Dreaming of a luxury home in Tampa but worried your credit score will kill the deal? It’s a common fear. Trying to get a jumbo loan with less-than-perfect credit can feel like hitting a brick wall with traditional banks, but it's far from impossible.

With the right guide and a lender who knows how to handle these situations, you can absolutely find a path to approval.

Yes, You Can Secure a Jumbo Loan in Tampa with Bad Credit

Let's be honest, staring at Tampa's hot luxury home market when you have a challenging credit history is discouraging. The big question hangs in the air: can you really get a jumbo loan for that dream property?

The answer is a resounding yes. It's entirely possible, but here's the catch: you have to partner with the right kind of lender. You need someone who sees you as more than just a three-digit number.

That’s where a specialized lender like Residential Acceptance Corporation (RAC Mortgage) comes in. We firmly believe your financial story is more than just a score.

Your Roadmap to Approval

We’re going to break down exactly what a jumbo loan means here in the Tampa market, peel back the curtain on why big banks often say no, and give you a clear roadmap to getting that approval.

It all boils down to understanding a few key things:

- The Lender's Perspective: Most traditional lenders are stuck using automated, algorithm-based systems. For a high-value jumbo loan, a credit score below their rigid threshold often means an instant "no," no questions asked.

- The Power of Compensating Factors: This is where the magic happens. A specialized lender like RAC Mortgage looks at your entire financial profile. We're talking about your assets, how stable your income is, and the size of your down payment. These are your "compensating factors."

- A Personalized Approach: Forget one-size-fits-all. We dig into the unique details of your application to build a strong, common-sense case for why you're a good candidate for the loan.

Getting a jumbo loan with bad credit isn't about finding some secret loophole. It's about finding a lender who looks at the whole picture of your financial health. A solid income and significant assets can often completely outweigh a lower credit score.

This isn’t just about giving you false hope; it’s about providing real, actionable advice to make your dream home a reality.

While navigating Tampa home loans with bad credit can feel complicated, our mission is to make the process clear. With past credit stumbles behind you, that goal of homeownership is closer than you think.

Navigating Jumbo Loan Obstacles with RAC Mortgage

For many jumbo loan applicants with credit issues, the process feels like a series of closed doors. Here's a quick look at those common roadblocks and how a specialized lender creates a clear path forward.

| Common Obstacle | Typical Lender Response | The RAC Mortgage Approach |

|---|---|---|

| Low Credit Score | Automatic denial from underwriting software. | We look at the reason for the score and focus on your strong compensating factors like income and assets. |

| Complex Income (Self-Employed) | Inability to verify income through standard W-2s and pay stubs leads to rejection. | We specialize in alternative documentation, using bank statements or asset-based methods to prove your ability to pay. |

| Past Financial Hardship | A past bankruptcy, foreclosure, or short sale is often a deal-breaker. | We understand life happens. We evaluate your current financial stability and recovery, not just past events. |

| High Debt-to-Income (DTI) Ratio | Rigid DTI limits mean even high earners can be denied. | Our flexible guidelines allow for higher DTI ratios when your overall financial profile is strong. |

Ultimately, overcoming these hurdles is about partnering with a lender that has the flexibility and expertise to build a loan around your specific financial situation, not trying to force you into a box you were never meant to fit in.

What Makes a Tampa Mortgage a Jumbo Loan

Before we can tackle how to get a jumbo loan with less-than-perfect credit, let's first get a handle on what "jumbo" actually means. Think of a standard mortgage like an off-the-rack suit—it's made to fit a specific set of guidelines backed by the government. These are what we call conforming loans.

A jumbo loan, then, is the custom-tailored suit. It's for anyone buying a home that costs more than the standard limits set by government agencies like Fannie Mae and Freddie Mac. Because it doesn't fit into that neat little box, the lender has to write their own rules and take on all the risk themselves.

And that's the key difference. When a loan is "non-conforming," or jumbo, the lender is the one left holding the bag if the borrower defaults. This is exactly why they put applications under a microscope, especially when there’s a blemish or two on the credit report.

The Magic Number in Hillsborough County

So, what’s the number that officially tips a mortgage into jumbo territory here in Tampa? It’s not just a random figure; it’s updated every year based on what’s happening in the local housing market.

Here in Tampa, a jumbo mortgage is any loan that goes above the conforming loan limit for Hillsborough County, which currently sits at $806,500. Anything over that amount is considered jumbo. With the Tampa housing market exploding in recent years, it’s become a real hotspot for luxury homebuyers who absolutely need this kind of financing.

Even with the median home price in Tampa being much lower, jumbo loans are essential for anyone eyeing high-end properties or premium investment homes.

A jumbo loan isn’t defined by the size or luxury of the home itself, but purely by the dollar amount borrowed. A modest home in a high-cost area could require a jumbo loan just as easily as a sprawling waterfront estate.

Why Tampa's Market Demands Jumbo Loans

Tampa’s real estate scene is all over the map, with a seriously booming luxury market in neighborhoods like South Tampa, Davis Islands, and all along Bayshore Boulevard. It’s no surprise that home prices in these areas often soar way past that conforming loan limit.

This creates a situation where jumbo financing isn't just a nice-to-have; it's a flat-out necessity for a huge chunk of the market. Lenders who get the local scene, like Residential Acceptance Corporation (RAC Mortgage), understand this completely. They know that a simple credit score doesn't paint the full picture, especially for high-net-worth folks or entrepreneurs with more complex financial lives.

Because these loans are a bigger risk for lenders, your entire financial profile—your assets, how stable your income is, and your down payment—becomes the real foundation of your application. This is where a specialized lender's flexibility becomes your biggest asset, especially when you're looking for a jumbo mortgage lender tampa bad credit applicant.

Why Bad Credit Creates a Hurdle for Jumbo Loans

First, let's pull back the curtain on why "bad credit" and "jumbo loan" don't usually mix. It all comes down to risk. Unlike the standard home loans you hear about, which can be neatly packaged and sold to big players like Fannie Mae and Freddie Mac, jumbo mortgages are a different beast.

The lender who writes you the check keeps the loan on their own books. This means they are on the hook for 100% of the risk.

When a bank is looking at lending out that much money, a low credit score flashes like a big red warning light. From their perspective, it signals a higher chance of default. It’s a straightforward risk-reward calculation, and with hundreds of thousands—or millions—of dollars at stake, they get incredibly cautious.

This is the central challenge when you're looking for a jumbo mortgage lender in Tampa with bad credit. You're essentially asking a financial institution to take a gamble that their automated underwriting systems are specifically programmed to avoid.

The Great Divide in Credit Scores

In the mortgage world, a FICO score below 640 is often considered "bad credit." But for a jumbo loan? The goalposts are in a completely different stadium. Most traditional lenders won't even glance at an application with a score under 700, and they really prefer to see scores of 740 or higher. That’s a massive gap that can feel impossible to cross.

But life happens. A sudden medical bill, a rough patch for your business, or a family crisis can take a sledgehammer to a credit score, even if you're a high earner. These events don't say much about your ability to make payments next year, but they leave a scar that a computer algorithm just can't understand.

A credit score is just a snapshot of your financial past. It's not a complete picture of your financial future. The best lenders get this and are willing to look at the story behind the numbers.

This is where finding the right partner makes all the difference. A specialized firm like Residential Acceptance Corporation (RAC Mortgage) is built to look at the whole person, not just a three-digit score.

Navigating Tampa's Unique Lending Challenges

Trying to get a jumbo loan in Tampa with less-than-perfect credit is a unique puzzle. The underwriting standards are already tight, and the local market adds its own pressures. While most Tampa lenders stick to that 700+ credit score rule, we know how to bring other strengths to the table.

These "compensating factors" usually mean a much larger down payment, often well over 10% of the purchase price, and showing you have significant cash reserves sitting in the bank. This helps offset the lender's perceived risk.

Bad credit complicates things because these loans are huge and have no government backing.

How to Build a Strong Case for Your Jumbo Loan Approval

Let's be real. Securing a jumbo loan in Tampa when you have a less-than-perfect credit score isn't about just filling out a form and hoping for the best. It's about painting a complete financial picture that proves you're a solid borrower, even if your credit history has a few blemishes.

Here at Residential Acceptance Corporation (RAC Mortgage), we look past the numbers on a credit report. We want to see the whole story.

This is where "compensating factors" come into play. Think of them as the aces up your sleeve—powerful evidence of financial stability that can outweigh a lower credit score. They're tangible proof that you're a low-risk borrower, which is exactly what a lender needs to see to say "yes."

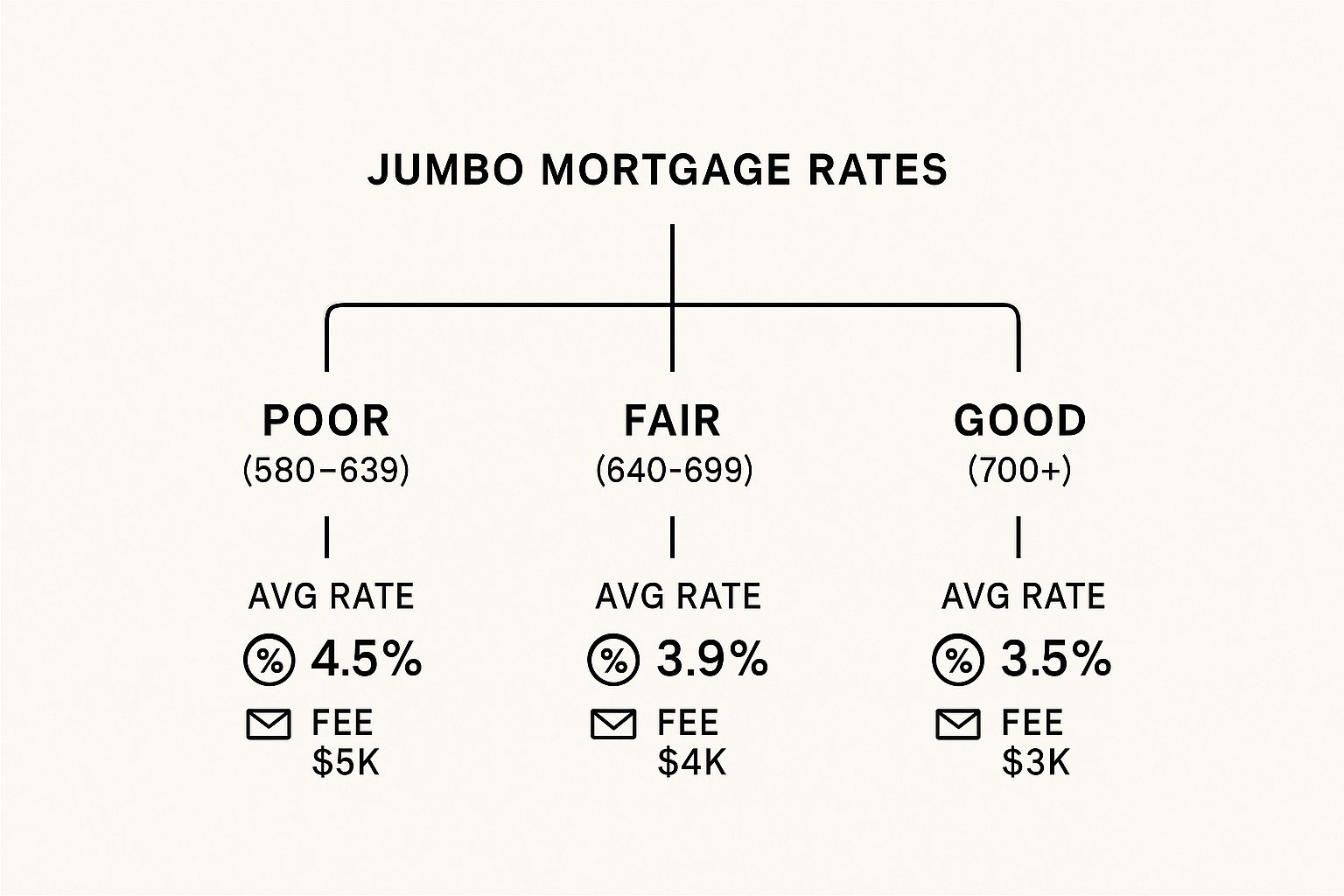

The image below gives you a clear idea of how different credit tiers can affect the rates and fees for a jumbo mortgage.

As you can see, better credit definitely leads to lower costs. But the key takeaway is that specialized lenders can find a path to approval for applicants in any tier by focusing on your other financial strengths.

Fortify Your Application with Compensating Factors

To make up for a lower credit score, your application needs to absolutely shine in other areas. At RAC Mortgage, we conduct a holistic review, and these are the factors that carry the most weight:

-

Substantial Down Payment: This is your number one tool. A bigger down payment is the single most effective way to strengthen your application. Putting down 20% or more dramatically lowers the loan-to-value (LTV) ratio, which instantly reduces the lender's risk.

-

Significant Cash Reserves: What does your bank account look like after you’ve paid the down payment and closing costs? Showing you have 12 to 24 months of mortgage payments sitting in liquid assets (like a savings or investment account) is a huge confidence booster. It proves you can handle life's curveballs without ever missing a payment.

-

Low Debt-to-Income (DTI) Ratio: Your DTI is a simple comparison of your monthly debt payments against your gross monthly income. The lower this number, the better. It tells a lender you have plenty of breathing room in your budget to comfortably take on a new, larger mortgage payment.

-

Stable and High Income: A long, consistent history of high earnings, especially in a recession-proof industry, speaks volumes about your ability to repay the loan over the long haul. This is especially crucial if you're self-employed or your income fluctuates.

A truly strong application is a mix of these elements. For instance, a 25% down payment paired with 18 months of cash reserves can make a lender feel much more secure about a credit score in the 600s.

Real-World Application and Next Steps

Picture a successful Tampa business owner who has a 650 credit score because of some old business debt. If they walk into a big bank, the automated system will almost certainly spit out a denial in seconds.

But by working with a lender like RAC Mortgage, they can tell their full story. They can show a 30% down payment, provide statements for a business account with $200,000 in it (hello, reserves!), and present two years of tax returns proving a high, stable income. Suddenly, the application goes from being a "risk" to a smart, well-supported financial move.

To get your own application in the best possible shape, it's always a good idea to explore effective debt management strategies. Understanding your complete financial picture is the critical first step. From there, learning how to get preapproved with RAC Mortgage can give you a clear, personalized roadmap to get you into your dream home.

Understanding Your Jumbo Loan Rates and Terms

When you start shopping for a jumbo mortgage in Tampa, especially with less-than-perfect credit, it's easy to get fixated on the interest rate. I get it. But it's crucial to understand that a lower credit score doesn't mean you're being penalized with a higher rate.

Think of it more like a "risk premium." Because lenders like Residential Acceptance Corporation (RAC Mortgage) are stepping outside the safety net of government backing, the rate has to reflect that added responsibility. This is just standard practice for any specialized jumbo mortgage lender in Tampa dealing with bad credit.

How Rates and Terms Are Really Determined

The secret to landing better terms isn't just about your credit score; it's about making the rest of your application as strong as possible.

Putting more money down is a perfect example. A larger down payment immediately reduces the lender's exposure and can give your interest rate a nice little nudge in the right direction. If you want to see exactly how this works, our guide on the loan-to-value ratio is explained in detail in our guide.

It also helps to keep an eye on the bigger picture. Things like broader economic and financial market updates can have a real impact on the lending climate, shaping the kinds of rates and terms available at any given time.

Here at RAC Mortgage, we believe in total transparency. Our job is to find a loan structure that’s not just affordable but truly sustainable for you, making sure you understand every single number before you sign.

The interest rate on a jumbo loan with bad credit isn't just about the credit score. It's a comprehensive assessment of risk, where factors like a large down payment and substantial cash reserves can significantly improve the terms offered.

Fixed-Rate vs. Adjustable-Rate Mortgages

Another big decision you'll face is whether to go with a fixed-rate or an adjustable-rate mortgage (ARM). Each one comes with a very different long-term financial reality.

- Fixed-Rate Mortgage: Your interest rate is locked in for good, usually for 15 or 30 years. This means you get a predictable, stable monthly payment that will never, ever change. It’s the definition of stability.

- Adjustable-Rate Mortgage (ARM): These usually hook you with a lower "introductory" rate for a few years (say, 5 or 7). After that initial period, the rate can change—either up or down—based on what the market is doing.

Right now in Tampa, we're seeing a lot of activity in the jumbo loan space, which kicks in for loans over $806,500. As a general rule, these larger loans tend to have slightly higher rates than their conforming counterparts. We’ll sit down with you and crunch the numbers for both fixed and adjustable options to figure out which one aligns best with where you see your finances heading in the future.

Why Choose RAC Mortgage for Your Tampa Jumbo Loan?

When you're looking for a jumbo loan in Tampa—especially if your credit isn't perfect—picking the right lender is everything. It's the one choice that can make the difference between a frustrating dead-end and a smooth path to closing on your dream home.

Many big banks and lenders lean on rigid, automated systems. If your credit score doesn't fit neatly into their box, you get an instant "no." That’s where Residential Acceptance Corporation (RAC Mortgage) comes in. We do things differently.

Our entire approach is built on flexible, non-traditional underwriting. We know that a credit score is just one number; it’s not your whole financial story. Our team has deep, firsthand knowledge of the Tampa real estate market and we specialize in looking past the score to see the full picture. Your strong income, healthy assets, and overall financial stability matter more to us than a single data point.

We See the Story Behind the Score

We’re committed to understanding the why behind your credit history. We don’t just tick boxes and collect documents. We work with you to build a compelling, common-sense case for your loan approval.

Take this real-world example:

Sarah, a Tampa entrepreneur with a 660 credit score, came to us after being turned down elsewhere. She had two years of solid, consistent business revenue and significant liquid assets. A traditional bank’s algorithm only saw the 660 score. We saw a successful business owner with a proven track record of managing large sums of money. We got her jumbo loan approved.

This is what we do day in and day out. It's how we turn an application that looks risky on paper into a sound investment that makes perfect sense.

Your Partner in Tampa Real Estate

Ultimately, you don't just need a lender; you need a partner. You need a jumbo mortgage lender in Tampa for bad credit that is in your corner from start to finish. That's us.

Here's what you can expect when you work with RAC Mortgage:

- Manual Underwriting: A real person—an expert underwriter—reviews every single detail of your file. We look for the strengths and compensating factors that algorithms are programmed to ignore.

- Local Market Expertise: We live and breathe Tampa real estate. We understand the nuances of its high-value properties and know exactly what it takes to get these complex loans funded.

- Creative Solutions: We specialize in finding a way forward. Where other lenders see roadblocks, we see opportunities to structure a loan that works.

At RAC Mortgage, your financial past doesn't have to define your future. We focus on your current stability and your potential, helping you get the keys to the home you've earned.

Frequently Asked Questions About Jumbo Loans and Bad Credit

When you're looking at jumbo financing in Tampa, a less-than-perfect credit history can feel like a major roadblock. It’s only natural to have a lot of questions. We hear these concerns all the time from borrowers in your exact situation, so let's clear up some of the most common ones.

What’s the Absolute Minimum Credit Score You'll Consider?

Honestly, there's no single magic number. Here at Residential Acceptance Corporation, we look at your entire financial story, not just a three-digit score. While the big banks often draw a hard line at a 700 FICO score, we know that’s just one piece of the puzzle.

What really matters are strong compensating factors. Think of it like balancing the scales. A substantial down payment, plenty of cash reserves, or a really low debt-to-income ratio can easily outweigh a credit score that would make other lenders slam the door shut. That’s the core of how we help people looking for a jumbo mortgage lender in Tampa with bad credit.

How Much Do I Need in Cash Reserves?

For a standard jumbo loan, lenders usually want to see 6-12 months of mortgage payments tucked away in reserves after you close. When bad credit is part of the equation, lenders need a bigger financial cushion to feel secure about the loan.

To offset the risk that comes with a lower credit score, you'll often need to show you have 12 to 24 months of mortgage payments in liquid assets. It’s a way of proving you have the stability to handle the unexpected. We'll work with you to figure out a reserve amount that makes sense for your situation and strengthens your application.

Can I Still Get a Jumbo Loan After a Bankruptcy?

A recent bankruptcy or foreclosure is a serious event, but it's not an automatic "no"—especially with a specialized lender like us. There are mandatory waiting periods we have to follow, of course. We’ll need to take a close look at what happened and how much time has passed since.

More importantly, we want to see what you've done since then to rebuild your financial health. Showing a solid history of financial responsibility and recovery is the single best way to move past a major credit event.

Ready to see how your complete financial picture—not just your credit score—can get you approved for the Tampa home you deserve? The team at Residential Acceptance Corporation specializes in finding a path to "yes" where others only see dead ends.