if your credit isn't perfect.

To give you a clearer picture, here's a quick summary of what it takes to qualify for a USDA loan in our area.

USDA Loan Eligibility Snapshot for Tampa Area Buyers

| Eligibility Factor | General Requirement | Tampa Area Consideration |

|---|---|---|

| Property Location | Must be in a USDA-designated "rural" area. | Many suburban towns in Hillsborough, Pasco, and Hernando counties qualify. |

| Household Income | Must be below the area's income limit. | For 2025, it's typically $112,450 (1-4 members) or $148,450 (5+ members). |

| Credit Score | No strict USDA minimum, but lenders prefer 640+. | Compensating factors like stable employment can help if your score is lower. |

| Debt-to-Income | Generally aim for a DTI ratio below 41%. | Lenders can be flexible with strong applications. |

| Citizenship | Must be a U.S. citizen or permanent resident. | Standard requirement for all government-backed loans. |

Remember, these are just guidelines. The best way to know for sure where you stand is to talk with an expert who can review your specific situation.

A Step-by-Step Guide to the USDA Loan Process

Trying to navigate the mortgage process can feel like you’re putting together a puzzle without all the pieces. But when you have a clear roadmap, securing a USDA first time home buyer loan in the Tampa area is a straightforward, manageable journey. This guide lays out the entire process in simple steps, so you can move confidently toward homeownership.

From the first phone call to the day you get your keys, every stage has a specific purpose. And when you’re working with a local expert like Residential Acceptance Corporation (RAC Mortgage), you’ll never be left wondering what comes next.

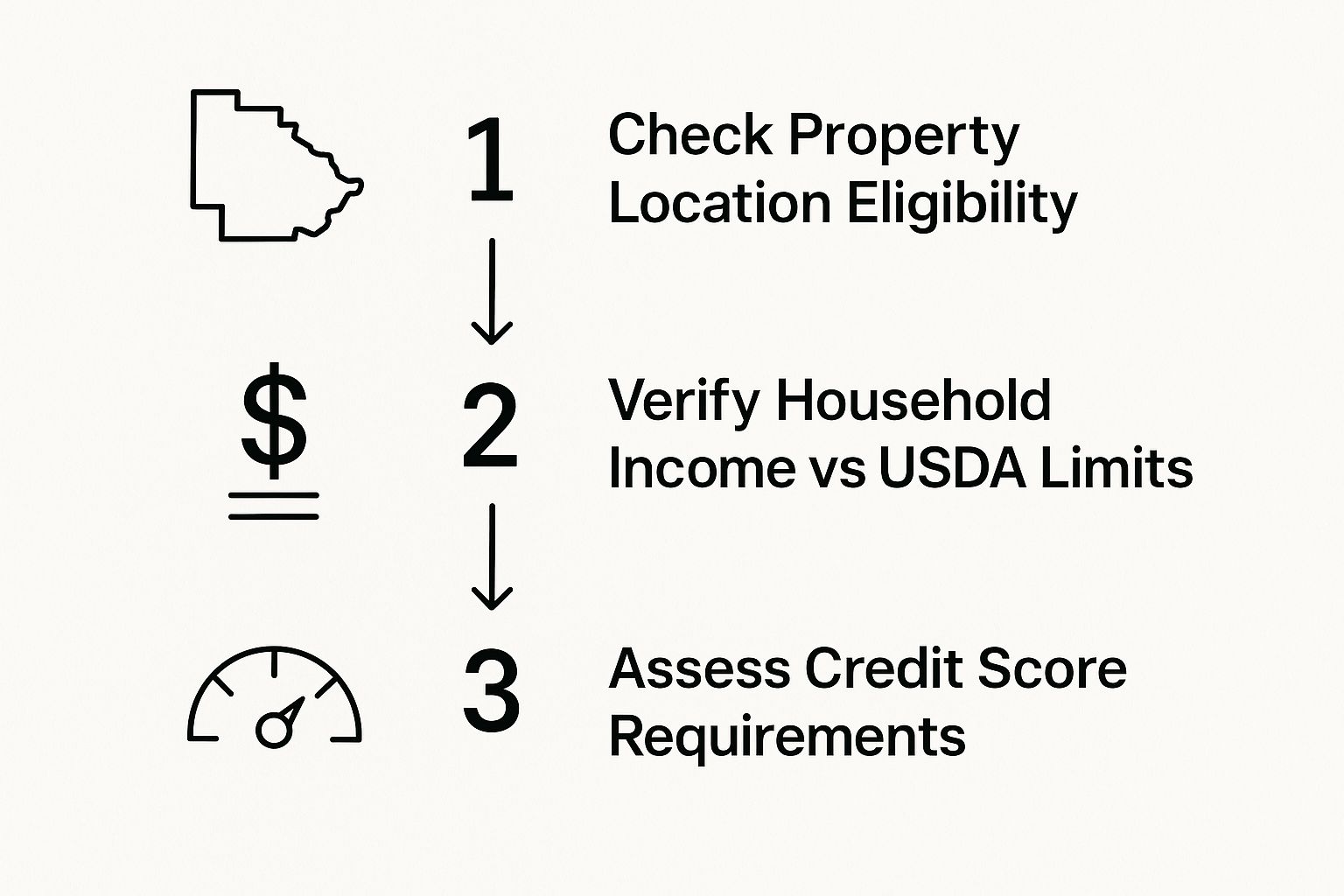

This infographic breaks down the very first things you need to check for any USDA loan application.

These three starting points—location, income, and credit—are the foundation of your whole application. Let's walk through the full process together.

Step 1: Getting Pre-Qualified with RAC Mortgage

Your first move is to get pre-qualified. Think of it as your initial strategy session. You’ll sit down with a loan officer at RAC Mortgage and go over your income, debts, and credit history.

This isn't the official application just yet. It's more of a quick check to give you a solid estimate of how much house you can actually afford under the USDA program. This part is critical because it sets a realistic budget for your house hunt and proves to sellers that you’re a serious contender.

Step 2: Finding a USDA-Eligible Home

Once you have that pre-qualification letter in hand, the fun part starts: shopping for a home! The main thing here is to keep your search focused on properties inside USDA-eligible areas. A good real estate agent, backed by the expertise of your RAC Mortgage loan officer, can easily pinpoint qualifying neighborhoods around Tampa.

You might be surprised how many great suburban communities in Hillsborough, Pasco, and Hernando counties are eligible. As you start touring homes, you’ll have the confidence of knowing exactly which price range you need to stick to.

Step 3: Submitting Your Offer and Formal Application

You found the perfect place—now it’s time to make an offer. After the seller accepts, the process gets real. You'll move on to officially completing your loan application with RAC Mortgage.

This is where you'll need to provide all the paperwork to verify your finances. This usually includes:

- Proof of Income: Your most recent pay stubs, W-2s from the past two years, and maybe your tax returns.

- Asset Verification: Bank statements from your checking and savings accounts.

- Identification: A copy of your driver’s license and Social Security card.

Your loan officer’s job is to package all these documents perfectly. A clean, organized file is the secret to moving smoothly and quickly through the next stages.

Step 4: Lender Underwriting and Final USDA Review

Once your file is all together, it heads to an underwriter at RAC Mortgage. The underwriter is like a financial detective—they dig into every detail to make sure your application meets all the lending guidelines. They'll confirm your income, check your credit, and look at the property appraisal to ensure the home is worth what you’re paying.

After RAC Mortgage gives its approval, the file goes to the USDA for one last look. This is a step unique to USDA first time home buyer loans. The USDA doesn’t re-do the underwriting; they just perform a final check to make sure everything meets their program rules. This final government sign-off is what activates the loan guarantee.

Step 5: Closing on Your New Home

The USDA gives the final thumbs-up, and you're cleared to close! This is it—the finish line. You'll sign all the official documents, the money gets transferred, and you officially become a homeowner. You get the keys to your new Tampa-area home, ready to start the next chapter. Your team at RAC Mortgage will work with the title company to make sure closing day is smooth and celebratory.

Why a Local Tampa Lender Matters for Your USDA Loan

Getting approved for a USDA first time home buyer loan isn't just about checking boxes on a form. It's about having the right guide in your corner, and this is where working with a local Tampa expert like Residential Acceptance Corporation (RAC Mortgage) really pays off.

Sure, the big national banks can process a USDA loan, but they just don't have the on-the-ground knowledge of our local market. A lender who actually lives and works here has a completely different perspective.

We understand the real estate scene across Tampa Bay because it's our backyard. We know the ins and outs of Hillsborough, Pasco, and Hernando counties—from how property values are trending to which specific communities actually qualify for USDA financing. That kind of insider knowledge is a huge advantage for you.

Expertise in Tampa's USDA-Eligible Zones

Trying to figure out the USDA's property eligibility maps on your own can be a headache. A lender halfway across the country sees a zip code; a local expert sees a neighborhood with its own unique character and potential.

The team here at RAC Mortgage knows the specific USDA-eligible zones in the Tampa Bay area inside and out. We can point you toward up-and-coming suburban spots that qualify and offer real insights that a national call center just can't match. This saves you from wasting your time and getting your hopes up on homes that don't meet the program's strict location rules.

Choosing a local lender means you get more than a loan processor; you get a strategic partner who understands your community and is personally invested in your success. Their hands-on approach is your greatest asset.

A Personalized Hands-On Approach

When you work with a giant, impersonal bank, it's easy to feel like you're just another application number in a massive queue. The process can drag on, and trying to get a straight answer from someone who knows your file can feel impossible.

A dedicated Tampa lender like RAC Mortgage offers a completely different, hands-on experience. You get a direct line to a real person who is committed to your loan from the day you apply to the day you get the keys.

This kind of streamlined communication means your questions get answered right away and any potential snags are dealt with before they can cause delays. For any first-time buyer, that dedicated support is what makes the journey to closing day feel smooth and stress-free.

Common Questions About USDA Home Loans

Even after you've wrapped your head around the basics, a few specific questions always seem to pop up. When you're trying to land a USDA first time home buyer loan in the Tampa area, the little details can make a big difference. We've gathered some of the most frequent questions we hear at Residential Acceptance Corporation (RAC Mortgage) to give you clear, no-nonsense answers.

Our goal is to tackle these points of confusion head-on. We want you to feel confident and prepared for your home-buying journey, not blindsided by surprises.

Can I Use a USDA Loan for a Condo or Townhouse?

Yes, you absolutely can! But there's a catch. It's not enough for just the unit to be in an eligible area; the entire condominium or townhouse complex has to be on the USDA's approved project list.

This approval means the project meets specific standards for things like insurance, ownership structure, and community rules. Not all of them make the cut. An experienced local lender can check the approved list for you, saving you from wasting time on a property that won't qualify.

What Is the USDA Guarantee Fee?

This is the secret sauce that makes the whole zero-down-payment program possible. The USDA guarantee fee is how the program funds itself without needing taxpayer money. Think of it as the price of admission for getting a 100% financed loan.

It's split into two parts:

- An Upfront Fee: This is a one-time fee, currently 1.0% of your total loan amount. The best part? It can almost always be rolled right into your mortgage, so you don't need cash at closing to cover it.

- An Annual Fee: This one is much smaller, currently just 0.35% of your outstanding loan balance each year. It gets broken down into 12 small pieces and added to your monthly mortgage payment, so you barely notice it.

We can walk you through the numbers to show you exactly how this fee affects your loan and monthly payment. It also helps to understand the other factors that influence interest rates for USDA loans to get the full picture of your costs.

The USDA guarantee fee is a small price to pay for the incredible benefit of 100% financing. It's the key that unlocks the door to homeownership for so many Tampa families who don't have a large down payment saved.

How Long Does USDA Loan Approval Take?

Patience is key here. A USDA loan can sometimes take a bit longer to close than a conventional one. Why? Because there's one extra hurdle: after your lender fully underwrites and approves your file, it has to be sent to the USDA for a final sign-off.

On average, you can expect the whole process to take between 30 and 60 days from application to closing day. The exact timing really hinges on how clean and complete your application file is when it's submitted.

This is where working with a lender who knows the USDA process inside and out is a game-changer. A team that packages the file perfectly for the USDA reviewer can help you avoid delays and keep your closing on schedule.

Ready to see if a USDA loan is your key to a new home in the Tampa area? The expert team at Residential Acceptance Corporation is here to answer all your questions and guide you through every step.

Start your journey to homeownership today!