As an international buyer, you might think securing a U.S. mortgage is a mountain of paperwork and red tape. The truth is, it’s absolutely possible, especially when you work with the right people. Here at Residential Acceptance Corporation (RAC Mortgage), we specialize as a foreign national mortgage lender in Tampa, and we've built our process to be as clear and direct as possible. Tampa is, without a doubt, a major draw for global investors, and we're here to help you get a piece of it.

Why Tampa Attracts Global Real Estate Investors

Tampa's real estate market isn't just a local secret anymore—it's a globally recognized hub for smart investment. What's the draw? It's a powerful mix of high-growth potential, reasonable property values, and a quality of life that’s hard to beat. This unique combination makes Tampa a magnet for buyers looking for everything from a sunny vacation home to a profitable, income-generating rental property.

The numbers don't lie. Florida consistently ranks as a top state for foreign real estate investment, and Tampa plays a starring role. Between August 2020 and July 2021, international buyers snapped up around 22,500 existing homes in Florida. A solid 8% of those sales were right here in the Tampa-St. Petersburg-Clearwater metro area.

Interestingly, the median purchase price for these international buyers was $347,300, which is noticeably higher than the statewide median. This tells me they aren't just buying property; they're investing in high-quality assets in prime locations.

What Makes Tampa an Ideal Choice?

So, what’s the secret sauce? From my experience working with clients from all over the world, a few key factors always come up:

- A Booming Economy: Tampa’s economy is diverse and expanding, constantly attracting new businesses and, with them, new residents. That steady influx directly fuels housing demand.

- Zero State Income Tax: This is a huge deal for investors. Florida's tax-friendly environment means you get to keep more of your returns, whether from rental income or property appreciation.

- An Unbeatable Lifestyle: Let's be honest, this is a big one. You've got world-class beaches, professional sports teams, incredible food, and a vibrant arts scene. It’s a place people want to visit and live.

For so many of our international clients, buying a home in Tampa goes beyond the balance sheet. It’s a lifestyle investment. The idea of generating steady rental income while also having a personal getaway for family vacations is incredibly appealing.

Thinking about your Tampa property as a rental? Getting the financing is just the first step. You'll also want to get a handle on the day-to-day operations. This a comprehensive guide to managing vacation rental property is a great resource for figuring out your post-purchase game plan.

And if you're laser-focused on the investment side of things, our team at RAC Mortgage can walk you through the specifics. As a dedicated Tampa investment property mortgage lender, we know exactly what it takes to get you from application to closing. Our goal is simple: to give you a clear, uncomplicated path to owning property in one of America's most exciting cities.

Qualifying for a Loan with RAC Mortgage

So, what does it actually take to get a loan approved as a foreign national in Tampa? Forget the generic checklists you might find elsewhere. At RAC Mortgage, we’ve built our process around the realities of international finance, not a rigid system that only understands U.S. credit scores and tax returns.

We know you won't have W-2s or American tax filings. That's why we focus on what you do have. This could be a detailed letter from your accountant, statements from your bank back home, or documents proving business ownership. It’s a practical, flexible approach built for the wonderfully diverse people buying property here.

Your Financial Profile Assessment

Think of it from our perspective as a lender: we need to build a clear, confident picture of your ability to manage this loan.

Let's say you're a buyer from the UK looking at a vacation home in Clearwater Beach. We wouldn't ask for a FICO score. Instead, we’d look at a few key pillars to understand your financial health:

- Income Verification: A letter from your chartered accountant breaking down your salary or business profits works perfectly.

- Asset Confirmation: We’ll review statements from your UK bank to see that you have the funds ready for the down payment and closing.

- Creditworthiness: No U.S. credit history? No problem. A simple letter of reference from your primary bank in the UK goes a long way to show you're in good financial standing.

The Tampa metro area is a magnet for international buyers. In fact, it attracts 8% of all foreign investment in Florida real estate. A massive 65% of these buyers live abroad and use their property for vacations or rental income. The market is particularly hot with buyers from Latin America (35%) and Canada (27%), proving Tampa's global appeal.

One of the biggest myths we have to bust is the idea that you need a specific visa to buy property here. For an investment property, that's often not the case. Many of our clients are purchasing purely for investment and don't have a long-term U.S. visa.

Down Payment and Loan Structure

For any foreign national loan, the down payment is a critical piece of the puzzle. You should expect it to be higher than a typical U.S. loan, usually starting around 25% of the home's purchase price.

This larger investment signals your financial stability and commitment, which helps balance out the fact that you don't have a U.S. credit history. Your down payment sets your loan-to-value (LTV) ratio. If you want to get into the nuts and bolts, we have a guide where the loan-to-value ratio is explained.

Putting more money down not only strengthens your application but can also help you secure better loan terms. We'll work closely with you to figure out the right structure for your specific financial goals.

Getting Your Paperwork in Order

If there’s one thing I’ve learned from years of experience, it’s that getting your documents together early is the single best way to guarantee a smooth mortgage process. When your application file is complete and well-organized, it tells a clear story about your financial health. This lets our underwriting team at RAC Mortgage make quick, confident decisions.

We’ve specifically designed our process for international buyers. We know you probably won't have U.S. tax returns or a Social Security number, and that's okay. Our system is built to work with the financial documents you do have from your home country. This kind of flexibility is what really sets a specialized foreign national mortgage lender in Tampa like RAC Mortgage apart.

The Core Documents We’ll Need

Think of this list as the foundation for your loan approval. Each piece of paper serves a specific purpose, helping us verify who you are and confirm your financial standing.

Here’s what you should start gathering:

- A valid, unexpired passport: This is the primary way we verify your identity.

- Proof of your home address: A recent utility bill or bank statement from your country of residence showing your address works perfectly.

- A financial reference letter: We'll need a letter from your primary bank confirming that you're a client in good standing. This is a huge credibility booster.

- Proof of assets: We need to see your last two months of bank statements to verify you have the funds for the down payment and closing costs.

It's also completely fine if many of your documents aren't in English. We work with international clients all the time. All we ask is for a certified translation for any document submitted in a foreign language—a standard and simple step in the international lending world.

How We Handle Income Verification

The biggest question I get from foreign nationals is, "How can I prove my income without U.S. tax forms?" This is exactly where our specialized approach makes a difference. Instead of asking for paperwork you can't possibly have, we rely on alternatives that paint an accurate picture of your earnings.

The most common and effective way to do this is with a letter from your accountant or employer. This letter simply needs to detail your income for the past two years and give us a projection for the current year. It provides the reliable, third-party verification our underwriters need, effectively taking the place of a U.S. tax return.

At RAC Mortgage, our whole approach is about removing roadblocks, not creating them. We don't try to squeeze you into a process made for U.S. borrowers. We built a different process from the ground up—one that actually works for a global investor buying property in Tampa.

Putting together a clean, organized file can seriously speed up your approval time. By gathering these key items early on, you’re putting your best foot forward. To get a head start, check out our more detailed guide on what documents are needed for a mortgage. A little proactivity now is the fastest way to get from application to closing on your new Tampa property.

A Look Inside the RAC Mortgage Process

So, what does it actually look like to go from an initial phone call to getting the keys for your new Tampa property? At RAC Mortgage, we’ve worked hard to make this journey as straightforward as possible for our international clients. It’s a process with clear milestones—pre-approval, appraisal, underwriting, and closing—and we're with you every step of the way.

Let’s walk through a real-world example. Imagine a client from Brazil, we’ll call him Marcos, who’s looking to buy an investment condo in Downtown Tampa. His journey starts with a simple conversation with one of our loan officers.

Getting Started: Pre-Approval and the Property Hunt

Marcos gets in touch with our team to talk about his goals and financial situation. We look at his income documents from Brazil and verify his proof of funds for the down payment. With that information, we can issue a pre-approval letter.

This isn't just a piece of paper. It's a powerful tool that shows sellers he's a serious, vetted buyer, which gives him a real edge in Tampa's busy market.

Armed with his pre-approval, Marcos and his real estate agent can now confidently shop for properties and make offers. Once he finds the perfect condo and the seller accepts his offer, we move into the next phase.

Due Diligence: Appraisal and Underwriting

This is where we do our homework. We immediately order a professional appraisal of the condo to confirm that its market value matches the loan amount. It’s a crucial step that protects both Marcos and us. An independent appraiser will evaluate the property’s condition, location, and what similar properties have recently sold for.

At the same time, Marcos’s complete file goes to our underwriting team. This includes his application, all his financial documents, and the property details. Our underwriters perform a final, meticulous review to make sure everything lines up with our lending guidelines. This is the moment of truth where the loan gets its final green light.

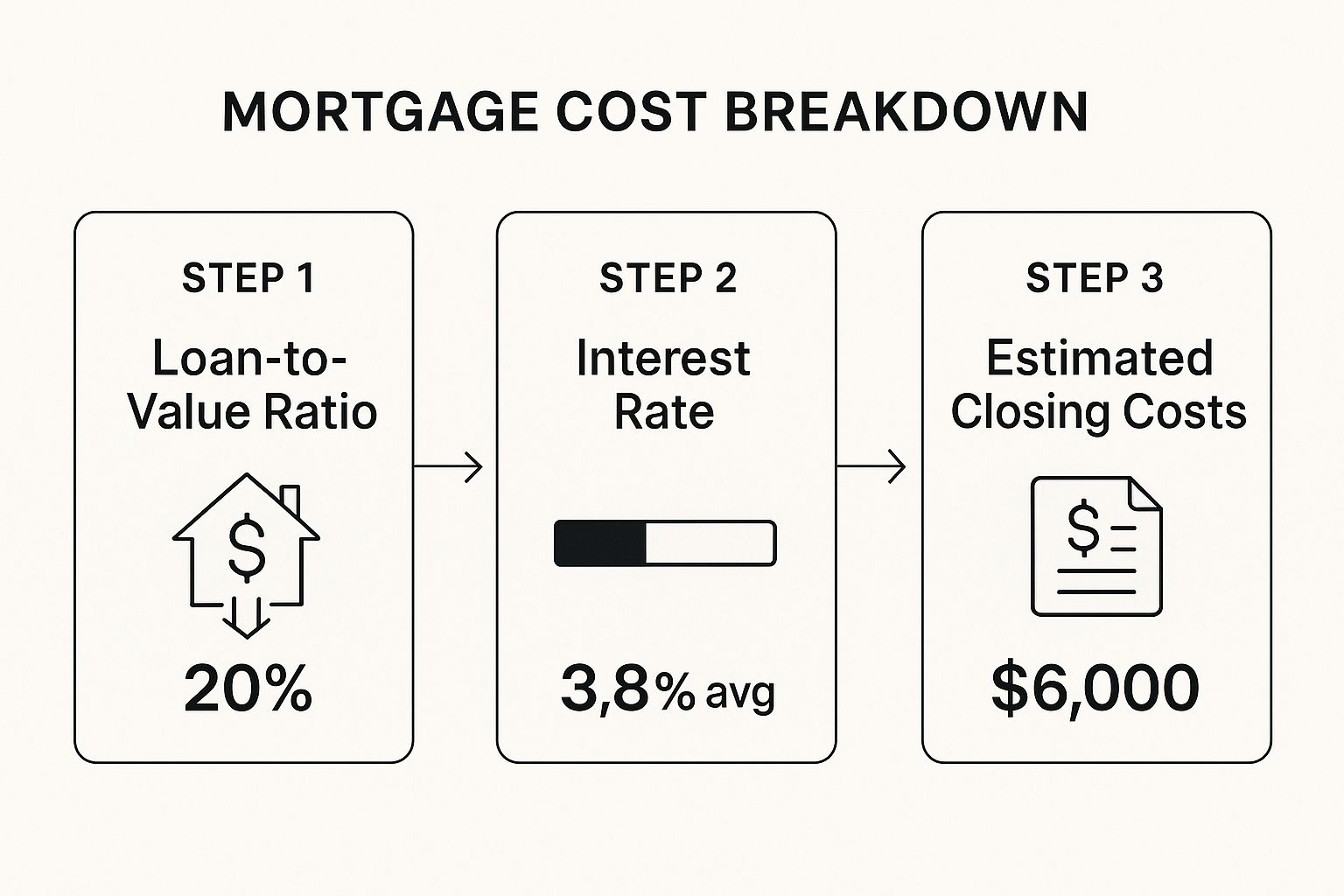

This chart breaks down the key financial pieces our team is looking at during this stage.

As you can see, it covers the core components of the mortgage, from the down payment percentage—which sets the Loan-to-Value (LTV) ratio—to the interest rate and estimated closing costs.

The Home Stretch: Funding and Closing

With the loan officially approved, it's time to head to the closing table. For an international buyer like Marcos, a big part of this is transferring the funds for his down payment and closing costs. We provide clear, secure instructions for wiring the money from his Brazilian bank to the U.S. title company.

Pro Tip: We always advise initiating this transfer well ahead of the closing date. International wire transfers can sometimes hit unexpected delays, so building in a buffer is a smart move.

The last step is the closing itself, where all the legal documents are signed. The good news for Marcos is that he can often handle this remotely by appointing a power of attorney. This means he doesn't necessarily have to fly back to Tampa just for the signing. Once the ink is dry and the funds are confirmed, the property is all his.

As your foreign national mortgage lender in Tampa, our job doesn’t stop once the application is in. We’re actively coordinating with the real estate agents, the title company, and you to ensure every detail comes together seamlessly—right up until you have the keys in your hand.

If you're curious about the mechanics behind the scenes, this article on how a leading mortgage lender optimizes their processes offers some great insights. That kind of efficiency is what allows us to guide clients like Marcos through what could otherwise be a very daunting process.

Insider Tips for a Smoother Transaction

Buying a property from another country definitely adds a few extra layers to the process, but honestly, a little bit of foresight goes a long way. As a foreign national mortgage lender in Tampa, our team at RAC Mortgage has been in the trenches and seen what separates a stressful closing from a smooth one.

These are the real-world tips we give our clients to get ahead of common hiccups before they even start.

First thing's first: open a U.S. bank account. Do it as soon as you can. While it might not be a deal-breaker for the initial application, having it ready makes moving money for your down payment and closing costs infinitely easier. Plus, you’ll thank yourself later when it’s time to handle property taxes, insurance, and other local expenses.

Make Your Loan Application Shine

You've gathered all the required documents, but how do you make your file stand out? This is where you can add a human touch that underwriters appreciate. I always recommend including a personal cover letter.

This isn't a resume; it's a chance to tell the story behind the paperwork.

- What are your goals? Tell us why you picked Tampa. Is it a vacation spot for your family, a long-term rental investment, or something else?

- Any local ties? Briefly mention any connections you have to Florida, whether it's through business or family.

- A quick financial snapshot. Just a short summary of your professional background and overall financial stability can add a lot of context.

A simple letter like this helps our underwriters at RAC Mortgage see you as a person with a solid plan, not just a stack of documents. It builds confidence and can genuinely make a difference.

Juggling the International Logistics

Moving money across borders is where planning becomes critical. Currency exchange rates are a moving target, and a sudden shift can have a real impact on the funds you need to have ready for closing.

Start watching the exchange rate between your home currency and the U.S. dollar as you get closer to your closing date. I suggest working with a good foreign exchange service that can help you lock in a favorable rate. Getting the transfer initiated a week or two ahead of schedule also builds in a much-needed cushion for any unexpected banking delays.

A quick note on property titles: In the U.S., the title system is what proves you legally own the property. We'll make sure you're connected with a trusted local title company that has experience with international buyers. Their job is to ensure the ownership is transferred cleanly and securely, giving you total peace of mind.

At the end of the day, our job isn't just to write the loan. The team at RAC Mortgage is here to be your guide on the ground, helping you anticipate these logistical hurdles. By tackling everything from bank accounts to currency conversions head-on, we make sure your journey to owning a piece of Tampa is as straightforward as it can be.

Got Questions About Getting a Foreign National Loan in Tampa?

Buying property from another country always brings up a lot of questions. As a lender that specializes in foreign national mortgages right here in Tampa, we at Residential Acceptance Corporation have heard just about everything. Let's tackle some of the most common ones we get from our international clients.

Do I Really Need a U.S. Credit Score?

Nope. It’s one of the biggest myths out there. We absolutely do not require a U.S. credit score to get you a foreign national loan with RAC Mortgage. In fact, we expect that you won't have one, and our entire process is built with that in mind.

So, how do we verify your financial standing? We look at other indicators of reliability. This usually involves:

- Pulling a credit report from your home country, if that's a standard practice there.

- Getting a formal reference letter from your main bank.

- Reviewing your complete financial picture, including your assets and income.

This gives us a solid understanding of your financial health without asking for documents you simply don't have.

What Kind of Down Payment Should I Expect?

This is where things differ from a standard U.S. mortgage. For a foreign national loan, you should plan on a down payment somewhere between 25% and 40% of the purchase price.

The final number really depends on your specific situation—like whether you're buying a single-family home or a condo—and the strength of your overall financial profile. This larger down payment helps offset the lender's risk, since we're working without the usual U.S. credit history.

A larger down payment does more than just secure the loan; it shows you're a serious, financially stable buyer. This can often translate into better loan terms for you down the road.

Can I Buy a Vacation Home or Investment Property?

Yes, of course! That's precisely what our foreign national loan program at RAC Mortgage is designed for. The majority of our international clients are buying property in Tampa as a rental to generate income or as a beautiful second home for getaways.

How Long Does This Whole Process Take?

Every deal is a little different, but you can generally expect the entire process to take between 45 and 60 days, from the day you apply to the day you get the keys.

What’s the biggest factor affecting that timeline? Your preparation. Clients who come to us with all their financial documents already organized tend to fly through the process. Our team at RAC Mortgage is committed to working with you every step of the way to prevent delays and keep everything on track.

Ready to make your move on a Tampa property? The team at Residential Acceptance Corporation specializes in making the financing process clear and simple for international buyers like you.

Start your application with RAC Mortgage today!