Learning how to compare mortgage lenders is really about seeing the whole picture, not just the flashy number they advertise upfront. The best way to do this? Get an official Loan Estimate and dig into the details. You're looking at the interest rate, sure, but also the Annual Percentage Rate (APR), the mountain of closing costs, and something just as important: the lender's local Tampa expertise.

Starting Your Tampa Home Loan Search the Right Way

It’s exciting to start looking for a home in the Tampa market. It's a fantastic place to live. But honestly, one of the biggest decisions you'll make happens way before you find "the one" and put in an offer. Choosing your mortgage lender sets the stage for everything that follows, from your monthly payment all the way to how smoothly things go on closing day.

A smart comparison isn't about chasing the lowest advertised rate you see on a billboard. It's about creating a simple, clear framework to weigh your options. The goal here is to cut through the marketing fluff and get down to the hard numbers that tell you the true cost of borrowing money.

Core Comparison Points for Tampa Buyers

When you start talking to lenders, you need to zero in on a few key things. These are the non-negotiables that will form the foundation of your comparison. When you connect with a lender like RAC Mortgage, these are the figures you should be asking about from the very first conversation:

- Interest Rate: This is the basic percentage the lender charges you for borrowing their money. It's the number everyone focuses on.

- Annual Percentage Rate (APR): This one is a much better indicator of the true cost. It rolls in the interest rate plus other lender fees like origination charges and discount points.

- Closing Costs: These are all the fees needed to seal the deal—everything from the home appraisal to title insurance and attorney fees. They can add up fast.

- Loan Officer Responsiveness: This isn't a number, but it’s critical. Is your loan officer easy to reach? Do they answer your questions clearly? Good service can make or break your experience in the fast-paced Tampa market.

Getting a firm grasp on these items is the first step toward making a confident decision. Of course, this whole process really kicks off once you get pre-approved. A pre-approval letter not only gives you a solid budget but also proves to sellers that you're a serious contender. You can dive deeper into that process by checking out our guide on how to get preapproved for a mortgage.

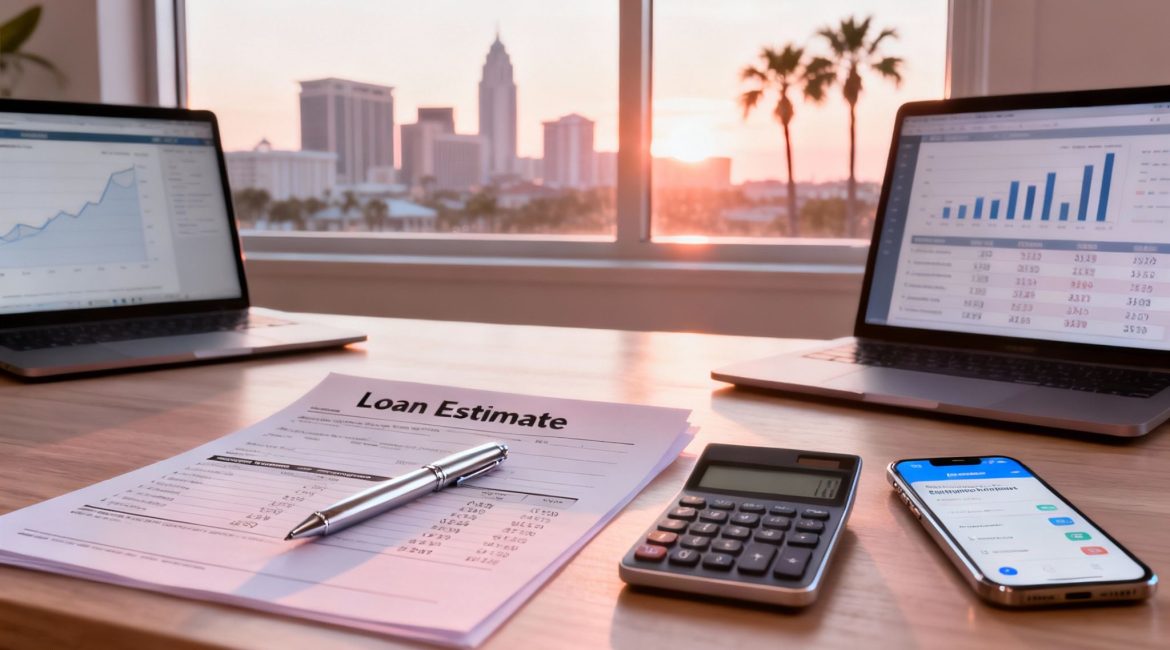

Your real mission is to get your hands on an official Loan Estimate from each lender you're considering. This standardized document is your secret weapon. It’s designed to give you a true apples-to-apples comparison, so you can see exactly what you're paying for.

When you approach your search with this organized mindset, you'll be able to tune out the noise. A dedicated Tampa-based lender like Residential Acceptance Corporation (RAC Mortgage) has the local market knowledge to help you navigate this, ensuring you move forward with total confidence.

Here’s a quick-reference table to keep these points top of mind.

Key Mortgage Comparison Points at a Glance

| Factor | What to Look For | Why It Matters for Your Tampa Home |

|---|---|---|

| Interest Rate | The base percentage rate offered by the lender. Compare fixed vs. adjustable rates. | A lower rate means a lower monthly payment and less interest paid over the life of the loan. Simple as that. |

| APR | The interest rate plus fees, expressed as a percentage. It's the "all-in" cost. | Two loans with the same interest rate can have wildly different APRs. This reveals the true cost of borrowing. |

| Closing Costs | Itemized list of fees in Section A of the Loan Estimate. Look for origination, application, and underwriting fees. | High fees can significantly increase your out-of-pocket expenses. Negotiating these can save you thousands. |

| Local Expertise | Does the lender understand Tampa's specific market conditions, insurance needs, and property types? | A local pro knows the appraisers, title companies, and potential hurdles (like flood zones) in Tampa, leading to a smoother closing. |

Ultimately, taking the time to compare these factors thoroughly will pay off, not just in potential savings, but in the peace of mind that comes with knowing you made the best possible choice for your new Tampa home.

Look Beyond the Advertised Interest Rate

That flashy, low interest rate is what every mortgage ad leads with, but it’s almost never the whole story. If you really want to know how to compare mortgage lenders, you’ve got to look past that number and see the full financial picture. This is where so many Tampa homebuyers can save thousands over the life of their loan.

The first concept to nail down is the difference between the interest rate and the Annual Percentage Rate (APR). The interest rate is simple—it’s just the percentage-based cost of borrowing the money. The APR, on the other hand, gives you the real picture.

Your APR takes that interest rate and rolls in all the various lender fees needed to get the loan, like origination fees, discount points, and other closing costs. Because it includes these extra expenses, the APR is almost always higher than the advertised rate, and it’s a far more accurate tool for comparing offers.

Unpacking Your Loan Estimate

This is where the official Loan Estimate comes in. It’s a standardized, three-page document designed specifically to prevent lenders from hiding fees and to let you make a direct, apples-to-apples comparison. When you work with a transparent lender like us here at Residential Acceptance Corporation (RAC Mortgage), we'll sit down and walk you through this document line by line so nothing gets missed.

Let’s run through a quick, real-world scenario for a home purchase here in Tampa:

- Offer A: Tempts you with a 3.99% interest rate but comes with $6,500 in lender fees.

- Offer B: Shows a 4.125% interest rate but has only $2,500 in lender fees.

At first glance, Offer A looks like the winner, right? Lower rate. But once you factor in those much higher fees, the APR for Offer A could easily be higher than Offer B’s. This means Offer B, even with its slightly higher rate, could actually be the cheaper mortgage over the long haul.

The Loan Estimate forces total transparency by itemizing every single cost. Your job is to zero in on Page 2, Section A ("Origination Charges"). This little box tells you exactly what the lender is charging you to create the loan.

The Role of Fees and Points

Getting a handle on the key fees is critical. Origination fees are what the lender charges for processing your application. Discount points are different—they’re optional fees you can pay upfront to lower your interest rate. A local Tampa expert like one from RAC Mortgage can help you run the numbers to see if paying for points actually makes sense based on how long you plan to be in the home.

Beyond the rates and fees, savvy homebuyers also consider the long-term financial picture. For example, understanding potential tax advantages, like mortgage interest deductions, adds another layer to your decision.

By digging into the APR and scrutinizing every fee on the Loan Estimate, you stop being just a "rate-shopper" and become a savvy loan-comparer—ready to make the best possible choice for your new Tampa home.

Finding the right loan program is less about what a large national lender wants to sell you and more about what actually fits your life. When you start comparing mortgage lenders, you quickly realize it's not just about the interest rate. It's about finding a loan that's tailored to your unique financial picture.

This is where a lender’s specific expertise and local knowledge really shine. A massive, out-of-state bank might try to fit you into a generic product, but a dedicated Tampa lender like RAC Mortgage gets the nuances of our market. They understand the programs that work best for Hillsborough County homebuyers because their success depends on finding the right match for you, not just hitting a national sales quota.

The Go-To Loan Programs for Tampa Homebuyers

For most folks buying in the Tampa Bay area, the choice will boil down to one of a few core loan types. Each one is built for a different kind of borrower, so getting a handle on the basics is your first real step toward making a smart decision.

- Conventional Loans: If you have a solid credit score and can put down at least 3% to 5%, this is often your best bet. These loans aren't backed by the government, which can mean more flexibility and sometimes better terms.

- FHA Loans: Backed by the Federal Housing Administration, these are a lifeline for many first-time homebuyers or people whose credit isn't perfect. The big draw? You can get into a home with a down payment as low as 3.5%.

- VA Loans: This is a fantastic benefit for our veterans, active-duty service members, and eligible surviving spouses. The highlights are hard to beat: often requiring $0 down payment and no private mortgage insurance (PMI).

When you work with a local expert like Residential Acceptance Corporation (RAC Mortgage), you're not just getting a loan officer; you're getting a guide. We can take a quick look at your finances and immediately steer you toward the program that will give you the best terms and save you the most money in the long run.

A lender's deep knowledge of local property values and market quirks isn't just a "nice to have"—it’s absolutely essential for a smooth approval and appraisal process here in Tampa. A team that's rooted in the community can see potential roadblocks from a mile away and knows exactly how to navigate them.

Why a Local Focus Is Everything

The power of a lender's regional focus isn't just a local phenomenon; it plays out on a global scale. Think about it: the Asia Pacific mortgage industry commanded 23.93% of the global market share in 2025, largely driven by powerhouses like China and India. That kind of regional dominance shows you where lenders are putting their energy and competing the hardest. Down in South America, Brazil leads a booming mortgage market. You can dig into these global mortgage trends yourself, but the takeaway is the same: presence matters.

Just like a lender in São Paulo understands the Brazilian market inside and out, a lender in Tampa gets Hillsborough County real estate. They know the flood zone requirements, the typical appraisal values for different neighborhoods, and the local challenges that can pop up. This isn't just trivia—it's invaluable knowledge. A lender who is truly established and competitive right here in your backyard, like RAC Mortgage, is set up to give you a far smoother and more confident homebuying journey from start to finish.

Why Customer Service and Local Knowledge Matter

After you've crunched the numbers on rates and fees, it’s time to look past the spreadsheets. A mortgage isn't some self-checkout transaction; it's a complicated journey with real hurdles. This is where the human element—specifically, your loan officer—becomes the most important piece of the puzzle.

The quality of service you get can single-handedly make the difference between a smooth, confident homebuying experience and a stressful, confusing mess.

This is where a local lender really shines. A dedicated loan officer from a Tampa-based firm like Residential Acceptance Corporation (RAC Mortgage) isn't some anonymous voice in a massive call center. They're your partner, right here in the community. They know the ins and outs of the Hillsborough County market and are personally invested in getting you across the finish line.

Gauging a Loan Officer’s Expertise

Think of your first conversation with a potential loan officer as an interview—and you’re the one doing the hiring. How they communicate and the depth of their knowledge will tell you everything you need to know about what your experience will be like.

To really get a feel for their level of service, it helps to know what great customer support best practices actually look like in the mortgage world.

Here are a few questions I always recommend asking to see if they've got what it takes:

- How do you communicate? "Will I be getting updates via phone calls, emails, or texts? If you're busy, who is my backup contact?"

- What's your availability? "What happens if a problem comes up after 5 PM or on a weekend? How can I reach someone?"

- Do you know Tampa? "Can you give me an example of a challenge you helped another Tampa buyer solve? Are you familiar with local flood zone quirks or specific appraisal issues we might see here?"

Pay close attention to their answers. If they're vague, that's a major red flag. A confident, specific response shows they have the hands-on experience to guide you through whatever comes up.

The true value of a great loan officer isn't when everything goes right; it's when something goes wrong. An unexpected appraisal issue or a last-minute document request is a minor bump with a proactive local expert. With a national call center, it can become a deal-killing nightmare.

Picture this: you’re in a multiple-offer situation, and the seller needs a quick confirmation on your financing to choose your offer. An accessible, local loan officer from RAC Mortgage can make that call in five minutes, locking in your dream home.

If you’re stuck waiting for a callback from a giant, impersonal lender, you could lose the house. When you compare lenders, you're not just picking a rate. You're choosing the person who will be in your corner from day one until you have the keys in your hand.

How Lender Efficiency Can Make or Break Your Closing Date

In a hot real estate market like Tampa's, a few days can mean the difference between getting the keys to your dream home and watching it go to another buyer. That's why a lender's internal efficiency is something you absolutely have to look at when comparing mortgage offers. A fantastic rate means nothing if your lender can’t get the loan cleared to close by the date on your contract.

The whole journey from application to closing is a complicated dance, but the underwriting phase is where things can really slow down. This is when the lender’s team digs into every detail of your financial life—income, assets, debts, and credit history—before stamping that final approval. Any delay here creates a domino effect, pushing your closing date back and piling on the stress.

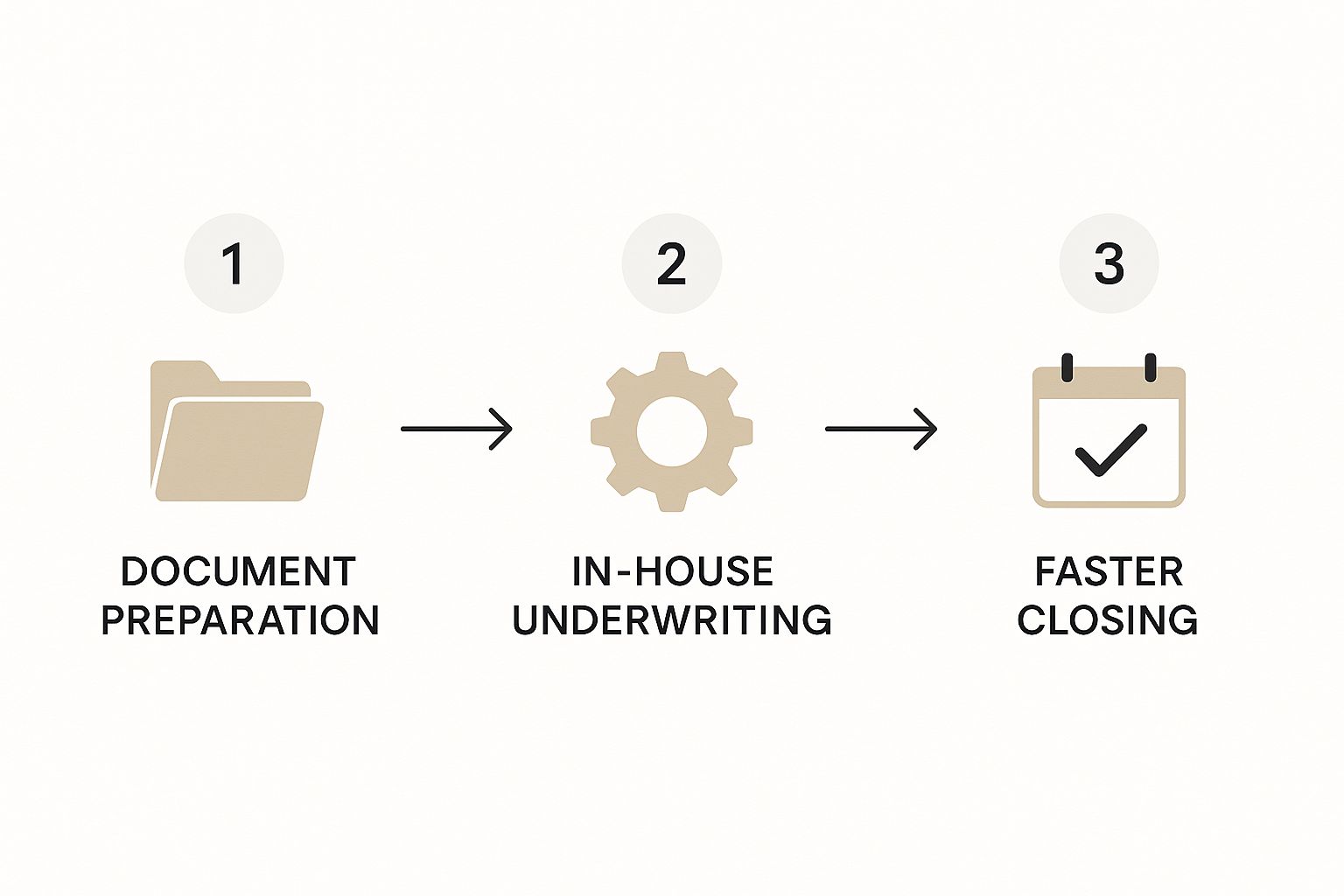

The Power of In-House Underwriting

The way a lender is structured has a massive impact on your timeline. Many lenders outsource their underwriting to different departments, sometimes in different states. This setup is a recipe for communication breakdowns and can drag the entire process to a crawl.

On the other hand, a dedicated mortgage company like RAC Mortgage handles everything under one roof. With in-house underwriting, your loan officer can literally walk down the hall and talk to the person reviewing your file. That direct line of communication is priceless for getting questions answered and clearing conditions in hours, not days.

A lender with a streamlined, in-house process is built for speed. It cuts out the unnecessary handoffs and communication gaps, giving you a serious edge when closing on time is everything.

Technology and Timelines in Today's Market

The mortgage world is also getting a major facelift from technology. The U.S. mortgage market is on track to hit $2.3 trillion in total originations in 2025, a rebound fueled by pent-up demand and new digital tools. Modern platforms now make submitting your application and documents faster than ever, which is a big deal when you're comparing lenders. This is especially true for the new wave of first-time homebuyers, like Gen Z, who expect everything to be seamless and digital. If you want to dive deeper, you can discover more insights about how the mortgage process has evolved on magistralconsulting.com.

At the end of the day, a lender’s efficiency says a lot about its commitment to you. A company built for speed and clear communication shows they value your time and get the pressures of the Tampa market. To see what that looks like in the real world, check out the advantages of working with a quick-close mortgage lender in Florida—because a fast, reliable closing might just be your biggest asset.

Making Your Final Decision with Confidence

You've done the legwork. You've gathered the rates, dug into the fees, and gotten a feel for how different lenders operate. Now it’s time to pull it all together and actually pick one.

This is where you move from research to decision, and the best way I’ve found to do this is with a simple, head-to-head comparison chart.

Organizing Your Final Comparison

Get everything down in one place. Line up your top lender choices and plug in the hard numbers: the final APR, the total estimated closing costs, and what that monthly payment looks like.

But don’t just stop at the numbers. This is your chance to factor in the human element. Add a column for things like your loan officer's expertise or how quickly you think they can get you to the closing table. Seeing it all laid out like this takes the emotion out of it and puts the focus squarely on what’s best for your finances.

A streamlined process, from application to close, is what you're really looking for.

The real takeaway here? Lenders with an efficient workflow, especially those with in-house underwriting, are almost always going to deliver a faster and more reliable closing. No last-minute surprises.

This kind of comparison often shines a spotlight on the value of working with a solid local partner. A firm like Residential Acceptance Corporation (RAC Mortgage) isn't just about offering a good rate; they bring local Tampa know-how and direct access to their team, which makes the whole process smoother.

This is especially true for first-time buyers. If that's you, our guide on the best mortgage lenders for first-time home buyers is worth a read.

Once you've made your choice, your very next conversation should be about locking in your interest rate. A rate lock is your shield against market swings while the loan is being finalized. It gives you peace of mind that your payment won't jump up unexpectedly before you get the keys.

It also helps to understand the bigger picture. The global mortgage lender market was valued at a staggering USD 1.29 trillion in 2025 and is only expected to grow. While you can dive deep and learn more about these mortgage market trends, the core lesson is simple: in a massive, expanding market, choosing a stable and knowledgeable lender is a smart move.

By following this final checklist, you’ll be ready to confidently select the right lender for your new Tampa home.

As you dive into the world of mortgage shopping, you'll find a few common questions pop up time and time again. Getting straight answers is the only way to move forward with confidence and find the right lender for your Tampa home.

How Many Mortgage Lenders Should I Talk To?

You're looking for the sweet spot—enough offers to find a great deal without getting totally overwhelmed. The magic number is usually three.

Getting official Loan Estimates from a few different lenders gives you a solid basis for comparison. You'll quickly see who's competitive and who's not. My advice? Make sure one of those is a dedicated local specialist. When you reach out to a Tampa-based firm like Residential Acceptance Corporation (RAC Mortgage), you get a powerful benchmark for what real local service and market know-how look like. It's a perspective the big national banks often can't provide.

Will Applying with Multiple Lenders Hurt My Credit Score?

This is probably the biggest myth out there, and it’s one you can safely ignore. The credit scoring models are built for this exact scenario.

All your mortgage-related credit inquiries get bundled together and treated as a single event, as long as they happen within a short window—usually 14 to 45 days. So, go ahead and shop around. The system is designed to let you compare offers without dinging your score.

Your most powerful tool in this entire process is the Loan Estimate. It’s a standardized, three-page government form that every lender is legally required to provide.

This document is your key to a true apples-to-apples comparison. It lays everything out in plain sight: interest rate, APR, projected monthly payments, and a detailed list of every single closing cost. No more guesswork. The Loan Estimate forces lenders to put their cards on the table so the numbers can do the talking.

Ready to see how a dedicated local lender can make a difference in your Tampa home search? The team at Residential Acceptance Corporation is here to provide a transparent, no-obligation Loan Estimate to help you make an informed decision. Get started on your application today!