When a low credit score is staring you in the face, buying a home in Tampa can feel like a distant dream. Many people think finding a Tampa mortgage lender for credit issues is a lost cause, but the truth is, it's really about finding the right partner. A specialized lender like Residential Acceptance Corporation (RAC Mortgage) knows how to look at your whole financial story, not just a three-digit number.

Your Path to a Tampa Home with Challenging Credit

Think of this guide as your roadmap. A less-than-perfect credit history isn't a dead end; it's just a detour. We're going to break down how to handle the common bumps in the road, like higher interest rates or tougher requirements, and give you a clear plan to get you mortgage-ready.

This is your practical strategy for making that dream of owning a Tampa home a reality, even with a few credit hiccups in your past. The journey starts with understanding one key thing: some lenders see the person behind the application, not just the score.

Understanding the Local Landscape

The Tampa housing market has its own unique rhythm of opportunities and challenges. With recent economic shifts, homeowners across the area have felt the squeeze. In fact, around 5.5% of Tampa Bay home mortgages were at least 30 days past due recently, a sharp rise from 3.3% just a year before. You can dive deeper into Tampa's mortgage delinquency trends from Axios.

That 2.2 percentage point jump shows the real financial pressure local families are under. It's also exactly why working with a lender who truly gets the local market is a game-changer. A lender like RAC Mortgage sees these trends and is ready to help borrowers who might have been caught in the crossfire.

Navigating the mortgage process with credit issues isn't about having a perfect record; it's about demonstrating current stability and future potential. A specialized lender helps you build that case.

What This Guide Will Cover

We're here to give you actionable steps and straightforward explanations that put you in the driver's seat. We'll walk through several key areas to get you ready for a successful home purchase:

- Choosing the right lender who specializes in your situation.

- Discovering flexible loan programs designed for various credit profiles.

- Taking concrete steps to improve your approval odds.

By the time you're done reading, you'll have a much clearer picture of how to find the right Tampa mortgage lender for your credit situation and get those keys in your hand.

Why a Specialized Tampa Lender Makes All the Difference

When you've got a few credit dings, picking a mortgage lender is a lot like picking a doctor. For a common cold, your family doctor is perfect. But for something more complex, you need a specialist who really gets the nuances of your situation.

Traditional banks often rely on a rigid, one-size-fits-all checklist. A specialized Tampa mortgage lender for credit issues, like us at Residential Acceptance Corporation (RAC Mortgage), is that specialist you need in your corner.

We just operate differently. Our underwriting process goes way beyond a simple credit score. We don't see you as just a number; we see your complete financial story. This means we dig into the factors that paint a much more realistic picture of your readiness for homeownership.

Going Beyond the Score

For a typical lender, the conversation often stops cold if your score dips below a certain number. It's a hard "no." We, on the other hand, focus on building a case for you based on where you are today—not just the bumps you hit in the past.

Our team looks for the real-world signs of financial responsibility that automated systems almost always miss:

- Consistent Rental History: Have you been paying your rent on time, every month? That's a huge indicator that you can handle a monthly housing payment.

- Steady Employment: A stable job history shows us you have a reliable income stream to support a mortgage. It’s common sense.

- Positive Financial Habits: Are you saving money? Managing your current accounts responsibly? These actions can speak louder than old credit mistakes.

This holistic review is absolutely critical here in Florida. Our state was hit hard during the 2000s subprime mortgage crisis, and the fallout was severe for borrowers with credit challenges. The state's serious delinquency rate exploded from 2% in 2007 to an unbelievable 20% by early 2010. That’s a tenfold increase, fueled by aggressive lending and the market collapse that followed. You can read more about Florida's volatile mortgage market history on predatorylending.duke.edu. This history is exactly why you need a lender who understands our local economic cycles and knows how to help borrowers get back on their feet.

We’ve Seen It All

Life happens. Bankruptcies, foreclosures, or a mountain of medical debt can wreck a credit score. Many lenders see these events as automatic disqualifiers, end of story. At RAC Mortgage, we have the experience to structure loans for people who have already fought through these hurdles and come out the other side.

We don’t just process applications; we analyze the why behind your credit history to map out a real path forward. This personalized strategy is what makes a specialized lender an invaluable partner on your journey to owning a home in Tampa. By focusing on your present financial health, we can often find solutions where others only see roadblocks.

Understanding Your Mortgage Options

When you’re dealing with credit challenges, the mortgage world can feel like an intimidating maze of acronyms and confusing terms. The key is finding the right Tampa mortgage lender for credit issues—a partner like Residential Acceptance Corporation (RAC Mortgage) who can cut through the jargon and show you a clear path to owning a home.

Let's break down the two main avenues available for borrowers who don't have perfect credit. These programs are built with flexibility in mind, recognizing that real life doesn't always fit into the neat little boxes traditional lenders want. Each offers its own set of benefits designed for specific financial situations.

FHA Loans: The Accessible Path

Think of an FHA loan as one of the most popular and trusted tools for homebuyers with credit bumps. These loans are backed by the Federal Housing Administration, which means the government provides a layer of insurance against default. This backing gives lenders the confidence to offer mortgages with more forgiving credit score requirements.

Because of this, FHA loans are a powerful option for many first-time buyers or anyone in the process of rebuilding their credit.

Here’s what makes them so appealing:

- Lower Credit Score Minimums: You don’t need a flawless credit history to get your foot in the door.

- Small Down Payments: You can often qualify with as little as 3.5% down.

- Flexible Underwriting: Lenders can look at the bigger picture of your finances, not just a single number.

An FHA loan is a fantastic starting point for many. You can see exactly how we help Tampa buyers by checking out our guide to being an FHA mortgage lender in Tampa. This program has opened the door to homeownership for countless families.

Non-QM Loans: The Flexible Alternative

But what if your financial story is a bit more complicated? Maybe you're self-employed with income that goes up and down, a real estate investor, or you've had a recent credit event like a bankruptcy. This is exactly where Non-Qualified Mortgage (Non-QM) loans shine. They are built for borrowers who don’t fit the strict paperwork rules of conventional loans.

A Non-QM loan is more like a custom-fit solution. Instead of just looking at W-2s and tax returns, we can use other ways to verify your ability to pay, such as analyzing your bank statements. This offers critical flexibility if your income doesn't come from a traditional 9-to-5 job.

The history of lending right here in Florida shows why these kinds of specialized options are so important. Back in the mid-2000s, Tampa was a major center for subprime lending, with nearly six of these loans for every 100 homes in 2005—way above the national average. When that market collapsed, it proved the need for safer, more reliable alternatives for borrowers with credit issues.

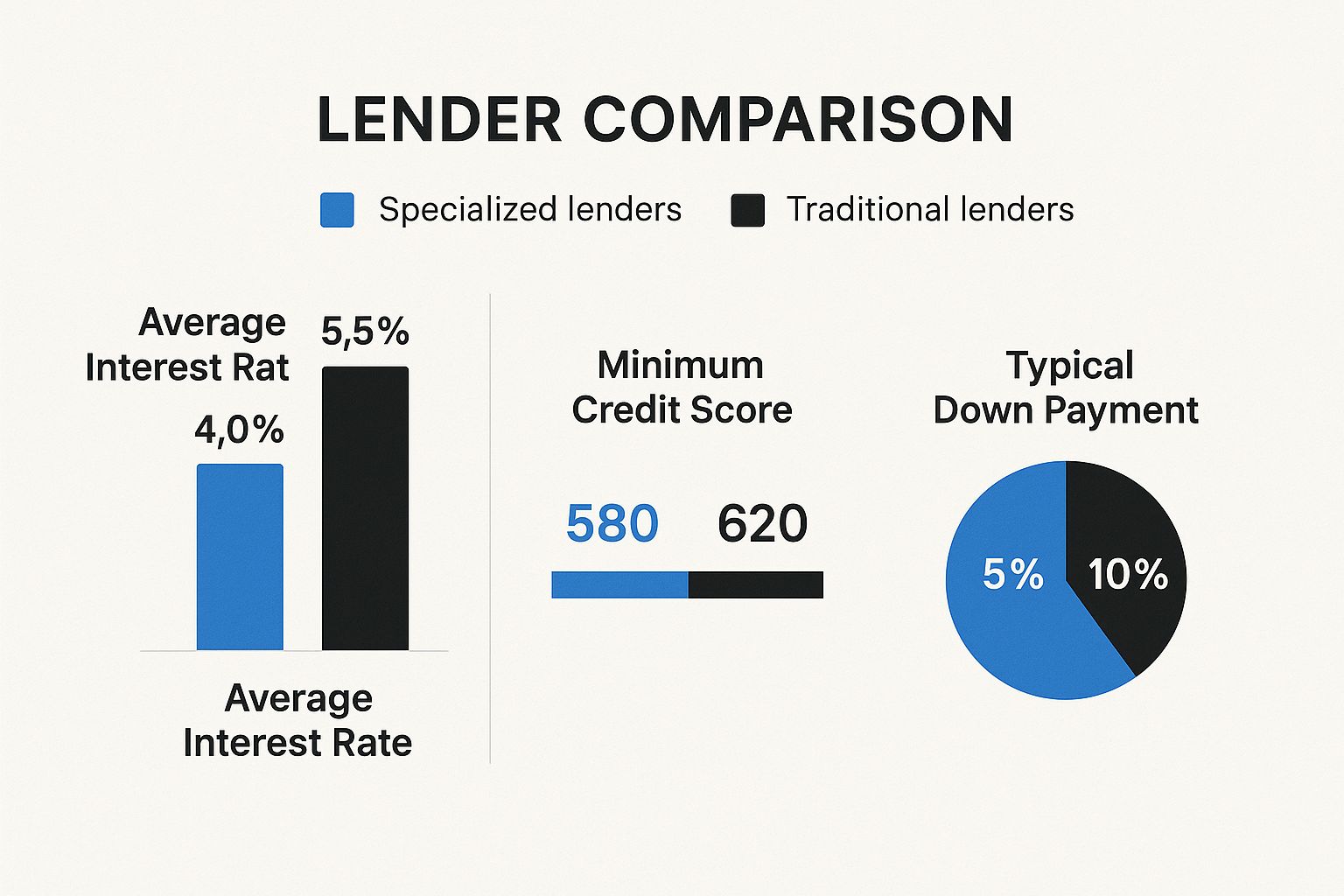

The image below shows the key differences you’ll find when comparing our programs to what traditional banks typically offer.

As you can see, a specialized lender like RAC Mortgage can often secure financing with lower credit score and down payment requirements, creating a realistic path to homeownership that might otherwise be out of reach.

To make things even clearer, here’s a quick comparison of the loan programs we offer for Tampa buyers facing credit hurdles.

Loan Program Snapshot from RAC Mortgage

| Loan Program | Typical Credit Score Range | Minimum Down Payment | Best For… |

|---|---|---|---|

| FHA Loan | 580+ | 3.5% | First-time homebuyers or those with limited savings and a few credit blemishes. |

| Non-QM Loan | 600+ | 10-20% | Self-employed individuals, real estate investors, or borrowers with recent credit events. |

This table gives you a high-level view, but the best way to know for sure which path is right for you is to have a conversation. Every situation is unique, and our goal is to find the perfect fit for your homeownership goals.

How to Strengthen Your Mortgage Application

When you're looking for a Tampa mortgage lender for credit issues, the application you submit is much more than a pile of paperwork. It’s your financial story. It’s your chance to show that, despite any past bumps in the road, you're ready and able to take on a mortgage today.

Taking the time to build a rock-solid application can be the difference between a quick denial and a confident approval. Think of it like getting ready for a big job interview—you wouldn't just walk in cold. You'd prepare, get your story straight, and put your best foot forward. That's exactly what you need to do here.

Tidy Up Your Credit Report

First things first: you need to become an expert on your own credit. Before any lender lays eyes on it, get copies of your full credit reports from all three bureaus—Equifax, Experian, and TransUnion. Don't just look at the score. You have to dig into the details.

Your job is to put on your detective hat and hunt for errors. These slip-ups are more common than you'd think and can seriously drag down your score. Look specifically for:

- Incorrect Personal Information: Even a simple typo in your name or a wrong address can cause problems.

- Accounts That Aren't Yours: This could be a sign of identity theft or just a clerical mistake.

- Outdated Negative Items: That late payment from 8 years ago? It should be long gone.

- Duplicate Accounts: A single debt listed twice can make it look like you owe more than you actually do.

If you find anything that looks off, dispute it immediately. The Fair Credit Reporting Act is on your side, giving you the right to challenge any inaccurate information.

Strategically Manage Your Debts

With a clean report, your next focus should be on your existing debts. How you handle them directly impacts your debt-to-income (DTI) ratio, a number underwriters obsess over. The goal isn't to be completely debt-free overnight, but to show you're in control of what you owe.

A lower credit card balance can do more for your score than just making minimum payments on a big loan. Lenders zero in on your credit utilization ratio—the amount of credit you're using versus your total limit. Keeping this ratio below 30% sends a powerful message that you’re managing your finances responsibly.

Tackle high-interest, revolving debts like credit cards first. Paying them down doesn't just save you a ton on interest; it gives your utilization ratio an immediate boost. For a deeper dive, check out our guide on how to improve your credit score for a mortgage.

Organize Your Financial Documents

Lenders need proof for every number on your application. Being organized shows you’re a serious and prepared borrower, making the entire process smoother for you and your loan officer. Don't wait until the last minute—start gathering these documents now.

Here’s a basic checklist of what you'll need:

- Proof of Income: Your last two years of W-2s and your most recent pay stubs.

- Tax Returns: Complete federal tax returns for the past two years.

- Bank Statements: At least two months of statements for all your checking and savings accounts.

- Identification: A clear copy of your driver’s license or another government-issued ID.

By getting these three key areas in order—your credit, your debts, and your documents—you're showing the lender the best version of your financial self. This is how you build a foundation of trust and prove you're ready for homeownership in Tampa.

Navigating the Application Process with RAC Mortgage

Applying for a home loan, especially when you need a Tampa mortgage lender for credit issues, can feel like stepping into the unknown. It’s easy to imagine a mountain of paperwork and a stressful, judgmental process. But with us, it’s a partnership from day one. We believe in pulling back the curtain and making the journey clear and manageable.

Our goal is to take the mystery out of each step. We want you to know exactly what’s happening with your application and why, turning an anxious waiting game into a team effort. The only thing we’re focused on is getting those keys in your hand.

From First Call to Pre-Qualification

It all starts with a simple conversation. This first call isn’t an interrogation; it's about us understanding your story—your goals and your current financial situation. One of our dedicated loan officers will chat with you about your income, debts, and credit history to get a solid starting point.

From there, we move to pre-qualification. This gives you a ballpark idea of how much you can likely borrow. Honestly, this is a game-changer before you start seriously looking at homes in Tampa. It helps you zero in on properties that are actually in your price range, saving you time and potential heartache.

The Underwriting Journey

Once you find a home and the seller accepts your offer, your file heads to underwriting. This is where the real deep dive happens. An underwriter’s job is to verify all your financial details and make sure everything lines up with the specific loan program’s rules. Think of them as a fact-checker making sure all the i's are dotted and t's are crossed for a successful approval.

This part can feel a little intense, especially if the underwriter comes back asking for more documents or clarification on past credit issues. It's totally normal to feel a bit stressed, but remember: these requests are standard procedure. They aren't a sign of trouble—they're just building the strongest possible case for your loan.

The best thing you can do is respond quickly and completely. Open communication with your loan officer is your secret weapon here. They are your guide and your advocate, and they'll help you understand exactly what’s needed and why.

To get a head start, check out our guide on what documents are needed for a mortgage application. Being prepared makes a huge difference.

After underwriting, a processor steps in to coordinate all the final pieces, like the appraisal and title search, getting you ready for the finish line. At RAC Mortgage, every single person on our team works together to make sure things move smoothly from one stage to the next, all the way to your closing day.

Partner with RAC Mortgage for Your Tampa Home

Your journey to owning a home doesn't have to dead-end because of past credit mistakes. As we've walked through, the path forward really just requires a guide who gets the unique financial stories of people right here in Tampa. For anyone dealing with credit challenges, finding the right Tampa mortgage lender for credit issues isn't just a nice-to-have—it's everything.

That's where Residential Acceptance Corporation (RAC Mortgage) comes in. We're not just another lender; we're deeply committed to our local community. Our team makes a point to look beyond the credit score to see your whole financial picture. Honestly, we specialize in navigating the complex histories and finding a way forward where other lenders only see a closed door.

Don't let uncertainty keep you from the dream of owning your own place any longer. The biggest hurdle is just taking that first step.

So, go ahead and take it. Reach out to the team here at RAC Mortgage for a no-pressure chat about what's actually possible for you. Our experts are ready to listen and help build a real plan for your future.

You can get started by visiting our website, giving us a call, or even applying online. It’s time to move from reading about it to taking that concrete step toward getting the keys to your new Tampa home.

Your Questions Answered

When you've had a few credit bumps along the way, the mortgage process can feel like it's full of questions and uncertainty. As a Tampa mortgage lender for credit issues, we at Residential Acceptance Corporation (RAC Mortgage) get it. We believe in giving you clear, honest answers, so we've put together some of the most common questions we hear to help you move forward with confidence.

What’s the Lowest Credit Score You’ll Accept?

Honestly, there isn't a single magic number. Here at RAC Mortgage, we believe in looking at your whole financial story, not just a three-digit score.

That said, many government-backed loans, like the popular FHA loan, are designed to be more flexible and can sometimes work for borrowers with scores down in the 500s. Things like having a bit more for a down payment or keeping your other debts low can make a huge difference and really strengthen your application. The only real way to know what's possible is to have a chat with our team about your specific situation.

Can I Get a Mortgage After a Bankruptcy or Foreclosure?

Yes, absolutely. It is 100% possible to get a home loan after a major credit event like a bankruptcy or foreclosure. We've helped many Tampa homebuyers navigate this exact path.

There are some federally-required waiting periods after these events, and the timeline can change depending on the loan you're aiming for.

The real key isn’t that you had a past credit issue, but how you've handled your finances since. We help you show lenders your current financial stability once that mandatory waiting period is over.

One of our experts can look at your timeline, figure out when you're eligible to apply again, and help you line up all the right paperwork to build a rock-solid case for approval.

How Much of a Down Payment Will I Really Need?

The down payment you'll need is tied directly to your credit score and the type of loan you get. For instance, an FHA loan is a go-to option for many, and it might only require 3.5% down if your credit score is 580 or higher.

If your score is a little below that mark, a 10% down payment might be what it takes. Our loan officers at RAC Mortgage are pros at digging in and finding the best loan that minimizes your out-of-pocket costs.

Ready to stop wondering and start your journey to owning a home in Tampa? The expert team at Residential Acceptance Corporation is here with the personalized guidance you need. Contact us today for a no-pressure consultation.