Thinking about buying a home in Tampa but feeling overwhelmed by the thought of a huge down payment? You're not alone. But here's the good news: you can absolutely get into a home in Tampa with a lot less cash than the old 20% rule of thumb. In fact, there are specific loan programs designed to make homeownership a reality for you.

Unlock Tampa Homeownership with Less Cash

The 20% down payment is often the biggest mental and financial hurdle for people wanting to buy a home in Tampa. With home prices where they are, saving up tens of thousands of dollars can feel like an impossible task, pushing your dream further and further away.

But that's the old way of thinking. What if you could move into your new Tampa home by putting down as little as 3%, 3.5%, or maybe even 0%? This isn't a fantasy—it's a real strategy made possible by modern mortgage options. These programs are built to help you clear that initial financial barrier so you can start building equity and living your life in your own home.

Why a Lower Down Payment Matters in Tampa

Choosing a low-down-payment mortgage isn't just about saving money upfront; it's a smart financial move, especially in a competitive market like Tampa's.

- Get in the Game Faster: Why wait years saving while home prices potentially climb? A lower down payment lets you buy now and start benefiting from any appreciation in the market.

- Keep Your Cash: Putting less money down means you hold onto your savings for other crucial costs like closing, moving, or even making a few updates to your new place.

- Maintain Financial Flexibility: Having a healthy savings account after you buy is huge. It gives you a safety net for life's unexpected moments, so you don't feel "house poor" the day you get the keys.

The real purpose of a low down payment mortgage isn’t just to lower the entry fee. It’s to give you a clear, realistic path to building long-term wealth through homeownership without draining your bank account.

Here at Residential Acceptance Corporation (RAC Mortgage), this is what we do every day. Our team helps Tampa residents navigate a whole range of programs designed to get you into a home with a minimal upfront investment. If you'd like to see what's out there, we have a ton of great information on down payment assistance programs that can make your goal even more achievable. We know the Tampa market inside and out, and we're here to help turn your dream of owning a home into a reality—sooner rather than later.

Navigating the Tampa Mortgage Market

To really get why a low down payment mortgage is such a game-changer in Tampa, you have to understand what's happening on the ground. Tampa isn't just a sunny spot on the map; it's a fast-moving, competitive real estate market. The interplay between home prices, buyer demand, and interest rates creates a unique landscape for anyone trying to buy a home here.

Let's be honest: the price of admission to the Tampa housing market has gone up. A lot. As home values have climbed, saving up for a traditional 20% down payment has gone from a standard goal to a massive financial hurdle for many people.

This is exactly why looking for a mortgage with a smaller upfront cost isn't just a clever shortcut—it's a necessary strategy.

The Impact of Local Economic Trends

Tampa is booming. New jobs and new residents are pouring in, which is fantastic for the city's economy but also cranks up the heat on the housing market. More demand means more competition for every home that hits the market. In this kind of environment, speed is everything.

If you wait years to save up a huge down payment, you risk watching home prices—and your future mortgage payment—climb right past what you can afford. This is where having a local expert like Residential Acceptance Corporation (RAC Mortgage) in your corner makes a real difference. We live and breathe these market pressures every day and know how to find solutions that get you into a home sooner, so you can start building equity now.

How Interest Rates Shape Your Strategy

Interest rates are the other big piece of the puzzle. They have a direct impact on your monthly payment and how much house you can ultimately afford. A quick look at historical mortgage rates in Tampa tells an interesting story. Between 2000 and 2018, local rates often followed national trends, dropping from around 8.02% in 2000 down to about 4.61% by 2018.

When rates are low, it's easier to stomach a higher purchase price because the monthly payments are more manageable. But the script flips when rates go up.

When interest rates rise, as they have in the current climate, the entire financial equation changes. Higher rates mean a higher monthly cost to borrow, making every single dollar of your loan more expensive over time.

This is precisely why a low down payment mortgage is so appealing to Tampa buyers right now. By needing less cash at the closing table, you free up funds to handle the higher monthly payments that come with today's rates. It’s all a balancing act. For broader perspectives on the real estate market and property ownership, Explore the titletrackr real estate blog for market insights.

At RAC Mortgage, our job is to analyze these moving parts—Tampa's home values, its economic pulse, and the current interest rate climate. We use this deep local knowledge to build a mortgage that fits your reality, making sure your dream of owning a home in Tampa is not just possible, but achievable.

Comparing Your Low Down Payment Loan Options

Okay, so we've established that the Tampa market can be tough to break into. Now, let's get into the practical solutions that can get you in the door. Choosing the right mortgage is a lot like picking the right tool for a job—you need the one that fits your specific situation.

At Residential Acceptance Corporation (RAC Mortgage), we focus on powerhouse loan programs that help Tampa buyers achieve homeownership without needing a mountain of cash upfront. Think of FHA, VA, and Conventional loans as different paths all leading to the same amazing destination: your new home. Each has its own rules and perks, and figuring out which one is for you is the first step toward making a smart, confident decision.

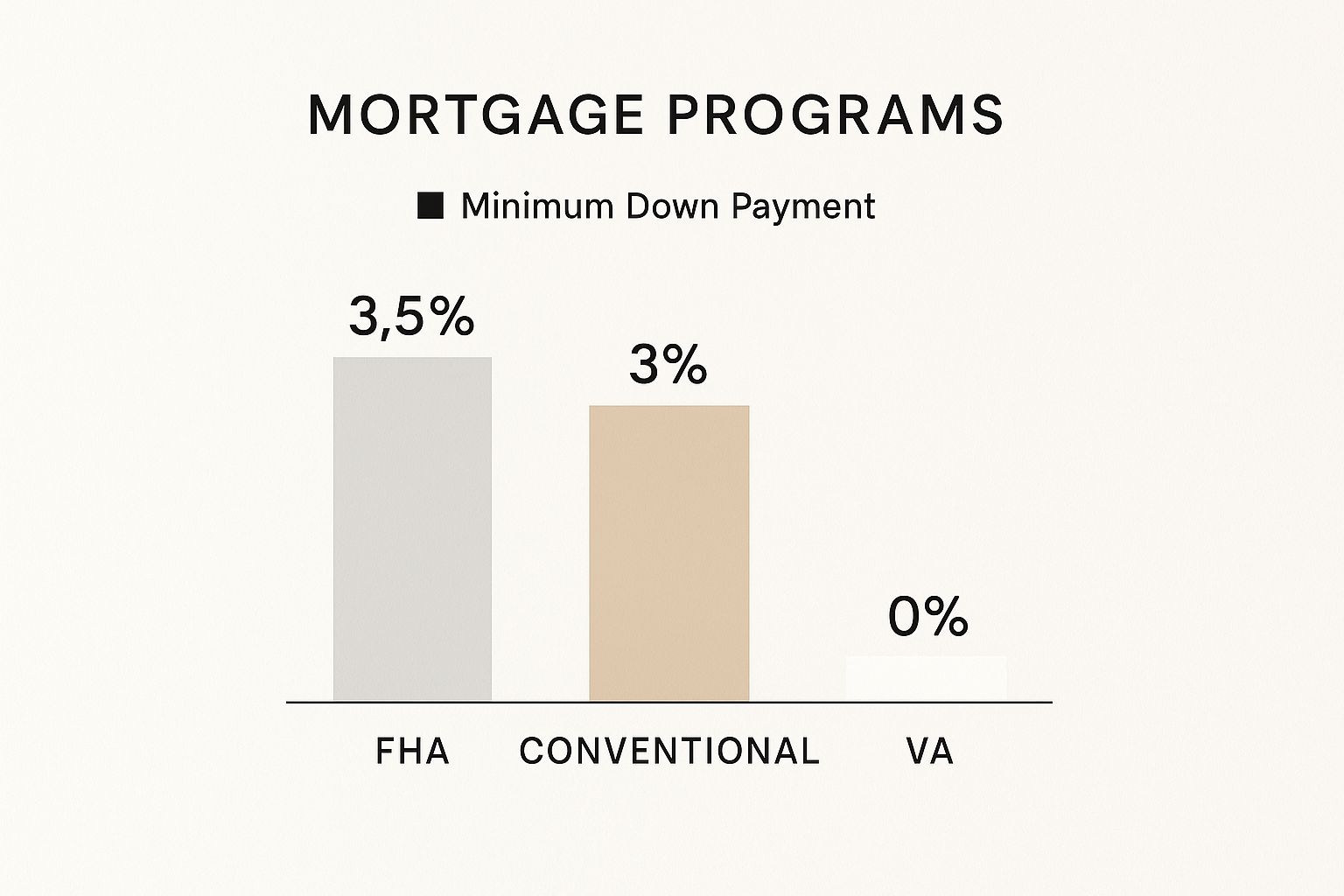

This quick visual breaks down the minimum you'll need to put down for each one.

As you can see, that VA loan is a standout. It gives eligible veterans and service members a path to homeownership with absolutely zero down.

Comparing Low Down Payment Mortgage Options at RAC Mortgage

To make things even clearer, here’s a side-by-side look at the programs we offer. This table is a great starting point for seeing where you might fit in.

| Program | Minimum Down Payment | Ideal For | Key Benefit |

|---|---|---|---|

| FHA Loan | 3.5% | First-time homebuyers or those with less-than-perfect credit. | Flexible credit and debt-to-income requirements. |

| Conventional Loan | 3% | Buyers with solid credit scores looking for flexibility. | Mortgage insurance (PMI) can be canceled later on. |

| VA Loan | 0% | Veterans, active-duty military, and eligible spouses. | No down payment and no monthly mortgage insurance. |

This at-a-glance comparison helps highlight the core strengths of each option. Now, let's dig into the details to understand what makes each program tick.

FHA Loans: The Flexible Path Forward

Backed by the Federal Housing Administration, FHA loans are a godsend for many first-time homebuyers or folks who have a few dings on their credit report. The whole point of this program is to make buying a home more attainable for everyone.

The headliner here is the low down payment—just 3.5% of the purchase price. Let's put that in perspective for Tampa. On a $350,000 home, that’s a down payment of $12,250. A traditional 20% down loan would demand a whopping $70,000. It's a massive difference. FHA guidelines are also more forgiving on credit scores and how much debt you carry, recognizing that life happens.

FHA loans are like a financial bridge. They help hardworking people get into a home years sooner than they could otherwise, giving them a real foothold in the competitive Tampa market.

This flexibility makes FHA a go-to choice for buyers with a reliable income who are ready to own but just haven't had the time to save up a huge nest egg or build a perfect credit profile.

Conventional Loans: The Modern Standard

There’s a common myth that you absolutely need 20% down for a conventional loan. That’s old news. Today's conventional loan programs—like the ones we offer at RAC Mortgage—are extremely competitive, with options requiring as little as 3% down.

These loans are a fantastic fit for buyers who have a good credit history. While you might need a higher credit score to snag a low down payment conventional loan compared to an FHA loan, the tradeoff can be huge: you can get rid of your mortgage insurance much sooner.

Here's what makes them so attractive:

- Tiny Down Payments: You can get started with as little as 3% down if you qualify.

- Escapable Mortgage Insurance: Private Mortgage Insurance (PMI) on conventional loans isn't forever. It can typically be canceled once your home equity hits 20%.

- More Versatility: Use them for your primary home, a vacation spot, or even an investment property.

For a Tampa homebuyer with a strong credit score, going conventional can be a savvy move to keep initial costs low while setting yourself up for better long-term savings.

VA Loans: The Ultimate Benefit for Service Members

For our veterans, active-duty service members, and eligible surviving spouses, the VA loan isn't just a great option—it's one of the best financial benefits earned through service. Its most incredible feature is the $0 down payment. That's right. You can buy a home in Tampa with absolutely no money down.

This isn't just helpful; it's a complete game-changer. The ability to finance 100% of a home's value single-handedly removes the biggest barrier to homeownership for those who have served our country.

But the perks don't stop there. VA loans also come with:

- No Monthly Mortgage Insurance: While other low down payment loans tack on mortgage insurance, VA loans don't. This alone can save you hundreds of dollars every single month.

- Great Interest Rates: VA-backed loans usually have some of the most competitive interest rates you'll find anywhere.

- Capped Closing Costs: The VA puts a limit on the closing costs lenders can charge, which helps keep your final out-of-pocket expenses manageable.

This powerful combination of benefits makes the VA loan truly unbeatable for those who qualify. If you think this might be you, it’s worth taking a closer look at the VA loan no down payment option. We're proud to help our military community here at RAC Mortgage navigate this fantastic program.

The Truth About Down Payments in Tampa

Let's talk about one of the biggest myths in real estate: the idea that you have to put down a whopping 20% to buy a home. For a lot of people trying to buy in Tampa, that number feels like an impossible wall to climb, pushing homeownership out of reach. But what if I told you that’s not what’s actually happening here in Tampa Bay?

The reality is, most of your neighbors aren't putting down anywhere near that much. The mortgage world has changed, and RAC Mortgage has made owning a home much more attainable. Let's dig into the real numbers and put this old myth to bed for good.

What Tampa Buyers Are Actually Paying

When you look at the local data, you see a pretty interesting story unfolding, one that makes our area stand out. While down payments are climbing in many parts of the country, Tampa is bucking the trend. It's becoming a place where getting your foot in the door is genuinely more realistic.

A recent analysis really brought this to light. In Tampa Bay, the median down payment has dropped quite a bit. As of this past December, it was $35,000, which comes out to about 10% of the home's price. That's a 16% decrease from the year before, when it was $41,793. What's even more telling is that over that same time, the national median down payment actually rose to almost 16%. You can dive deeper into this local trend in the full report on Tampa Bay down payments.

This isn't just a number on a page. It's proof that you're not alone. Looking for a low down payment mortgage in Tampa isn't the exception anymore—it's fast becoming the rule.

This trend makes one thing crystal clear: saving up a massive down payment is a real struggle for many folks in our community. With home prices on the rise and interest rates doing their own thing, buyers are looking for smarter, more flexible ways to get into a home.

Why Less Is More in Today’s Market

So, why are so many Tampa buyers putting less cash down? It boils down to a few smart, strategic moves that today's homebuyers are making.

- Getting into the Market Faster: Saving up 20% can take years. In that time, Tampa home prices will likely keep climbing. By getting into a home sooner with less money down, you start building your own equity right away instead of watching prices rise from the sidelines.

- Keeping Your Savings Liquid: A smaller down payment means more of your hard-earned money stays in your bank account. That cash is vital for closing costs, moving expenses, and all the little things you'll need for your new place, without feeling financially stretched thin.

- Holding onto a Financial Safety Net: Life happens. Not sinking every penny into your down payment means you still have a solid emergency fund for unexpected repairs or other surprises. That peace of mind is priceless.

At Residential Acceptance Corporation (RAC Mortgage), we don't just see these trends; we work with them every single day. We know Tampa's market requires a different playbook. Our whole focus is on finding the right loan programs that fit the financial reality of living here, making sure your path to owning a home is clear, doable, and sets you up for long-term success.

How Mortgage Insurance Opens Doors for Buyers

For a lot of folks looking to buy a home in Tampa, "mortgage insurance" sounds like just another fee tacked onto their costs. But what if you thought of it less as a penalty and more as a key? That's exactly what Private Mortgage Insurance, or PMI, is. It's one of the most effective tools out there for unlocking the door to homeownership, especially if you haven't saved up the traditional 20% down payment.

Think of it this way: PMI is an insurance policy, but it’s not actually for you—it’s for us. It gives us at Residential Acceptance Corporation (RAC Mortgage) the confidence to say "yes" to a low down payment mortgage in Tampa, even when a buyer is putting down as little as 3% or 5%. This insurance covers our risk, making you a much more attractive borrower in our eyes.

This is a huge deal in Florida's fast-moving housing market. In fact, our state is a national leader in low down payment lending, and Tampa Bay is right at the center of it all. In a recent year, Florida came in second nationwide for these types of mortgages, with over 76,400 new homeowners using PMI to get into a home with less than 20% down. A massive 57% of those loans went to first-time homebuyers, which shows just how vital this tool is for getting new people onto the property ladder. You can actually learn more about Florida's low down payment trends and check out the data for yourself.

How PMI Directly Benefits You

Okay, so PMI protects the lender. How does that help you? The benefits actually flow directly to you as the homebuyer. PMI is the engine that makes low down payment conventional loans go, letting you jump into homeownership and start building your own equity years sooner than you might have thought possible.

Instead of spending several more years stuck in a rental cycle, trying to scrape together a huge down payment, PMI allows you to buy a home now. You get to start benefiting from potential property appreciation in the hot Tampa market right away.

The cost is simply rolled into your monthly mortgage payment. For most people, that slightly higher payment is a fantastic trade-off for the massive advantage of owning their own home and finally saying goodbye to rent checks.

The Path to Removing Mortgage Insurance

Here's the best part about PMI on a conventional loan: it's not permanent. It’s designed to be a temporary helper, and there are clear-cut rules for when you can kick it to the curb for good.

You can usually ask your lender to cancel PMI once your home equity hits a certain target. This typically happens in a couple of ways:

- You Reach 20% Equity: Once your loan balance drops to 80% of your home's original purchase price, you can call your lender and officially request to have the PMI removed.

- Your Home's Value Goes Up: If Tampa's home prices climb, your equity can grow much faster. You can get a new appraisal done, and if it shows your loan is now less than 80% of the home's current value, you may be able to drop PMI well ahead of schedule.

By law, lenders are required to automatically terminate your PMI once your loan balance is scheduled to reach 78% of the original value of your home, as long as your payments are up to date.

This built-in exit strategy is what makes PMI such a smart, temporary solution instead of a lifelong expense. At Residential Acceptance Corporation (RAC Mortgage), we make sure our clients understand the entire journey of their loan, including exactly when and how they can eliminate this cost. We see it as a stepping stone, not a roadblock, on your path to affordable homeownership in Tampa.

Your Application Roadmap with RAC Mortgage

Ready to take the next step toward a low down payment mortgage in Tampa? The path to homeownership can feel a little intimidating, but it's really just a series of straightforward steps. At RAC Mortgage, we've designed our entire process to be as clear and supportive as possible, so you feel in control from our first chat to closing day.

Think of us as your guide. We'll walk you through each stage, explaining the paperwork and what to expect so there are no surprises along the way.

Stage 1: The Initial Consultation

It all starts with a simple conversation. This is a no-pressure call with one of our experienced loan officers where we get to know you, your financial situation, and what you’re hoping to achieve.

We’ll talk about your goals, what you're looking for in a new home, and which low down payment programs could be a great fit. It's all about mapping out a strategy that puts you in the best position to succeed.

Stage 2: Getting Pre-Approved

Once we have a plan, the next move is getting pre-approved. This isn't just a rough estimate; a pre-approval is a conditional commitment from us that says exactly how much you can confidently borrow.

In a market as competitive as Tampa's, this is a game-changer. It signals to sellers and their agents that you're a serious buyer, which makes your offer stand out from the crowd. The process is quick and gets you ready to start your home search with real buying power.

A mortgage pre-approval is your golden ticket in the Tampa housing market. It transforms you from a window shopper into a ready-to-buy contender, empowering you to make strong, credible offers on the homes you love.

Stage 3: Gathering Your Documents

With your pre-approval letter ready, it’s time to pull together your paperwork. I know, this is the part everyone dreads, but we make it easy with a simple, clear checklist.

These documents just help us verify your income, assets, and financial background to finalize everything. To get a head start, you can check out our guide on what documents are needed for a mortgage application at https://www.racmortgage.com/what-documents-needed-for-mortgage/. Having your documents organized is the single best way to speed things up.

You'll typically need to gather a few key items:

- Proof of Income: Your most recent pay stubs and W-2s from the last two years usually do the trick.

- Asset Information: Bank statements showing you have the funds for your down payment and closing costs.

- Identification: A clear copy of your driver's license or another government-issued ID.

Stage 4: Underwriting and Final Approval

Okay, you've found the perfect home and your paperwork is in. Now, your loan file goes to our underwriting team. An underwriter is a specialist who double-checks all your information to make sure it aligns perfectly with the loan program guidelines.

They'll also review the property appraisal to confirm the home's value supports the loan amount. Once they give the green light, you’ll get the three best words in real estate: "clear to close." That’s the final approval you’ve been waiting for! From there, it’s off to the closing table to sign the papers and get the keys to your new Tampa home.

Common Questions About Tampa Mortgages

Jumping into the world of home financing always brings up a lot of questions. As you start looking into a low down payment mortgage in Tampa, you need clear, direct answers, not more jargon. Here at Residential Acceptance Corporation (RAC Mortgage), we firmly believe that a well-informed buyer is an empowered one.

This final section tackles the most common questions we hear from homebuyers just like you. We want to give you straightforward answers that clear things up and help you feel confident about taking the next step.

Can I Get a Low Down Payment Mortgage in Tampa with Imperfect Credit?

Yes, you often can. The mortgage landscape has changed, and many programs are now built with more flexible credit requirements to help more people buy a home.

An FHA loan from RAC Mortgage, for instance, might let you put down just 3.5% with a qualifying credit score. While a higher score usually gets you a better interest rate, these programs make homeownership possible for a lot more people. Your best move is to talk with one of our loan officers to see exactly what your options are.

Does a Smaller Down Payment Mean a Higher Monthly Payment?

It does, but it’s often a very manageable trade-off. A smaller down payment means you're borrowing more, which nudges up the principal and interest portion of your monthly payment. Plus, if you put down less than 20%, you’ll almost always have to pay for mortgage insurance.

But for many buyers in Tampa, this slight increase is well worth it. It gets you into a home now so you can start building your own equity instead of waiting years to save up while home prices potentially climb even higher.

For many aspiring homeowners, the ability to enter the market now and start building wealth outweighs the slightly higher monthly cost associated with a lower down payment.

Are There Specific Programs for First-Time Homebuyers?

Absolutely. In fact, most low down payment options are a perfect fit for first-time homebuyers. FHA loans are a go-to choice, and even some conventional loans now allow for down payments as low as 3%.

At RAC Mortgage, we specialize in walking first-time buyers through these programs. We can also clue you in on any local down payment assistance you might qualify for. And as you prepare for homeownership, don't forget about protecting your investment—given our location, understanding the importance of flood insurance for Tampa homes is a must.

How Do I Get Started with RAC Mortgage?

It’s simple. The first step is just to reach out to a loan officer here at Residential Acceptance Corporation for a no-pressure consultation. We'll chat about your financial picture and what you're looking for to find the right mortgage program for you.

From there, we can get you pre-approved. In Tampa's competitive market, a pre-approval letter is a huge advantage, showing sellers you’re serious and ready to make a move.