For Tampa's entrepreneurs, freelancers, and small business owners, a W-2 and a paystub just aren't part of the picture. Your success is clear in your bank account, but your tax returns? They’re designed to show smart business write-offs, not your true purchasing power.

This is where bank statement home loans in Tampa come in. Instead of relying on tax documents, this modern mortgage solution uses 12 to 24 months of your bank statements to verify your income. It's a common-sense approach that looks at your actual cash flow, giving you a fair shot at homeownership.

Your Path to Tampa Homeownership Without W-2s

If you're self-employed in Tampa, you've likely felt the frustration. Your business is growing and the deposits are consistent, but lenders only want to see tax returns that don't tell the full story. A bank statement loan flips the script. It becomes your most powerful tool for buying a home in this competitive market.

Rather than being penalized for running your business intelligently, this type of mortgage focuses on the one thing that truly proves your ability to pay: your real, consistent income. Here at Residential Acceptance Corporation (RAC Mortgage), this is our specialty. We know your financial story is written in your bank statements, not a W-2.

To see the difference clearly, let's break down how these two loan types stack up.

W-2 Loan vs Bank Statement Loan At a Glance

| Feature | Traditional W-2 Loan | Bank Statement Home Loan |

|---|---|---|

| Primary Income Proof | W-2s, Paystubs, Tax Returns | 12-24 Months of Bank Statements |

| Ideal Applicant | Salaried or Hourly Employees | Self-Employed, Freelancers, Gig Workers |

| Income Calculation | Based on Gross or Net Taxable Income | Based on Average Monthly Deposits |

| Flexibility | Rigid, Standardized Underwriting | Flexible, Based on Real Cash Flow |

As you can see, the bank statement loan is purpose-built for those whose income isn't captured by traditional forms.

Navigating Tampa's Changing Market

The Tampa housing market is always moving, creating unique opportunities for buyers who are ready to act. Recently, the median home price in Tampa has adjusted, seeing a decrease of about 5% to 9.65% over the past year. Some forecasts even suggest prices could moderate further.

While this shift can be great for buyers, it often makes lenders tighten their requirements. That’s why having your documentation in perfect order—like a clean set of bank statements—is more important than ever.

A Mortgage Built for Entrepreneurs

Simply put, a bank statement loan is designed for anyone who doesn't earn a traditional paycheck. At RAC Mortgage, we work to make the process straightforward by focusing on your proven ability to repay the loan based on your actual cash flow.

This approach is a perfect fit for:

- Small Business Owners: Who constantly reinvest profits back into their company.

- Freelancers and Consultants: Whose monthly income can fluctuate.

- Gig Economy Workers: Juggling multiple income streams and 1099s.

When you partner with a lender who understands the self-employed world, you can move forward with confidence. Once you’ve secured your loan, connecting with great local Tampa services can make settling into your new home a breeze.

Ready to learn more? Check out our detailed guide on how RAC Mortgage can help you as a mortgage lender in Tampa with no W-2.

How Bank Statement Loans Actually Work

Think about a traditional mortgage application. It's really just a single snapshot of your finances—your tax return. It captures one moment in time, often after you’ve written off every possible business expense to lower your tax bill. Smart for taxes, but not so great for showing a lender what you really earn.

A bank statement loan, on the other hand, is like watching a full-length movie of your financial life. Instead of that one snapshot, we at Residential Acceptance Corporation (RAC Mortgage) look at the whole story over 12 or 24 months. This gives us a much more accurate and honest picture of your true earning power.

When you think about it, this approach just makes sense. Lenders get to see the consistent cash flowing into your accounts month after month, which is a far better indicator of your ability to handle a mortgage payment.

Calculating Your True Qualifying Income

With a bank statement loan, we shift the focus away from your taxable income and onto your actual cash flow. RAC Mortgage looks at your business or personal bank deposits to figure out what you can comfortably afford. The whole process is designed to be straightforward and friendly to business owners.

Here's a simplified look at how it works:

- Gather Your Statements: First, you’ll provide 12 or 24 consecutive months of bank statements. These can be from a business account, a personal one, or sometimes a mix of both.

- Analyze Deposits: We'll review all the deposits made into those accounts. We’re looking for consistency, so any large, one-off deposits that aren't part of your normal business operations are typically set aside.

- Determine Gross Income: Your regular, business-related deposits are added up and then averaged over the 12 or 24-month period. This gives us a stable, reliable monthly income figure to work with.

By focusing on your deposits, we get a realistic picture of your business's health and your actual ability to manage a mortgage. It's a view that a tax return, with all its deductions, often hides.

From Gross Deposits to Net Income

Of course, we know that your gross deposits aren't all take-home pay. Every business has expenses. To account for this, RAC Mortgage applies a standard "expense factor" to your averaged gross monthly deposits.

This is a pre-set percentage meant to represent your typical operating costs. For example, if you run a service-based business with low overhead, a smaller percentage will be deducted. This simple calculation gives us a solid qualifying income for your application, and the best part is we don't need to comb through every single business expense on your tax returns.

You can learn more by reviewing the official Non-QM loan requirements that outline the specifics of these programs. It’s this common-sense approach that's opening the door to homeownership for so many self-employed professionals and entrepreneurs here in Tampa.

Who Is an Ideal Candidate in Tampa?

A bank statement loan from Residential Acceptance Corporation (RAC Mortgage) isn’t for a specific job title—it’s built for a specific financial reality. This reality is shared by a growing wave of professionals who are the lifeblood of Tampa's economy. We’re talking about the people whose success is measured by consistent cash flow, not by a predictable, twice-a-month paycheck.

Think about a successful restaurant owner in Ybor City. Their tax returns are a maze of business reinvestments and write-offs, but their bank statements tell the real story: a thriving business with massive monthly deposits. Or picture a freelance web developer in Seminole Heights juggling clients across the country. Her income might ebb and flow with project deadlines, but her average monthly cash flow is more than enough to handle a mortgage.

These are the exact people who find success with bank statement home loans in Tampa.

The Core Financial Profile

Forget job descriptions for a moment. At RAC Mortgage, we look for key financial signs that show a borrower is truly ready for homeownership. The ideal candidate usually has a solid history of financial responsibility and a stable business.

You might be a perfect fit if you have:

- A self-employment history of at least two years, which tells us your business has staying power.

- A credit score generally in the mid-600s or higher, proving you have a track record of managing debt well.

- The ability to put down a down payment of at least 10%, showing you’re serious and invested in the purchase.

These aren't random numbers. They help us build a clear picture of a borrower who can comfortably manage the long-term commitment of a mortgage, even without a W-2.

Self-Assessing Your Readiness

So, how can you know if you're ready? The single most important step is to get familiar with your bank statements. We'll analyze either 12 or 24 months of your statements to figure out your qualifying income. The right choice often comes down to your business's recent performance.

If your income has been on a steady upward trend, using just the most recent 12 months can work in your favor by showing off your current, higher earnings. But if your business is more seasonal or has seen some ups and downs, a 24-month average smooths things out and gives a more stable, representative picture of your income.

This flexibility is at the heart of how RAC Mortgage serves Tampa's entrepreneurial community. It's all about finding the approach that best reflects your true financial muscle. With Tampa's population growing by about 3.3% since 2020, the housing market here is buzzing with opportunity. Understanding where you stand financially is the first step to confidently jumping in.

For a more detailed look at what it takes to qualify, our guide on self-employed home loans in Tampa is a great next step. It's packed with additional details to help you get prepared for a successful application.

The Application Process with RAC Mortgage

Applying for a mortgage can feel like a huge, intimidating task. We get it. But at Residential Acceptance Corporation (RAC Mortgage), we’ve worked hard to make our process for bank statement home loans in Tampa feel more like a guided tour than a mountain climb. We'll give you a clear map, showing you exactly what’s happening at every turn, from our very first chat to the moment you’re holding the keys to your new home.

It all starts with a simple conversation. We want to hear about your homeownership goals, of course, but we also want to understand your business and how your income works. This isn't just a numbers game; it's about helping us tell your unique financial story in the most effective way. From there, we'll map out a clear plan for gathering the right documents.

Gathering Your Key Documents

This is the most important part of the puzzle: collecting your bank statements. We'll typically need to see 12 or 24 consecutive months of statements, depending on your business's financial history and consistency. These can come from your main business account, a personal account where you deposit business income, or sometimes a mix of both.

Don't worry about figuring out which ones to send. Our team at RAC Mortgage will walk you through exactly which statements will paint the clearest picture of your true earning power. Once you have them ready, you’ll fill out our simple online application—we designed it to be quick and easy.

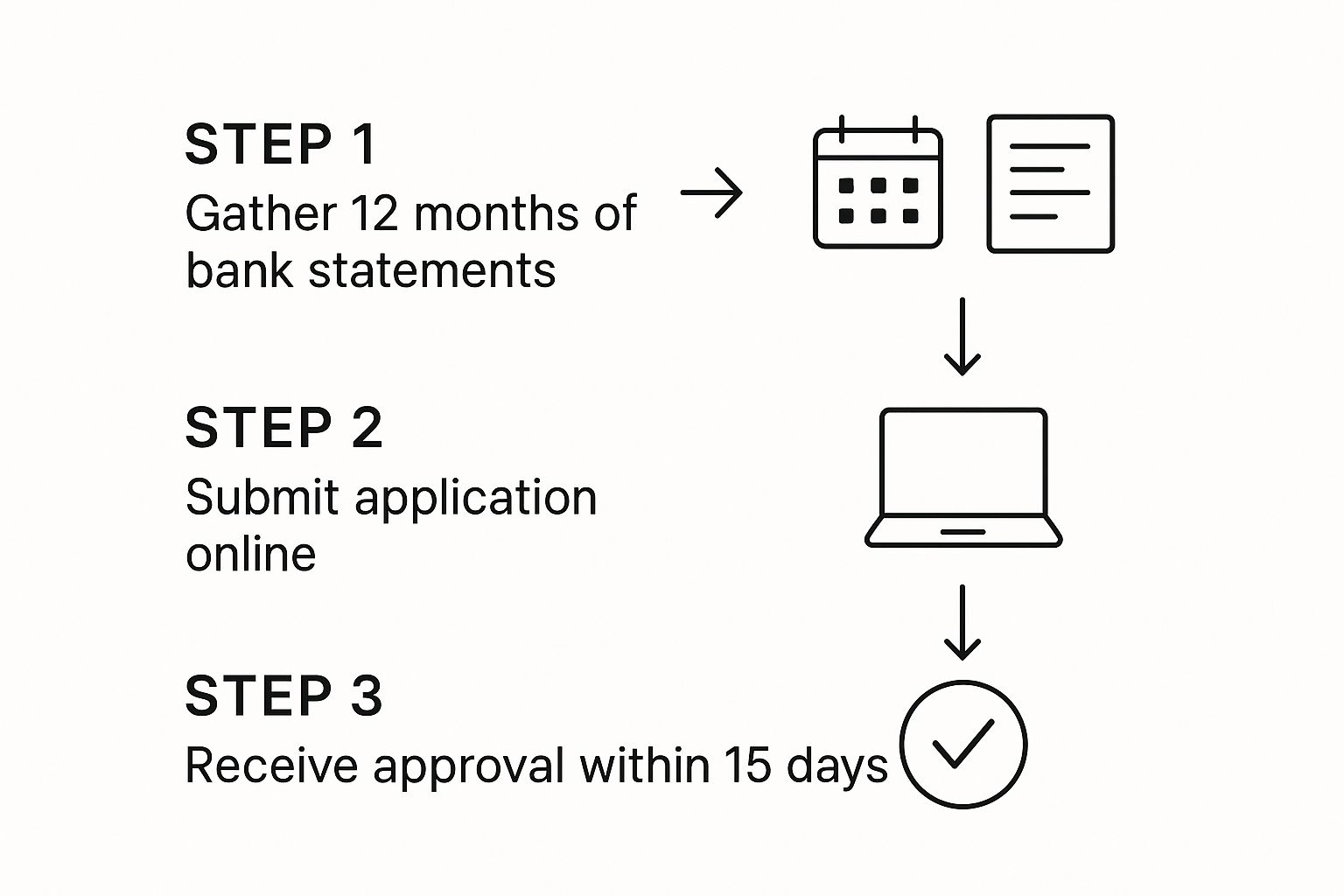

This visual breaks down the path from getting your documents together to getting approved.

As you can see, it’s a straightforward, three-stage progression that gets right to the point without wasting your time.

Underwriting and Final Approval

Once your application and documents are in, our specialized underwriters get to work. These aren't your typical mortgage underwriters; they are experts at analyzing the cash flow of self-employed professionals. They know how to look past the W-2s and see the real financial strength of your business by calculating your qualifying income from your average monthly deposits.

At RAC Mortgage, we see underwriting as a partnership. If a question pops up, we don’t just put up a roadblock. We reach out to you directly to find a solution together. Our entire team is committed to getting your application across the finish line.

After the underwriting review is finished and any conditions are cleared, you’ll receive your final approval and closing documents. We take a lot of pride in making this happen quickly and without drama, often closing loans much faster than the industry average. Our goal is to make your journey to homeownership in Tampa as smooth as it can be.

Gaining an Edge in the Tampa Housing Market

Anyone who's looked at property in Tampa knows the market moves fast. In desirable neighborhoods like Hyde Park or South Tampa, a home can go from "just listed" to "under contract" in what feels like a blink of an eye. In this kind of environment, you need more than just a desire to buy—you need speed and confidence.

For a self-employed buyer, this is where a solid pre-approval for a bank statement home loan from Residential Acceptance Corporation (RAC Mortgage) becomes your secret weapon. It’s not just a piece of paper; it’s a powerful signal to sellers that you're a serious, qualified buyer ready to close the deal.

While a typical W-2 earner is locked into the income shown on their tax returns, a bank statement loan lets you use your actual cash flow. This often puts you on equal, or even stronger, footing with other buyers. You can make an offer knowing your financing is built on the real financial health of your business.

Seizing Opportunities in a Fluctuating Market

Tampa’s market is incredibly responsive to economic changes, especially when it comes to mortgage rates. When the 30-year mortgage rate recently dipped, home loan applications in Tampa shot up significantly compared to the previous year.

That kind of spike shows just how quickly a quiet market can turn into a frenzy. Being prepared is everything.

Having your bank statement loan pre-approval from RAC Mortgage means you’re always ready to move. You're not scrambling for paperwork when the perfect property appears or when interest rates create a window of opportunity. You can just act. To keep a pulse on the local scene, it's always smart to stay updated with local Tampa Bay news and community insights.

A bank statement loan empowers you to compete effectively against traditional buyers. Your offer is backed by a clear financial picture that reflects your actual success, not just what’s left after business write-offs.

Here’s a quick look at the current market dynamics to give you a clearer picture:

Tampa Home Loan Market Snapshot

This table highlights some of the key data points illustrating the current housing and mortgage trends in the Tampa area.

| Market Indicator | Recent Data/Trend | Impact on Bank Statement Borrowers |

|---|---|---|

| Median Home Price | Increased ~5-7% year-over-year | Higher prices mean a stronger financial profile is needed. Your full business cash flow becomes a critical asset. |

| Housing Inventory | Remains tight, especially in desirable areas | Low inventory fuels bidding wars. A strong pre-approval makes your offer stand out from the competition. |

| Interest Rate Sensitivity | A 1% rate drop can trigger a 20-25% surge in applications | You need to be ready to act before the market gets crowded. Pre-approval is key. |

| Self-Employment Growth | Tampa has a growing gig economy and small business sector | More self-employed buyers are entering the market. A specialized lender who understands your finances is a must. |

As the data shows, the market favors those who are prepared, and for self-employed individuals, that preparation looks a little different.

The Strategic Advantage for Entrepreneurs

At the end of the day, a bank statement loan is a strategic tool. It's designed for savvy entrepreneurs who need to show their financial stability in a way that makes sense—through consistent cash flow.

Instead of being penalized by the very tax strategies that help your business thrive, you get to use your strong bank deposits to qualify for the home you’ve earned. With RAC Mortgage, you’re not just applying for a loan. You’re partnering with a team that knows how to frame your unique financial story in the best possible light, giving you the edge you need to win in Tampa's competitive market.

Why Work with RAC Mortgage?

When you’re self-employed, finding the right mortgage lender is about more than just securing a loan. You need a partner who actually gets it—the hustle, the variable income, and the smart business deductions that don't fit neatly on a W-2. That’s exactly where we come in. At RAC Mortgage, we specialize in bank statement home loans in Tampa, and we've built our entire approach around the realities of entrepreneurship.

We aren't a traditional bank trying to cram your unique financial picture into a standard, one-size-fits-all box. We look at your consistent bank deposits and see what they really are: a clear sign of a thriving business.

Local Experts Who Understand Tampa Real Estate

Getting a mortgage is one thing, but winning a bid in Tampa's competitive market is another. You need a team with real, on-the-ground knowledge of local neighborhoods and market dynamics. We live and work here, so we know what it takes to make a self-employed buyer’s offer stand out.

Our focus is squarely on non-QM (Non-Qualified Mortgage) lending. This isn't just a side-offering for us; it's the heart of what we do. This deep specialization means we have a long history of helping Tampa's entrepreneurs, freelancers, and independent contractors get into their dream homes, even when other lenders said no.

At RAC Mortgage, our philosophy is straightforward: We're here to find solutions, not create obstacles. Your hard work deserves a clear path to homeownership.

We’ve guided countless business owners through this exact process, turning frustration into celebration on closing day. We believe in being transparent partners every step of the way, so you always feel confident and in control.

Ready to see how a specialist can make all the difference? Connect with the RAC Mortgage team today and let's talk about getting you into your new Tampa home.

Frequently Asked Questions About Tampa Bank Statement Loans

It's completely normal to have questions when you're exploring a different way to finance a home. For self-employed buyers in Tampa, getting straight answers is the first step toward buying with confidence. Here at Residential Acceptance Corporation (RAC Mortgage), we've put together some of the most common questions we hear to give you the clear information you need.

Our job is to pull back the curtain on this process and show you that a bank statement home loan in Tampa is probably more straightforward than you think. Let's get into the specifics.

Can I Use Both Business and Personal Bank Statements?

Absolutely. In fact, for many business owners, using a mix of accounts is the only way to paint a complete and accurate picture of their income. We get it—every entrepreneur manages their money differently. Maybe you funnel all your revenue into a business account and then pay yourself, or perhaps some of your income lands in a personal account.

Our loan officers have seen it all. They'll sit down with you and figure out the right combination of statements to best represent your true cash flow. Consistency is what we're looking for, a clear story of your earnings over a 12 or 24-month period.

What’s the Typical Down Payment?

Bank statement loans do tend to require a bit more skin in the game than a standard loan. While you might see conventional loans with down payments as low as 3%, you should plan for a down payment starting around 10% for a bank statement program. This higher down payment helps balance the risk for the lender since we're not using W-2s or tax returns to verify your income.

It's also worth noting that a larger down payment can really work in your favor. Putting down 20% or more often opens the door to better interest rates and means you won't have to pay for private mortgage insurance (PMI).

How Fast Can RAC Mortgage Close This Kind of Loan?

This is where we really shine. Since non-QM loans are our bread and butter, our entire process is built for speed and efficiency. Every loan has its own unique wrinkles, of course, but we consistently close loans faster than most big banks. Once we have your full application and all your statements, we can often get to the closing table in about 18 to 20 days. In a hot market like Tampa, that kind of speed can be the difference-maker.

Is My Interest Rate Going to Be a Lot Higher?

It’s a fair question. The interest rates on bank statement loans are typically a little higher than what you’d see on a conventional mortgage. That's simply because lenders view them as a slightly higher-risk product. However, the gap is often much smaller than people worry about.

Your final rate will come down to a few key factors: your credit score, the size of your down payment, and your overall financial health. Here at RAC Mortgage, we fight to get you the most competitive rate out there, making sure the loan is a sustainable and smart move for your future.

Ready to get answers tailored to your situation? The experts at Residential Acceptance Corporation are here to map out a clear path to your new home in Tampa.

Start your homeownership journey with us today!