For Tampa's entrepreneurs, freelancers, and gig workers, getting a mortgage without a W-2 can feel like a massive hurdle. But it's absolutely doable when you partner with the right people. Lenders like us at Residential Acceptance Corporation (RAC Mortgage) specialize in what are called alternative documentation mortgages. We use things like your bank statements instead of W-2s to get your home loan approved, opening the door to homeownership for Tampa’s growing self-employed community.

Your Path to Homeownership in Tampa Without W-2s

Trying to buy a home in Tampa’s competitive market is tough enough. When you're self-employed, it adds another layer of complexity. Most traditional mortgage lenders are stuck in a W-2 and pay stub mindset, which just doesn't work for entrepreneurs. Their process can't accurately capture your true financial picture.

This is exactly why a specialized mortgage lender in Tampa for no W2 applicants, like Residential Acceptance Corporation, is so critical.

We don't see a lack of traditional paperwork as a reason for denial. Instead, we zero in on what really matters: your actual cash flow and the health of your business. The entire process hinges on using different, more realistic forms of income verification.

Understanding Alternative Documentation

Here at RAC Mortgage, we know a W-2 is just one piece of a much larger financial puzzle. For Tampa's self-starters, we build a powerful case for your loan approval using documents that tell the real story of your success.

We typically look at things like:

- 12 or 24 Months of Bank Statements: This is our go-to method. It lets our underwriters see your consistent deposits and track the reliable flow of income into your accounts.

- Profit & Loss (P&L) Statements: A clean, well-prepared P&L gives us a clear snapshot of your business's profitability, detailing all your revenues and expenses.

- Business Licenses and Certifications: These documents help us establish the legitimacy and history of your business.

This flexible approach ensures your non-traditional career path is seen as a strength, not a roadblock. You can dive deeper into how we handle these unique situations by exploring our guide on Tampa alternative documentation mortgage options. Our team has this process down to a science, helping countless self-employed people get the financing they deserve.

The key takeaway is that your income isn't the problem; it's just that the documentation is different. A lender who specializes in no-W2 loans knows exactly how to read your financial story through bank statements and P&L reports, spotting the stability that traditional lenders often miss.

To make this crystal clear, let's break down the differences between a conventional loan process and how we approach a No-W2 mortgage.

Traditional vs. No-W2 Mortgage Requirements

| Requirement | Conventional (W2) Mortgage | No-W2 Mortgage (RAC Mortgage) |

|---|---|---|

| Primary Income Proof | W-2s, pay stubs, tax returns | 12-24 months of personal or business bank statements |

| Business Analysis | Limited; focuses on personal income | In-depth review of business cash flow and P&L statements |

| Loan Officer Expertise | General mortgage processing | Specialized knowledge of self-employed income analysis |

| Flexibility | Rigid, follows strict guidelines | Flexible, tailored to the borrower's business structure |

As you can see, our process is built from the ground up to understand and work with the realities of being self-employed. We don't try to fit a square peg into a round hole.

Why This Matters in Tampa's Market

The need for these specialized loans is only getting bigger, thanks in large part to the city's incredible growth. As of early 2025, Tampa's population was just under 386,000 residents, which is a growth rate of about 3.3% since 2020.

This constant influx of new people is fueling a super dynamic housing market. It also means there's a growing base of non-traditional earners who need mortgage products that actually serve them. This growth highlights why it's so important to work with a lender who truly gets the local economic landscape.

Exploring Your No W2 Loan Options

If you’re self-employed here in Tampa, proving your income takes a bit of a different approach. Since you don’t have a traditional W-2 to hand over, we at Residential Acceptance Corporation have become experts in loan products designed to show off your true earning power.

The go-to solution for most entrepreneurs is the Bank Statement Loan. Honestly, this program is the cornerstone for anyone looking for a mortgage lender in Tampa with no W2 requirements. Instead of focusing on tax returns—which, let's be real, are designed to show lower net income thanks to all your business write-offs—our underwriters dig into your actual cash flow.

We'll look at either 12 or 24 months of your personal or business bank statements to get a solid, qualifying income figure. This method paints a much more accurate picture of your financial health because it's based on the real, consistent revenue your business is pulling in.

How Bank Statement Analysis Works

The process itself is pretty straightforward. Our underwriting team simply calculates your average monthly deposits over the period you’ve chosen. This lets us see the steady flow of money coming into your accounts, even if your client payments jump around from one month to the next.

Let's look at a real-world scenario.

Example: A Tampa Freelancer

Imagine a freelance marketing consultant right here in Tampa. Her income is great, but it varies depending on which client projects wrap up each month.

- January Deposits: $9,500

- February Deposits: $7,200

- March Deposits: $11,000

A traditional lender might get spooked by that inconsistency. But for us at RAC Mortgage, it's no problem. Our underwriters would average those deposits over 12 or 24 months, which creates a dependable monthly income number that truly reflects what she earns. Suddenly, she's a very strong candidate for a loan.

You can learn more about how this works by checking out our detailed guide on the Bank Statement Mortgage in Tampa.

Other Powerful No W2 Solutions

While bank statement loans are incredibly popular, they aren't your only play. Depending on how your business is structured and how you keep your records, another one of our programs might be an even better fit.

A Profit & Loss (P&L) Statement Loan is another fantastic tool in our belt. This type of loan is perfect for business owners who keep meticulous financial records, usually with the help of a CPA.

A P&L statement gives us a clean, organized snapshot of your business's revenues and expenses. For established businesses with clean books, it's a powerful way to demonstrate profitability and get the financing you need.

This option really shines for:

- S-Corps or LLCs that use formal accounting practices.

- Business owners who can provide a CPA-prepared or verified P&L statement.

- Applicants whose business profitability is crystal clear and easy to document.

By offering multiple paths to approval, we make sure your unique financial situation gets the evaluation it deserves. Our expertise as a mortgage lender for no W2 applicants in Tampa means we know how to find the program that best fits your business reality, clearing the way to your new home.

How to Prepare Your Financial Documents

A rock-solid application for a no-W2 mortgage all comes down to well-organized paperwork. At Residential Acceptance Corporation, we’ve seen it time and time again: for a self-employed borrower, the right documents tell the real story of your financial health.

It’s not just about dumping a pile of papers on a lender’s desk. It's about presenting a clear, compelling case that makes your approval a no-brainer.

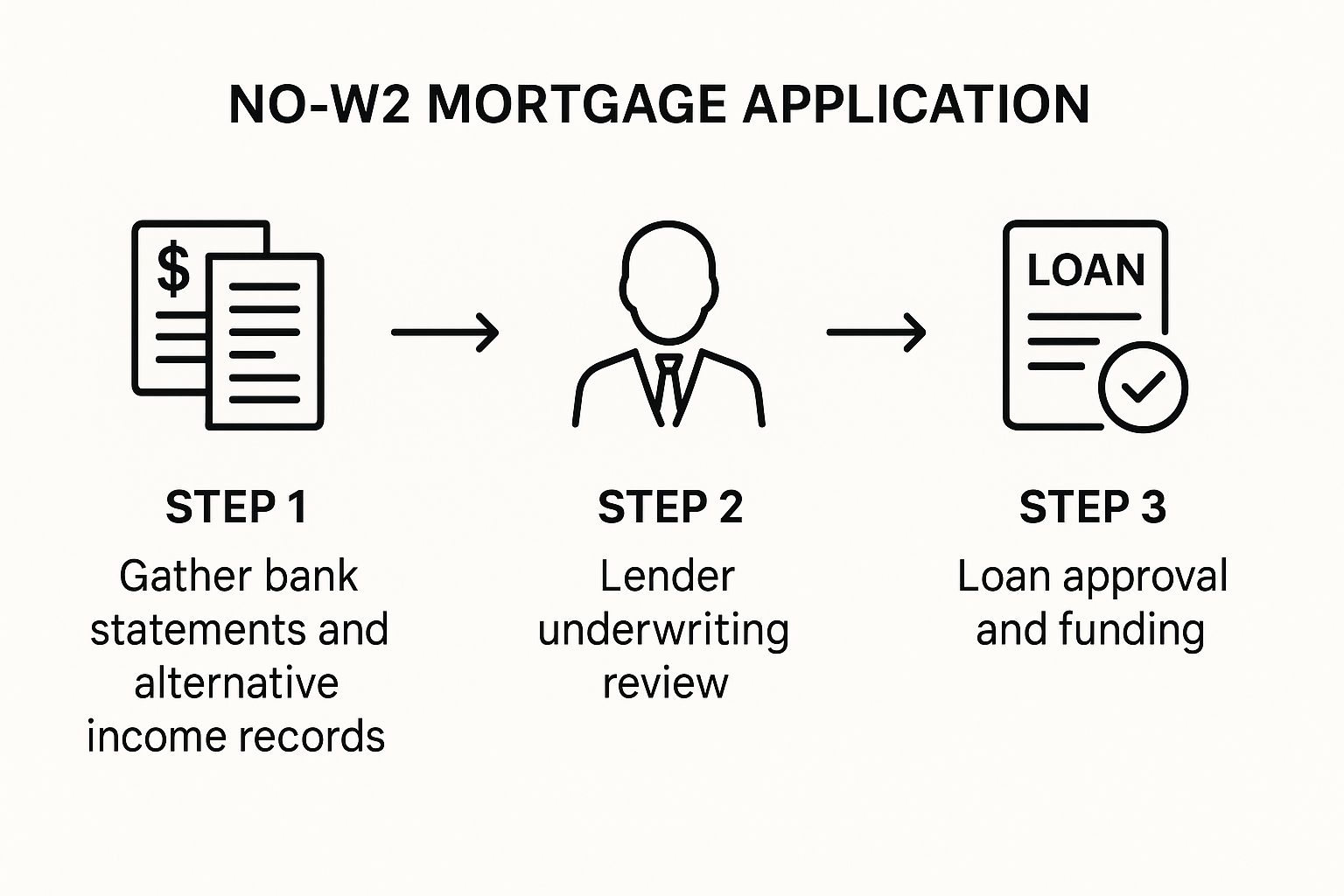

This visual breaks down the simple, three-stage process we use for no-W2 mortgage applications.

As you can see, your financial documents are the foundation. They come right at the start and directly influence the underwriting review and, ultimately, the final approval.

Beyond the Basic Bank Statement

Handing over bank statements is just the first step—how you present them is what really counts. Our underwriters are trained to look for consistency and clarity. You'll need to provide every single page of your 12 or 24 months of statements, and they all have to be perfectly legible. This is how you demonstrate a steady, reliable flow of business deposits.

Here’s what we’re analyzing in those statements:

- Consistent Deposits: We need to see a reliable pattern of income. It doesn’t have to be the exact same amount every month, but it needs to be consistent.

- Minimal Overdrafts: A clean record with few to no overdrafts is a huge sign of strong financial management.

- Separation of Funds: Keeping your business and personal accounts separate is a game-changer. It makes verifying your true business income so much cleaner and easier for us.

The goal is to paint a clear picture of financial stability. Large, unexplained cash deposits can raise red flags, so it's always best to be transparent. A simple Letter of Explanation (LOX) can proactively address any unusual activity, showing underwriters you're organized and on top of your finances.

Crafting a Compelling Financial Story

On top of your bank statements, a few other documents can really strengthen your file. A clean Profit & Loss (P&L) statement, for instance, gives us a quick, concise summary of your business's profitability.

For anyone who's self-employed, accurately documenting your financial health is everything. A big part of that involves creating a detailed business income worksheet to present your income in the most effective way possible.

This level of preparation is becoming more and more important, especially in major metro areas like Tampa. We're seeing a clear shift in mortgage trends toward alternative credit products, which just highlights the growing demand for lenders who get the needs of borrowers without traditional W-2s. As a top mortgage lender in Tampa for no W2 applicants, we see this trend firsthand in our city’s booming real estate market.

The Final Touches for Your Application

Before you send your package over to us at RAC Mortgage, do one final review. Make sure your business licenses are current and that every single document is crystal clear and easy to read.

When you assemble a complete and transparent file right from the start, you help us prevent delays and move your application forward much more efficiently. For a comprehensive checklist to make sure you haven't missed anything, check out our guide on what documents are needed for a mortgage. This proactive approach is exactly what builds a powerful, persuasive case for getting your home loan approved.

Navigating the Application and Underwriting Process

Getting your application in is the first major milestone, but knowing what comes next is what really gives you peace of mind. Here at Residential Acceptance Corporation, we’ve built a clear, straightforward path from application to approval specifically for the entrepreneurs and freelancers of Tampa. It all kicks off with a simple, direct conversation.

This initial chat is much more than just filling out paperwork. Think of it as a strategy session with a loan expert who gets the unique rhythm of self-employed income. We'll walk through your business structure, cash flow patterns, and what you’re hoping to achieve long-term. This lets us tailor our approach to your exact situation.

Once we have the full picture, your file goes to our specialized underwriting team. This is exactly where working with a dedicated mortgage lender in Tampa for no W2 borrowers really pays off.

The Underwriting Journey, Reimagined

Underwriting a no-W2 loan is a completely different ballgame than a conventional mortgage review. Our underwriters aren't looking for a W-2 that doesn't exist. Instead, they are experts at piecing together your income story using bank statements or P&L statements.

They zoom in on a few key areas:

- Business Health: They’re looking at the big picture—the overall financial stability and cash flow of your business, not just one number on a tax return.

- Income Consistency: Are deposits regular and predictable? This is what shows them your business has staying power.

- Financial Management: How you manage your business accounts matters. They’re looking for signs of stability, like keeping overdrafts to a minimum.

This kind of focused analysis means the unique nature of your self-employed income is actually understood and valued, not just glossed over.

The underwriting process for a no-W2 loan is fundamentally about seeing the story your documents tell. Residential Acceptance Corporation's underwriters are trained to read that story correctly, focusing on the strength and consistency of your business's cash flow rather than just tax-reported income.

Setting Expectations for a Smooth Process

We want this whole journey to feel manageable, not overwhelming. A huge part of that is setting realistic expectations right from the start. While no-W2 loans do require a closer look at your financials, our goal is always to keep things moving forward efficiently. On average, we aim to close loans in 18 to 20 days from the moment we have a complete file.

To hit that target, communication is key. Your underwriter might have a question about a specific deposit or need a bit more info. Getting back to your loan team at RAC Mortgage quickly helps sidestep delays and keeps your application cruising along. Our mission is to take what can be a complex process and turn it into a clear, direct path to owning your Tampa home.

What Lenders Look For When You Apply

Getting approved for a no-W2 mortgage is a fantastic step, but it's just as crucial to understand what shapes your final loan terms. Here at Residential Acceptance Corporation, we dig deeper than just a single income number to figure out your interest rate and the conditions of your loan. A few key elements really drive the final offer you’ll see.

A great application isn’t just about showing strong cash flow. What really gives our underwriters confidence—and gets you better terms for your Tampa home—are your financial habits, your history, and your overall stability.

The Power of Your Credit Score

Your credit score is one of the biggest pieces of the puzzle. There’s no single magic number, but a higher score is a clear sign that you’ve managed debt responsibly in the past, which lowers our risk. For a mortgage lender in Tampa for no W2 borrowers like RAC Mortgage, a solid credit profile is a powerful signal of reliability.

Generally, a score above 740 is considered top-tier and can open the door to the best interest rates we have for no-W2 programs. You might still get approved with a score in the high 600s, but the terms will likely look a bit different. Taking time to boost your score before you apply is one of the smartest moves you can make to improve your loan offer.

Think of your credit score as your financial reputation. A higher score tells lenders that you have a proven track record of paying back debts on time, making you a lower-risk borrower and often resulting in better rates and terms.

Your Down Payment and Cash Reserves

The money you put down upfront says a lot. A larger down payment dramatically reduces the lender's risk, which can earn you a better interest rate and help you sidestep private mortgage insurance (PMI). While some of our programs might let you get by with a down payment as low as 10%, putting down 20% or more makes your application significantly stronger.

We also look closely at your cash reserves—that’s the money you have left after covering your down payment and closing costs. Having a few months of mortgage payments tucked away acts as a financial safety net. It shows our underwriters that you can handle an unexpected bill or a slow business month without missing a payment. That kind of financial stability is a huge plus for any application.

The bigger economic picture plays a role, too. Mortgage rates in Florida are always on the minds of borrowers looking at no-W2 loans. As of September 17, 2025, the average 30-year fixed rate in Florida is hovering around 6.25%. With lending standards getting tighter, more self-employed folks in Tampa are turning to the alternative income verification methods we offer at RAC Mortgage. It's a good idea to learn more about current mortgage rate trends in Florida to stay ahead of the game.

Got Questions About No W2 Mortgages? We Have Answers.

Stepping into the world of no-W2 mortgages naturally brings up a lot of questions, especially for Tampa’s self-employed homebuyers. Here at Residential Acceptance Corporation, our team has heard it all, and we've put together some straight-to-the-point answers for you.

We want to clear up any confusion you might have, from how we handle fluctuating income to the kinds of businesses we work with all the time. Let's get you the clarity you need to move forward with confidence.

How Do You Actually Calculate My Income From Bank Statements?

This is probably the number one question we get, and it’s where having a true specialist really matters. When you work with a mortgage lender in Tampa with no W2 programs like ours, the process is different. Our underwriters at Residential Acceptance Corporation will dig into either 12 or 24 months of your bank statements, whether they're personal or for your business.

We start by calculating your average monthly deposits to get a solid baseline. From there, we might apply an expense factor that’s standard for your industry to figure out a qualifying gross monthly income. This approach gives us a much more realistic view of your actual cash flow, unlike traditional methods that just look at tax returns—which are often set up to minimize your income on paper.

Are The Interest Rates Higher For These Loans?

It's a fair question. The short answer is that sometimes, interest rates for no-W2 loans can be a little higher than for a conventional mortgage. This is mainly because the underwriting is a more hands-on process and lenders see it as taking on a bit more risk.

But a higher rate is definitely not a guarantee.

At Residential Acceptance Corporation, we’ve found that a few key things can help you lock in a really competitive rate. A solid credit score, a larger down payment, and having healthy cash reserves all signal financial strength and can make a huge difference in the loan terms you’re offered.

When you bring a strong financial profile to the table, you can often shrink—or even eliminate—the rate gap between a no-W2 loan and a conventional one.

What’s The Minimum Down Payment You Require?

There’s no single answer here, as the down payment really depends on your unique financial situation. The loan program you end up choosing, your credit score, and your cash reserves all play a part in determining that final number.

While some of our no-W2 programs at RAC Mortgage can get you in the door with as little as 10% down, putting more money down often works out better in the long run. Here’s why a bigger initial investment can be a smart move:

- Better Loan Terms: A down payment of 20% or more seriously reduces the lender's risk, which they'll often reward with a better interest rate.

- Avoids PMI: It also means you get to skip private mortgage insurance (PMI), which lowers your monthly payment right off the bat.

At the end of the day, our job is to work with you to find a down payment that makes sense for your budget while making your application as strong as possible.

Ready to see what your homeownership options in Tampa look like without needing W-2s? The team at Residential Acceptance Corporation is here to give you the expert guidance you've been looking for. We specialize in taking your entrepreneurial success and turning it into a clear path to your dream home.

Start your application with RAC Mortgage today